Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

France 10-Year OAT Auction Avg. Yield

France 10-Year OAT Auction Avg. YieldA:--

F: --

P: --

Euro Zone Consumer Inflation Expectations (Dec)

Euro Zone Consumer Inflation Expectations (Dec)A:--

F: --

P: --

Euro Zone Unemployment Rate (Nov)

Euro Zone Unemployment Rate (Nov)A:--

F: --

P: --

Euro Zone PPI MoM (Nov)

Euro Zone PPI MoM (Nov)A:--

F: --

P: --

Euro Zone Selling Price Expectations (Dec)

Euro Zone Selling Price Expectations (Dec)A:--

F: --

P: --

Euro Zone PPI YoY (Nov)

Euro Zone PPI YoY (Nov)A:--

F: --

P: --

Euro Zone Industrial Climate Index (Dec)

Euro Zone Industrial Climate Index (Dec)A:--

F: --

P: --

Euro Zone Economic Sentiment Indicator (Dec)

Euro Zone Economic Sentiment Indicator (Dec)A:--

F: --

Euro Zone Services Sentiment Index (Dec)

Euro Zone Services Sentiment Index (Dec)A:--

F: --

Euro Zone Consumer Confidence Index Final (Dec)

Euro Zone Consumer Confidence Index Final (Dec)A:--

F: --

P: --

Mexico 12-Month Inflation (CPI) (Dec)

Mexico 12-Month Inflation (CPI) (Dec)A:--

F: --

P: --

Mexico Core CPI YoY (Dec)

Mexico Core CPI YoY (Dec)A:--

F: --

P: --

Mexico PPI YoY (Dec)

Mexico PPI YoY (Dec)A:--

F: --

P: --

Mexico CPI YoY (Dec)

Mexico CPI YoY (Dec)A:--

F: --

P: --

U.S. Challenger Job Cuts MoM (Dec)

U.S. Challenger Job Cuts MoM (Dec)A:--

F: --

P: --

U.S. Challenger Job Cuts (Dec)

U.S. Challenger Job Cuts (Dec)A:--

F: --

P: --

U.S. Challenger Job Cuts YoY (Dec)

U.S. Challenger Job Cuts YoY (Dec)A:--

F: --

P: --

U.S. Exports (Oct)

U.S. Exports (Oct)A:--

F: --

P: --

U.S. Trade Balance (Oct)

U.S. Trade Balance (Oct)A:--

F: --

U.S. Initial Jobless Claims 4-Week Avg. (SA)

U.S. Initial Jobless Claims 4-Week Avg. (SA)A:--

F: --

Canada Imports (SA) (Oct)

Canada Imports (SA) (Oct)A:--

F: --

U.S. Weekly Initial Jobless Claims (SA)

U.S. Weekly Initial Jobless Claims (SA)A:--

F: --

U.S. Weekly Continued Jobless Claims (SA)

U.S. Weekly Continued Jobless Claims (SA)A:--

F: --

Canada Exports (SA) (Oct)

Canada Exports (SA) (Oct)A:--

F: --

Canada Trade Balance (SA) (Oct)

Canada Trade Balance (SA) (Oct)A:--

F: --

U.S. Unit Labor Cost Prelim (SA) (Q3)

U.S. Unit Labor Cost Prelim (SA) (Q3)A:--

F: --

P: --

U.S. Wholesale Sales MoM (SA) (Oct)

U.S. Wholesale Sales MoM (SA) (Oct)A:--

F: --

P: --

U.S. EIA Weekly Natural Gas Stocks Change

U.S. EIA Weekly Natural Gas Stocks ChangeA:--

F: --

P: --

U.S. Consumer Credit (SA) (Nov)

U.S. Consumer Credit (SA) (Nov)A:--

F: --

U.S. Weekly Treasuries Held by Foreign Central Banks

U.S. Weekly Treasuries Held by Foreign Central BanksA:--

F: --

P: --

Japan Foreign Exchange Reserves (Dec)

Japan Foreign Exchange Reserves (Dec)--

F: --

P: --

China, Mainland CPI YoY (Dec)

China, Mainland CPI YoY (Dec)--

F: --

P: --

China, Mainland PPI YoY (Dec)

China, Mainland PPI YoY (Dec)--

F: --

P: --

China, Mainland CPI MoM (Dec)

China, Mainland CPI MoM (Dec)--

F: --

P: --

Japan Leading Indicators Prelim (Nov)

Japan Leading Indicators Prelim (Nov)--

F: --

P: --

Germany Industrial Output MoM (SA) (Nov)

Germany Industrial Output MoM (SA) (Nov)--

F: --

P: --

Germany Exports MoM (SA) (Nov)

Germany Exports MoM (SA) (Nov)--

F: --

France Industrial Output MoM (SA) (Nov)

France Industrial Output MoM (SA) (Nov)--

F: --

P: --

Italy Retail Sales MoM (SA) (Nov)

Italy Retail Sales MoM (SA) (Nov)--

F: --

P: --

Euro Zone Retail Sales MoM (Nov)

Euro Zone Retail Sales MoM (Nov)--

F: --

P: --

Euro Zone Retail Sales YoY (Nov)

Euro Zone Retail Sales YoY (Nov)--

F: --

P: --

Italy 12-Month BOT Auction Avg. Yield

Italy 12-Month BOT Auction Avg. Yield--

F: --

P: --

India Deposit Gowth YoY

India Deposit Gowth YoY--

F: --

P: --

Brazil IPCA Inflation Index YoY (Dec)

Brazil IPCA Inflation Index YoY (Dec)--

F: --

P: --

Mexico Industrial Output YoY (Nov)

Mexico Industrial Output YoY (Nov)--

F: --

P: --

Brazil CPI YoY (Dec)

Brazil CPI YoY (Dec)--

F: --

P: --

U.S. Building Permits Revised YoY (SA) (Sept)

U.S. Building Permits Revised YoY (SA) (Sept)--

F: --

P: --

U.S. Building Permits Revised MoM (SA) (Sept)

U.S. Building Permits Revised MoM (SA) (Sept)--

F: --

P: --

U.S. U6 Unemployment Rate (SA) (Dec)

U.S. U6 Unemployment Rate (SA) (Dec)--

F: --

P: --

U.S. Manufacturing Employment (SA) (Dec)

U.S. Manufacturing Employment (SA) (Dec)--

F: --

P: --

U.S. Labor Force Participation Rate (SA) (Dec)

U.S. Labor Force Participation Rate (SA) (Dec)--

F: --

P: --

U.S. Private Nonfarm Payrolls (SA) (Dec)

U.S. Private Nonfarm Payrolls (SA) (Dec)--

F: --

P: --

U.S. Unemployment Rate (SA) (Dec)

U.S. Unemployment Rate (SA) (Dec)--

F: --

P: --

U.S. Nonfarm Payrolls (SA) (Dec)

U.S. Nonfarm Payrolls (SA) (Dec)--

F: --

P: --

U.S. Average Hourly Wage YoY (Dec)

U.S. Average Hourly Wage YoY (Dec)--

F: --

P: --

Canada Full-time Employment (SA) (Dec)

Canada Full-time Employment (SA) (Dec)--

F: --

P: --

Canada Part-Time Employment (SA) (Dec)

Canada Part-Time Employment (SA) (Dec)--

F: --

P: --

Canada Unemployment Rate (SA) (Dec)

Canada Unemployment Rate (SA) (Dec)--

F: --

P: --

Canada Labor Force Participation Rate (SA) (Dec)

Canada Labor Force Participation Rate (SA) (Dec)--

F: --

P: --

Canada Employment (SA) (Dec)

Canada Employment (SA) (Dec)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

Venezuelan bonds are back in focus, with a potential post-Maduro $170 billion debt restructuring hinging on U.S. sanctions.

Venezuelan bonds are back in the spotlight after the January 3 seizure of President Nicolas Maduro by U.S. special forces, with markets now actively pricing in a potential, long-overdue debt restructuring.

The country's economy has been devastated by corruption, mismanagement, and severe underinvestment. U.S. sanctions intensified the crisis by cutting off access to foreign financing and choking off oil exports, the government's primary source of income.

Investors are now betting that a post-Maduro government could normalize relations with Washington, leading to the easing of sanctions and a new flow of foreign capital into Venezuela's vital oil sector. This optimism fuels hopes for a debt deal where creditors would forgive a portion of the country's roughly $170 billion in overseas obligations in exchange for a sustainable repayment plan. Analysts estimate the government and state oil company Petróleos de Venezuela SA (PDVSA) alone owe a combined $100 billion, including unpaid interest.

The outlook remains highly uncertain. While acting President Delcy Rodriguez has indicated a willingness to engage with Washington, it is unclear if Venezuela's Socialist establishment will support the deep policy reforms the U.S. Trump administration would likely require before lifting sanctions.

The sheer scale of the debt is staggering. The International Monetary Fund pegged Venezuela's debt-to-GDP ratio at 164% for 2024, a figure reminiscent of Greece just before its major 2012 restructuring. According to Citigroup Inc., this burden would need to be slashed to at least 85% to align with historical debt workouts and meet anticipated IMF conditions.

Price is also a major draw. Although Venezuelan bonds have more than doubled in value over the past year, they still trade at deeply distressed levels, attracting speculative traders. Some investors see further upside.

"These bonds are probably a better buy today at 40 than they were at 30 two business days ago," Altana Wealth founder Lee Robinson noted in early January.

Washington effectively controls access to global capital markets for Caracas. Sanctions imposed by the U.S. Treasury Department have been the single biggest barrier to restructuring Venezuela's defaulted bonds, as most transactions require a license from the Office of Foreign Assets Control (OFAC). Without this authorization, even preliminary discussions about a settlement are legally prohibited.

Any restructuring would necessitate issuing new bonds, an impossibility without sanctions relief. Furthermore, oil exports—essential for servicing any new debt—would need to flow freely, but the U.S. currently has a blockade on oil shipments from the nation.

Because the U.S. financial system is so central, these restrictions can freeze trading for nearly all investors. Major U.S. asset managers like Fidelity Investments, BlackRock Inc., and T. Rowe Price Group Inc. are among the debt holders. Much of the litigation and some of Venezuela's most valuable overseas assets also fall under U.S. jurisdiction.

Venezuela began a gradual slide into default in 2017, about two years before the U.S. cut ties with Maduro's government and barred American investors from buying the country's debt. In response, some bondholders, including Ashmore Group Plc and Grantham, Mayo, Van Otterloo & Co., formed a creditor group to prepare for negotiations.

A sovereign debt restructuring typically involves reducing the total amount owed, extending repayment deadlines, and swapping old bonds for new, more manageable ones. In recent cases like Ecuador and Argentina, collective action clauses streamlined the process by allowing a supermajority of bondholders to approve a deal binding on all parties.

Venezuela's situation is far more complex.

The country's liabilities are massive and its creditor base is highly fragmented. It includes not only bondholders but also bilateral lenders like China and entities holding arbitration awards and court judgments. These competing claims are governed by different legal frameworks, creating a tangled web of priorities.

Wall Street banks estimate Venezuela owes around $100 billion in unpaid foreign-currency bonds and interest. Citigroup puts the total external debt, including bilateral loans and other obligations, at approximately $169 billion. The complexity, combined with U.S. sanctions and ongoing creditor lawsuits to seize assets, makes a swift resolution unlikely. Pictet Asset Management anticipates a "very protracted" process that could take as long as three years, potentially mirroring Greece's drawn-out, multi-stage settlement in 2012.

A Potential Path Forward: Oil-Linked Warrants

Venezuela's ability to pay its debts will ultimately depend on how quickly its oil production can recover after a political transition and how much foreign investment returns. This uncertainty has led to proposals for creative financial solutions.

One such solution involves oil-linked warrants. These instruments would give creditors a share in the upside if Venezuela's oil output rebounds strongly, while providing the government with breathing room if the recovery is slower than expected. Similar to GDP-linked securities used in other restructurings, oil warrants could help bridge the gap between creditor demands and the government's need for flexibility.

For now, investors are closely watching who will lead Venezuela through a transition. Rodríguez, Maduro's former second-in-command, has been sworn in as acting president and has been in contact with U.S. Secretary of State Marco Rubio.

Under the constitution, Rodríguez can hold executive power for up to 90 days, with a possible extension. Her ability to balance U.S. demands against pressure from hard-liners within the regime will be a critical test. Money managers are also watching for any signs that Washington might ease sanctions and encourage U.S. energy companies to help rebuild the country's oil industry. Ultimately, the recovery value of the debt hinges on economic stabilization and oil output.

Despite the renewed optimism, investing in Venezuelan debt remains a highly speculative bet. The political and economic outlook is fluid, with little clarity on the timing or structure of a potential restructuring.

Recovery value estimates vary widely, from 35 to 60 cents on the dollar, and could be lower if a market-friendly outcome doesn't materialize. A key risk is how different types of debt will be ranked. If bonds issued by the state oil company PDVSA are not treated equally with sovereign debt, losses could differ sharply across various instruments.

Any restructuring would be one of the largest and most complex in modern history, likely taking years to complete. Litigation and competing legal claims could easily derail the process.

Beyond the debt talks, other risks loom:

• A rapid recovery in Venezuelan oil output could depress global crude prices, limiting revenue gains.

• Political uncertainty remains high, with questions about the durability of the Rodríguez presidency.

• After years of underinvestment, oil production may recover much more slowly than optimists hope.

In short, this trade is a bet not just on a successful debt deal, but on sustained political stability, deep policy reform, and a durable economic rebound. If any of those pillars crumble, Venezuela's revival—and the value of its debt—could unravel.

Four key OPEC+ nations have committed to deeper oil production cuts through the first half of 2026, a strategic move to address compliance issues and stabilize an oversupplied global market. The United Arab Emirates, Iraq, Kazakhstan, and Oman will collectively reduce output by 829,000 barrels per day (bpd) by June, a figure three times larger than their previous pledge.

This move follows an earlier OPEC+ decision to extend its voluntary cuts of 2.9 million bpd, keeping that volume off the market through the first half of the year. The renewed caution reflects growing concerns over market imbalances as robust production from non-OPEC countries continues to pressure prices.

The distribution of the new 829,000 bpd cut highlights a significant commitment from Kazakhstan, which will shoulder the majority of the reduction. The specific pledges through June are:

• Kazakhstan: Will cut 669,000 bpd, a substantial increase from its prior commitment of 131,000 bpd.

• Iraq: Will maintain its cut of 100,000 bpd.

• UAE: Will raise its reduction to 55,000 bpd from just 10,000 bpd.

• Oman: Will implement a cut of approximately 5,700 bpd.

The global oil market is expected to remain oversupplied in 2026, primarily driven by strong production growth from countries outside the OPEC+ alliance. The United States, Brazil, Canada, Guyana, and Argentina are poised to lead this supply increase as new projects launch and operational efficiencies improve.

U.S. crude output is projected to stay near record levels after reaching an all-time high of 13.87 million bpd in October. This strength is supported by consistent shale output and offshore growth in the Gulf of Mexico, which helps offset softer production in Texas.

On the demand side, growth in 2026 is forecasted to be modest and below historical averages. This slowdown is attributed to a tougher macroeconomic environment, advancements in vehicle efficiency, and the increasing adoption of electric vehicles in major economies.

These combined supply and demand dynamics have already led to periods of inventory accumulation in global markets, with visible stock increases reported across parts of Asia. The latest cuts from OPEC+ are a direct response to these challenging conditions as the group attempts to manage supply and support prices.

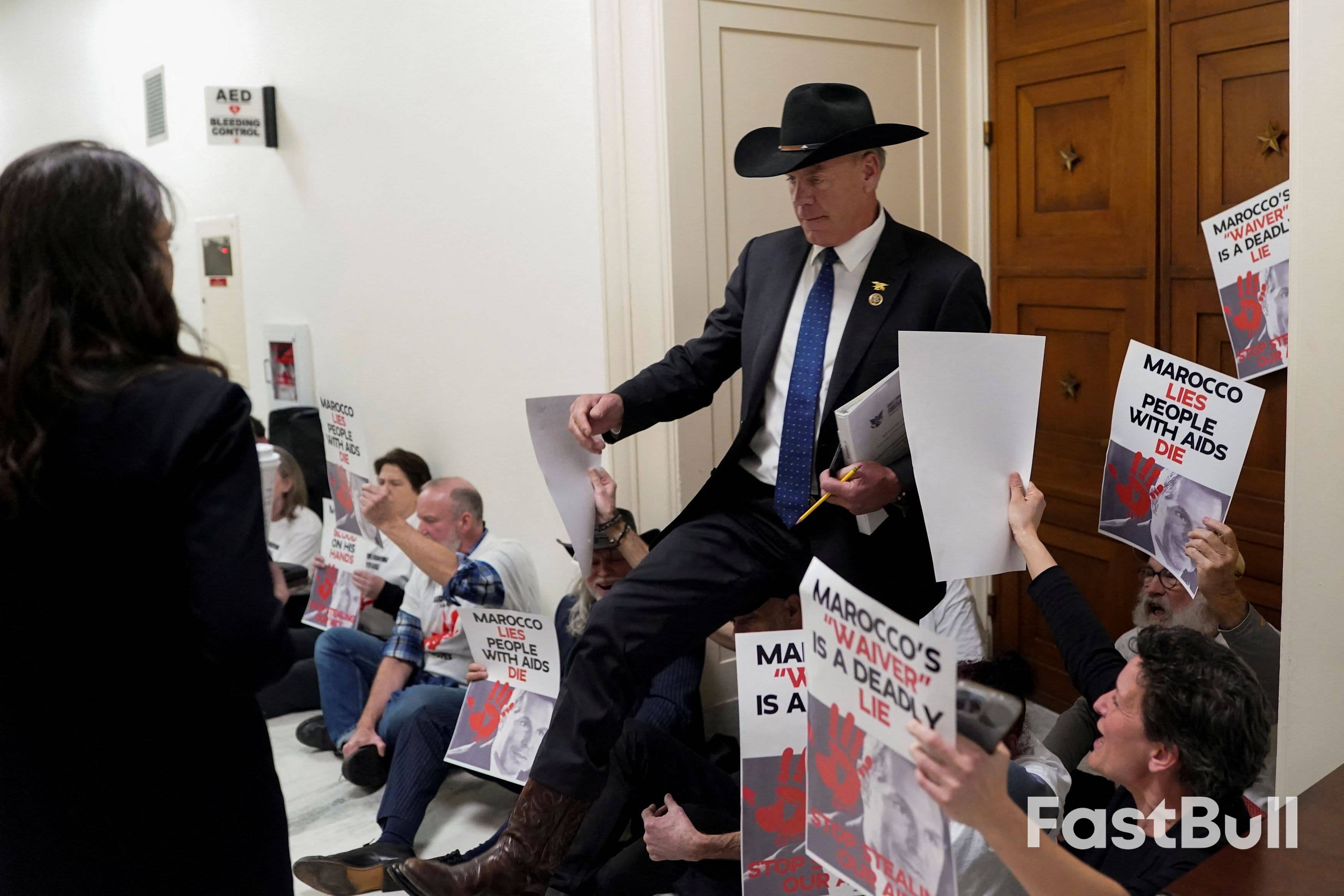

The White House has confirmed that President Donald Trump reserves the right to use military force to secure American oil interests in Venezuela. Press Secretary Karoline Leavitt stated Wednesday that while diplomacy remains the preferred approach, military action is a possibility if necessary.

When asked if the president would deploy troops to protect U.S. oil workers, Leavitt affirmed that Trump would act in the best interests of the American people and its energy industry. She clarified that the U.S. does not currently have troops on the ground in Venezuela.

This statement follows the Trump administration's recent military buildup in the Caribbean, which included the deployment of the USS Gerald R. Ford carrier strike group. Despite the increased presence, President Trump told NBC News on Monday that the United States is not at war with Venezuela.

The administration is actively engaging with top energy firms to rebuild Venezuela's oil sector. President Trump has called for U.S. oil majors to invest billions and is scheduled to meet with industry executives at the White House on Friday.

According to sources who spoke with CNBC's Brian Sullivan, the CEOs of ExxonMobil and ConocoPhillips, along with a representative from Chevron, are expected to attend.

Separately, Energy Secretary Chris Wright is set to speak with oil executives on Wednesday at Goldman Sachs' annual energy conference in Miami. Chevron is currently the only major U.S. oil company operating in Venezuela, doing so under a special license.

The U.S. government plans to manage Venezuela's oil sales for the foreseeable future. Energy Secretary Wright announced Wednesday that the U.S. will market all crude coming out of the country, starting with 30 million to 50 million barrels of stored, sanctioned oil.

"We're going to market the crude coming out of Venezuela," Wright said at the conference. "First this backed up stored oil and then indefinitely, going forward, we will sell the production that comes out of Venezuela into the marketplace."

He explained that this control is a strategic tool. "We need to have that leverage and that control of those oil sales to drive the changes that simply must happen in Venezuela," the energy secretary stated.

These developments follow the ouster of President Nicolas Maduro in a U.S. military raid over the weekend. Maduro was subsequently taken to New York City to face federal charges related to a drug-trafficking conspiracy.

Energy analysts note that U.S. oil companies will require assurances about security and governmental stability before committing to major investments in the country.

Venezuela holds the world's largest proven crude oil reserves, according to the U.S. Energy Information Administration. Data from energy consulting firm Kpler shows the nation was recently producing approximately 800,000 barrels per day.

Leading economists from Canada’s largest banks are sounding the alarm, arguing that Prime Minister Mark Carney’s latest budget investments fall short of what’s needed to make the country competitive. Their consensus: without fundamental tax reform, the new spending plans won't be enough to drive meaningful growth.

"I don't think it's enough," Beata Caranci, chief economist at Toronto-Dominion Bank, stated at a recent Economic Club of Canada event. "What we've seen is a good first step, but really what they've done so far is unwind previous bad policy."

The November budget outlined an ambitious goal to attract C$1 trillion ($723 billion) in public and private investment over five years, fueled by tax incentives and targeted spending on housing, infrastructure, and defense. However, many of the corporate tax changes were simply carried over from the previous government.

Jean-François Perrault, chief economist at Bank of Nova Scotia, described the C$1 trillion target as "completely unrealistic," noting that it would require Canada to double its current investment levels. Despite this, he acknowledged that the country stands to benefit from the push, even if it is only partially successful.

According to the panel of economists, the core issue lies within Canada's tax structure, which they argue actively discourages growth.

Caranci highlighted how the system can stifle higher earnings. For example, small businesses lose their preferential tax rates once they surpass C$500,000 in income. This creates a "bunching" effect where a large number of firms hover just below that threshold, hesitant to expand.

Her recommendation is to, at a minimum, index that figure to inflation. "You're artificially keeping companies smaller," she explained.

Perrault echoed this sentiment, adding that many businesses are not focused on maximizing profit growth because they view the tax system and regulatory environment as significant disadvantages.

This reluctance to invest feeds into a larger problem flagged by the Bank of Canada: a "vicious circle" where weak productivity leads to reduced investment, which in turn perpetuates weak productivity.

While Carney's government has worked to clear some regulatory hurdles for new west coast pipelines to export more oil to Asia, no company has yet committed to building one. Even if a project moves forward, the construction—and its economic benefits—would be years away.

This timeline is not aggressive enough for Stéfane Marion, chief economist at National Bank of Canada. "We need to be a little bit more aggressive in terms of building it, and hopefully we can do it in less than 10 years," he said.

Recent geopolitical shifts are adding to the pressure. U.S. President Donald Trump's efforts to access Venezuelan crude have reinforced calls for Canada to diversify its energy export markets. The urgency was underscored this week as prices for Canadian heavy oil grades fell after the capture of Venezuelan President Nicolas Maduro.

However, Caranci believes the more immediate threat for Canada is the existing global supply glut, arguing that unlocking Venezuelan oil will require many years and substantial investment.

Ultimately, the economists warned that Canada is at risk of losing the momentum it gained after President Trump imposed tariffs and made other threats.

"I'm worried that as much as we want to seize the moment, that we don't," Perrault concluded.

President Donald Trump's suggestion of military action to annex Greenland is being framed by his Republican allies on Capitol Hill as a hardball negotiation tactic, echoing the deal-making style he championed in his 1987 book. This defense comes as Trump refuses to rule out force, a stance that has alarmed European leaders and many in Washington.

The GOP has largely supported Trump following a recent strike he ordered to capture Venezuelan leader Nicolas Maduro without congressional approval. Now, as attention shifts to Greenland, some Republicans argue the president's aggressive posture is merely a bluff to secure greater U.S. influence over the strategic Arctic island.

Supporters of the former president claim his threats are part of a calculated strategy to bring Denmark to the negotiating table.

"He's from New York, he's one of the best negotiators and how he negotiates sometimes is everything is on the table," Rep. Ryan Zinke, a Montana Republican who served as Trump's first-term Secretary of the Interior, told CNBC.

Zinke added that he believes Secretary of State Marco Rubio is correct to downplay the idea of a military invasion. "I'd be supportive of negotiating a deal with Denmark to make sure that it stays influenced in the West," he said.

This perspective is shared by other Republicans who believe Trump's rhetoric is primarily about leverage.

"To Trump, everything is a deal, everything is a negotiation, a lot of things come down to leverage," said Rep. Nick LaLota, a New York Republican. "I think his administration is comfortable with the term about not taking any options off the table, I hope we don't read too much into that."

Rep. Mike Lawler, another New York Republican, acknowledged the island's importance but drew a clear line against military action. "Obviously there is strategic national security importance to it with respect to the Arctic, with respect to NATO, with respect to combating Russia," he said. "If you can enter into negotiations with Denmark, with Greenland, great. The idea of taking it by force, no... there is strong bipartisan opposition to any use of force with respect to Greenland."

Trump has long expressed interest in Greenland, a self-governing territory of Denmark, a NATO ally. He argues that U.S. control is a national security imperative for countering Russian and Chinese ambitions in the Arctic. His focus on the island has intensified following the raid that captured Maduro, who now faces drug charges in New York.

The White House has not dismissed the possibility of using force.

"The President and his team are discussing a range of options to pursue this important foreign policy goal, and of course, utilizing the U.S. Military is always an option at the Commander in Chief's disposal," White House Press Secretary Karoline Leavitt said in a statement Tuesday.

The administration's stance has rattled European leaders and angered Denmark, which, along with Greenland, has consistently rejected Trump's proposals.

"Greenland belongs to its people. It is for Denmark and Greenland, and them only, to decide on matters concerning Denmark and Greenland," Danish Prime Minister Mette Frederiksen, French President Emmanuel Macron, German Chancellor Friedrich Merz, British Prime Minister Keir Starmer, and the leaders of Italy, Spain, and Poland declared in a joint statement.

In Washington, Democrats have warned that an invasion of Greenland would shatter the NATO alliance.

• Sen. Ruben Gallego (D-AZ) announced he plans to introduce a War Powers Resolution to block Trump from ordering military action.

• Rep. Jim McGovern (D-MA) stated he is working on a similar resolution in the House, telling CNBC, "The people around him need to stage an intervention... He wants to destroy and blow up our NATO alliances."

Some Republicans have joined Democrats in condemning the rhetoric.

• Rep. Don Bacon (R-NE) called Trump's actions "appalling," adding, "It's creating a lot of long-term anger and hurt with our friends in Europe. I feel like we have a bunch of high school kids playing Risk."

• Sen. Thom Tillis (R-NC) and Sen. Jeanne Shaheen (D-NH) issued a joint statement affirming that any suggestion of coercion against a NATO ally "undermines the very principles of self-determination that our Alliance exists to defend."

Even Trump's allies concede that military action against Greenland would require congressional approval, unlike the Venezuela operation, which they characterized as a law enforcement function. "This would require congressional authorization," Zinke said.

Trump himself cast doubt on the alliance's value in a Truth Social post on Wednesday, writing, "RUSSIA AND CHINA HAVE ZERO FEAR OF NATO WITHOUT THE UNITED STATES, AND I DOUBT NATO WOULD BE THERE FOR US IF WE REALLY NEEDED THEM." He added, "We will always be there for NATO, even if they won't be there for us."

For now, influential House Republicans are standing by the president, maintaining that his threats are a means to an end. House Foreign Affairs Committee Chair Rep. Brian Mast, R-Fla., insisted the "post World War 2 order is not over in any way whatsoever."

"There's not a goal to break up NATO right now," Mast said. "There's looking to say, is there a good deal that can be made for what is a very strategic location, not just for the United States of America, but for others."

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up