Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

U.K. Retail Sales MoM (SA) (Dec)

U.K. Retail Sales MoM (SA) (Dec)A:--

F: --

P: --

France Manufacturing PMI Prelim (Jan)

France Manufacturing PMI Prelim (Jan)A:--

F: --

P: --

France Services PMI Prelim (Jan)

France Services PMI Prelim (Jan)A:--

F: --

P: --

France Composite PMI Prelim (SA) (Jan)

France Composite PMI Prelim (SA) (Jan)A:--

F: --

P: --

Germany Manufacturing PMI Prelim (SA) (Jan)

Germany Manufacturing PMI Prelim (SA) (Jan)A:--

F: --

P: --

Germany Services PMI Prelim (SA) (Jan)

Germany Services PMI Prelim (SA) (Jan)A:--

F: --

P: --

Germany Composite PMI Prelim (SA) (Jan)

Germany Composite PMI Prelim (SA) (Jan)A:--

F: --

P: --

Euro Zone Composite PMI Prelim (SA) (Jan)

Euro Zone Composite PMI Prelim (SA) (Jan)A:--

F: --

P: --

Euro Zone Manufacturing PMI Prelim (SA) (Jan)

Euro Zone Manufacturing PMI Prelim (SA) (Jan)A:--

F: --

P: --

Euro Zone Services PMI Prelim (SA) (Jan)

Euro Zone Services PMI Prelim (SA) (Jan)A:--

F: --

P: --

U.K. Composite PMI Prelim (Jan)

U.K. Composite PMI Prelim (Jan)A:--

F: --

P: --

U.K. Manufacturing PMI Prelim (Jan)

U.K. Manufacturing PMI Prelim (Jan)A:--

F: --

P: --

U.K. Services PMI Prelim (Jan)

U.K. Services PMI Prelim (Jan)A:--

F: --

P: --

Mexico Economic Activity Index YoY (Nov)

Mexico Economic Activity Index YoY (Nov)A:--

F: --

P: --

Russia Trade Balance (Nov)

Russia Trade Balance (Nov)A:--

F: --

P: --

Canada Core Retail Sales MoM (SA) (Nov)

Canada Core Retail Sales MoM (SA) (Nov)A:--

F: --

P: --

Canada Retail Sales MoM (SA) (Nov)

Canada Retail Sales MoM (SA) (Nov)A:--

F: --

U.S. IHS Markit Manufacturing PMI Prelim (SA) (Jan)

U.S. IHS Markit Manufacturing PMI Prelim (SA) (Jan)A:--

F: --

P: --

U.S. IHS Markit Services PMI Prelim (SA) (Jan)

U.S. IHS Markit Services PMI Prelim (SA) (Jan)A:--

F: --

P: --

U.S. IHS Markit Composite PMI Prelim (SA) (Jan)

U.S. IHS Markit Composite PMI Prelim (SA) (Jan)A:--

F: --

P: --

U.S. UMich Consumer Sentiment Index Final (Jan)

U.S. UMich Consumer Sentiment Index Final (Jan)A:--

F: --

P: --

U.S. UMich Current Economic Conditions Index Final (Jan)

U.S. UMich Current Economic Conditions Index Final (Jan)A:--

F: --

P: --

U.S. UMich Consumer Expectations Index Final (Jan)

U.S. UMich Consumer Expectations Index Final (Jan)A:--

F: --

P: --

U.S. Conference Board Leading Economic Index MoM (Nov)

U.S. Conference Board Leading Economic Index MoM (Nov)A:--

F: --

P: --

U.S. Conference Board Coincident Economic Index MoM (Nov)

U.S. Conference Board Coincident Economic Index MoM (Nov)A:--

F: --

P: --

U.S. Conference Board Lagging Economic Index MoM (Nov)

U.S. Conference Board Lagging Economic Index MoM (Nov)A:--

F: --

P: --

U.S. UMich 1-Year-Ahead Inflation Expectations Final (Jan)

U.S. UMich 1-Year-Ahead Inflation Expectations Final (Jan)A:--

F: --

P: --

U.S. Conference Board Leading Economic Index (Nov)

U.S. Conference Board Leading Economic Index (Nov)A:--

F: --

P: --

U.S. Weekly Total Rig Count

U.S. Weekly Total Rig CountA:--

F: --

P: --

U.S. Weekly Total Oil Rig Count

U.S. Weekly Total Oil Rig CountA:--

F: --

P: --

Germany Ifo Business Expectations Index (SA) (Jan)

Germany Ifo Business Expectations Index (SA) (Jan)--

F: --

P: --

Germany IFO Business Climate Index (SA) (Jan)

Germany IFO Business Climate Index (SA) (Jan)--

F: --

P: --

Germany Ifo Current Business Situation Index (SA) (Jan)

Germany Ifo Current Business Situation Index (SA) (Jan)--

F: --

P: --

U.S. Dallas Fed PCE Price Index YoY (Nov)

U.S. Dallas Fed PCE Price Index YoY (Nov)--

F: --

P: --

Brazil Current Account (Dec)

Brazil Current Account (Dec)--

F: --

P: --

Mexico Unemployment Rate (Not SA) (Dec)

Mexico Unemployment Rate (Not SA) (Dec)A:--

F: --

P: --

Canada National Economic Confidence Index

Canada National Economic Confidence Index--

F: --

P: --

U.S. Non-Defense Capital Durable Goods Orders MoM (Excl. Aircraft) (Nov)

U.S. Non-Defense Capital Durable Goods Orders MoM (Excl. Aircraft) (Nov)--

F: --

P: --

U.S. Durable Goods Orders MoM (Excl. Defense) (SA) (Nov)

U.S. Durable Goods Orders MoM (Excl. Defense) (SA) (Nov)--

F: --

P: --

U.S. Durable Goods Orders MoM (Excl.Transport) (Nov)

U.S. Durable Goods Orders MoM (Excl.Transport) (Nov)--

F: --

P: --

U.S. Durable Goods Orders MoM (Nov)

U.S. Durable Goods Orders MoM (Nov)--

F: --

P: --

U.S. Chicago Fed National Activity Index (Nov)

U.S. Chicago Fed National Activity Index (Nov)--

F: --

P: --

U.S. Dallas Fed New Orders Index (Jan)

U.S. Dallas Fed New Orders Index (Jan)--

F: --

P: --

U.S. Dallas Fed General Business Activity Index (Jan)

U.S. Dallas Fed General Business Activity Index (Jan)--

F: --

P: --

U.K. BRC Shop Price Index YoY (Jan)

U.K. BRC Shop Price Index YoY (Jan)--

F: --

P: --

China, Mainland Industrial Profit YoY (YTD) (Dec)

China, Mainland Industrial Profit YoY (YTD) (Dec)--

F: --

P: --

Mexico Trade Balance (Dec)

Mexico Trade Balance (Dec)--

F: --

P: --

U.S. S&P/CS 20-City Home Price Index YoY (Not SA) (Nov)

U.S. S&P/CS 20-City Home Price Index YoY (Not SA) (Nov)--

F: --

P: --

U.S. S&P/CS 20-City Home Price Index MoM (SA) (Nov)

U.S. S&P/CS 20-City Home Price Index MoM (SA) (Nov)--

F: --

P: --

U.S. FHFA House Price Index MoM (Nov)

U.S. FHFA House Price Index MoM (Nov)--

F: --

P: --

U.S. FHFA House Price Index (Nov)

U.S. FHFA House Price Index (Nov)--

F: --

P: --

U.S. Richmond Fed Manufacturing Composite Index (Jan)

U.S. Richmond Fed Manufacturing Composite Index (Jan)--

F: --

P: --

U.S. Conference Board Present Situation Index (Jan)

U.S. Conference Board Present Situation Index (Jan)--

F: --

P: --

U.S. Conference Board Consumer Expectations Index (Jan)

U.S. Conference Board Consumer Expectations Index (Jan)--

F: --

P: --

U.S. Richmond Fed Manufacturing Shipments Index (Jan)

U.S. Richmond Fed Manufacturing Shipments Index (Jan)--

F: --

P: --

U.S. Richmond Fed Services Revenue Index (Jan)

U.S. Richmond Fed Services Revenue Index (Jan)--

F: --

P: --

U.S. Conference Board Consumer Confidence Index (Jan)

U.S. Conference Board Consumer Confidence Index (Jan)--

F: --

P: --

Australia RBA Trimmed Mean CPI YoY (Q4)

Australia RBA Trimmed Mean CPI YoY (Q4)--

F: --

P: --

Australia CPI YoY (Q4)

Australia CPI YoY (Q4)--

F: --

P: --

Australia CPI QoQ (Q4)

Australia CPI QoQ (Q4)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

China’s growing advantage in artificial intelligence is closely linked to its early and large-scale investment in energy infrastructure and data centers, creating cost-efficient computing capacity that supports stable AI development at scale....

India is preparing to dramatically lower import tariffs on European cars, a move that would significantly open one of the world's most protected auto markets. According to sources familiar with the negotiations, tariffs could be slashed from a high of 110% down to 40% as part of a sweeping free trade agreement with the European Union.

The agreement, dubbed "the mother of all deals," could be announced as early as Tuesday, marking the conclusion of lengthy negotiations. Prime Minister Narendra Modi's government has reportedly agreed to an immediate tax reduction for a limited number of cars imported from the 27-nation bloc.

The proposed changes represent the most aggressive step India has taken to open its auto sector. The plan involves a multi-stage process designed to gradually integrate European vehicles into the market.

Key details of the reported plan include:

• Initial Cut: Import duties will immediately drop to 40% for roughly 200,000 combustion-engine cars per year.

• Price Threshold: The reduced tariff will apply to cars with an import price exceeding €15,000 ($17,739).

• Long-Term Goal: The tariff is expected to be lowered further to just 10% over time.

This new tariff structure stands in stark contrast to the current rates of 70% and 110%, which have been a point of contention for global automakers, including criticism from Tesla CEO Elon Musk.

Electric Vehicles Placed on a Slower Track

Notably, battery electric vehicles (EVs) will be excluded from the initial tariff reductions. This carve-out is designed to last for five years to shield investments made by domestic automakers like Mahindra & Mahindra and Tata Motors in India's growing EV industry. After this five-year period, EVs are expected to benefit from similar duty cuts.

India is the world's third-largest car market by sales, trailing only the United States and China. However, its 4.4-million-unit-per-year market is currently dominated by Japan's Suzuki Motor and homegrown brands Mahindra and Tata, which together command a two-thirds market share. European carmakers hold less than 4% of the market.

Lower import taxes would be a significant boost for European brands.

• Luxury Players: Companies like Mercedes-Benz and BMW, which already assemble some cars in India, could expand their offerings and market reach.

• Mass-Market Brands: Automakers such as Volkswagen, Renault, and Stellantis could sell imported models at more competitive prices, allowing them to test consumer demand before committing to local manufacturing.

This policy shift comes as the Indian auto market is projected to expand to 6 million units annually by 2030. Anticipating this growth, some European companies are already increasing their focus on India. Renault is planning a strategic comeback, while the Volkswagen Group is finalizing its next phase of investment through its Skoda brand.

Beyond the auto sector, the free trade pact is expected to expand bilateral trade and support Indian exports in other key areas, such as textiles and jewelry, which have faced tariff pressure in other markets.

The Trump administration's intense focus on Venezuela and Iran centers on a single commodity: oil. But the strategy runs deeper than controlling energy markets. It's a calculated effort to restrict China's access to cheap, reliable crude at the precise moment Beijing needs it most—to power its race for dominance in artificial intelligence (AI).

While this policy has multiple goals, including curbing China's influence in the West and countering the BRICS currency, its most critical function is to create an energy bottleneck for America's chief technological rival.

For years, Venezuela offered an incredibly good deal for China. Sanctioned by the U.S. and isolated from Western markets, Caracas sold its crude at a heavy discount to Chinese refiners willing to accept the risk. This oil wasn't premium, but it was dependable and cheap, supplying about 5% of China's annual needs—a small but significant buffer against global price volatility.

The Trump administration's decision to blockade Venezuelan oil exports and assert control over its infrastructure effectively killed this arrangement. With this U.S. intervention, China lost access to a supply source that accounted for roughly 4% of its needs, forcing Beijing to seek alternatives that are often more expensive, further away, or politically complicated. For the world's largest oil importer, even minor disruptions create major headaches.

Compared to Iran, Venezuela's oil flow to China is minor. China is Iran's single largest oil customer, purchasing as much as 80% of Tehran's exported crude. This deeply discounted oil is the lifeblood for China's independent refineries, petrochemical industry, and power-hungry industrial base. In short, Iranian oil is a critical input for China’s economic and technological growth.

This dependency casts Trump's pressure campaign against the Iranian regime in a new light. The combination of tariffs, strict sanctions enforcement, and support for internal dissent is designed to put China in a strategic bind. Beijing must choose between continuing to buy Iranian oil and risking severe U.S. economic retaliation, or complying with sanctions and losing one of its most vital and affordable energy sources. Either path forces China to pay more for less reliable energy.

There is a common misconception that AI operates in a clean, digital world of algorithms and cloud servers. The reality is that AI runs on electricity, which is still predominantly generated from fossil fuels and nuclear power. The energy requirements are staggering. Training a single large AI model consumes enormous power, and a hyperscale data center can use as much electricity as a medium-sized city.

This physical reality makes energy, not just silicon chips, the primary bottleneck in the global AI competition.

Beijing is acutely aware of this. It continues to approve new coal plants and expand its natural gas infrastructure even as it invests heavily in renewables. This isn't a contradiction; it's a strategy.

• Grid Stability: Oil and gas provide the stable, always-on power that intermittent renewables cannot guarantee, which is essential for data centers running AI systems.

• Industrial Inputs: AI hardware itself is petroleum-dependent. Plastics, resins, coolants, and advanced composites used in servers and chips are all derived from oil.

• Cost of Intelligence: Relatively cheap oil lowers the cost of training AI models. The nation that can train more models faster and for less money gains a decisive advantage.

By cutting China off from discounted oil, the U.S. isn't just raising fuel prices—it's raising the cost of developing intelligence itself.

This is the core of the strategy. The United States doesn't have to win by building more data centers if it can make it too expensive for China to power its own. America benefits from abundant domestic oil and gas, growing LNG exports, and the deep capital markets needed to finance new energy-intensive infrastructure.

China, in contrast, is fundamentally vulnerable. It imports over 70% of its oil, much of it from politically unstable or sanctioned nations. By disrupting these supply chains, the U.S. can make China's AI ambitions more fragile, expensive, and subject to geopolitical pressure. Oil thus becomes a powerful weapon that indirectly targets China's technological progress.

While Russia remains a factor in global energy markets, it is not the primary target of this strategy. The real objective is to slow China's momentum. The Trump administration's energy foreign policy is designed to blunt China's rise without direct conflict, forcing it to spend more capital and operate with a structural disadvantage in the most important technological race of the 21st century.

Ultimately, dominance in AI won't be achieved by writing the best code alone. It will be determined by who can affordably and reliably power the most machines for the longest time. By squeezing Venezuela and pressuring Iran, the U.S. is betting that energy geopolitics, not algorithms, will decide the winner. If that bet pays off, the future of AI will be shaped not just in Silicon Valley or Shenzhen, but in the oil fields and shipping lanes few are watching.

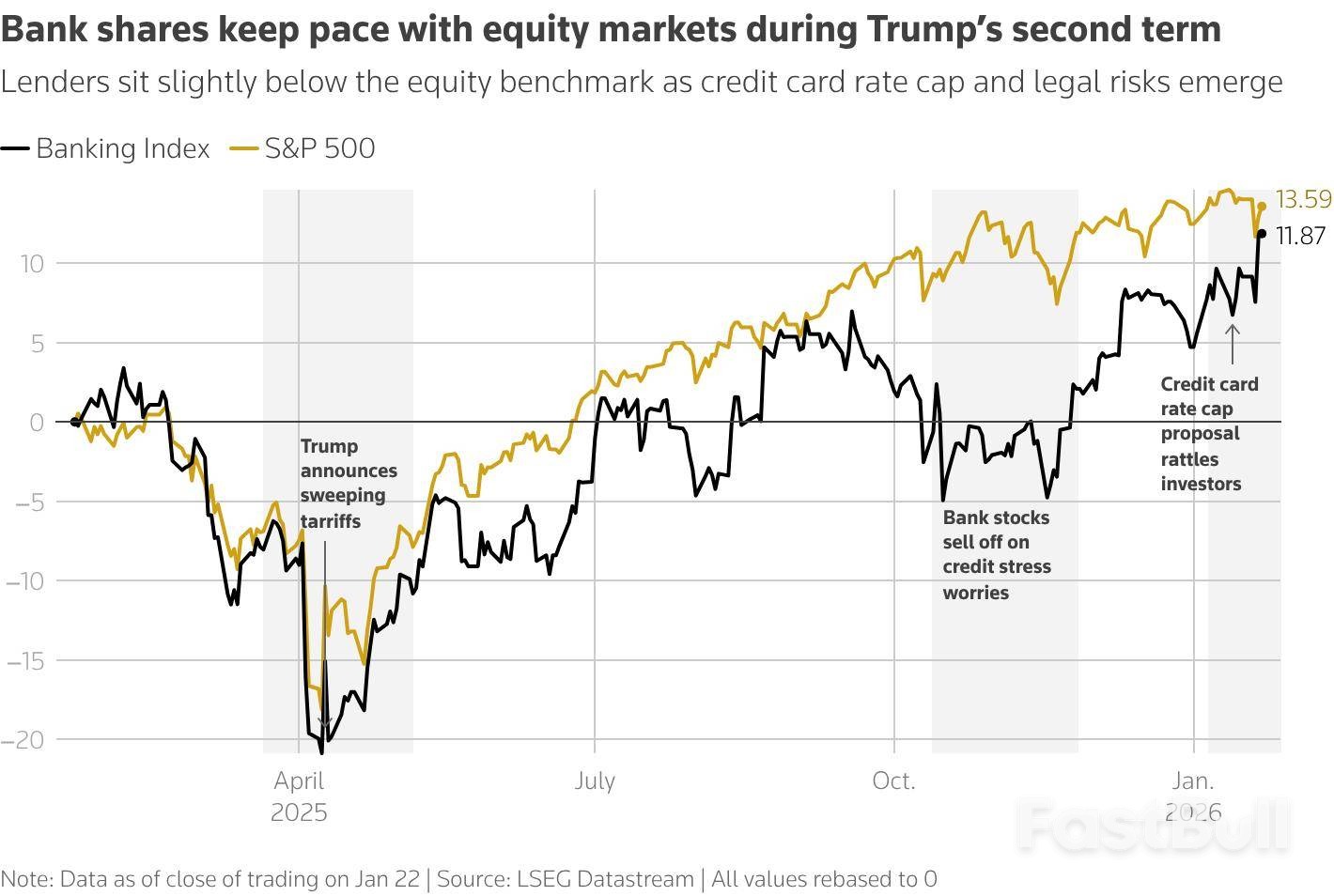

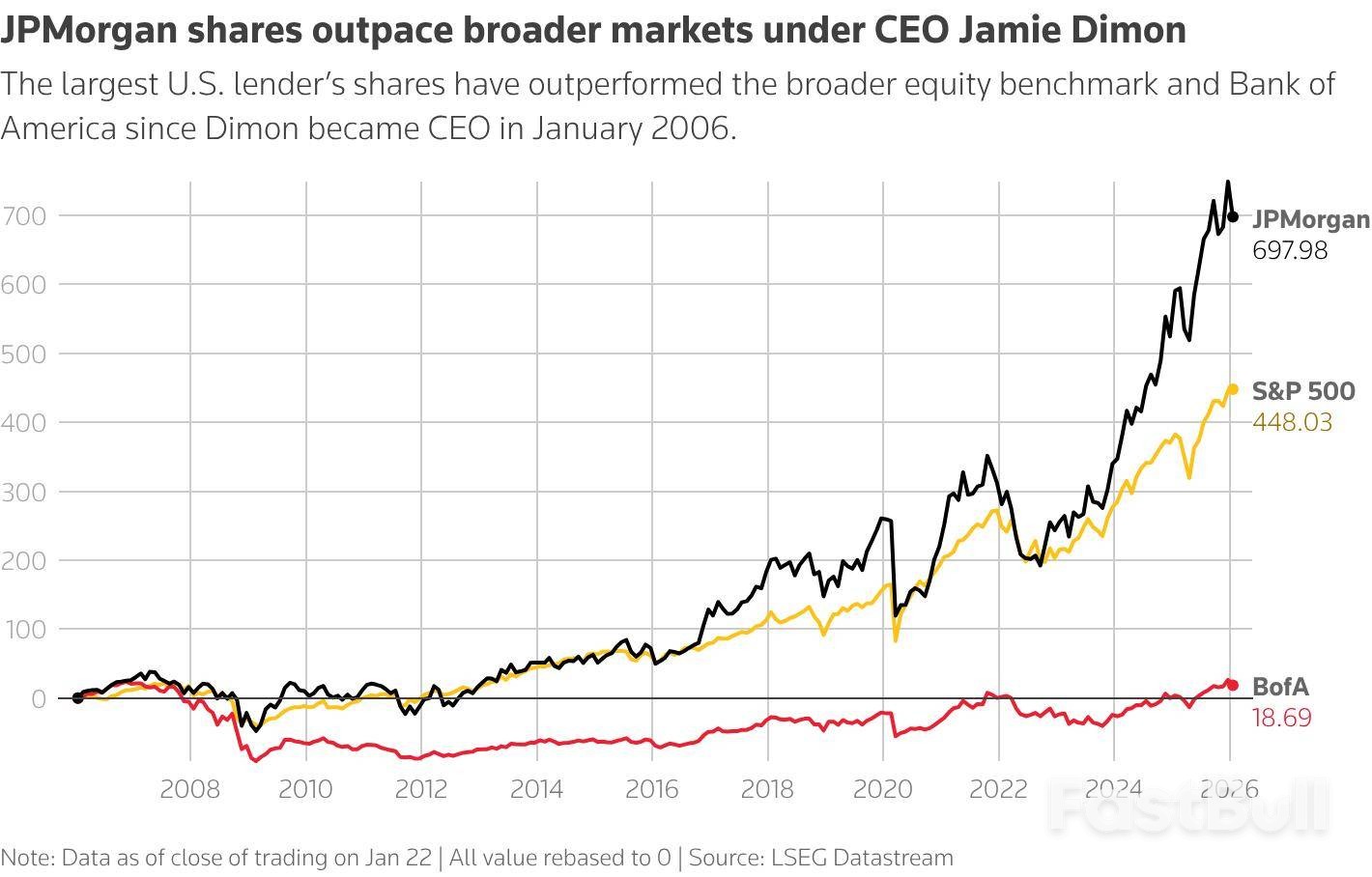

Donald Trump has launched his most direct assault on Wall Street yet, filing a $5 billion lawsuit against JPMorgan Chase and its CEO Jamie Dimon. The suit, which accuses the nation's largest bank of closing his accounts for political reasons, signals a volatile and unpredictable relationship between the administration and the financial sector.

While big banks anticipated a friendly, deregulated environment under Trump, they are now navigating a landscape marked by both significant wins and hostile political maneuvers. This escalating tension could reshape their business strategies, damage reputations, and force a complete overhaul of their lobbying efforts in Washington.

"The industry is losing as many battles as it wins on big issues and the constant pressure and random nature of developments is taking its toll," said Todd Baker, a senior fellow at Columbia University.

The lawsuit against JPMorgan alleges that the bank targeted Trump and his companies for their conservative views—a claim JPMorgan firmly denies. On Thursday, the bank stated, "we believe the suit has no merit... JPMC does not close accounts for political or religious reasons."

This legal challenge is not an isolated incident. The Trump Organization is also suing credit card company Capital One on similar grounds. Trump has publicly criticized other financial leaders, including Bank of America CEO Brian Moynihan over account closures and Goldman Sachs CEO David Solomon for the bank's skeptical view on tariffs.

These actions are creating a chilling effect across the industry. "Banks probably will be more cautious moving forward after seeing this reaction, seeing that they're no longer just under threat of regulatory retaliation, but also lawsuits," noted Nicholas Anthony, a policy analyst at the Cato Institute.

Bank of America, Goldman Sachs, and Capital One have either declined to comment or not provided immediate comment on the matter.

Beyond the courtroom, the administration's policy agenda is a mix of conflicting signals. Trump's recent threat to cap consumer credit card interest rates at 10%—a move Jamie Dimon called an "economic disaster"—has rattled the industry.

Simultaneously, Trump's regulators are working to open the door for fintech and crypto firms to compete more directly with traditional banks. According to three industry executives, some banking leaders are frustrated that these newer, less-regulated companies appear to be favored by the president's inner circle.

Despite the turbulence, the White House maintains its agenda is pro-growth. "The Trump administration is delivering by shoring up financial markets and cutting unnecessary red tape to accelerate growth," said White House spokesman Kush Desai.

In response to the uncertainty, Wall Street has significantly increased its presence in Washington. The eight largest U.S. lenders boosted their combined lobbying expenditures by nearly 40% in the fourth quarter of 2025, reaching $12 million, compared to the same period in 2024. Their efforts targeted Congress, the White House, and federal agencies on issues from credit card fees to crypto legislation.

The Financial Services Forum, a group representing these banks, also launched the American Growth Alliance in December. The non-profit plans to spend tens of millions advocating for what it calls "commonsense" economic policies.

"The biggest question that remains is what steps will be necessary to navigate an administration that has shown a willingness to intervene aggressively and unpredictably in the sector," said Myra Thomas, a banking analyst at eMarketer.

Despite the political headwinds, the financial industry is still poised for major victories. Regulators under the Trump administration are expected to deliver significant capital relief, potentially freeing up as much as $200 billion for big banks.

Lenders have also welcomed shifts in bank supervision and a more supportive stance on large mergers. At a recent conference hosted by JPMorgan, financial CEOs expressed optimism that these changes would unlock greater profits.

"There's just a much more rational approach on focusing on the big, important matters," Citizens Financial CEO Bruce Van Saun commented on Wednesday. "That's a refreshing change."

One bank CEO, speaking anonymously, confirmed that the industry still fully expects the capital relief measures to be implemented. Investors agree that these regulatory tailwinds continue to make bank stocks an attractive option. Brian Mulberry, a senior client portfolio manager at Zacks Investment Management, which holds JPMorgan shares, said the lawsuit "is not likely to move that needle much."

Overall, bank shares have kept pace with the broader market during Trump's presidency. However, the administration's whipsawing policies are souring the mood, particularly as Trump addresses voter concerns about the cost of living ahead of congressional elections.

The proposal to cap credit card rates caught banks by surprise, and they are now scrambling to help shape the administration's affordability agenda.

The administration's unpredictable approach leaves the financial sector in a precarious position, caught between beneficial deregulation and populist attacks. As Brian Jacobsen, chief economic strategist at Annex Wealth Management, put it, "I don't think Trump has a lot of love for the big banks."

Investors have enjoyed a strong market run for the better part of three years, fueled by technological innovation in AI and quantum computing, a resilient U.S. economy, and corporate-friendly tax policies that encourage stock buybacks. Many are now betting on the Federal Reserve to continue cutting interest rates in 2026, which would further stimulate business investment and hiring.

However, the very institution seen as a market stabilizer may soon become its biggest liability. As the new year unfolds, the Federal Reserve presents a double whammy of internal division and leadership uncertainty that could rattle an already expensive stock market.

The Federal Reserve's mandate is straightforward: maximize employment and keep prices stable. The Federal Open Market Committee (FOMC), the twelve-member body led by Chair Jerome Powell, primarily achieves this by adjusting the federal funds target rate to influence borrowing and lending across the economy.

While Wall Street typically forgives the occasional policy misstep, it thrives on predictability and consensus from the central bank. That consensus is now fracturing.

Recent FOMC meetings have revealed a historically divided committee. The last four gatherings have each featured at least one dissenting opinion. More alarmingly, the October and December meetings saw dissents in opposite directions—while a 25-basis-point rate cut was approved, some members argued for no cut at all, while another favored a more aggressive 50-basis-point reduction.

This level of discord is rare. Since 1990, there have been only three FOMC meetings with opposing dissents, and two of them occurred in the last three months. Such visible disagreement erodes investor confidence and signals deep uncertainty about the economic outlook and the correct policy path forward.

Adding to the instability is a looming leadership change at the top of the Fed. Jerome Powell's term as chair is set to expire on May 15, 2026. This transition comes amid a public clash between Powell and President Donald Trump over the direction of interest rates.

President Trump has consistently pushed for aggressive rate cuts to stimulate economic growth. In contrast, Powell has maintained that the Fed will remain data-dependent, citing stubbornly high shelter inflation as a reason for a cautious easing cycle to avoid reigniting price pressures.

With Powell on his way out, President Trump is set to nominate a new Fed chair. This creates two major concerns for the market:

1. Exacerbated Division: A nominee perceived as loyal to the president's call for lower rates could deepen the existing rift within the FOMC.

2. Experience and Credibility: Wall Street may react negatively if the eventual nominee is seen as lacking the necessary experience or independence to lead the central bank effectively.

This combination of internal conflict and leadership ambiguity is hitting at a particularly vulnerable time. According to the S&P 500's Shiller Price-to-Earnings Ratio, the stock market is entering 2026 with its second-highest valuation in 155 years.

In such a richly priced environment, there is little margin for error. The historic division within the FOMC, compounded by the uncertainty surrounding the next Fed chair, creates a precarious foundation for the market. For investors, this potential for policy disruption represents a critical risk in the year ahead.

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

Log In

Sign Up