Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

U.K. Retail Sales MoM (SA) (Dec)

U.K. Retail Sales MoM (SA) (Dec)A:--

F: --

P: --

France Manufacturing PMI Prelim (Jan)

France Manufacturing PMI Prelim (Jan)A:--

F: --

P: --

France Services PMI Prelim (Jan)

France Services PMI Prelim (Jan)A:--

F: --

P: --

France Composite PMI Prelim (SA) (Jan)

France Composite PMI Prelim (SA) (Jan)A:--

F: --

P: --

Germany Manufacturing PMI Prelim (SA) (Jan)

Germany Manufacturing PMI Prelim (SA) (Jan)A:--

F: --

P: --

Germany Services PMI Prelim (SA) (Jan)

Germany Services PMI Prelim (SA) (Jan)A:--

F: --

P: --

Germany Composite PMI Prelim (SA) (Jan)

Germany Composite PMI Prelim (SA) (Jan)A:--

F: --

P: --

Euro Zone Composite PMI Prelim (SA) (Jan)

Euro Zone Composite PMI Prelim (SA) (Jan)A:--

F: --

P: --

Euro Zone Manufacturing PMI Prelim (SA) (Jan)

Euro Zone Manufacturing PMI Prelim (SA) (Jan)A:--

F: --

P: --

Euro Zone Services PMI Prelim (SA) (Jan)

Euro Zone Services PMI Prelim (SA) (Jan)A:--

F: --

P: --

U.K. Composite PMI Prelim (Jan)

U.K. Composite PMI Prelim (Jan)A:--

F: --

P: --

U.K. Manufacturing PMI Prelim (Jan)

U.K. Manufacturing PMI Prelim (Jan)A:--

F: --

P: --

U.K. Services PMI Prelim (Jan)

U.K. Services PMI Prelim (Jan)A:--

F: --

P: --

Mexico Economic Activity Index YoY (Nov)

Mexico Economic Activity Index YoY (Nov)A:--

F: --

P: --

Russia Trade Balance (Nov)

Russia Trade Balance (Nov)A:--

F: --

P: --

Canada Core Retail Sales MoM (SA) (Nov)

Canada Core Retail Sales MoM (SA) (Nov)A:--

F: --

P: --

Canada Retail Sales MoM (SA) (Nov)

Canada Retail Sales MoM (SA) (Nov)A:--

F: --

U.S. IHS Markit Manufacturing PMI Prelim (SA) (Jan)

U.S. IHS Markit Manufacturing PMI Prelim (SA) (Jan)A:--

F: --

P: --

U.S. IHS Markit Services PMI Prelim (SA) (Jan)

U.S. IHS Markit Services PMI Prelim (SA) (Jan)A:--

F: --

P: --

U.S. IHS Markit Composite PMI Prelim (SA) (Jan)

U.S. IHS Markit Composite PMI Prelim (SA) (Jan)A:--

F: --

P: --

U.S. UMich Consumer Sentiment Index Final (Jan)

U.S. UMich Consumer Sentiment Index Final (Jan)A:--

F: --

P: --

U.S. UMich Current Economic Conditions Index Final (Jan)

U.S. UMich Current Economic Conditions Index Final (Jan)A:--

F: --

P: --

U.S. UMich Consumer Expectations Index Final (Jan)

U.S. UMich Consumer Expectations Index Final (Jan)A:--

F: --

P: --

U.S. Conference Board Leading Economic Index MoM (Nov)

U.S. Conference Board Leading Economic Index MoM (Nov)A:--

F: --

P: --

U.S. Conference Board Coincident Economic Index MoM (Nov)

U.S. Conference Board Coincident Economic Index MoM (Nov)A:--

F: --

P: --

U.S. Conference Board Lagging Economic Index MoM (Nov)

U.S. Conference Board Lagging Economic Index MoM (Nov)A:--

F: --

P: --

U.S. UMich 1-Year-Ahead Inflation Expectations Final (Jan)

U.S. UMich 1-Year-Ahead Inflation Expectations Final (Jan)A:--

F: --

P: --

U.S. Conference Board Leading Economic Index (Nov)

U.S. Conference Board Leading Economic Index (Nov)A:--

F: --

P: --

U.S. Weekly Total Rig Count

U.S. Weekly Total Rig CountA:--

F: --

P: --

U.S. Weekly Total Oil Rig Count

U.S. Weekly Total Oil Rig CountA:--

F: --

P: --

Germany Ifo Business Expectations Index (SA) (Jan)

Germany Ifo Business Expectations Index (SA) (Jan)--

F: --

P: --

Germany IFO Business Climate Index (SA) (Jan)

Germany IFO Business Climate Index (SA) (Jan)--

F: --

P: --

Germany Ifo Current Business Situation Index (SA) (Jan)

Germany Ifo Current Business Situation Index (SA) (Jan)--

F: --

P: --

Mexico Unemployment Rate (Not SA) (Dec)

Mexico Unemployment Rate (Not SA) (Dec)--

F: --

P: --

Canada National Economic Confidence Index

Canada National Economic Confidence Index--

F: --

P: --

U.S. Non-Defense Capital Durable Goods Orders MoM (Excl. Aircraft) (Nov)

U.S. Non-Defense Capital Durable Goods Orders MoM (Excl. Aircraft) (Nov)--

F: --

P: --

U.S. Durable Goods Orders MoM (Excl. Defense) (SA) (Nov)

U.S. Durable Goods Orders MoM (Excl. Defense) (SA) (Nov)--

F: --

P: --

U.S. Durable Goods Orders MoM (Excl.Transport) (Nov)

U.S. Durable Goods Orders MoM (Excl.Transport) (Nov)--

F: --

P: --

U.S. Durable Goods Orders MoM (Nov)

U.S. Durable Goods Orders MoM (Nov)--

F: --

P: --

U.S. Dallas Fed General Business Activity Index (Jan)

U.S. Dallas Fed General Business Activity Index (Jan)--

F: --

P: --

U.K. BRC Shop Price Index YoY (Jan)

U.K. BRC Shop Price Index YoY (Jan)--

F: --

P: --

China, Mainland Industrial Profit YoY (YTD) (Dec)

China, Mainland Industrial Profit YoY (YTD) (Dec)--

F: --

P: --

Mexico Trade Balance (Dec)

Mexico Trade Balance (Dec)--

F: --

P: --

U.S. S&P/CS 20-City Home Price Index YoY (Not SA) (Nov)

U.S. S&P/CS 20-City Home Price Index YoY (Not SA) (Nov)--

F: --

P: --

U.S. S&P/CS 20-City Home Price Index MoM (SA) (Nov)

U.S. S&P/CS 20-City Home Price Index MoM (SA) (Nov)--

F: --

P: --

U.S. FHFA House Price Index MoM (Nov)

U.S. FHFA House Price Index MoM (Nov)--

F: --

P: --

U.S. FHFA House Price Index (Nov)

U.S. FHFA House Price Index (Nov)--

F: --

P: --

U.S. Richmond Fed Manufacturing Composite Index (Jan)

U.S. Richmond Fed Manufacturing Composite Index (Jan)--

F: --

P: --

U.S. Conference Board Present Situation Index (Jan)

U.S. Conference Board Present Situation Index (Jan)--

F: --

P: --

U.S. Conference Board Consumer Expectations Index (Jan)

U.S. Conference Board Consumer Expectations Index (Jan)--

F: --

P: --

U.S. Richmond Fed Manufacturing Shipments Index (Jan)

U.S. Richmond Fed Manufacturing Shipments Index (Jan)--

F: --

P: --

U.S. Richmond Fed Services Revenue Index (Jan)

U.S. Richmond Fed Services Revenue Index (Jan)--

F: --

P: --

U.S. Conference Board Consumer Confidence Index (Jan)

U.S. Conference Board Consumer Confidence Index (Jan)--

F: --

P: --

Australia RBA Trimmed Mean CPI YoY (Q4)

Australia RBA Trimmed Mean CPI YoY (Q4)--

F: --

P: --

Australia CPI YoY (Q4)

Australia CPI YoY (Q4)--

F: --

P: --

Australia CPI QoQ (Q4)

Australia CPI QoQ (Q4)--

F: --

P: --

Germany GfK Consumer Confidence Index (SA) (Feb)

Germany GfK Consumer Confidence Index (SA) (Feb)--

F: --

P: --

India Industrial Production Index YoY (Dec)

India Industrial Production Index YoY (Dec)--

F: --

P: --

India Manufacturing Output MoM (Dec)

India Manufacturing Output MoM (Dec)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

Risks around the central bank’s independence and expectations that Fed Chair Jerome Powell’s successor will be swayed by Trump to lower rates faster are also weighing on the dollar.

Recent months have seen Saudi Arabia execute a significant realignment in its regional strategy, moving away from its US-aligned partners and the vision of an integrated, modern Middle East. The kingdom is reviving its historical rhetoric against Zionism and in favor of the Muslim Brotherhood, signaling a dramatic pivot in its foreign policy.

In a striking departure from its long-standing rivalry with Iran, Riyadh recently lobbied President Donald Trump to spare the Iranian regime. This move comes amid a series of policy shifts that are reshaping its alliances and priorities across the region.

Saudi Arabia's new direction is evident in its actions from Yemen to Sudan, where it has consistently broken ranks with its traditional allies.

A Split with the UAE over Yemen

The divergence with the United Arab Emirates (UAE) over the conflict in Yemen marks a critical fracture. The Saudi air force conducted strikes on Emirati assets, which cleared a path for its Yemeni allies—primarily the Muslim Brotherhood-affiliated Al-Islah party—to push south toward Aden. This military action underscores a clear break in the Saudi-Emirati coalition.

Siding with Islamists in Sudan

In Sudan, Riyadh has abandoned the Quad Plan, an agreement it co-signed that called for a ceasefire between the country's two warring generals, Abdul-Fattah al-Burhan of the Sudanese Armed Forces (SAF) and Muhammad "Hemedti" Daglo of the Rapid Support Forces (RSF). The plan was designed to transition power to a civilian government.

Instead, Saudi Arabia has pledged to fund Burhan's $1.5 billion purchase of Pakistani weapons, a move that violates a global arms embargo on Sudan. Burhan is a remnant of Omar al-Bashir's Muslim Brotherhood regime and, like Hemedti, is under US sanctions. His forces are allied with the Sudanese Islamic Movement and its militias.

The policy pivot is matched by a significant shift in public discourse, with Saudi media reviving aggressive anti-Israel and, more surprisingly, anti-American narratives. This contrasts sharply with the reformist image projected by King Salman Abdul-Aziz and Crown Prince Mohammed bin Salman (MBS) since 2015.

From Normalization Talks to Open Criticism

For years, normalization with Israel seemed like an inevitability, with Riyadh only requiring a "pathway" to a Palestinian state rather than its full establishment. Now, the tone has completely reversed.

Saudi columnists, who reflect official government positions, argue that normalization between Muslims and Jews is impossible. An editorial in the daily Al-Riyadh stated, "Wherever Israel is present, there is ruin and destruction," accusing the country of disregarding international law and exploiting conflicts.

This sentiment was amplified after Israel recognized Somaliland, with Riyadh accusing both Israel and the UAE of advancing a "Zionist project" to partition and weaken Arab and Muslim nations.

A New Animosity Toward the United States

Uncharacteristically, Saudi media has also begun to target the United States. This is a notable departure from the approach of other Islamist-leaning governments like Qatar and Turkey, which typically criticize Israel while praising their ties with Washington.

A Saudi pundit writing in Okaz described President Trump's doctrine as "an era characterized by violent and direct intervention based on exploiting technological and informational superiority to impose a new political reality."

The most likely driver behind this unmistakable realignment is the pressure of domestic economic challenges. With the 2030 deadline for MBS's flagship Vision 2030 plan approaching, the kingdom is struggling to transition its economy away from oil dependency.

• Oil Dependence: In 2025, oil activities accounted for 40–45% of Saudi GDP, compared to just 22% in the UAE.

• Budget Pressure: Riyadh needs oil prices around $96 per barrel to balance its budget. However, the average price in 2025 was $65.

• Growing Deficit: This price gap has caused the Saudi deficit to swell to approximately $65 billion.

Economic prosperity is the cornerstone of the Saudi social contract. As this foundation weakens, the government faces potential sociopolitical unrest. In response, Riyadh appears to be deploying a classic tactic used by regional governments: deflecting public anger by championing Islamist and anti-Zionist causes.

If Saudi Arabia continues on this trajectory, it risks becoming more like Qatar and Turkey, or eventually even Iran. These nations have perfected a strategy of speaking from both sides of their mouth—praising their alliance with America while simultaneously promoting anti-Western sentiment and aligning with powers like Russia and China.

Washington's sustained relationships with Ankara and Doha, despite their rhetoric and support for the Muslim Brotherhood, may have sent a signal to Riyadh. The Saudis, who worked to eradicate jihadi Islam after 9/11, might now believe they can use Islamism as a foreign policy tool without consequence, as long as it doesn't directly target American interests.

This developing shift in Saudi Arabia presents a significant challenge for the United States. Washington must recognize the change underway to avoid a future where it is once again left asking why its allies have turned against it.

As Japan gears up for a general election on February 8, nearly every political party is converging on a single, powerful promise: to cut the national consumption tax. This positions Japan squarely within a global populist trend where tax reductions have become a go-to strategy for winning over voters.

The debate centers on the country's 10% consumption tax, which includes a reduced 8% rate on food. Prime Minister Sanae Takaichi has made tax relief a key issue, instructing her ruling Liberal Democratic Party (LDP) to include a two-year food tax exemption in its campaign manifesto. Despite some reservations within the LDP, the election has rapidly transformed into a contest over who can offer the biggest tax break.

The push for tax cuts is nearly universal across the political spectrum. Opposition parties are escalating the promises, creating a highly competitive environment.

Key proposals include:

• The newly formed Centrist Reform Alliance and the Conservative Party of Japan are calling for the permanent elimination of the consumption tax on food.

• A broad coalition of other opposition groups—including the Democratic Party for the People, the Japanese Communist Party, Reiwa Shinsengumi, Sanseito, and the Social Democratic Party—is advocating for lowering the tax to 5% across the board or abolishing it entirely.

In this landscape, Team Mirai stands out as the only political party that has not promised a tax reduction.

The strategy of advocating for lower taxes is not unique to Japan. It's a simple, resonant message that gains traction easily, especially as voters increasingly form their political views through social media. This approach has become a standard feature in major democracies.

In the 2024 U.S. presidential race, Republican candidate Donald Trump campaigned on a platform of massive, permanent tax cuts. His opponent, Democrat Kamala Harris, proposed raising the corporate tax rate but also pledged to extend income tax reductions for individuals earning less than $400,000 annually.

The U.K.'s 2022 Conservative Party leadership election also revolved around tax policy. Liz Truss championed significant breaks on income and business taxes to support struggling families. Her opponent, Rishi Sunak, adopted a more cautious stance, prioritizing the restoration of the U.K.'s fiscal health.

Truss’s tenure as prime minister serves as a cautionary tale. Her attempt to implement huge, unfunded tax cuts triggered market turmoil. Investors, skeptical of the plan's sustainability, drove up the yield on British government bonds and caused the pound to depreciate sharply. The market backlash forced Truss to resign just a month and a half after taking office.

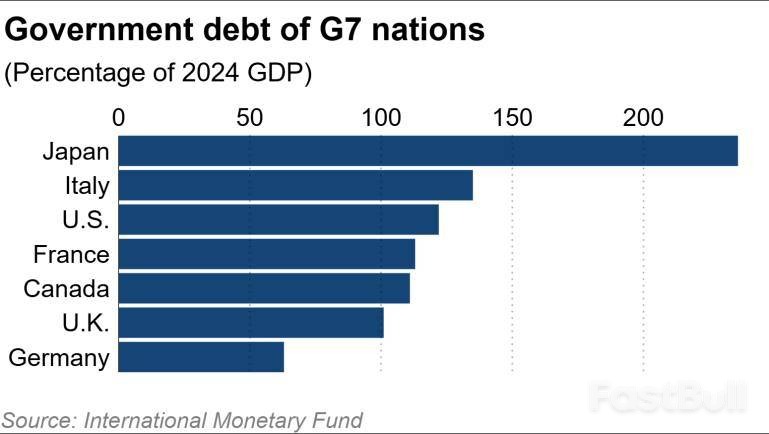

While Japan has joined the global tax-cut movement, its fiscal situation is far more precarious. The nation’s balance of debt is approximately 230% of its gross domestic product—the highest and most severe ratio in the Group of Seven.

Prime Minister Takaichi has argued that economic growth will eventually reduce this debt ratio, but market reaction remains a major concern. The discourse in Japan, much like in the 2024 lower house and 2025 upper house elections, has shifted to prioritize tax cuts over fiscal discipline.

The intensity of the current debate appears linked to an unusually short election cycle, with this being the third national election in two years. When winning elections becomes the primary focus, parties are incentivized to propose policies that offer immediate appeal to voters, pushing aside long-term priorities that may require sacrifice.

There is a growing concern that cutting the consumption tax could erode confidence in Japan's public finances. Early warning signs are already visible, with yields on Japanese government bonds beginning to rise and the yen trending weaker.

To address the funding question, Takaichi has proposed establishing an interparty "national council" after the election. However, whether Japan's ruling and opposition parties can reach a consensus on how to pay for these tax cuts remains a critical and unanswered question.

Ukraine's energy situation has "significantly" deteriorated following a new wave of Russian air attacks, forcing emergency power outages across most of the country, according to Kyiv's national grid operator, Ukrenergo.

This urgent warning comes just a day after Energy Minister Denys Shmyhal stated that Ukraine's energy system had endured its most challenging day since the widespread blackouts of November 2022, when Russia began its campaign of bombing the power grid.

In recent weeks, Moscow has intensified its airstrikes, inflicting further damage on already battered infrastructure. The attacks have left large numbers of people without electricity and heat during a period of subzero temperatures.

Ukrenergo reported on the Telegram messaging app that several power generation facilities are now undergoing emergency repairs due to a combination of drone and missile strikes. "The equipment is operating at the limits of its capabilities," the operator stated, adding that power blocks are under a "tremendous" overload from previous damage.

The escalating crisis prompted Maxim Timchenko, CEO of Ukraine's largest private energy company, to tell Reuters the situation is "close to a humanitarian catastrophe." He stressed that any future peace agreement between Russia and Ukraine must include a halt to attacks on energy infrastructure.

His comments coincide with diplomatic efforts, as Ukrainian and Russian negotiators meet in Abu Dhabi for U.S.-brokered trilateral talks aimed at moving toward a resolution to the nearly four-year-old war.

As the grid struggles, international support is being mobilized. The European Commission announced Friday it would send 447 emergency generators, valued at 3.7 million euros ($4.3 million), to restore power to Ukrainian hospitals, shelters, and other critical services. The move follows President Volodymyr Zelenskiy's declaration of an energy emergency last week.

Ukraine's energy grid, which is almost entirely dependent on nuclear power plants, has already lost half of its generating capacity.

Despite the severe strain, Ukrenergo expressed hope that repairs could be completed in "the near future." This would allow the system to transition from unpredictable emergency blackouts back to a schedule of planned outages.

Oil prices climbed to their highest point in over a week, fueled by a combination of escalating geopolitical tensions in the Middle East and significant supply disruptions in Central Asia. Both Brent and West Texas Intermediate crude benchmarks surged as the United States intensified its stance against Iran while a major oilfield in Kazakhstan remained offline.

The renewed pressure from Washington on Tehran has sparked concerns about potential oil supply disruptions from a critical producing region.

President Donald Trump’s recent actions and statements have directly contributed to market anxiety. The U.S. administration is applying pressure through both economic sanctions and military posturing.

New Sanctions Target Iranian Oil Transport

The U.S. Treasury announced fresh sanctions targeting nine vessels and eight related firms involved in the transportation of Iranian oil and petroleum products. This move directly targets Iran's ability to export its crude, heightening concerns over global supply stability.

As OPEC's fourth-largest producer with an output of around 3.2 million barrels per day, any disruption to Iran's exports has significant implications for the global market, particularly for major importers like China.

Military "Armada" Heads to Middle East

Adding to market jitters, President Trump announced an "armada" was en route to the Middle East. A U.S. official confirmed that naval assets, including an aircraft carrier and guided-missile destroyers, are expected to arrive in the region within days. These deployments follow U.S. strikes conducted on Iran last June and renewed warnings to Tehran.

Compounding the geopolitical risks, the oil market is also contending with a major supply outage in Kazakhstan. Chevron confirmed that production at the Tengiz oilfield, one of the world's largest, has not yet resumed following a fire that prompted a shutdown on Monday.

This shutdown worsens existing challenges for Kazakhstan's oil sector, which has already faced export bottlenecks at its primary Black Sea gateway due to damage from Ukrainian drones.

According to an analysis from JP Morgan, the Tengiz field—which accounts for nearly half of the country's production—could stay offline for the rest of the month. The bank projects Kazakhstan’s crude output will likely average just 1 to 1.1 million barrels per day (bpd) in January, a steep drop from its typical level of around 1.8 million bpd.

The dual pressures from Iran and Kazakhstan sent key oil benchmarks soaring.

• Brent crude futures jumped by $1.93, a 3% increase, to settle at $65.99 a barrel.

• U.S. West Texas Intermediate (WTI) crude climbed $1.80, also up 3%, to $61.16 a barrel.

Both benchmarks hit their highest levels since January 14 and were on track to close the week with gains exceeding 2.5%.

The week's trading was volatile. Prices had initially dropped by approximately 2% on Thursday after President Trump backed away from tariff threats against Europe and ruled out military action. This followed earlier market movements related to U.S.-Denmark discussions, where Trump announced a deal allowing "total access" to Greenland.

Mexico's government is internally reviewing its policy of supplying oil to Cuba, a critical economic lifeline for the island nation. According to sources familiar with the discussions, President Claudia Sheinbaum's administration is growing increasingly concerned about potential retaliation from the United States.

With Venezuelan oil shipments to Cuba halted following a U.S. blockade and the capture of President Nicolas Maduro, Mexico has become the island's single largest energy provider. This unique position has placed the country directly in Washington's line of sight as it grapples with Cuba's severe energy shortages and widespread blackouts.

The pressure from the United States is direct and unambiguous. President Donald Trump has declared that Cuba is "ready to fall" and issued a stark warning in a January 11 Truth Social post: "THERE WILL BE NO MORE OIL OR MONEY GOING TO CUBA - ZERO!"

This escalating rhetoric has fueled anxiety within Sheinbaum's cabinet. While Mexico publicly maintains that the oil shipments are part of longstanding international aid contracts, the internal policy review reflects a delicate balancing act. The government is simultaneously attempting to renegotiate the USMCA trade pact and convince Washington of its commitment to combating drug cartels without needing U.S. military intervention on its soil.

The sources, who requested anonymity, confirmed that the review is ongoing, with all options on the table—from a complete halt of shipments to a reduction or a full continuation of the current policy.

The Mexican presidency reiterated its sovereign right to the policy, stating the country "has always been in solidarity with the people of Cuba." A White House official reinforced President Trump's position, suggesting Cuba should "make a deal before it is too late."

The tension has manifested in direct communications and military posturing. During a recent phone call, President Trump reportedly questioned President Sheinbaum about the crude shipments and the presence of thousands of Cuban doctors in Mexico. Sheinbaum defended the oil as "humanitarian aid" and stated the medical program complies with Mexican law. Sources noted that Trump did not explicitly demand a stop to the oil deliveries during the call.

Adding to the concerns are reports of U.S. Navy drone activity over the Gulf of Mexico. Since December, at least three Northrop Grumman MQ-4C Triton drones have been tracked flying over the Bay of Campeche, appearing to follow the routes used by tankers transporting Mexican fuel to Cuba. Similar reconnaissance flights were observed off the Venezuelan coast just before the U.S. action there.

One government source expressed the growing fear that "the United States could take unilateral action on our territory."

To manage the relationship, Sheinbaum's administration has taken significant steps on other fronts. It has launched an offensive against the Sinaloa Cartel and authorized the transfer of nearly 100 drug kingpins to the United States—actions praised by U.S. officials. However, Sheinbaum has firmly stated that any unilateral U.S. military action in Mexico would be a violation of sovereignty.

Despite the external pressure, Sheinbaum has publicly defended the oil policy. "Very little of the crude oil produced in Mexico is sent to Cuba, but it is a form of solidarity in a situation of hardship and difficulty," she said on Wednesday, adding, "That doesn't have to disappear."

Cuba is heavily reliant on imported fuel for electricity, transport, and industry. U.S. sanctions and a severe economic crisis have long hampered its ability to purchase fuel, forcing it to depend on allies.

Within the Mexican government, some officials argue that cutting off Cuba's oil supply could trigger an unprecedented humanitarian crisis. They fear such a disaster would lead to mass migration toward Mexico, creating a new set of challenges. This concern is a powerful incentive to maintain at least some level of fuel supply to the island.

With Venezuelan supplies cut and a heavy U.S. military presence in the region, it is unlikely other producers would step in to fill the gap. The U.S. has already seized tankers involved in shipping sanctioned crude from countries like Iran and Russia.

According to data from state oil company Pemex filed with the U.S. Securities and Exchange Commission, Mexico shipped an average of 17,200 barrels per day of crude oil and 2,000 bpd of refined products to Cuba between January and September of last year, valued at approximately $400 million.

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up