Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

U.S. PPI MoM (SA) (Nov)

U.S. PPI MoM (SA) (Nov)A:--

F: --

U.S. Current Account (Q3)

U.S. Current Account (Q3)A:--

F: --

U.S. Retail Sales YoY (Nov)

U.S. Retail Sales YoY (Nov)A:--

F: --

P: --

U.S. Retail Sales (Nov)

U.S. Retail Sales (Nov)A:--

F: --

P: --

U.S. Core Retail Sales MoM (Nov)

U.S. Core Retail Sales MoM (Nov)A:--

F: --

U.S. Retail Sales MoM (Excl. Automobile) (SA) (Nov)

U.S. Retail Sales MoM (Excl. Automobile) (SA) (Nov)A:--

F: --

U.S. Core Retail Sales (Nov)

U.S. Core Retail Sales (Nov)A:--

F: --

P: --

U.S. Retail Sales MoM (Excl. Gas Stations & Vehicle Dealers) (SA) (Nov)

U.S. Retail Sales MoM (Excl. Gas Stations & Vehicle Dealers) (SA) (Nov)A:--

F: --

U.S. Retail Sales MoM (Nov)

U.S. Retail Sales MoM (Nov)A:--

F: --

U.S. Core PPI MoM (SA) (Nov)

U.S. Core PPI MoM (SA) (Nov)A:--

F: --

Philadelphia Fed President Henry Paulson delivers a speech

Philadelphia Fed President Henry Paulson delivers a speech U.S. Commercial Inventory MoM (Oct)

U.S. Commercial Inventory MoM (Oct)A:--

F: --

U.S. Existing Home Sales Annualized Total (Dec)

U.S. Existing Home Sales Annualized Total (Dec)A:--

F: --

U.S. Existing Home Sales Annualized MoM (Dec)

U.S. Existing Home Sales Annualized MoM (Dec)A:--

F: --

U.S. EIA Weekly Cushing, Oklahoma Crude Oil Stocks Change

U.S. EIA Weekly Cushing, Oklahoma Crude Oil Stocks ChangeA:--

F: --

P: --

U.S. EIA Weekly Crude Stocks Change

U.S. EIA Weekly Crude Stocks ChangeA:--

F: --

P: --

U.S. EIA Weekly Gasoline Stocks Change

U.S. EIA Weekly Gasoline Stocks ChangeA:--

F: --

P: --

U.S. EIA Weekly Crude Demand Projected by Production

U.S. EIA Weekly Crude Demand Projected by ProductionA:--

F: --

P: --

U.S. EIA Weekly Crude Oil Imports Changes

U.S. EIA Weekly Crude Oil Imports ChangesA:--

F: --

P: --

U.S. EIA Weekly Heating Oil Stock Changes

U.S. EIA Weekly Heating Oil Stock ChangesA:--

F: --

P: --

U.S. Refinitiv/Ipsos Primary Consumer Sentiment Index (PCSI) (Jan)

U.S. Refinitiv/Ipsos Primary Consumer Sentiment Index (PCSI) (Jan)A:--

F: --

P: --

China, Mainland M2 Money Supply YoY (Dec)

China, Mainland M2 Money Supply YoY (Dec)--

F: --

P: --

China, Mainland M0 Money Supply YoY (Dec)

China, Mainland M0 Money Supply YoY (Dec)--

F: --

P: --

China, Mainland M1 Money Supply YoY (Dec)

China, Mainland M1 Money Supply YoY (Dec)--

F: --

P: --

Japan Domestic Enterprise Commodity Price Index YoY (Dec)

Japan Domestic Enterprise Commodity Price Index YoY (Dec)A:--

F: --

P: --

Japan PPI MoM (Dec)

Japan PPI MoM (Dec)A:--

F: --

P: --

Japan Domestic Enterprise Commodity Price Index MoM (Dec)

Japan Domestic Enterprise Commodity Price Index MoM (Dec)A:--

F: --

P: --

Australia Consumer Inflation Expectations (Jan)

Australia Consumer Inflation Expectations (Jan)A:--

F: --

P: --

U.K. 3-Month RICS House Price Balance (Dec)

U.K. 3-Month RICS House Price Balance (Dec)A:--

F: --

South Korea Benchmark Interest Rate

South Korea Benchmark Interest RateA:--

F: --

P: --

Saudi Arabia CPI YoY (Dec)

Saudi Arabia CPI YoY (Dec)--

F: --

P: --

U.K. Services Index MoM (SA) (Nov)

U.K. Services Index MoM (SA) (Nov)--

F: --

P: --

U.K. Services Index YoY (Nov)

U.K. Services Index YoY (Nov)--

F: --

P: --

U.K. Manufacturing Output MoM (Nov)

U.K. Manufacturing Output MoM (Nov)--

F: --

P: --

U.K. Trade Balance (Nov)

U.K. Trade Balance (Nov)--

F: --

P: --

U.K. Monthly GDP 3M/3M Change (Nov)

U.K. Monthly GDP 3M/3M Change (Nov)--

F: --

P: --

U.K. GDP MoM (Nov)

U.K. GDP MoM (Nov)--

F: --

P: --

U.K. Industrial Output MoM (Nov)

U.K. Industrial Output MoM (Nov)--

F: --

P: --

U.K. Trade Balance Non-EU (SA) (Nov)

U.K. Trade Balance Non-EU (SA) (Nov)--

F: --

P: --

U.K. Trade Balance (SA) (Nov)

U.K. Trade Balance (SA) (Nov)--

F: --

P: --

U.K. Manufacturing Output YoY (Nov)

U.K. Manufacturing Output YoY (Nov)--

F: --

P: --

U.K. Construction Output MoM (SA) (Nov)

U.K. Construction Output MoM (SA) (Nov)--

F: --

P: --

U.K. Industrial Output YoY (Nov)

U.K. Industrial Output YoY (Nov)--

F: --

P: --

U.K. Services Index MoM

U.K. Services Index MoM--

F: --

P: --

U.K. Construction Output YoY (Nov)

U.K. Construction Output YoY (Nov)--

F: --

P: --

U.K. GDP YoY (SA) (Nov)

U.K. GDP YoY (SA) (Nov)--

F: --

P: --

U.K. Trade Balance EU (SA) (Nov)

U.K. Trade Balance EU (SA) (Nov)--

F: --

P: --

France HICP Final MoM (Dec)

France HICP Final MoM (Dec)--

F: --

P: --

Germany Annual GDP Growth

Germany Annual GDP Growth--

F: --

Italy Industrial Output YoY (SA) (Nov)

Italy Industrial Output YoY (SA) (Nov)--

F: --

P: --

Canada Existing Home Sales MoM (Dec)

Canada Existing Home Sales MoM (Dec)--

F: --

P: --

Euro Zone Industrial Output MoM (Nov)

Euro Zone Industrial Output MoM (Nov)--

F: --

P: --

Euro Zone Trade Balance (SA) (Nov)

Euro Zone Trade Balance (SA) (Nov)--

F: --

P: --

Euro Zone Trade Balance (Not SA) (Nov)

Euro Zone Trade Balance (Not SA) (Nov)--

F: --

P: --

Euro Zone Industrial Output YoY (Nov)

Euro Zone Industrial Output YoY (Nov)--

F: --

P: --

South Africa Refinitiv/Ipsos Primary Consumer Sentiment Index (PCSI) (Jan)

South Africa Refinitiv/Ipsos Primary Consumer Sentiment Index (PCSI) (Jan)--

F: --

P: --

U.K. Refinitiv/Ipsos Primary Consumer Sentiment Index (PCSI) (Jan)

U.K. Refinitiv/Ipsos Primary Consumer Sentiment Index (PCSI) (Jan)--

F: --

P: --

China, Mainland Outstanding Loans Growth YoY (Dec)

China, Mainland Outstanding Loans Growth YoY (Dec)--

F: --

P: --

Brazil Retail Sales MoM (Nov)

Brazil Retail Sales MoM (Nov)--

F: --

P: --

Canada Wholesale Sales MoM (SA) (Nov)

Canada Wholesale Sales MoM (SA) (Nov)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

Amazon.com Inc. is challenging Saks Global Enterprises' foray into Chapter 11, saying the luxury retailer breached a deal related to the sale of Saks products on its website and that its equity investment in the now bankrupt business is "presumptively worthless."

Amazon.com Inc. is challenging Saks Global Enterprises' foray into Chapter 11, saying the luxury retailer breached a deal related to the sale of Saks products on its website and that its equity investment in the now bankrupt business is "presumptively worthless."

Amazon challenged Saks' bid to fund its bankruptcy with financing that would provide the retailer with as much $1.75 billion in fresh cash, according to court documents filed late Wednesday. The financing would saddle the retailer with billions of dollars of new obligations and includes other terms that would harm Amazon and other unsecured creditors of Saks, the filing said.

In 2024, Amazon took a minority stake in the retailer as part of an agreement that helped facilitate Saks' $2.65 billion acquisition of Neiman Marcus. Amazon said it invested $475 million of preferred equity in the luxury retailer as part of the deal.

The investment was also contingent upon an agreement for Saks to sell products on the e-commerce giant's platform, which included launching "Saks on Amazon," according to Amazon's filing on Wednesday. In return, Saks agreed to pay a referral fee and guaranteed at least $900 million in payments to Amazon over eight years, the web giant said.

"Saks continuously failed to meet its budgets, burned through hundreds of millions of dollars in less than a year, and ran up additional hundreds of millions of dollars in unpaid invoices owed to its retail partners," Amazon alleged in its filing.

The company's chief restructuring officer, Mark Weinsten, testified Wednesday that the retailer desperately needed additional financing to keep paying vendors and covering payroll and other expenses.

Without access to that funding, Weinsten said, "we'll be dead in the water." The retailer was seeking court permission to make an initial $400 million draw, with the remaining amounts becoming available later in the Chapter 11 case.

A representative for Amazon declined to comment, while Saks didn't immediately respond to requests for comment. A Texas bankruptcy judge was scheduled to consider approving its request to start tapping the financing during a hearing Wednesday evening.

Days before Saks filed Chapter 11, Amazon said it would oppose the company's bankruptcy financing, according to a Jan. 9 letter made public Wednesday. Amazon claimed the luxury retailer needs the online giant's consent for a key part of the loan, but that Amazon refused to give its consent.

Instead, Saks moved forward with financing from a group of existing lenders, an arrangement the retailer said would strengthen its business. The company said in a Wednesday statement that stores under all its brands were open.

Alibaba Group Holding Ltd. plans to link its flagship online shopping and travel services to its AI app, taking its biggest step yet to build Qwen into its one-stop artificial intelligence platform for consumers.

China's online retail leader aims to connect Taobao, Alipay, travel service Fliggy and Amap to the Qwen app starting Thursday. The idea is to eventually help Qwen's 100 million users to shop, book travel and pay for services via a single platform with the help of AI, the company said in a statement. The newly integrated functions are now available for public testing in China.

The ambitious undertaking underscores how companies from Amazon.com Inc. to Meta Platforms Inc. are exploring agentic AI, where artificial intelligence helps people perform actual tasks. Companies like Alibaba and Tencent Holdings Ltd., which already operate "super apps" with hundreds of different services, are considered to have an initial advantage in that sphere.

Alibaba, which also operates a Netflix-like streaming service and one of China's biggest meal delivery platforms, launched Qwen in November as a major step into consumer-facing AI services. It plans to build Qwen into an all-around personal assistant by gradually integrating individual services under the Alibaba umbrella. The company also launched an invite-only "task assistant" feature designed to conduct more complicated tasks, such as making phone calls to restaurants or building web applications.

In doing so, it's seeking to answer global concerns about the money-making potential of AI. Investors are worried in particular about the hundreds of billions of dollars flowing into Nvidia-powered datacenters around the world, given persistent uncertainty about demand for AI services in future.

Alibaba is emphasizing the extent of its ambition by hooking Qwen up with Taobao: the service that launched the company into e-commerce decades ago and remains its main Chinese shopping showcase.

On Thursday, executives will demonstrate how the new Qwen features work. They plan to walk users through detailed tasks such as ordering bubble tea from a local store, buying and paying for stuff on Taobao and confirming restaurant or hotel reservations.

"AI is evolving from intelligence to agency," said Wu Jia, an Alibaba vice president. "What we are launching today represents a shift from models that understand to systems that act — deeply connected to real-world services."

Alibaba has been among the most aggressive investors in and advocates for AI since DeepSeek fired up the local tech industry. Chief Executive Officer Eddie Wu has pledged more than $53 billion for infrastructure and AI development — an outlay he's said the company could surpass over time.

While US apps like OpenAI's ChatGPT are not available in China, it faces stiff competition from domestic rivals including ByteDance Ltd.'s Doubao, by some measures the most popular with about 172 million monthly active users as of the end of September, according to QuestMobile.

Still, investors have largely endorsed Alibaba's broader endeavors in AI, judging by the stock.

The shares have more than doubled since the start of 2025. Alibaba's ability to control costs around consumer services while investing in cloud operations is something investors will monitor over the longer term.

Technology and bank stocks led Wall Street indexes into a second day of declines on Wednesday, while oil prices snapped back from the day's highs after U.S. President Donald Trump softened warnings about unrest in Iran, although persistent economic and geopolitical uncertainty continued to support precious metals.

Banner earnings releases from three of the largest U.S. banks showed rising profits from lending to credit-hungry consumers and businesses and rising fees from a dealmaking rebound, although Wells Fargo missed profit expectations.

Investors sold bank stocks, sending Bank of America (BAC.N), opens new tab shares down more than 4%, Citigroup (C.N), opens new tab 4.5% lower and Wells Fargo (WFC.N), opens new tab sliding more than 5%.

Bank shares (.SPXBK), opens new tab had jumped 25% in the past 12 months but fell this week in part due to a proposal from Trump to cap credit card interest rates.

"After a nice run, and so-so or mediocre earnings, you're seeing profit-taking and consolidation" in the banks, said Michael O'Rourke, chief market strategist at JonesTrading in Stamford, Connecticut. "Generally speaking, people are still optimistic on the group."

Selling spread to tech and growth stocks as investors looked for bargains, while Broadcom and Fortinet (FTNT.O) fell after a Reuters report about new limits from Chinese authorities on domestic companies using cybersecurity software made by roughly a dozen U.S. and Israeli firms.

The tech-heavy Nasdaq Composite (.IXIC) closed 1% lower at 23,471.75. The Dow Jones Industrial Average (.DJI) declined 0.09% to 49,149.63, and the S&P 500 (.SPX) fell 0.53% to 6,926.60.

Data showed U.S. retail sales increased more than expected and producer prices picked up slightly in November, lending further support to broad expectations that the Federal Reserve will cut interest rates twice later this year.

Traders are grappling this week with questions over Federal Reserve independence, the U.S. desire to control Greenland and its implications for the NATO alliance, and whether the U.S. would attack Iran after a crackdown on historic protests.

Oil prices settled higher but then gave back most of the day's gains after Trump said on Wednesday afternoon he had been told that killings in Iran's crackdown on nationwide protests were subsiding and he believed there was currently no plan for large-scale executions.

"The market now thinks that maybe there is not going to be an attack on Iran so the stock market rallied and oil prices plummeted really quickly," said Phil Flynn, senior analyst with the Price Futures Group.

Trump said the U.S. would "watch what the process is" in Iran.

U.S. crude fell 1.1% to $60.49 a barrel and Brent declined 0.93% to $64.86 per barrel.

Expectations of more supply from Venezuela and news that the country's state energy company has begun reversing oil production cuts made under a U.S. embargo limited price gains.

The dollar, meanwhile, strengthened modestly against the euro, benefiting from the prospect that the Fed will wait several months before restarting rate cuts.

The dollar index , which measures the greenback against a basket of currencies including the yen and the euro, fell 0.1% to 99.09, with the euro last up 0.01% at $1.1643.

Much market momentum was reserved for precious metals.

Silver rose past $92 per ounce for the first time on Wednesday. It began 2025 under $30 an ounce, and has surged 29% in the first nine trading days of this year.

Gold touched yet another record high of $4,641.40 per ounce and was last seen up 0.73% at $4,620.60 an ounce. Copper is also at unprecedented levels.

"All roads are leading to gold and silver," said Alex Ebkarian, chief operating officer at Allegiance Gold, citing demand from diverse buyers and noting the market is in a structural bull phase.

Gold yields no interest and typically performs well when interest rates are low and uncertainty is high.

The U.S. Supreme Court took one item off the day's agenda when it did not issue a ruling on the legality of Trump's global tariffs. Meanwhile, U.S. high-end department store conglomerate Saks Global filed for bankruptcy protection.

U.S. President Donald Trump struck a more conciliatory tone regarding an ICE officer's fatal shooting of a Minnesota mother, saying on Wednesday that it was "sad to see on both sides."

During a wide-ranging interview with Reuters in the Oval Office, Trump called the shooting "unfortunate," a more moderate response than earlier remarks by Vice President JD Vance and Trump's own social media post.

The U.S. Immigration and Customs Enforcement officer, Jonathan Ross, fatally shot U.S. citizen Renee Good, a mother of three, on January 7 in Minneapolis after Trump surged more than 2,000 federal officers to Minnesota to ramp up immigration enforcement.

Videos reviewed by Reuters showed Ross fired the first of three shots as the car began moving past him.

In a post on Truth Social shortly after the shooting, Trump called Good "a professional agitator" who "violently, willfully, and viciously ran over the ICE Officer," saying it appeared the officer shot her in self-defense.

When Reuters asked on Wednesday if he believed the ICE officer did the right thing, the Republican president struck a more cautious tone.

"I don't get into right or wrong. I know that it was a tough situation to be in," Trump said of the officer's involvement. "There was very little respect shown to the police, in this case, the ICE officers."

"It's so sad to see on both sides," he added.

When asked if he would pardon Ross if he was charged and convicted in the shooting, Trump said he would wait to see how the process played out.

"I think that we're gonna have to see what happens. That was a very unfortunate incident. We're just going to see what happens," Trump said.

Federal agents are generally immune from state prosecution for actions taken as part of their official duties although local officials have rejected the idea that the shooting was in self-defense.

Trump said he would continue to send ICE officers into U.S. cities, saying it was needed to combat crime, even as the surges have led to violent confrontations.

ICE data shows many of those arrested in Trump's crackdown have no criminal charges or prior convictions.

Verizon Communications' (VZ.N) U.S. wireless network remained down late Wednesday evening for many users in the U.S., prompting several major cities to advise residents to use other carriers to call emergency services.

With the outage more than seven hours old, the carrier said it was still working to fix the problem but saw no indication of a cyberattack.

The company did not disclose the scope of the disruption. But Downdetector, which aggregates data on service outages, said more than 180,000 reports had been submitted at the peak, while some media outlets said more than a million customers may have been affected.

"Our teams remain fully deployed and are focused on the issue," Verizon said. "We ... remain committed to resolving this as quickly as possible."

Federal Communications Commission Chair Brendan Carr told Reuters after a congressional hearing the agency will review the issue "and take appropriate action." Democratic FCC Commissioner Anna Gomez said she would ask the agency to investigate.

New York City told residents the outage could affect some users trying to call 911 for emergency help. "Call using a device from another carrier, a landline, or go to a police/fire station to report emergencies," the city said on X. The District of Columbia issued a similar alert.

Some Verizon customers posted frantic messages on social media seeking updates on service restoration.

Verizon faced a nationwide wireless outage in late 2024 that impacted over 100,000 users at its peak. The outage drew the FCC's attention after several services were affected and iPhone users were stuck in "SOS" mode.

XRP dips as concerns over the Market Structure Bill trigger profit-taking and rotation into BTC and the broader crypto market.

This week, the US Senate Banking Committee released its Market Structure Bill text ahead of the highly anticipated January 15 markup. However, the text received mixed reviews, weighing on the demand for XRP.

Despite concerns over the Bill, robust inflows into XRP-spot ETFs and increased XRP utility continue to support a bullish short- to medium-term price outlook for XRP.

Below, I will explore the key drivers behind recent price trends, the medium-term (4-8 weeks) outlook, and the key technical levels traders should watch.

The US Senate Banking Committee published a bipartisan text of the Market Structure Bill on Tuesday, January 13, setting the stage for a Committee vote on Thursday, January 15.

Hopes for crypto-friendly legislation sent XRP to a January 6 high of $2.4151 before briefly dropping below $2.1.

However, negative reviews of the text and investor caution ahead of the January 15 US Senate Banking Committee markup left XRP in negative territory mid-week.

Coinbase (COIN) CEO Brian Armstrong criticized the Banking Committee's text, stating:

"After reviewing the Senate Banking draft text over the last 48hrs, Coinbase unfortunately can't support the bill as written. […] We appreciate all the hard work by members of the Senate to reach a bipartisan outcome, but this version would be materially worse than the current status quo. We'd rather have no bill than a bad bill. Hopefully, we can all get to a better draft."

Armstrong highlighted several issues with the bill, including:

Armstrong's view on the bill giving the SEC greater authority than the CFTC likely weighed on buyer appetite for XRP, given the SEC vs. Ripple case. The US Court of Appeals approved Ripple and the SEC's appeal withdrawals in August 2025 following a lengthy legal battle that lasted almost five years.

Crucially, the SEC withdrew its appeal against Judge Torres' July 2023 ruling that programmatic sales of XRP did not satisfy the third prong of the Howey Test. The court ruling paved the way for a US XRP-spot ETF market and enabled Ripple to expand its US footprint, thereby increasing the real-world utility of XRP.

Despite the negative comments, Armstrong remained hopeful for a crypto-friendly regulatory environment, concluding:

"I'm actually quite optimistic that we will get to the right outcome with continued effort. We will keep showing up and working with everyone to get there."

Notably, Coinbase was also embroiled in a legal battle with the SEC. In 2023, the SEC charged Coinbase with allegedly operating as an unregistered securities exchange, broker, and clearing agency. Additionally, the SEC charged Coinbase for the unregistered offering and selling of securities in connection with its staking-as-a-service program.

The SEC dismissed the Coinbase lawsuit in February 2025, following Chair Gary Gensler's departure from the agency.

Legislation giving the SEC greater authority exposes XRP and the broader crypto market to political risk. An anti-crypto US administration could potentially establish an agency tasked with challenging the digital asset space through the courts.

Despite Armstrong's concerns, other market participants were less critical about the Banking Committee's draft text. Ripple CEO Brad Garlinghouse commented on the draft text, stating:

"While long overdue, this move by Senator Tim Scott and the Banking Committee on market structure is a massive step forward in providing workable frameworks for crypto, while continuing to protect consumers. Ripple (and I) know firsthand that clarity beats chaos, and the bill's success is crypto's success. We are at the table and will continue to move forward with fair debate. I remain optimistic that issues can be resolved through the markup process."

The progress of the Market Structure Bill on Capitol Hill remains key to XRP's bullish short- to medium-term price outlook.

For context, the token surged 14.69% on July 17 after the US House of Representatives passed the Market Structure Bill to the Senate. XRP then rallied from a December 31 $1.8746 to an eight-week high of $2.4151 on January 6 after the Banking Committee announced a January 15 markup.

XRPUSD – Weekly Chart – 150126 – Market Structure Bill Price Action

XRPUSD – Weekly Chart – 150126 – Market Structure Bill Price ActionThe progress of the Market Structure Bill, strong XRP-spot ETF inflows, and increased XRP utility reinforce a positive short-term (1-4 weeks) outlook, with a $2.5 price target.

Furthermore, expectations that the Senate will pass crypto-friendly legislation reaffirmed the bullish longer-term price targets:

Several scenarios could derail the positive outlook. These include:

These scenarios would likely weigh on sentiment, pushing XRP below $2, which would signal a bearish trend reversal.

Technical Analysis: Key Levels to Watch

XRP fell 1.24% on Wednesday, January 14, partially reversing the previous day's 5.43% rally to close at $2.1376. The token underperformed the broader crypto market cap, which gained 1.09%.

Despite the pullback, XRP remained above its 50-day EMA, while the token continued trading below the 200-day EMA. The EMAs signaled a bullish near-term but a bearish longer-term bias. However, the bullish fundamentals remain dominant.

Key technical levels to watch include:

Viewing the daily chart, a breakout above $2.2 would pave the way toward the 200-day EMA. A sustained move through the 200-EMA would signal a bullish trend reversal, opening the door to testing the $2.5 resistance level.

Importantly, a break above the EMAs would reaffirm the bullish medium-term outlook and the longer-term (8-12 weeks) $3.66 price target.

XRPUSD – Daily Chart – 150126 – EMAs

XRPUSD – Daily Chart – 150126 – EMAsNear-term price drivers include:

Holding above the $2 psychological support level remains pivotal for the short- to medium-term outlook. Favorable fundamentals continue to outweigh bearish longer-term technicals, indicating a sustained rebound. The recovery from December's lows and January's gains reinforced the bullish structure and constructive short- to medium-term bias.

A breakout above $2.2 would enable the bulls to target the upper trendline. A sustained move through the upper trendline would affirm the bullish trend reversal and validate the bullish structure, supporting the price targets:

However, a drop below $2.0 would bring the lower trendline into play. A sustained fall through the lower trendline would invalidate the bullish structure, signaling a bearish trend reversal.

XRPUSD – Daily Chart – 150126 – Bullish Structure

XRPUSD – Daily Chart – 150126 – Bullish StructureLooking ahead, today's Banking Committee markup, central bank chatter, and XRP-spot ETF flows will influence the near-term price outlook.

Increasing expectation of a March Fed rate cut, and a dovish BoJ neutral rate (potentially 1%-1.25%) would lift sentiment. Strong demand for XRP-spot ETFs and bipartisan support for the Market Structure Bill would reinforce the constructive bias.

In summary, robust XRP-spot ETF inflows and the progress of the Market Structure Bill support a medium-term (4–8 weeks) move to $3.0. A March Fed rate cut and the Senate passing the Market Structure Bill would reaffirm the longer-term (8–12 weeks) price target of $3.66.

Looking beyond 12 weeks, these events are likely to send XRP above its all-time high of $3.66. A break above $3.66 would support the $5 price target over a 6- to 12-month time horizon.

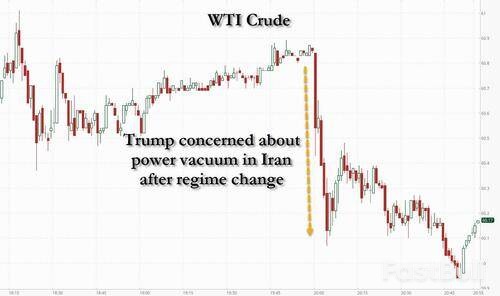

Global traders anxiously awaiting news of military action in Iran were met with reports suggesting that a US strike is not imminent and could be days away, if it happens at all. An NBC report, citing multiple US officials and sources familiar with White House discussions, has cooled expectations of immediate conflict.

This uncertainty has sent ripples through commodity markets, with both crude oil and precious metals falling sharply as the geopolitical risk premium evaporates.

According to sources, President Trump has made his conditions for military action clear to his national security team. He reportedly wants any strike against Iran to be a "swift and decisive blow" that avoids dragging the US into a sustained conflict lasting weeks or months.

"If he does something, he wants it to be definitive," one person familiar with the discussions noted.

However, a key obstacle has emerged: Trump's advisers have been unable to guarantee that a US military strike would lead to a quick collapse of the Iranian regime. Officials are also concerned that the US may not have sufficient assets in the region to counter what they anticipate would be an aggressive Iranian response.

This logistical challenge is highlighted by the position of US aircraft carriers, which are still days away from the gulf, delaying the timeline for any potential large-scale operation.

The current situation could push Trump toward a more limited initial offensive, while keeping options open for escalation. As of Wednesday afternoon, sources confirmed that no final decisions had been made in the fast-evolving scenario.

Adding to the military and logistical challenges are political concerns about what would follow a potential regime change in Iran. In a separate interview with Reuters, Trump expressed uncertainty about whether Iranian opposition figure Reza Pahlavi could rally enough support within the country to take power.

Pahlavi is the son of the late shah of Iran, who was ousted in 1979. While Trump described him as seeming "very nice," he questioned his political viability.

"I don't know how he'd play within his own country," Trump said. "I don't know whether or not his country would accept his leadership, and certainly if they would, that would be fine with me."

These comments suggest a lack of a clear succession plan, raising the risk of a power vacuum in a post-strike scenario. While Trump acknowledged that the current government in Tehran could fall due to internal protests, he stated that "any regime can fail."

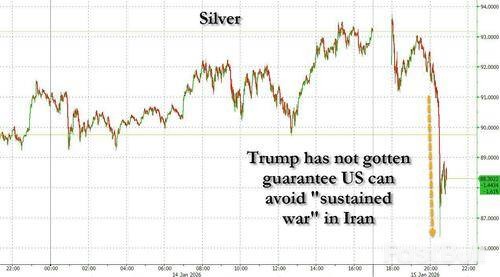

The combined reports from NBC and Reuters effectively reduced the probability of an imminent US strike, triggering a sharp reversal in commodity markets.

Crude oil, which had been rising on geopolitical tensions, tumbled. WTI crude was set to dip below $60 a barrel after trading above that level for the entire day.

Precious metals also saw a significant sell-off. Silver plunged as much as $6 in seconds, falling from $92 to $86 as stop-loss orders were triggered. The rapid decline offered a preview of how quickly the recent rally could unwind as geopolitical fears subside.

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up