Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

MSCI's Nordic Countries Index Rose 0.3%, Marking Its Third Consecutive Day Of Gains, Closing At 394.43 Points. Among The Ten Sectors, The Nordic Industrials Sector Saw The Largest Increase. Boliden Ab Closed Up 5.3%, Leading The Pack Among Nordic Stocks

[Italian Banking Sector Hits Record Closing High] Germany's DAX 30 Index Closed Down 0.02% At 24,793.06 Points. France's Stock Index Closed Down 0.13%, Italy's Stock Index Closed Up 0.80% With The Banking Index Up 1.24%, And The UK Stock Index Closed Down 0.39%

[Bitcoin Falls Below $77,000, 24-Hour Decline Of 2.8%] February 4Th, According To Htx Market Data, Bitcoin Fell Below $77,000, Now Trading At $76,900, A 24-Hour Decrease Of 2.8%

Spot Gold Surged $302.83 During The Day, Currently Trading At $4,963.79 Per Ounce, A Gain Of 6.50%

Denmark's Forex Reserves 673.9 Billion DKK At End-January Versus 651.1 Billion At End-December

Fitch: Forecasts UK's Inflation Outlook To Be More Benign This Year And For Bank Of England To Respond With Three Rate Cuts In 2026

U.K. Manufacturing PMI Final (Jan)

U.K. Manufacturing PMI Final (Jan)A:--

F: --

P: --

Turkey Trade Balance (Jan)

Turkey Trade Balance (Jan)A:--

F: --

P: --

Brazil IHS Markit Manufacturing PMI (Jan)

Brazil IHS Markit Manufacturing PMI (Jan)A:--

F: --

P: --

Canada National Economic Confidence Index

Canada National Economic Confidence IndexA:--

F: --

P: --

Canada Manufacturing PMI (SA) (Jan)

Canada Manufacturing PMI (SA) (Jan)A:--

F: --

P: --

U.S. IHS Markit Manufacturing PMI Final (Jan)

U.S. IHS Markit Manufacturing PMI Final (Jan)A:--

F: --

P: --

U.S. ISM Output Index (Jan)

U.S. ISM Output Index (Jan)A:--

F: --

P: --

U.S. ISM Inventories Index (Jan)

U.S. ISM Inventories Index (Jan)A:--

F: --

P: --

U.S. ISM Manufacturing Employment Index (Jan)

U.S. ISM Manufacturing Employment Index (Jan)A:--

F: --

P: --

U.S. ISM Manufacturing New Orders Index (Jan)

U.S. ISM Manufacturing New Orders Index (Jan)A:--

F: --

P: --

U.S. ISM Manufacturing PMI (Jan)

U.S. ISM Manufacturing PMI (Jan)A:--

F: --

P: --

US President Trump delivered a speech

US President Trump delivered a speech South Korea CPI YoY (Jan)

South Korea CPI YoY (Jan)A:--

F: --

P: --

Japan Monetary Base YoY (SA) (Jan)

Japan Monetary Base YoY (SA) (Jan)A:--

F: --

P: --

Australia Building Approval Total YoY (Dec)

Australia Building Approval Total YoY (Dec)A:--

F: --

Australia Building Permits MoM (SA) (Dec)

Australia Building Permits MoM (SA) (Dec)A:--

F: --

Australia Building Permits YoY (SA) (Dec)

Australia Building Permits YoY (SA) (Dec)A:--

F: --

P: --

Australia Private Building Permits MoM (SA) (Dec)

Australia Private Building Permits MoM (SA) (Dec)A:--

F: --

Australia Overnight (Borrowing) Key Rate

Australia Overnight (Borrowing) Key RateA:--

F: --

P: --

RBA Rate Statement

RBA Rate Statement Japan 10-Year Note Auction Yield

Japan 10-Year Note Auction YieldA:--

F: --

P: --

The U.S. House of Representatives voted on a short-term spending bill to end the partial government shutdown.

The U.S. House of Representatives voted on a short-term spending bill to end the partial government shutdown. Saudi Arabia IHS Markit Composite PMI (Jan)

Saudi Arabia IHS Markit Composite PMI (Jan)A:--

F: --

P: --

RBA Press Conference

RBA Press Conference Turkey PPI YoY (Jan)

Turkey PPI YoY (Jan)A:--

F: --

P: --

Turkey CPI YoY (Jan)

Turkey CPI YoY (Jan)A:--

F: --

P: --

Turkey CPI YoY (Excl. Energy, Food, Beverage, Tobacco & Gold) (Jan)

Turkey CPI YoY (Excl. Energy, Food, Beverage, Tobacco & Gold) (Jan)A:--

F: --

P: --

U.K. 10-Year Note Auction Yield

U.K. 10-Year Note Auction YieldA:--

F: --

P: --

Richmond Federal Reserve President Barkin delivered a speech.

Richmond Federal Reserve President Barkin delivered a speech. U.S. Weekly Redbook Index YoY

U.S. Weekly Redbook Index YoYA:--

F: --

P: --

Mexico Manufacturing PMI (Jan)

Mexico Manufacturing PMI (Jan)A:--

F: --

P: --

U.S. API Weekly Refined Oil Stocks

U.S. API Weekly Refined Oil Stocks--

F: --

P: --

U.S. API Weekly Gasoline Stocks

U.S. API Weekly Gasoline Stocks--

F: --

P: --

U.S. API Weekly Cushing Crude Oil Stocks

U.S. API Weekly Cushing Crude Oil Stocks--

F: --

P: --

U.S. API Weekly Crude Oil Stocks

U.S. API Weekly Crude Oil Stocks--

F: --

P: --

Japan IHS Markit Services PMI (Jan)

Japan IHS Markit Services PMI (Jan)--

F: --

P: --

Japan IHS Markit Composite PMI (Jan)

Japan IHS Markit Composite PMI (Jan)--

F: --

P: --

China, Mainland Caixin Services PMI (Jan)

China, Mainland Caixin Services PMI (Jan)--

F: --

P: --

China, Mainland Caixin Composite PMI (Jan)

China, Mainland Caixin Composite PMI (Jan)--

F: --

P: --

India HSBC Services PMI Final (Jan)

India HSBC Services PMI Final (Jan)--

F: --

P: --

India IHS Markit Composite PMI (Jan)

India IHS Markit Composite PMI (Jan)--

F: --

P: --

Russia IHS Markit Services PMI (Jan)

Russia IHS Markit Services PMI (Jan)--

F: --

P: --

South Africa IHS Markit Composite PMI (SA) (Jan)

South Africa IHS Markit Composite PMI (SA) (Jan)--

F: --

P: --

Italy Services PMI (SA) (Jan)

Italy Services PMI (SA) (Jan)--

F: --

P: --

Italy Composite PMI (Jan)

Italy Composite PMI (Jan)--

F: --

P: --

Germany Composite PMI Final (SA) (Jan)

Germany Composite PMI Final (SA) (Jan)--

F: --

P: --

Euro Zone Composite PMI Final (Jan)

Euro Zone Composite PMI Final (Jan)--

F: --

P: --

Euro Zone Services PMI Final (Jan)

Euro Zone Services PMI Final (Jan)--

F: --

P: --

U.K. Composite PMI Final (Jan)

U.K. Composite PMI Final (Jan)--

F: --

P: --

U.K. Total Reserve Assets (Jan)

U.K. Total Reserve Assets (Jan)--

F: --

P: --

U.K. Services PMI Final (Jan)

U.K. Services PMI Final (Jan)--

F: --

P: --

U.K. Official Reserves Changes (Jan)

U.K. Official Reserves Changes (Jan)--

F: --

P: --

Euro Zone Core CPI Prelim YoY (Jan)

Euro Zone Core CPI Prelim YoY (Jan)--

F: --

P: --

Euro Zone Core HICP Prelim YoY (Jan)

Euro Zone Core HICP Prelim YoY (Jan)--

F: --

P: --

Euro Zone PPI MoM (Dec)

Euro Zone PPI MoM (Dec)--

F: --

P: --

Euro Zone HICP Prelim YoY (Jan)

Euro Zone HICP Prelim YoY (Jan)--

F: --

P: --

Euro Zone Core HICP Prelim MoM (Jan)

Euro Zone Core HICP Prelim MoM (Jan)--

F: --

P: --

Italy HICP Prelim YoY (Jan)

Italy HICP Prelim YoY (Jan)--

F: --

P: --

Euro Zone Core CPI Prelim MoM (Jan)

Euro Zone Core CPI Prelim MoM (Jan)--

F: --

P: --

Euro Zone PPI YoY (Dec)

Euro Zone PPI YoY (Dec)--

F: --

P: --

U.S. MBA Mortgage Application Activity Index WoW

U.S. MBA Mortgage Application Activity Index WoW--

F: --

P: --

No matching data

View All

No data

Technical Analysis

Traders' Opinions

Remarks of Officials

Data Interpretation

Economic

Central Bank

Commodity

Daily News

Gold and silver surged dramatically after a historic sell-off, as analysts noted a technical rebound amid bullish long-term prospects.

Gold and silver prices surged on Tuesday, with gold on track for its largest single-day gain since November 2008 as investors rushed back into precious metals following a historic two-day sell-off.

Spot gold climbed 4.9% to trade at $4,895.69 an ounce by 1120 GMT, rebounding sharply from a low of $4,403.24 hit on Monday. The metal’s price remains below the recent historic peak of $5,594.82 per ounce reached last week. U.S. gold futures for April delivery also saw strong buying, rising 5.7% to $4,918.10 per ounce.

Silver experienced an even more dramatic recovery, surging 8.6% to $86.3 an ounce. The rally comes after the metal posted a record 27% one-day drop on Friday, followed by another 6% decline on Monday.

Analysts suggest the sharp recovery is a technical rebound after prices became oversold. "The market was oversold after the announcement of U.S. President Donald Trump to nominate Kevin Warsh as the next Federal Reserve chairman. What we see today is a rebound," said Peter Fertig, an analyst at Quantitative Commodity Research.

Fertig added that traders who had previously sold to lock in profits are now re-entering the market. "You also see investors who have sold on profit taking are now regarding the prices as attractive again for buying," he explained.

The initial price slump was driven by two key factors. While investors believe potential Fed chair Kevin Warsh would favor rate cuts, they also anticipate he will tighten the central bank's balance sheet—a policy move that typically supports the U.S. dollar and pressures gold.

Pressure on prices was amplified when the CME Group raised margin requirements on precious metal futures, making it more expensive to hold leveraged positions.

Despite the recent volatility, many analysts believe the long-term bull run for gold remains intact and expect the metal to hit new record highs later this year.

"Gold has now cleared its first retracement hurdle at $4,858, shifting focus toward $5,000 — the 50 per cent retracement of the latest slump," noted Ole Hansen, head of commodity strategy at Saxo Bank. For silver, Hansen identified the equivalent technical levels higher up at $90.58 and $96.52.

Adding a layer of uncertainty to the market, the U.S. Bureau of Labor Statistics announced on Monday that the January employment report, a critical economic indicator, would not be released this Friday due to the partial shutdown of the federal government.

Other precious metals also saw significant gains on Tuesday.

• Spot platinum climbed 5.1% to $2,228.84 per ounce, recovering from a slide after hitting a record high of $2,918.80 on January 26.

• Palladium rose 4.5% to trade at $1,796.44.

Donald Trump has intensified his campaign to force the Federal Reserve into cutting interest rates, but his focus has pivoted from the Fed's policy rate to the long-term borrowing costs that directly impact voters. This shift presents a major challenge for his Fed Chair nominee, Kevin Warsh, who may find it impossible to deliver.

The stakes are high for millions of Americans facing steep mortgage rates and for Trump himself, as his success in the November midterm elections could hinge on addressing the "affordability crisis." Treasury Secretary Scott Bessent has voiced a desire for a 10-year Treasury yield starting with a "3," a level only briefly seen during Trump's second term. The White House has consistently blamed current Fed Chair Jerome Powell for this, but that argument misses the mark.

The Federal Reserve’s direct power is primarily over the short-term Fed funds rate. While this rate serves as a foundation for credit card, auto, and business loans, it's the benchmark 10-year Treasury yield that truly dictates long-term borrowing costs like mortgages—and the Fed has very little control over it.

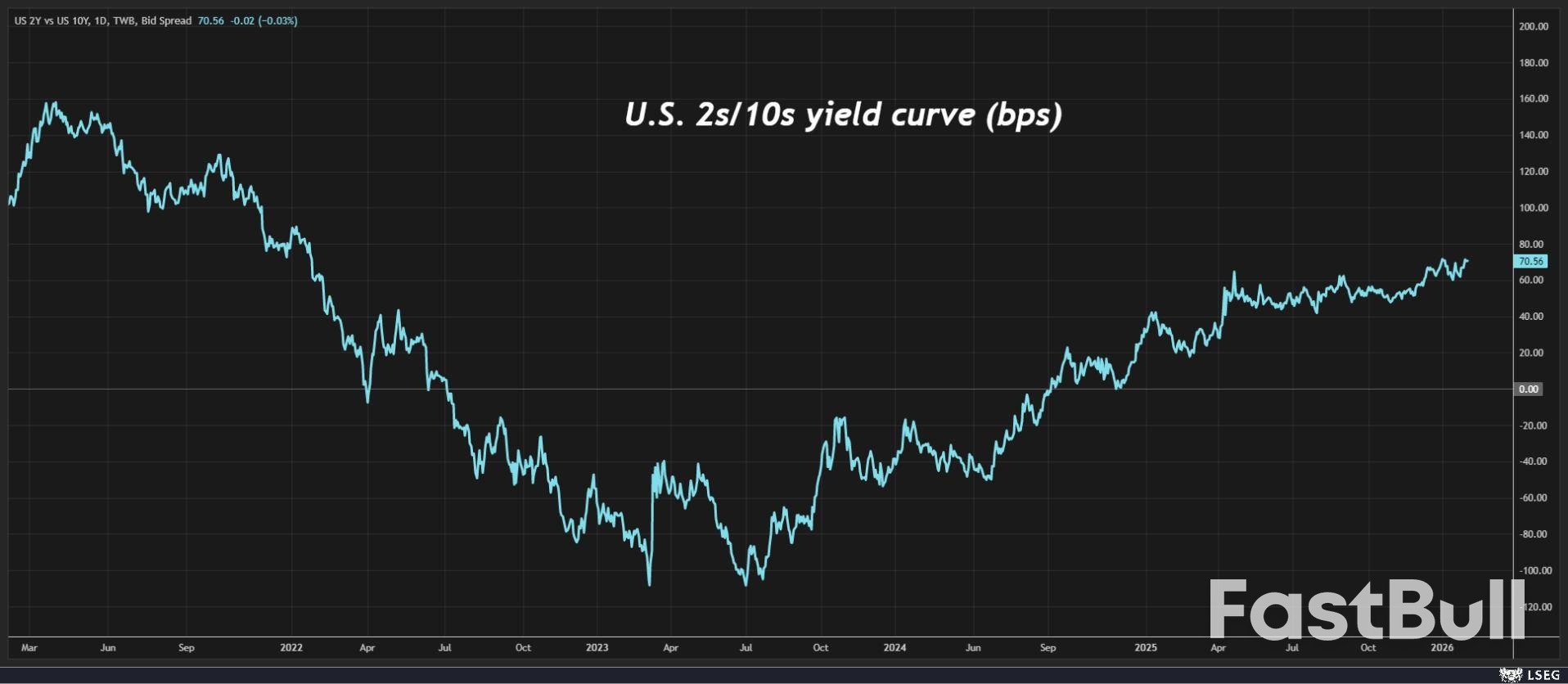

A clear example of this disconnect occurred late last year when Powell's Fed cut its policy rate by 75 basis points. Instead of falling, the 10-year Treasury yield actually climbed, now hovering around 4.30%. This has caused the yield curve to "steepen," widening the gap between short- and long-term yields to its largest in four years.

While a steeper curve can signal a healthy, normalizing economy, today's trend may point to a darker outlook for long-term inflation and interest rates.

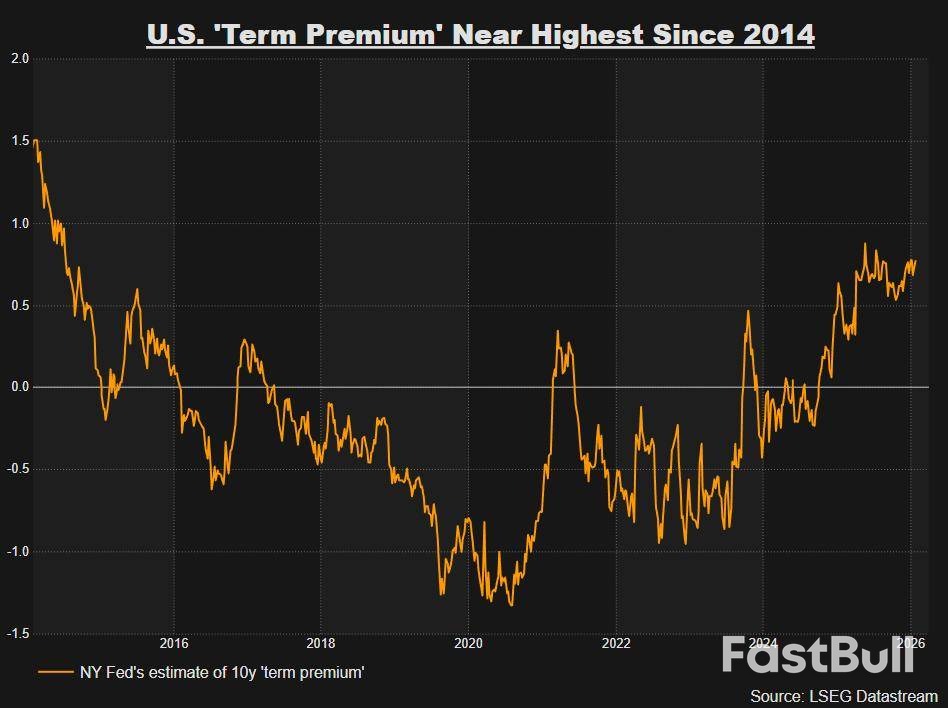

The stubbornness of long-term rates reflects a rising "term premium"—the extra compensation investors demand to hold long-term government bonds instead of rolling over short-term debt. This premium on 10-year Treasuries is now near its highest level in more than a decade.

Several factors are driving this increase:

• Sticky Inflation: Both current inflation and consumer expectations for future inflation remain elevated.

• Fiscal Worries: The long-term trajectory of U.S. public finances is a growing concern for investors.

• Central Bank Independence: Questions about the Fed's independence have not helped stabilize market sentiment.

Interest rate futures markets predict a Warsh-led Fed would cut the funds rate by 50 basis points this year, but there is little confidence that long-term rates would follow. Investors seem to be signaling a potential policy mistake: that further rate cuts now could ignite higher inflation and, consequently, higher rates down the road.

Warsh and Bessent believe they have a solution: an artificial intelligence-driven productivity boom. They argue that AI could lower inflation expectations and, ultimately, bring down long-term borrowing costs. Even Powell has acknowledged that such a scenario could help the Fed achieve its inflation target.

If this plays out, falling mortgage rates could revive the housing market and create a powerful "wealth effect" for consumers. Thirty-year mortgage rates have remained above 6% since mid-2022, a fact that Trump, a former real estate developer, is keenly aware of.

However, banking on an AI-powered bailout is a significant gamble. The productivity-enhancing effects of AI are still unproven, and it’s a stretch to assume they can counteract the powerful forces currently pushing yields higher.

Several key economic indicators suggest that long-term yields are unlikely to fall anytime soon.

• Strong Growth: The Atlanta Fed's GDPNow model estimates real economic growth is running at around 4%, implying nominal growth of nearly 7%.

• Loose Financial Conditions: According to Goldman Sachs, financial conditions are the loosest they have been in four years.

• Booming Markets: Wall Street continues to perform strongly.

None of these factors support the case for lower long-term yields or continued cuts to the Fed funds rate. Only a sharp economic downturn, a collapse in the labor market, or a major geopolitical shock would likely change this outlook—scenarios that aren't part of the Bessent-Warsh playbook.

Recognizing these limitations, Trump has started to target long-term rates more directly, threatening to cap credit card interest rates at 10% and directing the government to purchase more mortgage-backed securities. Yet he will almost certainly continue to pressure the next Fed Chair to lower rates. The fundamental problem remains: the Fed's power to control long-term borrowing costs is far more limited than the White House believes.

China has released its annual "No 1 document," a key policy blueprint outlining the government's top priorities for rural and agricultural development. The plan focuses on stabilizing grain and oilseed production, diversifying agricultural imports, and providing greater support to farmers.

This strategy comes as Beijing contends with a complex mix of trade friction with major food exporters like the US and Canada, a domestic economic slowdown, and mounting climate challenges. While China achieved record grain output last year, its heavy reliance on imports has prompted an accelerated push toward self-sufficiency through investments in machinery and seed technology.

A central theme of the new policy is the push to diversify supply chains. The document mentions "diversification" three times, a notable increase from just once in 2025, signaling a strategic pivot. The goals are to expand oilseed supplies, develop a more varied food system, and broaden the sources of agricultural imports.

According to Even Rogers Pay, director at the Beijing-based consultancy Trivium China, this emphasis shows that policymakers view diversification as crucial for making the country's food system more secure. "(It's) a strategy to make China's food system... more resilient when shocks like natural disasters or trade wars occur," Pay noted. This approach could reduce dependence on traditional exporters and boost trade with nations in the Global South.

The policy on soybeans clearly illustrates this new focus. The directive has shifted from consolidating gains in planting area in 2025 to a new mandate of "consolidating and enhancing production capacity."

Pay suggests this change indicates a greater emphasis on improving crop yield and quality rather than simply expanding the land used for cultivation. This move is part of a broader effort to reduce reliance on US soybeans, which are primarily used for animal feed in China's massive pork industry. Since the first trade war, Beijing has actively boosted domestic production to bolster food security. As a result, the US market share for soybeans in China dropped from 41% in 2016 to just 15% in 2025.

The document also outlines ambitious plans to modernize the agricultural sector through technological innovation. Key initiatives include:

• Strengthening agricultural research platforms.

• Supporting leading agri-tech companies.

• Advancing industrialized biotech cultivation.

• Integrating artificial intelligence (AI) with farming practices.

• Cultivating a new generation of specialized agricultural talent.

Beyond technology, the plan aims to build internationally competitive agricultural enterprises, support key exports, and crack down on the smuggling of agricultural products while actively participating in global food governance.

The policy blueprint also addresses challenges within the domestic meat industry, which has recently struggled with oversupply and low prices that have squeezed producer profits. The government intends to strengthen the management of pork production, a staple in the country.

Additionally, the plan calls for targeted support for the beef and dairy sectors and includes measures to promote dairy consumption. The government has already implemented policies to stabilize the industry, such as introducing a quota system for beef imports and placing tariffs on certain EU dairy products.

The U.S. House of Representatives is preparing for a tense vote on Tuesday to end the latest government shutdown, as a spending deal faces unexpected resistance from both Democrats and hardline conservatives.

While the funding package sailed through the Senate with bipartisan support and has President Donald Trump's endorsement, its passage in the House is far from certain.

The legislation is designed to fund several key government functions through October. If passed, the bill would allocate funds for:

• Defense

• Healthcare and Labor

• Education

• Housing and other agencies

Crucially, it also includes a temporary funding extension for the Department of Homeland Security. This measure is intended to give lawmakers more time to negotiate potential changes to the nation's immigration enforcement policies. After clearing the House, the bill would head to President Trump's desk to be signed into law.

The bill's path is complicated by an unusual alignment of opposition, with both sides of the aisle threatening to block it for different reasons.

Democrats Push for Immigration Restraints

Democrats are demanding new controls on President Trump's aggressive immigration enforcement strategies. Their position has hardened following an incident last month in Minneapolis where federal agents killed two U.S. citizens.

House Democratic Leader Hakeem Jeffries confirmed his party plans to vote "no" on an initial procedural vote Tuesday morning. However, he left the door open for some members to support the final package if it manages to clear that first hurdle.

Conservatives Demand Voter ID Rules

On the other side, a group of hardline Republicans is threatening to derail the legislation unless it incorporates new voting requirements. Their demands include provisions that would require proof of U.S. citizenship for voter registration and photo IDs for casting a ballot.

House Speaker Mike Johnson dismissed the proposal, stating that such measures do not belong in a spending bill. "Republicans are serious about governing. We'll demonstrate that," he said.

The political math for House Republicans is tight. With a slim 218-214 majority, they can only afford to lose a single Republican vote if Democrats remain united in their opposition.

President Trump weighed in on Monday, urging lawmakers not to amend the bill. He warned that any changes could risk prolonging the partial government shutdown that officially began on Saturday.

A swift resolution is needed to prevent widespread disruption to government services and the broader economy. The memory of the most recent government shutdown, which lasted a record 43 days in October and November, looms large.

That shutdown resulted in furloughs for hundreds of thousands of federal workers and is estimated to have cost the U.S. economy around $11 billion.

The Federal Reserve's recent interest rate cuts are a strategic "insurance" policy designed to protect the U.S. job market, according to Richmond Fed President Tom Barkin. Speaking on Tuesday, Barkin framed the moves as a way to support employment while the central bank navigates the "last mile" of its battle to bring inflation back to its 2% target.

Since the fall of 2024, the Fed has approved 1.75 percentage points in rate cuts. Barkin explained these actions have "taken out some insurance to support the labor market as we work to complete the last mile to bring inflation back to target."

He noted that while the unemployment rate remains low by historical standards, inflation is still about a percentage point above the Fed’s goal but is expected to fall in the coming months.

"So far so good," Barkin said, but he emphasized the need for the central bank to finish the task of returning inflation to 2% after a nearly five-year miss.

Barkin expressed serious concern about the persistence of high prices. "Inflation...still remains above our target. That's been the case since 2021," he stated in prepared remarks for a South Carolina education group. "I take this sustained miss seriously."

He argued that current price levels have a direct impact on future expectations, stating, "Today's inflation numbers, regardless of the 'why,' significantly influence tomorrow's inflation."

Although Barkin is not a voting member on monetary policy this year, his comments align with the Fed's current pause on further cuts. The central bank is awaiting more data confirming an expected decline in inflation, all while navigating a leadership transition following the nomination of former Governor Kevin Warsh to succeed Jerome Powell as Chair.

Looking ahead, Barkin projected that the U.S. economy will remain resilient in 2026. He anticipates "significant stimulus" from upcoming deregulation and tax reductions, which he believes will keep economic activity strong.

Business and consumer confidence also appears solid. "It's hard to imagine consumers and businesses moving to the sidelines," Barkin said. He added that corporate contacts confirm this sentiment, telling him that "demand is fine" and that "most firms I speak to still aren't doing layoffs at scale."

A recent jump in productivity is providing another key support for the economy. Barkin noted that this trend helps ease inflationary pressures directly.

When productivity is high, "businesses can bear higher input costs without facing as much pressure to increase prices," he explained. This allows companies to absorb rising costs rather than passing them on to consumers.

China's independent "teapot" refiners are strategically shifting their crude oil purchases, turning to discounted Iranian supplies to fill a major void left by the sudden disruption of Venezuelan oil exports. This pivot by the world’s largest crude importer follows a dramatic halt in shipments from the South American nation.

Venezuelan oil shipments to China effectively ceased after a series of events drastically altered the country's political and industrial landscape. The disruption began when US President Donald Trump imposed a blockade in December on Venezuelan oil tankers attempting to leave the country.

The situation reportedly escalated on January 3rd, when U.S. forces bombed the capital city of Caracas, abducted Venezuelan President Nicholas Maduro, and took control of the nation's oil sector. Washington subsequently announced it was placing Venezuela’s oil revenues into accounts in Qatar, to be controlled by the White House.

In the face of this uncertainty, the state-owned firm PetroChina has halted all its oil purchases from Caracas. While the White House has permitted global trading firms Vitol and Trafigura to sell up to 50 million barrels of Venezuelan oil, the direct flow to key Chinese buyers has been severed.

In response to the supply vacuum, Beijing's independent refiners have ramped up their purchases of Iranian heavy crude. According to sources familiar with the matter, this oil is being sourced from bonded storage tanks within China and from ships, all at steep discounts.

Further Chinese purchases of Iranian Heavy and Pars crude grades are expected to continue through February and March. The primary driver is economic: with few willing buyers due to U.S. sanctions, Iran is offering its Heavy crude at a discount of about $12 per barrel.

This pricing makes Iranian oil highly competitive. For comparison, Russian Urals crude also trades at a significant discount of $11 to $12 per barrel due to sanctions. Meanwhile, the Venezuelan crude being offered by Vitol with Washington's permission carries a much smaller discount of roughly $5 per barrel.

Before the disruption, China's imports from Venezuela were substantial, averaging 394,000 barrels per day (bpd) and accounting for around 4% of Beijing's total seaborne crude imports.

The geopolitical chessboard for energy continues to change. President Trump recently announced that India will begin purchasing Venezuelan oil, a move intended to help replace its Russian supplies amid U.S. tariff threats. This comes after New Delhi had previously stopped buying oil from Caracas last year after the Trump administration imposed a 25% tariff on countries doing so.

Ultimately, aggressive U.S. sanctions targeting Russia, Venezuela, and Iran have forced major energy consumers like China and India to constantly adapt their procurement strategies in a volatile global market.

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

Log In

Sign Up