Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

U.S. Philadelphia Fed Business Activity Index (SA) (Jan)

U.S. Philadelphia Fed Business Activity Index (SA) (Jan)A:--

F: --

P: --

U.S. EIA Weekly Natural Gas Stocks Change

U.S. EIA Weekly Natural Gas Stocks ChangeA:--

F: --

P: --

Richmond Federal Reserve President Barkin delivered a speech.

Richmond Federal Reserve President Barkin delivered a speech. U.S. Weekly Treasuries Held by Foreign Central Banks

U.S. Weekly Treasuries Held by Foreign Central BanksA:--

F: --

P: --

Germany CPI Final MoM (Dec)

Germany CPI Final MoM (Dec)A:--

F: --

P: --

Germany CPI Final YoY (Dec)

Germany CPI Final YoY (Dec)A:--

F: --

P: --

Germany HICP Final MoM (Dec)

Germany HICP Final MoM (Dec)A:--

F: --

P: --

Germany HICP Final YoY (Dec)

Germany HICP Final YoY (Dec)A:--

F: --

P: --

Brazil PPI MoM (Nov)

Brazil PPI MoM (Nov)A:--

F: --

P: --

Canada New Housing Starts (Dec)

Canada New Housing Starts (Dec)A:--

F: --

U.S. Capacity Utilization MoM (SA) (Dec)

U.S. Capacity Utilization MoM (SA) (Dec)A:--

F: --

U.S. Industrial Output YoY (Dec)

U.S. Industrial Output YoY (Dec)A:--

F: --

P: --

U.S. Manufacturing Capacity Utilization (Dec)

U.S. Manufacturing Capacity Utilization (Dec)A:--

F: --

P: --

U.S. Manufacturing Output MoM (SA) (Dec)

U.S. Manufacturing Output MoM (SA) (Dec)A:--

F: --

U.S. Industrial Output MoM (SA) (Dec)

U.S. Industrial Output MoM (SA) (Dec)A:--

F: --

U.S. NAHB Housing Market Index (Jan)

U.S. NAHB Housing Market Index (Jan)A:--

F: --

P: --

Russia CPI YoY (Dec)

Russia CPI YoY (Dec)A:--

F: --

P: --

U.S. Weekly Total Rig Count

U.S. Weekly Total Rig CountA:--

F: --

P: --

U.S. Weekly Total Oil Rig Count

U.S. Weekly Total Oil Rig CountA:--

F: --

P: --

Japan Core Machinery Orders YoY (Nov)

Japan Core Machinery Orders YoY (Nov)A:--

F: --

P: --

Japan Core Machinery Orders MoM (Nov)

Japan Core Machinery Orders MoM (Nov)A:--

F: --

P: --

U.K. Rightmove House Price Index YoY (Jan)

U.K. Rightmove House Price Index YoY (Jan)A:--

F: --

P: --

China, Mainland Urban Area Unemployment Rate (Dec)

China, Mainland Urban Area Unemployment Rate (Dec)A:--

F: --

P: --

China, Mainland GDP YoY (YTD) (Q4)

China, Mainland GDP YoY (YTD) (Q4)A:--

F: --

P: --

China, Mainland GDP (Q4)

China, Mainland GDP (Q4)A:--

F: --

P: --

China, Mainland GDP QoQ (SA) (Q4)

China, Mainland GDP QoQ (SA) (Q4)A:--

F: --

P: --

China, Mainland Annual GDP

China, Mainland Annual GDPA:--

F: --

P: --

China, Mainland Annual GDP Growth

China, Mainland Annual GDP GrowthA:--

F: --

P: --

China, Mainland GDP YoY (Q4)

China, Mainland GDP YoY (Q4)A:--

F: --

P: --

China, Mainland Industrial Output YoY (YTD) (Dec)

China, Mainland Industrial Output YoY (YTD) (Dec)A:--

F: --

P: --

Japan Industrial Output Final MoM (Nov)

Japan Industrial Output Final MoM (Nov)--

F: --

P: --

Japan Industrial Output Final YoY (Nov)

Japan Industrial Output Final YoY (Nov)--

F: --

P: --

Euro Zone Core HICP Final MoM (Dec)

Euro Zone Core HICP Final MoM (Dec)--

F: --

P: --

Euro Zone HICP Final MoM (Dec)

Euro Zone HICP Final MoM (Dec)--

F: --

P: --

Euro Zone HICP Final YoY (Dec)

Euro Zone HICP Final YoY (Dec)--

F: --

P: --

Euro Zone HICP MoM (Excl. Food & Energy) (Dec)

Euro Zone HICP MoM (Excl. Food & Energy) (Dec)--

F: --

P: --

Euro Zone Core CPI Final YoY (Dec)

Euro Zone Core CPI Final YoY (Dec)--

F: --

P: --

Euro Zone Core HICP Final YoY (Dec)

Euro Zone Core HICP Final YoY (Dec)--

F: --

P: --

Euro Zone CPI YoY (Excl. Tobacco) (Dec)

Euro Zone CPI YoY (Excl. Tobacco) (Dec)--

F: --

P: --

Euro Zone Core CPI Final MoM (Dec)

Euro Zone Core CPI Final MoM (Dec)--

F: --

P: --

Canada National Economic Confidence Index

Canada National Economic Confidence Index--

F: --

P: --

Canada CPI MoM (SA) (Dec)

Canada CPI MoM (SA) (Dec)--

F: --

P: --

Canada Core CPI MoM (SA) (Dec)

Canada Core CPI MoM (SA) (Dec)--

F: --

P: --

Canada CPI YoY (SA) (Dec)

Canada CPI YoY (SA) (Dec)--

F: --

P: --

Canada Trimmed CPI YoY (SA) (Dec)

Canada Trimmed CPI YoY (SA) (Dec)--

F: --

P: --

Canada CPI YoY (Dec)

Canada CPI YoY (Dec)--

F: --

P: --

Canada CPI MoM (Dec)

Canada CPI MoM (Dec)--

F: --

P: --

Canada Core CPI YoY (Dec)

Canada Core CPI YoY (Dec)--

F: --

P: --

Canada Core CPI MoM (Dec)

Canada Core CPI MoM (Dec)--

F: --

P: --

South Korea PPI MoM (Dec)

South Korea PPI MoM (Dec)--

F: --

P: --

China, Mainland 1-Year Loan Prime Rate (LPR)

China, Mainland 1-Year Loan Prime Rate (LPR)--

F: --

P: --

China, Mainland 5-Year Loan Prime Rate

China, Mainland 5-Year Loan Prime Rate--

F: --

P: --

U.K. Average Weekly Earnings (3-Month Average, Including Bonuses) YoY (Nov)

U.K. Average Weekly Earnings (3-Month Average, Including Bonuses) YoY (Nov)--

F: --

P: --

U.K. Average Weekly Earnings (3-Month Average, Excluding Bonuses) YoY (Nov)

U.K. Average Weekly Earnings (3-Month Average, Excluding Bonuses) YoY (Nov)--

F: --

P: --

Germany PPI YoY (Dec)

Germany PPI YoY (Dec)--

F: --

P: --

Germany PPI MoM (Dec)

Germany PPI MoM (Dec)--

F: --

P: --

U.K. Unemployment Rate (Dec)

U.K. Unemployment Rate (Dec)--

F: --

P: --

U.K. 3-Month ILO Unemployment Rate (Nov)

U.K. 3-Month ILO Unemployment Rate (Nov)--

F: --

P: --

U.K. 3-Month ILO Employment Change (Nov)

U.K. 3-Month ILO Employment Change (Nov)--

F: --

P: --

U.K. Unemployment Claimant Count (Dec)

U.K. Unemployment Claimant Count (Dec)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

Trump's new European tariffs plunged Bitcoin by $4,000 amid market uncertainty and a looming Supreme Court trade ruling.

Bitcoin's price plunged by nearly $4,000 in a sudden evening sell-off after President Donald Trump announced plans for significant new tariffs on European goods. The sharp downturn triggered a cascade of forced liquidations across the cryptocurrency market.

Around 6 p.m. EST, a wave of selling pressure sent the world's largest cryptocurrency from approximately $95,500 to an intraday low of $91,935 in just two hours. This rapid decline wiped out over $500 million in leveraged long positions within a single hour, with total crypto long liquidations exceeding $525 million in the same timeframe.

The bitcoin price has since found a floor near $92,600 but remains down roughly 2.5% over the last 24 hours.

The market sell-off aligns with rising macroeconomic uncertainty following Trump's announcement that the U.S. will impose new tariffs on European nations starting February 1.

The proposal outlines a 10% tariff on goods from eight countries:

• Denmark

• Norway

• Sweden

• France

• Germany

• The United Kingdom

• The Netherlands

• Finland

This rate would escalate to 25% by June 1 if no agreement is reached. President Trump explicitly linked the trade measures to U.S. efforts to secure Greenland, intensifying already strained transatlantic relations.

European leaders responded with strong opposition. In a joint statement, the affected nations warned the tariff threats could ignite a "dangerous downward spiral." Danish Prime Minister Mette Frederiksen asserted that Europe "will not be blackmailed." Protests were also reported in Denmark and Greenland over the weekend.

In a classic flight to safety, gold prices climbed to a new all-time high of around $4,670.

Compounding the tariff issue is a high-stakes U.S. Supreme Court case that could redefine presidential authority on trade. The court is set to rule on whether President Trump has the power to impose sweeping tariffs under the International Emergency Economic Powers Act (IEEPA).

The case centers on Trump's use of the act to declare trade deficits a national emergency, which served as the legal basis for a baseline 10% duty on most imports. The ruling has major implications for trade policy and federal revenue.

A decision against Trump could compel the government to refund more than $100 billion in collected tariffs, potentially disrupting defense and budget plans. Conversely, if the court upholds the president's authority, existing tariffs will stand, and future actions—like the proposed duties on European goods—could move forward.

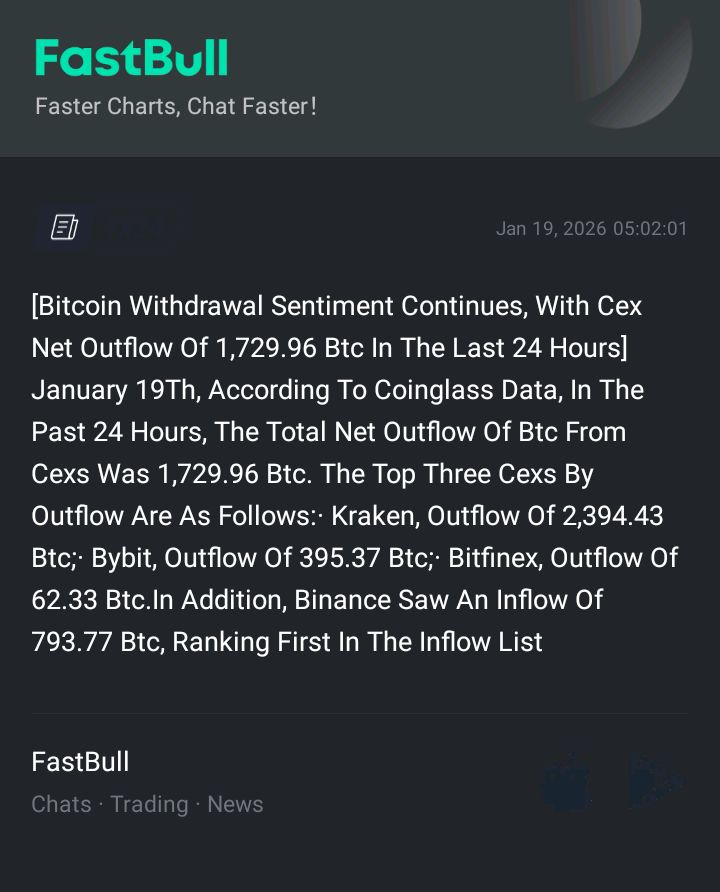

Following the recent volatility, Bitcoin is trading down approximately 3% from its seven-day high of $95,468 and remains within a narrow range above its seven-day low of $92,284.

The asset’s circulating supply stands at 19.98 million BTC, out of a maximum possible supply of 21 million. The global Bitcoin market capitalization is approximately $1.85 trillion, a daily decrease of about 2%, while 24-hour trading volume has hit $32 billion.

European Union leaders are set to hold an emergency meeting this week to formulate a response to a new tariff threat from US President Donald Trump. The move comes after Trump announced plans to impose a 10% tariff on eight European nations starting February 1, citing their actions related to Greenland.

Ambassadors from EU member states met in Brussels on Sunday evening to devise a joint strategy. Following the discussion, European Council President Antonio Costa confirmed the bloc's commitment to unity, stating that member states stand in solidarity with Greenland and Denmark.

In a social media post, Costa emphasized that Trump's proposed tariffs would be "incompatible with the EU-US trade agreement." An EU official confirmed that the bloc's leaders intend to meet in person toward the end of the week.

According to sources familiar with the internal discussions, the EU is considering several countermeasures. The most prominent option is the revival of a plan to impose retaliatory levies on US goods valued at €93 billion (US$108 billion).

Other potential responses being discussed include:

• The Anti-Coercion Instrument: French President Emmanuel Macron suggested on Sunday that the EU should consider using this powerful new tool. However, France has previously hesitated to deploy it after threats of retaliation from Trump.

• Withholding Trade Pact Approval: European lawmakers suggested over the weekend that they may delay the final approval of the existing EU-US trade agreement in light of the latest tariff announcement.

Last year, the EU had already approved the retaliatory tariffs on €93 billion worth of US products but suspended their implementation after both sides reached a trade pact. The current threat from the US now puts that entire agreement in jeopardy.

The European Union is pushing for diplomatic talks to resolve tariff threats from the United States concerning Greenland, choosing negotiation over immediate retaliation. This strategy aims to de-escalate a conflict that could impact up to €93 billion in US goods and disrupt transatlantic economic stability.

EU leaders are emphasizing a unified commitment to dialogue to protect peace, security, and the bloc's sovereignty. By prioritizing talks, the EU hopes to avoid a trade war and safeguard its economic interests.

Top European officials have consistently presented a united front against the US tariff threats. Ursula von der Leyen, President of the European Commission, highlighted the shared security interests in the Arctic.

"We have consistently underlined our shared transatlantic interest in peace and security in the Arctic, including through NATO," von der Leyen stated. She noted that a pre-coordinated Danish exercise with allies was designed to strengthen Arctic security and "poses no threat to anyone."

Von der Leyen warned that tariffs would backfire. "Tariffs would undermine transatlantic relations and risk a dangerous downward spiral. Europe will remain united, coordinated and committed to upholding its sovereignty," she added.

This position is backed by other prominent leaders, including Emmanuel Macron and Antonio Costa, who argue that the proposed tariffs are incompatible with existing EU-US agreements. Their collective focus remains on protecting shared European interests.

Rather than immediately preparing retaliatory measures, the EU is exploring strategic patience. The European Parliament may consider delaying votes on trade pacts to signal its preference for a coordinated diplomatic response over escalating tensions.

While the EU has an anti-coercion instrument (ACI) under discussion, it remains cautious about the economic fallout of a trade dispute. The consensus is that negotiation is preferable. Analysts suggest that maintaining EU-US trade synergy is vital to prevent broader economic repercussions, as historical data shows peaceful negotiations often lead to more favorable outcomes for both market stability and international relations.

The EU's current approach is guided by past successes. Just last year, a prepared tariff package against US goods was suspended following successful trade agreements with Washington. These events demonstrate the value of diplomatic resolution in averting economic conflict.

Ongoing negotiations are a constant feature of the transatlantic relationship. Recent White House actions emphasizing reciprocal trade and tariffs, along with the suspension of duty-free de minimis treatment detailed in a Federal Register notice, underscore a continued commitment to diplomatic engagement to resolve trade issues.

The Indonesian Rupiah is moving dangerously close to a record low against the US dollar, with analysts forecasting further weakness as concerns over the nation's fiscal health intensify.

Major financial institutions now predict a significant slide for the currency. MUFG Bank Ltd. projects the Rupiah could weaken to 17,000 per dollar within the first quarter, while analysts at Barclays Plc see a potential drop to 17,300 this year. The currency has already fallen for two consecutive weeks and is just 0.4% away from its all-time low set in April.

Investor anxiety has flared up after a January 8th announcement revealed that Indonesia's budget shortfall for last year nearly breached the legal limit. This news, coupled with weak revenue collection, has renewed pressure on the Rupiah.

"Investors are still pretty much concerned about the fiscal outlook for this year," explained Lloyd Chan, a currency strategist at MUFG. He noted that while Bank Indonesia is stepping in, "there are quite a lot of constraints on the policy side."

This month alone, the Rupiah has declined more than 1%, making it the worst-performing currency in Asia after the South Korean won.

Bank Indonesia (BI) has been actively working to stabilize the Rupiah, most recently intervening in currency markets on Wednesday. However, analysts suggest the central bank's efforts may be constrained by a likely tolerance for a modest depreciation, potentially limiting the impact of its actions.

To anchor the currency, BI is expected to hold its policy rate steady at its upcoming meeting on Wednesday. The central bank has also deployed several other tools, including:

• Adjusting the issuance of its bills

• Intervening directly in foreign-exchange markets

• Buying government bonds in the secondary market

Looking ahead, the fiscal picture remains a primary concern. Analysts worry that this year's deficit could also widen beyond the 3% legal limit as the government aims to increase spending despite sluggish tax revenue.

A government plan to tighten control over exporters' foreign-exchange earnings could provide a buffer for the Rupiah, according to Shier Lee Lim, a strategist at Convera Singapore.

Still, the new administration's policy direction is adding to the uncertainty. President Prabowo Subianto's pro-growth agenda may lead Bank Indonesia to lower interest rates later this year, which would likely add further downward pressure on the currency.

In a recent note, Barclays analysts including Themistoklis Fiotakis highlighted these risks. "We see greater medium-term risks that the government will attempt to embark on relatively unorthodox policies which could fuel more bearish rupiah sentiment," they wrote, referencing the 3% fiscal deficit limit.

A leading think tank has issued a stark warning to the British government: abandon its pattern of policy indecision and embrace bold reforms, or risk squandering early signs of an economic recovery.

In a new report, the Resolution Foundation argues that to build on recent momentum, the government must stop its "flip-flopping" and take decisive action on trade, housing construction, and employment. The call comes 18 months into Prime Minister Keir Starmer's term, a period the think tank characterizes as being defined by U-turns and timidity.

According to the Resolution Foundation, the government's record has so far failed to match its economic promises. Despite pledges from Prime Minister Starmer and finance minister Rachel Reeves to accelerate the economy, there has been no significant change in its trajectory.

The report notes that planned reforms in critical areas like welfare and taxation have either been abandoned or significantly weakened. This inconsistency, it argues, is undermining the potential for real growth.

"With signs that productivity may be turning a corner, the government must capitalise by ramping up its plans," said Greg Thwaites, research director at the Resolution Foundation.

The think tank outlines a clear path forward with significant potential benefits for households. It calculates that a combination of key reforms could boost annual household incomes by £2,000 ($2,680). These reforms include:

• Housing: Changing planning rules to help cities meet housing targets.

• Trade: Pursuing deeper regulatory alignment with the European Union.

• Employment: Implementing policies to get more young and older people into the workforce.

Such growth would also yield major fiscal benefits, generating enough tax revenue to fund a 25% increase in spending for the public health service.

The call for action comes against a bleak backdrop. The UK economy has largely stagnated in the nearly two decades since the global financial crisis. The report highlights that Britain's GDP per person has fallen further behind other major European nations since the pandemic.

This long-term trend was worsened by the combined shocks of COVID-19, high energy prices, and the economic impact of Brexit, which together caused a drop in productivity growth.

Furthermore, the Resolution Foundation presents growing evidence that the economic damage from Brexit may already be close to double the 4% impact assumed by Britain's official budget forecasters.

Despite the challenges, the report identifies a crucial opportunity. It points to a significant 3.1% leap in productivity in the year ending in the third quarter of 2025. This figure, which adjusts for previous under-recording of employment in official data, represents the "nascent signs of improvement" that the government is being urged to seize upon.

As Japan gears up for an anticipated snap general election, a potential cut to the consumption tax is rapidly becoming a central issue, with major political parties signaling their support for the measure to ease the burden of rising living costs on households.

Currently, Japan's tax system imposes a 10% rate on most goods and services, with a reduced rate of 8% applied to food. This tax is a crucial revenue stream for funding the country's growing social welfare expenses, driven by a rapidly ageing population.

Both the ruling coalition and the main opposition party are now publicly advocating for a temporary tax reduction, suggesting a rare point of political consensus.

Shunichi Suzuki, a key executive in the ruling Liberal Democratic Party (LDP), confirmed the party's commitment to an earlier agreement with its coalition partner, Ishin. "It's our basic stance to sincerely achieve what's written in the agreement," Suzuki stated on a television program, referring to the plan to scrap the 8% levy on food sales for two years.

This move aligns with reports from the Mainichi newspaper that Prime Minister Sanae Takaichi may pledge to temporarily eliminate the 8% food tax as a core promise when she calls for a general election next month.

The opposition is also on board. Jun Azumi, secretary-general of the main opposition Constitutional Democratic Party of Japan (CDP), announced on the same program that his party would also campaign for a temporary tax rate cut. The CDP recently agreed to form a new political entity with Komeito, solidifying this position.

Prime Minister Takaichi is expected to announce her intention to dissolve parliament and call a snap election for February, leveraging her administration's strong approval ratings.

However, the proposed tax cut carries significant financial implications. According to government data, eliminating the 8% food sales levy would reduce government revenue by an estimated 5 trillion yen ($31.71 billion) annually.

This revenue loss would place considerable strain on Japan's already stretched national finances. Analysts are concerned that such an expansionary fiscal policy could heighten the risk of a bond sell-off as investors scrutinize the government's fiscal discipline.

($1 = 157.6900 yen)

Precious metals surged to record highs after U.S. President Donald Trump announced plans to impose tariffs on eight European nations, escalating tensions over his administration's proposal to acquire Greenland. The move has ignited fears of a major trade war, sending investors flocking to safe-haven assets like gold and silver.

President Trump declared a new 10% tariff on goods from several countries, including France, Germany, and the United Kingdom. The tariffs are scheduled to take effect on February 1 and are set to increase to 25% in June.

This unexpected announcement has fueled concerns of swift retaliation from Europe, raising the prospect of a damaging trade conflict that could disrupt global markets and drive further demand for precious metals.

In response to the U.S. threat, European leaders are preparing to hold an emergency meeting to coordinate their strategy. Officials familiar with the discussions are exploring several countermeasures, including imposing retaliatory levies on €93 billion ($108 billion) worth of American goods.

French President Emmanuel Macron is also reportedly considering activating the EU's anti-coercion instrument, the bloc's most powerful tool for trade retaliation, signaling a serious potential for escalation.

The recent tariff threat adds to a series of geopolitical and economic drivers that have propelled precious metals higher this year, extending a dramatic rally that began in 2025. The market has been reacting to aggressive U.S. foreign policy, including the seizure of Venezuela's leader and repeated threats to take control of Greenland.

Simultaneously, the Trump administration has renewed its criticism of the Federal Reserve, raising concerns about the central bank's independence. This has fueled the "debasement trade," where investors move away from currencies and government bonds, fearing that rising debt levels will erode their value.

The market reaction to the tariff news was immediate and sharp:

• Spot gold climbed 1.7% to $4,676.22 an ounce as of 7:35 a.m. in Singapore, after reaching an earlier peak of $4,690.59.

• Silver surged 3.9% to $93.6305 an ounce, hitting a high of $94.1213.

• Platinum and palladium also posted gains.

• The Bloomberg Dollar Spot Index edged down 0.1%, reflecting currency market jitters.

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up