Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

Top USA And Israeli Generals Met On Friday At The Pentagon Amid Iran Tensions, Two USA Officials Tell Reuters

[Bitcoin Briefly Dips Below $77,000, Ethereum Briefly Dips Below $2,300] February 1st, According To Htx Market Data, Bitcoin Briefly Dropped Below $77,000, Now Trading At $77,011, With A 24-Hour Decrease Of 5.32%.Ethereum Briefly Dropped Below $2,300, Now Trading At $2,301.07, With A 24-Hour Decrease Of 9.28%

Qatar Prime Minister: Qatar To Introduce 10 Year Residency For Entrepreneurs And Senior Executives

[Speaker Of The U.S. House Of Representatives: Confident Of Sufficient Votes To End Partial Government Shutdown By Tuesday] February 1st, According To Nbc News, U.S. House Speaker Johnson Said He Is Confident That There Will Be Enough Votes By At Least Tuesday To End The Partial Government Shutdown

Iranian Official Tells Reuters: Media Reports Of Plans For Revolutionary Guards To Hold Military Exercise In Strait Of Hormuz Are Wrong

Ukraine's Defence Minister Says Kyiv And Spacex Working On System To Ensure Only Authorized Starlink Terminals Work In Ukraine

Russian Security Committee's Vice Chairman Medvedev: Europe Has Failed To Defeat Russia In Ukraine

Russian Security Committee's Vice Chairman Medvedev: We Never Found The Two Nuclear Submarines Trump Spoke Of Deploying Closer To Russia

Russian Security Committee's Vice Chairman Medvedev: Victory Will Come 'Soon' In Ukraine But Equally Important To Think Of How To Prevent New Conflicts

Russian Security Committee's Vice Chairman Medvedev: Trump Is An Effective Leader Who Seeks Peace

Russian Defence Ministry: Russia Gains Control Over Two Villages In Ukraine's Kharkiv And Donetsk Regions

U.K. M4 Money Supply (SA) (Dec)

U.K. M4 Money Supply (SA) (Dec)A:--

F: --

Italy Unemployment Rate (SA) (Dec)

Italy Unemployment Rate (SA) (Dec)A:--

F: --

P: --

Euro Zone Unemployment Rate (Dec)

Euro Zone Unemployment Rate (Dec)A:--

F: --

P: --

Euro Zone GDP Prelim QoQ (SA) (Q4)

Euro Zone GDP Prelim QoQ (SA) (Q4)A:--

F: --

P: --

Euro Zone GDP Prelim YoY (SA) (Q4)

Euro Zone GDP Prelim YoY (SA) (Q4)A:--

F: --

P: --

Italy PPI YoY (Dec)

Italy PPI YoY (Dec)A:--

F: --

P: --

Mexico GDP Prelim YoY (Q4)

Mexico GDP Prelim YoY (Q4)A:--

F: --

P: --

Brazil Unemployment Rate (Dec)

Brazil Unemployment Rate (Dec)A:--

F: --

P: --

South Africa Trade Balance (Dec)

South Africa Trade Balance (Dec)A:--

F: --

P: --

India Deposit Gowth YoY

India Deposit Gowth YoYA:--

F: --

P: --

Germany CPI Prelim YoY (Jan)

Germany CPI Prelim YoY (Jan)A:--

F: --

P: --

Germany CPI Prelim MoM (Jan)

Germany CPI Prelim MoM (Jan)A:--

F: --

P: --

Germany HICP Prelim YoY (Jan)

Germany HICP Prelim YoY (Jan)A:--

F: --

P: --

Germany HICP Prelim MoM (Jan)

Germany HICP Prelim MoM (Jan)A:--

F: --

P: --

U.S. Core PPI YoY (Dec)

U.S. Core PPI YoY (Dec)A:--

F: --

U.S. Core PPI MoM (SA) (Dec)

U.S. Core PPI MoM (SA) (Dec)A:--

F: --

P: --

U.S. PPI YoY (Dec)

U.S. PPI YoY (Dec)A:--

F: --

P: --

U.S. PPI MoM (SA) (Dec)

U.S. PPI MoM (SA) (Dec)A:--

F: --

P: --

Canada GDP MoM (SA) (Nov)

Canada GDP MoM (SA) (Nov)A:--

F: --

P: --

Canada GDP YoY (Nov)

Canada GDP YoY (Nov)A:--

F: --

P: --

U.S. PPI MoM Final (Excl. Food, Energy and Trade) (SA) (Dec)

U.S. PPI MoM Final (Excl. Food, Energy and Trade) (SA) (Dec)A:--

F: --

P: --

U.S. PPI YoY (Excl. Food, Energy & Trade) (Dec)

U.S. PPI YoY (Excl. Food, Energy & Trade) (Dec)A:--

F: --

P: --

U.S. Chicago PMI (Jan)

U.S. Chicago PMI (Jan)A:--

F: --

Canada Federal Government Budget Balance (Nov)

Canada Federal Government Budget Balance (Nov)A:--

F: --

P: --

U.S. Weekly Total Oil Rig Count

U.S. Weekly Total Oil Rig CountA:--

F: --

P: --

U.S. Weekly Total Rig Count

U.S. Weekly Total Rig CountA:--

F: --

P: --

China, Mainland NBS Manufacturing PMI (Jan)

China, Mainland NBS Manufacturing PMI (Jan)A:--

F: --

P: --

China, Mainland NBS Non-manufacturing PMI (Jan)

China, Mainland NBS Non-manufacturing PMI (Jan)A:--

F: --

P: --

China, Mainland Composite PMI (Jan)

China, Mainland Composite PMI (Jan)A:--

F: --

P: --

South Korea Trade Balance Prelim (Jan)

South Korea Trade Balance Prelim (Jan)A:--

F: --

Japan Manufacturing PMI Final (Jan)

Japan Manufacturing PMI Final (Jan)--

F: --

P: --

South Korea IHS Markit Manufacturing PMI (SA) (Jan)

South Korea IHS Markit Manufacturing PMI (SA) (Jan)--

F: --

P: --

Indonesia IHS Markit Manufacturing PMI (Jan)

Indonesia IHS Markit Manufacturing PMI (Jan)--

F: --

P: --

China, Mainland Caixin Manufacturing PMI (SA) (Jan)

China, Mainland Caixin Manufacturing PMI (SA) (Jan)--

F: --

P: --

Indonesia Trade Balance (Dec)

Indonesia Trade Balance (Dec)--

F: --

P: --

Indonesia Inflation Rate YoY (Jan)

Indonesia Inflation Rate YoY (Jan)--

F: --

P: --

Indonesia Core Inflation YoY (Jan)

Indonesia Core Inflation YoY (Jan)--

F: --

P: --

India HSBC Manufacturing PMI Final (Jan)

India HSBC Manufacturing PMI Final (Jan)--

F: --

P: --

Australia Commodity Price YoY (Jan)

Australia Commodity Price YoY (Jan)--

F: --

P: --

Russia IHS Markit Manufacturing PMI (Jan)

Russia IHS Markit Manufacturing PMI (Jan)--

F: --

P: --

Turkey Manufacturing PMI (Jan)

Turkey Manufacturing PMI (Jan)--

F: --

P: --

U.K. Nationwide House Price Index MoM (Jan)

U.K. Nationwide House Price Index MoM (Jan)--

F: --

P: --

U.K. Nationwide House Price Index YoY (Jan)

U.K. Nationwide House Price Index YoY (Jan)--

F: --

P: --

Germany Actual Retail Sales MoM (Dec)

Germany Actual Retail Sales MoM (Dec)--

F: --

Italy Manufacturing PMI (SA) (Jan)

Italy Manufacturing PMI (SA) (Jan)--

F: --

P: --

South Africa Manufacturing PMI (Jan)

South Africa Manufacturing PMI (Jan)--

F: --

P: --

Euro Zone Manufacturing PMI Final (Jan)

Euro Zone Manufacturing PMI Final (Jan)--

F: --

P: --

U.K. Manufacturing PMI Final (Jan)

U.K. Manufacturing PMI Final (Jan)--

F: --

P: --

Brazil IHS Markit Manufacturing PMI (Jan)

Brazil IHS Markit Manufacturing PMI (Jan)--

F: --

P: --

Canada National Economic Confidence Index

Canada National Economic Confidence Index--

F: --

P: --

Canada Manufacturing PMI (SA) (Jan)

Canada Manufacturing PMI (SA) (Jan)--

F: --

P: --

U.S. IHS Markit Manufacturing PMI Final (Jan)

U.S. IHS Markit Manufacturing PMI Final (Jan)--

F: --

P: --

U.S. ISM Output Index (Jan)

U.S. ISM Output Index (Jan)--

F: --

P: --

U.S. ISM Inventories Index (Jan)

U.S. ISM Inventories Index (Jan)--

F: --

P: --

U.S. ISM Manufacturing Employment Index (Jan)

U.S. ISM Manufacturing Employment Index (Jan)--

F: --

P: --

U.S. ISM Manufacturing New Orders Index (Jan)

U.S. ISM Manufacturing New Orders Index (Jan)--

F: --

P: --

U.S. ISM Manufacturing PMI (Jan)

U.S. ISM Manufacturing PMI (Jan)--

F: --

P: --

South Korea CPI YoY (Jan)

South Korea CPI YoY (Jan)--

F: --

P: --

Japan Monetary Base YoY (SA) (Jan)

Japan Monetary Base YoY (SA) (Jan)--

F: --

P: --

Australia Building Permits MoM (SA) (Dec)

Australia Building Permits MoM (SA) (Dec)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

India's new tax reform ends a key "business connection" risk for foreign electronics firms, accelerating manufacturing.

India's government has introduced a major tax reform that directly benefits foreign electronics companies like Apple, removing a key obstacle to expanding manufacturing in the country. The change allows foreign firms to supply machinery to their Indian contract manufacturers for five years without triggering a significant tax risk.

This move is a critical part of Prime Minister Narendra Modi's agenda to establish India as a global smartphone production hub. Apple had been actively lobbying for this reform, arguing that existing tax laws hindered its ability to scale up production efficiently.

Previously, Apple faced a unique challenge in India that it didn't encounter in China. Under Indian law, if Apple provided high-end iPhone machinery to its manufacturing partners, tax authorities could deem this a "business connection." This interpretation risked making Apple's profits from iPhone sales in India subject to local taxes.

To avoid this risk, Apple's contract manufacturers, including Foxconn and Tata, had to invest billions of dollars in their own equipment. The new policy, announced in the 2026-27 annual budget by Finance Minister Nirmala Sitharaman, directly addresses this long-standing concern.

The government's new rule change clarifies that a foreign company's income will not be taxed simply because it owns and provides capital goods to a local contract manufacturer.

Key details of the policy include:

• Targeted Application: The exemption applies to factories located in "customs-bonded areas," which are treated as being outside India's formal customs territory.

• Export Focus: Devices produced in these zones and sold domestically will still incur import taxes, making these facilities ideal for export-focused manufacturing.

• Time-Limited: The rule change will be in effect until the 2030-31 tax year.

The government's budget documents state that "any income arising on account of providing capital goods, equipment or tooling to a contract manufacturer...is eligible for exemption."

Industry experts believe this policy shift will significantly accelerate electronics manufacturing in India.

"This exemption removes a key deal-breaking risk for electronics manufacturing in India," noted Shankey Agrawal, a partner at the tax law firm BMR Legal. "The result is faster scale-up and greater confidence for global electronics players to manufacture in India."

The decision comes as Apple steadily increases its footprint in India as part of a broader strategy to diversify its supply chain beyond China. According to Counterpoint Research, the iPhone's market share in India has doubled to 8% since 2022. More significantly, India's share of global iPhone shipments has quadrupled to 25% over the same period, while China's share stands at 75%.

This legislative change is the result of numerous discussions between Apple and Indian officials, signaling a successful effort to create a more favorable environment for the company's future growth in the country.

OPEC+ is expected to maintain its current oil output policy for March, holding off on planned production increases when the group meets on Sunday. According to three OPEC+ delegates, the decision to pause comes even as crude prices have surged to six-month highs over concerns that the U.S. might launch military strikes against Iran, a key OPEC member.

The upcoming meeting of eight key OPEC+ producers follows a week where Brent crude closed near $70 a barrel, just shy of the $71.89 six-month peak reached on Thursday. This price strength persists despite some speculation that a supply glut in 2026 could eventually push prices lower.

The primary driver behind the recent oil price rally is the escalating tension between the United States and Iran. U.S. President Donald Trump is reportedly weighing several options against Tehran, including targeted strikes on security forces and leaders. Washington has already imposed extensive sanctions to cut off Iran's oil revenue, a critical source of state funding.

While both nations have signaled a potential willingness to engage in dialogue, Tehran stated on Friday that its defense capabilities would be part of any discussion. This tense geopolitical backdrop is keeping the oil market on edge and supporting higher prices.

The group of eight producers—Saudi Arabia, Russia, the United Arab Emirates, Kazakhstan, Kuwait, Iraq, Algeria, and Oman—previously agreed to raise their collective production quotas by approximately 2.9 million barrels per day between April and December 2025. This increase represented about 3% of global demand.

However, the alliance then decided to freeze any further output increases for the period of January through March 2026, citing seasonally weaker consumption patterns. Sunday's meeting is expected to uphold this pause for March, with no decisions anticipated for policy beyond that month.

The meeting of the eight OPEC+ members is scheduled to begin at 1330 GMT on Sunday. OPEC+, which includes the Organization of the Petroleum Exporting Countries along with Russia and other allies, collectively produces about half of the world's oil.

A separate OPEC+ panel, the Joint Ministerial Monitoring Committee (JMMC), is also set to meet on Sunday. However, this committee serves an advisory role and does not have the authority to make decisions on production policy.

Beyond the situation in Iran, oil prices have also found support from supply disruptions in Kazakhstan. The country's oil sector has faced a series of operational issues in recent months. On Wednesday, Kazakhstan announced it was in the process of restarting its massive Tengiz oilfield in stages, but the recent losses have contributed to market tightness.

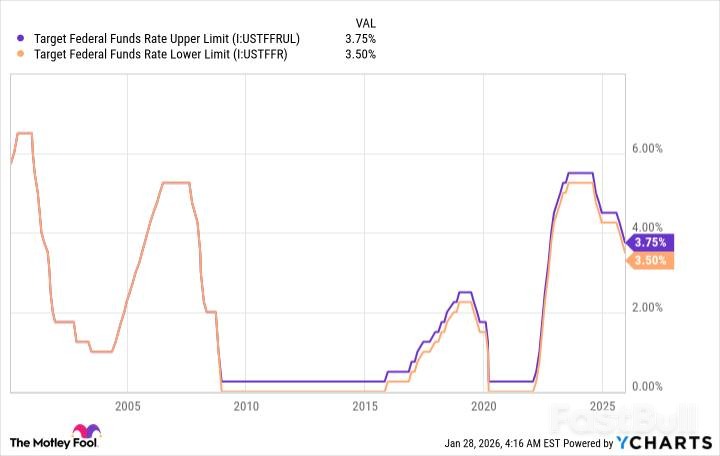

For the better part of seven years, optimists have dominated Wall Street, pushing the S&P 500, Dow Jones Industrial Average, and Nasdaq Composite to new heights. While history suggests major stock indexes trend upward over the long run, the journey is rarely a straight line. Right now, the biggest risk to the ongoing bull market may be the one institution designed to provide stability: the U.S. Federal Reserve.

A perfect storm of internal division, leadership uncertainty, and ominous historical patterns is brewing at the central bank, creating a scenario that could halt the market rally in its tracks.

The Federal Reserve's core mission is to manage U.S. monetary policy to maximize employment and keep prices stable. Its primary tool is the federal funds rate, the overnight lending rate for banks, which influences borrowing costs across the entire economy. These decisions are made by the 12-member Federal Open Market Committee (FOMC), led by Fed Chair Jerome Powell.

Markets can tolerate a policy mistake from a unified central bank. What they historically cannot stand is a central bank at war with itself.

Recently, dissent within the FOMC has become alarmingly common. Each of the last four meetings has seen at least one member disagree with the consensus decision. More significantly, the October and December meetings featured dissents in opposite directions—one member wanting no rate cut while another pushed for a larger 50-basis-point cut instead of the 25-basis-point reduction that was approved.

This is exceptionally rare. In the last 36 years, opposing dissents have occurred in only three FOMC meetings, and two of them happened in the last three months. This level of division erodes confidence and makes the Fed's future actions dangerously unpredictable.

Compounding this problem is a looming leadership change. Jerome Powell's term as Fed chair is set to expire on May 15, 2026. With President Trump's nominee still unknown, this adds another thick layer of uncertainty over a central bank already struggling with its direction.

On the surface, lower interest rates seem like a clear positive for stocks. Cheaper borrowing should encourage businesses to hire, invest, and innovate. However, history tells a different and more cautionary tale.

The Fed doesn't typically begin cutting rates unless it sees significant trouble brewing in the economy. As a result, the start of a rate-easing cycle has often preceded major market downturns, not rallies.

Looking at the last three major rate-cutting cycles this century, a clear pattern emerges where stocks plunged well after the Fed started easing.

• Dot-Com Bubble (2001): The FOMC began cutting rates on January 3, 2001, eventually slashing them by 475 basis points. The stock market didn't hit its bottom until 645 days after that first cut.

• Financial Crisis (2007): The Fed started easing on September 18, 2007, ultimately taking rates from 5% down to near zero. It took 538 days from that initial cut for the major indexes to find their floor.

• COVID-19 Crash (2019): Before the pandemic-induced crash, the Fed began cutting rates on August 1, 2019. The market bottomed out 236 days later.

This historical precedent, combined with the Fed's internal division and leadership questions, creates a potent mix of risks for investors. While the long-term outlook for stocks remains positive, 2026 is shaping up to be a volatile and potentially vulnerable period for the market.

Iran has sharply escalated its confrontation with the West, declaring it now considers all European Union militaries to be terrorist groups. The move, announced on February 1, 2026, is a direct retaliation against the EU for designating Iran's own Islamic Revolutionary Guard Corps a terrorist organization.

This development comes as Tehran navigates a tense standoff with the United States. While Iranian President Masoud Pezeshkian is publicly calling for a peaceful, diplomatic resolution, US President Donald Trump continues to hint at military action, noting a US naval fleet is deploying near the region.

Iran's parliament speaker, Mohammad Bagher Qalibaf, announced Sunday that Tehran has officially classified all EU armed forces as terrorist organizations. The decision mirrors the EU's recent blacklisting of the Islamic Revolutionary Guard Corps (IRGC) over its crackdown on nationwide anti-government protests.

In a symbolic show of support, Qalibaf and other members of the Iranian parliament wore Guard uniforms during the session.

"By seeking to strike at the (Guard), which itself has been the greatest barrier to the spread of terrorism to Europe, Europeans have in fact shot themselves in the foot," Qalibaf stated. He accused EU nations of "blind obedience to the Americans" against their own interests.

Citing Article 7 of a counter-terrorism law, Qalibaf confirmed the new designation for European armies. He also noted that the parliamentary commission on national security will consider expelling military attachés from EU countries.

While taking a hard line with Europe, Iran's leadership is sending mixed signals regarding the United States.

President Masoud Pezeshkian has emphasized the need for diplomacy to de-escalate tensions. In a phone call with Egyptian President Abdel Fattah al-Sissi, Pezeshkian said Iran has never wanted a war and does not seek one now, according to the state news agency IRNA. The report added that Tehran "deeply believes that war will not benefit Iran, the United States, or the region."

However, these calls for peace are set against a backdrop of military threats from Washington. President Trump recently told Fox News that military action remains a possibility.

"We have a big fleet heading out there," Trump said, confirming the deployment of US warships, including a nuclear-powered aircraft carrier, near Iran.

Adding another layer to the situation, a top Iranian official suggested that behind-the-scenes talks may be underway. Ali Larijani, secretary general of Iran's National Security Council, wrote on X that "contrary to the artificially manufactured media war narrative, the formation of a framework for negotiations is progressing."

The UK economy is showing clear signs of strain, raising the risk of a significant recession and setting the stage for aggressive interest rate cuts by the Bank of England, according to a recent analysis by BCA Research.

Key economic growth indicators in the United Kingdom are flashing warning signs. Analysts, including Robert Timper at BCA Research, point to weakening business confidence and deteriorating job data as evidence that the economy is on shaky ground.

The labor market, in particular, is a major source of concern. While widespread layoffs have been limited so far, falling corporate profit growth suggests that job cuts could increase. Analysts warn that the UK labor market is weakening at a worrying pace and is already exhibiting recessionary characteristics. Without a significant improvement in the data, mounting job market weakness could be enough to tip the entire economy into a recession.

As the economy slows, inflationary pressures are also receding. Wage growth has moderated, and price distribution in the services sector has returned to normal levels. These trends support projections that underlying inflation will fall back to the Bank of England's 2% target within the year.

This cooling inflation gives the central bank the justification it needs to shift its policy stance. The market is currently pricing in 41 basis points of interest rate cuts in 2024, followed by a more substantial 100 basis points of cuts in 2025.

Despite the bleak domestic outlook, analysts at BCA Research see a compelling investment case for UK stocks. They argue that several factors could drive market performance, making UK equities a better bet than their Eurozone counterparts over the next three to six months.

Key drivers for UK stocks include:

• Monetary Easing: Potential borrowing cost reductions from the Bank of England would support equity valuations.

• Currency Weakness: A weaker British pound would boost the value of overseas earnings for UK-listed multinational corporations.

• Global Exposure: Many companies in the UK market derive a large portion of their revenue from international sales, insulating them from domestic weakness.

Furthermore, UK stocks are currently trading at a discount and are not considered overbought, offering an attractive entry point for investors.

The energy sector could provide another catalyst for UK equities. Analysts highlight the possibility of a historic oil supply shock, potentially triggered by a collapse of the ruling regime in Iran.

Given the significant presence of major oil and gas companies on the London Stock Exchange, the UK's broad market has historically outperformed Eurozone equities during periods of rising oil prices. Such a scenario could provide an unexpected but powerful boost to UK stock performance.

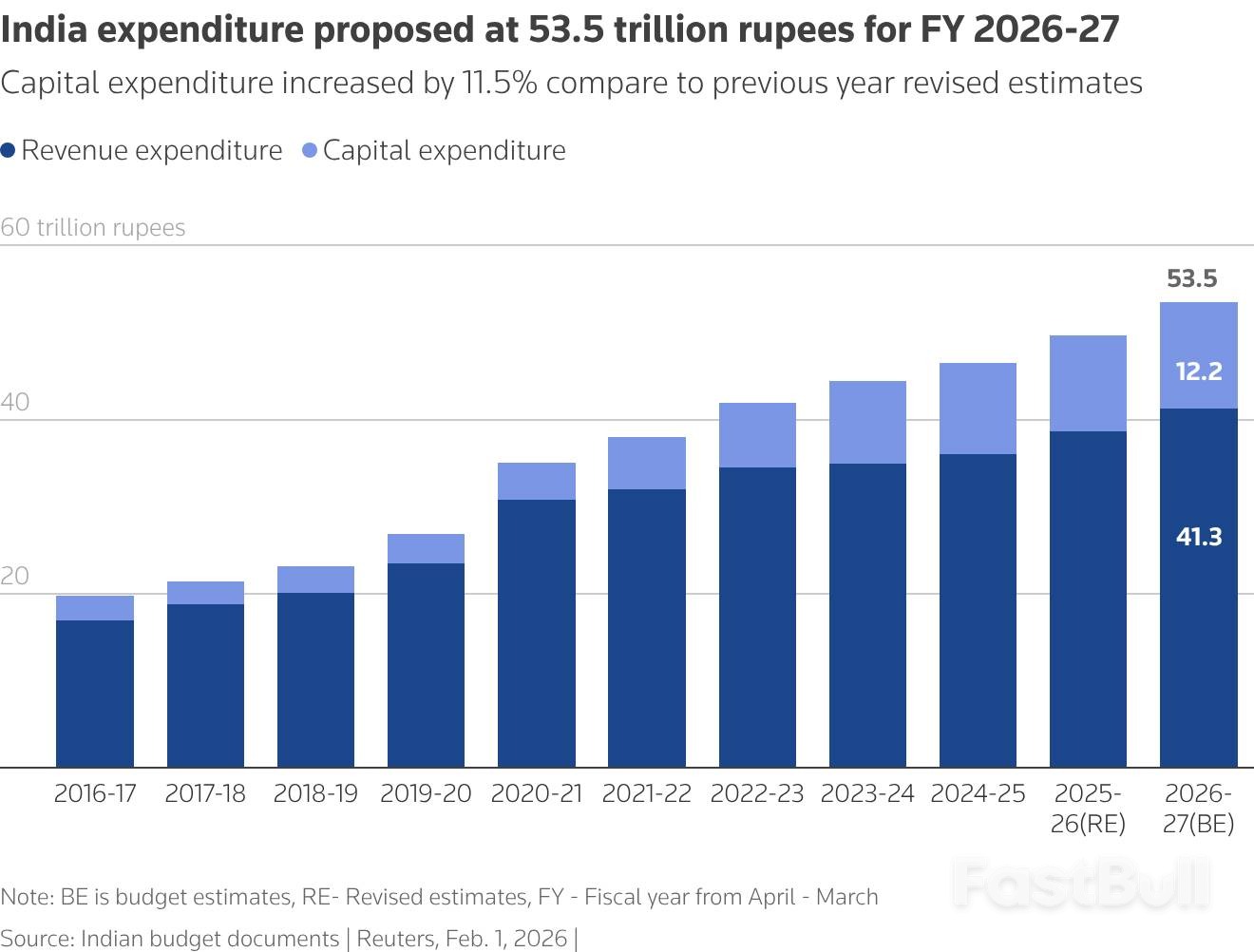

India has unveiled an annual budget that doubles down on manufacturing, signaling a strategic push to boost factory output and accelerate growth in Asia's third-largest economy. Finance Minister Nirmala Sitharaman outlined a plan focused on structural reforms designed to navigate a volatile global environment.

The budget prioritizes strengthening the manufacturing sector, building a more robust financial system, and increasing investment in advanced technologies like artificial intelligence. This comes as the Modi government aims to lift manufacturing's contribution to GDP from its current level of under 20% to a more ambitious 25%, a move critical for creating jobs for millions of new workforce entrants.

The Indian economy is projected to grow by 7.4% in the current financial year, with inflation expected to be near 2%. The government forecasts a fiscal deficit of 4.4% of GDP for the same period.

To drive private investment and demand, the government's budget builds on recent reforms, including tax cuts and an overhaul of labor laws. Sitharaman identified seven key sectors for a manufacturing scale-up:

• Pharmaceuticals

• Semiconductors

• Rare earth magnets

• Chemicals

• Capital goods

• Textiles

• Sports goods

In addition to focusing on these priority areas, the government also plans to revive 200 legacy industrial clusters to further bolster its manufacturing base.

A key shift in fiscal policy is the adoption of the debt-to-GDP ratio as the primary target. The government aims to reduce this ratio from 56.1% in the current year to 55.6%.

To achieve this, the fiscal deficit is targeted to remain at 4.4% in the new financial year. To finance its spending, the government will undertake gross borrowing of 17.2 trillion rupees from the bond markets.

A significant portion of this spending is earmarked for infrastructure. The budget allocates 12.2 trillion Indian rupees ($133.08 billion) for infrastructure projects in the upcoming year, an increase from 11.2 trillion rupees last year.

The government will establish a high-level committee to review the country's financial sector regulations. The goal is to ensure the financial system can effectively support a growing economy. This review will cover rules for non-banking financial companies (NBFCs) and streamline foreign investment management rules to improve market access for international investors.

The budget also introduces measures to deepen the corporate bond market. This includes the introduction of total return swaps (TRS), a type of derivative contract that allows parties to transfer the economic exposure of a bond without an outright sale. Incentives will also be provided to encourage fundraising through municipal bonds.

Prime Minister Narendra Modi framed the budget as part of a long-term strategy, stating, "The nation is moving away from long-term problems to tread the path of long-term solutions."

Before the budget announcement, the government's economic survey projected growth between 6.8% and 7.2% for the fiscal year starting in April. Modi affirmed that India will press ahead with "next-generation reforms," calling the next 25 years crucial for transforming the nation into a developed economy.

These domestic reforms are complemented by international trade efforts, such as a landmark agreement with the European Union, intended to counter the impact of U.S. tariffs on certain Indian goods.

The stock market registered a muted initial response to the budget announcement. India's benchmark Nifty 50 index was nearly flat on the day.

However, specific sectors targeted by the budget saw positive movement. Stocks in electronics manufacturing, infrastructure, textiles, and pharmaceuticals edged higher, with the Nifty pharmaceutical index rising 0.1% and an infrastructure company gauge advancing by about 0.2%.

($1 = 91.6710 Indian rupees)

India's federal government is set to spend a record 12.2 trillion rupees ($133.08 billion) on infrastructure in the 2027 fiscal year, an 11.4% annual increase designed to accelerate growth in Asia's third-largest economy amid global uncertainty.

The plan, unveiled in the federal budget presented by Finance Minister Nirmala Sitharaman, continues a strategy of significantly raising infrastructure investment that began after the COVID-19 pandemic. This approach aims to stimulate economic activity and create jobs in the world's most populous nation, with a renewed focus on the manufacturing sector.

For the current fiscal year ending in March 2026, the government's capital expenditure (capex) was revised down to 10.95 trillion rupees from the initially allocated 11.21 trillion rupees.

The upcoming fiscal year's proposed spending marks a clear commitment to continued public investment.

"The capex outlay for fiscal year 2027 looks a bit modest and misses market expectations slightly, but overall, a positive for the manufacturing sector," said Amit Anwani, an analyst at Prabhudas Lilladher. "It will also be good for private sector capex."

Following the budget announcement, capital goods companies saw their shares rise on the news of higher infrastructure development spending.

Key movers included:

• Larsen & Toubro

• IRB Infra

• NBCC

• Action Construction

These stocks jumped between 1.3% and 4% in response to the government's plans.

The consistent government spending on infrastructure, along with cuts to income and consumption taxes, has helped India's economy remain resilient. The country has so far weathered punitive U.S. tariffs imposed by President Donald Trump.

Economic growth for the current fiscal year is forecast at 7.4%, underscoring the effectiveness of the government's fiscal strategy.

($1 = 91.6710 Indian rupees)

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

Log In

Sign Up