Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

U.K. CPI MoM (Dec)

U.K. CPI MoM (Dec)A:--

F: --

P: --

U.K. Input PPI MoM (Not SA) (Dec)

U.K. Input PPI MoM (Not SA) (Dec)A:--

F: --

U.K. Core CPI MoM (Dec)

U.K. Core CPI MoM (Dec)A:--

F: --

P: --

U.K. Retail Prices Index MoM (Dec)

U.K. Retail Prices Index MoM (Dec)A:--

F: --

P: --

U.K. Input PPI YoY (Not SA) (Dec)

U.K. Input PPI YoY (Not SA) (Dec)A:--

F: --

P: --

U.K. CPI YoY (Dec)

U.K. CPI YoY (Dec)A:--

F: --

P: --

U.K. Output PPI MoM (Not SA) (Dec)

U.K. Output PPI MoM (Not SA) (Dec)A:--

F: --

P: --

U.K. Output PPI YoY (Not SA) (Dec)

U.K. Output PPI YoY (Not SA) (Dec)A:--

F: --

P: --

U.K. Core Retail Prices Index YoY (Dec)

U.K. Core Retail Prices Index YoY (Dec)A:--

F: --

P: --

U.K. Core CPI YoY (Dec)

U.K. Core CPI YoY (Dec)A:--

F: --

P: --

U.K. Retail Prices Index YoY (Dec)

U.K. Retail Prices Index YoY (Dec)A:--

F: --

P: --

Indonesia 7-Day Reverse Repo Rate

Indonesia 7-Day Reverse Repo RateA:--

F: --

P: --

Indonesia Loan Growth YoY (Dec)

Indonesia Loan Growth YoY (Dec)A:--

F: --

P: --

Indonesia Deposit Facility Rate (Jan)

Indonesia Deposit Facility Rate (Jan)A:--

F: --

P: --

Indonesia Lending Facility Rate (Jan)

Indonesia Lending Facility Rate (Jan)A:--

F: --

P: --

South Africa Core CPI YoY (Dec)

South Africa Core CPI YoY (Dec)A:--

F: --

P: --

South Africa CPI YoY (Dec)

South Africa CPI YoY (Dec)A:--

F: --

P: --

IEA Oil Market Report

IEA Oil Market Report U.K. CBI Industrial Output Expectations (Jan)

U.K. CBI Industrial Output Expectations (Jan)A:--

F: --

U.K. CBI Industrial Prices Expectations (Jan)

U.K. CBI Industrial Prices Expectations (Jan)A:--

F: --

P: --

South Africa Retail Sales YoY (Nov)

South Africa Retail Sales YoY (Nov)A:--

F: --

P: --

U.K. CBI Industrial Trends - Orders (Jan)

U.K. CBI Industrial Trends - Orders (Jan)A:--

F: --

P: --

Mexico Retail Sales MoM (Nov)

Mexico Retail Sales MoM (Nov)A:--

F: --

P: --

U.S. MBA Mortgage Application Activity Index WoW

U.S. MBA Mortgage Application Activity Index WoWA:--

F: --

P: --

Canada Industrial Product Price Index YoY (Dec)

Canada Industrial Product Price Index YoY (Dec)A:--

F: --

Canada Industrial Product Price Index MoM (Dec)

Canada Industrial Product Price Index MoM (Dec)A:--

F: --

U.S. Weekly Redbook Index YoY

U.S. Weekly Redbook Index YoYA:--

F: --

P: --

U.S. Pending Home Sales Index YoY (Dec)

U.S. Pending Home Sales Index YoY (Dec)A:--

F: --

P: --

U.S. Pending Home Sales Index MoM (SA) (Dec)

U.S. Pending Home Sales Index MoM (SA) (Dec)A:--

F: --

P: --

U.S. Construction Spending MoM (Oct)

U.S. Construction Spending MoM (Oct)A:--

F: --

U.S. Pending Home Sales Index (Dec)

U.S. Pending Home Sales Index (Dec)A:--

F: --

P: --

U.S. API Weekly Refined Oil Stocks

U.S. API Weekly Refined Oil Stocks--

F: --

P: --

U.S. API Weekly Gasoline Stocks

U.S. API Weekly Gasoline Stocks--

F: --

P: --

U.S. API Weekly Cushing Crude Oil Stocks

U.S. API Weekly Cushing Crude Oil Stocks--

F: --

P: --

U.S. API Weekly Crude Oil Stocks

U.S. API Weekly Crude Oil Stocks--

F: --

P: --

South Korea GDP Prelim YoY (SA) (Q4)

South Korea GDP Prelim YoY (SA) (Q4)--

F: --

P: --

South Korea GDP Prelim QoQ (SA) (Q4)

South Korea GDP Prelim QoQ (SA) (Q4)--

F: --

P: --

Japan Imports YoY (Dec)

Japan Imports YoY (Dec)--

F: --

P: --

Japan Exports YoY (Dec)

Japan Exports YoY (Dec)--

F: --

P: --

Japan Goods Trade Balance (SA) (Dec)

Japan Goods Trade Balance (SA) (Dec)--

F: --

P: --

Japan Trade Balance (Not SA) (Dec)

Japan Trade Balance (Not SA) (Dec)--

F: --

Australia Employment (Dec)

Australia Employment (Dec)--

F: --

P: --

Australia Labor Force Participation Rate (SA) (Dec)

Australia Labor Force Participation Rate (SA) (Dec)--

F: --

P: --

Australia Unemployment Rate (SA) (Dec)

Australia Unemployment Rate (SA) (Dec)--

F: --

P: --

Australia Full-time Employment (SA) (Dec)

Australia Full-time Employment (SA) (Dec)--

F: --

P: --

Turkey Consumer Confidence Index (Jan)

Turkey Consumer Confidence Index (Jan)--

F: --

P: --

Turkey Capacity Utilization (Jan)

Turkey Capacity Utilization (Jan)--

F: --

P: --

Turkey Late Liquidity Window Rate (LON) (Jan)

Turkey Late Liquidity Window Rate (LON) (Jan)--

F: --

P: --

Turkey Overnight Lending Rate (O/N) (Jan)

Turkey Overnight Lending Rate (O/N) (Jan)--

F: --

P: --

Turkey 1-Week Repo Rate

Turkey 1-Week Repo Rate--

F: --

P: --

U.K. CBI Distributive Trades (Jan)

U.K. CBI Distributive Trades (Jan)--

F: --

P: --

U.K. CBI Retail Sales Expectations Index (Jan)

U.K. CBI Retail Sales Expectations Index (Jan)--

F: --

P: --

U.S. Weekly Continued Jobless Claims (SA)

U.S. Weekly Continued Jobless Claims (SA)--

F: --

P: --

U.S. Initial Jobless Claims 4-Week Avg. (SA)

U.S. Initial Jobless Claims 4-Week Avg. (SA)--

F: --

P: --

U.S. Real Personal Consumption Expenditures Final QoQ (Q3)

U.S. Real Personal Consumption Expenditures Final QoQ (Q3)--

F: --

P: --

Canada New Housing Price Index MoM (Dec)

Canada New Housing Price Index MoM (Dec)--

F: --

P: --

U.S. Weekly Initial Jobless Claims (SA)

U.S. Weekly Initial Jobless Claims (SA)--

F: --

P: --

U.S. Real GDP Annualized QoQ Final (Q3)

U.S. Real GDP Annualized QoQ Final (Q3)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

Spot gold jumped 1.7% to a new all-time high of $4,844.39 an ounce by 21:13 ET (02:13 GMT), extending a relentless rally that has pushed bullion to successive all-time highs this month.

Gold prices smashed through $4,800 an ounce on Wednesday, scaling another record high as escalating tensions linked to Greenland and renewed trade frictions rattled global markets and drove investors toward safe-haven assets.

Spot gold jumped 1.7% to a new all-time high of $4,844.39 an ounce by 21:13 ET (02:13 GMT), extending a relentless rally that has pushed bullion to successive all-time highs this month.

U.S. Gold Futures climbed1.3% to $4,830.04.

Gold prices have jumped more than 5% this week, including today's gains.

The latest surge came as relations between the U.S. and Europe remained strained over Greenland's strategic importance.

U.S. President Donald Trump has insisted there is "no going back" on Greenland, citing security concerns in the Arctic, and has threatened tariffs against European countries, unsettling markets already on edge over global trade risks.

French President Emmanuel Macron said Europe would not bow to "bullies," stressing that respect and cooperation, not coercion, should define relations between allies.

His remarks, delivered on the sidelines of the World Economic Forum in Davos, underscored growing unease in Europe over Washington's rhetoric and trade threats tied to the Greenland dispute.

Trump sought to calm nerves by saying the U.S. was working on the issue and aimed for an outcome that would satisfy NATO, but investors remained cautious.

Investor demand for gold was further boosted by weakness in the U.S. dollar, which slid about 0.8% on Tuesday to a two-week low.

The US Dollar Index traded 0.2% lower during Asian hours on Wednesday.

A softer dollar makes gold cheaper for holders of other currencies and typically lifts demand for the non-yielding metal.

Among other precious metals, silver prices edged slightly lower to $93.9/oz after hitting a record high of $95.87.oz on Tuesday.

Platinum rose to a record high of $2,519.51/oz on Wednesday but later pared gains to trade 0.6% lower at $2,450.9/oz.

South Korean President Lee Jae Myung has stated that the country's currency could strengthen and find stability around the 1,400 won per dollar mark within the next one to two months.

Speaking at a press conference on Wednesday, Lee addressed concerns over the won's recent weakness, framing it as part of a broader global trend rather than a problem unique to South Korea. He noted that other major currencies, like the Japanese yen, have experienced even greater pressure.

Lee pointed to the nation's economic fundamentals as a source of strength. "We have achieved a record-high $700 billion in exports, the trade balance remains in surplus, and growth is recovering, yet the exchange rate is hovering at levels seen last year," he said.

Despite the president's optimistic outlook, the won has fallen over 8% against the US dollar since the beginning of the second half of 2025. This decline has persisted despite various market interventions by policymakers.

Several factors are contributing to the downward pressure on the currency:

• Retail Investor Outflows: Korean retail investors have shown a strong appetite for US stocks, with their holdings reaching a new record of nearly $172 billion this month, according to data from the Korea Securities Depository. This demand for dollars weighs on the won.

• US Investment Pledges: A commitment made last year to invest a total of $350 billion in the United States as part of a trade deal has raised concerns about financing the capital outflow. A source familiar with the matter told Bloomberg News that the government plans to delay a pledged $20 billion investment in the US this year due to the currency pressure.

President Lee acknowledged the difficulty of the situation, stating that arresting the won's drop is hard to resolve "through our own policies alone."

President Lee defended the won's relative performance, comparing it favorably to the yen. "Compared to Japan, ours has depreciated less," he commented, adding that if the won had fallen at the same rate, the exchange rate would be closer to 1,600. In his view, the currency was "holding up relatively well."

He reiterated the government's commitment to currency stability, promising to "explore possible means and strive to stabilize the exchange rate."

The president's remarks triggered an immediate market response. The won, which had been lagging behind a broader trend of global dollar weakness, reversed course. It rose as much as 0.6% to 1,468.90 against the dollar in Seoul trading.

Gyeong-Won Min, an economist at Woori Bank, explained the rally: "The won...rebounded after the president's comments, prompting demand to unwind bets on dollar strength."

Ethereum (ETH) price slipped below a closely watched support level this week, putting short-term pressure on the market.

Still, stakeholder growth, strong network use, and steady institutional activity continue to shape the broader outlook.

Ethereum (ETH) price has been under pressure after losing support around the $3,060 level. Traders had been watching this zone for weeks, as it held this price point during earlier pullbacks.

Once it gave way, selling picked up and pushed Ethereum (ETH) lower. The move did not trigger panic, but it did shift near-term sentiment.

Meanwhile, many short-term traders now see the $2,900 area as the next level to watch. This zone has acted as support before and could slow further declines.

Ethereum Price Chart | Source: OSHO

Ethereum Price Chart | Source: OSHOIf that level fails, attention turns to the $2,300 range, which some market participants still view as a major downside target.

That area lines up with earlier trading ranges where buyers were active.

Despite the drop, Ethereum price action remains controlled. Volumes have stayed moderate, suggesting this is not a rush for the exits.

Instead, ETH price appears stuck in a narrow range as buyers and sellers wait for direction. This kind of movement often follows long rallies, especially when markets lack fresh news.

Still, the big question is whether Ethereum price can still push toward $4,000. For that to happen, the market would need to reclaim lost support and break through resistance near recent highs.

That likely requires stronger demand and a clearer shift in sentiment. Until then, sideways movement remains the base case.

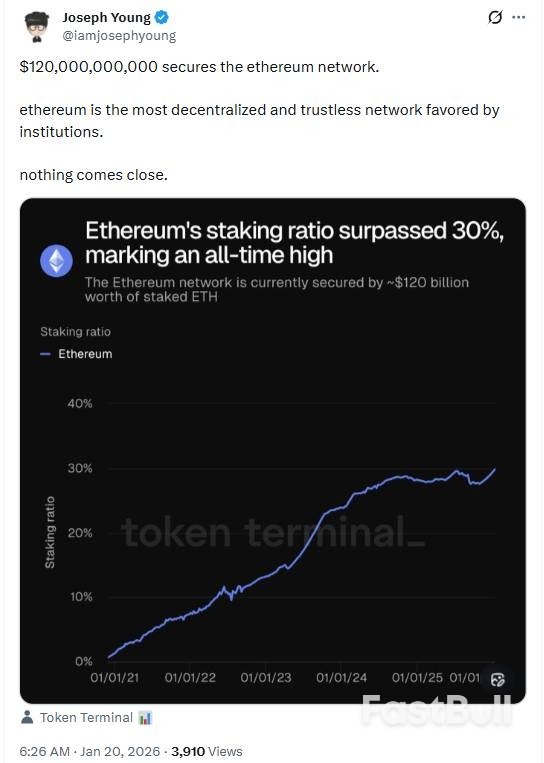

Away from Ethereum price charts, the protocol continues to show strength at the network level. More than 30% of all ETH is now staked, marking a new record.

At current prices, this represents roughly $120 billion securing the network. This steady rise points to growing trust in Ethereum's long-term role.

Notably, staking removes ETH from active circulation, which can reduce sudden supply shocks. It also strengthens network security by increasing the value locked by validators.

For many holders, staking offers a reason to hold through price swings rather than trade short-term moves.

Still, Ethereum remains one of the most decentralized public blockchains in use, according to Joseph Young. Validators are spread across regions and operators, lowering the risk of control by a small group.

Ethereum Decentralization Showcase | Source: Joseph Young

Ethereum Decentralization Showcase | Source: Joseph YoungThis structure continues to appeal to developers, institutions, and users who value neutrality and uptime.

The rise in staking during a period of weaker price action is notable. It suggests that many participants are focused less on short-term price and more on yield and network participation.

This behavior supports the view that Ethereum is maturing beyond a pure trading asset.

In a separate development, institutional interest in Ethereum has continued to grow, even as the price cools.

Large financial firms are launching real products on Ethereum and its scaling networks, not just pilot programs. Tokenized funds, stocks, and money market products are now live and in use.

Several asset managers have moved to offer Ethereum exposure that includes staking rewards.

This reflects comfort with Ethereum's structure and its yield model. For institutions, staking turns ETH into an income-generating asset rather than a static holding.

Banks, payment firms, and fintech companies are also building on Ethereum to support stablecoins and settlements.

These projects depend on network reliability, not daily price moves. Their growth adds steady demand for Ethereum block space.

Ethereum price may struggle in the short term, but institutional behavior points to a longer positive view. Firms are committing capital and infrastructure, not chasing quick gains.

If broader market conditions improve, this base could support another run toward $4,000. Until then, Ethereum remains in a pause, balancing price weakness against deepening adoption.

Demand for Indonesian bonds fell to the lowest in 10 months at an auction as a selloff in the rupiah deepened and concerns over the country's fiscal health persisted.

Indonesia sold 36 trillion rupiah ($2.1 billion) of debt on Tuesday, an upsized amount that drew just 82.9 trillion rupiah of bids, according to the Ministry of Finance's debt management office. The bid-to-target ratio fell to 2.51, the weakest since March 18, according to data compiled by Bloomberg.

The waning appetite for Indonesian bonds reflects a broader selloff in the global debt markets, led by declines in Japanese notes as Prime Minister Sanae Takaichi's tax plan raised fiscal fears. In the Southeast Asian country, populist spending and concerns over the central bank independence have added pressure to the rupiah, pushing the currency to a record low.

Overseas investors submitted bids for just 3.9 trillion rupiah of debt at the auction, well below last year's average of 15.6 trillion rupiah, said Handy Yunianto, head of fixed-income research at PT Mandiri Sekuritas. "Foreign investors always look at yield spread and foreign-exchange risks and both of them are currently not favorable for Indonesian bonds."

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up