Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

Turkey Trade Balance

Turkey Trade BalanceA:--

F: --

P: --

Germany Construction PMI (SA) (Nov)

Germany Construction PMI (SA) (Nov)A:--

F: --

P: --

Euro Zone IHS Markit Construction PMI (Nov)

Euro Zone IHS Markit Construction PMI (Nov)A:--

F: --

P: --

Italy IHS Markit Construction PMI (Nov)

Italy IHS Markit Construction PMI (Nov)A:--

F: --

P: --

U.K. Markit/CIPS Construction PMI (Nov)

U.K. Markit/CIPS Construction PMI (Nov)A:--

F: --

P: --

France 10-Year OAT Auction Avg. Yield

France 10-Year OAT Auction Avg. YieldA:--

F: --

P: --

Euro Zone Retail Sales MoM (Oct)

Euro Zone Retail Sales MoM (Oct)A:--

F: --

P: --

Euro Zone Retail Sales YoY (Oct)

Euro Zone Retail Sales YoY (Oct)A:--

F: --

P: --

Brazil GDP YoY (Q3)

Brazil GDP YoY (Q3)A:--

F: --

P: --

U.S. Challenger Job Cuts (Nov)

U.S. Challenger Job Cuts (Nov)A:--

F: --

P: --

U.S. Challenger Job Cuts MoM (Nov)

U.S. Challenger Job Cuts MoM (Nov)A:--

F: --

P: --

U.S. Challenger Job Cuts YoY (Nov)

U.S. Challenger Job Cuts YoY (Nov)A:--

F: --

P: --

U.S. Initial Jobless Claims 4-Week Avg. (SA)

U.S. Initial Jobless Claims 4-Week Avg. (SA)A:--

F: --

P: --

U.S. Weekly Initial Jobless Claims (SA)

U.S. Weekly Initial Jobless Claims (SA)A:--

F: --

P: --

U.S. Weekly Continued Jobless Claims (SA)

U.S. Weekly Continued Jobless Claims (SA)A:--

F: --

P: --

Canada Ivey PMI (SA) (Nov)

Canada Ivey PMI (SA) (Nov)A:--

F: --

P: --

Canada Ivey PMI (Not SA) (Nov)

Canada Ivey PMI (Not SA) (Nov)A:--

F: --

P: --

U.S. Non-Defense Capital Durable Goods Orders Revised MoM (Excl. Aircraft) (SA) (Sept)

U.S. Non-Defense Capital Durable Goods Orders Revised MoM (Excl. Aircraft) (SA) (Sept)A:--

F: --

U.S. Factory Orders MoM (Excl. Transport) (Sept)

U.S. Factory Orders MoM (Excl. Transport) (Sept)A:--

F: --

P: --

U.S. Factory Orders MoM (Sept)

U.S. Factory Orders MoM (Sept)A:--

F: --

P: --

U.S. Factory Orders MoM (Excl. Defense) (Sept)

U.S. Factory Orders MoM (Excl. Defense) (Sept)A:--

F: --

P: --

U.S. EIA Weekly Natural Gas Stocks Change

U.S. EIA Weekly Natural Gas Stocks ChangeA:--

F: --

P: --

Saudi Arabia Crude Oil Production

Saudi Arabia Crude Oil ProductionA:--

F: --

P: --

U.S. Weekly Treasuries Held by Foreign Central Banks

U.S. Weekly Treasuries Held by Foreign Central BanksA:--

F: --

P: --

Japan Foreign Exchange Reserves (Nov)

Japan Foreign Exchange Reserves (Nov)A:--

F: --

P: --

India Repo Rate

India Repo RateA:--

F: --

P: --

India Benchmark Interest Rate

India Benchmark Interest RateA:--

F: --

P: --

India Reverse Repo Rate

India Reverse Repo RateA:--

F: --

P: --

India Cash Reserve Ratio

India Cash Reserve RatioA:--

F: --

P: --

Japan Leading Indicators Prelim (Oct)

Japan Leading Indicators Prelim (Oct)A:--

F: --

P: --

U.K. Halifax House Price Index YoY (SA) (Nov)

U.K. Halifax House Price Index YoY (SA) (Nov)--

F: --

P: --

U.K. Halifax House Price Index MoM (SA) (Nov)

U.K. Halifax House Price Index MoM (SA) (Nov)--

F: --

P: --

France Current Account (Not SA) (Oct)

France Current Account (Not SA) (Oct)--

F: --

P: --

France Trade Balance (SA) (Oct)

France Trade Balance (SA) (Oct)--

F: --

P: --

France Industrial Output MoM (SA) (Oct)

France Industrial Output MoM (SA) (Oct)--

F: --

P: --

Italy Retail Sales MoM (SA) (Oct)

Italy Retail Sales MoM (SA) (Oct)--

F: --

P: --

Euro Zone Employment YoY (SA) (Q3)

Euro Zone Employment YoY (SA) (Q3)--

F: --

P: --

Euro Zone GDP Final YoY (Q3)

Euro Zone GDP Final YoY (Q3)--

F: --

P: --

Euro Zone GDP Final QoQ (Q3)

Euro Zone GDP Final QoQ (Q3)--

F: --

P: --

Euro Zone Employment Final QoQ (SA) (Q3)

Euro Zone Employment Final QoQ (SA) (Q3)--

F: --

P: --

Euro Zone Employment Final (SA) (Q3)

Euro Zone Employment Final (SA) (Q3)--

F: --

Brazil PPI MoM (Oct)

Brazil PPI MoM (Oct)--

F: --

P: --

Mexico Consumer Confidence Index (Nov)

Mexico Consumer Confidence Index (Nov)--

F: --

P: --

Canada Unemployment Rate (SA) (Nov)

Canada Unemployment Rate (SA) (Nov)--

F: --

P: --

Canada Labor Force Participation Rate (SA) (Nov)

Canada Labor Force Participation Rate (SA) (Nov)--

F: --

P: --

Canada Employment (SA) (Nov)

Canada Employment (SA) (Nov)--

F: --

P: --

Canada Part-Time Employment (SA) (Nov)

Canada Part-Time Employment (SA) (Nov)--

F: --

P: --

Canada Full-time Employment (SA) (Nov)

Canada Full-time Employment (SA) (Nov)--

F: --

P: --

U.S. Dallas Fed PCE Price Index YoY (Sept)

U.S. Dallas Fed PCE Price Index YoY (Sept)--

F: --

P: --

U.S. PCE Price Index YoY (SA) (Sept)

U.S. PCE Price Index YoY (SA) (Sept)--

F: --

P: --

U.S. PCE Price Index MoM (Sept)

U.S. PCE Price Index MoM (Sept)--

F: --

P: --

U.S. Personal Outlays MoM (SA) (Sept)

U.S. Personal Outlays MoM (SA) (Sept)--

F: --

P: --

U.S. Core PCE Price Index MoM (Sept)

U.S. Core PCE Price Index MoM (Sept)--

F: --

P: --

U.S. UMich 5-Year-Ahead Inflation Expectations Prelim YoY (Dec)

U.S. UMich 5-Year-Ahead Inflation Expectations Prelim YoY (Dec)--

F: --

P: --

U.S. Core PCE Price Index YoY (Sept)

U.S. Core PCE Price Index YoY (Sept)--

F: --

P: --

U.S. 5-10 Year-Ahead Inflation Expectations (Dec)

U.S. 5-10 Year-Ahead Inflation Expectations (Dec)--

F: --

P: --

U.S. UMich Current Economic Conditions Index Prelim (Dec)

U.S. UMich Current Economic Conditions Index Prelim (Dec)--

F: --

P: --

U.S. UMich Consumer Sentiment Index Prelim (Dec)

U.S. UMich Consumer Sentiment Index Prelim (Dec)--

F: --

P: --

U.S. UMich 1-Year-Ahead Inflation Expectations Prelim (Dec)

U.S. UMich 1-Year-Ahead Inflation Expectations Prelim (Dec)--

F: --

P: --

U.S. UMich Consumer Expectations Index Prelim (Dec)

U.S. UMich Consumer Expectations Index Prelim (Dec)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

ICE Brent settled a little more than 1% higher yesterday, with the market moving closer to the $65/bbl level. Market participants appear more concerned about supply risks than the odds of a surplus going forward.

ICE Brent settled a little more than 1% higher yesterday, with the market moving closer to the $65/bbl level. Market participants appear more concerned about supply risks than the odds of a surplus going forward.

These concerns are clearly reflected in the middle distillate market, where the ICE gasoil crack continued to rally. It's now above US$38/bbl, up from around $23/bbl in mid-October. Meanwhile, the prompt ICE gasoil timspread surged to a backwardation of more than $43/t. Worries over Russian diesel supply amid sanctions and Ukrainian attacks on Russian refineries are driving the market's strength.

The strength in the middle distillate market should prompt refiners to maximise yields on middle-of-the-barrel products. Meanwhile, broader strength in refinery margins should support refinery runs. The strength in refinery margins certainly makes a more bearish view of the crude oil market less likely.

ICE Futures Europe said that the delivery of diesel under the ICE gasoil contract, which is produced from Russian oil in third countries, will be banned from January. This move by the exchange aligns with the EU ban on refined products derived from Russian oil, which also comes into effect in January.

Numbers overnight from the American Petroleum Institute show that US crude oil inventories increased by 4.4m barrels over the last week. Refined products also saw stock builds, with gasoline and distillate stocks increasing by 1.5m barrels and 600k barrels, respectively. Overall, the report was relatively bearish. However, the market will be more focused on the release of the widely followed US Energy Information Administration (EIA) inventory numbers later today.

Freeport said it plans to restore copper production at its Grasberg operations in Indonesia drove a rally in copper prices. A September mudslide led the miner to declare force majeure. It restarted production from two parts of the copper mine in late October (the Deep Mill Level Zone and Big Gossan) and plans to ramp up at the Grasberg Block Cave underground mine in the second quarter of 2026. Freeport expects Grasberg to produce about one billion pounds of copper and nearly one million ounces of gold in 2026. That's roughly 10% lower than what the company estimated in September following the incident.

The partial restart at Grasberg will help to ease supply challenges for smelters facing feedstock shortages. Grasberg is the world's second-largest copper mine, contributing around 4% of global production.

Copper supply has been hit by a wave of disruptions this year. The disruption at Grasberg has added to the already high number of supply problems this year, including flooding at the Kamoa-Kakula mine in the Democratic Republic of the Congo (DRC) in May and an accident at the El Teniente mine in Chile in July.

Data from China's National Bureau of Statistics (NBS) show that refined copper output rose 8.9% year on year to 1.204mt in October, primarily driven by stronger ore purchases. In other metals, zinc output rose 15.7% YoY to record highs of 665kt, as smelters benefited from higher fees and improved ore supply, whereas lead production decreased 2.4% YoY to 645kt for the period.

The USDA announced further export sales of US soybeans to China for the 2025/26 marketing year. China has bought a further 792k tonnes of US soybeans, according to the USDA, which takes total purchases since October to a little over 1m tonnes. However, the pace will need to pick up if China is to buy 12m tonnes of soybeans before the end of the year. The number was mentioned by the US following talks between President Trump and President Xi. However, US soybeans are more expensive than the Brazilian supply. With estimates for yet another record harvest from Brazil next season, competition from Brazil will likely remain fierce.

Understanding what is xrp doesn’t have to be complicated. XRP is a digital asset built for fast, low-cost cross-border transactions—designed to solve the slow and expensive system banks rely on today. This guide explains XRP in plain English, covering how it works, what it’s used for, and key points beginners should know in 2025.

Understanding what is xrp doesn’t have to be complicated. XRP is a digital asset built for fast, low-cost cross-border transactions—designed to solve the slow and expensive system banks rely on today. This guide explains XRP in plain English, covering how it works, what it’s used for, and key points beginners should know in 2025.

For readers who want a fast answer, XRP is a digital asset designed for quick, low-cost international transfers. Instead of relying on slow banking rails, XRP settles transactions in seconds and works on a decentralized ledger. The table below highlights key facts for anyone asking what is xrp or xrp what is it in 2025.

| Feature | Quick Facts |

|---|---|

| Purpose | Fast, low-fee cross-border payments |

| Settlement Time | 3–5 seconds |

| Average Cost | Under $0.01 per transfer |

| Total Supply | 100 billion |

| Network | XRP Ledger (XRPL) |

| Main Use Case | Liquidity bridge and global remittances |

XRP is a digital currency that runs on the XRP Ledger, a decentralized settlement network created to move value globally in seconds. Unlike traditional systems or bank wires, the ledger processes thousands of transactions without relying on mining. Many beginners searching what is xrp crypto or what is ripple xrp are simply trying to understand why this asset exists and how it works in practice.

Many new users confuse XRP with Ripple, the private company that develops payment solutions, and the XRP Ledger, the underlying open-source network. A simple way to understand the difference is: Ripple builds payment software, the XRP Ledger processes transactions, and XRP is the asset moved across that ledger. This clarification helps readers who ask what is xrp coin or what is xrp used for.

| Item | What It Is | Purpose |

|---|---|---|

| XRP | Digital asset | Transfers value quickly and cheaply |

| Ripple | Technology company | Builds payment and liquidity products |

| XRP Ledger | Open-source blockchain | Records and validates transactions |

XRP was created to solve a real financial problem: slow and expensive cross-border payments. Instead of money passing through multiple banks, XRP allows value to move almost instantly. People who look up what is xrp stock or the future of xrp often want to understand its real purpose before considering its long-term potential.

Traditional SWIFT transfers rely on correspondent banks, locked liquidity, and manual reconciliation. This system can take several days and cost significant fees. XRP acts as a bridge asset, letting institutions source liquidity on demand and remove the need for prefunded accounts. This is one of the strongest answers to what is xrp used for and why it matters.

Bitcoin functions as a store of value, while XRP focuses on efficient payments. Bitcoin settles in minutes and depends on mining, whereas the XRP Ledger confirms transactions in seconds using a unique consensus model. For readers comparing digital assets and asking what is xrp crypto or how it differs from bitcoin, the key point is that each serves a different role in the market.

XRP was designed to move value across borders within seconds. Instead of relying on multiple correspondent banks, the XRP Ledger processes transactions in a simple, streamlined flow. This helps beginners who search xrp what is it or what is ripple xrp understand how the asset functions in practice.

| Stage | Description |

|---|---|

| Initiation | User or institution requests a transfer |

| Ledger Validation | Trusted validators check and approve the transaction |

| Settlement | Transfer finalizes on the ledger within seconds |

| Cost | Typically less than $0.01 per transaction |

This simple structure is why XRP is often mentioned when people ask what is xrp used for or why it performs differently from traditional payment rails.

The XRP Ledger does not rely on mining or staking. Instead, it uses a consensus model where independent validators agree on transaction order and legitimacy. This design keeps the network fast and energy efficient. For readers comparing what is xrp crypto to Bitcoin or other networks, this mechanism is a major difference.

The result is a network optimized for payments, which helps explain what is the future of xrp in industries needing speed and reliability.

Everyday users can use XRP in several practical ways. It offers faster transfers than traditional banking and lower fees than many digital assets. These points often come up when people search what is xrp coin or what is xrp crypto.

While XRP is not designed as a daily spending currency, it remains useful for fast value transfer and remittances.

Banks primarily use XRP as a bridge asset to source liquidity on demand. This removes the need for prefunded Nostro accounts and helps reduce cross-border settlement time. Understanding this institutional usage is important for readers exploring what is ripple xrp or what is xrp used for in global finance.

Several companies and financial platforms use or test XRP and the XRP Ledger for payments. These examples help clarify what is xrp in real economic activity, beyond trading or speculation.

| Company | Country | How They Use XRP |

|---|---|---|

| Tranglo | Malaysia | ODL-based remittance settlement |

| SentBe | South Korea | Low-cost cross-border transfers |

| SBI Remit | Japan | Remittance payments using XRP liquidity |

These cases demonstrate how XRP moves from theory to real-world usage, a key point for readers assessing what is xrp or what is the future of xrp.

The regulatory history of XRP plays a major role in evaluating its safety. In 2020, the U.S. SEC argued that Ripple sold XRP as an unregistered security. The case caused uncertainty, especially for beginners searching what is xrp crypto or trying to understand how regulation affects digital assets.

By 2025, the market views XRP as operating with clearer classification than in previous years, though full regulatory certainty is still developing. This context is important for anyone asking what is xrp used for or what is the future of xrp in the U.S. market.

Evaluating the strengths and weaknesses of XRP helps investors make informed decisions. These factors matter whether someone is exploring what is xrp stock, what is ripple xrp, or how XRP compares to other digital currencies.

| Pros | Cons |

|---|---|

| Fast settlement within seconds | Regulatory uncertainty still exists |

| Low cost per transaction | Ripple holds a significant portion of supply |

| Energy-efficient consensus model | Centralization concerns from some users |

| Used by global payment partners | Price volatility like other digital assets |

Before buying XRP, investors should evaluate several practical factors, including utility, long-term demand, and adoption trends. These details help people searching xrp what is it or what is xrp coin understand the asset’s strengths and limitations.

What XRP Is NOT Designed For: Another key consideration is understanding what XRP is not meant to do. It is not designed to replace Bitcoin as a store of value, not a stablecoin, and not built as a universal currency for everyday consumer spending. It also is not a token for decentralized app ecosystems. Misunderstanding its intended purpose can lead to unrealistic expectations about what is the future of xrp or its potential market role.

Like any digital asset, XRP carries risks that investors should consider seriously. These concerns are relevant to users exploring what is xrp or how XRP fits within the broader crypto market.

Understanding these risks helps investors make informed decisions rather than relying on overly optimistic assumptions about what is the future of xrp.

Users can buy XRP on major exchanges that support the asset. The basic process includes creating an account, completing verification, depositing funds, and purchasing XRP. Some platforms allow bank transfers, while others support card payments or stablecoin pairs.

XRP is used as a bridge asset for fast international transfers, enabling institutions to source liquidity on demand. Payment companies use it to settle remittances, reduce costs, and improve transparency. For everyday users, XRP supports quick asset transfers between exchanges and low-cost cross-border transactions.

XRP’s long-term outlook depends on adoption, regulatory clarity, and its role in global payments. Many investors researching what is the future of xrp want to understand whether institutions will continue integrating XRP for settlement and liquidity bridging. As payment corridors expand and more financial firms explore blockchain-based solutions, XRP may remain relevant in specific payment use cases.

Understanding what is xrp helps new users see why the asset was created and how it fits into modern payment systems. XRP offers fast settlement, low fees, and real-world adoption in remittances and institutional liquidity. While risks remain, informed users can evaluate XRP’s potential based on utility, regulation, and long-term market trends.

US President Donald Trump gave Saudi Arabia's crown prince a lavish reception in Washington, offering a defense agreement that includes cutting-edge warplanes and absolving him of the murder of an American journalist.

Less clear was what Trump got in return.

The US leader greeted Mohammed bin Salman with a dozen flag-carrying soldiers on horseback, a Marine Corps band playing from the White House balcony and a flyover by the F-35 fighter jets that the Saudis have long coveted. The presidency later said Trump and the crown prince signed a defense cooperation pact, though details were scarce, and agreed to formalize negotiations on help with a civil nuclear program.

The pomp matched that which greeted Trump on his visit to Saudi Arabia earlier this year. In exchange, Trump got a vague promise for the Saudis to invest as much as $1 trillion in the US — up from a previous pledge of $600 billion. That adds to trillions of dollars in similar pledges that Trump has received in trade deals with other partners, and which experts say may never materialize.

It was a victory for the crown prince, who has sought to repair and deepen ties with the US while using closer relations with China as leverage. Trump repeatedly praised MBS, as Saudi Arabia's 40-year-old de facto leader is known, calling him a "very good friend of mine" and saying he'd done incredible things "in terms of human rights and everything else."

"I do think it's lopsided," said Frederic Wehrey, a former Air Force officer who is a senior fellow in the Middle East program at the Carnegie Endowment for International Peace. "The US is surrendering enormous leverage here by giving up so much, so quickly."

In addition to the sale of F-35 fighter jets, the US agreed to green-light the first deliveries of advanced artificial intelligence chips to a Saudi Arabian firm, according to people familiar with the deal. That came despite US national security concerns about economic ties between Saudi Arabia and China.

Just as important, Trump offered Prince Mohammed's image a much-needed rehabilitation in the seven years since the killing of commentator Jamal Khashoggi. A US intelligence report concluded that MBS authorized the killing of the Saudi insider turned Washington Post columnist, who was dismembered inside the Saudi consulate in Istanbul by a team that included officers of the prince's protective detail.

"He knew nothing about it, and we can leave it at that," Trump said, criticizing a journalist who asked about it as "insubordinate."

Live Q&A: What the MBS-Trump Talks Mean For Oil, Tech and Gaza

The Khashoggi assassination — as well as civilian casualties as a result of Saudi Arabia's war in Yemen — hung over US-Saudi relations for years, including in the second half of Trump's first term. Former President Joe Biden called MBS a "pariah," though he later softened his tone and started negotiations on a sweeping defense pact.

To be sure, the lush pageantry of the Oval Office meeting obscured the scarcity of hard details and timeline on some of the agreements. While a fact sheet was released laying out the broad framework of deals, there was no signing ceremony, and negotiations beforehand had been fraught.

While a potential sale of marquee warplanes and oil-fueled investment pledges helped bolster the impression of a much closer US-Saudi relationship, Trump was unable to get Saudi Arabia to normalize ties with Israel by signing onto the Abraham Accords he's championed since his first term. And Saudi Arabia did not — at least, as of yet — obtain a mutual defense pact similar to that of fellow Gulf state Qatar.

"The fact he was able to come to Washington and to be received at the White House was a win for him," said Abdullah Alaoudh, a Washington-based Saudi human rights advocate. "But the trip so far has failed on a strategic level."

As with many of the initial announcements on deals that Trump reaches with partners, it wasn't immediately clear how fast Saudi Arabia will be able to reap the benefits of US promises. The pledge to sell F-35s will kickstart a long negotiating process that likely won't see planes delivered for several years — if ever. National security officials in Washington are wary about the technology being shared elsewhere, particularly with Beijing.

While the announcements on Tuesday allowed both leaders to claim wins, the biggest deal between the two sides — the complex security and diplomatic agreement that requires the cooperation of the US, Saudi Arabia and Israel — may still take years.

The Saudis envision a deal that would see the US offer Senate-ratified security guarantees to the kingdom, in return for Riyadh normalizing diplomatic ties with Israel.

Given the devastation caused by Israel's war in Gaza, Saudi Arabia says normalization is also conditional on concrete steps toward Palestinian statehood.

"The big thing the Saudis want is a mutual defense treaty and that's only going to be available if there's a whole packaged deal involving normalization," said Michael Ratney, who was the US ambassador to Saudi Arabia during the Biden administration and is now at the Center for Strategic and International Studies.

Khashoggi's murder was "a horrific incident," he said. "But even the Biden administration sort of figured that as horrible as it was, it can't be a reason not to pursue things where we have fundamental national security interests."

Bank Indonesia's balancing act between stability and growth has lately led to more surprises than signals for markets, keeping investors on edge ahead of Wednesday's interest rate decision.

The central bank has spurned market expectations at half of its 10 policy meetings so far this year, including its decision last month to maintain the key rate. In January and September, BI defied nearly all analyst forecasts by cutting rates.

Bank of America Corp. zeroed in on the unpredictability in a Nov. 7 note reviewing several years of rate decisions. The central bank surprised three times in 2018, and at most twice in other years, it said.

"When global economic policy uncertainty is high, less predictable central bank decisions could potentially weigh further on investor sentiment," said Euben Paracuelles, a Nomura Holdings Inc. economist who uses his own daily gauge of external risks such as the US dollar index, US Treasury yields and market volatility to assess BI's likely response.

Analysts largely expect BI to pause yet again on Wednesday to avoid further eroding support for the rupiah, the worst-performing currency in Asia this year. A Bloomberg survey shows 28 of 33 economists seeing the benchmark BI-Rate staying at 4.75%, while the rest predict a 25-basis-point cut.

Once focused narrowly on maintaining rupiah and price stability, BI's mandate was formally expanded in late 2022 to also include supporting sustainable growth. Balancing these responsibilities has become tougher in the face of global economic turbulence and the need to align closely with President Prabowo Subianto's growth agenda.

"BI has had to pivot quickly between supporting growth and defending rupiah stability, resulting in reactive rather than pre-signaled moves, complicating market alignment with forward guidance," said Krystal Tan, an economist at Australia & New Zealand Banking Group Ltd.

The rupiah has dropped 3.8% against the dollar this year, while neighboring Malaysia and Thailand have seen their currencies gain by at least 5%.

BI, like other central banks including the Federal Reserve, is under pressure to support government efforts to accelerate economic growth.

In the region, the Bank of Thailand and the Bangko Sentral ng Pilipinas have delivered surprises in 40% of their rate meetings this year as monetary authorities loosen policy to differing degrees, according to Oversea-Chinese Banking Corp. economist Lavanya Venkateswaran.

BI will likely cut by a quarter-point on Wednesday, she said, adding that its focus on growth has been "prudent" given well-managed inflation.

"The path for lower rates was well signaled, but the timing of the cuts has been a close call given the volatility in currency moves," said Venkateswaran. BI, which holds policy meetings every month, also has more wiggle room in terms of timing, she said.

Some investors remain wary of the possibility BI couls its policy stance again in the near term, BofA Securities analysts Kai Wei Ang and Rahul Bajoria wrote in their report. Even so, softer domestic demand and a slowdown in third-quarter growth mean BI is still expected to keep an easing bias.

Governor Perry Warjiyo on Nov. 12 slightly raised BI's forecast for 2025 growth to above the midpoint of 4.7% to 5.5%, up from 4.6% to 5.4%. But he also reiterated that more rate cuts should be expected through 2026, though the timing and scale of easing will hinge on currency stability and inflation risks.

Even if BI thinks the economy needs a boost, it may not be through a rate cut. When he held rates in October, Warjiyo announced measures aimed at getting banks to pass on lower borrowing costs to their customers.

Nomura expects BI to stand pat on Wednesday, citing the central bank's increased vigilance over still-elevated external risks. The rupiah weakened by 0.7% against the dollar this month as foreign capital flight intensified, erasing all of this year's inflows into government bonds.

The central bank also needs to keep an eye on inflation. Volatile food prices rose 6.6% in October compared to the year before, helping drive the headline inflation rate to its highest level in 18 months.

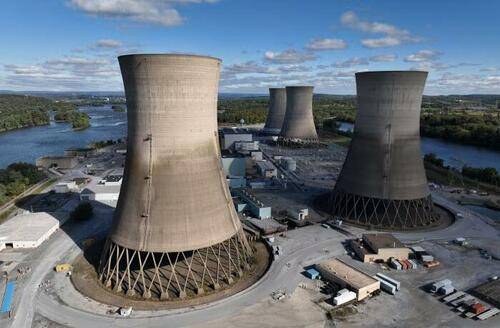

One week ago we said that "hundreds of billions" of dollars are about to be loaned out to nuclear projects by the US government. Well, the first billion is about to be wired.

The Wall Street Journal reports Constellation Energy has secured a $1 billion federal loan from the Energy Department's Loan Programs Office (LPO) to restart the Unit 1 reactor at the Three Mile Island reactor plant in Pennsylvania, recently renamed the Crane Clean Energy Center. Constellation has said it would pay about $1.6 billion to restart the plant in 2027.

The plant's Unit 2 reactor infamously suffered a partial meltdown in the 1970s, but Unit 1 continued to operate without issue for decades until it was shut down in 2019. The reactor was shuttered due to its inability to compete economically with cheap natural gas, as the company notes "before it was prematurely shuttered due to poor economics, this plant was among the safest and most reliable nuclear plants on the grid".

Constellation announced the intention to restart Unit 1 after Microsoft signed a $16 billion, 20-year offtake agreement in an effort to secure a carbon-free source of reliable energy for their data centers.

Energy Wright said Three Mile Island will add around 800 megawatts of power generation to the grid. Wright added that "constellation's restart of a nuclear power plant in Pennsylvania will provide affordable, reliable, and secure energy to Americans across the Mid-Atlantic region. It will also help ensure America has the energy it needs to grow its domestic manufacturing base and win the AI race."

WSJ notes "the deal calls for Constellation to revive the plant's undamaged reactor, which was too costly to run and closed in 2019. The power generated will be sold to Microsoft under a 20-year deal. The tech industry has a nearly insatiable demand for 24-hour-a-day power for AI data centers."

The 835 MW reactor produces enough power for approximately 800,000 homes and will provide reliable and affordable baseload power to the PJM Interconnection region. Along with clean energy, the project will strengthen grid reliability and create over 600 jobs.

Thomas Hochman, Director of Energy & Infrastructure Policy with the Foundation for American Innovation, notes multiple important points with the latest closed LPO deal, in particular that it's "it's really the first LPO loan to tackle the issue of AI-driven load growth".

He notes that it's a novel construct between a technology firm and an energy developer and represents the tech sector's continued move into the infrastructure space. He also importantly point salad, but this is "not a behind-the-meter deal. The electrons from Three Mile Island will flow directly into PJM, benefitting ratepayers and adding extra reserve margin to the grid."

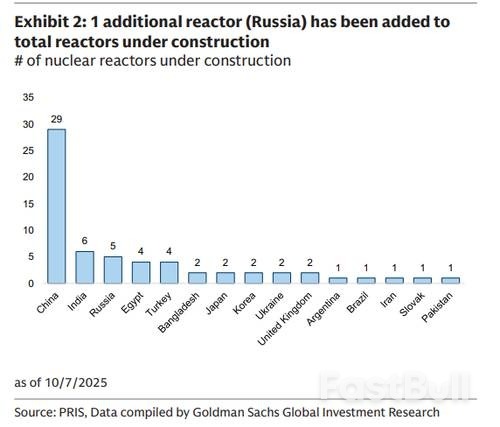

As for today's loan, it's just the first of many in a space we expect to see a flood of capital...

... as the US scrambles to catch up to China's massive nuclear head start.

Cryptocurrency markets experienced a significant shift today as the Bitcoin price fell below the crucial $92,000 threshold. According to Bitcoin World market monitoring, BTC is currently trading at $91,982.99 on the Binance USDT market, marking a notable decline that has caught the attention of investors worldwide.

The recent Bitcoin price drop represents a substantial market correction that could signal changing investor sentiment. When the Bitcoin price experiences such movements, it often reflects broader market trends and investor confidence levels. This particular decline below $92,000 suggests that traders are reacting to various market factors that we'll explore in detail.

Market analysts are closely watching this Bitcoin price development because it represents a key psychological barrier for investors. The $92,000 level had previously served as an important support zone, and breaking below it indicates potential further volatility ahead.

Several elements contribute to the current Bitcoin price situation. Understanding these factors helps investors make informed decisions about their cryptocurrency portfolios.

The Bitcoin price often serves as a barometer for the entire cryptocurrency market. Therefore, when we see significant movements in Bitcoin valuation, other digital assets typically follow similar patterns.

Experienced cryptocurrency traders understand that Bitcoin price fluctuations are normal market behavior. However, sudden drops like today's movement require careful consideration and strategic thinking.

For long-term investors, this Bitcoin price correction might present buying opportunities. Meanwhile, short-term traders need to reassess their positions and risk management strategies. The key is to avoid emotional decisions and instead rely on solid market analysis.

Remember that the Bitcoin price has historically recovered from similar corrections. Market cycles are inherent to cryptocurrency investing, and understanding these patterns can help navigate volatile periods.

Looking ahead, market watchers will monitor whether the Bitcoin price stabilizes or continues its downward trajectory. Several indicators suggest potential support levels that could halt further declines.

The current Bitcoin price situation underscores the importance of staying informed and maintaining a balanced perspective on market movements.

Oil steadied as traders weighed a report showing rising US stockpiles against concerns about the fallout from sanctions on Russia.

West Texas Intermediate traded below $61 a barrel, after gaining more than 1% on Tuesday, when Brent closed near $65. The industry-funded American Petroleum Institute reported a 4.4 million barrel increase in US crude inventories, as well as builds in products. That would take oil inventories to the highest in more than five months, if confirmed by official data.

US sanctions against Russian producers Rosneft PJSC and Lukoil PJSC are set to kick in within days, part of efforts to raise the pressure against Moscow to end the war in Ukraine. Ahead of that, some major Asian buyers have paused at least some purchases, and diesel markets have strengthened in Europe.

Oil has lost ground this year, including a run of three monthly declines in the period to October, on concern that worldwide supplies will top demand. The International Energy Agency has forecast a record glut next year, driven by higher output from OPEC+ as well as nations outside the cartel.

In a sign of burgeoning supplies, the amount of crude being carried on tankers hit another high, with the looming US sanctions deadline bolstering traders' attention on the volumes. Almost 1.4 billion barrels were being hauled to destinations or sitting in floating storage last week, according to Vortexa Ltd.

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up