Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

The Main Lithium Carbonate Futures Contract Continued To Fall, Dropping More Than 6% Intraday, And Is Currently Trading At 160,020 Yuan/ton

[Sources: Trump Considers Major Strikes Against Iran Amid Nuclear Negotiations] Sources Revealed That US President Trump Is Considering A New Major Strike Against Iran After Initial Discussions Between The US And Iran Failed To Make Progress On Limiting Iran's Nuclear Program And Ballistic Missile Production. Sources Said That Options Trump Is Currently Considering Include Airstrikes Against Iranian Leaders And Security Officials Believed To Be Responsible For Deaths And Injuries During Protests In Iran, As Well As Strikes Against Iranian Nuclear Facilities And Government Institutions. Sources Also Indicated That Trump Has Not Yet Finalized His Decision On How To Act, But He Believes His Military Options Are More Abundant Than At The Beginning Of The Month With The Deployment Of US Carrier Strike Groups To The Region

Singapore's Monetary Authority Of Singapore - The Risks To The Growth And Inflation Outlook Are Tilted To The Upside At This Point

Singapore's Monetary Authority Of Singapore - For The Full Year, GDP Growth Is Expected To Ease Relative To The Stronger Outturn In 2025

Singapore's Monetary Authority Of Singapore - On Average Over 2026, Core Inflation Momentum Is Expected To Come In At A Pace That Is Slightly Below Trend

There Will Be No Change To Its Width And The Level At Which It Is Centred - Monetary Authority Of Singapore

New Zealand Business Confidence 64.1% In January Versus 73.6% In Previous Survey - ANZ Bank Survey

U.S. API Weekly Refined Oil Stocks

U.S. API Weekly Refined Oil StocksA:--

F: --

P: --

U.S. API Weekly Crude Oil Stocks

U.S. API Weekly Crude Oil StocksA:--

F: --

P: --

U.S. API Weekly Gasoline Stocks

U.S. API Weekly Gasoline StocksA:--

F: --

P: --

U.S. API Weekly Cushing Crude Oil Stocks

U.S. API Weekly Cushing Crude Oil StocksA:--

F: --

P: --

Australia RBA Trimmed Mean CPI YoY (Q4)

Australia RBA Trimmed Mean CPI YoY (Q4)A:--

F: --

P: --

Australia CPI YoY (Q4)

Australia CPI YoY (Q4)A:--

F: --

P: --

Australia CPI QoQ (Q4)

Australia CPI QoQ (Q4)A:--

F: --

P: --

Germany GfK Consumer Confidence Index (SA) (Feb)

Germany GfK Consumer Confidence Index (SA) (Feb)A:--

F: --

P: --

Germany 10-Year Bund Auction Avg. Yield

Germany 10-Year Bund Auction Avg. YieldA:--

F: --

P: --

India Industrial Production Index YoY (Dec)

India Industrial Production Index YoY (Dec)A:--

F: --

P: --

India Manufacturing Output MoM (Dec)

India Manufacturing Output MoM (Dec)A:--

F: --

P: --

U.S. MBA Mortgage Application Activity Index WoW

U.S. MBA Mortgage Application Activity Index WoWA:--

F: --

P: --

Canada Overnight Target Rate

Canada Overnight Target RateA:--

F: --

P: --

BOC Monetary Policy Report

BOC Monetary Policy Report U.S. EIA Weekly Crude Stocks Change

U.S. EIA Weekly Crude Stocks ChangeA:--

F: --

P: --

U.S. EIA Weekly Cushing, Oklahoma Crude Oil Stocks Change

U.S. EIA Weekly Cushing, Oklahoma Crude Oil Stocks ChangeA:--

F: --

P: --

U.S. EIA Weekly Crude Demand Projected by Production

U.S. EIA Weekly Crude Demand Projected by ProductionA:--

F: --

P: --

U.S. EIA Weekly Crude Oil Imports Changes

U.S. EIA Weekly Crude Oil Imports ChangesA:--

F: --

P: --

U.S. EIA Weekly Heating Oil Stock Changes

U.S. EIA Weekly Heating Oil Stock ChangesA:--

F: --

P: --

U.S. EIA Weekly Gasoline Stocks Change

U.S. EIA Weekly Gasoline Stocks ChangeA:--

F: --

P: --

BOC Press Conference

BOC Press Conference Russia PPI MoM (Dec)

Russia PPI MoM (Dec)A:--

F: --

P: --

Russia PPI YoY (Dec)

Russia PPI YoY (Dec)A:--

F: --

P: --

U.S. Interest Rate On Reserve Balances

U.S. Interest Rate On Reserve BalancesA:--

F: --

P: --

U.S. Target Federal Funds Rate Lower Limit (Overnight Reverse Repo Rate)

U.S. Target Federal Funds Rate Lower Limit (Overnight Reverse Repo Rate)A:--

F: --

P: --

U.S. Federal Funds Rate Target

U.S. Federal Funds Rate TargetA:--

F: --

P: --

U.S. Target Federal Funds Rate Upper Limit (Excess Reserves Ratio)

U.S. Target Federal Funds Rate Upper Limit (Excess Reserves Ratio)A:--

F: --

P: --

FOMC Statement

FOMC Statement FOMC Press Conference

FOMC Press Conference Brazil Selic Interest Rate

Brazil Selic Interest RateA:--

F: --

P: --

Australia Import Price Index YoY (Q4)

Australia Import Price Index YoY (Q4)A:--

F: --

P: --

Japan Household Consumer Confidence Index (Jan)

Japan Household Consumer Confidence Index (Jan)--

F: --

P: --

Turkey Economic Sentiment Indicator (Jan)

Turkey Economic Sentiment Indicator (Jan)--

F: --

P: --

Euro Zone M3 Money Supply (SA) (Dec)

Euro Zone M3 Money Supply (SA) (Dec)--

F: --

P: --

Euro Zone Private Sector Credit YoY (Dec)

Euro Zone Private Sector Credit YoY (Dec)--

F: --

P: --

Euro Zone M3 Money Supply YoY (Dec)

Euro Zone M3 Money Supply YoY (Dec)--

F: --

P: --

Euro Zone 3-Month M3 Money Supply YoY (Dec)

Euro Zone 3-Month M3 Money Supply YoY (Dec)--

F: --

P: --

South Africa PPI YoY (Dec)

South Africa PPI YoY (Dec)--

F: --

P: --

Euro Zone Consumer Confidence Index Final (Jan)

Euro Zone Consumer Confidence Index Final (Jan)--

F: --

P: --

Euro Zone Selling Price Expectations (Jan)

Euro Zone Selling Price Expectations (Jan)--

F: --

P: --

Euro Zone Industrial Climate Index (Jan)

Euro Zone Industrial Climate Index (Jan)--

F: --

P: --

Euro Zone Services Sentiment Index (Jan)

Euro Zone Services Sentiment Index (Jan)--

F: --

P: --

Euro Zone Economic Sentiment Indicator (Jan)

Euro Zone Economic Sentiment Indicator (Jan)--

F: --

P: --

Euro Zone Consumer Inflation Expectations (Jan)

Euro Zone Consumer Inflation Expectations (Jan)--

F: --

P: --

Italy 5-Year BTP Bond Auction Avg. Yield

Italy 5-Year BTP Bond Auction Avg. Yield--

F: --

P: --

Italy 10-Year BTP Bond Auction Avg. Yield

Italy 10-Year BTP Bond Auction Avg. Yield--

F: --

P: --

France Unemployment Class-A (Dec)

France Unemployment Class-A (Dec)--

F: --

P: --

South Africa Repo Rate (Jan)

South Africa Repo Rate (Jan)--

F: --

P: --

Canada Average Weekly Earnings YoY (Nov)

Canada Average Weekly Earnings YoY (Nov)--

F: --

P: --

U.S. Nonfarm Unit Labor Cost Final (Q3)

U.S. Nonfarm Unit Labor Cost Final (Q3)--

F: --

P: --

U.S. Initial Jobless Claims 4-Week Avg. (SA)

U.S. Initial Jobless Claims 4-Week Avg. (SA)--

F: --

P: --

U.S. Weekly Continued Jobless Claims (SA)

U.S. Weekly Continued Jobless Claims (SA)--

F: --

P: --

U.S. Trade Balance (Nov)

U.S. Trade Balance (Nov)--

F: --

P: --

U.S. Weekly Initial Jobless Claims (SA)

U.S. Weekly Initial Jobless Claims (SA)--

F: --

P: --

Canada Trade Balance (SA) (Nov)

Canada Trade Balance (SA) (Nov)--

F: --

P: --

U.S. Exports (Nov)

U.S. Exports (Nov)--

F: --

P: --

Canada Imports (SA) (Nov)

Canada Imports (SA) (Nov)--

F: --

P: --

Canada Exports (SA) (Nov)

Canada Exports (SA) (Nov)--

F: --

P: --

U.S. Unit Labor Cost Revised MoM (SA) (Q3)

U.S. Unit Labor Cost Revised MoM (SA) (Q3)--

F: --

U.S. Factory Orders MoM (Nov)

U.S. Factory Orders MoM (Nov)--

F: --

P: --

U.S. Wholesale Sales MoM (SA) (Nov)

U.S. Wholesale Sales MoM (SA) (Nov)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

The Federal Reserve held interest rates steady, shifting to a "wait-and-see" approach amid internal dissent.

The Federal Reserve has officially pumped the brakes, ending its streak of three consecutive interest rate cuts. On Wednesday, the Federal Open Market Committee announced it would hold the federal funds rate steady in its current range of 3.5% to 3.75%.

Fed Chair Jerome Powell signaled a clear shift to a "wait-and-see" approach. After a series of "maintenance" cuts designed to safeguard against a shaky labor market, the central bank now believes it can afford to stay on the sidelines. Powell pointed to stabilizing job gains and inflation that, while still slightly high, is behaving as expected.

"If you look at the incoming data since the last meeting, [there is] clear improvement in the outlook for growth," Powell explained. "Inflation performed about as expected, and… some of the labor market data came in suggesting evidence of stabilization."

The decision to hold rates was not unanimous. Two governors appointed by President Donald Trump, Stephen Miran and Christopher Waller, voted against the consensus, favoring another quarter-point rate cut. This marked Miran's fourth time dissenting from the committee's decision.

The internal division highlights ongoing debates about the economy's direction. Powell himself had previously advocated for a larger half-point cut. With his term as chair ending this Saturday, the committee's future direction remains a key question for markets.

In its official statement, the committee expressed growing confidence, noting, "Available indicators suggest that economic activity has been expanding at a solid pace. Job gains have remained low, and the unemployment rate has shown some signs of stabilization. Inflation remains somewhat elevated."

With only two meetings left before his term as chair concludes in May, Powell faced questions about his legacy and the institution's future. He remained tight-lipped on his personal plans, refusing to say whether he would stay on as a Fed governor until his term ends in 2028. "I have nothing for you on that," he told reporters.

He used the same phrase to deflect questions about grand jury subpoenas related to a Justice Department investigation into the Fed's building-renovation project.

A Warning on Central Bank Independence

While avoiding personal commentary, Powell was clear in his advice for his successor: stay out of politics. He stressed the need for the Fed to remain independent from political pressure to maintain its credibility.

"When central banks lose independence from political pressures, it's hard to restore the credibility of the institution," he warned, adding that he hopes and believes the Fed will not lose its independence. He clarified that engaging with lawmakers is a necessary part of democratic accountability, but the next chair must "not get pulled into elected politics."

Defending the Fed's Playbook

Powell also mounted a robust defense of the Federal Reserve's staff and its economic models, which have faced criticism for being outdated. He called the staff "the most qualified group of people you will ever work with" and asserted that the Fed is well aware that technology may be driving productivity higher.

He addressed the recent conflict between strong GDP growth—3.8% in Q2 and 4.4% in Q3 of 2025—and slowing job creation. In his view, the jobs data often provides a more accurate picture of the underlying economy, suggesting GDP figures might be overstating its strength.

He dismissed critiques of the Fed's forecasting tools, arguing that no model can perfectly predict an economy subject to massive shocks like a pandemic or a trade war. He then issued a direct challenge to critics who believe they can do better: "Bring them on."

Ultimately, Powell concluded the day with a frank self-assessment of his deliberately reserved performance. "I'm tempted to call this the 'Nothing for you' press conference," he said.

Gold and silver prices are pushing into record territory, but the rally shows no signs of fatigue. The core driver is a sustained weakness in the U.S. dollar, which is fueling a significant shift in investor sentiment toward hard assets.

With silver surging past $110 an ounce and gold trading around $5,300, markets are reacting to persistent geopolitical uncertainty and economic volatility tied to President Donald Trump's policy agenda. This has led analysts to question the long-term viability of the U.S. dollar as the world's primary reserve currency.

While gold may be due for a short-term pullback, experts believe the broader upward trend is firmly established.

Julia Khandoshko, CEO of Mind Money, identified several converging factors supporting gold's appeal as a safe-haven asset:

• An acceleration of de-dollarization globally.

• Steady demand from developing countries.

• Continued global monetary issuance.

• Concerns over U.S. debt sustainability.

• Growing geopolitical tensions, such as new tariffs.

• Perceived pressure on the Federal Reserve's independence.

This momentum builds on a wave of "Sell America" sentiment that first appeared in April 2025, when Trump enacted aggressive global tariffs to shrink the U.S. trade deficit.

The rising importance of gold is becoming increasingly visible in the composition of global reserves. According to Linh Tran, Market Analyst at XS.com, this signals a fundamental change in the financial landscape.

"It becomes clear that gold is rising not merely due to market anxiety, but also because confidence in the global monetary–fiscal order is shifting toward a more cautious stance," Tran noted. "This does not appear to be a short-lived shock, but rather a process of re-positioning gold's role within the system."

Tran argues that gold's future trajectory won't depend on a single factor like interest rates but on the overall stability of the global monetary and fiscal framework.

The dollar's poor performance has been a key catalyst. In 2025, the U.S. dollar index recorded one of its worst years in over five decades, falling approximately 9.4% from a December 2024 close near 108.5 to around 98.3.

That downward trend has continued into the new year, with the dollar shedding nearly 2% in January. This week, the index touched a fresh multi-year low of 95.55 points.

President Trump, however, has expressed no concern over the currency's slide. "I think it's great," he told reporters in Iowa on Tuesday. "I think the value of the dollar — look at the business we're doing. The dollar's doing great."

Analysts caution that the consequences of a weaker dollar are complex and reinforce gold's role as both an inflation hedge and a store of wealth.

"While a softer USD benefits exporters... it can increase inflationary pressures," explained Aaron Hill, Chief Market Analyst at FP Markets. "When the USD declines, if you want to buy something abroad, it will cost more as the dollar buys less. For business, for those who import materials, for example, they will also face higher costs, which they can pass on to customers, hence inflation."

Hill added that Trump's unpredictability continues to unsettle markets, prompting investors to reduce their exposure to U.S. assets and adding further downward pressure on the dollar.

Beyond the dollar, some experts see a wider erosion of confidence in fiat currencies altogether. Recent turmoil in Japanese bond markets has sparked concerns about liquidity risks across the global financial system.

Guy Wolf, Global Head of Market Analytics at Marex, suggested that fears of global currency debasement could support gold for years to come.

"Private investors are returning to gold as both a hedge against currency debasement and a form of insurance against geopolitical risk, equity market overvaluation, and broader macro uncertainty," Wolf said. "Gold's rise is not simply a function of US dollar weakness; rather, it reflects a broader erosion of confidence in fiat currencies globally, with gold appreciating in virtually every currency."

Looking ahead, the outlook for gold remains strong. Nitesh Shah, Head of Commodities & Macroeconomic Research at WisdomTree, believes prices could climb significantly higher before the year ends.

He noted that his firm's models suggest investors should allocate between 15% and 20% of their portfolios to gold. Given the enormous size of the global bond market, even a small shift in asset allocation could have an outsized effect on the metal's price.

"I can see why gold prices are where they are," Shah concluded. "There is a massive threat to the status quo and the global monetary system if the U.S. dollar remains the world's reserve currency."

Remarks of Officials

Traders' Opinions

Energy

Political

Data Interpretation

Middle East Situation

Commodity

Oil traders are paying a premium for bullish call options, a clear signal they are hedging against a potential new conflict between the United States and Iran. This market action has created a sustained "call skew," where the price of bullish options outpaces bearish ones.

For the global benchmark Brent crude, this skew has been in place for 14 consecutive sessions. The equivalent U.S. marker has seen the same pattern for 13 straight trading days. These are the longest such streaks since late 2024, a period marked by Israeli attacks on Iranian military installations.

The anxiety stems from escalating tensions in the Middle East. Recent unrest in Iran has reportedly led to thousands of deaths, provoking an international outcry against Supreme Leader Ayatollah Ali Khamenei's regime.

The situation drew a sharp warning from U.S. President Donald Trump, who threatened "strong action" if the killings continued. This week, Trump added that a "big armada" was heading to the region because of Iran, though he expressed hope it would not need to be used.

For years, the options market has been the primary venue for traders to place bets on heightened geopolitical risk in the Middle East. This trend became especially prominent after Hamas's attack on Israel in October 2023.

A similar pattern emerged last year when the U.S. struck Iran. Premiums for call options soared before collapsing once it became clear that oil facilities were not targeted.

"The focus on Iran continues," said Arne Lohmann Rasmussen, chief analyst at A/S Global Risk Management. "The market will likely remain nervous over the coming days."

The current uncertainty is driving a significant accumulation of bullish options contracts. According to a Bloomberg analysis of ICE Futures Europe data, open interest in Brent call options has grown this month at its fastest rate in at least six years. This follows the busiest single day of trading ever recorded for Brent crude call options, which occurred earlier this month.

Other indicators point in the same direction. Hedge funds have increased their net-bullish wagers on crude oil to the highest level since August, and several key volatility gauges have reached multi-month highs in recent weeks.

A potential U.S. military intervention could directly threaten Iran's oil production, which currently stands at roughly 3.3 million barrels per day.

The risk of a major supply shock is being taken seriously across the industry. Consultant Rapidan Energy Group recently increased its probability estimate that an Iranian retaliation to potential U.S. strikes would cause a substantial disruption to Gulf energy flows, raising the odds from 15% to 20%.

Mainland Chinese capital is pouring into Hong Kong's property and stock markets, driving both to record highs in the last year. This surge aligns with Beijing's strategy to revitalize the city's role as an international financial hub following the 2020 National Security Law.

The trend was recently highlighted by the sale of a three-story house on Hong Kong Island for HK$860 million ($110 million) to a mainland Chinese buyer, as reported by local media on January 18.

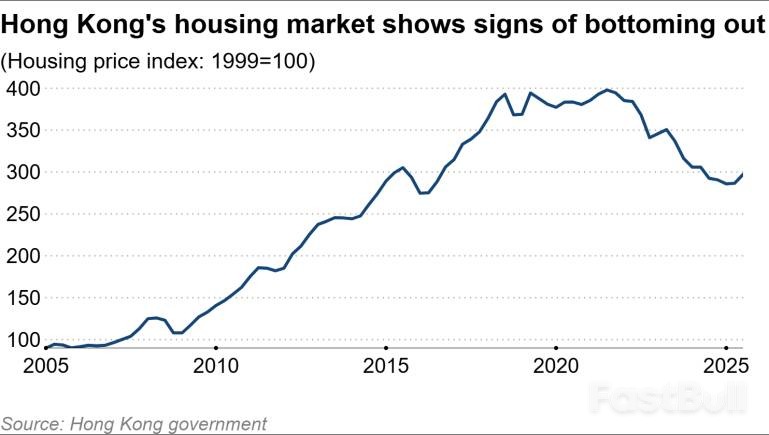

Hong Kong's real estate market is experiencing a significant turnaround. The government announced that the housing price index reached 298.6 in December, marking its seventh consecutive month of growth. For the full year of 2025, prices rose by approximately 3%, the first annual increase in four years.

This recovery follows a substantial downturn. After peaking in 2021, Hong Kong housing prices fell by about 30%. Because the Hong Kong dollar is pegged to the U.S. dollar, the city's monetary policy mirrors that of the United States. This forced Hong Kong to raise interest rates during an economic slowdown, which put heavy pressure on the property market.

Praveen Choudhary, head of Hong Kong real estate at Morgan Stanley, believes the 2025 recovery signals the start of a new growth cycle. He forecasts that housing prices will climb by more than 10% in 2026.

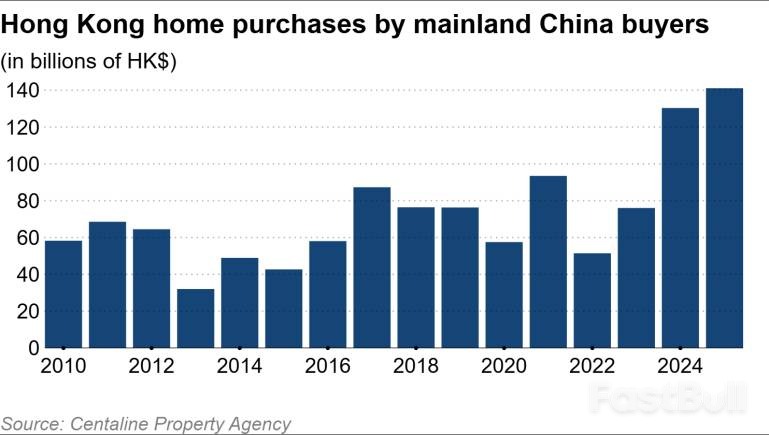

Mainland buyers are the primary force behind this uptick. According to an analysis of registration data by Centaline Property Agency, housing transactions involving mainland buyers increased by 20% in 2025 to 13,958. The total value of these purchases rose by 8% to a record HK$141 billion, with mainland buyers now accounting for nearly 30% of the market.

The influence of mainland money is just as pronounced in the stock market. Through the Stock Connect program, which links the Hong Kong, Shanghai, and Shenzhen exchanges, mainland investors are channeling unprecedented funds into the city.

In 2025, net purchases of Hong Kong stocks by mainland investors reached a record high of approximately HK$1.4 trillion, a 70% increase. Reflecting this confidence, the Hang Seng Index recently climbed 3% in a single day to its highest level in about four and a half years.

A massive pool of domestic savings is fueling this cross-border investment. As of the end of June, total deposits in mainland China stood at 160 trillion yuan ($23 trillion), with an estimated 50 trillion yuan in excess savings. With China's domestic real estate market facing an uncertain outlook, this capital is seeking opportunities elsewhere, and Hong Kong has become a prime destination.

Beijing's policies are also actively supporting this trend. After the National Security Law prompted a population outflow, Hong Kong implemented policies to attract new talent. This led to an influx from mainland China, increasing the city's population by 180,000 in three years to 7.52 million and creating upward pressure on housing demand.

Furthermore, obtaining a Hong Kong visa provides a practical way to move capital. While mainland China has strict controls limiting overseas remittances to $50,000 per year, these rules are different for those relocating.

"If you get a Hong Kong visa, remittances from mainland China are allowed for living expenses, making it easier to buy real estate," explained a financial industry professional who moved from the mainland to Hong Kong in 2024. A portion of this remitted money is also finding its way into the stock market.

This capital influx is part of a broader strategic push by Beijing. Following the implementation of the National Security Law, international concerns grew that political changes would diminish Hong Kong's appeal to foreign firms and capital.

In response, Chinese President Xi Jinping issued a directive in 2022 to strengthen Hong Kong's position as an international financial center. As a gateway for international capital into mainland China and a key hub for the yuan's internationalization, Hong Kong's economic vitality is a strategic priority.

This support was recently reaffirmed by People's Bank of China Deputy Governor Zou Lan. In a speech in Hong Kong, Zou expressed support for expanding the circulation of the yuan in the city and announced plans to establish an international gold trading center. He emphasized that China and Hong Kong would achieve victory through cooperation in a new era.

The recovery in Hong Kong's property and stock markets suggests the city is regaining its economic momentum. However, this resurgence is defined by a much closer relationship with the mainland.

This deeper integration means Hong Kong's economy is now more exposed to fluctuations in the Chinese economy and potential policy shifts from Beijing. For global investors, this shift also has wider implications. Mainland capital flowing into Hong Kong may slow investment in other overseas markets.

"I'm advising my clients to sell properties in Tokyo and buy in Hong Kong," said a real estate broker from mainland China now working in the city, highlighting a potential redirection of international investment flows.

The Japanese yen has extended its slide against the US dollar after a clear signal from Washington: America will not step in to rescue the struggling currency. US Treasury Secretary Scott Bessent's recent comments have erased any lingering hopes of a coordinated intervention, highlighting a stark divergence in monetary strategy between the two economic powers.

For traders and analysts, this confirms that the yen's fate rests solely on the shoulders of Japanese policymakers, who are grappling with deep-seated economic challenges.

In an interview with CNBC, Treasury Secretary Scott Bessent explicitly ruled out any US action to prop up the Japanese yen. His statement was a direct refutation of rumors that had circulated the previous week suggesting a potential "rate check" between US and Japanese authorities—an action often seen as a precursor to market intervention.

Those rumors had caused a temporary sell-off in the US dollar. However, Bessent’s remarks prompted a swift rebound for the dollar, as he reaffirmed the administration's commitment to a "strong dollar policy." He explained this policy is about "setting the right fundamentals" to encourage capital flows into the US, making intervention in a foreign currency market a direct contradiction of that goal.

The yen's current weakness is not a new phenomenon. It stems from years of loose monetary policy by the Bank of Japan (BOJ), which kept interest rates low to stimulate economic growth. This strategy stood in sharp contrast to the policies of other major economies like the United States.

This interest rate differential fueled the popular "yen carry trade." Investors would borrow yen at a very low cost, convert it into US dollars, and invest in higher-yielding American assets. However, this dynamic began to unravel dramatically.

In April 2024, the yen plummeted to its weakest level against the dollar since the early 1990s. The trigger was a BOJ interest rate hike that made the carry trade unprofitable. As investors rushed to exit their positions, they sold off massive amounts of yen, causing the currency to crash. The BOJ has struggled to stabilize the currency ever since.

The situation has been compounded by domestic policy decisions. On January 13, 2026, the yen fell to its weakest point against the dollar since the summer of 2024. This decline was largely driven by market concerns over Prime Minister Sanae Takaichi's preference for loose monetary policy, which could expand Japan's already enormous national deficit.

Japan's debt-to-GDP ratio currently stands at over 230%, one of the highest among developed nations. Further fueling investor anxiety, the Takaichi administration approved a massive stimulus package that pushed yields on 40-year Japanese bonds to record highs. This move triggered significant capital flight from the Japanese bond market, placing the nation's economy in an even more precarious position.

Looking ahead, the path for Japan's economy remains challenging. A January report from Goldman Sachs projected moderate but steady growth of around 0.8% for 2026, driven primarily by domestic demand rather than exports. The report also forecasts inflation to remain near the 2% target.

Despite the recent stimulus package, Japan's debt-to-GDP ratio has seen a slight decline. However, planned government spending and the potential elimination of consumption taxes threaten to reverse this trend. If the Takaichi administration delays necessary interest rate adjustments, the BOJ may be forced to intervene.

Several key risks continue to undermine confidence in the Japanese economy:

• Fiscal Instability: Further increases in government spending could push the national debt higher.

• Demographic Headwinds: An aging population and persistent labor shortages could hinder long-term growth.

• Global Factors: Broader shifts in global trade and ongoing currency volatility remain significant external threats.

Tensions are escalating in the Middle East as the United States deploys an aircraft carrier and additional bombers to the region, positioning key military assets for a potential confrontation with Iran. Following President Donald Trump's threats to strike the Islamic Republic over its crackdown on protesters, analysts are assessing a critical question: how would Tehran respond?

Experts agree that Iran would be largely powerless to stop a direct American aerial attack. However, its defensive vulnerabilities are only half the story. Tehran possesses a formidable arsenal of missiles and drones, giving it significant capacity to retaliate against US military and commercial interests across the region.

Recent conflicts have exposed critical weaknesses in Iran's defenses. During a 12-day war last June, Israeli strikes hit Iranian military infrastructure, including missile production centers, radars, and Russian-made S-300 air-defense systems. With an aging air force, these attacks left Iran's ability to fend off aerial assaults severely weakened.

"In terms of purely defensive capabilities, Iran is practically naked," said Michael Horowitz, an independent defense expert based in Israel.

Despite this, Iran demonstrated its offensive strength by firing hundreds of ballistic missiles at Israel during that same conflict, with dozens penetrating Israel's advanced air defenses to hit military sites.

This offensive power remains the core of its strategy. "Iran still has a large arsenal of short and medium range missiles that can easily hit US bases in the Middle East, as well as cruise missiles and drones that it would likely use to try and target US ships," Horowitz added.

To understand Iran's retaliatory threat, it's essential to break down its missile capabilities. Israel's strikes in June specifically targeted production facilities at the Parchin military complex, the Khojir military base, and the Shahrud missile site to hinder the development of medium-range ballistic missiles.

According to Sascha Bruchmann, a military analyst at the International Institute for Strategic Studies, these missiles are "fairly potent" but have a key weakness.

• Medium-Range Ballistic Missiles: Many are liquid-fueled and depend on fixed infrastructure for loading and launch. This makes their launchers easier to find and destroy, as Israel demonstrated during the war. The number of operational launchers remaining is unclear.

• Short-Range Ballistic Missiles: These weapons pose a more immediate and flexible danger. Bruchmann notes that Tehran has several thousand of these missiles, which are often solid-fueled, making them more mobile and harder to detect before launch. He warns they "constitute a real threat, especially for the smaller Gulf countries" like Qatar and Bahrain, which both host significant US military forces.

Beyond its conventional weapons, Iran's most powerful tool may be its ability to disrupt the global economy. The Persian Gulf region produces approximately 40% of the world's oil, and about one-fifth of the entire world's supply flows through the Strait of Hormuz—a narrow waterway Iran can threaten to close.

"The Islamic republic has long prepared a set of military assets meant to shut down this key maritime route," Horowitz explained. "This would create an economic shock that Iran could exploit."

According to US media reports, President Trump is weighing a range of military options in response to Iran's crackdown on protests, which saw authorities kill thousands of people. These options reportedly include:

• Strikes on largely symbolic targets.

• "Decapitation" strikes targeting Supreme Leader Ayatollah Ali Khamenei.

• A sustained bombing campaign against military and security infrastructure.

Experts warn that any US military action is fraught with risk and could easily trigger a full-blown regional conflict. The ultimate goal of a potential strike also remains unclear—whether it is to force regime change, encourage defections, or simply bring a weakened Tehran back to the negotiating table.

Most analysts agree that an aerial campaign alone, without a ground invasion, is unlikely to topple the regime. A ground war in Iran, the largest and most populous country in the Middle East, is widely considered a non-starter. Even a sustained US air campaign, which Trump reportedly wishes to avoid in favor of a limited attack, would not guarantee the regime's fall.

"A sustained US air campaign could severely degrade Iran's conventional military by ripping up command-and-control, and fixed infrastructure," said Horowitz. "But it is unlikely by itself to produce the collapse of Iran's security forces, which can disperse, hide, and shift to low-signature internal repression."

The bottom line, he adds, is that "airpower can punish and paralyze, but it would need a simultaneous political fracture on the ground...to really deliver a full collapse."

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

Log In

Sign Up