Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

France Trade Balance (SA) (Oct)

France Trade Balance (SA) (Oct)A:--

F: --

Euro Zone Employment YoY (SA) (Q3)

Euro Zone Employment YoY (SA) (Q3)A:--

F: --

Canada Part-Time Employment (SA) (Nov)

Canada Part-Time Employment (SA) (Nov)A:--

F: --

P: --

Canada Unemployment Rate (SA) (Nov)

Canada Unemployment Rate (SA) (Nov)A:--

F: --

P: --

Canada Full-time Employment (SA) (Nov)

Canada Full-time Employment (SA) (Nov)A:--

F: --

P: --

Canada Labor Force Participation Rate (SA) (Nov)

Canada Labor Force Participation Rate (SA) (Nov)A:--

F: --

P: --

Canada Employment (SA) (Nov)

Canada Employment (SA) (Nov)A:--

F: --

P: --

U.S. PCE Price Index MoM (Sept)

U.S. PCE Price Index MoM (Sept)A:--

F: --

P: --

U.S. Personal Income MoM (Sept)

U.S. Personal Income MoM (Sept)A:--

F: --

P: --

U.S. Core PCE Price Index MoM (Sept)

U.S. Core PCE Price Index MoM (Sept)A:--

F: --

P: --

U.S. PCE Price Index YoY (SA) (Sept)

U.S. PCE Price Index YoY (SA) (Sept)A:--

F: --

P: --

U.S. Core PCE Price Index YoY (Sept)

U.S. Core PCE Price Index YoY (Sept)A:--

F: --

P: --

U.S. Personal Outlays MoM (SA) (Sept)

U.S. Personal Outlays MoM (SA) (Sept)A:--

F: --

U.S. 5-10 Year-Ahead Inflation Expectations (Dec)

U.S. 5-10 Year-Ahead Inflation Expectations (Dec)A:--

F: --

P: --

U.S. Real Personal Consumption Expenditures MoM (Sept)

U.S. Real Personal Consumption Expenditures MoM (Sept)A:--

F: --

U.S. Weekly Total Rig Count

U.S. Weekly Total Rig CountA:--

F: --

P: --

U.S. Weekly Total Oil Rig Count

U.S. Weekly Total Oil Rig CountA:--

F: --

P: --

U.S. Consumer Credit (SA) (Oct)

U.S. Consumer Credit (SA) (Oct)A:--

F: --

China, Mainland Foreign Exchange Reserves (Nov)

China, Mainland Foreign Exchange Reserves (Nov)A:--

F: --

P: --

Japan Trade Balance (Oct)

Japan Trade Balance (Oct)A:--

F: --

P: --

Japan Nominal GDP Revised QoQ (Q3)

Japan Nominal GDP Revised QoQ (Q3)A:--

F: --

P: --

China, Mainland Imports YoY (CNH) (Nov)

China, Mainland Imports YoY (CNH) (Nov)A:--

F: --

P: --

China, Mainland Exports (Nov)

China, Mainland Exports (Nov)A:--

F: --

P: --

China, Mainland Imports (CNH) (Nov)

China, Mainland Imports (CNH) (Nov)A:--

F: --

P: --

China, Mainland Trade Balance (CNH) (Nov)

China, Mainland Trade Balance (CNH) (Nov)A:--

F: --

P: --

China, Mainland Exports YoY (USD) (Nov)

China, Mainland Exports YoY (USD) (Nov)A:--

F: --

P: --

China, Mainland Imports YoY (USD) (Nov)

China, Mainland Imports YoY (USD) (Nov)A:--

F: --

P: --

Germany Industrial Output MoM (SA) (Oct)

Germany Industrial Output MoM (SA) (Oct)A:--

F: --

Euro Zone Sentix Investor Confidence Index (Dec)

Euro Zone Sentix Investor Confidence Index (Dec)A:--

F: --

P: --

Canada National Economic Confidence Index

Canada National Economic Confidence IndexA:--

F: --

P: --

U.K. BRC Like-For-Like Retail Sales YoY (Nov)

U.K. BRC Like-For-Like Retail Sales YoY (Nov)--

F: --

P: --

U.K. BRC Overall Retail Sales YoY (Nov)

U.K. BRC Overall Retail Sales YoY (Nov)--

F: --

P: --

Australia Overnight (Borrowing) Key Rate

Australia Overnight (Borrowing) Key Rate--

F: --

P: --

RBA Rate Statement

RBA Rate Statement RBA Press Conference

RBA Press Conference Germany Exports MoM (SA) (Oct)

Germany Exports MoM (SA) (Oct)--

F: --

P: --

U.S. NFIB Small Business Optimism Index (SA) (Nov)

U.S. NFIB Small Business Optimism Index (SA) (Nov)--

F: --

P: --

Mexico 12-Month Inflation (CPI) (Nov)

Mexico 12-Month Inflation (CPI) (Nov)--

F: --

P: --

Mexico Core CPI YoY (Nov)

Mexico Core CPI YoY (Nov)--

F: --

P: --

Mexico PPI YoY (Nov)

Mexico PPI YoY (Nov)--

F: --

P: --

U.S. Weekly Redbook Index YoY

U.S. Weekly Redbook Index YoY--

F: --

P: --

U.S. JOLTS Job Openings (SA) (Oct)

U.S. JOLTS Job Openings (SA) (Oct)--

F: --

P: --

China, Mainland M1 Money Supply YoY (Nov)

China, Mainland M1 Money Supply YoY (Nov)--

F: --

P: --

China, Mainland M0 Money Supply YoY (Nov)

China, Mainland M0 Money Supply YoY (Nov)--

F: --

P: --

China, Mainland M2 Money Supply YoY (Nov)

China, Mainland M2 Money Supply YoY (Nov)--

F: --

P: --

U.S. EIA Short-Term Crude Production Forecast For The Year (Dec)

U.S. EIA Short-Term Crude Production Forecast For The Year (Dec)--

F: --

P: --

U.S. EIA Natural Gas Production Forecast For The Next Year (Dec)

U.S. EIA Natural Gas Production Forecast For The Next Year (Dec)--

F: --

P: --

U.S. EIA Short-Term Crude Production Forecast For The Next Year (Dec)

U.S. EIA Short-Term Crude Production Forecast For The Next Year (Dec)--

F: --

P: --

EIA Monthly Short-Term Energy Outlook

EIA Monthly Short-Term Energy Outlook U.S. API Weekly Gasoline Stocks

U.S. API Weekly Gasoline Stocks--

F: --

P: --

U.S. API Weekly Cushing Crude Oil Stocks

U.S. API Weekly Cushing Crude Oil Stocks--

F: --

P: --

U.S. API Weekly Crude Oil Stocks

U.S. API Weekly Crude Oil Stocks--

F: --

P: --

U.S. API Weekly Refined Oil Stocks

U.S. API Weekly Refined Oil Stocks--

F: --

P: --

South Korea Unemployment Rate (SA) (Nov)

South Korea Unemployment Rate (SA) (Nov)--

F: --

P: --

Japan Reuters Tankan Non-Manufacturers Index (Dec)

Japan Reuters Tankan Non-Manufacturers Index (Dec)--

F: --

P: --

Japan Reuters Tankan Manufacturers Index (Dec)

Japan Reuters Tankan Manufacturers Index (Dec)--

F: --

P: --

Japan Domestic Enterprise Commodity Price Index MoM (Nov)

Japan Domestic Enterprise Commodity Price Index MoM (Nov)--

F: --

P: --

Japan Domestic Enterprise Commodity Price Index YoY (Nov)

Japan Domestic Enterprise Commodity Price Index YoY (Nov)--

F: --

P: --

China, Mainland PPI YoY (Nov)

China, Mainland PPI YoY (Nov)--

F: --

P: --

China, Mainland CPI MoM (Nov)

China, Mainland CPI MoM (Nov)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

U.S. President Joe Biden and House Republican Speaker Kevin McCarthy will meet to discuss the debt ceiling on Monday, after a "productive" phone call as the president headed back to Washington, the two sides said on Sunday.

U.S. President Joe Biden and House Republican Speaker Kevin McCarthy will meet to discuss the debt ceiling on Monday, after a "productive" phone call as the president headed back to Washington, the two sides said on Sunday.

McCarthy, speaking to reporters at the U.S. Capitol following the call, said there were positive discussions on solving the crisis and that staff-level talks were set to resume later on Sunday.

Asked if he was more hopeful after talking to the president, McCarthy said: "Our teams are talking today and we're setting [sic] to have a meeting tomorrow. That's better than it was earlier. So, yes."

A White House official confirmed Monday's meeting but offered no specific time. Staff members from both sides will reconvene for talks at 6 p.m. on Sunday.

Biden, before leaving Japan following the G-7 summit earlier on Sunday, said he would be willing to cut spending together with tax adjustments to reach a deal, but the latest offer from Republicans was "unacceptable."

Less than two weeks remain until June 1, when the Treasury Department has warned that the federal government could be unable to pay all its debts, a deadline U.S. Treasury Secretary Janet Yellen reaffirmed on Sunday. A failure to lift the debt ceiling by that date would trigger a default that would cause chaos in financial markets and spike interest rates.

McCarthy's comments on Sunday appeared more positive than the increasingly heated rhetoric in recent days, as both sides reverted to calling the other's position extremist and talks stalled.

"Much of what they've already proposed is simply, quite frankly, unacceptable," Biden told a news conference in Hiroshima. "It's time for Republicans to accept that there is no bipartisan deal to be made solely, solely on their partisan terms. They have to move as well."

The president later tweeted that he would not agree to a deal that protected "Big Oil" subsidies and "wealthy tax cheats," while putting health care and food assistance at risk for millions of Americans.

He also suggested some Republican lawmakers were willing to see the U.S. default on its debt so that the disastrous results would prevent Biden, a Democrat, from winning reelection in 2024.

After Sunday's call, McCarthy said while there was still no final deal, there was an understanding to get negotiators on both sides back together before the two leaders met: "There's no agreement. We're still apart."

"What I'm looking at are where our differences are and how could we solve those, and I felt that part was productive," he told reporters.

Meanwhile, concerns about default are weighing on markets as an increase in the government's self-imposed borrowing limit is needed regularly to cover costs of spending and tax cuts previously approved by lawmakers.

On Friday, the United States was forced to pay record-high interest rates in a recent debt offer.

McCarthy said Republicans backed an increase in the defense budget while cutting overall spending, and that debt ceiling talks have not included discussions about tax cuts passed under former President Donald Trump.

A source familiar with the negotiations said the Biden administration had proposed keeping non-defense discretionary spending flat for the next year.

Biden ahead of the call stressed that he was open to making spending cuts and said he was not concerned they would lead to a recession, but he could not agree to Republicans' current demands.

The Republican-led House last month passed legislation that would cut a wide swath of government spending by 8% next year. Democrats say that would force average cuts of at least 22% on programs like education and law enforcement, a figure top Republicans have not disputed.

Republicans hold a slim majority in the House and Biden's fellow Democrats have narrow control of the Senate, so no deal can pass without bipartisan support. But time is running short as Monday's meeting will take place with just 10 days left to hammer out a deal before hitting Treasury's deadline.

McCarthy has said he will give House lawmakers 72 hours to review an agreement before bringing it up for a vote.

The last time the nation has come this close to default was in 2011, also with a Democratic president and Senate with a Republican-led House.

Congress eventually averted default, but the economy endured heavy shocks, including the first-ever downgrade of the United States' top-tier credit rating and a major stock sell-off.

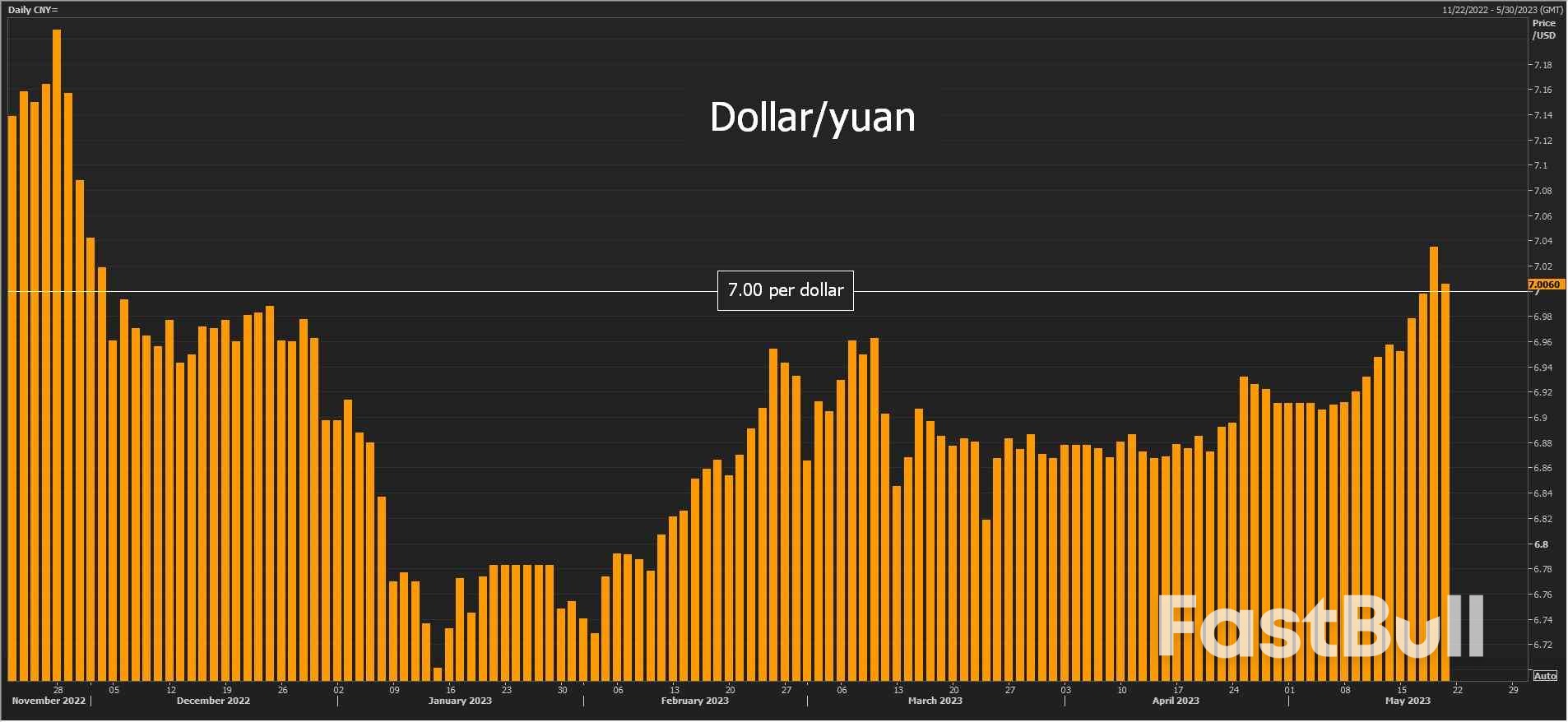

The Chinese yuan has fallen through the 7.00 per dollar barrier but is unlikely to get any immediate policy support, as the PBOC is expected to leave one-year and five-year loan prime rates unchanged on Monday at 3.65% and 4.30%, respectively.

The Chinese yuan has fallen through the 7.00 per dollar barrier but is unlikely to get any immediate policy support, as the PBOC is expected to leave one-year and five-year loan prime rates unchanged on Monday at 3.65% and 4.30%, respectively. Wider market sentiment on Monday could be set by the mood music in Washington around the debt ceiling. President Joe Biden and House Republican Speaker Kevin McCarthy will meet after a "productive" phone call on Sunday as the president returned from the G7 summit.

Wider market sentiment on Monday could be set by the mood music in Washington around the debt ceiling. President Joe Biden and House Republican Speaker Kevin McCarthy will meet after a "productive" phone call on Sunday as the president returned from the G7 summit.

In turn, electricity generation is the second largest source of greenhouse gas emissions in the United States after transport, accounting for 25% of national emissions in 2021, according to the U.S. Environmental Protection Agency.

In turn, electricity generation is the second largest source of greenhouse gas emissions in the United States after transport, accounting for 25% of national emissions in 2021, according to the U.S. Environmental Protection Agency. Large apartment buildings accounted for the second-largest share of dwellings, and totalled around 23 million units, while smaller apartment buildings, attached single-family houses and mobile homes made up the remainder.

Large apartment buildings accounted for the second-largest share of dwellings, and totalled around 23 million units, while smaller apartment buildings, attached single-family houses and mobile homes made up the remainder.White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up