Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

Mexico Unemployment Rate (Not SA) (Dec)

Mexico Unemployment Rate (Not SA) (Dec)A:--

F: --

P: --

Canada National Economic Confidence Index

Canada National Economic Confidence IndexA:--

F: --

P: --

U.S. Non-Defense Capital Durable Goods Orders MoM (Excl. Aircraft) (Nov)

U.S. Non-Defense Capital Durable Goods Orders MoM (Excl. Aircraft) (Nov)A:--

F: --

U.S. Durable Goods Orders MoM (Excl. Defense) (SA) (Nov)

U.S. Durable Goods Orders MoM (Excl. Defense) (SA) (Nov)A:--

F: --

U.S. Durable Goods Orders MoM (Excl.Transport) (Nov)

U.S. Durable Goods Orders MoM (Excl.Transport) (Nov)A:--

F: --

P: --

U.S. Durable Goods Orders MoM (Nov)

U.S. Durable Goods Orders MoM (Nov)A:--

F: --

U.S. Chicago Fed National Activity Index (Nov)

U.S. Chicago Fed National Activity Index (Nov)A:--

F: --

U.S. Dallas Fed New Orders Index (Jan)

U.S. Dallas Fed New Orders Index (Jan)A:--

F: --

P: --

U.S. Dallas Fed General Business Activity Index (Jan)

U.S. Dallas Fed General Business Activity Index (Jan)A:--

F: --

U.S. 2-Year Note Auction Avg. Yield

U.S. 2-Year Note Auction Avg. YieldA:--

F: --

P: --

U.K. BRC Shop Price Index YoY (Jan)

U.K. BRC Shop Price Index YoY (Jan)A:--

F: --

P: --

China, Mainland Industrial Profit YoY (YTD) (Dec)

China, Mainland Industrial Profit YoY (YTD) (Dec)A:--

F: --

P: --

Germany 2-Year Schatz Auction Avg. Yield

Germany 2-Year Schatz Auction Avg. YieldA:--

F: --

P: --

Mexico Trade Balance (Dec)

Mexico Trade Balance (Dec)A:--

F: --

P: --

U.S. Weekly Redbook Index YoY

U.S. Weekly Redbook Index YoYA:--

F: --

P: --

U.S. S&P/CS 20-City Home Price Index YoY (Not SA) (Nov)

U.S. S&P/CS 20-City Home Price Index YoY (Not SA) (Nov)A:--

F: --

P: --

U.S. S&P/CS 20-City Home Price Index MoM (SA) (Nov)

U.S. S&P/CS 20-City Home Price Index MoM (SA) (Nov)A:--

F: --

U.S. FHFA House Price Index MoM (Nov)

U.S. FHFA House Price Index MoM (Nov)A:--

F: --

P: --

U.S. FHFA House Price Index (Nov)

U.S. FHFA House Price Index (Nov)A:--

F: --

P: --

U.S. FHFA House Price Index YoY (Nov)

U.S. FHFA House Price Index YoY (Nov)A:--

F: --

U.S. S&P/CS 10-City Home Price Index YoY (Nov)

U.S. S&P/CS 10-City Home Price Index YoY (Nov)A:--

F: --

P: --

U.S. S&P/CS 10-City Home Price Index MoM (Not SA) (Nov)

U.S. S&P/CS 10-City Home Price Index MoM (Not SA) (Nov)A:--

F: --

P: --

U.S. S&P/CS 20-City Home Price Index (Not SA) (Nov)

U.S. S&P/CS 20-City Home Price Index (Not SA) (Nov)A:--

F: --

P: --

U.S. S&P/CS 20-City Home Price Index MoM (Not SA) (Nov)

U.S. S&P/CS 20-City Home Price Index MoM (Not SA) (Nov)A:--

F: --

P: --

U.S. Richmond Fed Manufacturing Composite Index (Jan)

U.S. Richmond Fed Manufacturing Composite Index (Jan)A:--

F: --

P: --

U.S. Conference Board Present Situation Index (Jan)

U.S. Conference Board Present Situation Index (Jan)A:--

F: --

P: --

U.S. Conference Board Consumer Expectations Index (Jan)

U.S. Conference Board Consumer Expectations Index (Jan)A:--

F: --

P: --

U.S. Richmond Fed Manufacturing Shipments Index (Jan)

U.S. Richmond Fed Manufacturing Shipments Index (Jan)A:--

F: --

P: --

U.S. Richmond Fed Services Revenue Index (Jan)

U.S. Richmond Fed Services Revenue Index (Jan)A:--

F: --

P: --

U.S. Conference Board Consumer Confidence Index (Jan)

U.S. Conference Board Consumer Confidence Index (Jan)A:--

F: --

U.S. 5-Year Note Auction Avg. Yield

U.S. 5-Year Note Auction Avg. Yield--

F: --

P: --

U.S. API Weekly Refined Oil Stocks

U.S. API Weekly Refined Oil Stocks--

F: --

P: --

U.S. API Weekly Crude Oil Stocks

U.S. API Weekly Crude Oil Stocks--

F: --

P: --

U.S. API Weekly Gasoline Stocks

U.S. API Weekly Gasoline Stocks--

F: --

P: --

U.S. API Weekly Cushing Crude Oil Stocks

U.S. API Weekly Cushing Crude Oil Stocks--

F: --

P: --

Australia RBA Trimmed Mean CPI YoY (Q4)

Australia RBA Trimmed Mean CPI YoY (Q4)--

F: --

P: --

Australia CPI YoY (Q4)

Australia CPI YoY (Q4)--

F: --

P: --

Australia CPI QoQ (Q4)

Australia CPI QoQ (Q4)--

F: --

P: --

Germany GfK Consumer Confidence Index (SA) (Feb)

Germany GfK Consumer Confidence Index (SA) (Feb)--

F: --

P: --

Germany 10-Year Bund Auction Avg. Yield

Germany 10-Year Bund Auction Avg. Yield--

F: --

P: --

India Industrial Production Index YoY (Dec)

India Industrial Production Index YoY (Dec)--

F: --

P: --

India Manufacturing Output MoM (Dec)

India Manufacturing Output MoM (Dec)--

F: --

P: --

U.S. MBA Mortgage Application Activity Index WoW

U.S. MBA Mortgage Application Activity Index WoW--

F: --

P: --

Canada Overnight Target Rate

Canada Overnight Target Rate--

F: --

P: --

BOC Monetary Policy Report

BOC Monetary Policy Report U.S. EIA Weekly Crude Stocks Change

U.S. EIA Weekly Crude Stocks Change--

F: --

P: --

U.S. EIA Weekly Cushing, Oklahoma Crude Oil Stocks Change

U.S. EIA Weekly Cushing, Oklahoma Crude Oil Stocks Change--

F: --

P: --

U.S. EIA Weekly Crude Demand Projected by Production

U.S. EIA Weekly Crude Demand Projected by Production--

F: --

P: --

U.S. EIA Weekly Crude Oil Imports Changes

U.S. EIA Weekly Crude Oil Imports Changes--

F: --

P: --

U.S. EIA Weekly Heating Oil Stock Changes

U.S. EIA Weekly Heating Oil Stock Changes--

F: --

P: --

U.S. EIA Weekly Gasoline Stocks Change

U.S. EIA Weekly Gasoline Stocks Change--

F: --

P: --

BOC Press Conference

BOC Press Conference Russia PPI MoM (Dec)

Russia PPI MoM (Dec)--

F: --

P: --

Russia PPI YoY (Dec)

Russia PPI YoY (Dec)--

F: --

P: --

U.S. Target Federal Funds Rate Lower Limit (Overnight Reverse Repo Rate)

U.S. Target Federal Funds Rate Lower Limit (Overnight Reverse Repo Rate)--

F: --

P: --

U.S. Interest Rate On Reserve Balances

U.S. Interest Rate On Reserve Balances--

F: --

P: --

U.S. Federal Funds Rate Target

U.S. Federal Funds Rate Target--

F: --

P: --

U.S. Target Federal Funds Rate Upper Limit (Excess Reserves Ratio)

U.S. Target Federal Funds Rate Upper Limit (Excess Reserves Ratio)--

F: --

P: --

FOMC Statement

FOMC Statement FOMC Press Conference

FOMC Press Conference Brazil Selic Interest Rate

Brazil Selic Interest Rate--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

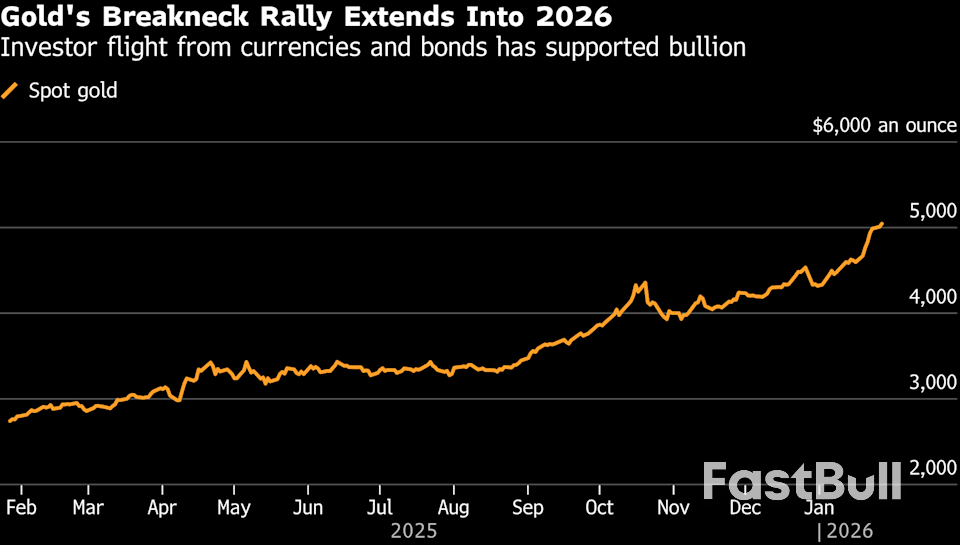

Gold stayed above $5,000 as investors fled currencies and bonds amid geopolitical risks and debasement fears, while silver surged on strong demand, pushing precious metals sharply higher.

Russia's central bank is grappling with conflicting signals on inflation from businesses and consumers ahead of its crucial interest rate decision on February 13. While a rate cut was widely expected this year to stimulate an economy that slowed to 1% growth, fresh price pressures are complicating the outlook.

Two key surveys, one of businesses and one of households, are painting a confusing picture for policymakers. These polls are critical gauges for the central bank as it charts its course on monetary policy.

Business Pessimism Hits a Post-2022 High

A recent poll of Russian businesses reveals that price expectations have surged to their highest level since the early months of the military action in Ukraine in 2022. Companies are now projecting a 2026 inflation rate of 9.3%, more than double the official government forecast of 4% to 5%.

Household Views Remain High but Stable

In contrast, household inflation expectations held steady at 13.7% in January, matching the December figure after rising in the previous two months. However, this highlights a significant gap with official data. The same poll showed that the public's perceived inflation rate is 14.5%, far above the official annual rate of 6.5%. This deep-seated mistrust of official statistics helps explain why Russia's central bank maintains one of the world's highest real interest rates.

The recent spike in prices, driven by a government decision to raise the value-added tax (VAT) to 22% on January 1, has cast doubt on earlier declarations that inflation was defeated. This has left analysts divided on the bank's next move.

Andrei Melaschenko of Renaissance Capital noted that the acceleration in prices through December and early January makes holding the rate steady a more probable outcome. "The option of keeping the rate unchanged [is] more likely at the moment," he said.

This view challenges earlier market consensus. A Reuters poll from December showed analysts anticipated the central bank would lower its key rate from the current 16% to 15% in the first quarter of the year.

The central bank has previously signaled that it views the inflation surge from the VAT hike as a one-off event with short-term effects. Officials have also pointed to the positive long-term impact on the government's budget balance.

However, some experts warn against an overly aggressive response. Analysts at BCS brokerage argued that keeping rates high to fight a temporary price shock could backfire. "An excessively strict response to short-term effects... could significantly intensify the slowdown in the economy in the medium term," they stated.

Following the upcoming meeting, the bank's next rate-setting decision is scheduled for March 20.

UK Prime Minister Keir Starmer has declared that his government will not be forced to pick a side between the United States and China, emphasizing a dual approach of maintaining close ties with Washington while actively engaging with Beijing. His comments signal a key foreign policy direction ahead of his planned visit to China.

Starmer confirmed that the UK will preserve its strong security, business, and defense relationship with the U.S. However, he argued that "sticking your head in the sand and ignoring China" is not a viable strategy.

The Prime Minister's planned state visit to China—the first by a UK leader in eight years—is framed as a move to unlock major economic benefits. Starmer stated the trip could create "significant opportunities" for British companies and is expected to include a delegation of UK business leaders for stops in Shanghai and Beijing.

Addressing potential security concerns, Starmer insisted that building a relationship with China "does not mean compromising on national security – quite the opposite."

This diplomatic outreach follows the UK government's recent and controversial approval for China to establish a new embassy in London. The decision proceeded despite opposition concerns that the facility could be used for espionage activities against the United Kingdom.

Starmer’s balanced approach comes amid a backdrop of global trade tensions, particularly involving the United States under President Trump. The Prime Minister's visit to China could risk friction with Washington, which has previously threatened allies over their economic ties with Beijing.

Trump's Tariff Threats on Allies

President Trump has shown a willingness to use tariffs to enforce his foreign and economic policy goals. In one instance, he threatened to impose tariffs on allied nations that opposed the U.S. acquisition of Greenland, stating, "we need Greenland for national security." While tensions later subsided after Trump clarified he would seek negotiations rather than use force, the episode highlighted his transactional approach.

More directly, Trump threatened Canada with a 100% tariff after the country reached a "strategic partnership" trade deal with the Chinese government. The threat emerged after Canadian Prime Minister Carney's speech in Davos was perceived as critical of the U.S. world order.

The Canada-China agreement included several key tariff reductions:

• China would lower levies on Canadian canola oil from 85% to 15%.

• Canada would cut taxes on Chinese electric vehicles from 100% to 6.1%.

Pressure on South Korea

The U.S. has also applied economic pressure on other key partners. Trump threatened to raise tariffs on South Korean goods from 15% to 25%, targeting products like automobiles, lumber, and pharmaceuticals. He accused South Korea of failing to honor a trade deal struck the previous year.

The announcement caused a sharp reaction in South Korea's stock market, particularly affecting carmakers. In response, Seoul urged Trump to reaffirm his commitment to their trade agreement, under which President Lee Jae Myung had agreed last July for South Korea to invest $350 billion in the United States.

The European Union’s competition chief has issued a sharp warning against becoming overly dependent on liquefied natural gas (LNG) from the United States as the bloc works to secure its energy future.

"We know that we cannot rely on Russian gas, and that we should pay attention not to rely too much on American gas," Teresa Ribera said in a radio interview on Tuesday.

This cautionary stance comes as Europe rapidly pivots away from its former primary supplier, Russia, following the invasion of Ukraine.

To replace lost volumes of Russian gas, European nations have increasingly turned to US LNG. This shift is solidified by a major trade agreement with Washington, which includes a commitment to purchase $750 billion in American energy by 2028.

The momentum is significant. A recent report from the Institute for Energy Economics and Financial Analysis (IEEFA) projected that if current supply deals are fulfilled and gas demand reduction efforts lag, the US could account for as much as 80% of Europe's gas imports by 2030. This would be a substantial increase from a projected 57% in 2025.

Even as the EU diversifies, Russia remains a key player, currently providing about 15% of the bloc's LNG supplies and standing as its second-largest provider after the United States.

Top officials are openly cautioning that trading one dependency for another is not a sustainable long-term strategy.

"One of the reasons why we need to produce much more of our own energy is that it is not good to be reliant on any country in the world fundamentally for our energy supply," EU energy chief Dan Jorgensen told reporters. He added, "we need to be very careful that now we're moving out of Russian energy, that we're not replacing that dependency with other dependencies."

These concerns are amplified by geopolitical uncertainties. Past actions by former US President Donald Trump, including his interest in Greenland's mining rights and threats of tariffs against European nations, serve as a reminder of the political risks associated with over-reliance on a single partner.

The EU's overarching goal remains a complete phaseout of Russian gas. To achieve true energy security, the bloc is focused on a two-pronged approach: seeking a diverse range of alternative suppliers while simultaneously accelerating its own transition to renewable energy.

This strategy is designed not only to secure its energy supply chain but also to meet the continent's ambitious climate target of achieving zero emissions by 2050.

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

Log In

Sign Up