Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

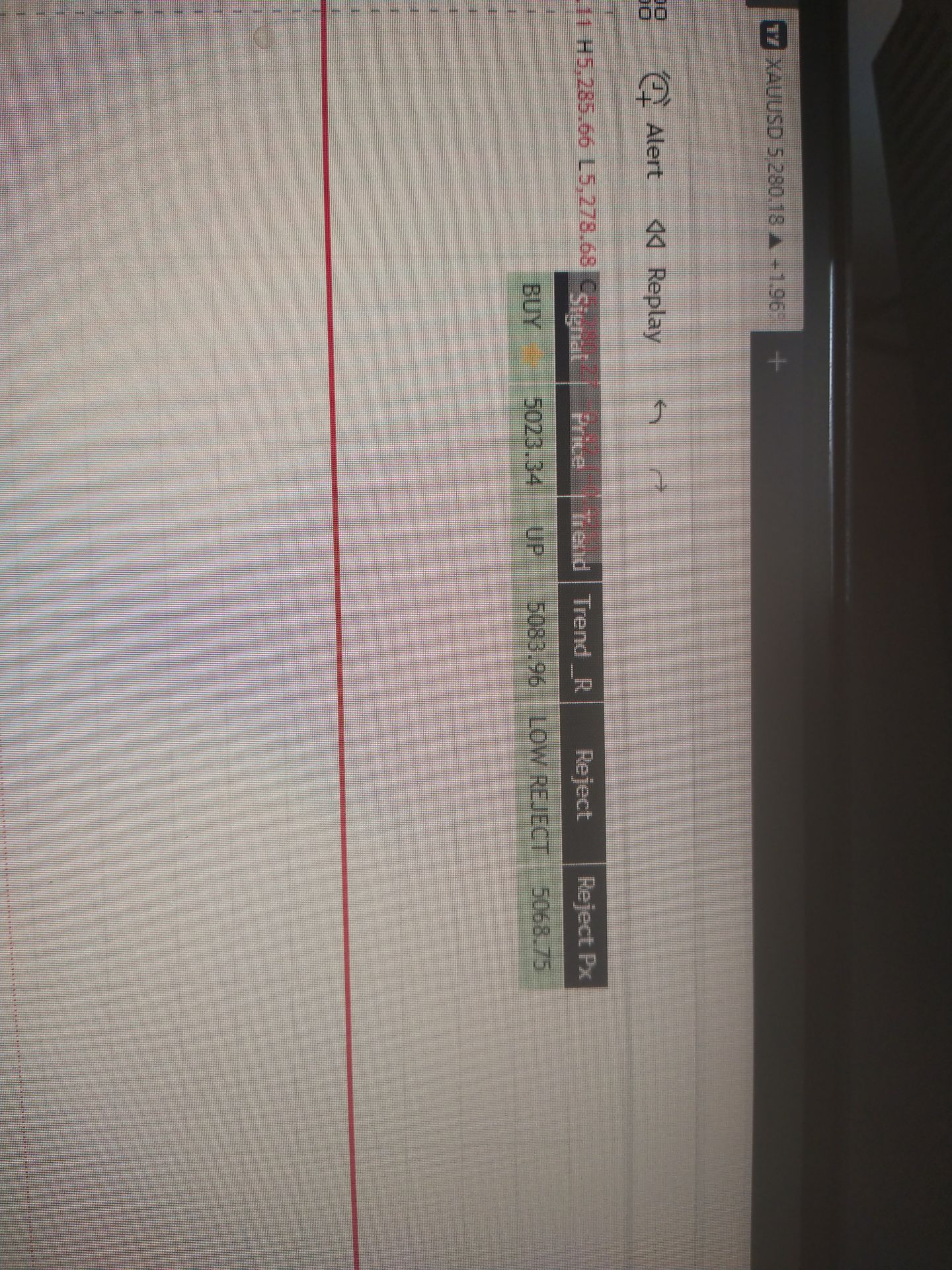

Signal Accounts for Members

All Signal Accounts

All Contests

U.S. 2-Year Note Auction Avg. Yield

U.S. 2-Year Note Auction Avg. YieldA:--

F: --

P: --

U.K. BRC Shop Price Index YoY (Jan)

U.K. BRC Shop Price Index YoY (Jan)A:--

F: --

P: --

China, Mainland Industrial Profit YoY (YTD) (Dec)

China, Mainland Industrial Profit YoY (YTD) (Dec)A:--

F: --

P: --

Germany 2-Year Schatz Auction Avg. Yield

Germany 2-Year Schatz Auction Avg. YieldA:--

F: --

P: --

Mexico Trade Balance (Dec)

Mexico Trade Balance (Dec)A:--

F: --

P: --

U.S. Weekly Redbook Index YoY

U.S. Weekly Redbook Index YoYA:--

F: --

P: --

U.S. S&P/CS 20-City Home Price Index YoY (Not SA) (Nov)

U.S. S&P/CS 20-City Home Price Index YoY (Not SA) (Nov)A:--

F: --

P: --

U.S. S&P/CS 20-City Home Price Index MoM (SA) (Nov)

U.S. S&P/CS 20-City Home Price Index MoM (SA) (Nov)A:--

F: --

U.S. FHFA House Price Index MoM (Nov)

U.S. FHFA House Price Index MoM (Nov)A:--

F: --

P: --

U.S. FHFA House Price Index (Nov)

U.S. FHFA House Price Index (Nov)A:--

F: --

P: --

U.S. FHFA House Price Index YoY (Nov)

U.S. FHFA House Price Index YoY (Nov)A:--

F: --

U.S. S&P/CS 10-City Home Price Index YoY (Nov)

U.S. S&P/CS 10-City Home Price Index YoY (Nov)A:--

F: --

P: --

U.S. S&P/CS 10-City Home Price Index MoM (Not SA) (Nov)

U.S. S&P/CS 10-City Home Price Index MoM (Not SA) (Nov)A:--

F: --

P: --

U.S. S&P/CS 20-City Home Price Index (Not SA) (Nov)

U.S. S&P/CS 20-City Home Price Index (Not SA) (Nov)A:--

F: --

P: --

U.S. S&P/CS 20-City Home Price Index MoM (Not SA) (Nov)

U.S. S&P/CS 20-City Home Price Index MoM (Not SA) (Nov)A:--

F: --

P: --

U.S. Richmond Fed Manufacturing Composite Index (Jan)

U.S. Richmond Fed Manufacturing Composite Index (Jan)A:--

F: --

P: --

U.S. Conference Board Present Situation Index (Jan)

U.S. Conference Board Present Situation Index (Jan)A:--

F: --

P: --

U.S. Conference Board Consumer Expectations Index (Jan)

U.S. Conference Board Consumer Expectations Index (Jan)A:--

F: --

P: --

U.S. Richmond Fed Manufacturing Shipments Index (Jan)

U.S. Richmond Fed Manufacturing Shipments Index (Jan)A:--

F: --

P: --

U.S. Richmond Fed Services Revenue Index (Jan)

U.S. Richmond Fed Services Revenue Index (Jan)A:--

F: --

P: --

U.S. Conference Board Consumer Confidence Index (Jan)

U.S. Conference Board Consumer Confidence Index (Jan)A:--

F: --

U.S. 5-Year Note Auction Avg. Yield

U.S. 5-Year Note Auction Avg. YieldA:--

F: --

P: --

U.S. API Weekly Refined Oil Stocks

U.S. API Weekly Refined Oil StocksA:--

F: --

P: --

U.S. API Weekly Crude Oil Stocks

U.S. API Weekly Crude Oil StocksA:--

F: --

P: --

U.S. API Weekly Gasoline Stocks

U.S. API Weekly Gasoline StocksA:--

F: --

P: --

U.S. API Weekly Cushing Crude Oil Stocks

U.S. API Weekly Cushing Crude Oil StocksA:--

F: --

P: --

Australia RBA Trimmed Mean CPI YoY (Q4)

Australia RBA Trimmed Mean CPI YoY (Q4)A:--

F: --

P: --

Australia CPI YoY (Q4)

Australia CPI YoY (Q4)A:--

F: --

P: --

Australia CPI QoQ (Q4)

Australia CPI QoQ (Q4)A:--

F: --

P: --

Germany GfK Consumer Confidence Index (SA) (Feb)

Germany GfK Consumer Confidence Index (SA) (Feb)A:--

F: --

P: --

Germany 10-Year Bund Auction Avg. Yield

Germany 10-Year Bund Auction Avg. Yield--

F: --

P: --

India Industrial Production Index YoY (Dec)

India Industrial Production Index YoY (Dec)--

F: --

P: --

India Manufacturing Output MoM (Dec)

India Manufacturing Output MoM (Dec)--

F: --

P: --

U.S. MBA Mortgage Application Activity Index WoW

U.S. MBA Mortgage Application Activity Index WoW--

F: --

P: --

Canada Overnight Target Rate

Canada Overnight Target Rate--

F: --

P: --

BOC Monetary Policy Report

BOC Monetary Policy Report U.S. EIA Weekly Crude Stocks Change

U.S. EIA Weekly Crude Stocks Change--

F: --

P: --

U.S. EIA Weekly Cushing, Oklahoma Crude Oil Stocks Change

U.S. EIA Weekly Cushing, Oklahoma Crude Oil Stocks Change--

F: --

P: --

U.S. EIA Weekly Crude Demand Projected by Production

U.S. EIA Weekly Crude Demand Projected by Production--

F: --

P: --

U.S. EIA Weekly Crude Oil Imports Changes

U.S. EIA Weekly Crude Oil Imports Changes--

F: --

P: --

U.S. EIA Weekly Heating Oil Stock Changes

U.S. EIA Weekly Heating Oil Stock Changes--

F: --

P: --

U.S. EIA Weekly Gasoline Stocks Change

U.S. EIA Weekly Gasoline Stocks Change--

F: --

P: --

BOC Press Conference

BOC Press Conference Russia PPI MoM (Dec)

Russia PPI MoM (Dec)--

F: --

P: --

Russia PPI YoY (Dec)

Russia PPI YoY (Dec)--

F: --

P: --

U.S. Target Federal Funds Rate Lower Limit (Overnight Reverse Repo Rate)

U.S. Target Federal Funds Rate Lower Limit (Overnight Reverse Repo Rate)--

F: --

P: --

U.S. Interest Rate On Reserve Balances

U.S. Interest Rate On Reserve Balances--

F: --

P: --

U.S. Federal Funds Rate Target

U.S. Federal Funds Rate Target--

F: --

P: --

U.S. Target Federal Funds Rate Upper Limit (Excess Reserves Ratio)

U.S. Target Federal Funds Rate Upper Limit (Excess Reserves Ratio)--

F: --

P: --

FOMC Statement

FOMC Statement FOMC Press Conference

FOMC Press Conference Brazil Selic Interest Rate

Brazil Selic Interest Rate--

F: --

P: --

Australia Import Price Index YoY (Q4)

Australia Import Price Index YoY (Q4)--

F: --

P: --

Japan Household Consumer Confidence Index (Jan)

Japan Household Consumer Confidence Index (Jan)--

F: --

P: --

Turkey Economic Sentiment Indicator (Jan)

Turkey Economic Sentiment Indicator (Jan)--

F: --

P: --

Euro Zone M3 Money Supply (SA) (Dec)

Euro Zone M3 Money Supply (SA) (Dec)--

F: --

P: --

Euro Zone Private Sector Credit YoY (Dec)

Euro Zone Private Sector Credit YoY (Dec)--

F: --

P: --

Euro Zone M3 Money Supply YoY (Dec)

Euro Zone M3 Money Supply YoY (Dec)--

F: --

P: --

Euro Zone 3-Month M3 Money Supply YoY (Dec)

Euro Zone 3-Month M3 Money Supply YoY (Dec)--

F: --

P: --

South Africa PPI YoY (Dec)

South Africa PPI YoY (Dec)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

U.S. Q3 GDP revised up; U.S. PCE data meet expectations......

TikTok's Chinese owner, ByteDance, finalized a deal on Thursday to set up a majority American-owned joint venture company to avoid a U.S. ban on the popular social media app used by more than 200 million Americans.

The deal is a milestone for the short video app after years of battles that began in August 2020, when President Donald Trump first tried unsuccessfully to ban the app over national security concerns.

TikTok USDS Joint Venture LLC will secure U.S. user data, apps and the algorithm through data privacy and cybersecurity measures, the company said.

The agreement provides for American and global investors, including cloud computing giant Oracle, private equity group Silver Lake and Abu Dhabi-based MGX, to hold a stake of 80.1% in the new joint venture, while ByteDance will retain 19.9%.

Following its Q2 FY26 earnings release on 10 December, Oracle raised its FY2026 capital expenditure plans by $15bn to $50bn. At the same time, free cash flow deteriorated sharply, blowing out to around -$10bn, alongside an increased net debt position.

As a result, Oracle now carries a net leverage ratio, measured as net debt to EBITDA, close to a precarious 4x. This has placed considerable strain on the balance sheet and elevated investor concern around funding sustainability.

As a major strategic partner to OpenAI, Oracle sits at the heart of the global AI infrastructure expansion. Any sustained rise in market volatility or tightening in corporate bond and private credit markets would have meaningful implications for OpenAI's funding environment and, in turn, the returns Oracle can generate on its rapidly expanding base of invested capital.

Importantly, Oracle has increasingly become the poster child for perceived risk within the AI ecosystem.

Investor attention is firmly centred on the high execution risk associated with Oracle's aggressive data-centre expansion, the company's ability and cost to fund this growth through corporate debt markets, and the additional pressure this places on an already constrained balance sheet.

Concerns have been building around the risk of a future credit rating downgrade and the possibility that Oracle may ultimately need to raise additional capital through equity issuance. These risks sit uncomfortably alongside uncertainty over the returns that can be generated from such large-scale capital deployment.

It is therefore little surprise that options pricing implies a punchy +/-10.3% move in Oracle's share price on earnings day. This makes Oracle the stock with the highest expected earnings-day move across Pepperstone's US 24-hour CFD universe.

Oracle's management will be acutely aware of how sensitive the equity market is to any further increase in planned capex. Preserving the company's BBB credit rating will be a key priority if Oracle is to continue funding its expansion plans successfully in the debt markets.

Oracle's earnings are not just a risk or opportunity for traders in Oracle US 24-hour CFDs. The detail disclosed has the potential to resonate across the broader AI investable landscape, reinforcing the view that Oracle may be the most important US company to report earnings this quarter.

USD/JPY takes center stage on Friday, January 23, as markets await the Bank of Japan's monetary policy decision and quarterly outlook report.

Economists expect the BoJ to leave interest rates at 0.75%. However, the weaker Japanese yen has fueled uncertainty about the timing of further rate hikes, exposing the USD/JPY pair to potential volatility.

Ahead of the monetary policy decision, inflation and private sector PMI data gave insights into Japan's economy and price trends. Softer-than-expected inflation and a hotter Services PMI numbers increased fueled speculation about an H1 2026 BoJ rate hike.

While inflation cooled, Japan's Services PMI supported a bearish medium-term outlook for USD/JPY.

Below, I'll discuss the macro backdrop, the near-term price catalysts, and technical levels traders should closely watch.

Japan's annual inflation rate dropped from 2.9% in November to 2.1% in December, while 'core-core' inflation eased from 3% to 2.9%.

On the face of it, the December numbers are likely to reduce pressure on the BoJ to raise interest rates. However, the BoJ's concerns about a weaker yen driving import prices higher and the resulting erosion of household purchasing power remain a key factor.

Furthermore, economists expect Prime Minister Sanae Takaichi's fiscal policies to also push inflation higher, supporting a more hawkish BoJ rate path. The BoJ may indicate the need for multiple rate hikes to counter the risk of elevated inflation.

According to January's Reuters poll, conducted between January 6-13, 43% of economists expected a July rate hike, 27% a June hike, and just 8% an April hike.

Since the poll, speculation has intensified about an April hike, raising the prospect of multiple monetary policy adjustments in 2026. The BoJ's Quarterly Outlook Report and Governor Kazuo Ueda's press conference will reveal the Bank's policy stance. BoJ Governor Kazuo Ueda previously stated that rate hikes would continue if the economy and prices aligned with the Bank's projections.

A more aggressive BoJ rate path would support the bearish short- to medium-term outlook for USD/JPY. Despite the potential for a hawkish BoJ policy stance, the yen weakened against the dollar in response to the inflation data. USD/JPY briefly dropped to 158.385 before climbing to a high of 158.532 as the market's focus shifted to the private sector PMIs.

USDJPY – 5 Minute Chart – 230126

USDJPY – 5 Minute Chart – 230126The all-important S&P Global Japan Services PMI increased from 51.6 in December to 53.4 in January. Notably, the rate of job creation was the most marked since April 2019, while service providers increased their charges, suggesting higher consumer prices. The January PMI data will draw the BoJ's attention, supporting a more hawkish stance, contrasting with the Fed's dovish rate path.

Expectations of BoJ rate hikes and Fed rate cuts reaffirm the bearish medium- to longer-term price projections.

While the yen faces a potentially choppy session awaiting the BoJ's monetary policy decision and press conference, US economic data will influence bets on a June Fed rate cut.

Economists forecast the S&P Global US Services PMI to increase from 52.5 in December to 52.9 in January.

A higher headline PMI would indicate a pickup in economic momentum. The services sector contributes around 80% to the US GDP. However, traders should consider the employment and prices sub-components. Crucially, falling prices would support a more dovish Fed rate path, given that services sector inflation remains the key driver for headline and underlying inflation. A more dovish Fed rate path would weaken the US dollar, sending USD/JPY lower.

Other economic indicators include finalized consumer sentiment numbers. Barring a marked deviation from the preliminary figures, the Services PMI figures are likely to be key for USD/JPY.

Despite ongoing concerns about Japan's fiscal spending and debt-to-GDP, the expectation of multiple BoJ rate hikes and a new Fed Chair in favor of lower interest rates suggests a narrower US-Japan rate differential. These scenarios reaffirm the bearish medium-term outlook for USD/JPY.

For USD/JPY price trends, traders should consider technicals and monitor central bank and political headlines.

On the daily chart, USD/JPY trades comfortably above its 50-day and 200-day Exponential Moving Averages (EMAs), signaling bullish momentum. While technicals remain bullish, bearish fundamentals remain, countering the technicals. Despite recent gains, the pair sits below the January 14 high of 159.453.

A break below 157 would expose the 50-day EMA and the 155 support level. A sustained fall through the 50-day EMA would indicate a bearish near-term trend reversal, bringing the 200-day EMA into play. If breached, 150 would be the next key support level.

Significantly, a sustained fall through the EMAs would reaffirm the bearish medium-term price outlook.

USDJPY – Daily Chart – 230126 – EMAs

USDJPY – Daily Chart – 230126 – EMAsIn my view, expectations for hawkish BoJ policy outlook, potential yen intervention warnings, and expectations of Fed rate cuts support a negative price outlook. However, Japan's February election and US economic data will be key, given recent movements in the USD/JPY pair.

Furthermore, a hawkish BoJ neutral interest rate level (potentially 1.5%-2.5%) would signal multiple BoJ rate hikes and a narrower US-Japan interest rate differential. A narrower rate differential may trigger a yen carry unwind, as seen in mid-2024. A yen carry trade unwind would likely push USD/JPY toward 140 over the longer term.

However, upside risks to the bearish outlook include:

These factors would drive USD/JPY higher. However, the potential threat of yen interventions is likely to continue limiting the upside at the 160 level.

Read the full USD/JPY forecast, including chart setups and trade ideas.

In summary, the USD/JPY trends will hinge on Prime Minister Takaichi's election and fiscal spending goals, the BoJ's monetary policy outlook, and the Fed's rate path.

A higher neutral rate (1.5%-2.5%) would indicate a hawkish BoJ rate path, which would strengthen the yen. Meanwhile, Japan's upcoming election will be key for the near-term USD/JPY trends. The yen has weakened sharply since October, given Prime Minister Takaichi's fiscal and monetary policy stances. Additionally, a dovish Fed would signal narrower rate differentials, reinforcing the bearish medium-term outlook for USD/JPY.

A sharply stronger yen, triggering the unwinding of yen carry trades. A carry trade unwind would likely push USD/JPY toward 140 over the longer 6-12 month timeline.

European Union leaders are expressing cautious relief after Donald Trump backed away from threats over Greenland, a move that de-escalated a serious transatlantic standoff. At an emergency summit in Brussels, officials confirmed their desire to get a pivotal EU-US trade deal back on track but warned they remain prepared to act decisively against any future coercion.

The meeting was organized after the United States threatened steep tariffs and hinted at potential military action in Greenland. Following the US reversal, European Commission President Ursula von der Leyen credited the bloc's united front. "We were successful by being firm," she said, attributing Trump's decision to Europe’s resolve.

However, the incident has left deep scars on the relationship. EU foreign policy chief Kaja Kallas stated bluntly upon her arrival, "Transatlantic relations have definitely taken a big blow over the last week."

While the immediate crisis has subsided, top European figures made it clear that their trust in Washington has been eroded. The emergency summit did not result in concrete decisions, but the tone was one of wary optimism.

"Things are quietening down and we should welcome that," said French President Emmanuel Macron. However, he quickly added a note of caution. "We remain extremely vigilant and ready to use the instruments at our disposal should we find ourselves the target of threats again." Macron referenced the "bazooka" trade sanctions the EU had considered deploying.

This sentiment was echoed by European Council chief Antonio Costa, who affirmed that the EU "will defend itself, its member states, its citizens and its companies, against any form of coercion."

Most leaders agreed that the transatlantic partnership remains essential, but they now expect Washington to engage with respect. "Europe is not willing to junk 80 years of good transatlantic relations because of disagreements... we are willing to invest our time and energy in this," Kallas commented.

EU governments are now wary of another sudden shift from a president they increasingly see as unpredictable. One EU diplomat speaking on the condition of anonymity said the dynamic has fundamentally changed. "Trump crossed the Rubicon. He might do it again. There is no going back to what it was."

The diplomat added that the bloc must reduce its heavy reliance on the United States across multiple sectors. "We need to try to keep him (Trump) close while working on becoming more independent from the US. It is a process, probably a long one."

Danish Prime Minister Mette Frederiksen emphasized that while she is open to discussing security cooperation in Greenland, it must be based on mutual respect for sovereignty. "We have to work together respectfully without threatening each other," she said.

The episode highlights a core vulnerability for the European Union. After decades of relying on Washington for security under the NATO alliance, the bloc lacks the independent intelligence, transport, missile defense, and production capabilities to defend itself from a major threat like a potential Russian attack. This gives the United States substantial leverage.

Economically, the US is Europe's largest trading partner. This exposes the EU to Trump's tariff policies, which are used not only to address trade deficits but also to achieve other strategic objectives, as seen in the Greenland dispute.

A key challenge for the EU will be maintaining a united front. While all agree on the need for a common stance, historical ties and strategic priorities vary among member states.

"I still treat United States as our closest friend," said Lithuanian President Gitanas Nauseda, reflecting a perspective common in nations more exposed to Russian pressure.

Others took a more critical view. Poland's Prime Minister Donald Tusk drew a sharp distinction between influence and intimidation. "It is important for... our partners in Washington to understand the difference between domination and leadership. Leadership is OK," Tusk noted. "Coercion is not a good method."

With the immediate threat of US tariffs averted, the focus returns to economic cooperation. EU officials had prepared a package of retaliatory tariffs on €93 billion (US$108.74 billion) of American imports that were set to activate on February 1.

Now that the US has withdrawn its threats, the European Parliament is expected to resume work on ratifying the transatlantic trade deal, according to its president, Roberta Metsola. However, the negotiations will now proceed under the shadow of a relationship that has been severely tested.

Gold notched another record high on Friday, while silver and platinum also extended gains to hit all-time peaks, powered by geopolitical and economic uncertainties, a weaker dollar and bets for U.S. Federal Reserve interest rate cuts.

* Spot gold was up 0.5% at $4,961.57 per ounce, as of 0057 GMT, after scaling a record $4,966.59 earlier in the day.

* U.S. gold futures for February delivery added 1.1% to $4,964.60 per ounce.

* EU leaders heaved a sigh of relief over U.S. President Donald Trump's U-turn on Greenland as they met for an emergency summit in Brussels late on Thursday while issuing a warning that they were ready to act if Trump was to threaten them again.

* Trump for his part said he had secured total and permanent U.S. access to Greenland in a deal with NATO, whose head said allies would have to step up their commitment to Arctic security to ward off threats from Russia and China.

* But the details of any agreement were unclear and Denmark insisted its sovereignty over the island was not up for discussion.

* U.S. consumer spending increased solidly in November and October, likely keeping the economy on track for a third straight quarter of strong growth, but the labor market is still stuck in what economists and policymakers have termed a "low-hiring, low-firing" state.

* The dollar index fell to a more than two-week low on Friday, making greenback-priced metals cheaper for overseas buyers.

* Markets still anticipate the Fed to deliver two quarter-percentage point rate cuts in the latter half of the year, raising non-yielding gold's appeal.

* Spot silver rose 0.9% to $97.01 an ounce, after hitting a record high of $97.44 earlier.

* Spot platinum gained 1.4% to $2,665.85 per ounce after hitting a record $2,684.43 earlier, while palladium edged 0.1% lower to $1,917.50.

DATA/EVENTS (GMT) | |

0700 | UK Retail Sales MM, YY Dec |

0700 | UK Retail Sales Ex-Fuel MM Dec |

0745 | France Business Climate Mfg, Overall Jan |

0815 | France HCOB Mfg, Svcs, Comp Flash PMIs Jan |

0830 | Germany HCOB Mfg, Svcs, Comp Flash PMIs Jan |

0900 | EU HCOB Mfg, Svcs, Comp Flash PMIs Jan |

0930 | UK HCOB Mfg, Svcs, Comp Flash PMIs Jan |

1445 | US S&P Global Mfg, Svcs, Comp PMIs Flash Jan |

1500 | US U Mich Sentiment Final Jan |

- | EU Consumer Confid. Flash Jan |

- | Japan JP BOJ Rate Decision Jan |

The United States has announced a sweeping 25% tariff on countries engaging in trade with Iran, a move set to escalate global economic and political tensions. President Donald Trump confirmed the policy on January 12, 2026, framing it as a measure to exert pressure on Tehran.

The new tariff directly targets Iran's key economic partners, including nations like China and India. Announced aboard Air Force One, the policy is designed to disrupt Iran's international trade relationships amidst ongoing geopolitical friction.

President Trump underscored the tariff's strategic purpose, stating that military action remains a possibility if deemed necessary. Financial sectors and trade compliance experts are now closely monitoring the situation for shifts in international economic alliances.

The most immediate consequence of the 25% tariff is the potential for major disruptions in global oil and commodity markets. The policy threatens to destabilize supply chains that rely on Iranian resources, creating uncertainty for its trading partners.

In response to the announcement, Iran has signaled its military readiness. Iranian Foreign Minister Abbas Araghchi stated, "We are not looking for war, but we are prepared for war. Even more prepared than the previous war." This comment highlights the heightened political stakes surrounding the new economic measures.

While traditional markets are bracing for impact, the cryptocurrency landscape has shown no direct reaction to the tariff news. Historically, US trade policies of this nature have had a negligible effect on digital asset prices, which operate largely outside conventional trade and finance systems.

Experts note that the primary effect of the tariffs will likely be on global trade strategies. The move could incentivize affected nations to forge alternative trade alliances to bypass the economic pressure from the United States.

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

Log In

Sign Up