Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

U.S. Average Hourly Wage MoM (SA) (Dec)

U.S. Average Hourly Wage MoM (SA) (Dec)A:--

F: --

U.S. Average Weekly Working Hours (SA) (Dec)

U.S. Average Weekly Working Hours (SA) (Dec)A:--

F: --

P: --

U.S. New Housing Starts Annualized MoM (SA) (Oct)

U.S. New Housing Starts Annualized MoM (SA) (Oct)A:--

F: --

U.S. Total Building Permits (SA) (Oct)

U.S. Total Building Permits (SA) (Oct)A:--

F: --

P: --

U.S. Building Permits MoM (SA) (Oct)

U.S. Building Permits MoM (SA) (Oct)A:--

F: --

P: --

U.S. Annual New Housing Starts (SA) (Oct)

U.S. Annual New Housing Starts (SA) (Oct)A:--

F: --

U.S. U6 Unemployment Rate (SA) (Dec)

U.S. U6 Unemployment Rate (SA) (Dec)A:--

F: --

P: --

U.S. Manufacturing Employment (SA) (Dec)

U.S. Manufacturing Employment (SA) (Dec)A:--

F: --

U.S. Labor Force Participation Rate (SA) (Dec)

U.S. Labor Force Participation Rate (SA) (Dec)A:--

F: --

P: --

U.S. Private Nonfarm Payrolls (SA) (Dec)

U.S. Private Nonfarm Payrolls (SA) (Dec)A:--

F: --

U.S. Unemployment Rate (SA) (Dec)

U.S. Unemployment Rate (SA) (Dec)A:--

F: --

U.S. Nonfarm Payrolls (SA) (Dec)

U.S. Nonfarm Payrolls (SA) (Dec)A:--

F: --

U.S. Average Hourly Wage YoY (Dec)

U.S. Average Hourly Wage YoY (Dec)A:--

F: --

Canada Full-time Employment (SA) (Dec)

Canada Full-time Employment (SA) (Dec)A:--

F: --

P: --

Canada Part-Time Employment (SA) (Dec)

Canada Part-Time Employment (SA) (Dec)A:--

F: --

P: --

Canada Unemployment Rate (SA) (Dec)

Canada Unemployment Rate (SA) (Dec)A:--

F: --

P: --

Canada Labor Force Participation Rate (SA) (Dec)

Canada Labor Force Participation Rate (SA) (Dec)A:--

F: --

P: --

U.S. Government Employment (Dec)

U.S. Government Employment (Dec)A:--

F: --

P: --

Canada Employment (SA) (Dec)

Canada Employment (SA) (Dec)A:--

F: --

P: --

U.S. UMich Consumer Expectations Index Prelim (Jan)

U.S. UMich Consumer Expectations Index Prelim (Jan)A:--

F: --

P: --

U.S. UMich Consumer Sentiment Index Prelim (Jan)

U.S. UMich Consumer Sentiment Index Prelim (Jan)A:--

F: --

P: --

U.S. UMich Current Economic Conditions Index Prelim (Jan)

U.S. UMich Current Economic Conditions Index Prelim (Jan)A:--

F: --

P: --

U.S. UMich 1-Year-Ahead Inflation Expectations Prelim (Jan)

U.S. UMich 1-Year-Ahead Inflation Expectations Prelim (Jan)A:--

F: --

P: --

U.S. UMich 5-Year-Ahead Inflation Expectations Prelim YoY (Jan)

U.S. UMich 5-Year-Ahead Inflation Expectations Prelim YoY (Jan)A:--

F: --

P: --

U.S. 5-10 Year-Ahead Inflation Expectations (Jan)

U.S. 5-10 Year-Ahead Inflation Expectations (Jan)A:--

F: --

P: --

China, Mainland M1 Money Supply YoY (Dec)

China, Mainland M1 Money Supply YoY (Dec)--

F: --

P: --

China, Mainland M0 Money Supply YoY (Dec)

China, Mainland M0 Money Supply YoY (Dec)--

F: --

P: --

China, Mainland M2 Money Supply YoY (Dec)

China, Mainland M2 Money Supply YoY (Dec)--

F: --

P: --

U.S. Weekly Total Oil Rig Count

U.S. Weekly Total Oil Rig CountA:--

F: --

P: --

U.S. Weekly Total Rig Count

U.S. Weekly Total Rig CountA:--

F: --

P: --

Indonesia Retail Sales YoY (Nov)

Indonesia Retail Sales YoY (Nov)--

F: --

P: --

Euro Zone Sentix Investor Confidence Index (Jan)

Euro Zone Sentix Investor Confidence Index (Jan)--

F: --

P: --

India CPI YoY (Dec)

India CPI YoY (Dec)--

F: --

P: --

Germany Current Account (Not SA) (Nov)

Germany Current Account (Not SA) (Nov)--

F: --

P: --

Canada National Economic Confidence Index

Canada National Economic Confidence Index--

F: --

P: --

FOMC Member Barkin Speaks

FOMC Member Barkin Speaks U.S. 3-Year Note Auction Yield

U.S. 3-Year Note Auction Yield--

F: --

P: --

U.S. 10-Year Note Auction Avg. Yield

U.S. 10-Year Note Auction Avg. Yield--

F: --

P: --

Japan Trade Balance (Customs Data) (SA) (Nov)

Japan Trade Balance (Customs Data) (SA) (Nov)--

F: --

P: --

Japan Trade Balance (Nov)

Japan Trade Balance (Nov)--

F: --

P: --

U.K. BRC Overall Retail Sales YoY (Dec)

U.K. BRC Overall Retail Sales YoY (Dec)--

F: --

P: --

U.K. BRC Like-For-Like Retail Sales YoY (Dec)

U.K. BRC Like-For-Like Retail Sales YoY (Dec)--

F: --

P: --

Turkey Retail Sales YoY (Nov)

Turkey Retail Sales YoY (Nov)--

F: --

P: --

U.S. NFIB Small Business Optimism Index (SA) (Dec)

U.S. NFIB Small Business Optimism Index (SA) (Dec)--

F: --

P: --

Brazil Services Growth YoY (Nov)

Brazil Services Growth YoY (Nov)--

F: --

P: --

Canada Building Permits MoM (SA) (Nov)

Canada Building Permits MoM (SA) (Nov)--

F: --

P: --

U.S. CPI MoM (SA) (Dec)

U.S. CPI MoM (SA) (Dec)--

F: --

P: --

U.S. CPI YoY (Not SA) (Dec)

U.S. CPI YoY (Not SA) (Dec)--

F: --

P: --

U.S. Real Income MoM (SA) (Dec)

U.S. Real Income MoM (SA) (Dec)--

F: --

P: --

U.S. CPI MoM (Not SA) (Dec)

U.S. CPI MoM (Not SA) (Dec)--

F: --

P: --

U.S. Core CPI (SA) (Dec)

U.S. Core CPI (SA) (Dec)--

F: --

P: --

U.S. Core CPI YoY (Not SA) (Dec)

U.S. Core CPI YoY (Not SA) (Dec)--

F: --

P: --

U.S. Core CPI MoM (SA) (Dec)

U.S. Core CPI MoM (SA) (Dec)--

F: --

P: --

U.S. Weekly Redbook Index YoY

U.S. Weekly Redbook Index YoY--

F: --

P: --

U.S. New Home Sales Annualized MoM (Oct)

U.S. New Home Sales Annualized MoM (Oct)--

F: --

P: --

U.S. Annual Total New Home Sales (Oct)

U.S. Annual Total New Home Sales (Oct)--

F: --

P: --

U.S. Cleveland Fed CPI MoM (SA) (Dec)

U.S. Cleveland Fed CPI MoM (SA) (Dec)--

F: --

P: --

China, Mainland Imports YoY (CNH) (Dec)

China, Mainland Imports YoY (CNH) (Dec)--

F: --

P: --

China, Mainland Trade Balance (CNH) (Dec)

China, Mainland Trade Balance (CNH) (Dec)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

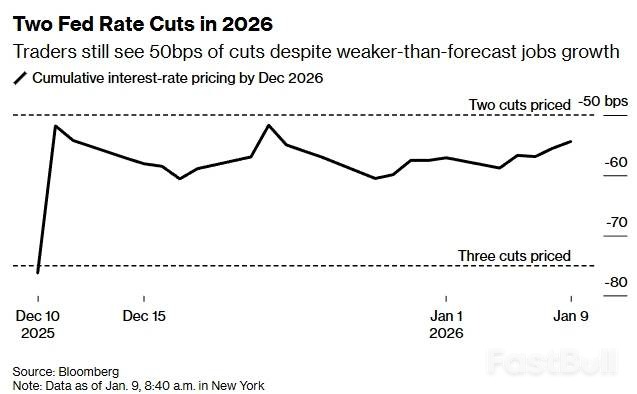

Wall Street forecasts 2026 Fed rate cuts under a new Trump-appointed Chair, signaling a dovish shift favorable for crypto.

Wall Street is bracing for the Federal Reserve to continue cutting interest rates in 2026, with analysts now forecasting at least a 50 basis point reduction. The expectation comes as President Donald Trump prepares to name a successor to Fed Chair Jerome Powell, signaling a potential policy shift.

Leading financial institutions have revised their outlooks, anticipating a more aggressive easing cycle. According to recent client notes:

• Morgan Stanley now projects two 25-bps rate cuts in 2026, shifting its timeline from January and April to June and September.

• Citigroup has also adjusted its forecast, now expecting rate cuts in March, July, and September. This outlook implies a total reduction of up to 75 bps in 2026, which would push the federal funds rate range below 3%.

The market's dovish sentiment is building on the three rate cuts already anticipated for 2025. The primary driver is the expected appointment of a new Fed Chair by President Trump, which investors believe will lead to a more accommodative monetary policy.

This view is supported by officials like Treasury Secretary Scott Bessent, who has advocated for lower interest rates to stimulate economic growth, despite weaker-than-expected jobs data.

This macroeconomic environment is seen as highly favorable for digital assets. The expected rate cuts align with other expansionary policies, including the Federal Reserve's Quantitative Easing (QE) program that began in early December 2025 and a planned $200 billion injection into the housing industry by President Trump.

These dovish signals are prompting Wall Street investors to adopt a "risk-on" appetite. As the stock market continues its bull rally, a capital rotation away from precious metals and into riskier assets is expected. Consequently, Bitcoin and the wider altcoin industry appear poised to benefit, potentially triggering a strong bull run in 2026.

Despite the escalating war in Ukraine and shattered relations between Russia and the European Union, a small window for cooperation between Washington and Moscow appears to remain open. In a rare instance of de-escalation, the United States agreed to release Russian crew members from a tanker seized in a high-stakes naval operation.

The incident began when the United States intercepted the Russian-flagged oil tanker Marinera in the North Atlantic. The vessel is allegedly part of a "shadow fleet" used to transport oil for sanctioned nations like Venezuela, Russia, and Iran.

The seizure was a particularly bold move ordered by the Trump administration because the Marinera was reportedly being escorted by the Russian Navy, including a submarine. This direct action raised fears of a potential exchange of fire between US and Russian naval forces, creating a tense standoff on the high seas. The vessel, previously named Bella 1, had reportedly been reflagged from Guyanese to Russian before its journey across the Atlantic.

Instead of spiraling into a military conflict, the crisis was resolved through direct appeals. Russia’s Foreign Ministry spokeswoman, Maria Zakharova, confirmed that the Kremlin had reached out to the White House to secure the release of its citizens.

"At our request, U.S. President Donald Trump has decided to release two Russian citizens aboard the Marinera tanker, who were previously detained by the United States," Zakharova stated.

Kirill Dmitriev, a special envoy for President Putin, also noted on Telegram that Trump had ordered the release of "all Russians" from the vessel.

The Russian government expressed public appreciation for the decision. "We welcome this decision and express our gratitude to the US leadership," Zakharova added.

The release averted what could have become a serious international incident. Moscow had previously warned that any attempt to prosecute the Russian nationals would be "categorically unacceptable" and would "only result in further military and political tensions." The Kremlin voiced alarm over "Washington's willingness to generate acute international crisis situations."

By resolving the matter diplomatically, both sides stepped back from a potentially explosive confrontation, signaling that even in an environment of deep hostility, channels for communication and de-escalation between the US and Russia still exist.

Myanmar's military regime is staging fraudulent, tightly controlled elections across the country, even as its airstrikes continue to terrorize the population. The largest opposition party, the National League for Democracy (NLD), has been banned from participating. Yet, troubling signs suggest that some world governments, including the United States, may be preparing to re-engage with the junta.

This is a critical moment. For the Trump administration to overhaul its Myanmar policy now would be a strategic error, rewarding a military that controls less than half the nation's territory and granting it the political legitimacy it desperately craves.

Since the military coup in 2021 that ousted the democratically elected government of Aung San Suu Kyi, U.S. policy has centered on diplomatic isolation and targeted economic sanctions, often coordinated with allies like the UK, EU, and Canada. Now, that approach appears to be under review.

The first major signal of a shift came last November when U.S. Secretary of Homeland Security Kristi Noem announced the termination of Temporary Protected Status (TPS) for thousands of Burmese refugees in the U.S. Her justification was starkly disconnected from reality.

Noem declared that the "situation in Burma has improved enough that it is safe for Burmese citizens to return home," citing supposed progress in governance, stability, and national reconciliation. Human rights advocates found their requests for meetings with DHS officials turned down, with the department stating that current policy was "under review." In response, the Asian American Legal Defense and Education Fund (AALDEF) and the International Refugee Assistance Project (IRAP) have filed a lawsuit challenging the TPS revocation.

Further fueling concerns, the U.S. recently remained silent on International Human Rights Day, failing to join allies like Canada, Norway, and the United Kingdom in a joint statement calling for an end to violence against civilians in Myanmar. The administration has also refrained from commenting on the junta's multi-phase election process, citing a policy directive from Secretary of State Marco Rubio to avoid criticizing foreign elections, with notable exceptions for Latin America and Europe.

The administration's actions have left Myanmar observers questioning whether these are isolated decisions or part of a coherent strategy to court the country's generals.

Last summer, proposals were reportedly floated for U.S. investment in Myanmar’s rare-earth mining sector. While these plans went nowhere—China dominates the industry, sourcing 57% of its rare-earth imports from Myanmar—they raised concerns that the administration is open to engaging the junta when an opportunity arises.

The confusion deepened in July when President Trump sent a letter to junta leader Min Aung Hlaing, addressing him as "His Excellency," to announce a 40% tariff on Myanmar's exports. This tariff is among the highest the U.S. imposes globally. Instead of protesting, Min Aung Hlaing responded with an enthusiastic letter of his own, thanking Trump and requesting sanctions relief.

Just two weeks later, the U.S. Treasury Department quietly lifted sanctions on several businesses and individuals close to the military regime. While analysts familiar with the move described it as "technical, not political," the junta immediately celebrated it as a major diplomatic victory, using it in propaganda to portray the democratic resistance as a losing cause.

In one area, the U.S. has acted decisively. In late 2025, the Justice Department created a new Scam Center Strike Force, and Congress passed legislation to dismantle the massive cyberscam industry flourishing in Myanmar and its border regions. These scam centers cost Americans over $10 billion in 2024 alone, demonstrating that Washington can act forcefully when it perceives a direct threat.

However, the Myanmar military is not a reliable partner in this fight. Despite staging symbolic crackdowns on notorious sites like KK Park, the junta cannot be trusted as long as its own corrupt officers and high-level officials benefit from the illicit industry.

The Trump administration's National Security Strategy explicitly states its willingness to work with authoritarian countries if it serves U.S. interests. But in Myanmar, there is no clear upside.

• Economic Interests: It is virtually impossible for Washington to break Beijing's dominance over Myanmar's rare-earth supply chain.

• Shared Goals: The U.S. has no conceivable shared interests with the Tatmadaw, as Myanmar's military is known.

While neighboring countries like China, India, and Thailand maintain working relations with the junta for their own strategic reasons—from border stability and infrastructure security to counter-insurgency operations—their logic does not apply to the United States.

Arguments that Washington is losing influence to Beijing and must therefore engage the junta are short-sighted. A better strategy would be to support Myanmar's democratic resistance. When military rule eventually collapses, the U.S. will have retained the goodwill of the people, who remain deeply distrustful of China.

A peaceful, democratic Myanmar is a far more sustainable partner for the U.S. than a corrupt and unstable military regime. Instead of pivoting toward the generals in Naypyidaw, Washington should focus on the long game.

This means increasing support for Myanmar’s opposition and civil society leaders, who are the architects of the country's future democracy. It also requires expanding coordination with like-minded allies such as Australia, Canada, the EU, and the UK, who share U.S. concerns about regional and global security.

The junta's sham election will not solve Myanmar’s deep political divisions; it will only exacerbate them. Washington should ignore the political theater and instead lay the groundwork for a future where a democratic Myanmar can become a meaningful American partner in the Indo-Pacific.

U.S. President Donald Trump met with executives from the world's largest oil companies on Friday, January 9, to outline a strategy for Venezuela, stating that boosting the nation's crude production would directly benefit the United States.

The high-stakes meeting at the White House follows the seizure of Venezuelan leader Nicolas Maduro by U.S. forces during a raid on the capital on January 3, underscoring oil's central role in the administration's plan for the OPEC member.

President Trump opened the meeting by framing the objective clearly: leveraging American corporate power to quickly rebuild Venezuela’s failing oil industry. The goal, he stated, is to restore millions of barrels of production to the global market, benefiting the U.S., Venezuela, and the world.

"We're going to be making the decision as to which oil companies are going to go in, that we're going to allow to go in," Trump announced.

Administration officials have emphasized the need to control Venezuela's oil sales and revenue streams indefinitely to ensure the country's alignment with American interests. Central to this strategy is the expectation that major oil companies will inject billions of dollars into rehabilitating the nation's oilfields.

Despite the administration's clear intentions, a significant gap exists between Washington's ambitions and the risk appetite of major energy firms. Investors remain skeptical about committing to large-scale, long-term projects in Venezuela.

Key sources of hesitation for oil majors include:

• Political Instability: The uncertain political future of the country poses a major risk to long-term capital investments.

• High Costs: Rebuilding Venezuela's dilapidated energy infrastructure would require massive financial outlays.

While firms like Chevron, Vitol, and Trafigura are reportedly competing for U.S. licenses to market Venezuela's existing crude oil, this short-term opportunism does not extend to the deeper commitments the White House is seeking. According to sources, industry giants like Chevron and ConocoPhillips are cautious about rushing into major investments.

The meeting's guest list highlighted the administration's focus on mobilizing the entire U.S. energy sector. Attendees included not only industry leaders like Chevron, Exxon Mobil, and ConocoPhillips but also several smaller independent and private equity-backed players.

Notably, some of these smaller firms have connections to Colorado, the home state of Energy Secretary Chris Wright, suggesting a broad-based effort to bring American oil expertise to bear on Venezuela's future.

U.S. President Donald Trump is taking a measured stance on the mass protests in Iran, pairing strong verbal warnings with a cautious, wait-and-see policy. While threatening severe consequences for a violent crackdown, his administration is holding back from deeper involvement as U.S. intelligence suggests the unrest does not yet pose a threat to Tehran's clerical leadership.

In recent days, Trump has warned Iranian leaders there will be "hell to pay" if they use force against the protest movement. "I have let them know that if they start killing people, which they tend to do during their riots… we're going to hit them very hard," Trump told radio host Hugh Hewitt on Thursday.

Human rights groups report that security forces have already killed and injured demonstrators. However, in a Fox News interview, Trump referenced past crackdowns, noting security forces have previously "stomped on" people in crowds and were "shooting the hell out of people."

A key indicator of Trump's cautious strategy is his decision to hold off on meeting with Reza Pahlavi, the exiled son of the late Shah of Iran. This move signals that the White House is waiting to see how the crisis develops before officially backing any opposition figure.

"I think that we should let everybody go out there and see who emerges," Trump said. "I'm not sure necessarily that it would be an appropriate thing to do."

Pahlavi, who resides near Washington, has been using social media to encourage the demonstrations. On Friday, he urged Trump to increase his involvement with "attention, support and action."

"You have proven and I know you are a man of peace and a man of your word. Please be prepared to intervene to help the people of Iran," he posted.

According to a source familiar with U.S. intelligence reports, an assessment from the intelligence community earlier this week concluded that the protests are not yet large enough to challenge Supreme Leader Ali Khamenei's hold on power.

However, U.S. analysts are monitoring the situation closely. The source noted a critical shift: "Prior to the last 24 hours the protests were broadly concentrated in cities where opposition to the regime has always been a thing. Moving to strongholds (like the Supreme Leader's hometown of Mashad) is the significant development."

A White House spokesperson declined to comment on intelligence matters but reiterated the president's position. "As the President has stated repeatedly, if Iran shoots and violently kills peaceful protesters, 'They will get hit very hard,'" the spokesperson said. The CIA also declined to comment.

The unrest in Iran comes as Trump's attention is divided, with active foreign policy focus on Venezuela's President Nicolas Maduro and discussions about acquiring Greenland. This follows a tense period last June when Trump ordered, then called off, U.S.-led bombing raids on Iranian nuclear facilities, warning he would do so again if Tehran restarted its program.

When asked for his message to the Iranian people, Trump said, "All I can say is you should feel strongly about freedom. There's nothing like freedom. You're brave people. It's a shame what's happened to your country."

Alex Vatanka, director of the Iran program at the Middle East Institute, suggests Trump is waiting to see if the protests can destabilize Iran's ruling clerics before committing to intervention.

"Trump wants to be on the winning side, but he prefers a quick win, not a win that requires a lot of investment and holding hands, certainly not in the Middle East," Vatanka explained. "To him, that's just against everything he stood for as a politician, going back to when he first ran."

The European Union has greenlit a landmark trade deal with the South American Mercosur bloc, concluding over 25 years of complex negotiations. The agreement, the largest in the EU's history, secured the necessary support from member states despite fierce opposition and widespread farmer protests.

At least 15 countries, representing 65% of the bloc's population, voted in favor of the deal with Mercosur, which includes Argentina, Brazil, Paraguay, and Uruguay. Some EU diplomats reported that the number of supporters was as high as 21 nations.

France, the EU's largest agricultural producer, led the charge against the agreement, ultimately voting no. The French government argues that the deal will flood the European market with cheaper food imports like beef, poultry, and sugar, directly harming its domestic farmers. Austria, Hungary, Ireland, and Poland joined France in opposition, while Belgium abstained.

This political resistance is amplified by massive protests on the ground. Farmers have blockaded highways in France and Belgium and marched in Poland, demonstrating their deep-seated anger over the deal's potential impact on their livelihoods.

The backlash in France has been particularly severe. Mathilde Panot, a leader of the far-left France Unbowed party, claimed France had been "humiliated" by Brussels. Both far-right and far-left parties are now planning to file no-confidence motions against the government over the agreement's expected approval.

French Agriculture Minister Annie Genevard insisted the fight is not over, vowing to rally opposition ahead of a crucial vote in the EU assembly.

Proponents, including Germany and Spain, view the Mercosur agreement as a critical strategic move. They contend it will help offset business losses from U.S. tariffs and reduce the EU's economic dependence on China by securing access to vital minerals.

German Chancellor Friedrich Merz hailed the vote as a "milestone" for Germany and Europe, though he criticized the lengthy negotiation process. "25 years of negotiations is too long," he stated. "It's vital that the next free trade agreements are concluded swiftly."

The economic stakes are high. The agreement is projected to eliminate €4 billion ($4.66 billion) in tariffs on EU exports. Mercosur nations currently impose steep duties on European goods, including:

• 35% on car parts

• 28% on dairy products

• 27% on wines

The EU and Mercosur aim to boost their goods trade, which was valued at €111 billion in 2024. While the EU primarily exports machinery, chemicals, and transport equipment, Mercosur's exports are dominated by agricultural products, minerals, and paper goods.

To win over wavering countries, the European Commission introduced several key concessions. These include safeguards to halt imports of sensitive agricultural products if markets are disrupted, stricter import controls for pesticide residues, and a new crisis fund for farmers.

These measures proved decisive in swaying Italy, which shifted from a "no" vote in December to a "yes." Italian Prime Minister Giorgia Meloni described the revised terms as a "sustainable" balance.

Beyond agricultural and economic concerns, the deal faces strong opposition from environmental groups. Organizations like Greenpeace argue that the agreement will fuel deforestation in the Amazon rainforest as commodities are produced for the European market.

"This unpopular deal is a disaster for the Amazon rainforest," said Greenpeace EU campaigner Lis Cunha, urging progressive members of the European Parliament to reject it.

Before the trade deal can take effect, it must be formally signed and then pass a final vote in the European Parliament. Bernd Lange, chair of the parliament's trade committee, anticipates that the deal will ultimately pass, with a final vote likely scheduled for April or May.

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up