Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

Citi Predicts Cn Allocation To Push Copper To Usd15-16K/ Ton In Coming Weeks, But Rather Unlikely To Sustain

Bombardier - Have Taken Note Of Post From President Of United States To Social Media And Are In Contact With Canadian Government

The Main Lithium Carbonate Futures Contract Hit Its Daily Limit Down, Falling 10.99% To 148,200 Yuan/ton

The Most Active Lithium Carbonate Futures Contract Fell 10.00% Intraday, Currently Trading At 149,540 Yuan/ton. The Most Active Platinum Futures Contract Declined 12.00% Intraday, Currently Trading At 627.10 Yuan/gram. The Most Active Tin Futures Contract On The Shanghai Stock Exchange Plummeted 6.00% Intraday, Currently Trading At 418,000.00 Yuan/ton. LME Tin Fell 2.00% Intraday, Currently Trading At 52,900.00 USD/ton

Platinum Futures Fell 10.00% Intraday, Currently Trading At 643.00 Yuan/gram; Spot Palladium Fell More Than 4.00% Intraday, Currently Trading At 1914.10 USD/ounce

WTI Crude Oil Touched $64 Per Barrel, Down 2.40% On The Day; Brent Crude Oil Fell Below $68 Per Barrel, Down 2.11% On The Day

The Most Active Shanghai Silver Futures Contract Fell 4.00% Intraday, Currently Trading At 28,324.00 Yuan/kg. The Most Active Shanghai Copper Futures Contract Declined 2.00% Intraday, Currently Trading At 104,120.00 Yuan/ton

Oil Futures Fell By More Than $1 Per Barrel, With Brent Crude Futures Dropping To A Low Of $69.62 Per Barrel And WTI Crude Futures Settling At $64.18 Per Barrel

The Australian Dollar Fell 1% Against The US Dollar; The New Zealand Dollar Fell 0.8% Against The US Dollar

U.S. Exports (Nov)

U.S. Exports (Nov)A:--

F: --

P: --

Canada Imports (SA) (Nov)

Canada Imports (SA) (Nov)A:--

F: --

Canada Exports (SA) (Nov)

Canada Exports (SA) (Nov)A:--

F: --

U.S. Factory Orders MoM (Excl. Defense) (Nov)

U.S. Factory Orders MoM (Excl. Defense) (Nov)A:--

F: --

P: --

U.S. Factory Orders MoM (Nov)

U.S. Factory Orders MoM (Nov)A:--

F: --

U.S. Wholesale Sales MoM (SA) (Nov)

U.S. Wholesale Sales MoM (SA) (Nov)A:--

F: --

P: --

U.S. Factory Orders MoM (Excl. Transport) (Nov)

U.S. Factory Orders MoM (Excl. Transport) (Nov)A:--

F: --

U.S. Non-Defense Capital Durable Goods Orders Revised MoM (Excl. Aircraft) (SA) (Nov)

U.S. Non-Defense Capital Durable Goods Orders Revised MoM (Excl. Aircraft) (SA) (Nov)A:--

F: --

U.S. EIA Weekly Natural Gas Stocks Change

U.S. EIA Weekly Natural Gas Stocks ChangeA:--

F: --

P: --

Brazil CAGED Net Payroll Jobs (Dec)

Brazil CAGED Net Payroll Jobs (Dec)A:--

F: --

P: --

U.S. Weekly Treasuries Held by Foreign Central Banks

U.S. Weekly Treasuries Held by Foreign Central BanksA:--

F: --

P: --

South Korea Industrial Output MoM (SA) (Dec)

South Korea Industrial Output MoM (SA) (Dec)A:--

F: --

P: --

South Korea Services Output MoM (Dec)

South Korea Services Output MoM (Dec)A:--

F: --

P: --

South Korea Retail Sales MoM (Dec)

South Korea Retail Sales MoM (Dec)A:--

F: --

P: --

Japan Tokyo CPI YoY (Excl. Food & Energy) (Jan)

Japan Tokyo CPI YoY (Excl. Food & Energy) (Jan)A:--

F: --

P: --

Japan Tokyo CPI MoM (Excl. Food & Energy) (Jan)

Japan Tokyo CPI MoM (Excl. Food & Energy) (Jan)A:--

F: --

P: --

Japan Unemployment Rate (Dec)

Japan Unemployment Rate (Dec)A:--

F: --

P: --

Japan Tokyo CPI YoY (Jan)

Japan Tokyo CPI YoY (Jan)A:--

F: --

P: --

Japan Jobs to Applicants Ratio (Dec)

Japan Jobs to Applicants Ratio (Dec)A:--

F: --

P: --

Japan Tokyo CPI MoM (Jan)

Japan Tokyo CPI MoM (Jan)A:--

F: --

P: --

Japan Tokyo Core CPI YoY (Jan)

Japan Tokyo Core CPI YoY (Jan)A:--

F: --

P: --

Japan Retail Sales YoY (Dec)

Japan Retail Sales YoY (Dec)A:--

F: --

Japan Industrial Inventory MoM (Dec)

Japan Industrial Inventory MoM (Dec)A:--

F: --

P: --

Japan Retail Sales (Dec)

Japan Retail Sales (Dec)A:--

F: --

P: --

Japan Retail Sales MoM (SA) (Dec)

Japan Retail Sales MoM (SA) (Dec)A:--

F: --

Japan Large-Scale Retail Sales YoY (Dec)

Japan Large-Scale Retail Sales YoY (Dec)A:--

F: --

P: --

Japan Industrial Output Prelim MoM (Dec)

Japan Industrial Output Prelim MoM (Dec)A:--

F: --

P: --

Japan Industrial Output Prelim YoY (Dec)

Japan Industrial Output Prelim YoY (Dec)A:--

F: --

P: --

Australia PPI YoY (Q4)

Australia PPI YoY (Q4)A:--

F: --

P: --

Australia PPI QoQ (Q4)

Australia PPI QoQ (Q4)A:--

F: --

P: --

Japan Construction Orders YoY (Dec)

Japan Construction Orders YoY (Dec)--

F: --

P: --

Japan New Housing Starts YoY (Dec)

Japan New Housing Starts YoY (Dec)--

F: --

P: --

France GDP Prelim YoY (SA) (Q4)

France GDP Prelim YoY (SA) (Q4)--

F: --

P: --

Turkey Trade Balance (Dec)

Turkey Trade Balance (Dec)--

F: --

P: --

France PPI MoM (Dec)

France PPI MoM (Dec)--

F: --

P: --

Germany Unemployment Rate (SA) (Jan)

Germany Unemployment Rate (SA) (Jan)--

F: --

P: --

Germany GDP Prelim YoY (Not SA) (Q4)

Germany GDP Prelim YoY (Not SA) (Q4)--

F: --

P: --

Germany GDP Prelim QoQ (SA) (Q4)

Germany GDP Prelim QoQ (SA) (Q4)--

F: --

P: --

Germany GDP Prelim YoY (Working-day Adjusted) (Q4)

Germany GDP Prelim YoY (Working-day Adjusted) (Q4)--

F: --

P: --

Italy GDP Prelim YoY (SA) (Q4)

Italy GDP Prelim YoY (SA) (Q4)--

F: --

P: --

U.K. M4 Money Supply (SA) (Dec)

U.K. M4 Money Supply (SA) (Dec)--

F: --

P: --

U.K. M4 Money Supply YoY (Dec)

U.K. M4 Money Supply YoY (Dec)--

F: --

P: --

U.K. M4 Money Supply MoM (Dec)

U.K. M4 Money Supply MoM (Dec)--

F: --

P: --

U.K. Mortgage Lending (Dec)

U.K. Mortgage Lending (Dec)--

F: --

P: --

U.K. Mortgage Approvals (Dec)

U.K. Mortgage Approvals (Dec)--

F: --

P: --

Italy Unemployment Rate (SA) (Dec)

Italy Unemployment Rate (SA) (Dec)--

F: --

P: --

Euro Zone Unemployment Rate (Dec)

Euro Zone Unemployment Rate (Dec)--

F: --

P: --

Euro Zone GDP Prelim QoQ (SA) (Q4)

Euro Zone GDP Prelim QoQ (SA) (Q4)--

F: --

P: --

Euro Zone GDP Prelim YoY (SA) (Q4)

Euro Zone GDP Prelim YoY (SA) (Q4)--

F: --

P: --

Italy PPI YoY (Dec)

Italy PPI YoY (Dec)--

F: --

P: --

India Deposit Gowth YoY

India Deposit Gowth YoY--

F: --

P: --

Mexico GDP Prelim YoY (Q4)

Mexico GDP Prelim YoY (Q4)--

F: --

P: --

Brazil Unemployment Rate (Dec)

Brazil Unemployment Rate (Dec)--

F: --

P: --

South Africa Trade Balance (Dec)

South Africa Trade Balance (Dec)--

F: --

P: --

Germany CPI Prelim YoY (Jan)

Germany CPI Prelim YoY (Jan)--

F: --

P: --

Germany CPI Prelim MoM (Jan)

Germany CPI Prelim MoM (Jan)--

F: --

P: --

Germany HICP Prelim YoY (Jan)

Germany HICP Prelim YoY (Jan)--

F: --

P: --

Germany HICP Prelim MoM (Jan)

Germany HICP Prelim MoM (Jan)--

F: --

P: --

Canada GDP MoM (SA) (Nov)

Canada GDP MoM (SA) (Nov)--

F: --

P: --

Canada GDP YoY (Nov)

Canada GDP YoY (Nov)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

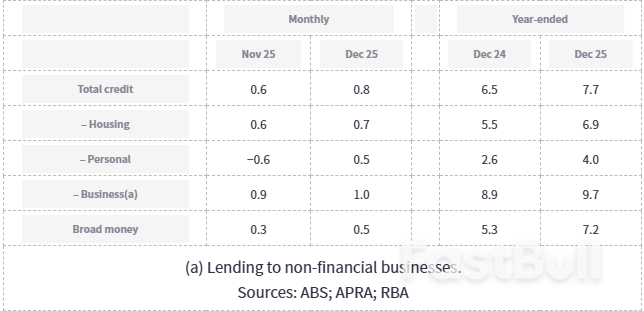

All growth rates for the financial aggregates are seasonally adjusted, and adjusted for theeffects of breaks in the series. Data for the levels of financial aggregates are notadjusted for series breaks, and growth rates should not be calculated from data on thelevels of credit.

The table below presents a summary of the latest financial aggregates statistics.

All growth rates for the financial aggregates are seasonally adjusted, and adjusted for theeffects of breaks in the series. Data for the levels of financial aggregates are notadjusted for series breaks, and growth rates should not be calculated from data on thelevels of credit.

Historical levels and growth rates for the financial aggregates have been revised owing tothe resubmission of data by some financial intermediaries, the re-estimation of seasonalfactors and the incorporation of securitisation data. The RBA credit aggregates measurecredit provided by financial institutions operating domestically. They do not capturecross-border or non-intermediated lending.

Since the July 2019 release, the financial aggregates have incorporated an improvedconceptual framework and a new data collection. This is referred to as the Economic andFinancial Statistics (EFS) collection. For more information, seeUpdates to Australia's FinancialAggregates and the July 2019 Financial Aggregates.

Since the March 2023 release, series that exclude lending to warehouse trusts in business credit were added tothe financial aggregates. More information is available in theChange Notice published 21 April 2023.

U.S. President Donald Trump issued a stark warning to the United Kingdom on Thursday, labeling its new business overtures to China as "very dangerous." The comments came as London and Beijing take significant steps to repair their strained relationship and forge a new long-term strategic partnership.

The diplomatic push is highlighted by Prime Minister Keir Starmer's four-day visit to China, the first by a British leader in eight years. Starmer, accompanied by a delegation of nearly 60 business executives, is aiming to reset bilateral ties and unlock new economic opportunities.

The meeting between Prime Minister Starmer and Chinese President Xi Jinping has already produced several key agreements designed to boost economic ties. According to Downing Street, the new measures include:

• Tariff Reduction: China has agreed to cut its import tariffs on British whisky in half, from 10% down to 5%.

• Visa-Free Travel: British nationals will be granted visa-free travel to China for stays of up to 30 days.

• Major Investment: British pharmaceutical giant AstraZeneca announced it will invest $15 billion in China through 2030.

When asked about Starmer's efforts, Trump told Reuters, "it's very dangerous for them to do that."

The U.K.'s diplomatic strategy mirrors a similar move by Canada, which signed its own trade agreement with China earlier this month. The visit by Canadian Prime Minister Mark Carney signaled Ottawa's intent to diversify its trade partners amid ongoing friction with Washington.

Trump directed an even stronger warning toward Canada, stating it was "even more dangerous for Canada to get into business with China." He added, "Canada is not doing well... You can't look at China as the answer."

In a sharp reversal of his previous stance, Trump has threatened to impose a 100% tariff on Canadian goods if Ottawa proceeds with the China trade deal.

"President Xi is a friend of mine, I know him very well," Trump said, before adding an unusual warning. "The first thing they're going to do is say you're not allowed to play ice hockey anymore. Canada's not going to like that."

Oil prices are on track for their most significant monthly surge in years, driven by escalating tensions in the Middle East over a potential U.S. conflict with Iran that could threaten global energy supplies.

While both major benchmarks saw a slight pullback on Friday, their monthly performance remains exceptionally strong. Brent crude futures dipped 21 cents to $70.50 a barrel, and the more active April contract fell 37 cents to $69.22. U.S. West Texas Intermediate (WTI) crude saw a 39-cent drop to $65.03 per barrel.

Despite the minor decline, both benchmarks are poised to break a five-month losing streak.

• Brent crude is set for a monthly gain of over 16%, its largest jump since January 2022.

• WTI crude is on pace to rise more than 14% in January, marking its biggest monthly increase since July 2023.

The primary driver behind the price surge is the heightened risk of conflict between the United States and Iran. U.S. President Donald Trump on Wednesday called for Iran to negotiate on its nuclear program or risk a military strike, prompting a sharp response from Tehran.

This standoff has injected a significant "risk premium" into oil prices. According to IG market analyst Tony Sycamore, traders are now pricing in the possibility of major disruptions to Iranian oil exports or a shutdown of shipping through the vital Strait of Hormuz.

Adding to the tension, the Trump administration is reportedly holding separate talks in Washington this week with senior defense and intelligence officials from Israel and Saudi Arabia to discuss Iran. While U.S. officials state that President Trump is still reviewing his options, the military buildup in the region has put the market on high alert.

Despite the heated rhetoric, some analysts believe a full-scale disruption to Iran's oil infrastructure is unlikely. Analysts at JPMorgan, led by Natasha Kaneva, noted that "elevated inflation and this year's mid-term elections" in the U.S. make a prolonged conflict undesirable.

Their analysis suggests that if military action does occur, it would likely be "targeted, avoiding Iran's oil production and export infrastructure." This view is shared by Citi, which estimates a 70% probability that the U.S. and Israel will opt for more restrained actions against Iran in the near term, such as limited strikes and oil tanker seizures.

Beyond the Middle East, a series of unrelated supply disruptions have further tightened the global oil market, collectively removing an estimated 1.5 million barrels per day (bpd) in January, according to JPMorgan.

Key supply challenges include:

• Kazakhstan: The massive Tengiz oilfield is slowly restarting production after electrical fires impacted 7.2 million barrels of output. It is expected to take a week to return to full capacity.

• United States: An Arctic weather wave is projected to reduce crude and condensate output by 340,000 bpd this month.

• Russia: Bad weather has hampered the country's oil exports.

• Venezuela: The nation was forced to cut production after U.S. forces ousted President Nicolas Maduro.

However, the situation in Venezuela is evolving. The new interim government approved a major reform of its oil law on Thursday, while the Trump administration eased some sanctions on the country's oil industry. These moves are designed to encourage investment and could eventually lead to an increase in Venezuela's oil and gas output.

The Trump administration has authorized tariffs on goods from any country that provides oil to Cuba, escalating economic pressure on the island nation's government.

President Donald Trump signed an executive order that directs officials to first identify which countries are supplying Cuba with oil and then determine appropriate export duties to impose on them.

In the order, Trump stated that "The Government of Cuba has taken extraordinary actions that harm and threaten the United States." The document accuses the Cuban government of aligning with and supporting "numerous hostile countries, transnational terrorist groups, and malign actors adverse to the United States."

This new policy places Mexico, the top trading partner of the US, directly in the spotlight. As Venezuela’s own economic crisis has caused its oil shipments to plummet, Mexico has become the primary foreign oil supplier to Cuba.

The pressure already appears to be having an effect. Earlier this month, Mexico canceled a planned crude shipment to the island, according to documents reviewed by Bloomberg News.

The timing of the announcement is notable, coming just hours after Mexican President Claudia Sheinbaum described a "cordial" trade-focused conversation with Trump that she said did not include any discussion of Cuba. Her office declined to comment on the new tariff order but indicated she would address it at a press conference on Friday morning. The Mexican foreign and economy ministries also did not provide immediate comments.

"This is mostly to deter Mexico from selling oil to Cuba," said Francisco Monaldi, an energy expert at Rice University. "This is a massive blow to Cuba that will push that island very quickly into a very dire situation."

The tariff threat adds another layer of complexity to the US-Mexico relationship. The two countries, along with Canada, are scheduled to review the USMCA regional trade agreement later this year—a pact with major consequences for Mexico's export-driven economy.

European diplomats have voiced concerns that continued fuel deprivation could trigger a humanitarian crisis in Cuba. The island's oil supplies have been significantly reduced since operations targeting Venezuela’s Nicolas Maduro began, with the Trump administration demanding that the interim government in Venezuela stop sending energy to Havana.

Trump amplified this stance in a recent social media post, declaring, "THERE WILL BE NO MORE OIL OR MONEY GOING TO CUBA - ZERO!" He urged the island's leaders to "make a deal, BEFORE IT IS TOO LATE."

Last year, data compiled by Bloomberg shows that Mexico's state-owned oil company, Pemex, sent an average of one tanker per month to Cuba, equating to roughly 20,000 barrels of crude oil per day.

The executive order justifies the action by framing the Cuban government as a supporter of terrorism and a source of regional instability that endangers American security. For years, US officials have also been concerned about China establishing an intelligence-gathering presence in Cuba, mirroring the role the Soviet Union played during the Cold War.

Secretary of State Marco Rubio, whose parents immigrated to the US from Cuba, was direct about the administration's goals at a hearing on Wednesday.

"It would be of great benefit to the United States if Cuba was no longer governed by an autocratic regime," Rubio said, adding that the US would "love to see" a change in the Cuban government.

President Donald Trump is set to announce his nominee for Federal Reserve Chair on Friday morning, bringing an end to months of speculation about the future leadership of the world's most influential central bank.

When asked about the timing of his decision at a Washington event on Thursday evening, Trump confirmed the announcement would be made "tomorrow morning." This timeline is an acceleration from just hours earlier, when the president had suggested the pick would be revealed next week.

The selection process, overseen by Treasury Secretary Scott Bessent, has reportedly narrowed the field to four potential candidates:

• Kevin Hassett, Director of the National Economic Council

• Christopher Waller, a Federal Reserve governor

• Kevin Warsh, a former Fed governor

• Rick Rieder, an executive at BlackRock Inc.

Without revealing a name, Trump hinted that his choice would not be a surprise to the financial community. "A lot of people think this is somebody that could've been there a few years ago," he commented.

The president has been transparent about his criteria, seeking a Fed leader who shares his desire to cut interest rates more aggressively. Trump's long-running public pressure campaign on current Chair Jerome Powell has focused on his belief that borrowing costs are too high.

"We're paying far too much interest in the Fed," Trump stated on Thursday. "We should have the lowest interest rate anywhere in the world. They should be two points and even three points lower."

This statement followed the Federal Reserve's decision on Wednesday to leave its benchmark rate unchanged, a move that came after three consecutive rate reductions in the final months of 2025.

Trump's nominee could face a difficult confirmation process in the U.S. Senate. Republican Senator Thom Tillis, a key member of the Banking Committee, has pledged to block any of the president's Fed nominees pending the resolution of a Justice Department investigation into the central bank's headquarters renovation.

The probe, which also involves Chair Powell's congressional testimony, has amplified existing concerns about political threats to the Federal Reserve's independence. The president's announcement will mark a new phase in his extended effort to influence the central bank's monetary policy.

A bearish outside day triggered in gold on Thursday, setting the stage for a possible pullback to lower prices or consolidation. The precious metal is set to have its first down day in nine days and end the pattern of higher daily lows that partially defines the short-term uptrend. Thursday's session began with a breakout to a new record high of $5,598, before sellers took back control and drove the price below Thursday's low to $5,101.

Sport gold outside day at extension resistance.

Sport gold outside day at extension resistance.Heightened volatility seen in the relatively large range day Thursday, shows price discovery expanding the price range. This implies that consolidation within the day's range may occur before a resolution out of the daily range. Given key short-term support represented by the rising 10-day average at $4,970, a correction could complete as consolidation. Once the average touches price, the chance for a move increases, as that will complete a successful test of support. And it would be the first test of the 10-day line since January 16. Retaining dynamic support at the 10-day average, followed by strength, would go a long way to preparing for a continuation of the bull trend.

Spot gold weekly chart showing acceleration in bullish momentum following channel breakout.

Spot gold weekly chart showing acceleration in bullish momentum following channel breakout.Several upside targets were exceeded earlier this week until a 341.4% (√2 + 2) extension of the October pullback at $5,576 was hit Thursday. That was shortly followed by a selloff resulting in an outside day. It is also interesting to note that Thursday is set to have the first lower daily close since the January 19 breakout.

The strength or weakness shown by this week's closing price may shed some light on momentum. This week's range is $4,990 to $5,598. Where the weekly closing price is relative to the range may add information about underlying strength or weakness. Although initial downside targets start with the 10-day average, the larger view shows the possibility of the drop to prior highs at $4,537, especially since the 10-week average is nearby at $4,536.

A correction of some degree, with either a pullback or range-bound price action, would be healthy for the long-term trend. And if support is retained above the 10-day average, the expectation is for a resolution to the upside, new trend highs.

Venezuela's national assembly today unanimously passed changes to its oil laws that allow more private-sector ownership in its fields and provide more investor assurances, as US administration officials have demanded.

The changes included repealing a group of six regulations that were in addition to the last major hydrocarbon law package passed in 2006, under late former President Hugo Chavez. Those laws had regulated the nationalization of major oil projects in the Orinoco heavy crude belt and assets of oilfield service companies, seizures that led to long-running legal claims from companies including ExxonMobil and ConocoPhillips.

"Every aspect of the oil business will no longer be 100pc state-owned, like Chavez wanted," Dolores Dobarro, who was deputy oil minister when Chavez implemented the laws around 2006, told Argus. "I'm for it, I think it's fine."

The changes mean that in some oil projects the government's take, in taxes plus royalties, will not automatically be of 83.33pc, but will instead hover from 65-80pc and perhaps even less, once other modifications are factored in.

Royalties in oil projects will no longer be a set 33.33pc but will instead be calculated on a sliding scale depending on the project, from 15-30pc, according to the changes to the hydrocarbons law itself passed today.

The tax rate is also no longer set at 50pc, independent of the project. A new tax rate was not specifically set, but this could come in later regulations.

Companies investing in oil and natural gas will also be exempted from a series of national, local and state taxes. The total financial impact will need to be tallied, experts told Argus, but it is a significant change.

"A lot has been left to the discretion of the authorities with these modifications," another former oil minister told Argus. "But I think by and large oil companies such as Chevron will see this as a positive."

The law as proposed by interim vice president Delcy Rodriguez had passed in a first debate on 22 January with no changes. The new legislation comes after the US has claimed the direction of Venezuela's oil policy in the wake of its capture of former president Nicolas Maduro.

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

Log In

Sign Up