Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

Mexico Unemployment Rate (Not SA) (Dec)

Mexico Unemployment Rate (Not SA) (Dec)A:--

F: --

P: --

Canada National Economic Confidence Index

Canada National Economic Confidence IndexA:--

F: --

P: --

U.S. Non-Defense Capital Durable Goods Orders MoM (Excl. Aircraft) (Nov)

U.S. Non-Defense Capital Durable Goods Orders MoM (Excl. Aircraft) (Nov)A:--

F: --

U.S. Durable Goods Orders MoM (Excl. Defense) (SA) (Nov)

U.S. Durable Goods Orders MoM (Excl. Defense) (SA) (Nov)A:--

F: --

U.S. Durable Goods Orders MoM (Excl.Transport) (Nov)

U.S. Durable Goods Orders MoM (Excl.Transport) (Nov)A:--

F: --

P: --

U.S. Durable Goods Orders MoM (Nov)

U.S. Durable Goods Orders MoM (Nov)A:--

F: --

U.S. Chicago Fed National Activity Index (Nov)

U.S. Chicago Fed National Activity Index (Nov)A:--

F: --

U.S. Dallas Fed New Orders Index (Jan)

U.S. Dallas Fed New Orders Index (Jan)A:--

F: --

P: --

U.S. Dallas Fed General Business Activity Index (Jan)

U.S. Dallas Fed General Business Activity Index (Jan)A:--

F: --

U.S. 2-Year Note Auction Avg. Yield

U.S. 2-Year Note Auction Avg. YieldA:--

F: --

P: --

U.K. BRC Shop Price Index YoY (Jan)

U.K. BRC Shop Price Index YoY (Jan)A:--

F: --

P: --

China, Mainland Industrial Profit YoY (YTD) (Dec)

China, Mainland Industrial Profit YoY (YTD) (Dec)A:--

F: --

P: --

Germany 2-Year Schatz Auction Avg. Yield

Germany 2-Year Schatz Auction Avg. YieldA:--

F: --

P: --

Mexico Trade Balance (Dec)

Mexico Trade Balance (Dec)A:--

F: --

P: --

U.S. Weekly Redbook Index YoY

U.S. Weekly Redbook Index YoYA:--

F: --

P: --

U.S. S&P/CS 20-City Home Price Index YoY (Not SA) (Nov)

U.S. S&P/CS 20-City Home Price Index YoY (Not SA) (Nov)A:--

F: --

P: --

U.S. S&P/CS 20-City Home Price Index MoM (SA) (Nov)

U.S. S&P/CS 20-City Home Price Index MoM (SA) (Nov)A:--

F: --

U.S. FHFA House Price Index MoM (Nov)

U.S. FHFA House Price Index MoM (Nov)A:--

F: --

P: --

U.S. FHFA House Price Index (Nov)

U.S. FHFA House Price Index (Nov)A:--

F: --

P: --

U.S. FHFA House Price Index YoY (Nov)

U.S. FHFA House Price Index YoY (Nov)A:--

F: --

U.S. S&P/CS 10-City Home Price Index YoY (Nov)

U.S. S&P/CS 10-City Home Price Index YoY (Nov)A:--

F: --

P: --

U.S. S&P/CS 10-City Home Price Index MoM (Not SA) (Nov)

U.S. S&P/CS 10-City Home Price Index MoM (Not SA) (Nov)A:--

F: --

P: --

U.S. S&P/CS 20-City Home Price Index (Not SA) (Nov)

U.S. S&P/CS 20-City Home Price Index (Not SA) (Nov)A:--

F: --

P: --

U.S. S&P/CS 20-City Home Price Index MoM (Not SA) (Nov)

U.S. S&P/CS 20-City Home Price Index MoM (Not SA) (Nov)A:--

F: --

P: --

U.S. Richmond Fed Manufacturing Composite Index (Jan)

U.S. Richmond Fed Manufacturing Composite Index (Jan)A:--

F: --

P: --

U.S. Conference Board Present Situation Index (Jan)

U.S. Conference Board Present Situation Index (Jan)A:--

F: --

P: --

U.S. Conference Board Consumer Expectations Index (Jan)

U.S. Conference Board Consumer Expectations Index (Jan)A:--

F: --

P: --

U.S. Richmond Fed Manufacturing Shipments Index (Jan)

U.S. Richmond Fed Manufacturing Shipments Index (Jan)A:--

F: --

P: --

U.S. Richmond Fed Services Revenue Index (Jan)

U.S. Richmond Fed Services Revenue Index (Jan)A:--

F: --

P: --

U.S. Conference Board Consumer Confidence Index (Jan)

U.S. Conference Board Consumer Confidence Index (Jan)A:--

F: --

U.S. 5-Year Note Auction Avg. Yield

U.S. 5-Year Note Auction Avg. Yield--

F: --

P: --

U.S. API Weekly Refined Oil Stocks

U.S. API Weekly Refined Oil Stocks--

F: --

P: --

U.S. API Weekly Crude Oil Stocks

U.S. API Weekly Crude Oil Stocks--

F: --

P: --

U.S. API Weekly Gasoline Stocks

U.S. API Weekly Gasoline Stocks--

F: --

P: --

U.S. API Weekly Cushing Crude Oil Stocks

U.S. API Weekly Cushing Crude Oil Stocks--

F: --

P: --

Australia RBA Trimmed Mean CPI YoY (Q4)

Australia RBA Trimmed Mean CPI YoY (Q4)--

F: --

P: --

Australia CPI YoY (Q4)

Australia CPI YoY (Q4)--

F: --

P: --

Australia CPI QoQ (Q4)

Australia CPI QoQ (Q4)--

F: --

P: --

Germany GfK Consumer Confidence Index (SA) (Feb)

Germany GfK Consumer Confidence Index (SA) (Feb)--

F: --

P: --

Germany 10-Year Bund Auction Avg. Yield

Germany 10-Year Bund Auction Avg. Yield--

F: --

P: --

India Industrial Production Index YoY (Dec)

India Industrial Production Index YoY (Dec)--

F: --

P: --

India Manufacturing Output MoM (Dec)

India Manufacturing Output MoM (Dec)--

F: --

P: --

U.S. MBA Mortgage Application Activity Index WoW

U.S. MBA Mortgage Application Activity Index WoW--

F: --

P: --

Canada Overnight Target Rate

Canada Overnight Target Rate--

F: --

P: --

BOC Monetary Policy Report

BOC Monetary Policy Report U.S. EIA Weekly Crude Stocks Change

U.S. EIA Weekly Crude Stocks Change--

F: --

P: --

U.S. EIA Weekly Cushing, Oklahoma Crude Oil Stocks Change

U.S. EIA Weekly Cushing, Oklahoma Crude Oil Stocks Change--

F: --

P: --

U.S. EIA Weekly Crude Demand Projected by Production

U.S. EIA Weekly Crude Demand Projected by Production--

F: --

P: --

U.S. EIA Weekly Crude Oil Imports Changes

U.S. EIA Weekly Crude Oil Imports Changes--

F: --

P: --

U.S. EIA Weekly Heating Oil Stock Changes

U.S. EIA Weekly Heating Oil Stock Changes--

F: --

P: --

U.S. EIA Weekly Gasoline Stocks Change

U.S. EIA Weekly Gasoline Stocks Change--

F: --

P: --

BOC Press Conference

BOC Press Conference Russia PPI MoM (Dec)

Russia PPI MoM (Dec)--

F: --

P: --

Russia PPI YoY (Dec)

Russia PPI YoY (Dec)--

F: --

P: --

U.S. Target Federal Funds Rate Lower Limit (Overnight Reverse Repo Rate)

U.S. Target Federal Funds Rate Lower Limit (Overnight Reverse Repo Rate)--

F: --

P: --

U.S. Interest Rate On Reserve Balances

U.S. Interest Rate On Reserve Balances--

F: --

P: --

U.S. Federal Funds Rate Target

U.S. Federal Funds Rate Target--

F: --

P: --

U.S. Target Federal Funds Rate Upper Limit (Excess Reserves Ratio)

U.S. Target Federal Funds Rate Upper Limit (Excess Reserves Ratio)--

F: --

P: --

FOMC Statement

FOMC Statement FOMC Press Conference

FOMC Press Conference Brazil Selic Interest Rate

Brazil Selic Interest Rate--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

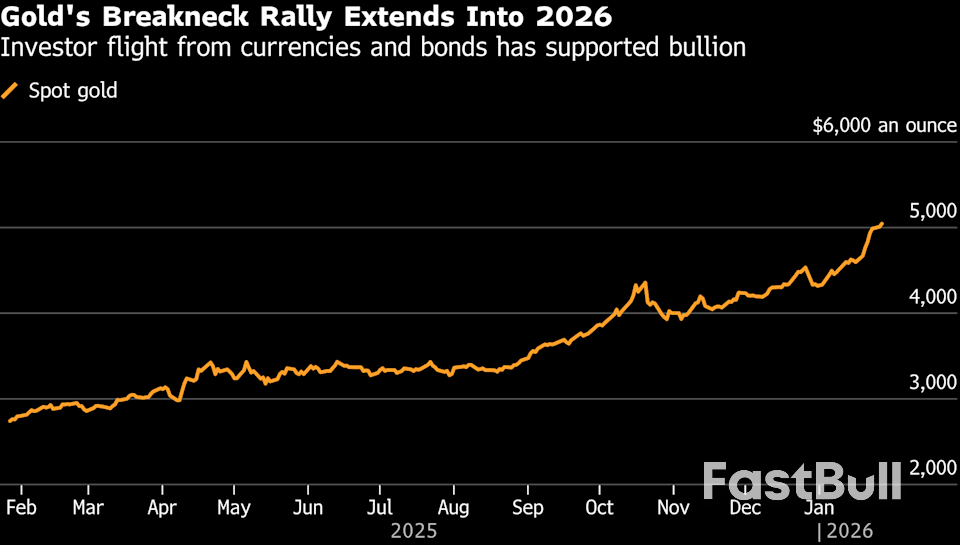

Gold continues to find buyers every time it slips, defending support at the $5,000 level even though it looks like we will remain noisy. Gold is still only a “long only” market from what I see.

Gold daily candlestick chart. Source: TradingView, as of Jan 27, 2026.

Gold daily candlestick chart. Source: TradingView, as of Jan 27, 2026.The gold market gapped lower to kick off the trading session, slipping down to the $5,000 level in the futures market, only to turn around and, as I record early in the New York session, we've basically wiped out all of the losses. Gold still looks very strong in general, and I do think that it is probably only a matter of time before we see gold really start to take off again, but a little bit of consolidation would do the market a lot of good.

$5,000, of course, is a large, round, psychologically significant figure, and as a result, I think you have to assume that maybe there was a little bit of profit-taking here. Nonetheless, I do think that the fundamental headwinds are all but gone at this point as traders start to look to the idea of central banks out there hoarding gold and, of course, a lot of concerns about trade policy and debt.

The risk-off sentiment that seems to be out there that people are tagging gold with is a bit of a misnomer; all you have to do is watch my video on US indices to see that it isn't true. So, what I would also point out is this is an inherently gold phenomenon because if you look at gold based in Australian dollars, Japanese yen, euros, Canadian dollars, it looks the same everywhere.

This is more about uncertainty and fear and, of course, massive debt around the planet. I like buying dips; $4,800 for me would be the floor in this market.

The Mexican peso is one of the world's best-performing emerging market currencies this year, yet it faces a critical test this summer: a high-stakes review of the USMCA trade pact. With Donald Trump threatening new tariffs, many currencies would falter, but investors are betting the peso’s rally has room to run.

The peso has climbed more than 4% in 2024, buoyed by powerful global tailwinds. The currency's strength is fueled by carry trades, where investors borrow in low-interest currencies to invest in Mexico's high-yielding assets. A softer U.S. dollar and soaring commodity prices have provided additional momentum.

Now, traders are increasingly placing their confidence in President Claudia Sheinbaum's ability to navigate the upcoming trade negotiations with the United States and Canada.

Optimism around the peso is backed by some aggressive forecasts. Jason Schenker, president of Prestige Economics and a top-ranked peso forecaster by Bloomberg, believes positive surprises in the trade talks could propel the currency significantly higher.

"Upside surprises in trade talks could push the peso to 16 to the dollar very easily, maybe even a 15 handle in the next 12 to 18 months," Schenker said. The currency currently trades around 17.3.

This confidence reflects a belief in the deepening economic ties between Mexico and the U.S. "It might take a while for everything to be fully hashed out," Schenker noted, but he expects cooperation and economic integration to accelerate over time.

President Sheinbaum has also highlighted the peso's performance as a sign of stability. "The peso wouldn't be where it is if there weren't certainty," she said at a press conference on January 2, referring to the outlook for the economy and its trade relationship with the U.S.

Not everyone shares this bullish outlook. Analysts at BBVA Mexico caution that the USMCA review will inevitably introduce volatility, which could weigh on the peso.

A more significant concern is speculative positioning. According to a note from strategists led by Ociel Hernandez, bets on the peso have reached their highest level since 2024. This makes the currency highly "vulnerability to any deterioration in sentiment," meaning any negative headlines could trigger a sharp reversal.

While the trade talks may not derail the currency long-term, investors should brace for turbulence as negotiations unfold.

The peso's strength isn't solely a domestic story. It's part of a broader trend lifting assets across developing nations as the U.S. dollar sinks to a four-year low.

Latin American currencies, in particular, have led gains this year. Ivan Riveros, a strategist at Citigroup, attributes this to a rally in commodities and a "huge wave into carry." This trend is widely expected by major banks to continue into 2026, providing a solid foundation for the peso.

Luis Estrada, a strategist at RBC Capital Markets, predicts the peso could strengthen to 17 per dollar this quarter. He believes that if the dollar continues to weaken, the market will likely look past the immediate risks associated with the USMCA negotiations. For now, the powerful momentum from global macro trends appears to be overriding political uncertainty.

A new trade agreement between India and the European Union will not alter the bloc's controversial carbon border tariff, EU officials have confirmed. The decision leaves the policy in place despite sharp criticism from New Delhi, which has warned the levy could disrupt its steel trade.

The EU's Carbon Border Adjustment Mechanism (CBAM) began its initial phase this month, imposing costs on high-carbon imports like steel and cement. An EU official stated plainly that "nothing will be phased out in terms of CBAM's implementation."

During negotiations, India expressed concern that the EU might offer exemptions to other partners, such as the United States under a potential deal with President Donald Trump.

However, Brussels has made it clear that no special treatment is on the table. A second EU official confirmed the bloc declined to change the levy or offer more flexible rules for Indian companies.

Instead of concessions, the EU and India agreed to hold technical discussions about the carbon tariff. The EU also committed to not granting other countries more favorable treatment than India under the scheme. This pledge, however, simply reaffirms existing EU legislation, which already prohibits discriminatory application of the CBAM.

"We have neither the intention, nor even the possibility to start discriminating between countries when we implement the CBAM," one official explained.

The EU designed the CBAM to create a level playing field between imported goods and those produced within the bloc, where local factories must already pay for their CO2 emissions.

The policy has drawn criticism from major trading partners, including South Africa and Brazil. They argue the tariff unfairly penalizes developing economies that lack the resources to meet the EU's environmental standards.

While the carbon tariff remains unchanged, the new trade agreement does offer some benefits for India. The EU has agreed to provide €500 million in support to help India's transition to a lower-emission economy.

Additionally, India will be able to export 1.6 million metric tons of steel to the EU duty-free, which accounts for roughly half of its annual shipments to the bloc.

Despite these provisions, industry analysts expect the CBAM will likely curb Indian steel exports to Europe over the long term. This could push Indian steel mills to find new buyers in markets across Africa and the Middle East. The carbon levy will be phased in gradually, meaning importers will initially only face costs on a limited portion of their products' emissions.

Daily March Crude Oil Futures

Daily March Crude Oil Futures

Canada is actively working to diversify its energy exports beyond the United States, with India emerging as a primary target for increased sales of oil, gas, and uranium. This strategic shift was highlighted by Canadian Energy Minister Tim Hodgson during a conference in India on Tuesday.

Speaking at the Indian Energy Week conference in Goa, Hodgson described Canada's heavy reliance on the U.S. market as a "strategic blunder," signaling a clear opportunity to strengthen energy ties with India.

Hodgson reiterated the government's ambition for Canada to become an "energy superpower," stating that this goal requires trading with major global energy consumers like India.

"If Canada wants to be an energy superpower, we need to be trading our energy and natural resources with one of the world's largest energy markets: India," he posted on the social media platform X.

The minister emphasized the significance of his visit, noting it marked Canada's first federal ministerial presence at India Energy Week and the first formal energy dialogue between the two nations in eight years.

He connected these diplomatic efforts to domestic infrastructure development, explaining that new projects at home will enable Canada to sell its products globally and forge "a new path for a stronger, more sovereign Canada."

This pivot toward Asia is part of a broader strategy to establish new export routes. The move signals a clear intent to boost energy exports to Asia from Canada's West Coast, positioning India—a key driver of future global oil and gas demand—as a priority destination.

Hodgson confirmed that infrastructure is being developed to support this strategy. "We're now building pipelines to the West Coast. We have three pipelines built here, looking at building more," he stated at the forum.

This initiative follows a major energy and trade partnership Canada signed with China, reflecting a wider move to diversify its international partners.

Although Canada launched its first LNG export project, LNG Canada, last year, it does not currently export liquefied natural gas to India. However, this is expected to change.

According to a draft joint statement on energy reviewed by Bloomberg News, the two countries are expected to formalize their relationship. The agreement will likely involve a pledge for:

• Increased Canadian exports of crude, LNG, and LPG to India.

• More Indian fuel exports to Canada.

This development marks a significant step in Canada's quest to reduce its dependency on the U.S. market and solidify its position as a global energy supplier.

Russia's central bank is grappling with conflicting signals on inflation from businesses and consumers ahead of its crucial interest rate decision on February 13. While a rate cut was widely expected this year to stimulate an economy that slowed to 1% growth, fresh price pressures are complicating the outlook.

Two key surveys, one of businesses and one of households, are painting a confusing picture for policymakers. These polls are critical gauges for the central bank as it charts its course on monetary policy.

Business Pessimism Hits a Post-2022 High

A recent poll of Russian businesses reveals that price expectations have surged to their highest level since the early months of the military action in Ukraine in 2022. Companies are now projecting a 2026 inflation rate of 9.3%, more than double the official government forecast of 4% to 5%.

Household Views Remain High but Stable

In contrast, household inflation expectations held steady at 13.7% in January, matching the December figure after rising in the previous two months. However, this highlights a significant gap with official data. The same poll showed that the public's perceived inflation rate is 14.5%, far above the official annual rate of 6.5%. This deep-seated mistrust of official statistics helps explain why Russia's central bank maintains one of the world's highest real interest rates.

The recent spike in prices, driven by a government decision to raise the value-added tax (VAT) to 22% on January 1, has cast doubt on earlier declarations that inflation was defeated. This has left analysts divided on the bank's next move.

Andrei Melaschenko of Renaissance Capital noted that the acceleration in prices through December and early January makes holding the rate steady a more probable outcome. "The option of keeping the rate unchanged [is] more likely at the moment," he said.

This view challenges earlier market consensus. A Reuters poll from December showed analysts anticipated the central bank would lower its key rate from the current 16% to 15% in the first quarter of the year.

The central bank has previously signaled that it views the inflation surge from the VAT hike as a one-off event with short-term effects. Officials have also pointed to the positive long-term impact on the government's budget balance.

However, some experts warn against an overly aggressive response. Analysts at BCS brokerage argued that keeping rates high to fight a temporary price shock could backfire. "An excessively strict response to short-term effects... could significantly intensify the slowdown in the economy in the medium term," they stated.

Following the upcoming meeting, the bank's next rate-setting decision is scheduled for March 20.

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

Log In

Sign Up