Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

U.S. IHS Markit Manufacturing PMI Prelim (SA) (Jan)

U.S. IHS Markit Manufacturing PMI Prelim (SA) (Jan)A:--

F: --

P: --

U.S. IHS Markit Services PMI Prelim (SA) (Jan)

U.S. IHS Markit Services PMI Prelim (SA) (Jan)A:--

F: --

P: --

U.S. IHS Markit Composite PMI Prelim (SA) (Jan)

U.S. IHS Markit Composite PMI Prelim (SA) (Jan)A:--

F: --

P: --

U.S. UMich Consumer Sentiment Index Final (Jan)

U.S. UMich Consumer Sentiment Index Final (Jan)A:--

F: --

P: --

U.S. UMich Current Economic Conditions Index Final (Jan)

U.S. UMich Current Economic Conditions Index Final (Jan)A:--

F: --

P: --

U.S. UMich Consumer Expectations Index Final (Jan)

U.S. UMich Consumer Expectations Index Final (Jan)A:--

F: --

P: --

U.S. Conference Board Leading Economic Index MoM (Nov)

U.S. Conference Board Leading Economic Index MoM (Nov)A:--

F: --

P: --

U.S. Conference Board Coincident Economic Index MoM (Nov)

U.S. Conference Board Coincident Economic Index MoM (Nov)A:--

F: --

P: --

U.S. Conference Board Lagging Economic Index MoM (Nov)

U.S. Conference Board Lagging Economic Index MoM (Nov)A:--

F: --

P: --

U.S. UMich 1-Year-Ahead Inflation Expectations Final (Jan)

U.S. UMich 1-Year-Ahead Inflation Expectations Final (Jan)A:--

F: --

P: --

U.S. Conference Board Leading Economic Index (Nov)

U.S. Conference Board Leading Economic Index (Nov)A:--

F: --

P: --

U.S. Weekly Total Rig Count

U.S. Weekly Total Rig CountA:--

F: --

P: --

U.S. Weekly Total Oil Rig Count

U.S. Weekly Total Oil Rig CountA:--

F: --

P: --

Japanese Prime Minister Sanae Takaichi delivers a speech

Japanese Prime Minister Sanae Takaichi delivers a speech Germany Ifo Business Expectations Index (SA) (Jan)

Germany Ifo Business Expectations Index (SA) (Jan)A:--

F: --

P: --

Germany IFO Business Climate Index (SA) (Jan)

Germany IFO Business Climate Index (SA) (Jan)A:--

F: --

P: --

Germany Ifo Current Business Situation Index (SA) (Jan)

Germany Ifo Current Business Situation Index (SA) (Jan)A:--

F: --

P: --

Brazil Current Account (Dec)

Brazil Current Account (Dec)A:--

F: --

P: --

Mexico Unemployment Rate (Not SA) (Dec)

Mexico Unemployment Rate (Not SA) (Dec)A:--

F: --

P: --

Canada National Economic Confidence Index

Canada National Economic Confidence IndexA:--

F: --

P: --

U.S. Non-Defense Capital Durable Goods Orders MoM (Excl. Aircraft) (Nov)

U.S. Non-Defense Capital Durable Goods Orders MoM (Excl. Aircraft) (Nov)A:--

F: --

U.S. Durable Goods Orders MoM (Excl. Defense) (SA) (Nov)

U.S. Durable Goods Orders MoM (Excl. Defense) (SA) (Nov)A:--

F: --

U.S. Durable Goods Orders MoM (Excl.Transport) (Nov)

U.S. Durable Goods Orders MoM (Excl.Transport) (Nov)A:--

F: --

P: --

U.S. Durable Goods Orders MoM (Nov)

U.S. Durable Goods Orders MoM (Nov)A:--

F: --

U.S. Chicago Fed National Activity Index (Nov)

U.S. Chicago Fed National Activity Index (Nov)A:--

F: --

U.S. Dallas Fed New Orders Index (Jan)

U.S. Dallas Fed New Orders Index (Jan)A:--

F: --

P: --

U.S. Dallas Fed General Business Activity Index (Jan)

U.S. Dallas Fed General Business Activity Index (Jan)A:--

F: --

U.S. 2-Year Note Auction Avg. Yield

U.S. 2-Year Note Auction Avg. YieldA:--

F: --

P: --

U.K. BRC Shop Price Index YoY (Jan)

U.K. BRC Shop Price Index YoY (Jan)A:--

F: --

P: --

China, Mainland Industrial Profit YoY (YTD) (Dec)

China, Mainland Industrial Profit YoY (YTD) (Dec)A:--

F: --

P: --

Germany 2-Year Schatz Auction Avg. Yield

Germany 2-Year Schatz Auction Avg. Yield--

F: --

P: --

Mexico Trade Balance (Dec)

Mexico Trade Balance (Dec)--

F: --

P: --

U.S. Weekly Redbook Index YoY

U.S. Weekly Redbook Index YoY--

F: --

P: --

U.S. S&P/CS 20-City Home Price Index YoY (Not SA) (Nov)

U.S. S&P/CS 20-City Home Price Index YoY (Not SA) (Nov)--

F: --

P: --

U.S. S&P/CS 20-City Home Price Index MoM (SA) (Nov)

U.S. S&P/CS 20-City Home Price Index MoM (SA) (Nov)--

F: --

P: --

U.S. FHFA House Price Index MoM (Nov)

U.S. FHFA House Price Index MoM (Nov)--

F: --

P: --

U.S. FHFA House Price Index (Nov)

U.S. FHFA House Price Index (Nov)--

F: --

P: --

U.S. FHFA House Price Index YoY (Nov)

U.S. FHFA House Price Index YoY (Nov)--

F: --

P: --

U.S. S&P/CS 10-City Home Price Index YoY (Nov)

U.S. S&P/CS 10-City Home Price Index YoY (Nov)--

F: --

P: --

U.S. S&P/CS 10-City Home Price Index MoM (Not SA) (Nov)

U.S. S&P/CS 10-City Home Price Index MoM (Not SA) (Nov)--

F: --

P: --

U.S. S&P/CS 20-City Home Price Index (Not SA) (Nov)

U.S. S&P/CS 20-City Home Price Index (Not SA) (Nov)--

F: --

P: --

U.S. S&P/CS 20-City Home Price Index MoM (Not SA) (Nov)

U.S. S&P/CS 20-City Home Price Index MoM (Not SA) (Nov)--

F: --

P: --

U.S. Richmond Fed Manufacturing Composite Index (Jan)

U.S. Richmond Fed Manufacturing Composite Index (Jan)--

F: --

P: --

U.S. Conference Board Present Situation Index (Jan)

U.S. Conference Board Present Situation Index (Jan)--

F: --

P: --

U.S. Conference Board Consumer Expectations Index (Jan)

U.S. Conference Board Consumer Expectations Index (Jan)--

F: --

P: --

U.S. Richmond Fed Manufacturing Shipments Index (Jan)

U.S. Richmond Fed Manufacturing Shipments Index (Jan)--

F: --

P: --

U.S. Richmond Fed Services Revenue Index (Jan)

U.S. Richmond Fed Services Revenue Index (Jan)--

F: --

P: --

U.S. Conference Board Consumer Confidence Index (Jan)

U.S. Conference Board Consumer Confidence Index (Jan)--

F: --

P: --

U.S. 5-Year Note Auction Avg. Yield

U.S. 5-Year Note Auction Avg. Yield--

F: --

P: --

U.S. API Weekly Refined Oil Stocks

U.S. API Weekly Refined Oil Stocks--

F: --

P: --

U.S. API Weekly Crude Oil Stocks

U.S. API Weekly Crude Oil Stocks--

F: --

P: --

U.S. API Weekly Gasoline Stocks

U.S. API Weekly Gasoline Stocks--

F: --

P: --

U.S. API Weekly Cushing Crude Oil Stocks

U.S. API Weekly Cushing Crude Oil Stocks--

F: --

P: --

Australia RBA Trimmed Mean CPI YoY (Q4)

Australia RBA Trimmed Mean CPI YoY (Q4)--

F: --

P: --

Australia CPI YoY (Q4)

Australia CPI YoY (Q4)--

F: --

P: --

Australia CPI QoQ (Q4)

Australia CPI QoQ (Q4)--

F: --

P: --

Germany GfK Consumer Confidence Index (SA) (Feb)

Germany GfK Consumer Confidence Index (SA) (Feb)--

F: --

P: --

Germany 10-Year Bund Auction Avg. Yield

Germany 10-Year Bund Auction Avg. Yield--

F: --

P: --

India Industrial Production Index YoY (Dec)

India Industrial Production Index YoY (Dec)--

F: --

P: --

India Manufacturing Output MoM (Dec)

India Manufacturing Output MoM (Dec)--

F: --

P: --

SURYAVANSHI

ID: 5249090

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

India and the EU finalized a landmark trade pact, hailed as transformative yet drawing sharp U.S. criticism over geopolitical links.

India and the European Union announced on Tuesday they have concluded negotiations on an ambitious trade pact, a move celebrated by both sides as the "mother of all deals" in a global economy shaken by U.S. President Donald Trump's tariff policies.

The agreement solidifies a powerful economic bloc. According to the European Commission, trade in goods and services between the EU and India already exceeds €180 billion ($213 billion) annually and supports nearly 800,000 jobs in the EU.

This new deal is projected to double the EU's goods exports to the nation of 1.4 billion people by 2032. The core mechanism is the elimination or reduction of tariffs on 96.6% of the value of EU shipments to India.

Prime Minister Narendra Modi, in a video message, emphasized that the agreement unlocks "big opportunities" for both economies. He noted that the partnership represents a combined 25% of global GDP and one-third of all international trade. "Along with trade, this agreement strengthens our shared commitment toward democracy and rule of law," Modi stated.

The Prime Minister highlighted the strategic value of the pact, framing it as a complement to India's existing agreements with Britain and the European Free Trade Association. "This will strengthen both trade and the global supply chain," he said.

Modi also pointed to specific domestic benefits, congratulating key Indian industries. "I congratulate all those attached with sectors such as textiles, gems and jewelry and leather and shoes as this pact will be very helpful to all of you," he remarked. "This trade deal will not only empower manufacturing in India but will also further expand sectors linked to services."

The agreement outlines significant reductions in Indian tariffs on key European products. Specific changes include:

• European Wines: Tariffs will be slashed from 150% to 75% initially, with a further reduction to as low as 20% over time.

• Olive Oil: The current 45% tariff will be phased out completely, dropping to 0% over a five-year period.

The summit in New Delhi, attended by European Commission President Ursula von der Leyen and European Council President Antonio Costa, also produced a Security and Defense Partnership. This complementary agreement aims to enhance cooperation beyond economics.

According to an EU handout, the partnership will focus on critical areas including:

• Maritime security

• The defense industry

• Cyber and hybrid threats

• Space

• Counter-terrorism

The historic India-EU deal was finalized against a backdrop of friction with the Trump administration. In August, President Trump imposed steep 50% tariffs on Indian goods, which included a 25% penalty targeting New Delhi’s purchases of Russian oil.

The U.S. administration has openly criticized the EU for pursuing the trade pact. In an interview with ABC News on Sunday, U.S. Treasury Secretary Scott Bessent directly challenged the European position.

"We have put 25% tariffs on India for buying Russian oil. Guess what happened last week? The Europeans signed a trade deal with India," Bessent said.

He argued that the EU's actions indirectly undermine sanctions against Russia. "And just to be clear again, the Russian oil goes into India. The refined products come out, and the Europeans buy the refined products. They are financing the war against themselves," Bessent explained. "So, [under] President Trump's leadership, we will eventually end this Ukraine-Russia war."

Canada and India are set to reboot their relationship with a renewed focus on energy, pledging to expand two-way trade in oil and gas after a period of diplomatic tension. The move signals a major strategic reset for both nations.

Under the revived partnership, Ottawa will commit to increasing shipments of crude oil, liquefied natural gas (LNG), and liquefied petroleum gas (LPG) to India. In return, New Delhi will boost its exports of refined petroleum products to Canada.

The agreement is expected to be formalized following a meeting between Canadian Energy Minister Tim Hodgson and Indian Petroleum and Natural Gas Minister Hardeep Singh Puri at India Energy Week in Goa on Tuesday.

This meeting serves to relaunch the "ministerial energy dialogue," a key channel for cooperation that had become inactive during a dispute over the killing of a Canadian Sikh activist.

The renewed dialogue extends beyond traditional fossil fuels. According to a joint statement, Hodgson and Puri will also commit to:

• Facilitating greater reciprocal investment in their respective energy sectors.

• Exploring collaboration on hydrogen, biofuels, and battery storage.

• Cooperating on critical minerals and modernizing electricity systems.

• Investigating the use of artificial intelligence in the energy industry.

This initiative is a key part of Prime Minister Mark Carney's effort to diversify Canada's export markets, particularly as trade tensions with the United States escalate. It reflects a shift toward a more pragmatic, economy-focused diplomacy with major Asian partners.

The relaunch signals that both governments recognize significant untapped potential in their energy relationship. Prime Minister Carney is expected to visit India in the coming weeks to solidify this reset, building on talks he and Prime Minister Narendra Modi restarted in November for a comprehensive economic partnership agreement.

In 2024, two-way goods trade between the two countries reached C$13.3 billion ($9.7 billion), and Ottawa sees substantial room for growth. Energy is a primary focus, with India currently accounting for just 1% of Canada's critical minerals exports.

New infrastructure, including the expansion of the Trans Mountain pipeline, creates a more direct path for Canadian crude to reach India, though most shipments still transit through the U.S. Gulf Coast. Canada's west coast LPG terminals also offer relatively short shipping routes to the Indian market, and the country began exporting LNG to Asia in June 2025.

Carney's push to strengthen ties with India follows a recent trip to Beijing, where an agreement to reduce tariff barriers prompted U.S. President Donald Trump to threaten 100% tariffs on Canadian goods. Carney has maintained that Canada is not pursuing a free trade agreement with China.

1315 – US Weekly ADP Employment Change (4 weeks ending Jan 3)1400 – US Nov. Home Price Index1500 – US Jan Conference Board Consumer Confidence1800 – US Treasury to auction 5-year notes0030 – Australia Dec. and Q4 CPI data

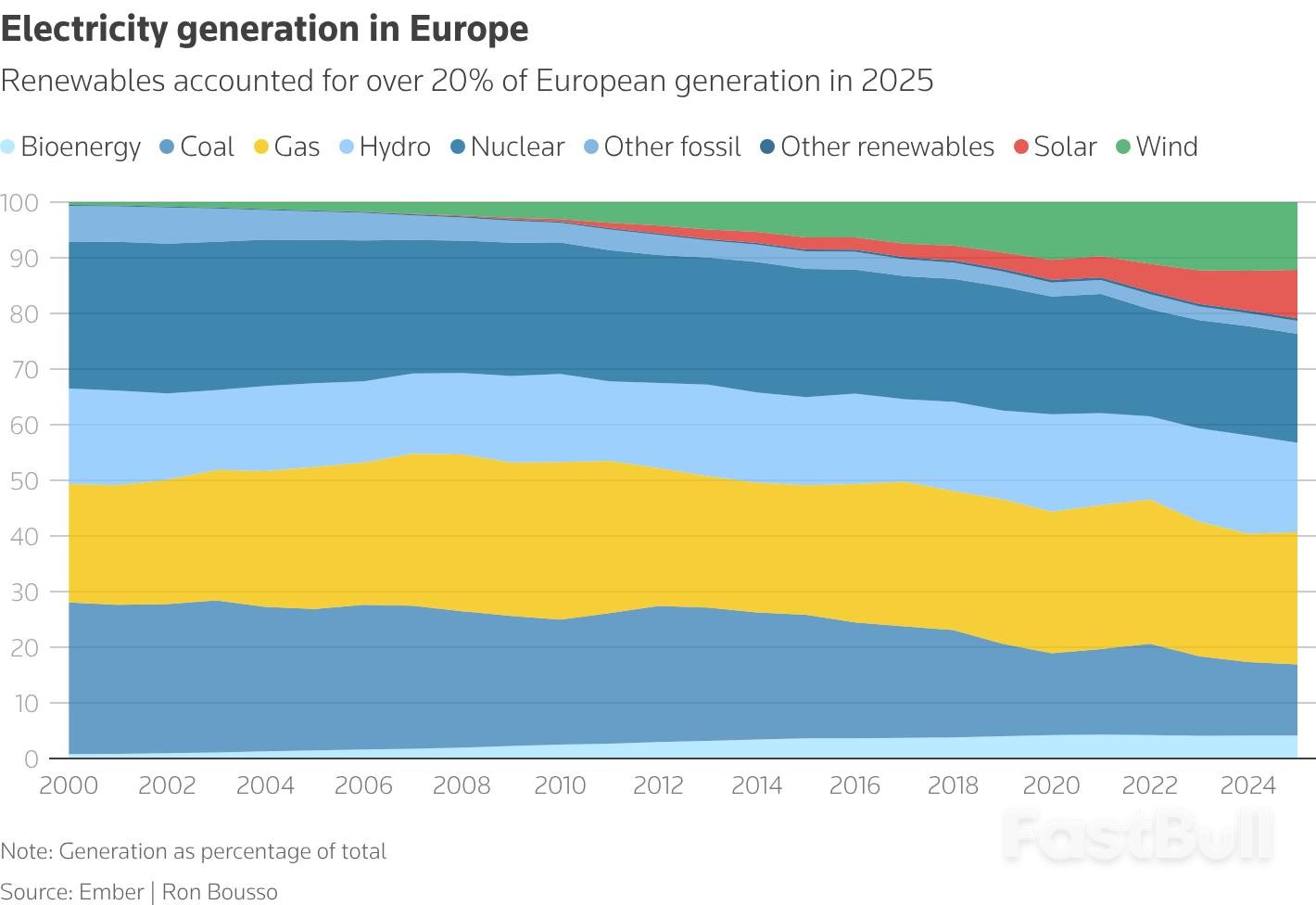

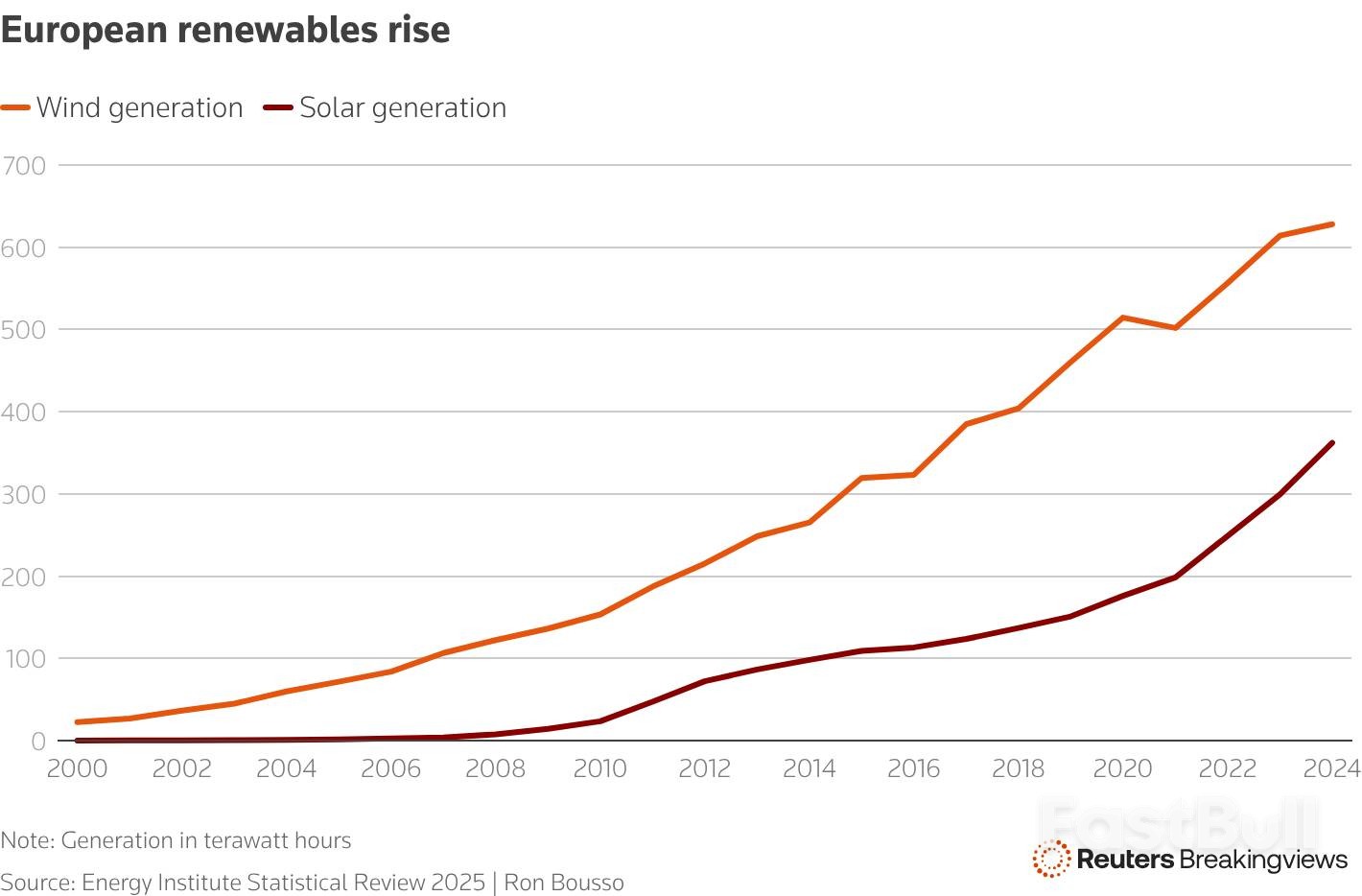

Ten European nations have agreed to jointly develop a massive offshore wind network, a landmark move designed to secure the region's energy supply, reduce dependence on U.S. natural gas, and manage the rising cost of renewables.

At the North Sea Summit, ministers from Britain, Belgium, Denmark, France, Germany, Iceland, Ireland, Luxembourg, the Netherlands, and Norway signed a pact to build 100 gigawatts (GW) of offshore wind capacity. This ambitious project aims to power over 50 million households and builds on a 2023 commitment to install 300 GW of offshore wind by 2050—a strategy initially driven by the energy crisis following Russia's 2022 invasion of Ukraine.

The agreement comes at a critical juncture in Europe's relationship with the United States. Following the disruption of Russian gas flows, Europe has become heavily reliant on U.S. liquefied natural gas (LNG). In 2025, U.S. gas made up 57% of all LNG imports into the EU and Britain, accounting for roughly a quarter of the region's total gas supply.

Concerns over this dependency have been amplified by President Donald Trump's "energy dominance" agenda and transactional approach to diplomacy, highlighted by a recent dispute over Greenland. This new wind power initiative is a clear effort to build a more independent and homegrown energy system.

While wind power is central to Northern Europe's energy strategy—generating 19% of EU electricity in 2025—the industry faces significant headwinds. The region currently operates just 37 GW of offshore wind capacity, making the planned 100 GW expansion a profound transformation of its power market.

Globally, investor confidence in clean energy has cooled due to rising capital costs, supply chain bottlenecks, and concerns over China's dominance in renewables manufacturing. In the U.S., the Trump administration's open hostility toward green energy, especially wind power, has led to the cancellation of multiple projects and further weakened market sentiment.

At the same time, Europe's cost-of-living crisis, exacerbated by high energy prices, has made climate policies a political battleground, creating public resistance to net-zero initiatives.

The multi-nation offshore wind pact is designed to address cost concerns as much as energy security. It includes several features aimed at lowering development expenses and, eventually, consumer electricity bills.

Leveraging Economies of Scale

The sheer scale of the 100 GW commitment is its most powerful feature. By providing the offshore wind supply chain with greater demand certainty, the plan is expected to spur investment in European manufacturing. Industry group WindEurope projects the initiative will:

• Cut costs by 30% between 2025 and 2040.

• Create 91,000 jobs.

• Generate 1 trillion euros ($1.19 trillion) in economic activity.

Building an Integrated Power Network

A core element of the agreement is a plan to connect wind farms to multiple countries through a network of bidirectional cables and interconnectors. This integrated grid will allow electricity to flow where it is most needed, improving efficiency and giving operators the flexibility to respond to shifting supply and demand across different markets.

This cross-border "arbitrage" should also minimize "negative pricing" events, where excess wind generation forces operators to shut down turbines and receive compensation. "When it is windy in Germany, it may not be windy in the UK, so if Germany can't use all of the power, the UK can take some instead of wasting it," explained Jordan May, a senior analyst at consultancy TGS 4C.

Furthermore, because the network will span multiple time zones, peak demand hours will vary by country. This diversity should make it easier to match supply with demand, reducing the need for gas-fired backup power.

An Unexpected Boost from US Policy

Europe may also benefit indirectly from President Trump's stance on wind energy. The U.S. offshore wind sector has seen a sharp downturn, with the International Energy Agency slashing its 2030 forecast for the country by over 50%. Reduced American demand for vessels, components, and services could lead to lower prices for European operators.

Despite the plan's potential, the path forward is complex. European governments must develop intricate new regulations to align different national subsidy programs and power market rules—a process that could take years and face political opposition.

The cost of transitioning to renewables remains a contentious issue in Europe. However, forecasting these costs is difficult, and the same uncertainty applies to fossil fuels, which are subject to volatile global prices. While offshore wind requires significant upfront investment, its long-term operating costs are generally lower. In contrast, gas-fired plants are cheaper to build but remain exposed to price shocks.

Critically, debates over the cost of renewables often overlook the cost of inaction. Europe's power demand is projected to nearly double by 2050, requiring massive investment to upgrade and expand aging grids regardless of the energy source. Delaying this work will only make it more expensive.

Ultimately, this joint offshore wind plan provides a clear path toward greater energy independence and industrial strength. Its success, however, will be measured by its ability to deliver lower, more stable electricity prices for European consumers.

Chancellor Friedrich Merz came to power with a promise to revive Europe's largest economy through an unprecedented fiscal stimulus after two years of contraction. While Germany's growth prospects are central to the eurozone's recovery, economists and business leaders warn that the deep structural reforms needed for sustainable growth have yet to materialize.

The country's sluggish federal decision-making process, combined with a coalition partner hesitant about some of Merz’s more aggressive plans, threatens to stall the reform agenda. Furthermore, idle industrial capacity will take time to bring back online, potentially slowing the recovery.

After expanding by a mere 0.2% in 2025, the German economy is projected to see healthier growth this year as government spending accelerates.

Forecasts for 2026 point toward a moderate upswing. The International Monetary Fund anticipates 1.1% growth, while the German government officially expects a 1.3% expansion, though a source told Reuters this figure will likely be revised down to 1.0%.

"A moderate upswing is a good sign, but the recovery remains fragile," noted Ulrich Reuter, president of Germany's savings banks association DSGV, who also forecasts 1.0% growth.

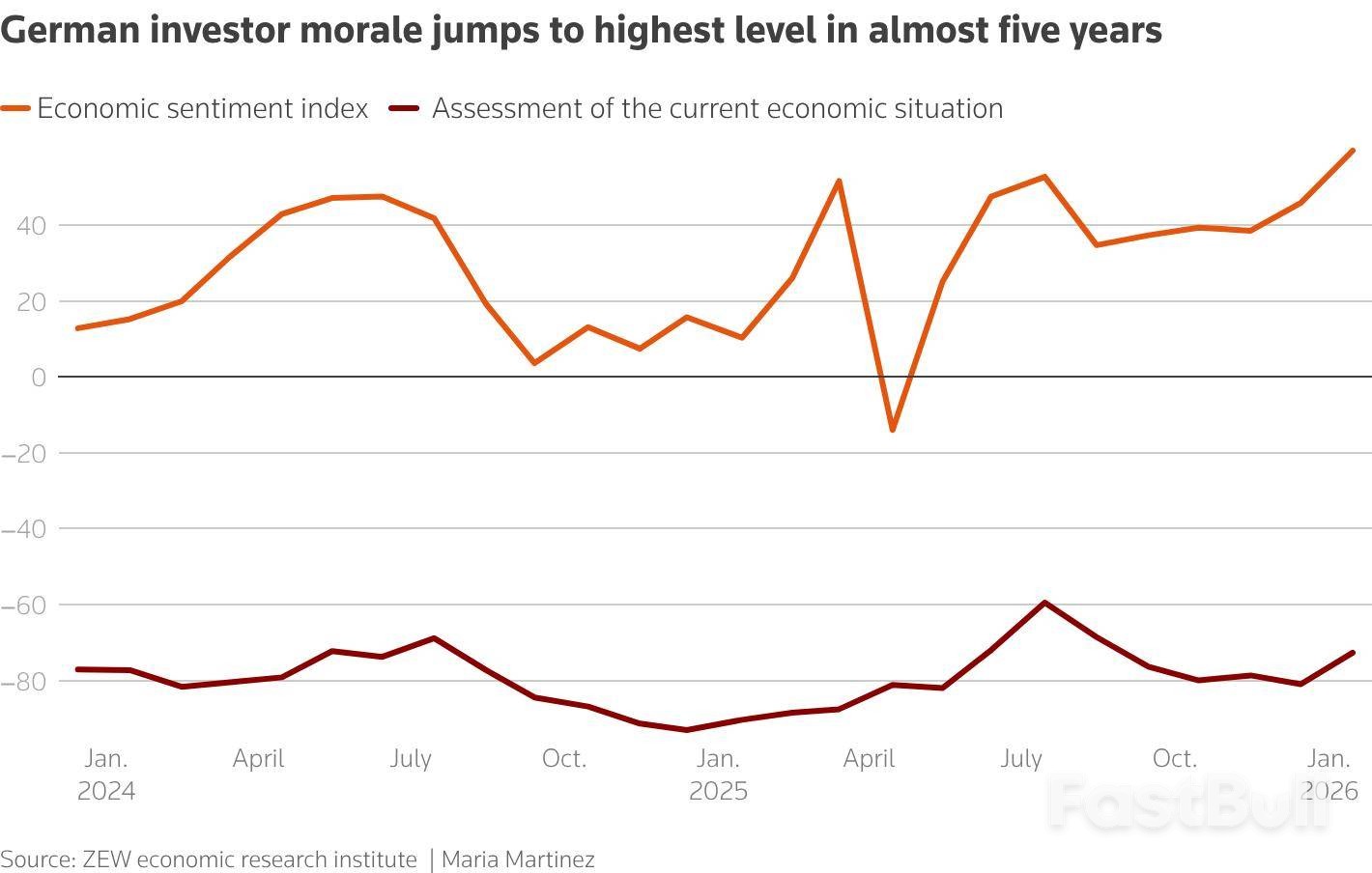

Investor morale is one bright spot, hitting its highest level since August 2021 in January, according to the ZEW economic research institute.

"It is reasonable to look ahead to 2026 with cautious optimism: If the fiscal measures that have already been decided take full effect, a noticeable pickup is possible," said Geraldine Dany-Knedlik, an economist at the German Institute for Economic Research DIW Berlin.

Despite the optimism, progress has been slow. A landmark 500 billion euro ($593 billion) special fund for infrastructure was approved by parliament last March, yet only 24 billion euros had been invested by the end of the year. This reflects the slow pace of decision-making inherent in Germany's federal system.

Public impatience has grown, especially now that Merz has been in office for over eight months. The initial enthusiasm surrounding the government's fiscal policy shift has also waned amid concerns that parts of the infrastructure fund are being used for daily spending rather than growth-enhancing projects.

Even if a recovery is underway, Germany's problems are structural, self-inflicted, and cannot be fixed quickly, according to Carsten Brzeski, global head of macro at ING.

"This time around, the economy almost needs a complete makeover," Brzeski said, pointing to the need to cut red tape, roll out e-government, and address the fiscal burden of an aging population.

However, Merz's pro-business agenda has met resistance from his centre-left Social Democrat (SPD) coalition partners. The SPD is wary of reforms they believe could weaken workers' rights, leading to disputes over pension changes and tax policy that have hindered progress.

The most difficult structural challenges—including pensions, health insurance financing, and fiscal rule reform—have been delegated to commissions that are not due to report until the end of 2026. This means many of the biggest decisions are still pending.

Fiscal stimulus is providing some support to the industrial sector, which has shown tentative signs of stabilization. Industrial production rose by 0.8% in November, marking its third consecutive monthly increase.

Industrial orders climbed 5.6% month-on-month in November, and private sector business activity grew at its fastest rate in three months in January, according to the flash composite PMI.

"This makes us more confident that, after six years of stagnation, Germany will grow again in 2026. However, we would not get carried away," commented Franziska Palmas, senior Europe economist at Capital Economics.

Despite these positive signals, the BDI industry association projects that industry will likely expand more slowly than the overall economy this year. BDI Managing Director Tanja Goenner highlighted that industrial capacity utilization was at 78% in October, well below the long-term average of 83.3%, marking the longest period of underutilization.

"This means machines are standing still, production potential remains unused, investments are being postponed and employment is being reduced," she explained.

On the domestic front, household demand remains weak. Consumer sentiment fell in January as the tendency to save reached its highest point since the 2008 financial crisis. Spending is expected to stay muted this year as unemployment rises, a lagging effect from the economic stagnation of previous years.

Meanwhile, corporate distress is on the rise. The number of bankruptcies and insolvency-related business closures has reached an 11-year high.

To reverse this trend, DIHK chief analyst Volker Treier insists that the structural problems facing companies must be addressed urgently. "It is up to Chancellor Friedrich Merz and his government to implement these reforms this year and turn a long-awaited rebound into a sustainable recovery," he said.

FX traders are preparing for a very lively day on Wednesday as focus should move away from geopolitical concerns and onto fundamentals for a few sessions. There is some key data out earlier in the day, but the real attention will be on the North American trading session where we hear interest rate updates from both the Bank of Canada and the Federal Reserve Bank, and as always, the Fed should dominate market sentiment across global markets.

After the drama of last month's meeting where the Fed closed out 2025 with another 25-basis point cut, the market is expecting this meeting conclusion to be slightly quieter with chances now up at 97% that they will keep rates on hold. Moves should come from forward guidance from the statement and press conference as projections are not declared at this meeting. Data has remained fairly stable in the US with growth remaining strong, jobs numbers still weak – although the unemployment rate dipped on the last reading – and inflation still sticky, the Core PCE still up at 2.8% well off the Fed's desired 2%.

Some currencies are sitting at very sensitive levels going into the meeting and anything slightly off expectations could see some big moves in the market. The dollar has taken a big hit over the last few sessions and Cable looks particularly vulnerable to a topside move if we hear anything more dovish than expected from the FOMC, while anything on the hawkish side should see it drop hard back into recent ranges. Key long-term trendline resistance on the Daily chart is now relatively close at 1.3730 and a break there opens the way for a move up to the 2025 high at 1.3788, while a move south could see the 200-day moving average at 1.3413 challenged.

Resistance 2: 1.3788 – 2025 High

Resistance 1: 1.3733 – Trendline Resistance

Support 1: 1.3413 – 200 – Day Moving Average

Support 2: 1.3335 – 19 Jan Low

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

Log In

Sign Up