Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

U.S. NY Fed Manufacturing Prices Received Index (Jan)

U.S. NY Fed Manufacturing Prices Received Index (Jan)A:--

F: --

P: --

U.S. NY Fed Manufacturing New Orders Index (Jan)

U.S. NY Fed Manufacturing New Orders Index (Jan)A:--

F: --

P: --

U.S. NY Fed Manufacturing Employment Index (Jan)

U.S. NY Fed Manufacturing Employment Index (Jan)A:--

F: --

P: --

U.S. Export Price Index YoY (Nov)

U.S. Export Price Index YoY (Nov)A:--

F: --

P: --

U.S. NY Fed Manufacturing Index (Jan)

U.S. NY Fed Manufacturing Index (Jan)A:--

F: --

U.S. Initial Jobless Claims 4-Week Avg. (SA)

U.S. Initial Jobless Claims 4-Week Avg. (SA)A:--

F: --

U.S. Export Price Index MoM (Nov)

U.S. Export Price Index MoM (Nov)A:--

F: --

P: --

Canada Manufacturing Unfilled Orders MoM (Nov)

Canada Manufacturing Unfilled Orders MoM (Nov)A:--

F: --

P: --

Canada Manufacturing New Orders MoM (Nov)

Canada Manufacturing New Orders MoM (Nov)A:--

F: --

P: --

U.S. Philadelphia Fed Manufacturing Employment Index (Jan)

U.S. Philadelphia Fed Manufacturing Employment Index (Jan)A:--

F: --

P: --

Canada Wholesale Sales YoY (Nov)

Canada Wholesale Sales YoY (Nov)A:--

F: --

P: --

Canada Wholesale Inventory MoM (Nov)

Canada Wholesale Inventory MoM (Nov)A:--

F: --

P: --

U.S. Philadelphia Fed Business Activity Index (SA) (Jan)

U.S. Philadelphia Fed Business Activity Index (SA) (Jan)A:--

F: --

P: --

U.S. EIA Weekly Natural Gas Stocks Change

U.S. EIA Weekly Natural Gas Stocks ChangeA:--

F: --

P: --

Richmond Federal Reserve President Barkin delivered a speech.

Richmond Federal Reserve President Barkin delivered a speech. U.S. Weekly Treasuries Held by Foreign Central Banks

U.S. Weekly Treasuries Held by Foreign Central BanksA:--

F: --

P: --

Germany CPI Final MoM (Dec)

Germany CPI Final MoM (Dec)A:--

F: --

P: --

Germany CPI Final YoY (Dec)

Germany CPI Final YoY (Dec)A:--

F: --

P: --

Germany HICP Final MoM (Dec)

Germany HICP Final MoM (Dec)A:--

F: --

P: --

Germany HICP Final YoY (Dec)

Germany HICP Final YoY (Dec)A:--

F: --

P: --

Brazil PPI MoM (Nov)

Brazil PPI MoM (Nov)A:--

F: --

P: --

Canada New Housing Starts (Dec)

Canada New Housing Starts (Dec)A:--

F: --

U.S. Capacity Utilization MoM (SA) (Dec)

U.S. Capacity Utilization MoM (SA) (Dec)A:--

F: --

U.S. Industrial Output YoY (Dec)

U.S. Industrial Output YoY (Dec)A:--

F: --

P: --

U.S. Manufacturing Capacity Utilization (Dec)

U.S. Manufacturing Capacity Utilization (Dec)A:--

F: --

P: --

U.S. Manufacturing Output MoM (SA) (Dec)

U.S. Manufacturing Output MoM (SA) (Dec)A:--

F: --

U.S. Industrial Output MoM (SA) (Dec)

U.S. Industrial Output MoM (SA) (Dec)A:--

F: --

U.S. NAHB Housing Market Index (Jan)

U.S. NAHB Housing Market Index (Jan)A:--

F: --

P: --

Russia CPI YoY (Dec)

Russia CPI YoY (Dec)A:--

F: --

P: --

U.S. Weekly Total Rig Count

U.S. Weekly Total Rig CountA:--

F: --

P: --

U.S. Weekly Total Oil Rig Count

U.S. Weekly Total Oil Rig CountA:--

F: --

P: --

Japan Core Machinery Orders YoY (Nov)

Japan Core Machinery Orders YoY (Nov)--

F: --

P: --

Japan Core Machinery Orders MoM (Nov)

Japan Core Machinery Orders MoM (Nov)--

F: --

P: --

U.K. Rightmove House Price Index YoY (Jan)

U.K. Rightmove House Price Index YoY (Jan)--

F: --

P: --

China, Mainland GDP YoY (YTD) (Q4)

China, Mainland GDP YoY (YTD) (Q4)--

F: --

P: --

China, Mainland Industrial Output YoY (YTD) (Dec)

China, Mainland Industrial Output YoY (YTD) (Dec)--

F: --

P: --

Japan Industrial Output Final MoM (Nov)

Japan Industrial Output Final MoM (Nov)--

F: --

P: --

Japan Industrial Output Final YoY (Nov)

Japan Industrial Output Final YoY (Nov)--

F: --

P: --

Euro Zone Core HICP Final MoM (Dec)

Euro Zone Core HICP Final MoM (Dec)--

F: --

P: --

Euro Zone HICP Final MoM (Dec)

Euro Zone HICP Final MoM (Dec)--

F: --

P: --

Euro Zone HICP Final YoY (Dec)

Euro Zone HICP Final YoY (Dec)--

F: --

P: --

Euro Zone HICP MoM (Excl. Food & Energy) (Dec)

Euro Zone HICP MoM (Excl. Food & Energy) (Dec)--

F: --

P: --

Euro Zone Core CPI Final YoY (Dec)

Euro Zone Core CPI Final YoY (Dec)--

F: --

P: --

Euro Zone Core HICP Final YoY (Dec)

Euro Zone Core HICP Final YoY (Dec)--

F: --

P: --

Euro Zone CPI YoY (Excl. Tobacco) (Dec)

Euro Zone CPI YoY (Excl. Tobacco) (Dec)--

F: --

P: --

Euro Zone Core CPI Final MoM (Dec)

Euro Zone Core CPI Final MoM (Dec)--

F: --

P: --

Canada National Economic Confidence Index

Canada National Economic Confidence Index--

F: --

P: --

Canada CPI MoM (SA) (Dec)

Canada CPI MoM (SA) (Dec)--

F: --

P: --

Canada Core CPI MoM (SA) (Dec)

Canada Core CPI MoM (SA) (Dec)--

F: --

P: --

Canada CPI YoY (SA) (Dec)

Canada CPI YoY (SA) (Dec)--

F: --

P: --

Canada Trimmed CPI YoY (SA) (Dec)

Canada Trimmed CPI YoY (SA) (Dec)--

F: --

P: --

Canada CPI YoY (Dec)

Canada CPI YoY (Dec)--

F: --

P: --

Canada CPI MoM (Dec)

Canada CPI MoM (Dec)--

F: --

P: --

Canada Core CPI YoY (Dec)

Canada Core CPI YoY (Dec)--

F: --

P: --

Canada Core CPI MoM (Dec)

Canada Core CPI MoM (Dec)--

F: --

P: --

South Korea PPI MoM (Dec)

South Korea PPI MoM (Dec)--

F: --

P: --

China, Mainland 1-Year Loan Prime Rate (LPR)

China, Mainland 1-Year Loan Prime Rate (LPR)--

F: --

P: --

China, Mainland 5-Year Loan Prime Rate

China, Mainland 5-Year Loan Prime Rate--

F: --

P: --

Germany PPI YoY (Dec)

Germany PPI YoY (Dec)--

F: --

P: --

Germany PPI MoM (Dec)

Germany PPI MoM (Dec)--

F: --

P: --

ALL MY TOPA LOVE YOU TOO

ALL MY TOPA LOVE YOU TOO

Y5JWJ9NOZD

ID: 4382071

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

Indian stocks face H1 2026 volatility from fiscal limits and elections, eyeing H2 recovery post-May via easing and reforms.

Indian stocks, particularly in the technology sector, are likely headed for a volatile first half of 2026, according to analysis from Amish Shah, a senior analyst at Bank of America Securities. A combination of fiscal constraints and political uncertainty is expected to weigh on market sentiment before conditions improve later in the year.

Shah anticipates that near-term events are stacked against investors, setting the stage for potential turbulence. While foreign capital inflows may recover in the latter half of the year, the initial six months are projected to be challenging.

A key risk for Indian equities is the upcoming Union Budget on February 1st. According to Shah, market expectations for a major government spending initiative are likely to be disappointed.

In a CNBC interview, he noted that the government lacks the fiscal room to implement either a capital expenditure (capex) stimulus or a consumption-focused stimulus—both of which the market is currently hoping for.

Without these growth-supporting measures, Shah predicts the budget announcement could act as a catalyst for a market sell-off next month. The absence of stimulus, coupled with already cautious foreign institutional investment, creates a fragile environment for Indian stocks.

Beyond fiscal policy, political developments are another significant headwind. India is scheduled to hold elections in five states in May, including major contests in Tamil Nadu and West Bengal, as well as in Kerala, Puducherry, and Assam.

Shah explained that governments often introduce "populist measures" in the run-up to elections—policies that "markets often don't like." This type of spending, combined with the cautious fiscal stance in the budget, could deter foreign investors and potentially lead to capital outflows.

According to the BofA analyst, market sentiment will likely remain weak as events are "set up against India" until the election cycle concludes in May.

Despite the near-term challenges, the outlook for Indian stocks appears to brighten significantly after May. Shah foresees a more "constructive environment" emerging in the second half of 2026 as several positive catalysts align.

"Post May, we think events and triggers for Indian markets start to turn favourable," he stated.

Key factors that could drive stock prices higher include:

• Monetary Easing: Potential interest rate cuts from the U.S. Federal Reserve and continued easing by the Reserve Bank of India (RBI).

• Consumption Boost: The implementation of the central government employees' pay commission, a once-a-decade event that typically lifts consumption.

• Window for Reform: With no further state elections until February 2027, the government will have a "clean window to do reforms."

Shah believes this reform agenda could excite the market and support higher valuations, ultimately creating compelling reasons for foreign institutional investor (FII) flows to return to India.

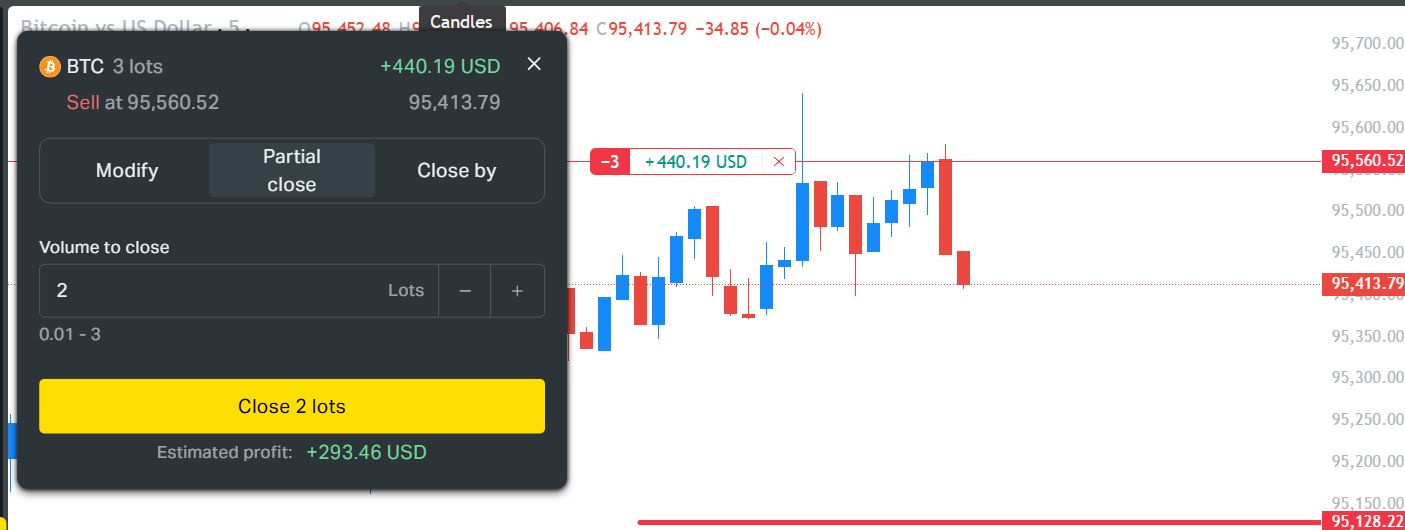

Global markets sold off sharply after comments from President Trump reshuffled expectations for the next leader of the Federal Reserve. Investors, who had anticipated a dovish turn, quickly repriced assets after Trump signaled that easy-money advocate Kevin Hassett would likely not be his pick for Fed Chair.

In a Fox Business appearance, U.S. Treasury Secretary Scott Bessent discussed President Trump's thinking on Federal Reserve leadership. The key moment came when Trump's own words on Kevin Hassett were relayed.

"Fed officials don't talk much. Hassett is good at talking. He was good on TV. I want to keep him where he is," Trump stated.

Hassett had been widely viewed as a strong contender for the top job at the central bank. Known for his support of looser monetary policy and lower interest rates, his appointment was seen as a bullish signal by many investors. Trump’s statement effectively removed Hassett from the running, immediately dampening hopes for more aggressive rate cuts.

The market for political speculation reacted instantly. On the prediction platform Polymarket, the odds of Kevin Warsh becoming the next Fed Chair surged to approximately 60%. Meanwhile, Hassett’s chances plummeted to around 15%.

Warsh, a former Federal Reserve Governor, is considered a candidate more likely to win Senate approval and preserve the Fed's traditional independence. However, he is not expected to push for the kind of deep rate cuts that markets had begun to price in under a potential Hassett leadership. This shift raised concerns that financial conditions could remain tighter for a longer period.

The sudden change in outlook triggered a significant market downturn. With the prospect of a dovish Fed Chair fading, investors moved quickly to de-risk.

The sell-off was broad-based:

• Gold: Lost over $500 billion in market value.

• Cryptocurrencies: Bitcoin pulled back from a local high of about $98,000 on January 15, correcting to roughly $94,500. Silver also fell.

• Equities: U.S. stock indices turned negative as rate-cut expectations diminished.

Treasury Secretary Scott Bessent confirmed that President Trump is close to making a final decision, stating that an announcement would come "within days or weeks." The timing could place it either before or after the upcoming Davos summit.

Bessent revealed that the administration had reviewed 11 candidates and has now narrowed the list to four. He noted the final choice would be based on who can bring stability to the Fed and work effectively with its Board.

He also called for greater accountability at the central bank, citing issues with inefficiency and cost overruns. "The Federal Reserve has a special place with the American people," Bessent said. "It has a lot of influence, but no real accountability. We need some sunshine here." When asked about an incident involving current Fed Chair Jerome Powell, Bessent declined to comment on any ongoing investigations.

The speculation around the Fed's next leader is more than just a Wall Street game. The outcome has direct consequences for the economy and personal finance.

Impact on Borrowing Costs

A shift in Fed leadership directly influences the direction of interest rates. This, in turn, affects the cost of mortgages, car loans, credit cards, and business financing over the next several years. A more hawkish chair could lead to higher borrowing costs, while a dovish one could keep them lower.

Why Markets Hang on Every Word

Financial markets are forward-looking. They constantly adjust asset prices based on future policy expectations. Even subtle hints about who might lead the Fed can trigger billions of dollars in trades as investors recalibrate their forecasts for inflation, economic growth, and liquidity.

Sector Sensitivity to Monetary Policy

Certain sectors are more exposed to changes in interest rate expectations.

• Highly Sensitive: Technology stocks, cryptocurrencies, and precious metals often react first and most dramatically.

• Gradual Impact: The housing market and small businesses tend to feel the effects more slowly through changes in the cost and availability of credit.

The European Union is preparing a major policy shift that would prioritize local companies in investment and public spending, marking a significant departure from the free-trade principles that have guided the bloc for decades.

Later this month, the European Commission is expected to introduce the "Industrial Accelerator Act," a set of new rules aimed at bolstering the region's industrial base.

According to a draft of the act seen by Bloomberg News, the proposal targets key foreign investments exceeding €100 million ($116 million). These investments would face strict new requirements, including:

• Mandatory technology sharing.

• Hiring local workers.

• Establishing joint ventures with European firms.

This move signals a more protectionist stance designed to ensure that large-scale investments directly benefit the EU's economy and workforce.

The proposed system also overhauls public procurement rules for EU member states. When purchasing goods like a new fleet of buses, for example, the lowest price will no longer be the sole deciding factor.

Instead, governments will be required to ensure that products contain a minimum percentage of European-origin content. Some exemptions are planned for countries that have a free-trade agreement with the EU.

This strategic pivot comes as Europe's industrial sector faces a deepening slowdown. The draft document highlights several pressures driving the change, including high energy prices following Russia's invasion of Ukraine, persistent supply chain disruptions, and escalating costs.

Simultaneously, China's growing dominance in new clean technology sectors is leaving European companies at a competitive disadvantage.

"The combination of high energy prices, the need for large-scale decarbonisation investments and unfair global competition places energy intensive industries at a competitive disadvantage, and there are growing signs of industrial decline," the draft states. It concludes that the EU's "economic security requires the strengthening of the resilience of its supply chains and the safeguarding of its single market and industrial capacity."

The plan is not without its critics. The proposal has reportedly sparked internal dissent among EU officials concerned about the risks of excessive protectionism. Senior diplomats from allied nations have also cautioned the bloc against going too far in its efforts to rebuild industry.

One EU official noted they encountered less resistance to the idea in China than within certain parts of the Commission itself. A representative for the European Commission did not immediately respond to a request for comment on the draft.

To further bolster resilience, the draft law also includes provisions for establishing "stockpiling centres" for critical raw materials to protect the EU from future supply shocks. The rules also aim to fast-track new industrial projects and create a new "green label" for steel. The document remains a draft and is subject to change before its official release.

After a multi-year bull market, Wall Street has become a wealth-generating powerhouse. The Dow Jones Industrial Average, S&P 500, and Nasdaq Composite have been buoyed by investor optimism surrounding artificial intelligence, quantum computing, and the prospect of lower interest rates.

But beneath the surface of record highs, a significant risk is brewing that has little to do with technology bubbles. While headwinds are a constant threat to the market, the most serious problem facing investors today is the internal division at the U.S. Federal Reserve.

Recent headlines have been dominated by the unprecedented news of a U.S. Justice Department criminal investigation into Federal Reserve Chair Jerome Powell. The probe centers on his June testimony to Congress about the central bank's $2.5 billion headquarters renovation and whether he was truthful.

Powell promptly issued a statement suggesting the investigation was politically motivated, calling it "a consequence of the Federal Reserve setting interest rates based on our best assessment of what will serve the public, rather than following the preferences of the President."

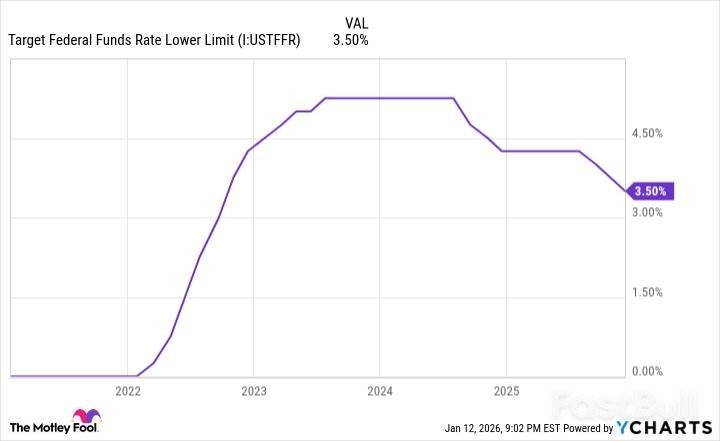

This public feud between President Trump and Chair Powell over interest rate policy has been escalating for a year. The President has been vocal in his demands for the Federal Open Market Committee (FOMC)—the 12-member body that sets U.S. monetary policy—to lower rates significantly. A lower-rate environment would ease credit burdens for consumers, reduce mortgage costs, and encourage businesses to borrow for hiring and innovation, potentially spurring faster economic growth.

However, the FOMC has moved cautiously. Citing stubbornly high inflation, especially in shelter costs, the central bank has opted for a slow and steady rate-easing cycle. This measured approach has placed Powell directly at odds with the President. But this political drama, while newsworthy, isn't the fundamental reason the Fed poses a major risk to the stock market in 2026.

The Federal Reserve has a straightforward dual mandate: maximize employment and stabilize prices. The FOMC uses several tools to achieve these goals, primarily by adjusting the federal funds rate, which influences borrowing costs across the economy. It also conducts open market operations, like buying or selling long-term U.S. Treasuries to make borrowing cheaper (quantitative easing) or more expensive (quantitative tightening).

Because the Fed relies on backward-looking economic data, its policy decisions aren't always perfect. Historically, Wall Street has tolerated occasional missteps. What the market may not forgive, however, is a divided central bank.

For over three decades, the FOMC has typically operated with unanimous agreement on its policy path. This consensus among the nation's top economic minds has provided a crucial foundation of stability for the markets.

That foundation is now cracking. We are witnessing a historic level of dissent:

• Each of the last four FOMC meetings has featured at least one dissenting vote.

• The last two meetings saw dissents in opposite directions—one member favored no rate cut, while another wanted a larger 50-basis-point reduction.

To put this in perspective, there have only been three FOMC meetings with dissents in opposing directions since 1990, and two of them have occurred since late October 2025.

Beyond the political headlines, a historically fractured Fed is a far greater concern for the stock market. This lack of cohesion at the FOMC risks undermining the very stability that the Federal Reserve is supposed to provide. When the central bank cannot agree on the correct course of action, its credibility and predictability suffer, creating uncertainty for investors.

Compounding this issue is the fact that Powell's term as Fed Chair is set to expire in just four months, which could introduce further instability into an already fractured committee.

While many on Wall Street are focused on a potential AI bubble, the biggest risk factor for the market in 2026 is the growing recognition that the Federal Reserve is fundamentally divided—a problem with no easy solution.

As Donald Trump’s second presidential term enters its second year, the policy landscape is shifting. While 2025 was marked by disruptive action, 2026 is shaping up to be a year of constrained policymaking, persistent political noise, and a growing tension between economic stimulus and risk, according to Wolfe Research strategist Tobin Marcus.

With major policies like tariffs, tax cuts, immigration enforcement, and a sweeping reconciliation bill already enacted, the administration faces new challenges. "Trump will face more limited horizons for new policymaking, and he'll need to sell his agenda to a midterm electorate that currently looks quite sour," Marcus explained in a recent report.

Here are the 10 key policy and political questions that will define the market environment in 2026.

1. How Potent is the 2026 Economic Stimulus?

Multiple sources of stimulus are set to impact the economy, primarily driven by the individual and corporate tax cuts passed in last year's reconciliation bill. However, Marcus notes that these effects, while meaningful, are temporary. They are unlikely to generate a sustained economic boom, particularly outside of investment related to artificial intelligence.

2. Will Trump's Trade Tariffs Continue to Dominate?

Tariffs are not expected to fade into the background. Trade policy will remain a central issue, fueled by a Supreme Court ruling on IEEPA tariffs, ongoing Section 232 investigations, and negotiations over the USMCA trade agreement. Even in the most dovish scenarios, Marcus anticipates only modest relief rather than a full reversal of existing tariffs.

3. Can the White House Tackle Affordability?

Affordability remains a significant political vulnerability for the administration. While officials have signaled their intent to act, they have few concrete tools at their disposal. Housing is seen as the only area where executive action could produce a tangible impact. Beyond that, Marcus believes there are no "silver bullets" without new legislation from Congress.

4. Is Another Major Spending Bill on the Horizon?

The prospect of another major reconciliation bill is highly unlikely. Although ideas for stimulus checks, increased defense funding, and healthcare reform are circulating, internal Republican divisions and growing concerns over the national deficit make another large-scale spending package a long shot.

5. Where Can Bipartisan Deals Actually Get Done?

A narrow set of bipartisan achievements is plausible in 2026. According to Marcus, the most likely areas for agreement include:

• Crypto Regulation: Legislation to create a market structure for digital assets has the clearest odds of passing.

• Government Funding: Congress must act to fund the government and address the looming ACA subsidy cliff.

• Housing: Broader housing legislation is possible but remains uncertain.

Meanwhile, more ambitious reforms for energy permitting and large-scale infrastructure are seen as difficult. There is a real risk that Congress will opt for temporary stopgap measures instead of comprehensive new packages.

6. What's Next for Strategic Government Investment?

Direct government investment in strategic sectors is expected to expand. Marcus identifies this "state capitalism" approach as politically and operationally attractive, especially when combined with pledges of foreign investment from allied nations.

7. Just How Dire Is the US Fiscal Outlook?

The nation's fiscal situation is set to deteriorate further. Deficits are expected to remain high, stuck at around 6% of GDP. With no credible path to reduction, Marcus warns that the risks are skewed toward even greater government borrowing needs in the future.

8. US-China Relations: A Fragile Truce?

An October truce between the U.S. and China is expected to provide roughly a year of relative stability. While the underlying structural tensions between the two powers remain unresolved, Marcus does not foresee an uncontrolled escalation of conflict in 2026.

9. Gauging the Risk of a Midterm "Blue Wave"

Historical trends for midterm elections favor the party out of power, in this case, the Democrats. However, current polling suggests only modest advantages for Democrats rather than the conditions for a massive "blue wave," Marcus notes. Special elections and voter turnout patterns will be critical signals to watch.

10. Why the 2026 Midterm Elections Are Critical

The stakes for the midterm elections go beyond simple control of Congress. The results will ultimately determine how much political capital and legislative freedom Trump has to advance his agenda in the second half of his term. The outcome will decide whether the current policy noise escalates once again into full-scale market disruption.

A major corruption scandal is prompting Ukrainian President Volodymyr Zelenskiy to engage with potential political rivals, signaling that preparations for a future election may be underway.

Recently, Zelenskiy has held a series of meetings with high-profile figures who could challenge him in a post-war vote. These discussions come at a sensitive time for the president, whose public image has been damaged by allegations of corruption within his government.

One notable meeting was with Valerii Zaluzhnyi, the former commander-in-chief of the armed forces and current ambassador to the UK. Zaluzhnyi is widely considered Zelenskiy's most significant political contender. The relationship between the two soured after Ukraine's 2023 counteroffensive failed, leading to Zaluzhnyi's dismissal in 2024.

Zelenskiy also confirmed meetings with other popular personalities, including former TV host Serhiy Prytula, whose charity supports the military, and nationalist activist Serhiy Sternenko.

Analysts see these meetings as a clear political strategy. Volodymyr Fesenko, head of the Penta Research Institute in Kyiv, stated, "There is no doubt that this is happening in the context of potential presidential elections."

According to Fesenko, Zelenskiy may be trying to achieve several objectives:

• Boost his own reputation by associating with other popular figures.

• Improve relationships with potential opposition leaders.

• Recruit these individuals as political allies to strengthen his own position.

This outreach coincides with discussions between Ukraine and the U.S. on a 20-point peace plan to be presented to Russian President Vladimir Putin. A key component of the plan is the requirement for Ukraine to hold presidential elections as soon as possible after a ceasefire is established—a condition also emphasized by U.S. President Donald Trump.

Currently, Ukrainian law prohibits elections under martial law. However, with the topic gaining prominence in peace talks, Zelenskiy has asked lawmakers to draft legislation that would permit a vote following a ceasefire.

Zelenskiy's political maneuvering comes as he faces the largest corruption scandal of his presidency. Late last year, anti-corruption investigators uncovered a scheme involving the misuse of funds intended for the defense of energy infrastructure.

The investigation implicated several members of the president's inner circle and resulted in the resignation of his influential top aide, Andriy Yermak. Following Yermak's departure, Zelenskiy appointed Kyrylo Budanov, the head of military intelligence and a popular wartime figure known for planning attacks inside Russia, as the new head of the presidential office.

Sources familiar with the situation suggest that Yermak's exit paved the way for the recent meetings. This allowed the president to communicate directly with various figures and gather information. One such meeting was with Oleksandr Kubrakov, a former deputy prime minister for infrastructure who was dismissed in 2024, reportedly after clashing with Yermak. More meetings are reportedly planned.

Prytula told Bloomberg News that his discussion with Zelenskiy did not cover politics, focusing instead on legal challenges faced by military volunteers.

Recent polling data provides a snapshot of the political landscape. A survey by the agency Socis at the end of last year showed that if an election were held soon:

• Valerii Zaluzhnyi would receive nearly 21% of the vote.

• Kyrylo Budanov would get less than 6%.

• Serhiy Prytula would secure about 1.5%.

The same poll indicated that Zelenskiy remains slightly ahead of Zaluzhnyi.

However, a separate survey in December by the Kyiv International Institute for Sociology found that the energy sector corruption scandal caused a 10-percentage-point drop in public trust in Zelenskiy.

The institute noted that trust in the president is "highly dynamic." Difficult situations on the battlefield and in diplomacy have previously caused Ukrainians to "rally around the flag," boosting his popularity.

While neither Zelenskiy nor Zaluzhnyi has officially announced a presidential bid, the president's recent actions suggest he is actively preparing for that possibility. "He's testing the waters and thinking about the future," Fesenko concluded.

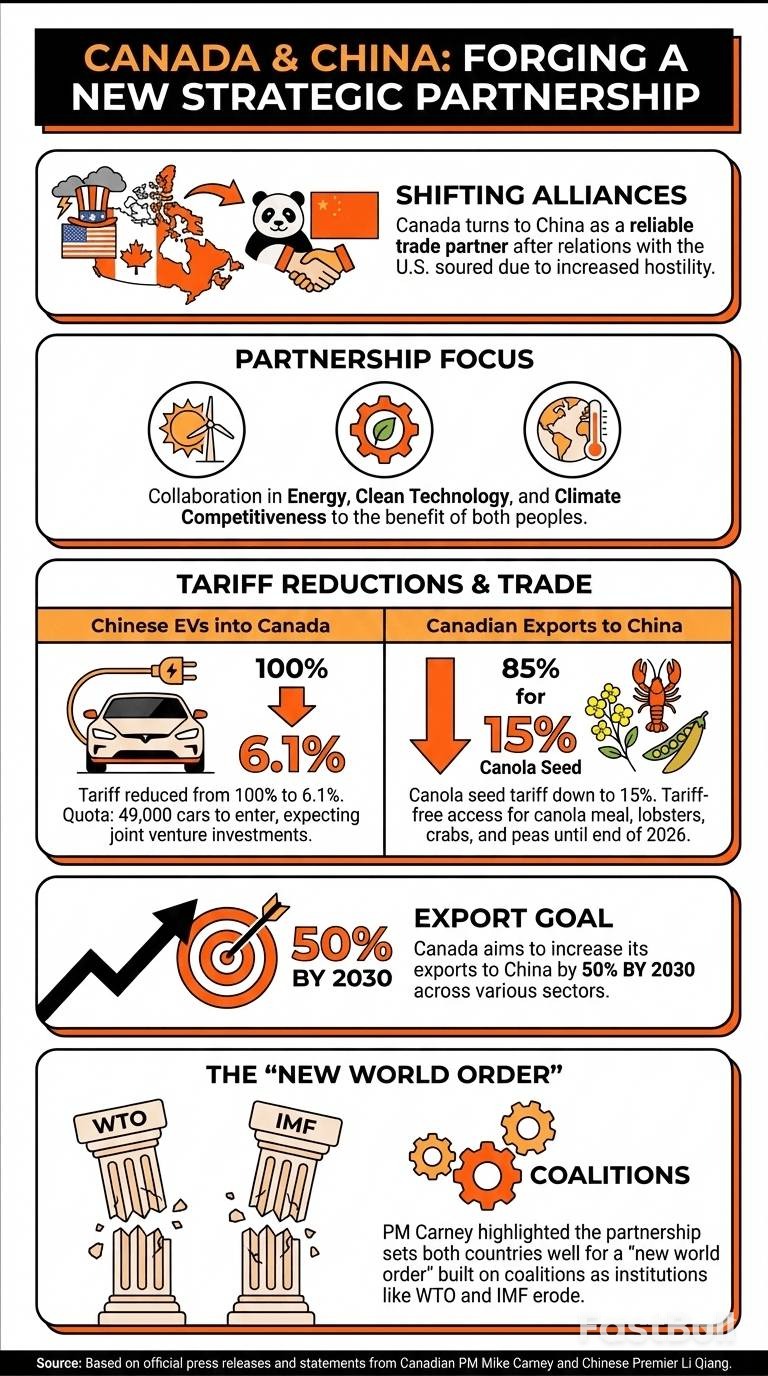

Canada is making a significant pivot in its foreign trade policy, building a new strategic partnership with China amid souring relations with its traditional ally, the United States. The move comes as the North American nation seeks more reliable trade partners in response to increased hostility and tariff threats from Washington.

During a four-day visit to China, Canadian Prime Minister Mike Carney announced the new alliance, stating it would be to "the benefit of both of our peoples." According to an official press release, the partnership will center on collaboration in energy, clean technology, and climate competitiveness.

The agreement includes substantial tariff adjustments designed to boost bilateral trade in key sectors. One of the most significant changes affects Chinese electric vehicles (EVs), which will now face a dramatically lower tariff of 6.1%, down from 100%. The Canadian government will permit up to 49,000 Chinese EVs to enter the country under this new rate.

In return, Canada secured major concessions for its agricultural exports:

• Canola Seed: Tariffs on Canadian canola seed entering China will be reduced from 85% to just 15%, opening a path for Canada to capture a share of the $4 billion market.

• Tariff-Free Goods: From March 1 until the end of 2026, Canadian canola meal, lobsters, crabs, and peas will be subject to zero tariffs.

Canada anticipates that these measures will encourage an influx of Chinese joint venture investments, leading to local production and job creation for Canadian workers.

The partnership is a cornerstone of Canada's strategy to diversify its export markets. The nation's goal is to increase its total exports to China by 50% by the year 2030. This growth is expected to come from expanded collaboration in clean energy, technology, agri-food, wood, and other key sectors.

The scope of the alliance extends beyond economics. Canada has also declared its support for multilateralism and pledged to deepen its collaboration with China on "improved global governance."

During a meeting with Chinese Premier Li Qiang, Prime Minister Carney highlighted the partnership's role in positioning both countries for what he termed the "new world order."

Carney later clarified that this concept refers to a future where global relationships are defined by new coalitions rather than by eroding legacy institutions like the World Trade Organization (WTO) and the International Monetary Fund (IMF).

"The expectation is that, rather than these being developed necessarily through the IMF, WTO, and other multilateral organizations, it is going to be coalitions that develop them, not for the world, but for subsectors of the world," Carney explained.

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up