Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

[Fear Of Losing To Starlink? French Government Blocks Eutelsat Sale Of Antenna Assets] French Minister Of Economy, Finance, Industry, Energy And Digital Sovereignty, Roland Lescuille, Disclosed To The Media On The 30th That The French Government Recently Blocked Eutelsat's Sale Of Ground Antenna Assets To A Swedish Buyer. He Said The Decision Was Based On "national Security" Concerns, Fearing That The Transaction Would Damage Eutelsat's Competitiveness And Allow Its Rival, SpaceX's Starlink System, To Dominate The European Market

[White House Office Of Management And Budget Instructs Affected Agencies To Begin Implementation Of Shutdown Plans] On January 30, Local Time, CCTV Reporters Learned That The Director Of The White House Office Of Management And Budget Issued A Memorandum To Heads Of Various Departments, Instructing Agencies Whose Funding Was Due At Midnight To Begin Preparations For A Government Shutdown. These Agencies Include The Department Of Defense, Department Of Homeland Security, Department Of State, Department Of Treasury, Department Of Labor, Department Of Health And Human Services, Department Of Education, Department Of Transportation, And Department Of Housing And Urban Development

Mexico's Ministry Of Foreign Affairs Says Minister Spoke With USA Secretary Of State Rubio To Reiterate Bilateral Collaboration On Agendas Of Common Interest

China Southern Command Says Carried Out Naval And Air Patrols Around Scarborough Shoal On 31 Jan

Pentagon - USA State Dept Approves Potential Sale Of Patriot Advanced Capability-3 Missile Segment Enhancement Missiles To Saudi Arabia For An Estimated $9.0 Billion

Hong Kong Port Operator Violated Panama's Constitution, Failed To Serve Public Interest, Panama Court Ruled

South Korea Signs Deal With Norway To Supply Multiple Launch Rocket System Valued At 1.3 Trillion Won -South Korea Presidential Chief Of Staff

[Arctic Cold Wave Hits: Florida Citrus Industry At Risk Of Frost] The Southeastern United States Is Bracing For A Powerful Storm, Potentially Bringing Devastating Frost To Florida's Citrus Belt And Heavy Snowfall To The Carolinas. The Wind Chill In Central Florida's Orange-growing Regions Could Drop To Single Digits (Fahrenheit); Much Of Polk County Is Expected To Experience Sub-zero Temperatures, Threatening The Statewide Citrus Harvest. The Storm Is Also Expected To Bring Strong Winds And Coastal Flooding To The East Coast. Approximately 1,000 Flights Have Already Been Canceled Across The U.S. This Weekend, With Half Of Them Concentrated At Hartsfield-Jackson Atlanta International Airport

[Former Goldman Sachs Executive: Warsh's Fed Chairship Could Reduce Risk Of Massive Sell-Off Of US Assets] Fulcrum Asset Management Stated That Nominating Kevin Warsh As The Next Federal Reserve Chairman Reduces The Risk Of A Massive Sell-off Of US Assets Because The New Leader Is Expected To Take Measures To Address Inflation. "The Market Will Breathe A Huge Sigh Of Relief, And So Will The Dollar Market," Said Gavyn Davies, Co-founder And Chairman Of The London-based Firm, In A Video Released On The Fulcrum Website. He Added That Choosing Warsh Reduces The Risk Of A "crisis-laden 'sell America' Trade."

MSCI Emerging Markets Benchmark Equity Index Fell 1.7%, Its Worst Single-day Performance Since November 2025, Narrowing Its January Gain To Approximately 9%, Still Its Best Monthly Performance Since 2012. The Emerging Markets Currency Index Fell About 0.3%, Narrowing Its January Gain To 0.6%. On Friday, The South African Rand Fell 2.6% Against The US Dollar, Its Worst Performance Since April

Pentagon - USA State Department Approves Sales Of Joint Light Tactical Vehicles To Israel For $1.98 Billion

Federal Reserve Governor Bowman: I Look Forward To Working With Kevin Warsh, President Trump's Nominee For Federal Reserve Chairman

On Friday (January 30), At The Close Of Trading In New York (05:59 Beijing Time On Saturday), The Offshore Yuan (CNH) Was Quoted At 6.9584 Against The US Dollar, Down 137 Points From The Close Of Trading In New York On Thursday, Trading Within A Range Of 6.9437-6.9612 During The Day. In January, The Offshore Yuan Generally Continued To Rise, Trading Within A Range Of 6.9959-6.9313

U.K. M4 Money Supply (SA) (Dec)

U.K. M4 Money Supply (SA) (Dec)A:--

F: --

U.K. M4 Money Supply YoY (Dec)

U.K. M4 Money Supply YoY (Dec)A:--

F: --

P: --

Italy Unemployment Rate (SA) (Dec)

Italy Unemployment Rate (SA) (Dec)A:--

F: --

P: --

Euro Zone Unemployment Rate (Dec)

Euro Zone Unemployment Rate (Dec)A:--

F: --

P: --

Euro Zone GDP Prelim QoQ (SA) (Q4)

Euro Zone GDP Prelim QoQ (SA) (Q4)A:--

F: --

P: --

Euro Zone GDP Prelim YoY (SA) (Q4)

Euro Zone GDP Prelim YoY (SA) (Q4)A:--

F: --

P: --

Italy PPI YoY (Dec)

Italy PPI YoY (Dec)A:--

F: --

P: --

Mexico GDP Prelim YoY (Q4)

Mexico GDP Prelim YoY (Q4)A:--

F: --

P: --

Brazil Unemployment Rate (Dec)

Brazil Unemployment Rate (Dec)A:--

F: --

P: --

South Africa Trade Balance (Dec)

South Africa Trade Balance (Dec)A:--

F: --

P: --

India Deposit Gowth YoY

India Deposit Gowth YoYA:--

F: --

P: --

Germany CPI Prelim YoY (Jan)

Germany CPI Prelim YoY (Jan)A:--

F: --

P: --

Germany CPI Prelim MoM (Jan)

Germany CPI Prelim MoM (Jan)A:--

F: --

P: --

Germany HICP Prelim YoY (Jan)

Germany HICP Prelim YoY (Jan)A:--

F: --

P: --

Germany HICP Prelim MoM (Jan)

Germany HICP Prelim MoM (Jan)A:--

F: --

P: --

U.S. Core PPI YoY (Dec)

U.S. Core PPI YoY (Dec)A:--

F: --

U.S. Core PPI MoM (SA) (Dec)

U.S. Core PPI MoM (SA) (Dec)A:--

F: --

P: --

U.S. PPI YoY (Dec)

U.S. PPI YoY (Dec)A:--

F: --

P: --

U.S. PPI MoM (SA) (Dec)

U.S. PPI MoM (SA) (Dec)A:--

F: --

P: --

Canada GDP MoM (SA) (Nov)

Canada GDP MoM (SA) (Nov)A:--

F: --

P: --

Canada GDP YoY (Nov)

Canada GDP YoY (Nov)A:--

F: --

P: --

U.S. PPI MoM Final (Excl. Food, Energy and Trade) (SA) (Dec)

U.S. PPI MoM Final (Excl. Food, Energy and Trade) (SA) (Dec)A:--

F: --

P: --

U.S. PPI YoY (Excl. Food, Energy & Trade) (Dec)

U.S. PPI YoY (Excl. Food, Energy & Trade) (Dec)A:--

F: --

P: --

U.S. Chicago PMI (Jan)

U.S. Chicago PMI (Jan)A:--

F: --

Canada Federal Government Budget Balance (Nov)

Canada Federal Government Budget Balance (Nov)A:--

F: --

P: --

U.S. Weekly Total Oil Rig Count

U.S. Weekly Total Oil Rig CountA:--

F: --

P: --

U.S. Weekly Total Rig Count

U.S. Weekly Total Rig CountA:--

F: --

P: --

China, Mainland NBS Manufacturing PMI (Jan)

China, Mainland NBS Manufacturing PMI (Jan)A:--

F: --

P: --

China, Mainland NBS Non-manufacturing PMI (Jan)

China, Mainland NBS Non-manufacturing PMI (Jan)A:--

F: --

P: --

China, Mainland Composite PMI (Jan)

China, Mainland Composite PMI (Jan)A:--

F: --

P: --

South Korea Trade Balance Prelim (Jan)

South Korea Trade Balance Prelim (Jan)--

F: --

Japan Manufacturing PMI Final (Jan)

Japan Manufacturing PMI Final (Jan)--

F: --

P: --

South Korea IHS Markit Manufacturing PMI (SA) (Jan)

South Korea IHS Markit Manufacturing PMI (SA) (Jan)--

F: --

P: --

Indonesia IHS Markit Manufacturing PMI (Jan)

Indonesia IHS Markit Manufacturing PMI (Jan)--

F: --

P: --

China, Mainland Caixin Manufacturing PMI (SA) (Jan)

China, Mainland Caixin Manufacturing PMI (SA) (Jan)--

F: --

P: --

Indonesia Trade Balance (Dec)

Indonesia Trade Balance (Dec)--

F: --

P: --

Indonesia Inflation Rate YoY (Jan)

Indonesia Inflation Rate YoY (Jan)--

F: --

P: --

Indonesia Core Inflation YoY (Jan)

Indonesia Core Inflation YoY (Jan)--

F: --

P: --

India HSBC Manufacturing PMI Final (Jan)

India HSBC Manufacturing PMI Final (Jan)--

F: --

P: --

Australia Commodity Price YoY (Jan)

Australia Commodity Price YoY (Jan)--

F: --

P: --

Russia IHS Markit Manufacturing PMI (Jan)

Russia IHS Markit Manufacturing PMI (Jan)--

F: --

P: --

Turkey Manufacturing PMI (Jan)

Turkey Manufacturing PMI (Jan)--

F: --

P: --

U.K. Nationwide House Price Index MoM (Jan)

U.K. Nationwide House Price Index MoM (Jan)--

F: --

P: --

U.K. Nationwide House Price Index YoY (Jan)

U.K. Nationwide House Price Index YoY (Jan)--

F: --

P: --

Germany Actual Retail Sales MoM (Dec)

Germany Actual Retail Sales MoM (Dec)--

F: --

Italy Manufacturing PMI (SA) (Jan)

Italy Manufacturing PMI (SA) (Jan)--

F: --

P: --

South Africa Manufacturing PMI (Jan)

South Africa Manufacturing PMI (Jan)--

F: --

P: --

Euro Zone Manufacturing PMI Final (Jan)

Euro Zone Manufacturing PMI Final (Jan)--

F: --

P: --

U.K. Manufacturing PMI Final (Jan)

U.K. Manufacturing PMI Final (Jan)--

F: --

P: --

Brazil IHS Markit Manufacturing PMI (Jan)

Brazil IHS Markit Manufacturing PMI (Jan)--

F: --

P: --

Canada National Economic Confidence Index

Canada National Economic Confidence Index--

F: --

P: --

Canada Manufacturing PMI (SA) (Jan)

Canada Manufacturing PMI (SA) (Jan)--

F: --

P: --

U.S. IHS Markit Manufacturing PMI Final (Jan)

U.S. IHS Markit Manufacturing PMI Final (Jan)--

F: --

P: --

U.S. ISM Output Index (Jan)

U.S. ISM Output Index (Jan)--

F: --

P: --

U.S. ISM Inventories Index (Jan)

U.S. ISM Inventories Index (Jan)--

F: --

P: --

U.S. ISM Manufacturing Employment Index (Jan)

U.S. ISM Manufacturing Employment Index (Jan)--

F: --

P: --

U.S. ISM Manufacturing New Orders Index (Jan)

U.S. ISM Manufacturing New Orders Index (Jan)--

F: --

P: --

U.S. ISM Manufacturing PMI (Jan)

U.S. ISM Manufacturing PMI (Jan)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

S&P Global upgraded Italy's outlook to "positive," signaling confidence in economic resilience and fiscal progress.

S&P Global Ratings has upgraded its outlook on Italy to "positive" from "stable," signaling growing confidence in the country's economic trajectory. The agency affirmed Italy's sovereign credit ratings at 'BBB+/A-2'.

The change reflects a brighter view of Italy's capacity to navigate global economic challenges and manage its public finances.

The core of S&P's positive revision lies in the resilience of Italy's large and open economy. Despite ongoing uncertainty in global trade and tariffs, the nation has demonstrated notable strength.

Key drivers behind the improved outlook include:

• Consistent Trade Surpluses: Italy has consistently posted net current account surpluses, a sign that the country earns more from its international trade and investments than it spends.

• Growing Private Wealth: These surpluses have helped bolster private wealth within the country.

• Stronger External Position: Italy's net external creditor position has shown continuous improvement, strengthening its financial standing on the world stage.

S&P expects Italy's diversified private sector to continue driving these trends, which supports the nation's overall economic stability.

While Italy's government debt remains high, S&P noted gradual progress in the country's budgetary consolidation efforts.

The agency projects the headline budget deficit will fall below 3% of GDP by 2026. Furthermore, cash flow adjustments related to the "Superbonus" incentive program are also winding down, easing fiscal pressure.

Although government debt is forecast to be around 136% of GDP in 2025, S&P anticipates this figure will begin a downward trend starting in 2028.

The positive outlook opens the door for a potential ratings upgrade, but S&P also outlined clear risks that could lead to a reversal.

The Path to a Higher Rating

S&P indicated that it could raise Italy's sovereign credit rating if the country achieves the following:

• Strengthens its external financial position further.

• Narrows its budget deficit on a cash basis.

• Puts government debt-to-GDP on a clear downward path.

Potential Downside Risks

Conversely, S&P would consider lowering the ratings if Italy's economic, external, or budgetary performance deteriorates significantly beyond current forecasts. Such a scenario could be triggered if prolonged international trade uncertainty erodes consumer and business confidence, ultimately weakening Italy's financial and fiscal standing.

Russia and Ukraine have paused attacks on each other's energy infrastructure in a temporary de-escalation, but the two sides have offered conflicting timelines for the agreement, casting doubt on the next steps in negotiations to end the nearly four-year war.

The move follows a request from U.S. President Donald Trump, which the Kremlin said it accepted. However, while Kyiv sees the moratorium lasting a week, Moscow has indicated it could end as soon as Sunday, February 1.

On Friday, Ukrainian President Volodymyr Zelenskiy confirmed that Russia had conducted virtually no strikes on energy facilities in the past 24 hours. He stated the moratorium went into effect at midnight on Friday for a full week.

"In all our regions, there were indeed no strikes on energy facilities from Thursday night to Friday," Zelenskiy said. "Ukraine is ready in reciprocal terms to refrain from strikes and today we did not strike at Russian energy facilities."

The Kremlin's account differs. Spokesman Dmitry Peskov confirmed President Vladimir Putin agreed to Trump's personal request to halt the bombardment of Kyiv but suggested the measure would expire on Sunday. The stated goal was to create "favourable conditions" for peace talks. Both sides acknowledge this is not a formal ceasefire.

The temporary pause offers a critical reprieve for Kyiv's residents, who have endured weeks of Russian strikes that knocked out power and heating for hundreds of thousands of people as temperatures dropped below minus 15 degrees Celsius.

On Friday, 378 residential high-rise buildings remained without heating. The situation is set to become more severe, with weather forecasters predicting temperatures in the capital will plunge to as low as minus 26 degrees Celsius starting Sunday.

Despite the halt in energy strikes, Ukrainian officials report that Moscow has merely shifted its strategy. Both Zelenskiy and Prime Minister Yulia Svyrydenko said Russia is now targeting logistical points, particularly railway junctions. Svyrydenko noted that Russia carried out seven drone attacks on railway facilities in the last 24 hours alone.

Diplomatic efforts to end the war remain stalled over fundamental disagreements. Two major unresolved issues stand in the way of progress:

• Territorial Control: Russia's demand that Ukraine cede all of the Donbass region.

• Nuclear Plant: Russia's control over the Zaporizhzhia nuclear power plant, the largest in Europe.

Zelenskiy has firmly ruled out surrendering territory. This impasse has left the diplomatic track without tangible results.

The next round of talks, originally scheduled for Sunday in the United Arab Emirates between Russian, Ukrainian, and U.S. negotiators, is now uncertain. Zelenskiy suggested a delay, citing external factors. "The date or the location may change – because, in our view, something is happening in the situation between the United States and Iran. And those developments could likely affect the timing," he said.

Meanwhile, two sources in Moscow told Reuters that Putin's special envoy, Kirill Dmitriev, would travel to Miami on Saturday for meetings with members of Trump's administration. Adding to the uncertainty, U.S. Secretary of State Marco Rubio said that Trump's top envoys, Steve Witkoff and Jared Kushner, would not participate in the scheduled Abu Dhabi meeting.

President Zelenskiy also revealed that Ukraine's air defenses have been depleted, blaming delayed payments from European allies under the U.S.-led PURL weapons purchase program. He said this delay meant U.S. Patriot air defense missiles did not arrive before heavy Russian airstrikes that crippled power across Kyiv this month.

On the streets of the capital, residents expressed doubt that the truce would last.

"I trust neither Putin nor Trump, so I think that even if he (Putin) complies now, he will stockpile missiles and will still keep firing," said Kostiantyn, a 61-year-old pensioner. "Putin's goal is the destruction of Ukraine, and all we can do is resist."

The grim reality of the ongoing conflict continues. The Ukrainian Air Force reported that in the latest overnight attacks, Russia launched one ballistic missile and 111 drones. Zelenskiy said the missile struck and damaged warehouses owned by the U.S. company Philip Morris in the northeastern Kharkiv region. All the while, Russian troops continue their grinding advance in the eastern Donetsk region.

Traders' Opinions

Daily News

Economic

Technical Analysis

Central Bank

Data Interpretation

Forex

Remarks of Officials

Energy

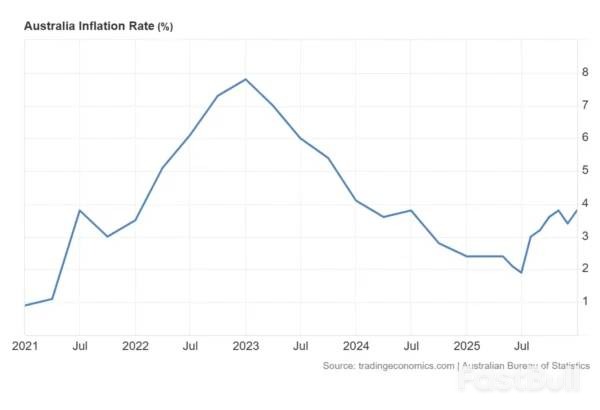

Australia's latest inflation data has put policymakers and investors on high alert, with a key measure of underlying price pressure surging past the central bank's target range. Markets are now pricing in a high probability of a February interest rate hike, setting the stage for a sharp policy pivot just months after the Reserve Bank of Australia's last rate cut.

The RBA's preferred gauge of inflation, the trimmed mean, rose to 3.4% year-on-year in the fourth quarter. This figure not only surpassed market expectations of 3.3% but also breached the upper limit of the RBA's 2–3% target band, signaling that underlying price pressures are more persistent than previously thought.

On a quarterly basis, core inflation registered a 0.9% increase, which was in line with forecasts. However, the acceleration in the annual rate suggests the path back to stable prices may be challenging.

Headline inflation figures also point to mounting price pressures across the economy. The Consumer Price Index (CPI) rose to 3.8% year-on-year in December, an increase from 3.4% the previous month.

The primary drivers behind this increase include:

• Housing: +5.5%

• Recreation and Culture: +4.4%

• Food and Non-alcoholic Beverages: +3.4%

A closer look at the data reveals particularly stubborn inflation in the services sector, which accelerated to 4.1% year-on-year from 3.6%. This typically indicates strong domestic demand and persistent wage pressures. Meanwhile, goods inflation stood at 3.4%, with a notable 21.5% surge in electricity prices adding further complexity for the RBA.

Compounding the inflation challenge is Australia's tight labor market. With unemployment hovering around 4%, demand in the economy remains robust. This combination of high inflation and low unemployment significantly constrains the central bank's options and raises the risk of price pressures becoming entrenched.

This situation is particularly delicate for the RBA, which cut interest rates as recently as August. By December, the bank had already signaled that its next move could be a hike if inflation data proved troubling.

Financial markets have reacted swiftly to the latest data. Overnight Index Swaps (OIS) now indicate a roughly 76% probability of a rate hike at the RBA's meeting on February 2–3.

Major financial institutions are aligning with this view. Both Westpac Banking Corp. and ANZ Bank are forecasting a 25-basis-point rate hike, which would lift the cash rate to 3.85%. However, Westpac noted that such a move would not necessarily signal the start of a prolonged tightening cycle, leaving a "wait-and-see" approach on the table if inflation eases in the coming months.

Interestingly, three-year government bond yields fell to 4.28%, suggesting some investors may believe the inflation spike is temporary or that the RBA will only implement a single tightening move.

The prospect of higher interest rates has provided a significant tailwind for the Australian dollar. The currency has appreciated by over 4% since the beginning of the year, making it the second-best performer among G10 currencies. This strength reflects both rising rate expectations and investor confidence in the Australian economy's relative resilience.

The upcoming RBA meeting is more than just another rate decision. It represents a critical test of the central bank's credibility. Policymakers must decide whether to pivot decisively to combat rising inflation or to treat the latest data as a temporary blip. The decision made in early February will likely set the tone for Australian monetary policy for the rest of the year.

The Senate is set to vote Friday on a crucial funding package aimed at keeping federal agencies open, with a partial government shutdown just hours away.

Even if the measure passes the Senate, a brief shutdown seems almost certain. The House of Representatives is not scheduled to return to Washington until Monday, and both chambers must approve the legislation before it can be signed into law by President Donald Trump.

Without final congressional action, a partial shutdown of federal operations will begin at 12:01 a.m. ET Saturday.

The vote was delayed after Senator Lindsey Graham, a Republican from South Carolina, placed a hold on the legislation, preventing a quick consideration of the package.

Graham announced on the Senate floor earlier Friday that he would not lift his hold without a guaranteed vote on his bill to criminalize "sanctuary city" policies. The legislation seeks to impose criminal penalties on state and local officials who interfere with federal immigration laws.

He also demanded a vote on an amendment connected to the "Arctic Frost" investigation led by then-special counsel Jack Smith. This amendment would require officials to notify senators if their phone records are obtained in a criminal investigation.

Graham had previously criticized House Speaker Mike Johnson for including language in the spending package that repealed a law allowing senators to sue for up to $500,000 if their records were obtained during that investigation.

The deadlock broke after Graham received assurances from Senate Majority Whip John Thune. In a statement Friday afternoon, Graham confirmed that Thune supports his efforts to bring the sanctuary cities bill to a future vote.

Graham added that Thune "also supports, at a time to be determined, a vote on creating the ability for groups and private citizens, not members of Congress, that may have been harmed by Jack Smith and the Biden DOJ [Department of Justice] to have their day in court."

Following these assurances, Graham concluded, "I will lift my hold and vote for the package." The Senate is now scheduled to vote on a series of amendments before a final vote to pass the funding deal.

The agreement is designed to fund most of the federal government through the end of the fiscal year on September 30.

However, the deal separates funding for the Department of Homeland Security (DHS). The DHS, which has faced criticism from Democrats over its immigration enforcement actions, will be funded temporarily by a stopgap measure. The question of its long-term funding will be addressed later.

The funding package received a notable endorsement from former President Donald Trump, who encouraged lawmakers in a Truth Social post to support it.

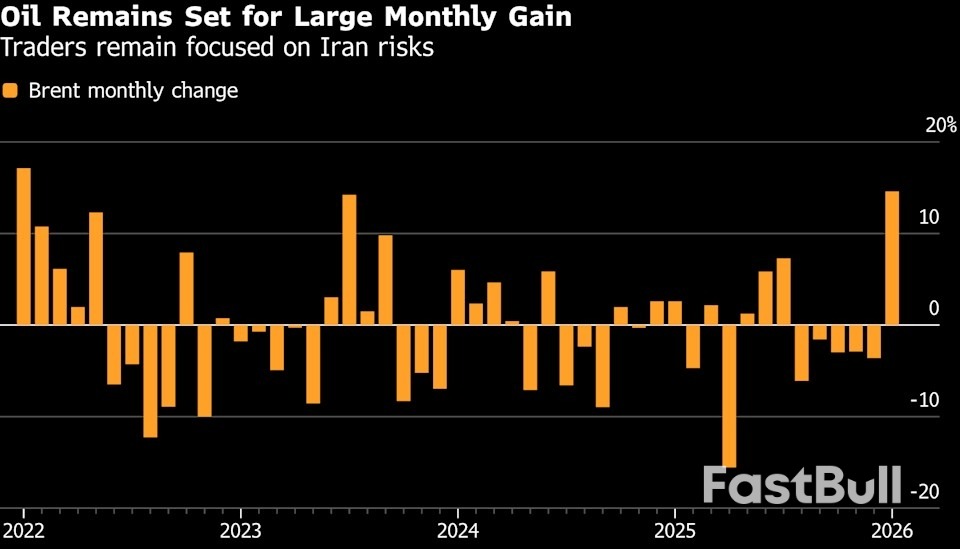

As tensions escalate between the United States and Iran, reports of an impending military confrontation are gaining traction. President Trump has signaled that Iranian leaders are aware of a looming deadline, while the U.S. has simultaneously bolstered its military presence in the Middle East, fueling speculation of a potential conflict.

A significant report from Drop Site News, citing unnamed U.S. and Arab sources, alleges that a U.S. offensive on Iran could be scheduled for this Sunday. While the claims lack definitive evidence, the precedent of last year's abrupt attack lends them a degree of credibility.

According to sources who spoke with Drop Site News, top U.S. military officials have briefed a key ally in the region on the situation. The briefing suggests President Trump may soon authorize military action, and the allied nation is reportedly preparing for strikes to commence on Sunday.

An adviser to several Arab governments claims the primary U.S. objective is not neutralizing nuclear threats but instigating a change in the Iranian regime. This perspective appears to align with President Trump’s recent comments about supporting resistance movements and potentially sending aid, suggesting that the goal of regime change may be a core part of the administration's strategy.

Further intelligence suggests the Trump administration believes a successful military intervention could trigger internal protests within Iran, ultimately leading to the collapse of the current government.

The credibility of these reports remains a key question, as major leaks would typically be confirmed by more established media outlets. With Iran supposedly aware of the deadline, observers are closely monitoring official channels for credible information. Some analysts suggest the "final deadline" might simply refer to the end of January.

Former intelligence officials have noted that Israeli Prime Minister Netanyahu anticipates an attack and has assured President Trump of Israel's support in establishing a new, friendly government in Iran. High-level Arab intelligence sources have also indicated to Drop Site News that a U.S. strike may be forthcoming.

Should a military assault materialize, the repercussions could be widespread and severe. The most likely outcomes include:

• Bitcoin Market Volatility: The cryptocurrency market could see fluctuations similar to trends observed during last year's geopolitical events.

• Heightened Regional Instability: The entire Middle East would likely experience a sharp increase in instability.

• Long-Term Disruption: The conflict could trigger lasting disruptions across the region with serious global implications.

As the reported deadline approaches, both Iran and the international community remain on high alert. The possibility of military action continues to cast a shadow over the geopolitical landscape.

A new Dutch government is rapidly taking shape after the social liberal D66, Christian Democrats (CDA), and liberal conservative VVD parties reached a coalition agreement. With the cabinet expected to be assembled and in place by the end of next month, this formation period is proving significantly faster than in previous election cycles.

However, the incoming government faces a major hurdle from day one. Holding only 66 of the 150 seats in parliament, it will operate as a minority government—a new dynamic for Dutch politics. This setup means the coalition must build a majority by winning over opposition parties for every policy it wants to pass.

The coalition's economic agenda is firmly pro-business, even with tax increases planned to fund higher defense spending. Key pillars of the plan include:

• Lowering energy costs for Dutch manufacturers.

• Providing subsidies to support the transition to green energy.

• Allocating additional funds for housing to boost the construction sector.

• Tackling high nitrogen emissions through financial support for farmers who voluntarily cease operations.

The government also intends to cut regulatory burdens for businesses and maintain favorable conditions for expats. By reversing previous cuts to the science and education budget, the agenda supports long-term innovation. The coalition is actively targeting a structural GDP growth rate of 1.5%.

Despite significant new spending on defense, the Netherlands is on track to keep its budget deficit within the EU's 3% of GDP limit. Government debt is already well below the 60% debt-to-GDP target, positioning the Dutch as one of Europe's most fiscally disciplined nations.

This fiscal balance comes at a price. To offset the increased defense expenditure, the government plans large cuts to healthcare spending, primarily through higher co-payments. Social security will also see reductions, while both households and businesses will face higher taxes. Longer-term spending plans are also expected to add budgetary pressure beyond the upcoming government period.

The incoming government is poised to adopt a more positive and cooperative approach toward the European Union. While it still denounces Eurobonds, its definition is narrow, focusing only on the pooling of national public debt.

Crucially, the coalition remains constructive toward existing common financing instruments—a notable shift from the previous government. It also expresses support for strengthening the capital market and banking unions.

The Netherlands is set to have a new government in short order, armed with an ambitious agenda focused on business competitiveness, increased defense spending, and strict fiscal management. The coalition’s success, however, will hinge on its ability to negotiate and win support from the opposition. A new political experiment is just beginning.

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

Log In

Sign Up