Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

The Main Lithium Carbonate Futures Contract Continued To Fall, Dropping More Than 6% Intraday, And Is Currently Trading At 160,020 Yuan/ton

[Sources: Trump Considers Major Strikes Against Iran Amid Nuclear Negotiations] Sources Revealed That US President Trump Is Considering A New Major Strike Against Iran After Initial Discussions Between The US And Iran Failed To Make Progress On Limiting Iran's Nuclear Program And Ballistic Missile Production. Sources Said That Options Trump Is Currently Considering Include Airstrikes Against Iranian Leaders And Security Officials Believed To Be Responsible For Deaths And Injuries During Protests In Iran, As Well As Strikes Against Iranian Nuclear Facilities And Government Institutions. Sources Also Indicated That Trump Has Not Yet Finalized His Decision On How To Act, But He Believes His Military Options Are More Abundant Than At The Beginning Of The Month With The Deployment Of US Carrier Strike Groups To The Region

Singapore's Monetary Authority Of Singapore - The Risks To The Growth And Inflation Outlook Are Tilted To The Upside At This Point

Singapore's Monetary Authority Of Singapore - For The Full Year, GDP Growth Is Expected To Ease Relative To The Stronger Outturn In 2025

Singapore's Monetary Authority Of Singapore - On Average Over 2026, Core Inflation Momentum Is Expected To Come In At A Pace That Is Slightly Below Trend

There Will Be No Change To Its Width And The Level At Which It Is Centred - Monetary Authority Of Singapore

New Zealand Business Confidence 64.1% In January Versus 73.6% In Previous Survey - ANZ Bank Survey

U.S. API Weekly Refined Oil Stocks

U.S. API Weekly Refined Oil StocksA:--

F: --

P: --

U.S. API Weekly Crude Oil Stocks

U.S. API Weekly Crude Oil StocksA:--

F: --

P: --

U.S. API Weekly Gasoline Stocks

U.S. API Weekly Gasoline StocksA:--

F: --

P: --

U.S. API Weekly Cushing Crude Oil Stocks

U.S. API Weekly Cushing Crude Oil StocksA:--

F: --

P: --

Australia RBA Trimmed Mean CPI YoY (Q4)

Australia RBA Trimmed Mean CPI YoY (Q4)A:--

F: --

P: --

Australia CPI YoY (Q4)

Australia CPI YoY (Q4)A:--

F: --

P: --

Australia CPI QoQ (Q4)

Australia CPI QoQ (Q4)A:--

F: --

P: --

Germany GfK Consumer Confidence Index (SA) (Feb)

Germany GfK Consumer Confidence Index (SA) (Feb)A:--

F: --

P: --

Germany 10-Year Bund Auction Avg. Yield

Germany 10-Year Bund Auction Avg. YieldA:--

F: --

P: --

India Industrial Production Index YoY (Dec)

India Industrial Production Index YoY (Dec)A:--

F: --

P: --

India Manufacturing Output MoM (Dec)

India Manufacturing Output MoM (Dec)A:--

F: --

P: --

U.S. MBA Mortgage Application Activity Index WoW

U.S. MBA Mortgage Application Activity Index WoWA:--

F: --

P: --

Canada Overnight Target Rate

Canada Overnight Target RateA:--

F: --

P: --

BOC Monetary Policy Report

BOC Monetary Policy Report U.S. EIA Weekly Crude Stocks Change

U.S. EIA Weekly Crude Stocks ChangeA:--

F: --

P: --

U.S. EIA Weekly Cushing, Oklahoma Crude Oil Stocks Change

U.S. EIA Weekly Cushing, Oklahoma Crude Oil Stocks ChangeA:--

F: --

P: --

U.S. EIA Weekly Crude Demand Projected by Production

U.S. EIA Weekly Crude Demand Projected by ProductionA:--

F: --

P: --

U.S. EIA Weekly Crude Oil Imports Changes

U.S. EIA Weekly Crude Oil Imports ChangesA:--

F: --

P: --

U.S. EIA Weekly Heating Oil Stock Changes

U.S. EIA Weekly Heating Oil Stock ChangesA:--

F: --

P: --

U.S. EIA Weekly Gasoline Stocks Change

U.S. EIA Weekly Gasoline Stocks ChangeA:--

F: --

P: --

BOC Press Conference

BOC Press Conference Russia PPI MoM (Dec)

Russia PPI MoM (Dec)A:--

F: --

P: --

Russia PPI YoY (Dec)

Russia PPI YoY (Dec)A:--

F: --

P: --

U.S. Interest Rate On Reserve Balances

U.S. Interest Rate On Reserve BalancesA:--

F: --

P: --

U.S. Target Federal Funds Rate Lower Limit (Overnight Reverse Repo Rate)

U.S. Target Federal Funds Rate Lower Limit (Overnight Reverse Repo Rate)A:--

F: --

P: --

U.S. Federal Funds Rate Target

U.S. Federal Funds Rate TargetA:--

F: --

P: --

U.S. Target Federal Funds Rate Upper Limit (Excess Reserves Ratio)

U.S. Target Federal Funds Rate Upper Limit (Excess Reserves Ratio)A:--

F: --

P: --

FOMC Statement

FOMC Statement FOMC Press Conference

FOMC Press Conference Brazil Selic Interest Rate

Brazil Selic Interest RateA:--

F: --

P: --

Australia Import Price Index YoY (Q4)

Australia Import Price Index YoY (Q4)A:--

F: --

P: --

Japan Household Consumer Confidence Index (Jan)

Japan Household Consumer Confidence Index (Jan)--

F: --

P: --

Turkey Economic Sentiment Indicator (Jan)

Turkey Economic Sentiment Indicator (Jan)--

F: --

P: --

Euro Zone M3 Money Supply (SA) (Dec)

Euro Zone M3 Money Supply (SA) (Dec)--

F: --

P: --

Euro Zone Private Sector Credit YoY (Dec)

Euro Zone Private Sector Credit YoY (Dec)--

F: --

P: --

Euro Zone M3 Money Supply YoY (Dec)

Euro Zone M3 Money Supply YoY (Dec)--

F: --

P: --

Euro Zone 3-Month M3 Money Supply YoY (Dec)

Euro Zone 3-Month M3 Money Supply YoY (Dec)--

F: --

P: --

South Africa PPI YoY (Dec)

South Africa PPI YoY (Dec)--

F: --

P: --

Euro Zone Consumer Confidence Index Final (Jan)

Euro Zone Consumer Confidence Index Final (Jan)--

F: --

P: --

Euro Zone Selling Price Expectations (Jan)

Euro Zone Selling Price Expectations (Jan)--

F: --

P: --

Euro Zone Industrial Climate Index (Jan)

Euro Zone Industrial Climate Index (Jan)--

F: --

P: --

Euro Zone Services Sentiment Index (Jan)

Euro Zone Services Sentiment Index (Jan)--

F: --

P: --

Euro Zone Economic Sentiment Indicator (Jan)

Euro Zone Economic Sentiment Indicator (Jan)--

F: --

P: --

Euro Zone Consumer Inflation Expectations (Jan)

Euro Zone Consumer Inflation Expectations (Jan)--

F: --

P: --

Italy 5-Year BTP Bond Auction Avg. Yield

Italy 5-Year BTP Bond Auction Avg. Yield--

F: --

P: --

Italy 10-Year BTP Bond Auction Avg. Yield

Italy 10-Year BTP Bond Auction Avg. Yield--

F: --

P: --

France Unemployment Class-A (Dec)

France Unemployment Class-A (Dec)--

F: --

P: --

South Africa Repo Rate (Jan)

South Africa Repo Rate (Jan)--

F: --

P: --

Canada Average Weekly Earnings YoY (Nov)

Canada Average Weekly Earnings YoY (Nov)--

F: --

P: --

U.S. Nonfarm Unit Labor Cost Final (Q3)

U.S. Nonfarm Unit Labor Cost Final (Q3)--

F: --

P: --

U.S. Initial Jobless Claims 4-Week Avg. (SA)

U.S. Initial Jobless Claims 4-Week Avg. (SA)--

F: --

P: --

U.S. Weekly Continued Jobless Claims (SA)

U.S. Weekly Continued Jobless Claims (SA)--

F: --

P: --

U.S. Trade Balance (Nov)

U.S. Trade Balance (Nov)--

F: --

P: --

U.S. Weekly Initial Jobless Claims (SA)

U.S. Weekly Initial Jobless Claims (SA)--

F: --

P: --

Canada Trade Balance (SA) (Nov)

Canada Trade Balance (SA) (Nov)--

F: --

P: --

U.S. Exports (Nov)

U.S. Exports (Nov)--

F: --

P: --

Canada Imports (SA) (Nov)

Canada Imports (SA) (Nov)--

F: --

P: --

Canada Exports (SA) (Nov)

Canada Exports (SA) (Nov)--

F: --

P: --

U.S. Unit Labor Cost Revised MoM (SA) (Q3)

U.S. Unit Labor Cost Revised MoM (SA) (Q3)--

F: --

U.S. Factory Orders MoM (Nov)

U.S. Factory Orders MoM (Nov)--

F: --

P: --

U.S. Wholesale Sales MoM (SA) (Nov)

U.S. Wholesale Sales MoM (SA) (Nov)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

Federal Reserve Chair Jerome Powell on Wednesday declined to say whether he will stay on at the Fed after his term as chair ends, or whether the central bank has responded to subpoenas involving renovation work at the central bank.When it comes to finishing out a governor’s term that ends in 2028 and extends beyond the end of his chair term in May, Powell said at a press conference that “there's a time and place for these questions" but the matter is "not something I'm going to be getting into today.”

Federal Reserve Chair Jerome Powell on Wednesday declined to say whether he will stay on at the Fed after his term as chair ends, or whether the central bank has responded to subpoenas involving renovation work at the central bank.

When it comes to finishing out a governor's term that ends in 2028 and extends beyond the end of his chair term in May, Powell said at a press conference that "there's a time and place for these questions" but the matter is "not something I'm going to be getting into today."

As for the legal investigation, the Fed leader said "I have nothing for you on that today."

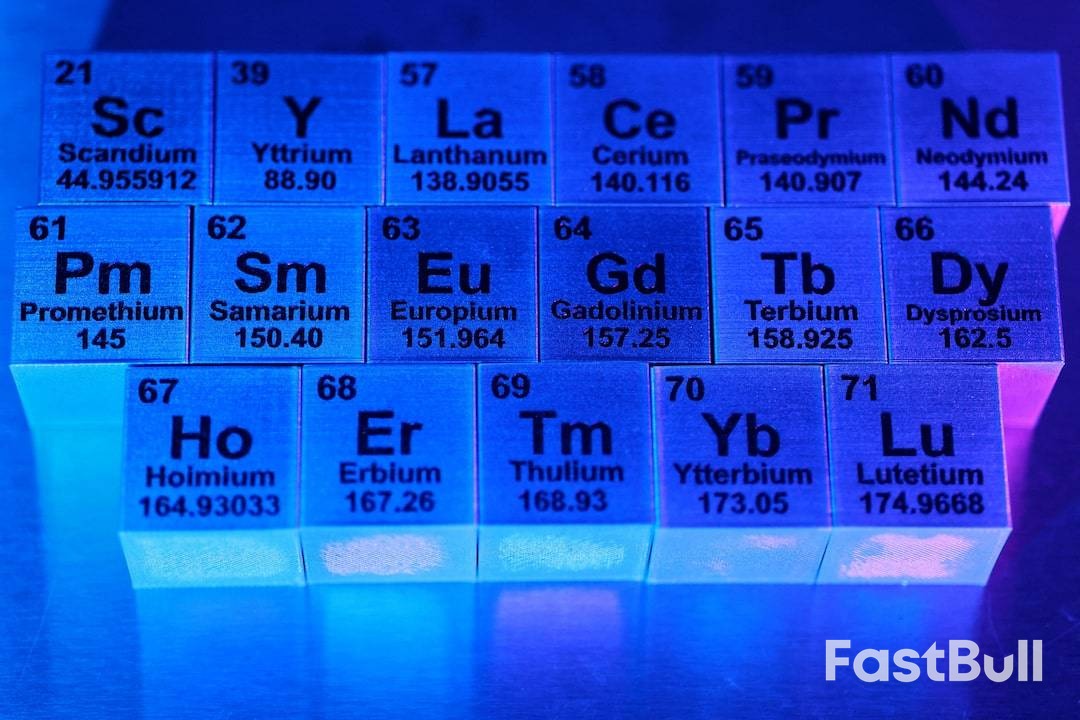

The Trump administration is backing away from its plan to provide guaranteed minimum prices for U.S. critical minerals projects, a significant policy reversal confirmed by multiple sources. This shift signals a new reality for domestic mining companies, driven by a lack of congressional funding and the complexities of market intervention.

This move marks a departure from earlier commitments to the industry and could distance Washington from G7 partners, who have been discussing joint price supports to bolster the production of minerals vital for electric vehicles, defense systems, and electronics. The change in strategy is already under the microscope, as a U.S. Senate committee is currently reviewing a price floor that was extended to MP Materials last year.

At a private meeting this month hosted by a Washington think tank, senior Trump administration officials delivered a direct message to U.S. minerals executives: government price supports are off the table. According to three attendees, the officials stated that projects must prove their financial independence without federal guarantees.

"We're not here to prop you guys up," said Audrey Robertson, an assistant secretary at the U.S. Department of Energy, during the meeting. "Don't come to us expecting that."

Robertson, who heads the Office of Critical Minerals and Energy Innovation, was joined by Joshua Kroon of the Commerce Department's International Trade Administration. Both officials confirmed that Washington is no longer in a position to offer price floors.

This stance is a stark contrast to a similar closed-door meeting last July. At that time, officials told executives that the price floor granted to MP Materials was "not a one-off" and that the administration was actively developing similar support for other projects.

U.S. mining and processing companies have long advocated for price floors as a necessary tool to compete with China. Industry leaders argue that China's state-backed producers can manipulate global prices to undercut competitors, deter private investment, and maintain market dominance.

However, critics of price floors warn of significant financial risks. Such guarantees could expose U.S. taxpayers to long-term liabilities by forcing the government to subsidize minerals if market prices fall. Legal experts also note that these supports could face challenges under U.S. procurement and trade laws, as they might be viewed as market-distorting subsidies that lack explicit congressional authorization.

The White House declined to comment on future price floors but affirmed its commitment to deregulation, tax cuts, and targeted investments in the sector, emphasizing its role as a "good steward of taxpayer dollars."

The administration's pivot appears linked to the fallout from its investment in MP Materials. That deal, which included a guaranteed purchase agreement for two types of rare earths at a minimum of $110 per kilogram, raised concerns among some officials and members of Congress. According to two sources, a key issue was that the funding for the price floor had not been authorized by Congress.

Market dynamics have also shifted since the investment was made. USA Rare Earth announced this week its intention to purchase the same rare earths on the open market for $125 per kilogram, above MP's guaranteed price.

The MP deal created confusion over whether Washington would offer similar terms to other companies. Sources say that as the administration considered other equity investments, it realized it lacked the congressional authority to fund more price floors. This conclusion was reinforced by an inquiry from the Senate Armed Services Committee, which requested a meeting with Pentagon staff last year to explain the rationale behind the MP Materials support and the government's broader investment strategy in the minerals sector.

While price floors may be off the table, the administration has other tools to support domestic critical minerals projects and counter foreign influence. These include:

• Equity Investments: The government has already taken equity positions in companies like Lithium Americas, Trilogy Metals, and USA Rare Earth.

• Strategic Stockpiling: Building national reserves of critical minerals can help stabilize demand and prices.

• Local Content Requirements: Mandating the use of domestically sourced materials can create a reliable market for U.S. producers.

Other nations, including Australia, have also explored price floors, highlighting the global challenge of securing stable supply chains for minerals essential to the modern economy.

The Federal Reserve's latest interest rate decision was a quiet affair. On Wednesday, the Federal Open Market Committee (FOMC) announced it would hold the federal funds rate steady at its current 3.5%-3.75% range, a move that caused barely a ripple in the stock market.

But the main event for investors wasn't the decision itself—it was the press conference with Fed Chair Jerome Powell that followed. Traders and analysts listen closely to these briefings for clues about the central bank's view of the economy. This time, Powell delivered a largely optimistic message, suggesting that several major economic risks have subsided. Here’s a breakdown of what he said and what it signals for investors.

Perhaps the most crucial part of Powell's assessment was his direct statement on the balance of risks. "I would say that the upside risks to inflation and the downside risks to employment have diminished, but they still exist," he commented.

This marks a significant shift from last year, when the economy faced the threat of stagflation—a damaging combination of rising inflation and rising unemployment, fueled by tariffs and a weakening labor market. According to Powell, that particular risk has cooled down considerably.

He noted that key labor market indicators suggest conditions are stabilizing after a period of softening. The unemployment rate, for example, has held firm around 4.4% in recent months.

Tariffs were a major headwind for investors last year, but Powell seemed to indicate that their economic impact has largely been absorbed. While he acknowledged that tariffs are still keeping inflation on goods above the Fed's 2% target, he also noted that inflation in services has started to ease. He expects the price effects from tariffs to peak soon before starting to fall.

The Fed Chair also offered a nuanced view of the labor market, suggesting that immigration restrictions may have contributed to slower job growth by reducing both the supply of and demand for labor.

Finally, despite some weak consumer confidence reports, Powell pointed out that the data shows overall consumer spending has been good.

Investors typically welcome falling interest rates, as lower rates make stocks more attractive than bonds and reduce borrowing costs for companies. However, the catch is that rate cuts are often triggered by a recession, which is bad news for stocks.

The biggest threats to the economy have recently appeared to be a weak labor market and sluggish consumer discretionary spending, issues cited by several retailers. But Powell’s comments suggest these problems may not be as severe as they seem.

If the economy can maintain stability and continue to grow this year, the stock market—already benefiting from the AI boom—appears well-positioned to continue its upward trend.

The Federal Reserve held interest rates steady at its January meeting, a move that came as no surprise to the market. The key message from the Federal Open Market Committee (FOMC) and Chair Jerome Powell, however, is that the bar for any future rate cuts has been raised.

The central bank appears to be carefully balancing its concerns over a weakening labor market with inflation that remains above its target. Following three consecutive 25-basis-point cuts in previous meetings, the Fed is signaling a more cautious, data-dependent approach.

The decision to hold rates was not unanimous. Governors Miran and Waller both dissented, arguing in favor of a 25-basis-point cut.

Interestingly, even the committee's more dovish members seem to be shifting their stance. Governor Michelle Bowman voted to keep rates unchanged, and Miran’s call for a cut was for 25 basis points, not a more aggressive 50. This suggests a growing consensus against immediate and deep easing.

The official post-meeting statement adopted a slightly more hawkish tone, particularly in its updated descriptions of the labor market and inflation.

Labor Market Language Shifts

Previous statements highlighted "downside risks" to the labor market. That language has been removed. The new text states that the unemployment rate has "shown some signs of stabilization," indicating reduced concern about an imminent downturn in employment.

A More Optimistic Inflation Outlook

The language on inflation was also cautiously optimistic. While the statement reiterated that "inflation remains somewhat elevated," it dropped a previous reference to inflation having moved up since early last year, acknowledging recent progress.

Chair Powell's press conference reinforced this theme of a more balanced outlook. He noted that the tension between the Fed's dual mandate of maximum employment and price stability has eased.

"We still have some tension between employment and inflation, but it's less than it was," Powell stated. "I think the upside risks to inflation and the down risks [to employment] are probably both diminished a bit."

Powell also sounded more positive about the economy, describing the outlook as "overall a stronger forecast" compared to the December meeting. Still, he stopped short of declaring victory. He emphasized that the committee has made no decisions about future meetings and urged caution on reading too much into recent data. "We saw data coming in which suggests some signs of stabilization," he said of the labor market. "I wouldn't go too far with that, but some signs of stabilization."

With three rate cuts already implemented, Powell stressed that the current policy rate is well-positioned to "let the data speak to us."

While the Fed is not in a hurry to resume easing, it has kept the door open for a potential rate cut in March if the labor market weakens or inflation slows further.

Our forecast remains for two additional 25-basis-point cuts this year, one at the March meeting and another in June. However, the risks to this outlook are increasingly tilted toward later and less aggressive easing. With expectations for solid GDP growth and a stabilizing labor market, the window for the Fed to cut rates may be narrower than previously thought.

During the press conference, Powell declined to comment on the Department of Justice's investigation into the Federal Reserve or his own plans after his term as Chair expires. When asked about attending Lisa Cook's case at the Supreme Court, he described it as "perhaps the most important legal case in the Fed's 113-year history," adding, "I thought it might be hard to explain why I didn't attend."

With the Federal Reserve holding interest rates steady, Wall Street’s attention is now turning to the long-term policy path through 2026. Forecasts from five major financial institutions reveal a significant divide on when—or if—the central bank will begin to cut rates.

While most analysts anticipate a cautious approach from the Fed, a clear consensus has yet to emerge. Here’s a breakdown of what JPMorgan Chase, Citigroup, Barclays, Bank of America, and Wells Fargo expect.

Four of the five institutions surveyed are projecting a total of 50 basis points (bps) in rate cuts during 2026, though they differ on the precise timing.

• Barclays: Expects two 25 bps cuts, one in June and another in December. The bank believes the Federal Open Market Committee (FOMC) will signal it is in no rush, emphasizing that risks to employment and inflation are now balanced.

• Bank of America: Also forecasts 50 bps in cuts, concentrated in June and July. They note, however, that current market pricing leaves room for the Fed to deliver a relatively dovish surprise.

• Citigroup: Maintains its forecast for 50 bps of easing, with cuts in June and September. Citi argues that if the cuts are for policy normalization rather than a crisis response, policymakers will seek a broader consensus, which requires clearer progress on inflation.

• Wells Fargo: Projects cuts in March and June. The bank suggests that the longer the FOMC waits, the higher the economic bar becomes to justify further monetary easing.

JPMorgan Chase stands apart from the crowd, forecasting no interest rate cuts at all in 2026.

The bank’s analysis suggests that after three previous rate cuts for risk management, many FOMC members now believe a pause is appropriate. According to JPMorgan, Fed Chair Jerome Powell will likely argue that the current policy stance is sufficient to manage risks under the Fed’s dual mandate while also avoiding political controversies.

Across the different forecasts, a common theme is the expectation that Fed Chair Jerome Powell will reaffirm a patient and data-driven approach.

Powell is anticipated to stress that the current monetary policy is appropriate for assessing the effects of previous hikes. He is also expected to emphasize that the labor market has stabilized and that the committee will wait for more definitive signs of progress on inflation before committing to a change in direction. While he may face questions on other topics, like a Justice Department investigation, his commentary on monetary policy is expected to remain consistent and cautious.

Federal Reserve Governor Christopher Waller broke ranks on Wednesday, dissenting from the central bank's decision to hold interest rates steady. This move immediately positions him closer to President Donald Trump, but it comes at a significant cost to both Waller's reputation and the Fed's institutional credibility.

Waller is a leading contender to become the next Fed chair. Following his dissent, his odds on the betting site Kalshi surged from 8% to 15%. The move is widely seen as a response to Trump's demand for a chair who will prioritize lower interest rates, effectively turning the nomination process into a public loyalty test for an otherwise respected public servant.

This development is particularly notable because Waller was long considered a champion of the Fed's independence. His image as a technocrat who bases decisions strictly on economic data, not political pressure, is now under scrutiny.

This isn't Waller's first break with the consensus. He, along with serial dissenter Stephen Miran, also pushed for a 25 basis point cut in July when the Fed held rates steady.

At that time, Waller built his case on several key arguments:

• Tariffs: He argued that tariffs were a one-off price increase that monetary policy should ignore.

• Inflation: He believed inflation was near the Fed's target if you adjusted for the duties.

• Jobs: He pointed to private sector job growth being "near stall speed."

• GDP: He noted that real GDP growth was soft in the first half of 2025 and was expected to remain so.

However, the economic landscape has shifted since July. While some of his points on inflation and jobs remain partly true, the argument for an urgent rate cut has been undermined by strong third-quarter GDP data and a stabilizing labor market.

Waller's goal in July was to move interest rates toward a "neutral" level—a rate that neither stimulates nor restrains the economy. Policymakers now estimate this neutral rate is somewhere between 2.6% and 3.9%. After three subsequent rate cuts, the current policy rate is in a range of 3.5%-3.75%, placing it squarely within the plausible neutral zone. This makes the immediate need for further cuts far less clear from a purely economic standpoint.

Waller himself has previously stated that dissents should be used carefully and intentionally. In a July interview on Bloomberg Television, he emphasized their rarity and importance. Yet, he has now dissented in two consecutive meetings where his—and Trump's—preferred policy was not adopted.

While lively debate and dissenting opinions are healthy for the Fed, they are most valuable when rooted in clear economic reasoning. When the economic justification appears weak, such moves can look more like political grandstanding.

Despite this recent action, Waller remains a strong candidate for the Fed's top job. He is an exceptional communicator with a solid track record of economic analysis since joining the Fed in 2020.

He correctly identified the risk of sustained inflation in 2021 and argued in 2022 that the Fed could combat it with high rates without causing a recession. As an institutionalist respected by his colleagues, he may still be the best choice to defend the Fed's independent tradition, especially as the executive branch has used the Justice Department to attack the central bank.

Even so, this particular dissent feels less like a principled stand and more like a political calculation. It highlights the damage caused by Trump's pressure campaign. Even if the Federal Reserve's independence ultimately survives, the institution is unlikely to emerge from this period unscathed. The unorthodox process of forcing candidates to publicly audition for the top job will leave a lasting mark, even if the right person ultimately wins the role.

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

Log In

Sign Up