Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

U.K. Trade Balance (Oct)

U.K. Trade Balance (Oct)A:--

F: --

P: --

France HICP Final MoM (Nov)

France HICP Final MoM (Nov)A:--

F: --

P: --

China, Mainland Outstanding Loans Growth YoY (Nov)

China, Mainland Outstanding Loans Growth YoY (Nov)A:--

F: --

P: --

China, Mainland M2 Money Supply YoY (Nov)

China, Mainland M2 Money Supply YoY (Nov)A:--

F: --

P: --

China, Mainland M0 Money Supply YoY (Nov)

China, Mainland M0 Money Supply YoY (Nov)A:--

F: --

P: --

China, Mainland M1 Money Supply YoY (Nov)

China, Mainland M1 Money Supply YoY (Nov)A:--

F: --

P: --

India CPI YoY (Nov)

India CPI YoY (Nov)A:--

F: --

P: --

India Deposit Gowth YoY

India Deposit Gowth YoYA:--

F: --

P: --

Brazil Services Growth YoY (Oct)

Brazil Services Growth YoY (Oct)A:--

F: --

P: --

Mexico Industrial Output YoY (Oct)

Mexico Industrial Output YoY (Oct)A:--

F: --

P: --

Russia Trade Balance (Oct)

Russia Trade Balance (Oct)A:--

F: --

P: --

Philadelphia Fed President Henry Paulson delivers a speech

Philadelphia Fed President Henry Paulson delivers a speech Canada Building Permits MoM (SA) (Oct)

Canada Building Permits MoM (SA) (Oct)A:--

F: --

P: --

Canada Wholesale Sales YoY (Oct)

Canada Wholesale Sales YoY (Oct)A:--

F: --

P: --

Canada Wholesale Inventory MoM (Oct)

Canada Wholesale Inventory MoM (Oct)A:--

F: --

P: --

Canada Wholesale Inventory YoY (Oct)

Canada Wholesale Inventory YoY (Oct)A:--

F: --

P: --

Canada Wholesale Sales MoM (SA) (Oct)

Canada Wholesale Sales MoM (SA) (Oct)A:--

F: --

P: --

Germany Current Account (Not SA) (Oct)

Germany Current Account (Not SA) (Oct)A:--

F: --

P: --

U.S. Weekly Total Rig Count

U.S. Weekly Total Rig CountA:--

F: --

P: --

U.S. Weekly Total Oil Rig Count

U.S. Weekly Total Oil Rig CountA:--

F: --

P: --

Japan Tankan Small Manufacturing Outlook Index (Q4)

Japan Tankan Small Manufacturing Outlook Index (Q4)A:--

F: --

P: --

Japan Tankan Large Non-Manufacturing Diffusion Index (Q4)

Japan Tankan Large Non-Manufacturing Diffusion Index (Q4)A:--

F: --

P: --

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)A:--

F: --

P: --

Japan Tankan Large Manufacturing Outlook Index (Q4)

Japan Tankan Large Manufacturing Outlook Index (Q4)A:--

F: --

P: --

Japan Tankan Small Manufacturing Diffusion Index (Q4)

Japan Tankan Small Manufacturing Diffusion Index (Q4)A:--

F: --

P: --

Japan Tankan Large Manufacturing Diffusion Index (Q4)

Japan Tankan Large Manufacturing Diffusion Index (Q4)A:--

F: --

P: --

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)A:--

F: --

P: --

U.K. Rightmove House Price Index YoY (Dec)

U.K. Rightmove House Price Index YoY (Dec)A:--

F: --

P: --

China, Mainland Industrial Output YoY (YTD) (Nov)

China, Mainland Industrial Output YoY (YTD) (Nov)A:--

F: --

P: --

China, Mainland Urban Area Unemployment Rate (Nov)

China, Mainland Urban Area Unemployment Rate (Nov)A:--

F: --

P: --

Saudi Arabia CPI YoY (Nov)

Saudi Arabia CPI YoY (Nov)--

F: --

P: --

Euro Zone Industrial Output YoY (Oct)

Euro Zone Industrial Output YoY (Oct)--

F: --

P: --

Euro Zone Industrial Output MoM (Oct)

Euro Zone Industrial Output MoM (Oct)--

F: --

P: --

Canada Existing Home Sales MoM (Nov)

Canada Existing Home Sales MoM (Nov)--

F: --

P: --

Euro Zone Total Reserve Assets (Nov)

Euro Zone Total Reserve Assets (Nov)--

F: --

P: --

U.K. Inflation Rate Expectations

U.K. Inflation Rate Expectations--

F: --

P: --

Canada National Economic Confidence Index

Canada National Economic Confidence Index--

F: --

P: --

Canada New Housing Starts (Nov)

Canada New Housing Starts (Nov)--

F: --

P: --

U.S. NY Fed Manufacturing Employment Index (Dec)

U.S. NY Fed Manufacturing Employment Index (Dec)--

F: --

P: --

U.S. NY Fed Manufacturing Index (Dec)

U.S. NY Fed Manufacturing Index (Dec)--

F: --

P: --

Canada Core CPI YoY (Nov)

Canada Core CPI YoY (Nov)--

F: --

P: --

Canada Manufacturing Unfilled Orders MoM (Oct)

Canada Manufacturing Unfilled Orders MoM (Oct)--

F: --

P: --

U.S. NY Fed Manufacturing Prices Received Index (Dec)

U.S. NY Fed Manufacturing Prices Received Index (Dec)--

F: --

P: --

U.S. NY Fed Manufacturing New Orders Index (Dec)

U.S. NY Fed Manufacturing New Orders Index (Dec)--

F: --

P: --

Canada Manufacturing New Orders MoM (Oct)

Canada Manufacturing New Orders MoM (Oct)--

F: --

P: --

Canada Core CPI MoM (Nov)

Canada Core CPI MoM (Nov)--

F: --

P: --

Canada Trimmed CPI YoY (SA) (Nov)

Canada Trimmed CPI YoY (SA) (Nov)--

F: --

P: --

Canada Manufacturing Inventory MoM (Oct)

Canada Manufacturing Inventory MoM (Oct)--

F: --

P: --

Canada CPI YoY (Nov)

Canada CPI YoY (Nov)--

F: --

P: --

Canada CPI MoM (Nov)

Canada CPI MoM (Nov)--

F: --

P: --

Canada CPI YoY (SA) (Nov)

Canada CPI YoY (SA) (Nov)--

F: --

P: --

Canada Core CPI MoM (SA) (Nov)

Canada Core CPI MoM (SA) (Nov)--

F: --

P: --

Canada CPI MoM (SA) (Nov)

Canada CPI MoM (SA) (Nov)--

F: --

P: --

Federal Reserve Board Governor Milan delivered a speech

Federal Reserve Board Governor Milan delivered a speech U.S. NAHB Housing Market Index (Dec)

U.S. NAHB Housing Market Index (Dec)--

F: --

P: --

Australia Composite PMI Prelim (Dec)

Australia Composite PMI Prelim (Dec)--

F: --

P: --

Australia Services PMI Prelim (Dec)

Australia Services PMI Prelim (Dec)--

F: --

P: --

Australia Manufacturing PMI Prelim (Dec)

Australia Manufacturing PMI Prelim (Dec)--

F: --

P: --

Japan Manufacturing PMI Prelim (SA) (Dec)

Japan Manufacturing PMI Prelim (SA) (Dec)--

F: --

P: --

U.K. Unemployment Rate (Nov)

U.K. Unemployment Rate (Nov)--

F: --

P: --

U.K. 3-Month ILO Unemployment Rate (Oct)

U.K. 3-Month ILO Unemployment Rate (Oct)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

A weekend march in Paris against anti-Semitism attracted Marine Le Pen's National Rally but many remain wary of the movement's true intentions.

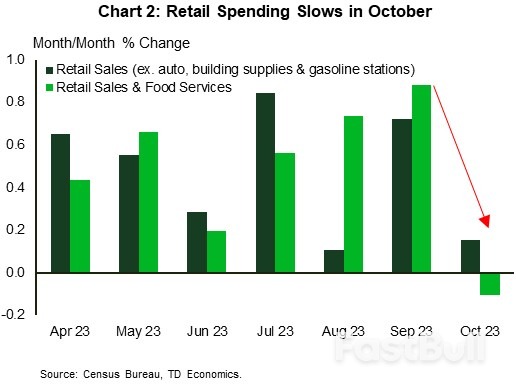

Retail sales data out this week showed that spending activity moderated in October. Although some of the weakness was attributed to a pullback in vehicle sales (possibly impacted by the UAW strike), the less volatile components still showed a meaningful deceleration in spending relative to prior months (Chart 2). Moreover, higher frequency credit card spend data reported through the first week of November has shown that spending activity has continued to moderate into the holiday shopping season.

Retail sales data out this week showed that spending activity moderated in October. Although some of the weakness was attributed to a pullback in vehicle sales (possibly impacted by the UAW strike), the less volatile components still showed a meaningful deceleration in spending relative to prior months (Chart 2). Moreover, higher frequency credit card spend data reported through the first week of November has shown that spending activity has continued to moderate into the holiday shopping season. At this point, the tailwinds for the consumer seem to be fading. Over two-thirds of the excess savings accumulated during the pandemic have now been exhausted, with most of the remaining savings likely residing with higher income households who tend to have a lower marginal propensity to consume. This is happening at a time when 27 million borrowers have started to make regular student loan repayments amidst a backdrop of deteriorating consumer sentiment and expectations of a cooling labor market.

At this point, the tailwinds for the consumer seem to be fading. Over two-thirds of the excess savings accumulated during the pandemic have now been exhausted, with most of the remaining savings likely residing with higher income households who tend to have a lower marginal propensity to consume. This is happening at a time when 27 million borrowers have started to make regular student loan repayments amidst a backdrop of deteriorating consumer sentiment and expectations of a cooling labor market.

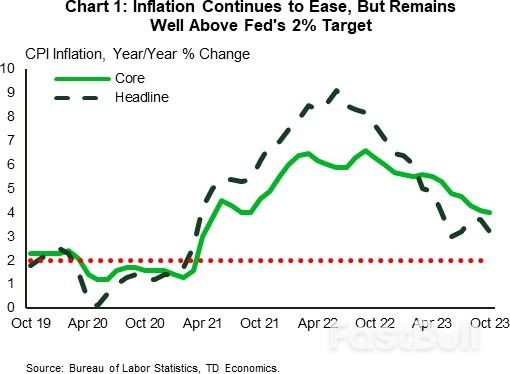

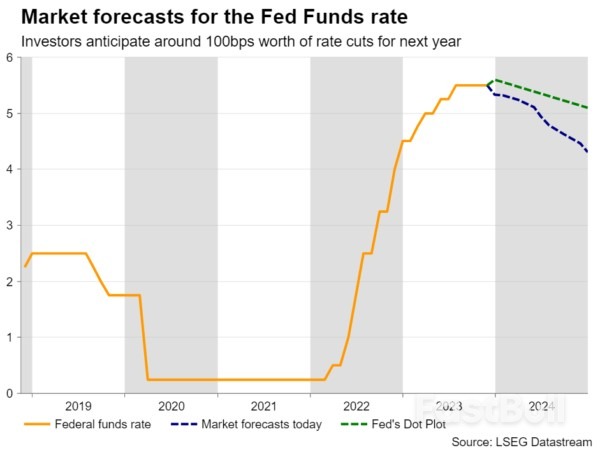

On the other hand, the Fed could start cutting rates and monetary policy would still stay tight, pushing inflation in the right direction. So, should data continue to suggest that inflation is drifting south faster than anticipated, then the Fed may be tempted to start cutting sooner than it currently anticipates, in order to avoid a more severe than forecast economic slowdown.

On the other hand, the Fed could start cutting rates and monetary policy would still stay tight, pushing inflation in the right direction. So, should data continue to suggest that inflation is drifting south faster than anticipated, then the Fed may be tempted to start cutting sooner than it currently anticipates, in order to avoid a more severe than forecast economic slowdown.

Between regions, steel production is the most electrified in the Middle East, where 95% of steel capacity are electric steel mills. In the US, that share was 69% in 2022, while in the EU, it stood at 43.7%.

Between regions, steel production is the most electrified in the Middle East, where 95% of steel capacity are electric steel mills. In the US, that share was 69% in 2022, while in the EU, it stood at 43.7%.

Steel is one of the most highly recycled materials in use today, and it can be recycled repeatedly without losing its properties. Today, around 90% of steel products are recovered at the end of their life and recycled to produce new steel. In theory, all new steel could be made using recycled steel, as its properties remain intact during the recycling process. However, this isn't feasible currently due to a shortage of scrap. Globally, the current production of steel is three times higher than the supplies of scrap available.

Steel is one of the most highly recycled materials in use today, and it can be recycled repeatedly without losing its properties. Today, around 90% of steel products are recovered at the end of their life and recycled to produce new steel. In theory, all new steel could be made using recycled steel, as its properties remain intact during the recycling process. However, this isn't feasible currently due to a shortage of scrap. Globally, the current production of steel is three times higher than the supplies of scrap available. The continued growth in steel demand means that it is unlikely for the industry to be able to transition to entirely scrap-based production during this century, according to Worldsteel calculations.

The continued growth in steel demand means that it is unlikely for the industry to be able to transition to entirely scrap-based production during this century, according to Worldsteel calculations. Global steel production experienced significant growth in the early 21st century, primarily driven by China's expansion. As more steel materials reach the end of their useful lives, the availability of scrap steel is expected to increase from the mid-2020s onwards. According to Worldsteel estimates, global end-of-life ferrous scrap availability was approximately 400 Mt in 2019. By 2030, global end-of-life scrap availability is projected to reach around 600 Mt – and by 2050, approximately 900 Mt.

Global steel production experienced significant growth in the early 21st century, primarily driven by China's expansion. As more steel materials reach the end of their useful lives, the availability of scrap steel is expected to increase from the mid-2020s onwards. According to Worldsteel estimates, global end-of-life ferrous scrap availability was approximately 400 Mt in 2019. By 2030, global end-of-life scrap availability is projected to reach around 600 Mt – and by 2050, approximately 900 Mt. Exports of ferrous scrap are most actively restricted in Africa, MENA countries and Asia, according to data from the Organisation for Economic Co-operation and Development (OECD). These are countries with historically low steel consumption and insufficient scrap resources. Export duty is the most common tool, but export bans are used almost as often as duties, as shown in data from the OECD.

Exports of ferrous scrap are most actively restricted in Africa, MENA countries and Asia, according to data from the Organisation for Economic Co-operation and Development (OECD). These are countries with historically low steel consumption and insufficient scrap resources. Export duty is the most common tool, but export bans are used almost as often as duties, as shown in data from the OECD. As an OECD member and the largest national seaborne importer of ferrous scrap, Turkey could benefit from the WSR and reduced competition for the material. The country remains the largest national seaborne importer of ferrous scrap, importing over 20 million tonnes last year (down 16.5% year-on-year), with the US as its main supplier (up 4.9% to 3.953 million tonnes), as shown in data from the BIR. Turkey is expected to remain a large net importer of scrap in the long term, given that its domestic scrap supply is too limited to satisfy its EAF production capacity. The country mainly produces steel via the EAF process. In 2022, the country's share of EAF in crude steel output was 71.5%.

As an OECD member and the largest national seaborne importer of ferrous scrap, Turkey could benefit from the WSR and reduced competition for the material. The country remains the largest national seaborne importer of ferrous scrap, importing over 20 million tonnes last year (down 16.5% year-on-year), with the US as its main supplier (up 4.9% to 3.953 million tonnes), as shown in data from the BIR. Turkey is expected to remain a large net importer of scrap in the long term, given that its domestic scrap supply is too limited to satisfy its EAF production capacity. The country mainly produces steel via the EAF process. In 2022, the country's share of EAF in crude steel output was 71.5%. As the second-largest steel scrap importer and a non-OECD member, India aims to become the largest steel producer after China. The country already relies on more than 50% on EAF production and therefore could be severely affected by the WSR. India imported 1.373 million tonnes of ferrous scrap from the EU last year, an increase of 156% from the year before. The country plans annually to import about 30 million tons of raw steel materials by 2030 to meet the government's vision of achieving 300 million tonnes per year of steel capacity.

As the second-largest steel scrap importer and a non-OECD member, India aims to become the largest steel producer after China. The country already relies on more than 50% on EAF production and therefore could be severely affected by the WSR. India imported 1.373 million tonnes of ferrous scrap from the EU last year, an increase of 156% from the year before. The country plans annually to import about 30 million tons of raw steel materials by 2030 to meet the government's vision of achieving 300 million tonnes per year of steel capacity. An amendment to the bloc's Critical Raw Materials Act (CRMA) could also result in ferrous scrap being categorised as a protected material, along with other strategic materials like lithium, copper, cobalt and nickel – all of which are seen as key to the green energy transition.

An amendment to the bloc's Critical Raw Materials Act (CRMA) could also result in ferrous scrap being categorised as a protected material, along with other strategic materials like lithium, copper, cobalt and nickel – all of which are seen as key to the green energy transition. Demand for ferrous scrap will continue to grow globally amid the increasing focus on the material as a key raw material in the low-carbon emissions steelmaking process. Steel scrap has an essential place in the decarbonisation drive toward establish a circular economy. Last year, the proportions of recycled steel used in crude steel production increased to 22% in China, 58% in the EU, 70% in the US and toward37% in Japan.

Demand for ferrous scrap will continue to grow globally amid the increasing focus on the material as a key raw material in the low-carbon emissions steelmaking process. Steel scrap has an essential place in the decarbonisation drive toward establish a circular economy. Last year, the proportions of recycled steel used in crude steel production increased to 22% in China, 58% in the EU, 70% in the US and toward37% in Japan. Steel mills look to secure scrap supply

Steel mills look to secure scrap supply Iran's Foreign Minister mocked Israel: Hezbollah has entered a war stage with Israel today, and Israel cannot withstand a war of attrition.

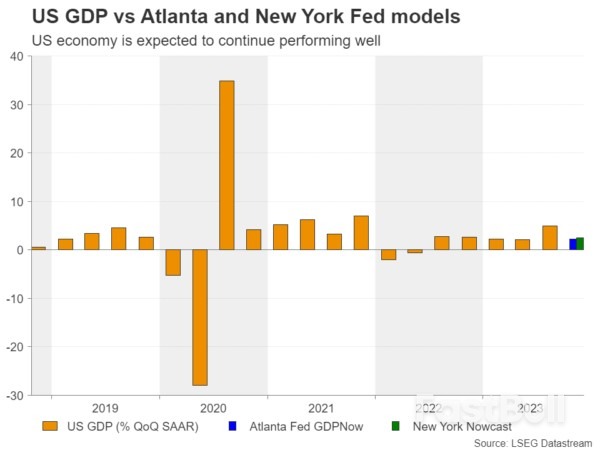

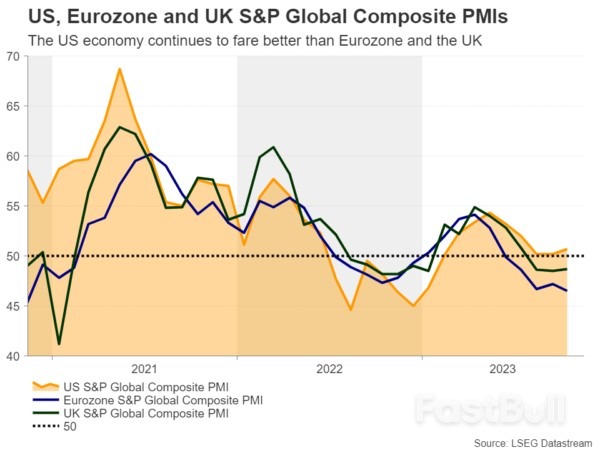

Iran's Foreign Minister mocked Israel: Hezbollah has entered a war stage with Israel today, and Israel cannot withstand a war of attrition. On the macro-economic front, a variety of economic data from key economies around the world strengthened the view that aggressive policy-tightening cycles from the Federal Reserve and other central banks have reached the end of the road, with the focus now turning to the timing, as well as the pace, of future rate cuts. Traders responded to softness in inflation and jobs data by raising 2024 rate cut expectations in the US and Europe to a full percentage point, with the first cuts so far pencilled in to occur sometime during the second quarter.

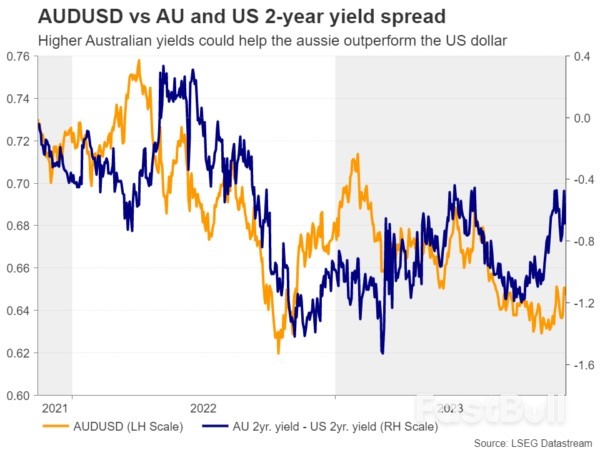

On the macro-economic front, a variety of economic data from key economies around the world strengthened the view that aggressive policy-tightening cycles from the Federal Reserve and other central banks have reached the end of the road, with the focus now turning to the timing, as well as the pace, of future rate cuts. Traders responded to softness in inflation and jobs data by raising 2024 rate cut expectations in the US and Europe to a full percentage point, with the first cuts so far pencilled in to occur sometime during the second quarter. Financial markets responded to these developments by sending US long-end Treasury yields sharply lower. The dollar suffered a broad retreat against its major peers, while global equity markets rose, especially those beaten down sectors that have struggled recently amid elevated levels of debt and an increasing cost of servicing that debt. Examples of themes benefiting were energy storage and renewable energy, two areas that support demand for metals such as beaten down and under owned silver and platinum.

Financial markets responded to these developments by sending US long-end Treasury yields sharply lower. The dollar suffered a broad retreat against its major peers, while global equity markets rose, especially those beaten down sectors that have struggled recently amid elevated levels of debt and an increasing cost of servicing that debt. Examples of themes benefiting were energy storage and renewable energy, two areas that support demand for metals such as beaten down and under owned silver and platinum. Silver takes the lead in strong week for precious metals

Silver takes the lead in strong week for precious metals

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up