Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

France 10-Year OAT Auction Avg. Yield

France 10-Year OAT Auction Avg. YieldA:--

F: --

P: --

Euro Zone Retail Sales YoY (Oct)

Euro Zone Retail Sales YoY (Oct)A:--

F: --

P: --

Brazil GDP YoY (Q3)

Brazil GDP YoY (Q3)A:--

F: --

P: --

U.S. Challenger Job Cuts (Nov)

U.S. Challenger Job Cuts (Nov)A:--

F: --

P: --

U.S. Challenger Job Cuts MoM (Nov)

U.S. Challenger Job Cuts MoM (Nov)A:--

F: --

P: --

U.S. Challenger Job Cuts YoY (Nov)

U.S. Challenger Job Cuts YoY (Nov)A:--

F: --

P: --

U.S. Initial Jobless Claims 4-Week Avg. (SA)

U.S. Initial Jobless Claims 4-Week Avg. (SA)A:--

F: --

P: --

U.S. Weekly Initial Jobless Claims (SA)

U.S. Weekly Initial Jobless Claims (SA)A:--

F: --

P: --

U.S. Weekly Continued Jobless Claims (SA)

U.S. Weekly Continued Jobless Claims (SA)A:--

F: --

P: --

Canada Ivey PMI (SA) (Nov)

Canada Ivey PMI (SA) (Nov)A:--

F: --

P: --

Canada Ivey PMI (Not SA) (Nov)

Canada Ivey PMI (Not SA) (Nov)A:--

F: --

P: --

U.S. Non-Defense Capital Durable Goods Orders Revised MoM (Excl. Aircraft) (SA) (Sept)

U.S. Non-Defense Capital Durable Goods Orders Revised MoM (Excl. Aircraft) (SA) (Sept)A:--

F: --

U.S. Factory Orders MoM (Excl. Transport) (Sept)

U.S. Factory Orders MoM (Excl. Transport) (Sept)A:--

F: --

P: --

U.S. Factory Orders MoM (Sept)

U.S. Factory Orders MoM (Sept)A:--

F: --

P: --

U.S. Factory Orders MoM (Excl. Defense) (Sept)

U.S. Factory Orders MoM (Excl. Defense) (Sept)A:--

F: --

P: --

U.S. EIA Weekly Natural Gas Stocks Change

U.S. EIA Weekly Natural Gas Stocks ChangeA:--

F: --

P: --

Saudi Arabia Crude Oil Production

Saudi Arabia Crude Oil ProductionA:--

F: --

P: --

U.S. Weekly Treasuries Held by Foreign Central Banks

U.S. Weekly Treasuries Held by Foreign Central BanksA:--

F: --

P: --

Japan Foreign Exchange Reserves (Nov)

Japan Foreign Exchange Reserves (Nov)A:--

F: --

P: --

India Repo Rate

India Repo RateA:--

F: --

P: --

India Benchmark Interest Rate

India Benchmark Interest RateA:--

F: --

P: --

India Reverse Repo Rate

India Reverse Repo RateA:--

F: --

P: --

India Cash Reserve Ratio

India Cash Reserve RatioA:--

F: --

P: --

Japan Leading Indicators Prelim (Oct)

Japan Leading Indicators Prelim (Oct)A:--

F: --

P: --

U.K. Halifax House Price Index YoY (SA) (Nov)

U.K. Halifax House Price Index YoY (SA) (Nov)A:--

F: --

P: --

U.K. Halifax House Price Index MoM (SA) (Nov)

U.K. Halifax House Price Index MoM (SA) (Nov)A:--

F: --

P: --

France Current Account (Not SA) (Oct)

France Current Account (Not SA) (Oct)A:--

F: --

P: --

France Trade Balance (SA) (Oct)

France Trade Balance (SA) (Oct)A:--

F: --

P: --

France Industrial Output MoM (SA) (Oct)

France Industrial Output MoM (SA) (Oct)A:--

F: --

P: --

Italy Retail Sales MoM (SA) (Oct)

Italy Retail Sales MoM (SA) (Oct)A:--

F: --

P: --

Euro Zone Employment YoY (SA) (Q3)

Euro Zone Employment YoY (SA) (Q3)--

F: --

P: --

Euro Zone GDP Final YoY (Q3)

Euro Zone GDP Final YoY (Q3)--

F: --

P: --

Euro Zone GDP Final QoQ (Q3)

Euro Zone GDP Final QoQ (Q3)--

F: --

P: --

Euro Zone Employment Final QoQ (SA) (Q3)

Euro Zone Employment Final QoQ (SA) (Q3)--

F: --

P: --

Euro Zone Employment Final (SA) (Q3)

Euro Zone Employment Final (SA) (Q3)--

F: --

Brazil PPI MoM (Oct)

Brazil PPI MoM (Oct)--

F: --

P: --

Mexico Consumer Confidence Index (Nov)

Mexico Consumer Confidence Index (Nov)--

F: --

P: --

Canada Unemployment Rate (SA) (Nov)

Canada Unemployment Rate (SA) (Nov)--

F: --

P: --

Canada Labor Force Participation Rate (SA) (Nov)

Canada Labor Force Participation Rate (SA) (Nov)--

F: --

P: --

Canada Employment (SA) (Nov)

Canada Employment (SA) (Nov)--

F: --

P: --

Canada Part-Time Employment (SA) (Nov)

Canada Part-Time Employment (SA) (Nov)--

F: --

P: --

Canada Full-time Employment (SA) (Nov)

Canada Full-time Employment (SA) (Nov)--

F: --

P: --

U.S. Personal Income MoM (Sept)

U.S. Personal Income MoM (Sept)--

F: --

P: --

U.S. Dallas Fed PCE Price Index YoY (Sept)

U.S. Dallas Fed PCE Price Index YoY (Sept)--

F: --

P: --

U.S. PCE Price Index YoY (SA) (Sept)

U.S. PCE Price Index YoY (SA) (Sept)--

F: --

P: --

U.S. PCE Price Index MoM (Sept)

U.S. PCE Price Index MoM (Sept)--

F: --

P: --

U.S. Personal Outlays MoM (SA) (Sept)

U.S. Personal Outlays MoM (SA) (Sept)--

F: --

P: --

U.S. Core PCE Price Index MoM (Sept)

U.S. Core PCE Price Index MoM (Sept)--

F: --

P: --

U.S. UMich 5-Year-Ahead Inflation Expectations Prelim YoY (Dec)

U.S. UMich 5-Year-Ahead Inflation Expectations Prelim YoY (Dec)--

F: --

P: --

U.S. Core PCE Price Index YoY (Sept)

U.S. Core PCE Price Index YoY (Sept)--

F: --

P: --

U.S. Real Personal Consumption Expenditures MoM (Sept)

U.S. Real Personal Consumption Expenditures MoM (Sept)--

F: --

P: --

U.S. 5-10 Year-Ahead Inflation Expectations (Dec)

U.S. 5-10 Year-Ahead Inflation Expectations (Dec)--

F: --

P: --

U.S. UMich Current Economic Conditions Index Prelim (Dec)

U.S. UMich Current Economic Conditions Index Prelim (Dec)--

F: --

P: --

U.S. UMich Consumer Sentiment Index Prelim (Dec)

U.S. UMich Consumer Sentiment Index Prelim (Dec)--

F: --

P: --

U.S. UMich 1-Year-Ahead Inflation Expectations Prelim (Dec)

U.S. UMich 1-Year-Ahead Inflation Expectations Prelim (Dec)--

F: --

P: --

U.S. UMich Consumer Expectations Index Prelim (Dec)

U.S. UMich Consumer Expectations Index Prelim (Dec)--

F: --

P: --

U.S. Weekly Total Rig Count

U.S. Weekly Total Rig Count--

F: --

P: --

U.S. Weekly Total Oil Rig Count

U.S. Weekly Total Oil Rig Count--

F: --

P: --

U.S. Consumer Credit (SA) (Oct)

U.S. Consumer Credit (SA) (Oct)--

F: --

P: --

China, Mainland Foreign Exchange Reserves (Nov)

China, Mainland Foreign Exchange Reserves (Nov)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

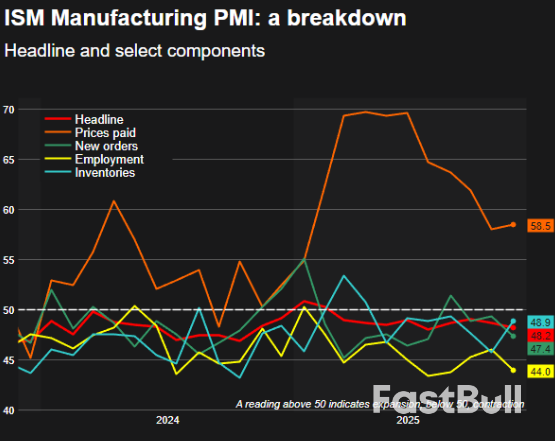

The Institute for Supply Management's survey showed U.S. manufacturing contracted for the ninth straight month in November, as factories dealt with slumping orders and higher prices as the effect from tariffs lingered.

Gold prices are modestly higher in midday U.S. trading Monday and hit a six-week high. Silver is on a tear and hit another record high. Some safe-haven demand for gold and silver is featured to start the trading week and the new month, amid bond market jitters that have originated from Japan. Chart-based buying is also featured in both metals as their near-term technical postures have become more bullish recently. February gold was last up $14.10 at $4,270.20. March silver prices were up $2.012 at $59.22 and hitting a contract/record high of $59.30 and climbing as of this writing.

Global stock markets were mostly weaker overnight. U.S. stock indexes are weaker near midday but up from session lows. There are some worries about Japan's bond market that have traders and investors a bit jittery to start the week.

President Trump on Sunday said he has decided on his pick for the next Federal Reserve chair and expects his nominee to deliver interest-rate cuts. Trump's chief economic adviser, Kevin Hassett, is seen as the likely choice to succeed current Fed chief Jerome Powell, according to people familiar with the matter and as reported by Bloomberg. The person Trump picks will require U.S. Senate confirmation as chair and likely to a 14-year Fed governor term that begins in February if the selection is an outsider. Powell's term ends in May. Hassett as the new Fed chair would be price-friendly for the precious metals.

The key outside markets today see the U.S. dollar index lower. Crude oil prices are firmer and trading around $59.25 a barrel. The yield on the benchmark 10-year U.S. Treasury note is presently around 4.1%.

Note: The gold market operates through two primary pricing mechanisms. The first is the spot market, which quotes prices for on-the-spot purchase and immediate delivery. The second is the futures market, which sets prices for delivery at a future date. Due to year-end positioning market liquidity, the December gold futures contract is currently the most actively traded on the CME.

Technically, February gold futures bulls' next upside price objective is to produce a close above solid resistance at the contract/record high of $4,433.00. Bears' next near-term downside price objective is pushing futures prices below solid technical support at $4,000.00. First resistance is seen at $4,300.00 and then at $4,350.00. First support is seen at the overnight low of $4,241.10 and then at $4,200.00. Wyckoff's Market Rating: 8.0.

March silver futures bulls have the strong overall near-term technical advantage. Their next upside price objective is closing prices above solid technical resistance at $60.00. The next downside price objective for the bears is closing prices below solid support at $52.50. First resistance is seen at $60.00 and then at $61.00. Next support is seen at the overnight low of $56.85 and then at $56.00. Wyckoff's Market Rating: 9.5.

Federal Reserve bank supervisors are monitoring community and regional banks' commercial real estate portfolios amid concerns over "elevated interest rates, tighter underwriting standards, and lower commercial property values," the agency said.

The central bank said those factors may affect borrowers' ability to refinance or pay off their loans, according to a supervision and regulation report released Monday. Officials are monitoring commercial real estate loan trends in addition to closely reviewing underwriting practices and credit loss reserve levels.

Among Wall Street lenders, the agency's watchdogs are monitoring for weaknesses in capital planning and liquidity risk-management practices among such lenders. Still, the Fed report found that the vast majority of banks continued to report capital levels well above applicable regulatory requirements as of the second quarter.

"Stress test results showed that large banks are well positioned to weather a severe recession while maintaining minimum capital requirements and the ability to lend to households and businesses," according to the report.

These areas of focus come as Fed Vice Chair for Supervision Michelle Bowman has urged supervisors to shift their focus to material risks rather than become distracted by process-related items that do not impact a firm's safety and soundness.

US regulators have recently moved to ease several capital requirements and finalized changes last month to its supervisory rating framework for large banks.

Gold prices rose to a six-week high on Monday, supported by growing expectations of U.S. interest rate cuts and a sliding dollar, while silver struck a record high ahead of key U.S. economic data.

Spot gold was up 0.3% at $4,244.29 per ounce, as of 09:21 AM ET (1421 GMT), its highest since October 21. U.S. gold futures for February delivery gained 0.6% to $4,278.40.Silver was up 1.8% to $57.39 per ounce, after hitting an all-time high of $57.86 earlier.

The U.S. dollar slipped to a two-week low, making gold more affordable for holders of other currencies.

"The underlying environment of expectations of further rate cuts, along with inflationary pressure still above the Fed target... is still the underlying support in gold and silver," said David Meger, director of metals trading at High Ridge Futures.

Traders have increased December rate-cut bets to an 87% probability, following softer U.S. economic data and dovish remarks from Fed officials, including Governor Christopher Waller and New York Fed President John Williams.

Lower interest rates tend to favor non-yielding assets such as gold.

Investors are also focusing on key U.S. data this week, including November ADP employment figures on Wednesday and the delayed September Personal Consumption Expenditures (PCE) Index, the Fed's preferred inflation gauge, due Friday.

Fed Chair Jerome Powell's remarks later on Monday are also expected to offer further policy clues.

Meanwhile, the expectation that the next Fed Chair is going to be more dovish than previous ones is also supporting gold and silver, Meger said.

White House economic adviser Kevin Hassett said on Sunday that, if chosen, he would be happy to serve as the next Fed chairman. Treasury Secretary Scott Bessent indicated a new chair could be named before Christmas.

"We still view gold and silver in a strong sideways to higher uptrend," Meger said.

Among other precious metals, platinu rose 0.3% to $1,677.28, while palladium fell 0.5% to $1,443.75.

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up