Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

Canada National Economic Confidence Index

Canada National Economic Confidence IndexA:--

F: --

P: --

U.S. Non-Defense Capital Durable Goods Orders MoM (Excl. Aircraft) (Nov)

U.S. Non-Defense Capital Durable Goods Orders MoM (Excl. Aircraft) (Nov)A:--

F: --

U.S. Durable Goods Orders MoM (Excl. Defense) (SA) (Nov)

U.S. Durable Goods Orders MoM (Excl. Defense) (SA) (Nov)A:--

F: --

U.S. Durable Goods Orders MoM (Excl.Transport) (Nov)

U.S. Durable Goods Orders MoM (Excl.Transport) (Nov)A:--

F: --

P: --

U.S. Durable Goods Orders MoM (Nov)

U.S. Durable Goods Orders MoM (Nov)A:--

F: --

U.S. Chicago Fed National Activity Index (Nov)

U.S. Chicago Fed National Activity Index (Nov)A:--

F: --

U.S. Dallas Fed New Orders Index (Jan)

U.S. Dallas Fed New Orders Index (Jan)A:--

F: --

P: --

U.S. Dallas Fed General Business Activity Index (Jan)

U.S. Dallas Fed General Business Activity Index (Jan)A:--

F: --

U.S. 2-Year Note Auction Avg. Yield

U.S. 2-Year Note Auction Avg. YieldA:--

F: --

P: --

U.K. BRC Shop Price Index YoY (Jan)

U.K. BRC Shop Price Index YoY (Jan)A:--

F: --

P: --

China, Mainland Industrial Profit YoY (YTD) (Dec)

China, Mainland Industrial Profit YoY (YTD) (Dec)A:--

F: --

P: --

Germany 2-Year Schatz Auction Avg. Yield

Germany 2-Year Schatz Auction Avg. YieldA:--

F: --

P: --

Mexico Trade Balance (Dec)

Mexico Trade Balance (Dec)A:--

F: --

P: --

U.S. Weekly Redbook Index YoY

U.S. Weekly Redbook Index YoYA:--

F: --

P: --

U.S. S&P/CS 20-City Home Price Index YoY (Not SA) (Nov)

U.S. S&P/CS 20-City Home Price Index YoY (Not SA) (Nov)A:--

F: --

P: --

U.S. S&P/CS 20-City Home Price Index MoM (SA) (Nov)

U.S. S&P/CS 20-City Home Price Index MoM (SA) (Nov)A:--

F: --

U.S. FHFA House Price Index MoM (Nov)

U.S. FHFA House Price Index MoM (Nov)A:--

F: --

P: --

U.S. FHFA House Price Index (Nov)

U.S. FHFA House Price Index (Nov)A:--

F: --

P: --

U.S. FHFA House Price Index YoY (Nov)

U.S. FHFA House Price Index YoY (Nov)A:--

F: --

U.S. S&P/CS 10-City Home Price Index YoY (Nov)

U.S. S&P/CS 10-City Home Price Index YoY (Nov)A:--

F: --

P: --

U.S. S&P/CS 10-City Home Price Index MoM (Not SA) (Nov)

U.S. S&P/CS 10-City Home Price Index MoM (Not SA) (Nov)A:--

F: --

P: --

U.S. S&P/CS 20-City Home Price Index (Not SA) (Nov)

U.S. S&P/CS 20-City Home Price Index (Not SA) (Nov)A:--

F: --

P: --

U.S. S&P/CS 20-City Home Price Index MoM (Not SA) (Nov)

U.S. S&P/CS 20-City Home Price Index MoM (Not SA) (Nov)A:--

F: --

P: --

U.S. Richmond Fed Manufacturing Composite Index (Jan)

U.S. Richmond Fed Manufacturing Composite Index (Jan)A:--

F: --

P: --

U.S. Conference Board Present Situation Index (Jan)

U.S. Conference Board Present Situation Index (Jan)A:--

F: --

P: --

U.S. Conference Board Consumer Expectations Index (Jan)

U.S. Conference Board Consumer Expectations Index (Jan)A:--

F: --

P: --

U.S. Richmond Fed Manufacturing Shipments Index (Jan)

U.S. Richmond Fed Manufacturing Shipments Index (Jan)A:--

F: --

P: --

U.S. Richmond Fed Services Revenue Index (Jan)

U.S. Richmond Fed Services Revenue Index (Jan)A:--

F: --

P: --

U.S. Conference Board Consumer Confidence Index (Jan)

U.S. Conference Board Consumer Confidence Index (Jan)A:--

F: --

U.S. 5-Year Note Auction Avg. Yield

U.S. 5-Year Note Auction Avg. YieldA:--

F: --

P: --

U.S. API Weekly Refined Oil Stocks

U.S. API Weekly Refined Oil Stocks--

F: --

P: --

U.S. API Weekly Crude Oil Stocks

U.S. API Weekly Crude Oil Stocks--

F: --

P: --

U.S. API Weekly Gasoline Stocks

U.S. API Weekly Gasoline Stocks--

F: --

P: --

U.S. API Weekly Cushing Crude Oil Stocks

U.S. API Weekly Cushing Crude Oil Stocks--

F: --

P: --

Australia RBA Trimmed Mean CPI YoY (Q4)

Australia RBA Trimmed Mean CPI YoY (Q4)--

F: --

P: --

Australia CPI YoY (Q4)

Australia CPI YoY (Q4)--

F: --

P: --

Australia CPI QoQ (Q4)

Australia CPI QoQ (Q4)--

F: --

P: --

Germany GfK Consumer Confidence Index (SA) (Feb)

Germany GfK Consumer Confidence Index (SA) (Feb)--

F: --

P: --

Germany 10-Year Bund Auction Avg. Yield

Germany 10-Year Bund Auction Avg. Yield--

F: --

P: --

India Industrial Production Index YoY (Dec)

India Industrial Production Index YoY (Dec)--

F: --

P: --

India Manufacturing Output MoM (Dec)

India Manufacturing Output MoM (Dec)--

F: --

P: --

U.S. MBA Mortgage Application Activity Index WoW

U.S. MBA Mortgage Application Activity Index WoW--

F: --

P: --

Canada Overnight Target Rate

Canada Overnight Target Rate--

F: --

P: --

BOC Monetary Policy Report

BOC Monetary Policy Report U.S. EIA Weekly Crude Stocks Change

U.S. EIA Weekly Crude Stocks Change--

F: --

P: --

U.S. EIA Weekly Cushing, Oklahoma Crude Oil Stocks Change

U.S. EIA Weekly Cushing, Oklahoma Crude Oil Stocks Change--

F: --

P: --

U.S. EIA Weekly Crude Demand Projected by Production

U.S. EIA Weekly Crude Demand Projected by Production--

F: --

P: --

U.S. EIA Weekly Crude Oil Imports Changes

U.S. EIA Weekly Crude Oil Imports Changes--

F: --

P: --

U.S. EIA Weekly Heating Oil Stock Changes

U.S. EIA Weekly Heating Oil Stock Changes--

F: --

P: --

U.S. EIA Weekly Gasoline Stocks Change

U.S. EIA Weekly Gasoline Stocks Change--

F: --

P: --

BOC Press Conference

BOC Press Conference Russia PPI MoM (Dec)

Russia PPI MoM (Dec)--

F: --

P: --

Russia PPI YoY (Dec)

Russia PPI YoY (Dec)--

F: --

P: --

U.S. Target Federal Funds Rate Lower Limit (Overnight Reverse Repo Rate)

U.S. Target Federal Funds Rate Lower Limit (Overnight Reverse Repo Rate)--

F: --

P: --

U.S. Interest Rate On Reserve Balances

U.S. Interest Rate On Reserve Balances--

F: --

P: --

U.S. Federal Funds Rate Target

U.S. Federal Funds Rate Target--

F: --

P: --

U.S. Target Federal Funds Rate Upper Limit (Excess Reserves Ratio)

U.S. Target Federal Funds Rate Upper Limit (Excess Reserves Ratio)--

F: --

P: --

FOMC Statement

FOMC Statement FOMC Press Conference

FOMC Press Conference Brazil Selic Interest Rate

Brazil Selic Interest Rate--

F: --

P: --

Australia Import Price Index YoY (Q4)

Australia Import Price Index YoY (Q4)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

Australian consumer price index inflation eased more than in November amid some cooling in electricity prices, although core inflation still remained sticky and above the Reserve Bank of Australia's target range.

Australian consumer price index inflation eased more than in November amid some cooling in electricity prices, although core inflation still remained sticky and above the Reserve Bank of Australia's target range.

CPI inflation rose 3.4% year-on-year in November, data from the Australian Bureau of Statistics showed on Wednesday. The print was softer than expectations of 3.6% and slowed from the 3.8% seen in October.

For more breaking news and insights on the Australian economy, subscribe to InvestingPro. Get 55% off today!

The drop in inflation was driven chiefly by electricity prices rising at a slower pace than the prior month. Housing, food, and transport prices all continued to trend higher.

Underlying inflation remained sticky, with annual trimmed mean CPI reading at 3.2% in November. While the print did drop slightly from the 3.3% seen in October, it remained above the RBA's 2% to 3% annual target.

Goods price inflation cooled to 3.3% in November from 3.8% in October, aided chiefly by a slower increase in electricity prices. Services inflation also cooled to 3.6% from 3.9%, although this was largely due to seasonal changes.

ABS analysts noted that the annual Black Friday shopping event had little impact on inflation in November.

While CPI inflation did cool in November, it remained unclear whether the change was sufficient in easing the RBA's hawkish stance. The central bank largely paused its rate-cut cycle in the second half of 2025, and signaled that interest rates will remain unchanged in the coming months due to sticky inflation.

Australian inflation unexpectedly picked up through late-2025 amid rising housing and food prices. A phasing out of Canberra's electricity subsidies also led to higher prices.

The Philippine peso has dropped to a new record low against the US dollar, driven by signals that the central bank is considering an interest rate cut and is tolerant of a weaker currency.

On Wednesday, the peso fell by as much as 0.2% to 59.34 per dollar. This move breached the previous all-time low of 59.26, which was set in late October.

Recent commentary from the central bank has intensified bearish sentiment among traders. The institution's stance on both currency levels and future monetary policy is signaling a clear path for peso weakness.

When asked on Tuesday about the risk of the peso hitting a new record low this year, Governor Eli Remolona stated that the central bank does not target specific exchange rate levels. Instead, he explained that monetary authorities are concerned only if a depreciation is "sharp enough" to have an impact on inflation.

Remolona also explicitly stated that an interest-rate cut is on the table for February, further cementing expectations of looser monetary policy ahead.

The peso has been under sustained pressure for months. A key factor has been a government corruption scandal that has undermined investor confidence and negatively affected the country's economic growth. The central bank's recent signals are now compounding these existing vulnerabilities, leading traders to push the currency into uncharted territory.

Japan's service sector expanded at its slowest pace since May in December, as softer overall demand countered a rebound in new export businesses, a private sector survey showed on Wednesday.

The S&P Global final Japan Services Purchasing Managers' Index (PMI) fell to 51.6 in December from 53.2 in November, worse than a flash reading of 52.5 but remaining above the 50.0 line that separates growth from contraction for the ninth consecutive month.

While foreign demand for Japanese services returned to expansion for the first time since June, new orders rose at a slower rate, the survey showed.

Input costs rose at the fastest pace since May, driven by higher prices for raw materials, staff and fuel as well as construction costs that prompted a significant rise in output charges.

"Input prices continue to be a major concern for businesses," said Annabel Fiddes, economics associate director at S&P Global Market Intelligence. "Companies face a difficult balance of passing on higher costs to clients where possible to ease pressure on margins, but also staying competitive to support sales."

Still, Japan's service sector saw staff numbers rising at the fastest rate in over two-and-a-half years, thanks to higher sales and the filling of long-held vacancies, according to the survey.

Business confidence for the next 12 months also remained strong, as firms were hopeful that new product launches, store openings and improved demand especially in transport and information technology sectors would boost sales.

The final S&P Global Japan Composite PMI, which includes both services and manufacturing, declined to 51.1 in December from 52.0 in November, reflecting the service sector's softest rate of growth in seven months even as manufacturing output stabilised after a period of decline.

Tokyo has officially protested Beijing's decision to implement immediate export controls on military-applicable items, a move that escalates a diplomatic standoff between the two Asian powers over Taiwan.

Hours after China announced the new trade measures on Tuesday, Masaaki Kanai, director-general of the Asian and Oceanian Affairs Bureau at Japan's Foreign Ministry, lodged a formal complaint with Chinese Deputy Chief of Mission Shi Yong. According to a ministry statement, Kanai demanded a full withdrawal of the policy, calling it "absolutely unacceptable and deeply regrettable" and a significant deviation from international norms.

The Chinese Ministry of Commerce confirmed on Tuesday that exports of all dual-use items with potential military applications to Japan are now banned. State-run media also reported that Beijing is considering stricter licensing reviews for certain medium and heavy rare earth-related exports.

This trade action is the latest fallout from remarks made in early November by Japanese Prime Minister Sanae Takaichi. She suggested that Tokyo could deploy its military if China were to use force against Taiwan.

Beijing reacted with fury, demanding Takaichi retract her statement. She has refused, asserting that Japan's long-standing position on Taiwan remains unchanged. In response, China has already restricted tourism to Japan, protested at the United Nations, and increased military maneuvers in the region.

While the full economic impact of the new controls remains uncertain, the measure puts Japan's access to critical rare earth supplies at risk. These elements are essential raw materials for advanced military hardware, including the high-strength magnets used in fighter jet motors and missile guidance systems.

Restricting rare earth exports has long been considered a key point of leverage for Beijing against Tokyo. This strategy was previously tested when China leveraged its industry dominance against U.S. tariffs last year.

Japan's dependency is significant. According to the Japan Organization for Metals and Energy Security, the country sourced approximately 70% of its rare earth imports from China as of 2024. This vulnerability was exposed over a decade ago when China weaponized these materials during a 2010 territorial dispute, causing widespread disruption across Japan's manufacturing sector.

Analysts suggest that the vagueness of China's announcement may be a deliberate tactic. "By triggering concern in Japan about the ongoing availability of critical Chinese industrial inputs, the announcement puts immediate pressure on Takaichi to offer concessions," noted Teneo analysts James Brady and Gabriel Wildau in a research report.

China's list of controlled dual-use exports is extensive, covering more than 800 items across chemicals, electronics, sensors, and technologies for the shipping and aerospace industries.

"Whether the impact remains limited or becomes more substantive will ultimately depend on how the rules are enforced," said Kenichi Doi, a senior research fellow at the Institute of Geoeconomics in Tokyo. "But the institutional setup clearly leaves room for meaningful pressure should Beijing choose to apply it."

In its official announcement, a spokesperson for China's Ministry of Commerce left no doubt about the reason for the controls. "Japan's leader recently made erroneous remarks on Taiwan, hinting at the possibility of military intervention in the Taiwan Strait," the spokesperson said Tuesday, describing the comments as having a "malicious nature with profoundly detrimental consequences."

The U.S. Supreme Court is set to rule on the legality of tariffs from the Trump administration this Friday, a decision that could invalidate billions in tariff collections and ripple through the global economy. At the heart of the case is whether the president had the authority to impose these duties under the International Emergency Economic Powers Act (IEEPA).

A ruling against the tariffs could force the U.S. government into a massive reimbursement scenario, dramatically impacting U.S. economic policy and international trade dynamics.

The tariffs, which targeted several U.S. trading partners during Donald Trump's presidency, prompted immediate legal challenges. A coalition of importers, including major companies like Costco and Revlon, have sued to overturn the duties and are seeking refunds for the payments they made.

These legal proceedings have now escalated to the nation's highest court, which will deliver a final verdict on the use of emergency economic powers for imposing broad tariffs.

The financial implications of the court's decision are enormous. If the tariffs are deemed illegal, the U.S. government could owe over $100 billion in refunds to importers. Such a massive payout would have a substantial market impact and raise complex political questions.

While former President Trump has advocated for potential rebate checks, analysts have expressed skepticism about the feasibility of such a program. The verdict carries significant economic and political consequences regardless of the outcome.

Beyond the financial stakes, the Supreme Court's decision is poised to reshape international relations and guide future U.S. trade policy. The ruling will determine whether tariffs remain a readily available tool for the executive branch or if their application will be more restricted.

Historical precedents show that similar court rulings often lead to considerable policy adjustments. The outcome of this case is expected to influence the landscape of trade legislation and economic strategies for years to come.

In a statement on the issue, former President Donald Trump wrote: "Tariffs are an overwhelming benefit to our Nation, as they have been incredible for our National Security and Prosperity (like nobody has ever seen before!). Losing our ability to Tariff other countries who treat us unfairly would be a terrible blow to the United States of America."

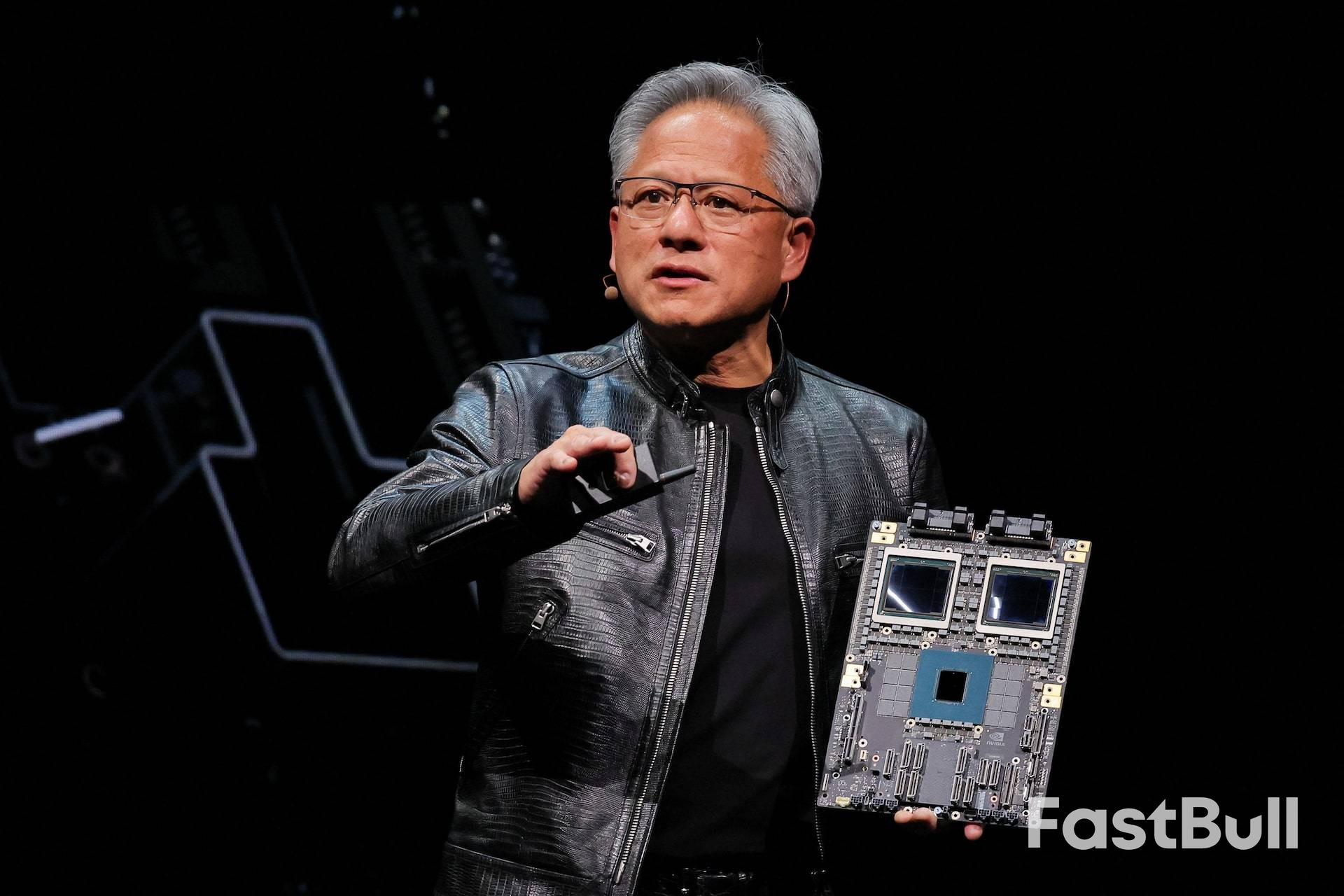

Top tech executives are sounding the alarm. From Nvidia's Jensen Huang to OpenAI, a narrative is building that the United States is falling behind in the global AI race due to an "electron gap." The argument is simple: China has vast, cheap electricity to power its AI ambitions, while America's aging grid struggles to keep up. But a closer look reveals this perceived advantage is largely an illusion, undermined by logistical nightmares and systemic waste.

On paper, China's energy dominance looks formidable. In 2024, the country generated over 10,000 terawatt-hours (TWh) of electricity—more than double the United States, whose installed capacity was just a third of China's.

This gap is widening. Beijing is aggressively expanding its renewable energy infrastructure. According to Wood Mackenzie, China's wind and solar capacity are set to double and nearly triple, respectively, by 2030. By then, renewables alone are projected to supply 5,500 TWh, easily covering the country's forecast data-center demand of 479 TWh.

The situation in the U.S. is the opposite. Decades of flat electricity demand have discouraged investment in new capacity. Now, as AI drives a surge in power consumption, data centers face a projected 44-gigawatt shortfall between 2025 and 2028, according to Morgan Stanley. A massive backlog of energy projects waiting for grid connection has become a critical bottleneck.

The theory is that China's abundant and cheap power—industrial electricity is about 30% cheaper than in the U.S.—should allow firms like Alibaba and ByteDance to compensate for using less powerful domestic chips, thereby blunting the impact of U.S. export controls.

Despite these advantages, China has not surged ahead. The country has lagged the U.S. in building new data centers and deploying computing power, suggesting that American chip controls remain a powerful constraint.

Bernstein analysts project that Chinese firms will spend just $147 billion on AI capital expenditures in 2027. To put that in perspective, this figure is less than what Amazon.com alone is expected to spend on total capex that year.

Furthermore, the focus on AI overlooks the bigger picture of China's energy needs. Electricity consumption has outpaced GDP growth for the past five years, driven primarily by energy-intensive industrial sectors switching from fossil fuels and the explosive popularity of electric vehicles. Data centers are a relatively small piece of this puzzle, expected to account for just 3% of total consumption by 2030.

China's renewable energy boom comes with a major catch: geography. Most of its solar and wind resources are located in the country's remote western regions, while the demand from AI hubs, EV factories, and manufacturing centers is concentrated in the east.

Transmitting this power over long distances is a massive challenge, leading to significant waste. In the first half of 2025, China's solar curtailment rate—the amount of generated power that cannot be used due to grid constraints—rose to 6.6%. In regions like Tibet, solar and wind curtailment rates were as high as 34% and 30%, respectively.

Beijing's ambitious solution, the "Eastern Data, Western Compute" plan launched in 2021, aimed to move the data centers to the power source. The idea was that transmitting data via fiber-optic networks would be more efficient than transmitting electricity. In reality, the transfer speeds proved too slow for AI applications that demand real-time responses. This has led to a glut of unviable data centers in western provinces, with some reporting utilization rates as low as 20%.

The issues with power and data centers are symptoms of a larger, systemic problem in China's tech sector: chronic overcapacity.

• Chips: While high-end training chips are scarce, analysts at Bernstein predict that by 2028, the local supply of less-powerful processors used for AI inference will exceed demand.

• AI Models: Companies from Alibaba to ByteDance are locked in a destructive race to the bottom on prices.

• Startups: Challengers like MiniMax and Zhipu are bleeding money. Zhipu, for example, reported a net loss of 2.4 billion yuan in the first half of 2025—more than 12 times its revenue for the period.

This trend extends to related fields. Officials recently warned of an investment bubble in the humanoid robotics industry, where over 150 manufacturers have emerged despite unproven technology and uncertain demand.

This pattern of destructive competition, known as "involution," has plagued other key Chinese industries, including electric vehicles, batteries, and solar panels. While it can lead to market dominance, it also results in deflationary price wars, poor returns on investment, and a massive misallocation of capital.

For a $20 trillion economy, these structural imbalances have serious knock-on effects that can stifle long-term innovation and growth.

While the "electron gap" may slow progress for U.S. firms like OpenAI and buy time for China to catch up in chip technology, it is not a decisive advantage. Instead, China's apparent energy edge risks setting the stage for another boom-and-bust cycle, ultimately undermining its own ambitions in the AI race.

Australia's inflation rate moderated in November, providing the Reserve Bank of Australia (RBA) with a reason to maintain its current interest rate stance as it evaluates the effects of its earlier policy decisions.

Data released Wednesday by the Australian Bureau of Statistics showed the headline Consumer Price Index (CPI) increased by 3.4% over the 12 months to November, coming in below the 3.6% forecast. The trimmed mean measure, a key gauge of core inflation for the central bank, eased to 3.2% from 3.3%, aligning with economists' expectations.

The softer inflation reading prompted an immediate reaction in financial markets. Traders adjusted their expectations for a February interest rate hike, with the probability falling from 40% to 30%.

In currency markets, the Australian dollar dropped 0.2% following the news, while stock prices extended their gains.

This latest data point arrives after a period of shifting policy signals from the RBA. The central bank had engaged in an easing cycle between February and August of last year, cutting its key rate by 75 basis points to 3.6%, a level not seen since April 2023.

However, a more recent resurgence in price pressures led Governor Michele Bullock to state in December that further rate cuts were off the table, suggesting a hike could be the next move. This sentiment was echoed in the minutes from the RBA's last meeting, which revealed the board had discussed the potential conditions that would necessitate raising rates again.

The RBA is now expected to hold its policy steady until it can analyze the comprehensive quarterly inflation report, which is scheduled for release on January 28. Any future policy moves will hinge on this and other incoming economic data.

Currently, money markets are pricing in a solid chance of a rate increase in May. Economists, however, remain split on what the central bank's next action will be.

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

Log In

Sign Up