Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

Japan Tankan Small Manufacturing Outlook Index (Q4)

Japan Tankan Small Manufacturing Outlook Index (Q4)A:--

F: --

P: --

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)A:--

F: --

P: --

Japan Tankan Large Manufacturing Outlook Index (Q4)

Japan Tankan Large Manufacturing Outlook Index (Q4)A:--

F: --

P: --

Japan Tankan Small Manufacturing Diffusion Index (Q4)

Japan Tankan Small Manufacturing Diffusion Index (Q4)A:--

F: --

P: --

Japan Tankan Large Manufacturing Diffusion Index (Q4)

Japan Tankan Large Manufacturing Diffusion Index (Q4)A:--

F: --

P: --

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)A:--

F: --

P: --

U.K. Rightmove House Price Index YoY (Dec)

U.K. Rightmove House Price Index YoY (Dec)A:--

F: --

P: --

China, Mainland Industrial Output YoY (YTD) (Nov)

China, Mainland Industrial Output YoY (YTD) (Nov)A:--

F: --

P: --

China, Mainland Urban Area Unemployment Rate (Nov)

China, Mainland Urban Area Unemployment Rate (Nov)A:--

F: --

P: --

Saudi Arabia CPI YoY (Nov)

Saudi Arabia CPI YoY (Nov)A:--

F: --

P: --

Euro Zone Industrial Output YoY (Oct)

Euro Zone Industrial Output YoY (Oct)A:--

F: --

P: --

Euro Zone Industrial Output MoM (Oct)

Euro Zone Industrial Output MoM (Oct)A:--

F: --

P: --

Canada Existing Home Sales MoM (Nov)

Canada Existing Home Sales MoM (Nov)A:--

F: --

P: --

Canada National Economic Confidence Index

Canada National Economic Confidence IndexA:--

F: --

P: --

Canada New Housing Starts (Nov)

Canada New Housing Starts (Nov)A:--

F: --

U.S. NY Fed Manufacturing Employment Index (Dec)

U.S. NY Fed Manufacturing Employment Index (Dec)A:--

F: --

P: --

U.S. NY Fed Manufacturing Index (Dec)

U.S. NY Fed Manufacturing Index (Dec)A:--

F: --

P: --

Canada Core CPI YoY (Nov)

Canada Core CPI YoY (Nov)A:--

F: --

P: --

Canada Manufacturing Unfilled Orders MoM (Oct)

Canada Manufacturing Unfilled Orders MoM (Oct)A:--

F: --

P: --

U.S. NY Fed Manufacturing Prices Received Index (Dec)

U.S. NY Fed Manufacturing Prices Received Index (Dec)A:--

F: --

P: --

U.S. NY Fed Manufacturing New Orders Index (Dec)

U.S. NY Fed Manufacturing New Orders Index (Dec)A:--

F: --

P: --

Canada Manufacturing New Orders MoM (Oct)

Canada Manufacturing New Orders MoM (Oct)A:--

F: --

P: --

Canada Core CPI MoM (Nov)

Canada Core CPI MoM (Nov)A:--

F: --

P: --

Canada Trimmed CPI YoY (SA) (Nov)

Canada Trimmed CPI YoY (SA) (Nov)A:--

F: --

P: --

Canada Manufacturing Inventory MoM (Oct)

Canada Manufacturing Inventory MoM (Oct)A:--

F: --

P: --

Canada CPI YoY (Nov)

Canada CPI YoY (Nov)A:--

F: --

P: --

Canada CPI MoM (Nov)

Canada CPI MoM (Nov)A:--

F: --

P: --

Canada CPI YoY (SA) (Nov)

Canada CPI YoY (SA) (Nov)A:--

F: --

P: --

Canada Core CPI MoM (SA) (Nov)

Canada Core CPI MoM (SA) (Nov)A:--

F: --

P: --

Canada CPI MoM (SA) (Nov)

Canada CPI MoM (SA) (Nov)A:--

F: --

P: --

Federal Reserve Board Governor Milan delivered a speech

Federal Reserve Board Governor Milan delivered a speech U.S. NAHB Housing Market Index (Dec)

U.S. NAHB Housing Market Index (Dec)--

F: --

P: --

Australia Composite PMI Prelim (Dec)

Australia Composite PMI Prelim (Dec)--

F: --

P: --

Australia Services PMI Prelim (Dec)

Australia Services PMI Prelim (Dec)--

F: --

P: --

Australia Manufacturing PMI Prelim (Dec)

Australia Manufacturing PMI Prelim (Dec)--

F: --

P: --

Japan Manufacturing PMI Prelim (SA) (Dec)

Japan Manufacturing PMI Prelim (SA) (Dec)--

F: --

P: --

U.K. 3-Month ILO Employment Change (Oct)

U.K. 3-Month ILO Employment Change (Oct)--

F: --

P: --

U.K. Unemployment Claimant Count (Nov)

U.K. Unemployment Claimant Count (Nov)--

F: --

P: --

U.K. Unemployment Rate (Nov)

U.K. Unemployment Rate (Nov)--

F: --

P: --

U.K. 3-Month ILO Unemployment Rate (Oct)

U.K. 3-Month ILO Unemployment Rate (Oct)--

F: --

P: --

U.K. Average Weekly Earnings (3-Month Average, Including Bonuses) YoY (Oct)

U.K. Average Weekly Earnings (3-Month Average, Including Bonuses) YoY (Oct)--

F: --

P: --

U.K. Average Weekly Earnings (3-Month Average, Excluding Bonuses) YoY (Oct)

U.K. Average Weekly Earnings (3-Month Average, Excluding Bonuses) YoY (Oct)--

F: --

P: --

France Services PMI Prelim (Dec)

France Services PMI Prelim (Dec)--

F: --

P: --

France Composite PMI Prelim (SA) (Dec)

France Composite PMI Prelim (SA) (Dec)--

F: --

P: --

France Manufacturing PMI Prelim (Dec)

France Manufacturing PMI Prelim (Dec)--

F: --

P: --

Germany Services PMI Prelim (SA) (Dec)

Germany Services PMI Prelim (SA) (Dec)--

F: --

P: --

Germany Manufacturing PMI Prelim (SA) (Dec)

Germany Manufacturing PMI Prelim (SA) (Dec)--

F: --

P: --

Germany Composite PMI Prelim (SA) (Dec)

Germany Composite PMI Prelim (SA) (Dec)--

F: --

P: --

Euro Zone Composite PMI Prelim (SA) (Dec)

Euro Zone Composite PMI Prelim (SA) (Dec)--

F: --

P: --

Euro Zone Services PMI Prelim (SA) (Dec)

Euro Zone Services PMI Prelim (SA) (Dec)--

F: --

P: --

Euro Zone Manufacturing PMI Prelim (SA) (Dec)

Euro Zone Manufacturing PMI Prelim (SA) (Dec)--

F: --

P: --

U.K. Services PMI Prelim (Dec)

U.K. Services PMI Prelim (Dec)--

F: --

P: --

U.K. Manufacturing PMI Prelim (Dec)

U.K. Manufacturing PMI Prelim (Dec)--

F: --

P: --

U.K. Composite PMI Prelim (Dec)

U.K. Composite PMI Prelim (Dec)--

F: --

P: --

Euro Zone ZEW Economic Sentiment Index (Dec)

Euro Zone ZEW Economic Sentiment Index (Dec)--

F: --

P: --

Germany ZEW Current Conditions Index (Dec)

Germany ZEW Current Conditions Index (Dec)--

F: --

P: --

Germany ZEW Economic Sentiment Index (Dec)

Germany ZEW Economic Sentiment Index (Dec)--

F: --

P: --

Euro Zone Trade Balance (Not SA) (Oct)

Euro Zone Trade Balance (Not SA) (Oct)--

F: --

P: --

Euro Zone ZEW Current Conditions Index (Dec)

Euro Zone ZEW Current Conditions Index (Dec)--

F: --

P: --

Euro Zone Trade Balance (SA) (Oct)

Euro Zone Trade Balance (SA) (Oct)--

F: --

P: --

U.S. Retail Sales MoM (Excl. Automobile) (SA) (Oct)

U.S. Retail Sales MoM (Excl. Automobile) (SA) (Oct)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

Gold struggled to reclaim $2,000 in the holiday-shortened week.

Dollar ended as the weakest performer last week, with it poor performance aligning with broader rally in both stock and commodity markets, underpinned by growing investor sentiment favoring US economic soft-landing. Furthermore, minutes from FOMC meeting suggested a potential softening of Fed’s hawkish stance. As risk-on sentiment seems poised to continue in the near term, potentially until the next FOMC rate decision, Dollar may continue to face downward pressure.

Japanese Yen, ranking as the second weakest currency last week, saw a reversal of some of its recent gains. The lack of fresh stimuli in the market meant there wasn’t enough impetus for Yen buyers to drive further appreciation of the currency. Euro ended up as the third weakest, struggling in its crosses despite improvements in economic data.

Sterling emerged as one of the top performers of the week, ranking third. Its strength was driven by improved economic outlook and comments from officials at BoE. Australian Dollar stood out as the second strongest, supported by hawkish RBA minutes, as well as rallies in key commodities, particularly Iron Ore and Copper. New Zealand Dollar claimed the top spot as the strongest performer. Market participants are now eagerly awaiting RBNZ rate decision, scheduled for the coming Wednesday.

Dollar notably ended as the weakest performer last week, continuing its near-term selloffs. This decline coincided with an extended rally in risk markets. DOW achieved a four-week winning streak, reflecting growing sentiment among investors betting on soft-landing scenario for the US economy, contrary to earlier fears of harsh economic downturn.

Meanwhile, minutes of November FOMC meeting was rather balanced, and possibly indicate a softening hawkish stance. A notable change is that the previous stance, which suggested that “one more increase in the target federal funds rate at a future meeting would likely be appropriate,” was conspicuously absent in the latest minutes.

The current bullish momentum in major stock indexes suggests that this positive trend has the potential to carry forward into early December. While this period features several important economic indicators including PCE inflation data and non-farm payroll figures, they’re not too likely to deter current risk-on sentiment.

The performance of these indexes through the end of the year, including whether they reach new all-time highs, will likely hinge on the Federal Reserve’s rate decision and new economic projections set for December 13. These announcements are pivotal, as they will provide crucial information about the timing and speed of policy loosening next year.

Technically, near term outlook in DOW will stay bullish as long as 34818.03 support holds. Current rise should extend through 35679.13 resistance. The real hurdle lies in resistance zone between top channel line (now at around 36077), and 36952.65 (2021 high).

Rejection by 36952.65 would suggest that the long term consolidation pattern from there is still in progress, and would extend with another medium term falling leg. However, sustained break of 36952.65 will confirm up trend resumption.

Dollar Index’s fall from 107.34 continued last but recovered after hitting 103.17. Further decline is expected as long as 104.55 resistance holds. Next target is 61.8% retracement of 99.57 to 107.34 at 102.53.

As noted before, it’s uncertain for now whether fall from 107.34 is a correction to rise from 99.57, the second leg of a range pattern above 99.57, or resuming the whole down trend from 114.77 (2022 high). Firm break of above mentioned 102.53 fibonacci level could tile the favor to the latter two bearish scenarios. On the other hand, strong bounce from 102.53 will favor the former case, which is still medium term bullish.

Sterling stood out as one of the top performers, driven by improved economic outlook and significant comments from top officials at BoE. Sterling’s performance was particularly noteworthy against Dollar, where it reached a two-month high, and against Japanese Yen, where it resumed its long-term uptrend.

The release of the UK’s preliminary PMI figures for November played a significant role in bolstering Sterling. The data revealed an unexpected expansion in the vital services sector, a key driver of the UK economy. Although the manufacturing sector’s PMI remained below the 50 threshold, signaling contraction, the extent of contraction was smaller than expected, lending further support to the Pound.

The set of PMI data suggests that the overall pace of UK’s economic slowdown might be more moderate than initially feared. S&P Global emphasized this positive development, stating, “The UK economy found its feet again.” Nonetheless, the PMI data also pointed to resurgence in input cost pressures, which could signal ongoing inflation challenges.

BoE Governor Andrew Bailey, speaking at a Treasury Committee hearing, warned cautioned that the markets might be “underestimating” the persistent nature of inflation and stressed that it was “far too early to be thinking about rate cuts.” This perspective indicates a continued commitment to a tighter monetary policy.

Bailey’s sentiment was echoed by some economists, with Citigroup revising its expectations for the BoE’s first rate cut to August next year, later than its earlier prediction of May. This delay in anticipated rate cuts reflects an expectation of prolonged inflationary pressures and a sustained tight monetary policy in the UK.

GBP/CHF is a pair to watch in the coming days to verify underlying momentum of the Pound. Near term pullback from 1.1150 is possibly completed at 1.0986 already. Break of 1.1150 will resume the rise from 1.0779 to 61.8% projection of 1.0779 to 1.1150 from 1.0986 at 1.1215.

Decisive break of 1.1215 will also bolster the case that whole medium term consolidation from 1.1574 (2022 high) has completed with three waves down to 1.0779. Next near term target will be 100% projection at 1.1357.

Australian Dollar was also among the top performers of the week, buoyed by a combination of hawkish monetary policy signals from RBA and the surge in commodity prices, particularly in base metals.

RBA’s November 7 meeting minutes revealed a clear commitment to tackling inflation, reiterating the low tolerance for unexpected inflationary pressures. This firm stance was further emphasized by RBA Governor Michele Bullock, who indicated in a separate speech that the nature of inflation in Australia is increasingly becoming “homegrown and demand driven”, necessitating a stronger policy response.

Additionally, Aussie found support from the rally in base metal prices. Notably, the benchmark Iron Ore price on Singapore Exchange recorded its fifth consecutive week of gains. This rally was primarily driven by China’s recent measures to revitalize its debt-ridden property sector, a significant consumer of steel. There are reports that China may allow banks to offer unsecured short-term loans to qualified property developers for the first time, signaling a potential shift in policy to support the ailing sector.

Speculation surrounding Chinese government’s plans to stimulate economic growth and bolster the property market suggests a larger and more immediate intervention than previously expected. Such measures are likely to increase demand for Australian exports, particularly metals and minerals like iron ore and copper. This expected rise in demand typically leads to higher commodity prices, which in turn supports Australian Dollar, given the country’s status as a major commodity exporter.

As with Iron Ore, the strong break of 132.53 resistance should confirm resumption of whole up trend from 77.78 (2022 low). Next medium term target is 100% projection of 77.78 to 132.53 from 99.69 at 154.44.

Copper is now pressing 55 W EMA (now at 3.7966) after last week’s rise. Sustained break there will strengthen the case that correction from 4.3556 has completed at 3.5021. Further rally would then be seen to 4.0145 resistance first. Firm break there will argue that whole rise from 3.1314 (2022 low), is ready to resume through 4.3556 in the medium term.

Late rally in AUD/JPY suggests that rise from 86.04 is ready to resume and extend. Near term outlook will now stay bullish as long as 96.80 support holds. Next target is 61.8% projection of 86.04 to 97.66 from 93.00 at 100.18. If realized, that would also have 99.32 resistance taken out too, indicating resumption of whole up trend from 59.85 (2020 low).

GBP/USD’s rise from 1.2036 continued last week and hit as high as 1.2613. Initial bias stays on the upside this week for 61.8% retracement of 1.3141 to 1.2036 at 1.2716 next. On the downside, below 1.2523 minor support will turn intraday bias neutral and bring consolidations first, before staging another rally.

In the bigger picture, price actions from 1.3141 are seen as a corrective pattern to rise from 1.0351 (2022 low). Strong rebound from 38.2% retracement of 1.0351 (2022 low) to 1.3141 at 1.2075 suggests that current rise from 1.2036 is already the second leg. However, while further rally could be seen, upside should be limited by 1.3141 to bring the third leg of the pattern.

In the long term picture, a long term bottom should be in place at 1.0351 on bullish convergence condition in M MACD. But momentum of the rebound from 1.3051 argues GBP/USD is merely in consolidation, rather than trend reversal. Range trading is likely between 1.0351/4248 for some more time.

Reminder that the American currency came under significant pressure on November 14 following the release of the Consumer Price Index (CPI) report in the USA. In October, the Consumer Price Index (CPI) decreased from 0.4% to 0% (m/m), and on an annual basis, it dropped from 3.7% to 3.2%. The Core CPI for the same period decreased from 4.1% to 4.0%: reaching the lowest level since September 2021. These figures caused a tumble in the Dollar Index (DXY) from 105.75 to 103.84. According to Bank of America, this marked the most significant dollar sell-off since the beginning of the year. Naturally, this had an impact on the dynamics of the EUR/USD pair, which marked this day with an impressive bullish candle of almost 200 pips, reaching resistance in the 1.0900 zone.

DXY continued to consolidate near 103.80 last week, maintaining positions at the lows from the end of August to the beginning of September. Meanwhile, the EUR/USD pair, transforming 1.0900 from resistance to a pivot point, continued its movement along this line.

Market reassurance, besides Thanksgiving Day, was also influenced by the uncertainty regarding what to expect from the Federal Reserve (FRS) and the European Central Bank (ECB). Following the release of the inflation report, the majority of investors believed in the imminent conclusion of the hawkish monetary policy of the American central bank. Expectations that the regulator would raise interest rates at its meeting on December 14 plummeted to zero. Moreover, among market participants, the opinion circulated that the FRS might shift towards easing its monetary policy not in mid-summer but already in the spring of the following year.

However, the minutes of the latest Federal Open Market Committee (FOMC) meeting were published on November 21, and their content contradicted market expectations. The minutes indicated that the leadership of the regulator considered the possibility of additional tightening of monetary policy in case of inflation growth. Furthermore, FRS members concluded that it would be prudent to keep the rate high until inflation reaches the target.

The content of the minutes slightly supported the American currency: EUR/USD crossed the 1.0900 horizon from top to bottom, dropping from 1.0964 to 1.0852. However, overall, the market reaction was restrained since the formulations mentioned above were quite vague and lacked specificity regarding the future monetary policy of the United States.

If in the United States, market expectations clashed with the FRS protocols, in Europe, the ECB protocols contradicted the subsequent rhetoric of individual leaders of this regulator. In its latest protocol, the Governing Council of the European Central Bank left the door open for the resumption of the monetary restriction cycle and urged policymakers to avoid unwarranted easing of financial conditions. A similar sentiment was expressed by the ECB President, Christine Lagarde, in her speech on Friday, November 24, stating that the fight against inflation is not yet over. However, a little earlier, the head of the Bank of France, Francois Villeroy de Galhau, stated that interest rates would not be raised anymore.

So, the question of what the future monetary policy of the ECB will be remains open. In favour of hawks, it is noted that wage growth in the Eurozone accelerated in Q3 from 4.4% to 4.7%, and purchasing managers highlighted an increase in inflationary pressure. On the other hand, the Eurozone’s economy continues to experience stagflation. Business activity (PMI) has been below the critical 50-point mark for the sixth consecutive month, indicating technical recession.

A glimmer of light in the darkness came from macro statistics from Germany, some indicators of which gradually improved. PMI dropped to a minimum of 38.8 points in July and then began to grow slowly. Preliminary data published on Thursday, November 23rd, showed that this index rose to 47.1 (though still below 50.0). The economic sentiment index from the ZEW Institute returned to the positive territory for the first time in half a year, sharply rising from -1.1 to 9.8. According to some economists, this growth is likely linked to a noticeable decrease in inflation (CPI) in Germany over the last two months: from 6.1% to 3.8%.

However, only desperate optimists can claim that the country’s economy has rebounded and transitioned to recovery. Germany’s recession is far from over. For the fourth consecutive quarter, GDP is not growing; worse yet, it is contracting: GDP for Q3 2023 decreased by 0.1% and compared to the same quarter of the previous year, it declined by 0.4%. According to Bloomberg, the budget crisis in Germany could lead to many infrastructure and environmental projects not receiving funding. As a result, economic growth may slow down by 0.5% next year.

In general, the prospects for both currencies, the dollar and the euro, are shrouded in the fog of uncertainty. As economists from the Japanese MUFG Bank note, “the window for the dollar to reach the highs set in October and/or beyond may already be closed. However, the growth prospects in the Eurozone also do not indicate significant opportunities for EUR/USD.”

For the second consecutive week, EUR/USD concluded near the 1.0900 level, specifically at 1.0938. Currently, expert opinions regarding its near future are divided as follows: 40% voted for the strengthening of the dollar, 40% sided with the euro, and 20% remained neutral. In terms of technical analysis, all trend indicators and oscillators on the D1 timeframe are in green, but one-third of the latter are in overbought territory. The nearest support for the pair is located around 1.0900, followed by 1.0830-1.0840, 1.0740, 1.0620-1.0640, 1.0480-1.0520, 1.0450, 1.0375, 1.0200-1.0255, 1.0130, and 1.0000. Bulls will encounter resistance around 1.0965-1.0985, 1.1070-1.1090, 1.1150, 1.1260-1.1275, and 1.1475.

In the upcoming week, preliminary inflation (CPI) data for Germany and the GDP for the United States for Q3 will be released on Wednesday, November 29. The following day will reveal the CPI and retail sales volumes for the Eurozone as a whole, along with the Personal Consumption Expenditures (PCE) Index and the number of initial jobless claims in the United States. The workweek will conclude on Friday, December 1st, with the publication of the Purchasing Managers’ Index (PMI) for the manufacturing sector in the United States and a speech by the Federal Reserve Chair, Jerome Powell.

Recent macroeconomic data indicates that the UK’s economy is on the mend, contributing to the strengthening of the British pound. Business activity in the country is rebounding, with the Services PMI and Composite PMI indices showing growth, although they remain in contraction territory after three months of decline. The Manufacturing PMI is also below the threshold value of 50.0, indicating contraction/growth, but it rose from 44.8 to 46.7, surpassing forecasts of 45.0. The growth in business activity is supported by a decrease in core inflation. According to the latest CPI data, it decreased from 6.7% to 4.6%, and despite this, the economy managed to avoid a recession, with GDP remaining at 0%.

Against this backdrop, according to several analysts, unlike the Federal Reserve (FRS) and the European Central Bank (ECB), there is a significant likelihood of another interest rate hike by the Bank of England (BoE). This conviction has been fuelled by recent hawkish comments from the regulator’s head, Andrew Bailey, who emphasized that rates should be raised for a longer period, even if it may have a negative impact on the economy.

The Chief Economist of the BoE, Hugh Pill, also stated in an interview with the Financial Times on Friday, November 24, that the Central Bank would continue to combat inflation, and it cannot afford to weaken its tight monetary policy. According to Pill, key indicators, namely inflation in service prices and wage growth, remained persistently high throughout the summer. Therefore, even though “both of these measures have shown a slight – but welcome – sign of coming down, they remain at very high levels.”

Such hawkish statements from Bank of England leaders contribute to bullish sentiments for the pound. However, according to economists at Commerzbank, despite Andrew Bailey’s efforts to convey a hawkish stance with his comments, it is not necessarily guaranteed that real actions, such as an interest rate hike, will follow. “Even in the case of positive surprises from the real sector of the UK economy, the market always keeps in mind the rather indecisive approach of the Bank of England. In this case, the potential for sterling to rise in the near future will be limited,” warns Commerzbank.

Despite Thanksgiving Day in the United States, some preliminary data on the state of the American economy was still released on Friday, November 24. The S&P Global PMI for the services sector increased from 50.6 to 50.8. The composite PMI remained unchanged in November at the previous level of 50.7. However, the manufacturing sector’s PMI in the country showed a significant decline – despite the previous value of 50.0 and expectations of 49.8, the actual figure dropped to 49.4, reflecting a slowdown in growth. Against this backdrop, taking advantage of the low-liquidity market, pound bulls pushed the pair higher to a height of 1.2615.

As for technical analysis, over the past week, GBP/USD has surpassed both the 100-day and 200-day moving averages (DMA) and even breached the resistance at 1.2589 (50% correction level from the July-October decline), marking the highest level since early September. The week concluded with the pair reaching 1.2604.

Economists at Scotiabank believe that “in the short term, the pound will find support on minor dips (to the 1.2500 area) and looks technically poised for further gains.” Regarding the median forecast of analysts in the near future, only 20% supported Scotiabank’s projection for pound growth. The majority (60%) took the opposite position, while the remaining analysts maintained a neutral stance. All trend indicators and oscillators on the D1 timeframe point north, with 15% of the latter signalling overbought conditions. In the event of a southward movement, the pair will encounter support levels and zones at 1.2570, followed by 1.2500-1.2520, 1.2450, 1.2370, 1.2330, 1.2210, and 1.2040-1.2085. In the case of an upward movement, resistance awaits at levels such as 1.2615-1.2635, 1.2690-1.2710, 1.2785-1.2820, 1.2940, and 1.3140.

One notable event in the upcoming week’s calendar is the scheduled speech by the Bank of England Governor Andrew Bailey on Wednesday, November 29. As of now, there are no other significant events related to the United Kingdom’s economy expected in the coming days.

The momentum gained by USD/JPY after the release of the U.S. inflation report on November 14th proved to be so strong that it continued into the past week. On Tuesday, November 21, the pair found a local bottom at the level of 147.14. Once again, news from the other side of the Pacific, specifically the release of the Federal Reserve’s minutes, served as a signal for a northward reversal.

As the primary catalyst for the yen revolves around speculations about changes in the Bank of Japan’s (BoJ) policy, markets awaited the release of national inflation data on Friday, November 24th. It was anticipated that the core CPI would increase by 3.0% (year-on-year) compared to the previous value of 2.8%. However, it grew less than expected, reaching 2.9%. The rise in the overall national CPI was 3.3% (year-on-year), exceeding the previous figure of 3.0% but falling short of forecasts at 3.4%. As a result, this had little to no impact on the Japanese yen’s exchange rate.

According to economists at Commerzbank, the inflation indicators suggest that the Bank of Japan is unlikely to aim for an exit from its ultra-easy monetary policy in the foreseeable future. The dynamics of USD/JPY in the coming weeks will likely depend almost entirely on the movement of the dollar.

This stance is probably acceptable to the Japanese central bank, reflecting the market’s low expectations regarding a tightening of its passive and dovish policy. This sentiment was reaffirmed by Japan’s Prime Minister Fumio Kishida, who addressed Parliament on Wednesday, November 22nd. Kishida stated that the BoJ’s monetary policy is not aimed at directing currency rates in a particular direction. From this, it can be inferred that the country’s leadership has entrusted the Federal Reserve of the United States with this function.

The closing note of the week for USD/JPY settled at the level of 149.43, maintaining its position above the critical 100- and 200-day SMAs. This suggests that the broader trend still leans towards bullish sentiments, despite recent local victories for bears. Regarding the immediate prospects of the pair, only 20% of experts anticipate further strengthening of the dollar, another 20% side with the yen, while the majority (60%) refrain from making any forecasts. As for the technical analysis on the daily chart (D1), the forecast remains uncertain. Among trend indicators, the ratio is evenly split between red and green (50% each). Among oscillators, 60% favour red, 20% favour green, and 20% are neutral-grey. The nearest support level is located in the zone of 149.20, followed by 148.90, 148.10-148.40, 146.85-147.15, 145.90-146.10, 145.30, 144.45, 143.75-144.05, and 142.20. The nearest resistance is at 149.75, followed by 150.00-150.15, 151.70-151.90, then 152.80-153.15 and 156.25.

There is no planned release of any significant statistics regarding the state of the Japanese economy next week.

From the events of the past week, one stands out. It has been reported that the largest crypto exchange, Binance, reached a global settlement with the US Department of Justice, the Commodity Futures Trading Commission, the Office of Foreign Assets Control, and the Financial Crimes Enforcement Network, related to their investigations into registration issues, compliance, and violations of anti-Russian sanctions.

As part of the agreement, on November 21, 2023, CZ (Changpeng Zhao) stepped down as the CEO of the exchange. Additionally, under the agreement, Binance will pay regulators and law enforcement substantial amounts (around $7 billion) in the form of fines and compensations to settle charges and claims against them. In addition to the financial settlement, Binance has agreed to completely withdraw from the US markets and will “comply with a set of stringent sanction requirements.” Furthermore, the exchange will be under a five-year observation by the US Treasury with open access to its accounting books, records, and systems.

The $7 billion payouts are a substantial amount that will significantly impact the company. Can it survive this? After news of these fines, a wave of panic sentiments swept through the market. According to DeFiLlama data, Binance’s reserves decreased by $1.5 billion in two days, with an outflow of $710 million during the same period. These are substantial losses. However, looking at history, such withdrawal rates are not extraordinary. In June, after the SEC filed a lawsuit, the outflow exceeded $1 billion in a day, and in January, amid the BUSD stablecoin scandal, the outflow reached a record $4.3 billion for 2023. So, there is likely no catastrophe, and the exchange will face local difficulties.

Representatives of Binance stated that they firmly believe in the crypto industry and the bright future of their company. Many experts view the exchange’s agreement with US authorities as a positive event, considering Binance’s leading role in the crypto industry. Confirmation of this was the bitcoin dynamics: in the first hours, BTC/USD dropped by 6%, but then rebounded: on Friday, November 24, it even broke through resistance in the $38,000 zone, reaching a high of $38,395.

According to several experts, the fundamental indicators of the leading cryptocurrency have never looked better. For example, 70% of the existing BTC supply has not moved from one wallet to another during this year. “This is a record level in bitcoin’s history: such withdrawal rates are extraordinary for a financial asset,” summarizes a group of analysts led by Gautam Chhugani.

Glassnode, an analytical company, also notes a consistent outflow of BTC coins from exchanges. The total supply of the leading cryptocurrency is becoming increasingly scarce, and the circulating supply is currently at an all-time low.

In a recent Glassnode report, it is stated that 83.6% of all circulating bitcoins were acquired by current owners at a lower cost than the current value. If this figure surpasses the 90% mark, it could indicate the beginning of the euphoria stage, where almost all market participants have unrealized profits.

According to analysts, statistical data can help determine the current market stage. For instance, when less than 58% of all BTC coins are profitable, the market is in the bottoming formation stage. Once the indicator surpasses the 58% mark, the market transitions into the recovery stage, and above 90%, it enters the euphoria stage.

Glassnode believes that over the last ten months, the market has been in the second of these three stages, recovering from a series of negative events in 2022, such as the collapse of the Luna project and the bankruptcy of the crypto exchange FTX.

So, the chances of entering the New Year 2024 on an upward trajectory are increasing. Positive expectations are reinforced by the upcoming halving in April. It may reduce the monthly selling pressure from miners from $1 billion to $500 million (at the current BTC rate). Additionally, the potential approval of bitcoin exchange-traded funds (ETFs) in the U.S. is a positive catalyst, easing access to cryptocurrency for major investors. According to experts at Bernstein, against this backdrop, by the beginning of 2025, the price of the first cryptocurrency could rise to $150,000.

Can one expect a significant downward correction from bitcoin in the near future? The crypto market is known for its unpredictability and volatility. However, according to renowned analyst Willy Woo, this is unlikely. He examined blockchain data reflecting the average purchase price of BTC by investors, concluding that the primary cryptocurrency is unlikely to drop below $30,000 again.

Woo shared a chart with readers, showing a dense grey band representing the price around which a significant portion of bitcoin’s supply fluctuated. According to the expert, this reflects “strong consensus price.” Woo claims that since the inception of bitcoin, this band has acted as a reliable price support. The chart demonstrates that such bands formed eight times throughout bitcoin’s existence, always supporting its price.

However, it’s important to acknowledge that not everyone trusts Woo’s calculations. An analyst using the pseudonym TXMC reminded that Woo made a similar forecast in 2021, stating that bitcoin would never drop below $40,000. Yet, the next year saw exactly that happen: on November 20, 2022, BTC/USD reached a minimum in the $15,480 range.

Since that tragic date, bitcoin has appreciated by more than 2.4 times. As of the evening of Friday, November 24, BTC/USD is trading around $37,820. The total market capitalization of the crypto market is $1.44 trillion (compared to $1.38 trillion a week ago). The Crypto Fear and Greed Index has risen from 63 to 66 points and continues to be in the Greed zone.

As for the U.S. Securities and Exchange Commission (SEC), it remains proactive. Following the resolution with Binance, it has now filed charges against the cryptocurrency trading platform Kraken. According to the SEC, the platform operated as an unregistered exchange for securities, broker, dealer, and clearing agency. The SEC lawsuit alleges that since September 2018, Kraken has earned hundreds of millions of dollars by unlawfully facilitating the buying and selling of securities in crypto assets. It remains to be seen how much it will cost Kraken to settle its issues with U.S. authorities.

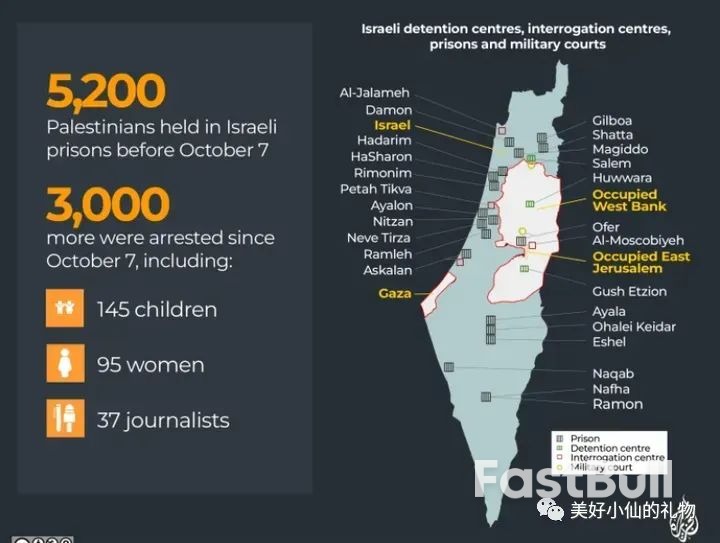

In Jenin, north of the occupied West Bank, thousands of Palestinians attended the funeral of five Palestinians killed by Israeli occupying forces in the city last night.

In Jenin, north of the occupied West Bank, thousands of Palestinians attended the funeral of five Palestinians killed by Israeli occupying forces in the city last night.White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up