Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

Reserve Bank Of Australia Governor Bullock: Much Of The Recent Increase In Inflation Is Judged To Be Temporary - But Some Of It Seems To Be Persistent

Reserve Bank Of Australia Governor Bullock: We Need To Dampen The Growth Of Demand, Unless The Supply Side Of The Economy Can Expand A Little Quicker

[Russian Foreign Minister: Russia's Patience Is Not Without Limits] Russian Foreign Minister Sergey Lavrov, In A Media Interview On February 5, Addressed Russia's Previous Goodwill Gestures, Including The Reneging Of The 2025 Energy Truce Agreement With Ukraine. Lavrov Stated That Russia's Patience Is Not Without Limits, And That Russia Always Carefully Weighs Its Options Before Taking Any Action

(US Stocks) The Philadelphia Gold And Silver Index Closed Down 6.25% At 372.66 Points. (Global Session) The NYSE Arca Gold Miners Index Fell 6.03% To 2660.11 Points. (US Stocks) The Materials Index Closed Down 3.87%, And The Metals & Mining Index Closed Down 2.95%

Spot Gold Fell 4.0% To $4,763.2 Per Ounce. New York Gold Fell 3.0% To $4,793 Per Ounce. New York Silver Fell 15.5% To $71.12 Per Ounce. Spot Silver Fell 18.5% To $71.67 Per Ounce. The Commodity Currency Australian Dollar Fell 1.0% Against The US Dollar To 0.6927

Securities And Exchange Commission (SEC) Chairman Atkins Will Appear Before The Senate On February 12

The Federal Reserve's Discount Window Lending Balance Was $4.52 Billion In The Week Ending February 4, Unchanged From The Previous Week

Argentina End-2026 Inflation Seen At 22.4%, Up 2.3 Percentage Points From Prior Forecast, In Central Bank Market Expectations Survey

Argentina End-2026 GDP Growth Seen At 3.2%,Down 0.3 Percentage Points From Prior Forecast, In Central Bank Market Expectations Survey

Toronto Stock Index .GSPTSE Unofficially Closes Down 576.95 Points, Or 1.77 Percent, At 31994.60

The Nasdaq Golden Dragon China Index Closed Up 0.8% Initially. Among Popular Chinese Concept Stocks, Dingdong Maicai Closed Down 15%, Canadian Solar Fell 8.4%, Alibaba And New Oriental Fell 1%, While Xiaomi, Li Auto, And Meituan Rose Over 2%, WeRide Rose 3.6%, Yum China Rose 4.6%, And NIO Rose 6%. In The ETF Market, Ashes Fell 1.7%, Ashr Fell 0.8%, Cqqq Fell 0.8%, And Kweb Fell 0.1%

On Thursday (February 5), The Bloomberg Electric Vehicle Price Return Index Fell 1.88% To 3467.18 Points In Late Trading. It Briefly Rose At 08:17 Beijing Time Before Continuing Its Decline. Among Its Components, Volvo Cars (European Shares) Closed Down 22.53%, Aurora Innovation Shares Fell 9.7%, Plug Power Systems Fell 9%, Mp Materials Fell 7.3%, RoboSense H Shares Closed Up 2.79%, Ranking Fifth, Xiaomi Group H Shares Closed Up 2.83%, WeRide Rose 3.5%, Horizon Robotics H Shares Closed Up 3.64%, And Panasonic Corporation Closed Up 8.41%

Argentina's Merval Index Closed Down 2.65% At 2.936 Million Points, Fluctuating At Low Levels For More Than Half Of The Trading Session

Chicago Soybean Futures Rose About 1.7%, And Soybean Meal Futures Rose More Than 2.2%. At The Close Of Trading In New York On Thursday (February 5), The Bloomberg Grains Index Rose 1.57% To 29.8095 Points. CBOT Corn Futures Rose 1.34%, And CBOT Wheat Futures Rose 1.57%. CBOT Soybean Futures Rose 1.69% To $11.1075 Per Bushel, Soybean Meal Futures Rose 2.26%, And Soybean Oil Futures Were Roughly Unchanged

Italy IHS Markit Construction PMI (Jan)

Italy IHS Markit Construction PMI (Jan)A:--

F: --

P: --

Euro Zone IHS Markit Construction PMI (Jan)

Euro Zone IHS Markit Construction PMI (Jan)A:--

F: --

P: --

Germany Construction PMI (SA) (Jan)

Germany Construction PMI (SA) (Jan)A:--

F: --

P: --

Italy Retail Sales MoM (SA) (Dec)

Italy Retail Sales MoM (SA) (Dec)A:--

F: --

P: --

U.K. Markit/CIPS Construction PMI (Jan)

U.K. Markit/CIPS Construction PMI (Jan)A:--

F: --

P: --

France 10-Year OAT Auction Avg. Yield

France 10-Year OAT Auction Avg. YieldA:--

F: --

P: --

Euro Zone Retail Sales YoY (Dec)

Euro Zone Retail Sales YoY (Dec)A:--

F: --

Euro Zone Retail Sales MoM (Dec)

Euro Zone Retail Sales MoM (Dec)A:--

F: --

U.K. BOE MPC Vote Cut (Feb)

U.K. BOE MPC Vote Cut (Feb)A:--

F: --

P: --

U.K. BOE MPC Vote Hike (Feb)

U.K. BOE MPC Vote Hike (Feb)A:--

F: --

P: --

U.K. BOE MPC Vote Unchanged (Feb)

U.K. BOE MPC Vote Unchanged (Feb)A:--

F: --

P: --

U.K. Benchmark Interest Rate

U.K. Benchmark Interest RateA:--

F: --

P: --

MPC Rate Statement

MPC Rate Statement U.S. Challenger Job Cuts (Jan)

U.S. Challenger Job Cuts (Jan)A:--

F: --

P: --

U.S. Challenger Job Cuts MoM (Jan)

U.S. Challenger Job Cuts MoM (Jan)A:--

F: --

P: --

U.S. Challenger Job Cuts YoY (Jan)

U.S. Challenger Job Cuts YoY (Jan)A:--

F: --

P: --

Bank of England Governor Bailey held a press conference on monetary policy.

Bank of England Governor Bailey held a press conference on monetary policy. Euro Zone ECB Marginal Lending Rate

Euro Zone ECB Marginal Lending RateA:--

F: --

P: --

Euro Zone ECB Deposit Rate

Euro Zone ECB Deposit RateA:--

F: --

P: --

Euro Zone ECB Main Refinancing Rate

Euro Zone ECB Main Refinancing RateA:--

F: --

P: --

ECB Monetary Policy Statement

ECB Monetary Policy Statement U.S. Weekly Initial Jobless Claims (SA)

U.S. Weekly Initial Jobless Claims (SA)A:--

F: --

P: --

U.S. Initial Jobless Claims 4-Week Avg. (SA)

U.S. Initial Jobless Claims 4-Week Avg. (SA)A:--

F: --

P: --

U.S. Weekly Continued Jobless Claims (SA)

U.S. Weekly Continued Jobless Claims (SA)A:--

F: --

ECB Press Conference

ECB Press Conference U.S. JOLTS Job Openings (SA) (Dec)

U.S. JOLTS Job Openings (SA) (Dec)A:--

F: --

U.S. EIA Weekly Natural Gas Stocks Change

U.S. EIA Weekly Natural Gas Stocks ChangeA:--

F: --

P: --

BOC Gov Macklem Speaks

BOC Gov Macklem Speaks Mexico Policy Interest Rate

Mexico Policy Interest RateA:--

F: --

P: --

U.S. Weekly Treasuries Held by Foreign Central Banks

U.S. Weekly Treasuries Held by Foreign Central BanksA:--

F: --

P: --

Reserve Bank of Australia Governor Bullock testified before Parliament.

Reserve Bank of Australia Governor Bullock testified before Parliament. Japan Foreign Exchange Reserves (Jan)

Japan Foreign Exchange Reserves (Jan)--

F: --

P: --

India Benchmark Interest Rate

India Benchmark Interest Rate--

F: --

P: --

India Cash Reserve Ratio

India Cash Reserve Ratio--

F: --

P: --

India Repo Rate

India Repo Rate--

F: --

P: --

India Reverse Repo Rate

India Reverse Repo Rate--

F: --

P: --

Japan Leading Indicators Prelim (Dec)

Japan Leading Indicators Prelim (Dec)--

F: --

P: --

Germany Industrial Output MoM (SA) (Dec)

Germany Industrial Output MoM (SA) (Dec)--

F: --

P: --

Germany Exports MoM (SA) (Dec)

Germany Exports MoM (SA) (Dec)--

F: --

P: --

U.K. Halifax House Price Index YoY (SA) (Jan)

U.K. Halifax House Price Index YoY (SA) (Jan)--

F: --

P: --

U.K. Halifax House Price Index MoM (SA) (Jan)

U.K. Halifax House Price Index MoM (SA) (Jan)--

F: --

P: --

France Trade Balance (SA) (Dec)

France Trade Balance (SA) (Dec)--

F: --

P: --

Canada Leading Index MoM (Jan)

Canada Leading Index MoM (Jan)--

F: --

P: --

India Deposit Gowth YoY

India Deposit Gowth YoY--

F: --

P: --

Canada Employment (SA) (Jan)

Canada Employment (SA) (Jan)--

F: --

Canada Full-time Employment (SA) (Jan)

Canada Full-time Employment (SA) (Jan)--

F: --

Canada Part-Time Employment (SA) (Jan)

Canada Part-Time Employment (SA) (Jan)--

F: --

Canada Unemployment Rate (SA) (Jan)

Canada Unemployment Rate (SA) (Jan)--

F: --

P: --

Canada Labor Force Participation Rate (SA) (Jan)

Canada Labor Force Participation Rate (SA) (Jan)--

F: --

P: --

Due to the previous government shutdown, the release date of the US January non-farm payroll report has been changed to February 11.

Due to the previous government shutdown, the release date of the US January non-farm payroll report has been changed to February 11. Canada Ivey PMI (Not SA) (Jan)

Canada Ivey PMI (Not SA) (Jan)--

F: --

P: --

Canada Ivey PMI (SA) (Jan)

Canada Ivey PMI (SA) (Jan)--

F: --

P: --

U.S. 5-10 Year-Ahead Inflation Expectations (Feb)

U.S. 5-10 Year-Ahead Inflation Expectations (Feb)--

F: --

P: --

U.S. UMich Consumer Sentiment Index Prelim (Feb)

U.S. UMich Consumer Sentiment Index Prelim (Feb)--

F: --

P: --

U.S. UMich 1-Year-Ahead Inflation Expectations Prelim (Feb)

U.S. UMich 1-Year-Ahead Inflation Expectations Prelim (Feb)--

F: --

P: --

U.S. UMich 5-Year-Ahead Inflation Expectations Prelim YoY (Feb)

U.S. UMich 5-Year-Ahead Inflation Expectations Prelim YoY (Feb)--

F: --

P: --

U.S. UMich Current Economic Conditions Index Prelim (Feb)

U.S. UMich Current Economic Conditions Index Prelim (Feb)--

F: --

P: --

U.S. UMich Consumer Expectations Index Prelim (Feb)

U.S. UMich Consumer Expectations Index Prelim (Feb)--

F: --

P: --

China, Mainland Foreign Exchange Reserves (Jan)

China, Mainland Foreign Exchange Reserves (Jan)--

F: --

P: --

Russia Retail Sales YoY (Dec)

Russia Retail Sales YoY (Dec)--

F: --

P: --

Russia Unemployment Rate (Dec)

Russia Unemployment Rate (Dec)--

F: --

P: --

No matching data

View All

No data

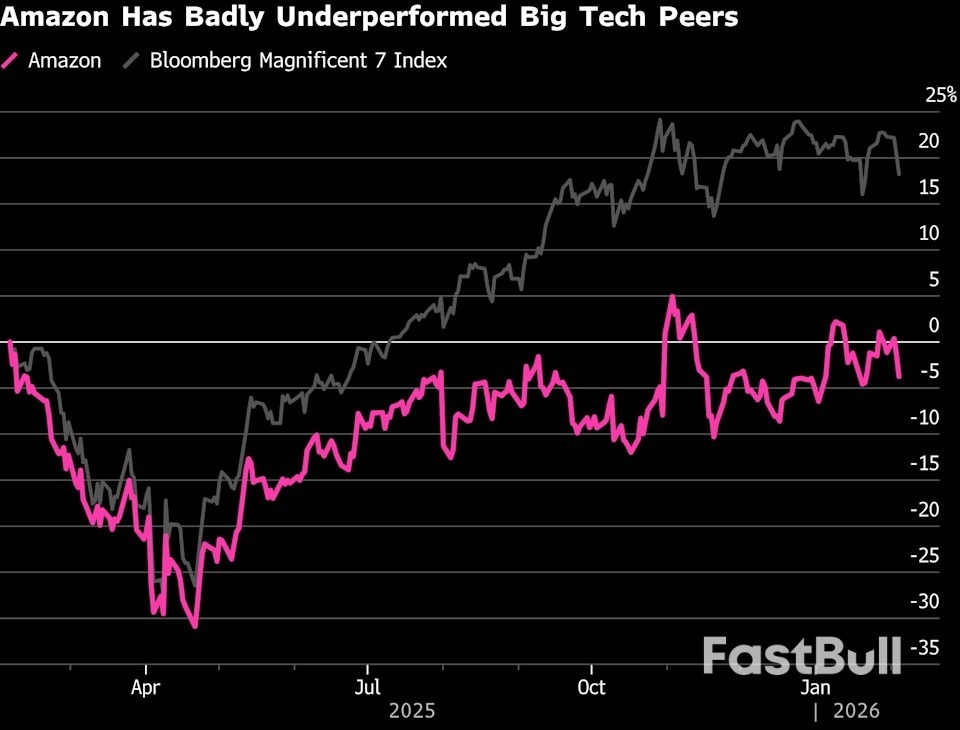

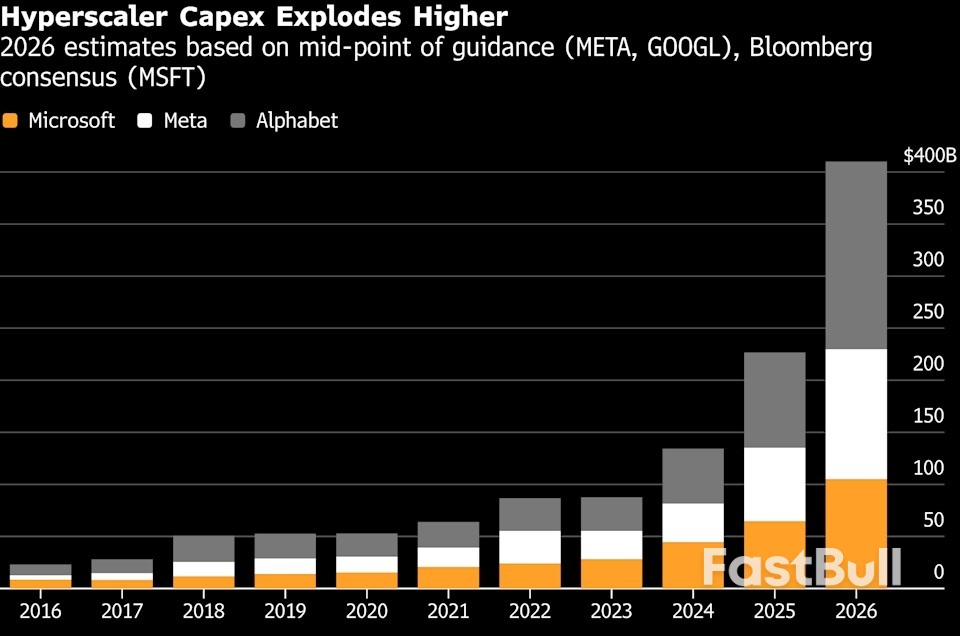

On Thursday, Microsoft shares were hit by a rare downgrade from analysts at Stifel, who cut the stock to hold from buy with a warning about Azure growth.

Despite recent volatility shaking the metals market, analysts at Canadian bank CIBC are doubling down on their bullish outlook for gold and silver, expecting prices to climb significantly by year-end.

In a recent report, CIBC’s commodity analysts sharply raised their gold price forecast, projecting an average of $6,000 per ounce this year. This marks a substantial increase from their previous estimate of $4,500 per ounce. The bank sees a continued uptrend, with prices potentially peaking at an average of $6,500 an ounce in 2027.

The bullish call comes as gold encounters fresh resistance at the $5,000 level and enters a consolidation phase. Spot gold was last trading at $4,863.10 an ounce. For silver, CIBC forecasts an average price of around $105 an ounce this year, rising to $120 an ounce in the next.

According to the bank's analysts, the fundamental drivers that supported precious metals in 2025 are still firmly in place, even with the recent price correction. Two factors stand out:

• Persistent Geopolitical Uncertainty: This is expected to continue fueling safe-haven demand for gold.

• Anticipated U.S. Dollar Weakness: This is viewed as a key tailwind that will push gold prices higher.

Analysts noted that "dollar debasement is likely to persist" as central banks and investors react to heightened uncertainty by quietly shifting allocations away from U.S. treasuries. They also anticipate that rate cuts and ongoing tension between the Federal Reserve and the White House will exert further pressure on the dollar.

CIBC noted that gold's recent selloff from record highs was triggered by President Donald Trump's announcement that he would nominate Kevin Warsh to replace Jerome Powell as head of the Federal Reserve.

Markets reacted negatively, expecting Warsh, a former Federal Reserve Governor, to tighten monetary policy. However, CIBC analysts describe Trump's pick as a "dove in hawk's clothing," suggesting the market’s initial reaction was misplaced.

Their report states, "Mr. Warsh is seemingly more aligned with a dovish stance than last week's negative market reaction would imply." The analysts point out that Warsh has previously argued for tightening the Fed's balance sheet as a method to control inflation, which would then allow for lower interest rates for "Main Street." More recently, he has supported Trump's government efficiency initiatives as another path to temper inflation and enable lower rates.

Ultimately, CIBC believes that "it is unlikely that any candidate would do anything but guide the Federal Reserve Board to lower rates in 2026."

Beyond U.S. monetary policy, CIBC points to the broader trend of global fiat currency debasement as a long-term catalyst for gold demand.

The report argues that with U.S. Treasuries—the traditional safe-haven asset—no longer considered "risk-free," both investors and central banks are actively seeking alternatives. The options are slim, as most Western economies face near-record debt-to-GDP ratios and are choosing to inflate rather than restrain their way out of the problem.

This environment has eroded investor confidence in fiat currencies, a trend that has directly fueled a "flight to safety" into gold.

The last remaining nuclear arms control treaty between the United States and Russia expired Thursday, removing caps on the world's two largest atomic arsenals for the first time in over 50 years and fueling expert warnings of a new, unconstrained arms race.

As the New START treaty officially ended, U.S. President Donald Trump renewed his call for a stronger, modernized pact to replace it, emphasizing that any new agreement must include China. The Kremlin, meanwhile, expressed regret over the treaty's expiration, a sentiment echoed by arms control advocates concerned about global stability.

President Trump has been a vocal critic of the existing agreement, framing it as a flawed deal for the United States. In a social media post, he argued against extending the pact.

"Rather than extend 'NEW START' (A badly negotiated deal by the United States that, aside from everything else, is being grossly violated), we should have our Nuclear Experts work on a new, improved, and modernized Treaty that can last long into the future," Trump stated.

A central pillar of Trump's position is the necessity of bringing China into any future negotiations. U.S. Secretary of State Marco Rubio reiterated this stance, stating that "in order to have true arms control in the 21st century, it's impossible to do something that doesn't include China because of their vast and rapidly growing stockpile."

During his first term, Trump's administration attempted to broker a three-way nuclear pact involving China, but the effort was unsuccessful.

Moscow officially views the treaty's expiration "negatively," according to Kremlin spokesman Dmitry Peskov. He stated that Russia will maintain a "responsible, thorough approach to stability when it comes to nuclear weapons" while being guided by its national interests.

Russian President Vladimir Putin had previously declared his readiness to extend the treaty's limits for another year, an offer the U.S. did not commit to. In a discussion with Chinese leader Xi Jinping, Putin noted the U.S. failure to respond to his proposal.

The Russian Foreign Ministry issued a statement confirming that Moscow "remains ready to take decisive military-technical measures to counter potential additional threats to the national security" but is also open to diplomatic solutions if the right conditions emerge.

What Was the New START Treaty?

Signed in 2010 by then-President Barack Obama and his Russian counterpart, Dmitry Medvedev, the New START treaty placed clear limits on nuclear stockpiles. It restricted each nation to:

• A maximum of 1,550 deployed nuclear warheads.

• A maximum of 700 deployed missiles and bombers.

The treaty, which included on-site inspections to verify compliance, was extended for five years in 2021. However, inspections were halted in 2020 due to the COVID-19 pandemic and never resumed. In February 2023, Putin suspended Moscow's participation, citing a lack of U.S. cooperation.

Beijing has consistently rejected calls to join nuclear disarmament negotiations, arguing that its arsenal is not comparable to those of the U.S. and Russia.

"China's nuclear forces are not at all on the same scale as those of the U.S. and Russia, and thus China will not participate in nuclear disarmament negotiations at the current stage," said Foreign Ministry spokesperson Lin Jian. He urged the U.S. to resume its nuclear dialogue with Russia.

Moscow has reaffirmed that it respects Beijing's position. Russian officials have suggested that if the treaty framework is to be expanded, it should also include the nuclear arsenals of NATO members France and the United Kingdom.

The end of New START has been met with alarm by arms control experts, who see it as a trigger for a dangerous period of strategic competition.

Daryl Kimball, executive director of the Arms Control Association, warned of the potential consequences if the U.S. increases its deployed strategic arsenal. He argued it would "only lead Russia to follow suit and encourage China to accelerate its ongoing strategic buildup."

"Such a scenario could lead to a years-long, dangerous three-way nuclear arms buildup," Kimball said.

Despite the treaty's termination, there was one sign of continued communication. The U.S. and Russia agreed Thursday to reestablish a high-level, military-to-military dialogue that had been suspended in 2021.

The United States and Iran are scheduled to hold direct talks in Oman this Friday, but the diplomatic effort is overshadowed by a fundamental disagreement on the agenda. Officials from both nations have confirmed the meeting will take place in Muscat.

A key sticking point remains Washington's insistence that the negotiations must cover Tehran's missile arsenal. Iran, however, has maintained that it will only discuss its nuclear program.

Iranian Foreign Minister Abbas Araqchi is leading the diplomatic delegation to the Omani capital.

On Thursday, Iranian Foreign Ministry spokesperson Esmail Baghaei stated that the country's objective is to achieve a "fair, mutually acceptable and dignified understanding on the nuclear issue." He emphasized that the Iranian delegation would engage in the talks "with authority."

"We hope the American side will also participate in this process with responsibility, realism and seriousness," Baghaei added, outlining Iran's expectations for the U.S. approach to the negotiations.

This delicate diplomatic initiative comes at a time of heightened tensions in the Middle East. The talks are set against a backdrop of a U.S. military buildup in the region, fueling concerns among regional actors.

Many observers fear that without a diplomatic breakthrough, the current situation could escalate into a military confrontation and potentially a wider war.

The United States convened a summit with officials from 55 countries this week, launching a major initiative to stabilize critical mineral supply chains and reduce global dependence on China. The Trump administration is advocating for policies like price floors and expanded private investment to ensure American manufacturers have reliable access to essential materials.

Key allies, including the European Union, Japan, and Mexico, have agreed to collaborate with Washington on these new policies. According to the US Trade Representative, the partners are working toward a binding multilateral trade agreement, signaling a coordinated effort to address supply chain vulnerabilities.

The central proposal from the U.S. involves establishing price floors for key minerals, a mechanism designed to protect producers outside of China from market manipulation and unpredictable price swings.

"Today, the international market for critical minerals is failing," said Vice President JD Vance at the summit. "Consistent investment is nearly impossible, and it will stay that way so long as prices are erratic and unpredictable."

Vance called for creating stable investment conditions and proposed a "preferential trade center for critical minerals protected from external disruptions." This approach aims to shield non-Chinese producers from being undercut by market flooding, making their operations more economically viable over the long term.

The summit has already produced tangible diplomatic progress. The U.S. and the EU are working to finalize a memorandum of understanding within 30 days to bolster supply security. Meanwhile, the U.S. and Mexico plan to identify priority minerals and explore price guarantees before a scheduled review of the US-Mexico-Canada trade agreement.

To formalize this collaboration, Secretary of State Marco Rubio announced a new partnership called FORGE, which will succeed the Minerals Security Partnership. This move underscores a commitment to creating a durable, allied framework for mineral procurement.

Adding financial weight to the initiative, Vance highlighted the administration's $100 billion lending authority as a tool to support these efforts.

While officials at the summit largely avoided naming China directly, the context was clear. Rubio noted that the supply of critical minerals is "heavily concentrated in the hands of one country," creating significant geopolitical and economic risks.

This concentration is stark: China currently controls over 90% of the world's refining capacity for rare earths and magnets. Demand for these materials is simultaneously rising, driven by advancements in artificial intelligence and computing.

"Everything is geographically concentrated in China," explained Under Secretary Jacob Helberg. "Countries want to diversify and de-risk the supply chain."

These concerns were amplified last year when Beijing announced export restrictions on rare earths. In response to the summit, Chinese spokesman Lin Jian criticized the formation of "small groups" that could disrupt global trade. President Donald Trump noted on Wednesday that he had a "long and thorough call" with Xi Jinping on trade and plans to visit China in April.

A cornerstone of the U.S. strategy is the creation of a nearly $12 billion national stockpile of essential materials. Known as Project Vault, the initiative aims to protect American manufacturers from sudden shortages and price shocks that can halt production.

The project has already attracted participation from over a dozen major corporations, including:

• General Motors

• Stellantis

• Boeing

• Corning

• GE Vernova

To manage the sourcing and purchasing of materials for the stockpile, the government has enlisted three large trading firms: Hartree Partners, Traxys North America, and Mercuria Energy.

"We're crowding in, most importantly, US private equity participation," said Ex-Im chief John Jovanovic, pointing to strong repayment assurances and physical collateral as incentives for investors. The summit, hosted by Rubio, also involved Treasury Secretary Scott Bessent and Trade Representative Jamieson Greer, building on programs initiated under both the Trump and Biden administrations.

Venezuela has officially ended the state-run monopoly of its oil industry, creating a new legal framework to privatize the sector and attract foreign investment. The move by the regime, led by interim President Delcy Rodriguez, dismantles the long-standing dominance of state oil company PDVSA and directly addresses demands from U.S. President Donald Trump as Washington begins to ease trade restrictions.

This policy shift follows the recent capture of President Nicolas Maduro and his wife Cilia Flores by U.S. forces in Caracas. The White House has made it clear to the remaining leadership that compliance, particularly in reopening the oil industry, is non-negotiable. While this represents a major step toward addressing a key concern for energy majors, significant questions remain about whether the country's heavily corroded infrastructure and political risks make it a viable bet.

Despite the new framework, the international energy community remains cautious. In a recent meeting with President Trump, ExxonMobil CEO Darren Woods labeled Venezuela "uninvestable," citing the need for fundamental changes to the country's commercial and legal systems. Woods stressed the importance of durable investment protections and new hydrocarbon laws, reflecting a sentiment shared by many in the industry, even if other CEOs have expressed more optimism.

This hesitation is rooted in history. When former leader Hugo Chavez nationalized foreign-controlled oil assets in 2007, international firms lost billions. ExxonMobil alone claimed losses of $16.6 billion. That event triggered a massive decline in Venezuela's oil sector as investment dried up and skilled workers fled. The new privatization laws aim to reverse this damage, but eliminating the deep-seated risk of state interference is critical to attracting new capital.

Even with a more stable political climate, the financial logic for investing in Venezuela's oil fields is complex. The country's primary oil-producing region, the Orinoco Belt, holds roughly 80% of Venezuela's 303 billion barrels of reserves but comes with high costs.

While Venezuela's average breakeven price for oil production is estimated between $42 and $56 per barrel, the figures for the Orinoco Belt are higher. Existing operational facilities break even at $49.26 per barrel, but new projects or those needing significant refurbishment require prices as high as $80 per barrel to be profitable.

With the global benchmark Brent crude trading around $67 a barrel, investing billions to develop the region's extra-heavy, high-sulfur oil makes little economic sense. This problem is compounded by the fact that Venezuela's main export grade, Merey, trades at a significant discount to Brent. In 2025, Merey averaged $56.68 per barrel, a discount of $12.28 compared to Brent's average of $69.14. Even with U.S. sanctions removed, Merey is expected to maintain a discount of around $10 per barrel.

The oil in the Orinoco Belt is not only costly to produce but also technically challenging. The extra-heavy, viscous substance resembles tar and is filled with contaminants like vanadium and nickel, making it difficult to extract and transport.

To make this crude marketable, it must be mixed with a diluent—a lighter petroleum product like light sweet crude, condensate, or naphtha. This process reduces its viscosity and dilutes hazardous contaminants. Venezuela historically used its own Santa Barbara light sweet crude, which has an API gravity of 39 degrees, for this purpose. The diversion of Santa Barbara crude, which accounts for about 15% of the country's total output, away from refineries contributed significantly to the nationwide gasoline shortages that began in 2017.

A sharp decline in light oil production due to underinvestment, worsened by U.S. sanctions, caused Venezuela’s overall output to plummet to a historic low of 500,000 barrels per day in 2020. Production only stabilized after Iran began shipping condensate to PDVSA. More recently, Chevron started importing U.S. naphtha for its operations after its license was reinstated, as Treasury Department rules prevent the use of Iranian products.

Despite the obstacles, U.S. supermajor Chevron, one of the few foreign companies still active in Venezuela, is planning to expand its output. With a history in the country dating back to 1923, Chevron is uniquely positioned to capitalize on the reopening of the industry.

Following a fourth-quarter 2025 earnings beat, Chairman and CEO Mike Wirth confirmed the company's intent to increase production. CFO Eimear Bonner added that Chevron could boost its Venezuelan output by up to 50% over the next 18 to 24 months. This would take production from the current 250,000 barrels per day to as much as 375,000 barrels per day by 2028. Wirth also noted that Chevron's U.S. refineries have the capacity to process an additional 100,000 barrels per day of Venezuelan heavy crude.

However, Chevron's approach underscores the prevailing caution. The company plans to fund this expansion by reinvesting the proceeds from its oil sales rather than committing significant new capital. This strategy highlights the reluctance of even the most established players to pour the hundreds of billions of dollars needed to fully rejuvenate Venezuela's shattered petroleum industry.

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

Log In

Sign Up