Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

U.K. Retail Sales MoM (SA) (Dec)

U.K. Retail Sales MoM (SA) (Dec)A:--

F: --

P: --

France Manufacturing PMI Prelim (Jan)

France Manufacturing PMI Prelim (Jan)A:--

F: --

P: --

France Services PMI Prelim (Jan)

France Services PMI Prelim (Jan)A:--

F: --

P: --

France Composite PMI Prelim (SA) (Jan)

France Composite PMI Prelim (SA) (Jan)A:--

F: --

P: --

Germany Manufacturing PMI Prelim (SA) (Jan)

Germany Manufacturing PMI Prelim (SA) (Jan)A:--

F: --

P: --

Germany Services PMI Prelim (SA) (Jan)

Germany Services PMI Prelim (SA) (Jan)A:--

F: --

P: --

Germany Composite PMI Prelim (SA) (Jan)

Germany Composite PMI Prelim (SA) (Jan)A:--

F: --

P: --

Euro Zone Composite PMI Prelim (SA) (Jan)

Euro Zone Composite PMI Prelim (SA) (Jan)A:--

F: --

P: --

Euro Zone Manufacturing PMI Prelim (SA) (Jan)

Euro Zone Manufacturing PMI Prelim (SA) (Jan)A:--

F: --

P: --

Euro Zone Services PMI Prelim (SA) (Jan)

Euro Zone Services PMI Prelim (SA) (Jan)A:--

F: --

P: --

U.K. Composite PMI Prelim (Jan)

U.K. Composite PMI Prelim (Jan)A:--

F: --

P: --

U.K. Manufacturing PMI Prelim (Jan)

U.K. Manufacturing PMI Prelim (Jan)A:--

F: --

P: --

U.K. Services PMI Prelim (Jan)

U.K. Services PMI Prelim (Jan)A:--

F: --

P: --

Mexico Economic Activity Index YoY (Nov)

Mexico Economic Activity Index YoY (Nov)A:--

F: --

P: --

Russia Trade Balance (Nov)

Russia Trade Balance (Nov)A:--

F: --

P: --

Canada Core Retail Sales MoM (SA) (Nov)

Canada Core Retail Sales MoM (SA) (Nov)A:--

F: --

P: --

Canada Retail Sales MoM (SA) (Nov)

Canada Retail Sales MoM (SA) (Nov)A:--

F: --

U.S. IHS Markit Manufacturing PMI Prelim (SA) (Jan)

U.S. IHS Markit Manufacturing PMI Prelim (SA) (Jan)A:--

F: --

P: --

U.S. IHS Markit Services PMI Prelim (SA) (Jan)

U.S. IHS Markit Services PMI Prelim (SA) (Jan)A:--

F: --

P: --

U.S. IHS Markit Composite PMI Prelim (SA) (Jan)

U.S. IHS Markit Composite PMI Prelim (SA) (Jan)A:--

F: --

P: --

U.S. UMich Consumer Sentiment Index Final (Jan)

U.S. UMich Consumer Sentiment Index Final (Jan)A:--

F: --

P: --

U.S. UMich Current Economic Conditions Index Final (Jan)

U.S. UMich Current Economic Conditions Index Final (Jan)A:--

F: --

P: --

U.S. UMich Consumer Expectations Index Final (Jan)

U.S. UMich Consumer Expectations Index Final (Jan)A:--

F: --

P: --

U.S. Conference Board Leading Economic Index MoM (Nov)

U.S. Conference Board Leading Economic Index MoM (Nov)A:--

F: --

P: --

U.S. Conference Board Coincident Economic Index MoM (Nov)

U.S. Conference Board Coincident Economic Index MoM (Nov)A:--

F: --

P: --

U.S. Conference Board Lagging Economic Index MoM (Nov)

U.S. Conference Board Lagging Economic Index MoM (Nov)A:--

F: --

P: --

U.S. UMich 1-Year-Ahead Inflation Expectations Final (Jan)

U.S. UMich 1-Year-Ahead Inflation Expectations Final (Jan)A:--

F: --

P: --

U.S. Conference Board Leading Economic Index (Nov)

U.S. Conference Board Leading Economic Index (Nov)A:--

F: --

P: --

U.S. Weekly Total Rig Count

U.S. Weekly Total Rig CountA:--

F: --

P: --

U.S. Weekly Total Oil Rig Count

U.S. Weekly Total Oil Rig CountA:--

F: --

P: --

Germany Ifo Business Expectations Index (SA) (Jan)

Germany Ifo Business Expectations Index (SA) (Jan)--

F: --

P: --

Germany IFO Business Climate Index (SA) (Jan)

Germany IFO Business Climate Index (SA) (Jan)--

F: --

P: --

Germany Ifo Current Business Situation Index (SA) (Jan)

Germany Ifo Current Business Situation Index (SA) (Jan)--

F: --

P: --

U.S. Dallas Fed PCE Price Index YoY (Nov)

U.S. Dallas Fed PCE Price Index YoY (Nov)--

F: --

P: --

Brazil Current Account (Dec)

Brazil Current Account (Dec)--

F: --

P: --

Mexico Unemployment Rate (Not SA) (Dec)

Mexico Unemployment Rate (Not SA) (Dec)A:--

F: --

P: --

Canada National Economic Confidence Index

Canada National Economic Confidence Index--

F: --

P: --

U.S. Non-Defense Capital Durable Goods Orders MoM (Excl. Aircraft) (Nov)

U.S. Non-Defense Capital Durable Goods Orders MoM (Excl. Aircraft) (Nov)--

F: --

P: --

U.S. Durable Goods Orders MoM (Excl. Defense) (SA) (Nov)

U.S. Durable Goods Orders MoM (Excl. Defense) (SA) (Nov)--

F: --

P: --

U.S. Durable Goods Orders MoM (Excl.Transport) (Nov)

U.S. Durable Goods Orders MoM (Excl.Transport) (Nov)--

F: --

P: --

U.S. Durable Goods Orders MoM (Nov)

U.S. Durable Goods Orders MoM (Nov)--

F: --

P: --

U.S. Chicago Fed National Activity Index (Nov)

U.S. Chicago Fed National Activity Index (Nov)--

F: --

P: --

U.S. Dallas Fed New Orders Index (Jan)

U.S. Dallas Fed New Orders Index (Jan)--

F: --

P: --

U.S. Dallas Fed General Business Activity Index (Jan)

U.S. Dallas Fed General Business Activity Index (Jan)--

F: --

P: --

U.K. BRC Shop Price Index YoY (Jan)

U.K. BRC Shop Price Index YoY (Jan)--

F: --

P: --

China, Mainland Industrial Profit YoY (YTD) (Dec)

China, Mainland Industrial Profit YoY (YTD) (Dec)--

F: --

P: --

Mexico Trade Balance (Dec)

Mexico Trade Balance (Dec)--

F: --

P: --

U.S. S&P/CS 20-City Home Price Index YoY (Not SA) (Nov)

U.S. S&P/CS 20-City Home Price Index YoY (Not SA) (Nov)--

F: --

P: --

U.S. S&P/CS 20-City Home Price Index MoM (SA) (Nov)

U.S. S&P/CS 20-City Home Price Index MoM (SA) (Nov)--

F: --

P: --

U.S. FHFA House Price Index MoM (Nov)

U.S. FHFA House Price Index MoM (Nov)--

F: --

P: --

U.S. FHFA House Price Index (Nov)

U.S. FHFA House Price Index (Nov)--

F: --

P: --

U.S. Richmond Fed Manufacturing Composite Index (Jan)

U.S. Richmond Fed Manufacturing Composite Index (Jan)--

F: --

P: --

U.S. Conference Board Present Situation Index (Jan)

U.S. Conference Board Present Situation Index (Jan)--

F: --

P: --

U.S. Conference Board Consumer Expectations Index (Jan)

U.S. Conference Board Consumer Expectations Index (Jan)--

F: --

P: --

U.S. Richmond Fed Manufacturing Shipments Index (Jan)

U.S. Richmond Fed Manufacturing Shipments Index (Jan)--

F: --

P: --

U.S. Richmond Fed Services Revenue Index (Jan)

U.S. Richmond Fed Services Revenue Index (Jan)--

F: --

P: --

U.S. Conference Board Consumer Confidence Index (Jan)

U.S. Conference Board Consumer Confidence Index (Jan)--

F: --

P: --

Australia RBA Trimmed Mean CPI YoY (Q4)

Australia RBA Trimmed Mean CPI YoY (Q4)--

F: --

P: --

Australia CPI YoY (Q4)

Australia CPI YoY (Q4)--

F: --

P: --

Australia CPI QoQ (Q4)

Australia CPI QoQ (Q4)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

Colombia will suspend electricity sales to Ecuador and impose a 30% tariff on 20 products from its neighbor, it said on Thursday, in an escalating dispute over trade and the fight against drug trafficking.

Colombia will suspend electricity sales to Ecuador and impose a 30% tariff on 20 products from its neighbor, it said on Thursday, in an escalating dispute over trade and the fight against drug trafficking.

The move came a day after Ecuador's President Daniel Noboa said his government would impose a 30% "security charge" on goods from Colombia, starting on February 1, citing a trade deficit and a lack of cooperation on fighting drug trafficking.

Colombia, which has repeatedly denied accusations it is not doing enough to tackle drug smuggling, is an important exporter of power to its South American neighbor. Noboa's government later said the measure included exceptions for the sale of electricity and oil logistics services.

In response to Bogota's tariff announcement on Thursday, Ecuador's energy minister said Colombian crude being transported on the OCP pipeline - Ecuador's second-largest - would have "the reciprocity given in the case of electricity". She gave no further details on what that would mean in practice.

Ecuador's trade deficit with Colombia totaled $838 million in the first 10 months of last year, according to Ecuador's central bank.

Colombia shipped $1.67 billion worth of goods to its neighbor in the first 11 months of last year, according to statistics agency DANE, representing 3.6% of total exports.

"The collaboration with the armed forces of Ecuador is tight," Colombian President Gustavo Petro wrote on X Wednesday, adding that Colombia had seized 200 metric tons of cocaine on the two countries' shared border.

"I hope Ecuador has been grateful, when they have needed us, that we have acted energetically in solidarity."

His government was willing to expand joint efforts with Ecuador to fight fentanyl trafficking, he said.

Posting on X overnight, Colombia's commerce and industry ministry said the 30% tariff was "proportional, transitory and revisable" and is meant to restore balance in trade relations following Ecuador's "security charge" decision. It added that Colombia remained open to dialogue.

In its announcement, it did not say what products were covered under the tariff. Colombia's leading imports from Ecuador are fish, vegetable oil and auto parts.

Colombia's energy ministry later said it had issued a resolution suspending "international transactions of electricity with Ecuador".

It did not link the decision to Ecuador's trade measures, instead calling it "a preventative measure to guarantee internal supply in the face of climate variability."

"When adequate technical, energy and commercial conditions exist, exports will be reactivated," the ministry added.

Colombia Energy Minister Edwin Palma had previously criticized Ecuador's actions and on Wednesday cancelled a recent initiative to allow private firms to take part in energy sales between the countries.

Noboa, a close ally of U.S. President Donald Trump, has made the fight against criminal gangs a cornerstone of his administration, aligning Ecuador with one of the White House's main policy priorities in South America.

He has declared several states of emergency and recently mobilized over 10,000 soldiers to tackle organized crime. The government has said turf wars between splintered gangs caused murder rates to soar 30% last year.

Trump has, meanwhile, pressured Colombia, as well as Mexico, over drug trafficking, both before and after U.S. forces captured Venezuela's President Nicolas Maduro, whom the White House called a "narco-dictator", earlier this month.

Accused of failing to stop the flow of cocaine to the U.S., which he denied, Colombia's Petro was sanctioned by the U.S. last year. But tensions eased in January, following a cordial phone call between Petro and Trump.

An ambitious U.S. Senate effort to create a comprehensive regulatory framework for cryptocurrencies has been delayed for weeks, if not months, after a major industry player pulled its support and stalled legislative momentum.

The Senate Banking Committee has indefinitely postponed work on its highly anticipated market structure bill. The move came after Coinbase, one of the crypto industry’s largest exchanges, publicly withdrew its backing for the proposed legislation.

The timing of Coinbase’s decision was critical, occurring just before a scheduled hearing where lawmakers were set to debate and potentially advance the bill. With the exchange no longer supporting the measure "as written," the committee has shifted its focus to other legislative priorities, including housing affordability initiatives connected to President Donald Trump's agenda. According to reports from Bloomberg, the delay could push any further action on the bill to late February or March as lawmakers struggle to resolve policy disputes and rebuild bipartisan support.

The core of the dispute lies in fundamental disagreements between crypto firms and the bill's authors. The withdrawal of support by Coinbase, a decision made by CEO Brian Armstrong, signals deep industry opposition to several key provisions.

Industry leaders argue that the current draft of the bill contains measures that could stifle innovation. Their primary concerns include:

• Weakening CFTC Authority: Provisions that could undermine the authority of the Commodity Futures Trading Commission.

• Restricting DeFi: Language that may impose limitations on the decentralized finance (DeFi) sector.

• Curtailing Stablecoin Rewards: Measures that would restrict rewards programs for stablecoins, a feature many firms see as crucial for growth.

The crypto bill faces opposition from outside the digital asset industry as well. The traditional banking sector has actively lobbied lawmakers to impose tighter restrictions on yield-bearing crypto products. Banks have warned that these features could draw deposits away from their institutions and potentially destabilize lending markets, a lobbying effort that appears to have influenced the bill's current language.

Furthermore, shifting political priorities are contributing to the slowdown. With midterm elections approaching, senators are under pressure to concentrate on more voter-centric issues, such as housing affordability, which has taken precedence over complex crypto regulation.

While some lawmakers insist the delay is only temporary, the interruption underscores how fragile the legislative consensus on digital assets truly is. Members of the Senate Agriculture Committee have released a separate draft for a crypto market structure, but observers doubt it has enough bipartisan backing to succeed.

Patrick Witt, the executive director of the White House council on digital assets, has urged all parties to continue negotiations. He described regulatory clarity as "a question of when, not if," signaling that federal oversight is inevitable. However, Witt also warned that if the crypto industry fails to cooperate, future versions of the legislation could be far less favorable.

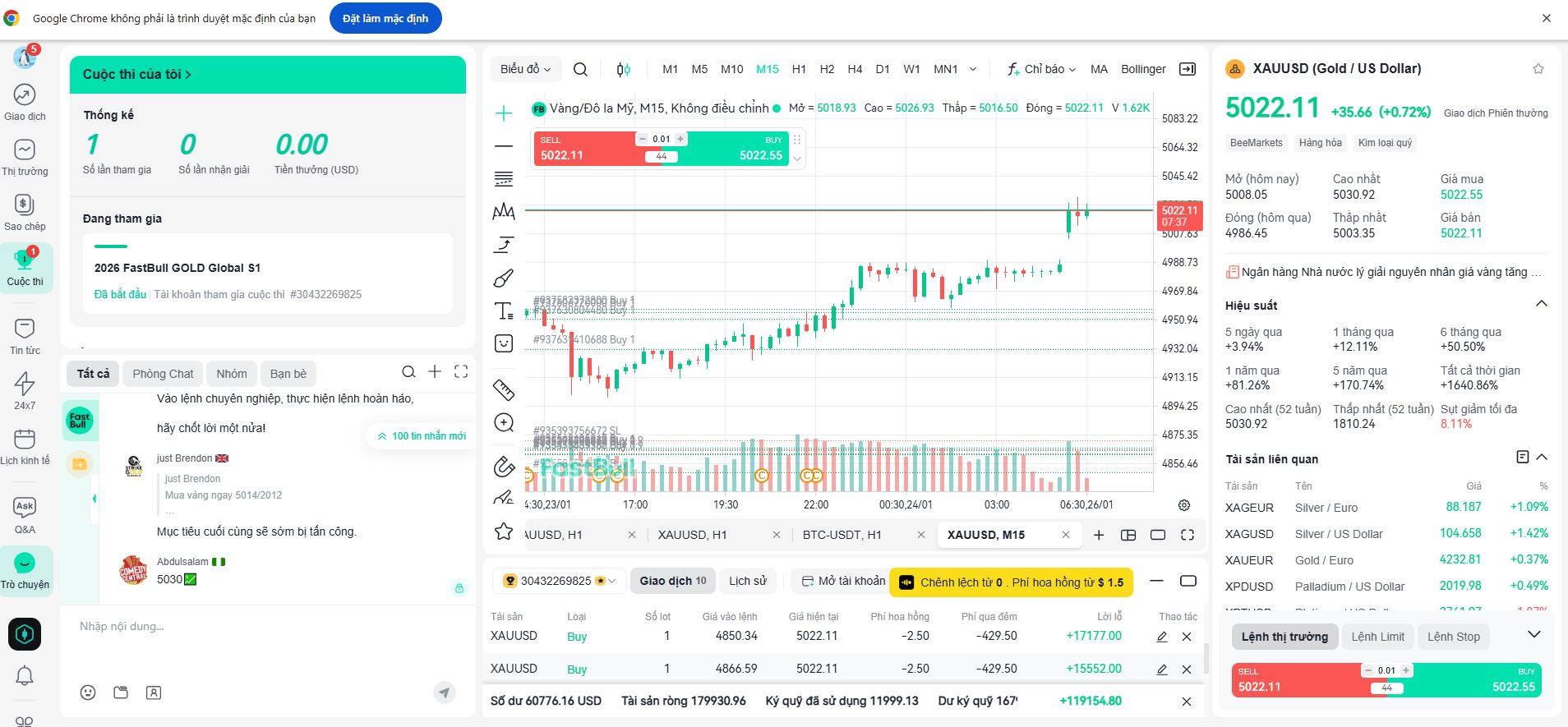

Gold prices declined on Thursday as investors' appetite for riskier assets grew, driven by signs of easing trade tensions from the United States. The safe-haven metal also faced pressure from traders taking profits after its recent rally.

By 8:57 a.m. ET, spot gold had slipped 0.4% to $4,819.39 per ounce, after falling by nearly 1% earlier in the session. U.S. gold futures for February delivery lost 0.3%, trading at $4,821 per ounce.

Market sentiment improved significantly after U.S. President Donald Trump backed off from threats of Greenland-related tariffs. This renewed optimism fueled buying appetite for equities, with U.S. stock index futures climbing on Thursday.

Adding to the positive tone, Trump launched his Board of Peace, an initiative initially designed for Gaza's ceasefire that he envisions playing a wider role. He also commented that peace efforts in Ukraine were "getting close" ahead of a scheduled meeting with President Volodymyr Zelenskiy in Davos.

Bart Melek, global head of commodity strategy at TD Securities, attributed the sell-off to a clear shift in investor behavior.

"We have seen significant resurgence in risk appetite that essentially prompted the market to be a little less cautious of risk assets," Melek explained. This shift, he noted, "resulted in less appetite for gold and some profit-taking."

Investors are also closely monitoring the U.S. Federal Reserve, which is widely expected to hold interest rates steady at its next policy meeting.

The central bank's independence was a topic of discussion as U.S. Supreme Court justices heard arguments over President Trump's attempt to fire Federal Reserve Governor Lisa Cook. The court appeared to support the idea that the Fed's authority to set monetary policy must be preserved.

Looking ahead, traders are awaiting the November Personal Consumption Expenditures (PCE) data, a key inflation indicator that could offer clues about the Fed's future policy path.

While gold prices fell, performance across other precious metals was mixed.

• Silver: Spot silver was up 0.2% at $93.47 an ounce after hitting a record high of $95.87 on Tuesday. Melek commented that silver's rally might be "a little overdone" and could face a correction as global liquidity increases.

• Platinum: Spot platinum rose 1.5% to $2,520.45 per ounce, a day after touching a record peak of $2,511.80.

• Palladium: Palladium also gained, rising 1.1% to $1,860.25.

President Donald Trump’s recent statements at Davos seemed to de-escalate a brewing transatlantic crisis. He announced the US would not use military force over Greenland and would pause new tariffs on some European countries—for now. But while the immediate threat has subsided, the episode has shattered a core illusion about the US-EU alliance.

The confrontation may have cooled, but the underlying power dynamics have been permanently altered. Trump’s approach framed Greenland as a strategic necessity for the US, treating European resistance as a problem to be managed rather than a partnership to be respected.

For the European Union, the critical takeaway is not that this specific crisis was averted. The real issue is that economic coercion has been normalized as a legitimate tool within the transatlantic relationship. The question is no longer if another escalation will occur, but how the EU will respond when it does.

American strategic interest in Greenland, valued for its missile defense and Arctic access, is nothing new. What shocked European capitals was President Trump's readiness to use tariffs and market access as leverage to force compliance from an EU member state over its own territory.

Though the threats were suspended, the signal was sent. From the EU's perspective, this behavior is precisely what it has sought to deter from other global actors. The bloc's Anti-Coercion Instrument (ACI), which came into force in December 2023, was designed for situations where economic pressure is applied to force political change. The fact that its first major test could involve the United States is a stark geopolitical reality check.

When a core ally treats sovereign territory as negotiable under economic pressure, the line between alliance management and coercive bargaining becomes dangerously thin.

The Greenland incident has served as a powerful catalyst, accelerating the EU's push for "strategic autonomy." For years, this concept was a slow-moving, often divisive debate, sometimes dismissed as a pet project of the French geopolitical agenda. Now, it is an urgent necessity.

The episode made it undeniably clear that the EU remains structurally exposed to pressure from its closest ally. Trump's gambit demonstrated that Washington can apply, adjust, and withdraw economic leverage at will, forcing the EU to react rather than set its own course. The absence of a military threat offers little comfort; it simply highlights that the most effective pressure can be applied below the threshold of armed conflict, where Europe is least prepared.

The LNG Trap: From Solidarity to Dependence

Nowhere is this vulnerability clearer than in the energy sector. In 2025, the United States accounted for nearly 60% of the EU's Liquefied Natural Gas (LNG) imports. Following Russia's invasion of Ukraine, this was celebrated as transatlantic energy solidarity.

Viewed through a strategic lens today, it looks more like a new asymmetric dependence. In a friendly relationship, this interdependence is manageable. In a strained one, it becomes a critical liability, paving the way for future political weakness.

This is why the EU is fast-tracking its strategic autonomy—not necessarily to distance itself from the US, but because deep integration without the ability to counteract pressure leaves the bloc exposed to an unpredictable administration.

The shift in attitude was palpable at Davos, where European leaders were unusually direct.

Speaking just a day before Trump, French President Emmanuel Macron argued that Europe must become "stronger and more autonomous" to remain credible, even while emphasizing cooperation with Washington. He warned that the EU could no longer afford to be naïve about power in a world increasingly shaped by "bullies" and coercion.

Belgian Prime Minister Bart De Wever was even more blunt. He warned that Europe could become the "slave" of the US president if it fails to urgently develop its "own technological platforms to build tomorrow's prosperity." His comments underscore a core structural fear: an EU reliant on systems it does not control is an EU permanently at risk.

However, the EU is far from powerless. Its Anti-Coercion Instrument (ACI) gives Brussels a formidable tool to retaliate against economic pressure. The ACI allows the EU to deploy targeted countermeasures in sectors like services, public procurement, and investment—areas where US companies are deeply exposed to the vast EU single market.

This is a critical piece of leverage. US firms hold the largest stock of foreign direct investment in the EU, especially in high-value services. By targeting specific firms and constituencies, the EU can impose concentrated political costs on Washington, a powerful deterrent less than a year before the US midterm elections.

Trump's decision to back down may, in fact, highlight the deterrent power of the ACI. The simple belief among markets and policymakers that the EU is willing to use this "economic nuclear weapon" creates a powerful precedent. As former Italian Prime Minister Enrico Letta noted, the single market is "much more than a market." The Greenland affair may have been the moment the EU finally realized it.

US Commerce Secretary Howard Lutnick has sharply criticized Canada's recent efforts to forge closer trade ties with China, labeling the move "political noise" and warning it could jeopardize upcoming talks to renew the North American trade agreement.

Speaking at the World Economic Forum in Davos, Lutnick questioned the logic behind Canadian Prime Minister Mark Carney's strategy.

"Do you think China is going to open their economy to accept exports from Canada? This is the silliest thing I've ever seen," Lutnick stated in a Bloomberg TV interview.

Lutnick's comments follow a deal last week between Prime Minister Carney and Chinese President Xi Jinping. The agreement aims to facilitate Chinese investment in Canada's electric vehicle and auto sectors, with China expected to reduce tariffs on Canadian canola in return.

Following the deal, Carney described China as a "more predictable" trading partner than the United States.

Lutnick dismissed this sentiment, arguing that the economic reality of the U.S.-Canada relationship is irreplaceable.

"We should look at it as just political noise coming out of a prime minister," he said. "I don't think it can be real, because he took out the math of Canada's economy and doing business with the United States of America's $30 trillion economy. There's no such thing as changing what they have today."

Lutnick emphasized that Canada currently has "the second-best deal in the world" through its access to the U.S. market, second only to Mexico.

The Commerce Secretary directly linked Canada's actions to the future of the U.S.-Mexico-Canada Agreement (USMCA), suggesting that Ottawa's new alignment with Beijing could become a major issue during its review.

He questioned whether the White House would allow Canada to maintain its favorable trade status if it proceeds with plans like importing Chinese electric vehicles.

"Do you think the president of the United States is going to say you should keep having the second-best deal in the world?" Lutnick asked, referencing the upcoming USMCA talks.

He projected that the renegotiation process for the trade accord is likely to begin "towards the end of the summer and the middle of the summer" this year.

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

Log In

Sign Up