Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

Italy Manufacturing PMI (SA) (Dec)

Italy Manufacturing PMI (SA) (Dec)A:--

F: --

P: --

Euro Zone Manufacturing PMI Final (Dec)

Euro Zone Manufacturing PMI Final (Dec)A:--

F: --

P: --

Euro Zone M3 Money Supply (SA) (Nov)

Euro Zone M3 Money Supply (SA) (Nov)A:--

F: --

P: --

Euro Zone 3-Month M3 Money Supply YoY (Nov)

Euro Zone 3-Month M3 Money Supply YoY (Nov)A:--

F: --

P: --

Euro Zone Private Sector Credit YoY (Nov)

Euro Zone Private Sector Credit YoY (Nov)A:--

F: --

P: --

Euro Zone M3 Money Supply YoY (Nov)

Euro Zone M3 Money Supply YoY (Nov)A:--

F: --

P: --

U.K. Manufacturing PMI Final (Dec)

U.K. Manufacturing PMI Final (Dec)A:--

F: --

P: --

India Deposit Gowth YoY

India Deposit Gowth YoYA:--

F: --

P: --

Brazil IHS Markit Manufacturing PMI (Dec)

Brazil IHS Markit Manufacturing PMI (Dec)A:--

F: --

P: --

Canada Manufacturing PMI (SA) (Dec)

Canada Manufacturing PMI (SA) (Dec)A:--

F: --

P: --

U.S. IHS Markit Manufacturing PMI Final (Dec)

U.S. IHS Markit Manufacturing PMI Final (Dec)A:--

F: --

P: --

Mexico Manufacturing PMI (Dec)

Mexico Manufacturing PMI (Dec)A:--

F: --

P: --

U.S. Weekly Treasuries Held by Foreign Central Banks

U.S. Weekly Treasuries Held by Foreign Central BanksA:--

F: --

P: --

Philadelphia Fed President Henry Paulson delivers a speech

Philadelphia Fed President Henry Paulson delivers a speech Japan Manufacturing PMI Final (Dec)

Japan Manufacturing PMI Final (Dec)A:--

F: --

P: --

China, Mainland Caixin Composite PMI (Dec)

China, Mainland Caixin Composite PMI (Dec)A:--

F: --

P: --

China, Mainland Caixin Services PMI (Dec)

China, Mainland Caixin Services PMI (Dec)A:--

F: --

P: --

Indonesia Trade Balance (Nov)

Indonesia Trade Balance (Nov)A:--

F: --

P: --

Indonesia Core Inflation YoY (Dec)

Indonesia Core Inflation YoY (Dec)A:--

F: --

P: --

Indonesia Inflation Rate YoY (Dec)

Indonesia Inflation Rate YoY (Dec)A:--

F: --

P: --

Saudi Arabia IHS Markit Composite PMI (Dec)

Saudi Arabia IHS Markit Composite PMI (Dec)A:--

F: --

P: --

Turkey CPI YoY (Excl. Energy, Food, Beverage, Tobacco & Gold) (Dec)

Turkey CPI YoY (Excl. Energy, Food, Beverage, Tobacco & Gold) (Dec)--

F: --

P: --

Turkey CPI YoY (Dec)

Turkey CPI YoY (Dec)A:--

F: --

P: --

Turkey PPI YoY (Dec)

Turkey PPI YoY (Dec)A:--

F: --

P: --

U.K. Mortgage Approvals (Nov)

U.K. Mortgage Approvals (Nov)A:--

F: --

U.K. M4 Money Supply MoM (Nov)

U.K. M4 Money Supply MoM (Nov)A:--

F: --

P: --

U.K. Mortgage Lending (Nov)

U.K. Mortgage Lending (Nov)A:--

F: --

U.K. M4 Money Supply (SA) (Nov)

U.K. M4 Money Supply (SA) (Nov)--

F: --

P: --

Euro Zone Sentix Investor Confidence Index (Jan)

Euro Zone Sentix Investor Confidence Index (Jan)--

F: --

P: --

U.K. M4 Money Supply YoY (Nov)

U.K. M4 Money Supply YoY (Nov)A:--

F: --

P: --

Canada National Economic Confidence Index

Canada National Economic Confidence IndexA:--

F: --

P: --

U.S. ISM Inventories Index (Dec)

U.S. ISM Inventories Index (Dec)--

F: --

P: --

U.S. ISM Output Index (Dec)

U.S. ISM Output Index (Dec)--

F: --

P: --

U.S. ISM Manufacturing PMI (Dec)

U.S. ISM Manufacturing PMI (Dec)--

F: --

P: --

U.S. ISM Manufacturing Employment Index (Dec)

U.S. ISM Manufacturing Employment Index (Dec)--

F: --

P: --

U.S. ISM Manufacturing New Orders Index (Dec)

U.S. ISM Manufacturing New Orders Index (Dec)--

F: --

P: --

Japan Monetary Base YoY (SA) (Dec)

Japan Monetary Base YoY (SA) (Dec)--

F: --

P: --

Japan Foreign Exchange Reserves (Dec)

Japan Foreign Exchange Reserves (Dec)--

F: --

P: --

U.K. BRC Shop Price Index YoY (Dec)

U.K. BRC Shop Price Index YoY (Dec)--

F: --

P: --

Japan 10-Year Note Auction Yield

Japan 10-Year Note Auction Yield--

F: --

P: --

India HSBC Services PMI Final (Dec)

India HSBC Services PMI Final (Dec)--

F: --

P: --

India IHS Markit Composite PMI (Dec)

India IHS Markit Composite PMI (Dec)--

F: --

P: --

South Africa IHS Markit Composite PMI (SA) (Dec)

South Africa IHS Markit Composite PMI (SA) (Dec)--

F: --

P: --

Turkey Trade Balance (Dec)

Turkey Trade Balance (Dec)--

F: --

P: --

Italy Composite PMI (Dec)

Italy Composite PMI (Dec)--

F: --

P: --

Italy Services PMI (SA) (Dec)

Italy Services PMI (SA) (Dec)--

F: --

P: --

Germany Composite PMI Final (SA) (Dec)

Germany Composite PMI Final (SA) (Dec)--

F: --

P: --

Euro Zone Composite PMI Final (Dec)

Euro Zone Composite PMI Final (Dec)--

F: --

P: --

Euro Zone Services PMI Final (Dec)

Euro Zone Services PMI Final (Dec)--

F: --

P: --

U.K. Services PMI Final (Dec)

U.K. Services PMI Final (Dec)--

F: --

P: --

U.K. Composite PMI Final (Dec)

U.K. Composite PMI Final (Dec)--

F: --

P: --

U.K. Total Reserve Assets (Dec)

U.K. Total Reserve Assets (Dec)--

F: --

P: --

U.K. Official Reserves Changes (Dec)

U.K. Official Reserves Changes (Dec)--

F: --

P: --

Germany 2-Year Schatz Auction Avg. Yield

Germany 2-Year Schatz Auction Avg. Yield--

F: --

P: --

Mexico Consumer Confidence Index

Mexico Consumer Confidence Index--

F: --

P: --

Germany CPI Prelim MoM (Dec)

Germany CPI Prelim MoM (Dec)--

F: --

P: --

Germany CPI Prelim YoY (Dec)

Germany CPI Prelim YoY (Dec)--

F: --

P: --

Brazil IHS Markit Services PMI (Dec)

Brazil IHS Markit Services PMI (Dec)--

F: --

P: --

Germany HICP Prelim MoM (Dec)

Germany HICP Prelim MoM (Dec)--

F: --

P: --

Brazil IHS Markit Composite PMI (Dec)

Brazil IHS Markit Composite PMI (Dec)--

F: --

P: --

Germany HICP Prelim YoY (Dec)

Germany HICP Prelim YoY (Dec)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

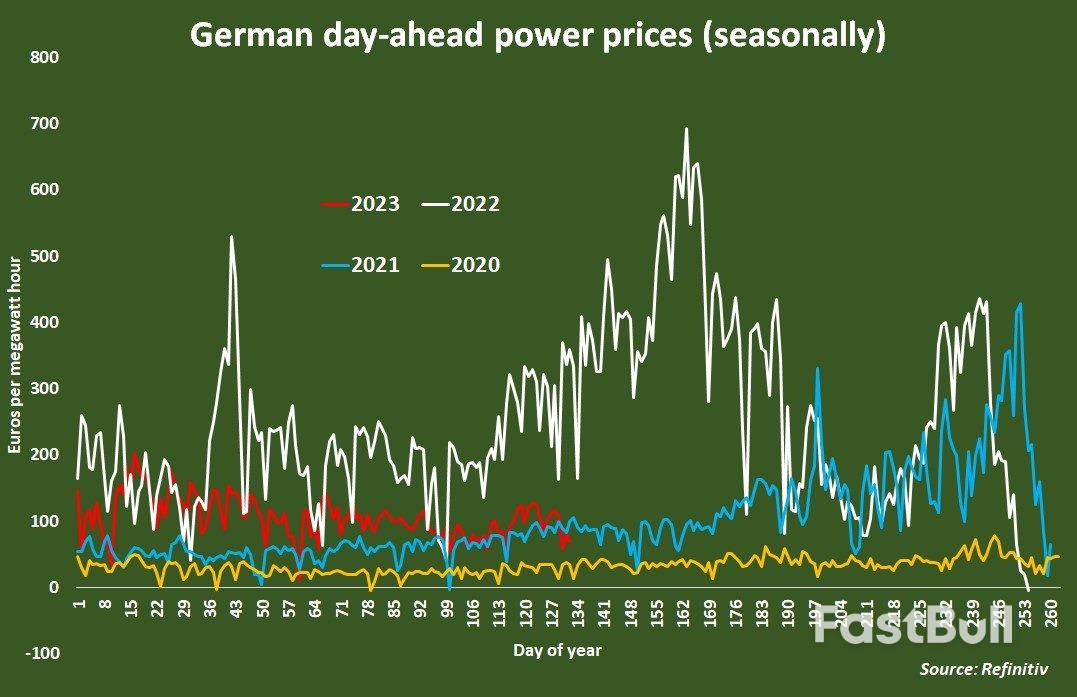

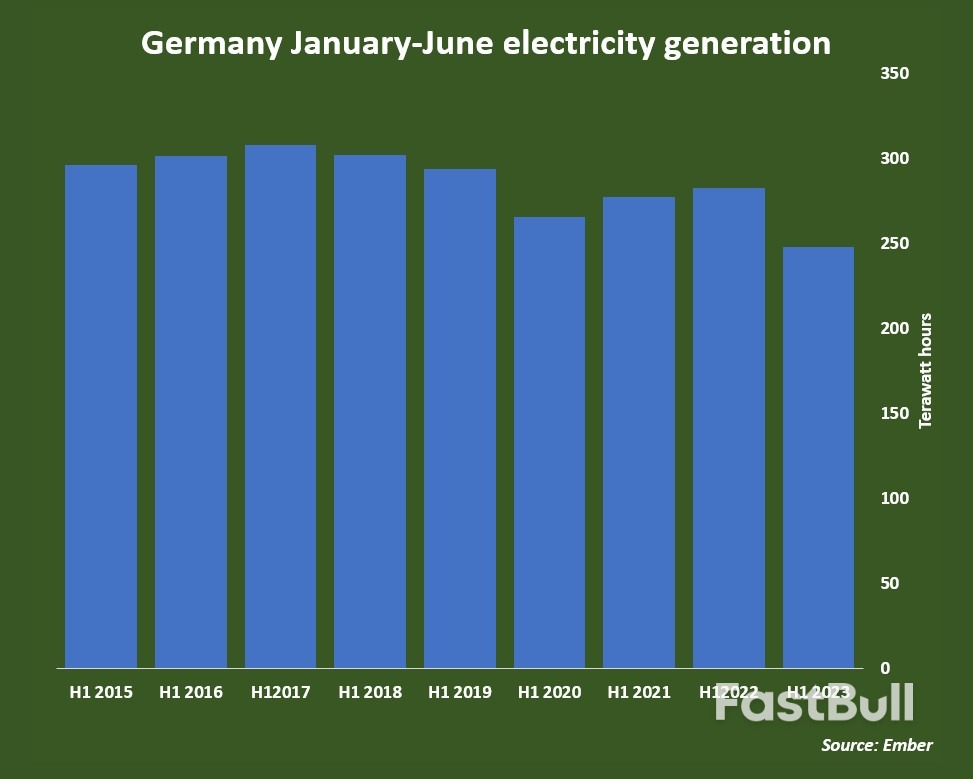

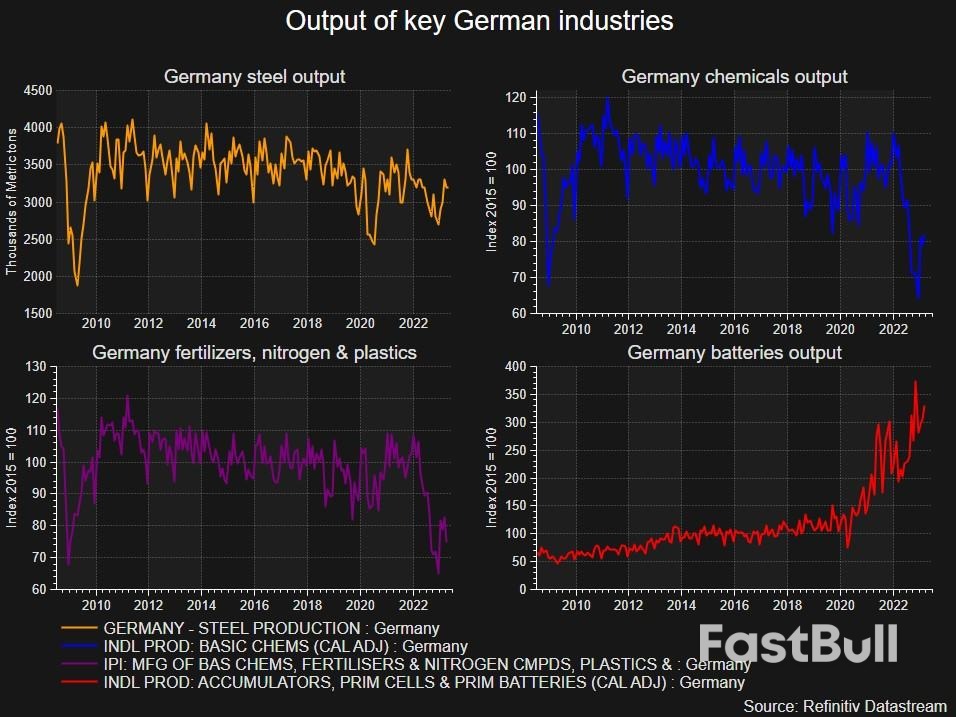

German day-ahead power prices in the first half of 2023 averaged roughly half of their 2022 levels, but industrial power use remains so restricted that electricity generation was curtailed to its lowest first-half total since at least 2015.

But unless power prices undergo a significant further and persistent decline, total German energy consumption - and output - may remain depressed and cause enduring economic harm.

But unless power prices undergo a significant further and persistent decline, total German energy consumption - and output - may remain depressed and cause enduring economic harm. Some energy efficiency improvements have also helped lower the total amount of electricity needed, especially among households and in office buildings sporting new devices such as heat pumps.

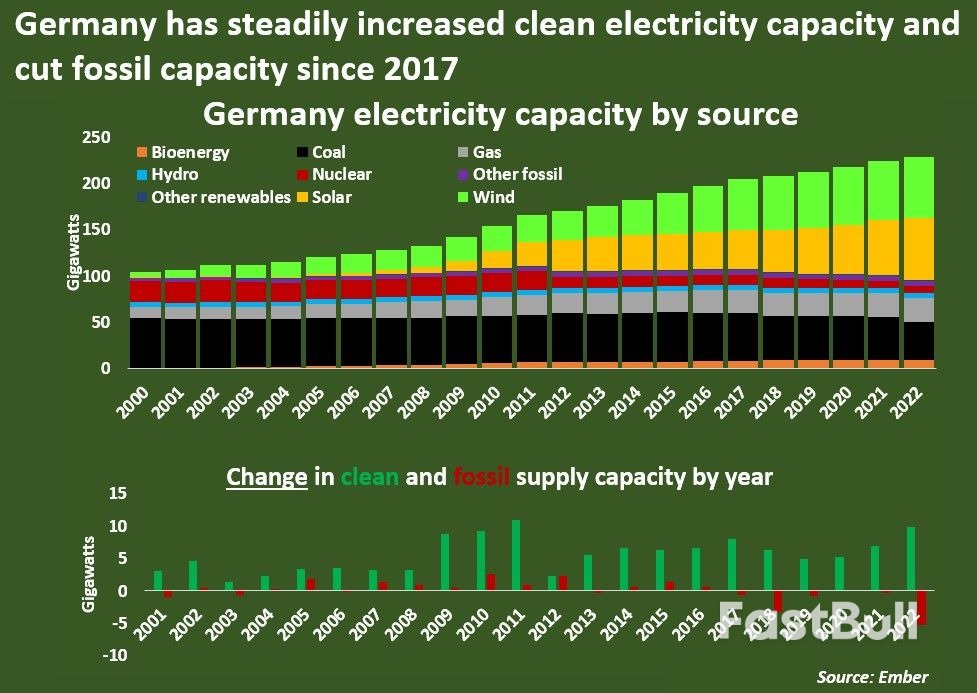

Some energy efficiency improvements have also helped lower the total amount of electricity needed, especially among households and in office buildings sporting new devices such as heat pumps. Utilities reduced fossil fuel capacity by close to 7% in 2022, to 72.3 gigawatts, by closing outdated coal plants, and in 2023 also cut nuclear supply capacity completely.

Utilities reduced fossil fuel capacity by close to 7% in 2022, to 72.3 gigawatts, by closing outdated coal plants, and in 2023 also cut nuclear supply capacity completely.

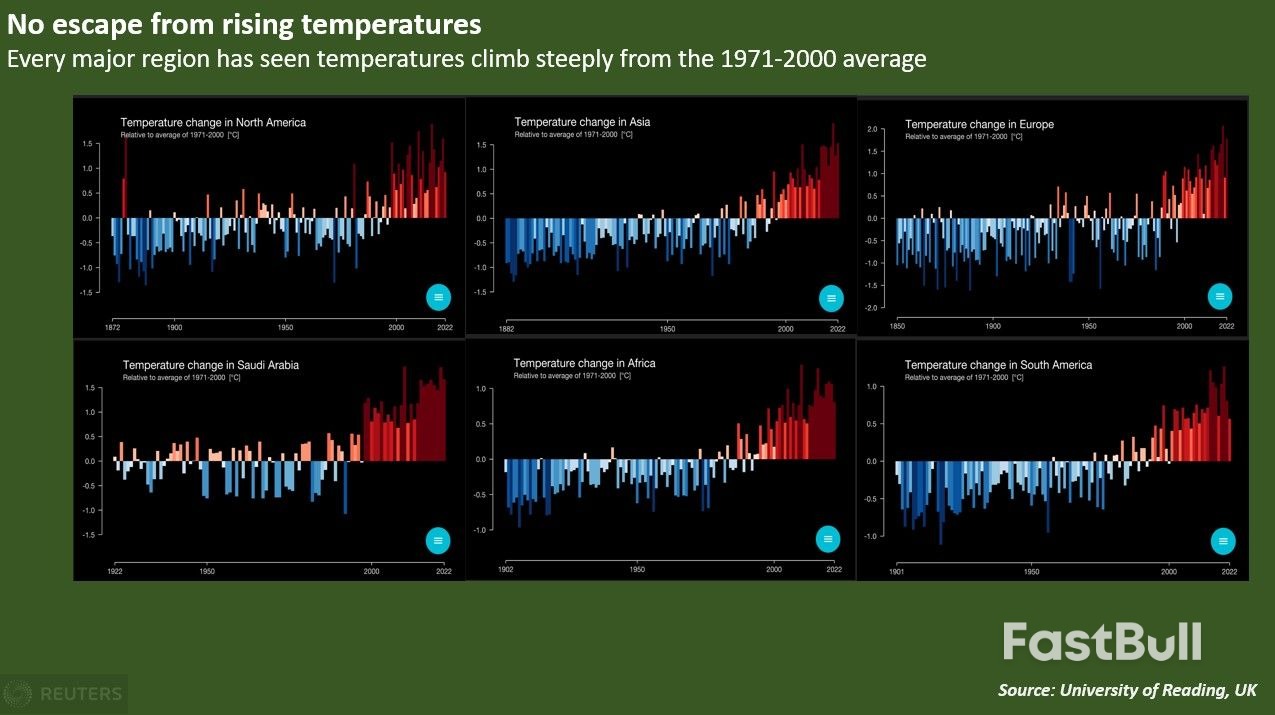

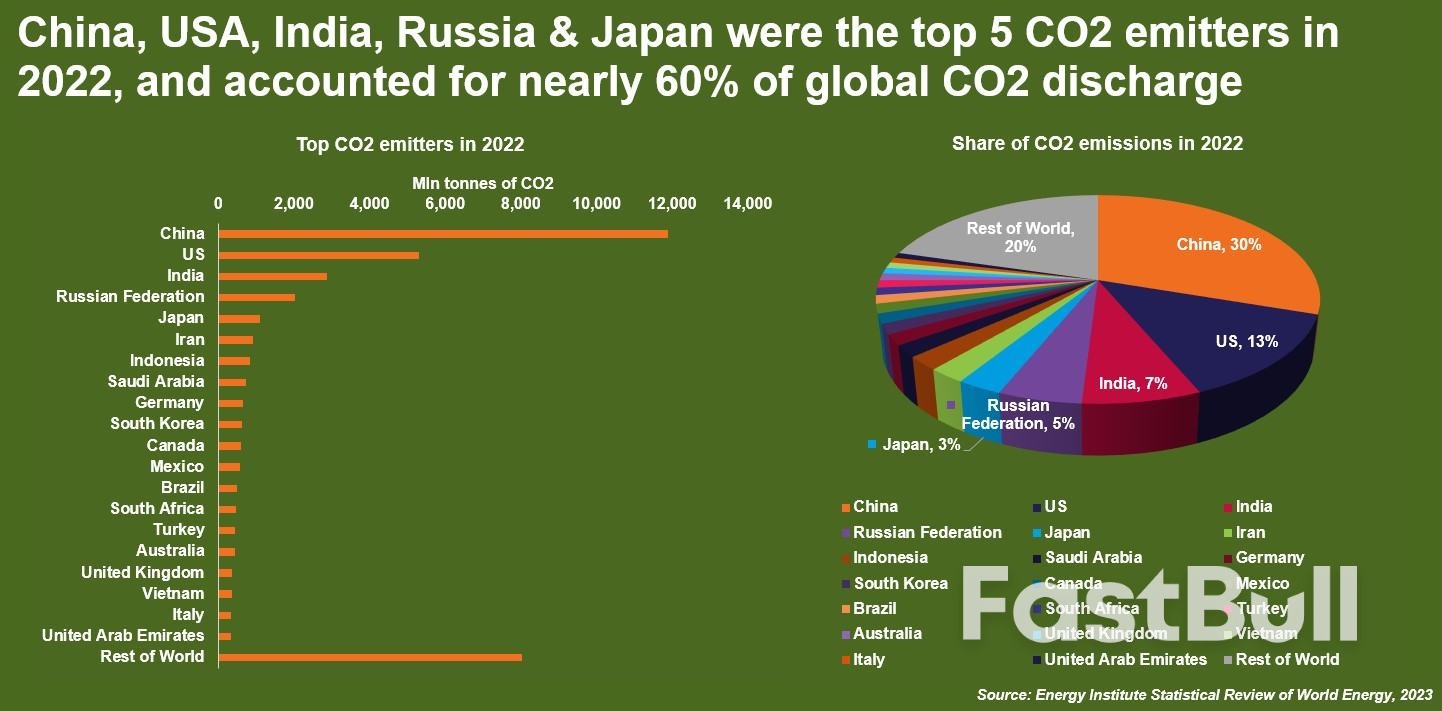

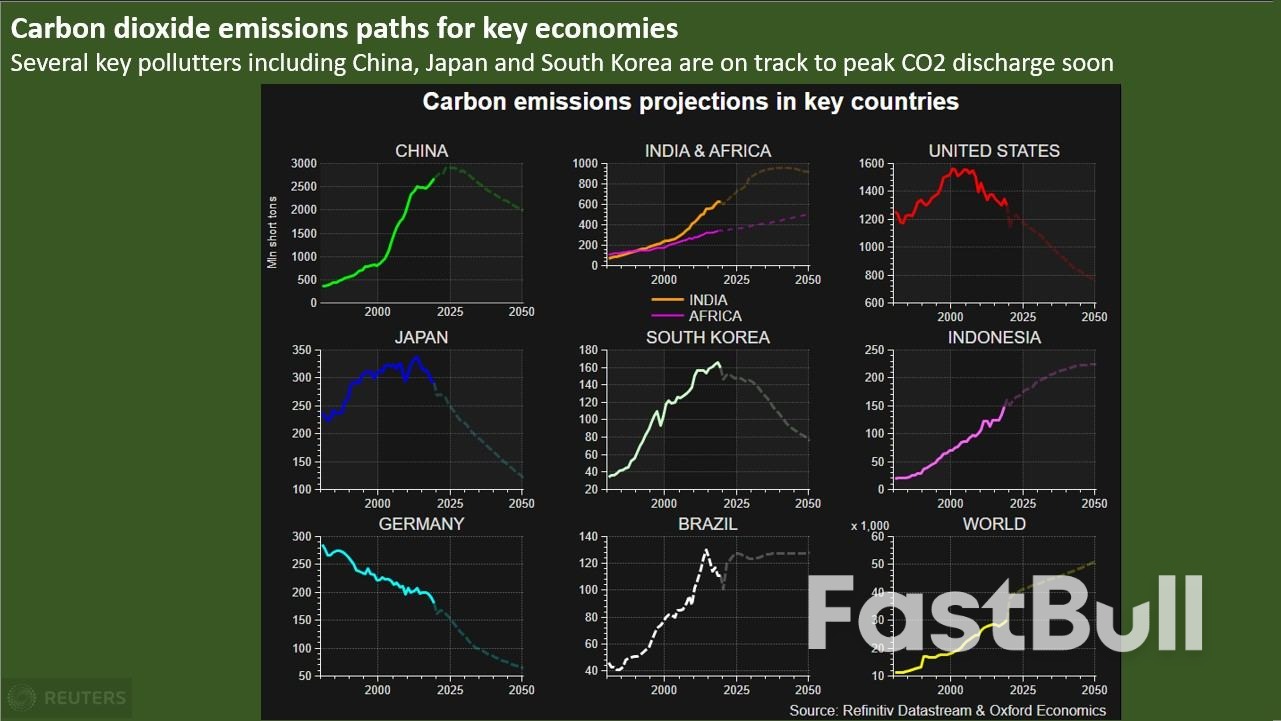

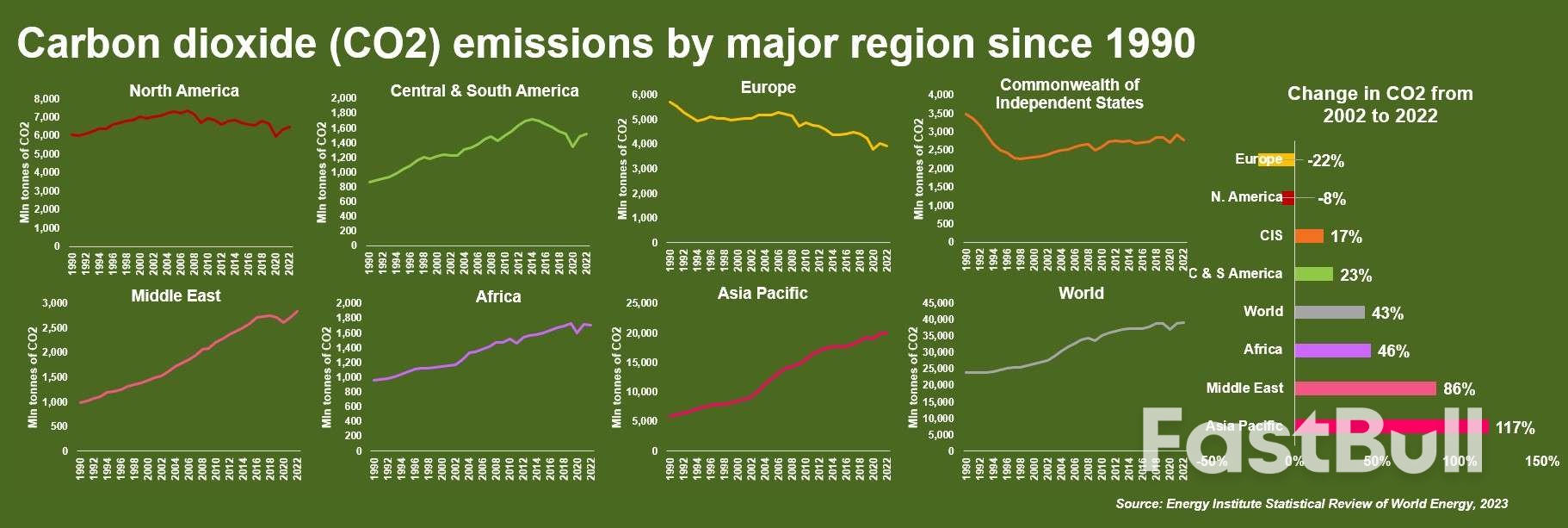

However, as the world's largest and fastest-growing producer of renewable power, China is also the global leader in clean energy efforts, and is on track to reach peak CO2 emissions as soon as this year, according to the Centre for Research on Energy and Clean Air (CREA).

However, as the world's largest and fastest-growing producer of renewable power, China is also the global leader in clean energy efforts, and is on track to reach peak CO2 emissions as soon as this year, according to the Centre for Research on Energy and Clean Air (CREA). The United States, the second largest polluter in 2022 and by far the largest overall CO2 emitter in history, has already brought emissions onto a downward trajectory, as has Germany, Europe's largest polluter.

The United States, the second largest polluter in 2022 and by far the largest overall CO2 emitter in history, has already brought emissions onto a downward trajectory, as has Germany, Europe's largest polluter. India, already the world's third largest CO2 polluter in 2022, is seen increasing total CO2 discharge until 2040, while CO2 emissions in Indonesia - the seventh largest polluter last year - may not peak until 2050.

India, already the world's third largest CO2 polluter in 2022, is seen increasing total CO2 discharge until 2040, while CO2 emissions in Indonesia - the seventh largest polluter last year - may not peak until 2050.White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up