Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

Canada Leading Index MoM (Dec)

Canada Leading Index MoM (Dec)A:--

F: --

U.S. MBA Mortgage Application Activity Index WoW

U.S. MBA Mortgage Application Activity Index WoWA:--

F: --

P: --

U.S. PPI YoY (Excl. Food, Energy & Trade) (Oct)

U.S. PPI YoY (Excl. Food, Energy & Trade) (Oct)A:--

F: --

U.S. PPI MoM Final (Excl. Food, Energy and Trade) (SA) (Oct)

U.S. PPI MoM Final (Excl. Food, Energy and Trade) (SA) (Oct)A:--

F: --

U.S. Core PPI YoY (Nov)

U.S. Core PPI YoY (Nov)A:--

F: --

U.S. PPI MoM (SA) (Nov)

U.S. PPI MoM (SA) (Nov)A:--

F: --

U.S. PPI YoY (Nov)

U.S. PPI YoY (Nov)A:--

F: --

U.S. Current Account (Q3)

U.S. Current Account (Q3)A:--

F: --

U.S. Retail Sales YoY (Nov)

U.S. Retail Sales YoY (Nov)A:--

F: --

P: --

U.S. Retail Sales (Nov)

U.S. Retail Sales (Nov)A:--

F: --

P: --

U.S. Core Retail Sales MoM (Nov)

U.S. Core Retail Sales MoM (Nov)A:--

F: --

U.S. Retail Sales MoM (Excl. Automobile) (SA) (Nov)

U.S. Retail Sales MoM (Excl. Automobile) (SA) (Nov)A:--

F: --

U.S. Core Retail Sales (Nov)

U.S. Core Retail Sales (Nov)A:--

F: --

P: --

U.S. Retail Sales MoM (Excl. Gas Stations & Vehicle Dealers) (SA) (Nov)

U.S. Retail Sales MoM (Excl. Gas Stations & Vehicle Dealers) (SA) (Nov)A:--

F: --

U.S. Retail Sales MoM (Nov)

U.S. Retail Sales MoM (Nov)A:--

F: --

U.S. Core PPI MoM (SA) (Nov)

U.S. Core PPI MoM (SA) (Nov)A:--

F: --

Philadelphia Fed President Henry Paulson delivers a speech

Philadelphia Fed President Henry Paulson delivers a speech U.S. Commercial Inventory MoM (Oct)

U.S. Commercial Inventory MoM (Oct)A:--

F: --

U.S. Existing Home Sales Annualized Total (Dec)

U.S. Existing Home Sales Annualized Total (Dec)A:--

F: --

U.S. Existing Home Sales Annualized MoM (Dec)

U.S. Existing Home Sales Annualized MoM (Dec)A:--

F: --

U.S. EIA Weekly Cushing, Oklahoma Crude Oil Stocks Change

U.S. EIA Weekly Cushing, Oklahoma Crude Oil Stocks ChangeA:--

F: --

P: --

U.S. EIA Weekly Crude Stocks Change

U.S. EIA Weekly Crude Stocks ChangeA:--

F: --

P: --

U.S. EIA Weekly Gasoline Stocks Change

U.S. EIA Weekly Gasoline Stocks ChangeA:--

F: --

P: --

U.S. EIA Weekly Crude Demand Projected by Production

U.S. EIA Weekly Crude Demand Projected by ProductionA:--

F: --

P: --

U.S. EIA Weekly Crude Oil Imports Changes

U.S. EIA Weekly Crude Oil Imports ChangesA:--

F: --

P: --

U.S. EIA Weekly Heating Oil Stock Changes

U.S. EIA Weekly Heating Oil Stock ChangesA:--

F: --

P: --

U.S. Refinitiv/Ipsos Primary Consumer Sentiment Index (PCSI) (Jan)

U.S. Refinitiv/Ipsos Primary Consumer Sentiment Index (PCSI) (Jan)A:--

F: --

P: --

China, Mainland M2 Money Supply YoY (Dec)

China, Mainland M2 Money Supply YoY (Dec)--

F: --

P: --

China, Mainland M0 Money Supply YoY (Dec)

China, Mainland M0 Money Supply YoY (Dec)--

F: --

P: --

China, Mainland M1 Money Supply YoY (Dec)

China, Mainland M1 Money Supply YoY (Dec)--

F: --

P: --

Japan Domestic Enterprise Commodity Price Index YoY (Dec)

Japan Domestic Enterprise Commodity Price Index YoY (Dec)--

F: --

P: --

Japan Domestic Enterprise Commodity Price Index MoM (Dec)

Japan Domestic Enterprise Commodity Price Index MoM (Dec)--

F: --

P: --

Japan PPI MoM (Dec)

Japan PPI MoM (Dec)--

F: --

P: --

Australia Consumer Inflation Expectations (Jan)

Australia Consumer Inflation Expectations (Jan)--

F: --

P: --

U.K. 3-Month RICS House Price Balance (Dec)

U.K. 3-Month RICS House Price Balance (Dec)--

F: --

P: --

South Korea Benchmark Interest Rate

South Korea Benchmark Interest Rate--

F: --

P: --

Saudi Arabia CPI YoY (Dec)

Saudi Arabia CPI YoY (Dec)--

F: --

P: --

U.K. Services Index MoM (SA) (Nov)

U.K. Services Index MoM (SA) (Nov)--

F: --

P: --

U.K. Services Index YoY (Nov)

U.K. Services Index YoY (Nov)--

F: --

P: --

U.K. Manufacturing Output MoM (Nov)

U.K. Manufacturing Output MoM (Nov)--

F: --

P: --

U.K. Trade Balance (Nov)

U.K. Trade Balance (Nov)--

F: --

P: --

U.K. Monthly GDP 3M/3M Change (Nov)

U.K. Monthly GDP 3M/3M Change (Nov)--

F: --

P: --

U.K. GDP MoM (Nov)

U.K. GDP MoM (Nov)--

F: --

P: --

U.K. Industrial Output MoM (Nov)

U.K. Industrial Output MoM (Nov)--

F: --

P: --

U.K. Trade Balance Non-EU (SA) (Nov)

U.K. Trade Balance Non-EU (SA) (Nov)--

F: --

P: --

U.K. Trade Balance (SA) (Nov)

U.K. Trade Balance (SA) (Nov)--

F: --

P: --

U.K. Manufacturing Output YoY (Nov)

U.K. Manufacturing Output YoY (Nov)--

F: --

P: --

U.K. Construction Output MoM (SA) (Nov)

U.K. Construction Output MoM (SA) (Nov)--

F: --

P: --

U.K. Industrial Output YoY (Nov)

U.K. Industrial Output YoY (Nov)--

F: --

P: --

U.K. Services Index MoM

U.K. Services Index MoM--

F: --

P: --

U.K. Construction Output YoY (Nov)

U.K. Construction Output YoY (Nov)--

F: --

P: --

U.K. GDP YoY (SA) (Nov)

U.K. GDP YoY (SA) (Nov)--

F: --

P: --

U.K. Trade Balance EU (SA) (Nov)

U.K. Trade Balance EU (SA) (Nov)--

F: --

P: --

France HICP Final MoM (Dec)

France HICP Final MoM (Dec)--

F: --

P: --

Germany Annual GDP Growth

Germany Annual GDP Growth--

F: --

Italy Industrial Output YoY (SA) (Nov)

Italy Industrial Output YoY (SA) (Nov)--

F: --

P: --

Canada Existing Home Sales MoM (Dec)

Canada Existing Home Sales MoM (Dec)--

F: --

P: --

Euro Zone Industrial Output MoM (Nov)

Euro Zone Industrial Output MoM (Nov)--

F: --

P: --

Euro Zone Trade Balance (SA) (Nov)

Euro Zone Trade Balance (SA) (Nov)--

F: --

P: --

Euro Zone Industrial Output YoY (Nov)

Euro Zone Industrial Output YoY (Nov)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

U.S. consumer spending surged unexpectedly in November, signaling economic resilience but complicating the Federal Reserve's rate decisions.

U.S. consumer spending showed surprising strength in November, with retail sales rising more than economists expected and signaling a robust start to the 2025 holiday shopping season. This resilience presents a new challenge for the Federal Reserve as it weighs its next move on interest rates.

Key highlights from the delayed Census Bureau report include:

• Headline Growth: Retail sales climbed 0.6% in November from the previous month.

• Exceeding Forecasts: The increase surpassed the 0.4% rise anticipated by economists surveyed by The Wall Street Journal and Dow Jones Newswires.

• Broad-Based Gains: Growth was driven by stronger sales of vehicles, building materials, and sporting goods.

The report, released Wednesday, was postponed due to the government shutdown in the fall. The data is a critical barometer for the economy, as consumer spending accounts for the majority of U.S. economic growth and directly impacts corporate earnings and job creation.

November's retail sales totaled $735.9 billion, a significant rebound from October's more sluggish performance. The strong figures suggest that American consumers are still willing to spend, providing a positive signal for retailers during their most critical sales period.

"Coming in slightly ahead of expectations, November retail sales point to ongoing consumer resilience," noted Brett Kenwell, a U.S. investment analyst at eToro. "November's results give some hope that consumer spending remained upbeat into year-end."

The data revealed healthy activity across several key sectors. Sales improved for sporting goods, building materials, and automobiles. Additionally, spending at restaurants and bars—a key discretionary category that reflects consumer confidence—also saw a healthy increase. Miscellaneous store retailers, which include sellers of used merchandise, recorded a notable rise in sales as well.

Economists at Wells Fargo pointed to a 0.4% increase in the "control group" of retail sales. This metric offers a clearer view of underlying consumer demand by excluding volatile categories like cars, gasoline, and building materials.

Based on this data, the economists stated that holiday season sales "are tracking toward the top end" of their projected 3.5% to 4% year-over-year growth range.

"The upshot is a still-resilient consumer coming into the homestretch with plenty of momentum," wrote Wells Fargo economists Tim Quinlan and Shannon Grein.

The solid retail performance in November is particularly noteworthy given the growing concerns about a weakening labor market. Consumer spending, which constitutes over two-thirds of the U.S. economy, has continued to power forward.

Kathy Bostjancic, Chief Economist at Nationwide, offered an explanation for this trend. "Despite lackluster employment growth and diminished dynamism in the labor market, the unemployment rate remains low," she wrote. "Continued wealth gains from higher equity prices fuels spending by upper middle-income and upper income households."

This unexpectedly strong sales data adds a layer of complexity for Federal Reserve officials, who are scheduled to meet later this month to decide on interest rates. While recent reports have indicated that inflation is cooling, the robust consumer activity could make it harder for the central bank to justify another rate cut.

The Fed's policy committee has already cut interest rates at its last three meetings, though officials have been divided on the necessity of further easing. This division persists even as President Donald Trump has advocated for more aggressive rate reductions.

According to the CME FedWatch tool, which uses fed funds futures trading to estimate rate probabilities, market participants see only a 5% chance that the Fed will lower its benchmark rate at its next meeting on January 28.

Scott Anderson, Chief U.S. Economist at BMO, suggested the retail numbers reinforce the case for holding rates steady. "Today's retail sales numbers bolster the narrative of economic resilience," he wrote, "and will help cement market expectations for a pause in Fed rate cuts at the upcoming January FOMC meeting."

Asian liquefied natural gas (LNG) prices have fallen roughly 30% year-on-year, hitting their lowest point since April 2024 despite peak winter heating season. Spot prices for LNG in Asia are now in the mid-$9 range per million British thermal units, a level not seen between late December and early January since 2020.

This downturn is a story of two opposing forces: a global supply glut clashing with weakening demand across Asia.

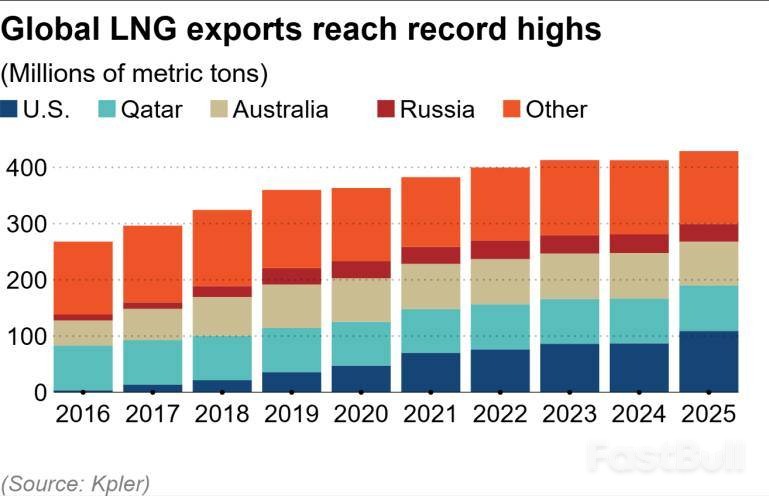

A primary driver behind the price drop is a surge in supply. According to shipping data from Kpler, global LNG exports climbed 4% in 2025 to a record high of approximately 429 million metric tons.

The United States led this expansion, with its exports jumping 25% to 109 million tons—the first time the country has surpassed the 100-million-ton mark. This growth was fueled by new production from the Plaquemines export facility in Louisiana. Qatar also contributed to the supply increase, with its exports rising 2% to 81 million tons following equipment upgrades.

The trend is expected to continue. Both the U.S. and Qatar have major projects scheduled to begin production, and global exports are forecast to rise 9% in January compared to December, setting a new monthly record of 44 million tons.

While supply is booming, demand in Asia—the world's largest LNG market—is shrinking. In the last year, Asian nations imported 275 million tons of LNG, a 4% decline.

China's market showed a particularly sharp contraction. The country's LNG imports fell by 15% to 66.5 million tons, the second-largest percentage decline on record after the price spike in 2022.

Yutaka Shirakawa, a gas analyst at the International Energy Agency, noted that "multiple factors were at work, such as increased natural gas production in China and higher imports through pipelines."

China Pivots to Discounted Russian LNG

Geopolitical tensions have also reshaped trade flows. China has significantly reduced its LNG purchases from the U.S., turning instead to the Middle East and Russia for supply.

Russia's Arctic LNG 2 facility made its first shipment to China in August, and the Portovaya facility on the Baltic Sea followed in December. Although the U.S. under President Joe Biden sanctioned both facilities, President Donald Trump has not yet penalized China for the imports, effectively allowing them to continue.

This shift comes with a significant financial incentive. "China is believed to be buying sanctioned Russian LNG much more cheaply—40% below market prices, for example," said Daisuke Harada, director general of the energy business unit at the Japan Organization for Metals and Energy Security.

Kpler estimates that if Arctic LNG 2 continues its exports to China, the facility's total exports could hit 5.7 million tons in 2026, four times its 2025 total. This influx of inexpensive Russian LNG is expected to loosen the market further, applying more downward pressure on prices.

In Japan, where LNG is a critical fuel for power generation, the falling prices are already impacting the electricity market.

Electricity futures traded by power companies have dropped about 10% since late November, settling around 11 yen (7 cents) per kilowatt-hour in the Tokyo market. This decline reflects both the restart of nuclear power plants and the anticipated effect of lower fuel costs.

However, the benefit to consumers is not immediate. Most Japanese electric and gas companies import LNG on long-term contracts linked to crude oil prices. But if low spot prices persist, it could eventually lead to rate cuts for customers, depending on their provider and plan.

Still, the trend introduces a new risk. Electricity consultant Hiroyasu Mizukami warned that if market power prices continue to fall, they could drop below the actual cost of imported fuel. "Profit margins for major electricity and gas companies could fall," he said.

President Donald Trump has escalated his push for the United States to acquire Greenland, framing the move as a matter of national security and urging NATO to support the acquisition of the world's largest island from Denmark. The heightened pressure came as top officials from the U.S., Denmark, and Greenland convened in Washington for high-stakes discussions on the territory's future.

On Wednesday, U.S. Vice President JD Vance and Secretary of State Marco Rubio met for approximately one hour with Danish Foreign Minister Lars Løkke Rasmussen and Greenlandic Foreign Minister Vivian Motzfeldt. The meeting was organized to address the future of Greenland, a semiautonomous territory of Denmark and a key NATO ally.

However, just hours before the talks began, President Trump took to social media to intensify his demands. He declared that the U.S. "needs Greenland for the purpose of National Security" and insisted that "NATO should be leading the way for us to get it."

Trump warned that if the U.S. did not take control, Russia or China would, stating, "AND THAT IS NOT GOING TO HAPPEN!" He concluded that NATO becomes "far more formidable and effective with Greenland in the hands of the UNITED STATES," calling anything less "unacceptable."

In response to the escalating situation, Denmark announced it would increase its military activities in the Arctic and North Atlantic. Danish Defense Minister Troels Lund Poulsen confirmed the plan was being developed "in close cooperation with our allies" to address an unpredictable security environment.

"This means that from today and in the coming time there will be an increased military presence in and around Greenland of aircraft, ships and soldiers, including from other NATO allies," Poulsen said. While he did not specify which allies were involved, Swedish Prime Minister Ulf Kristersson later confirmed on X that officers from the Swedish Armed Forces were arriving in Greenland as part of an allied group to prepare for the Danish exercise "Operation Arctic Endurance."

Greenland's representatives to the U.S. and Canada responded to Trump's social media posts by asking, "Why don't you ask us?" and highlighting that a very low percentage of residents support becoming part of the United States.

Greenland's Prime Minister, Jens-Frederik Nielsen, made his position clear: "If we have to choose between the United States and Denmark here and now, we choose Denmark. We choose NATO. We choose the Kingdom of Denmark. We choose the EU."

When asked about Nielsen's comments, Trump was dismissive. "I disagree with him. I don't know who he is. I don't know anything about him. But, that's going to be a big problem for him," the President replied.

Local residents echoed their government's sentiment. Tuuta Mikaelsen, a 22-year-old student in Nuuk, told The Associated Press she hoped American officials would "back off," explaining that Greenlanders benefit from Denmark's provisions of free healthcare and education.

The U.S. interest in Greenland is tied to its strategic location and resources. As climate change melts Arctic ice, new, shorter trade routes to Asia could open up. The island also holds untapped deposits of critical minerals essential for electronics like computers and phones.

President Trump specifically mentioned that Greenland is "vital" for the "Golden Dome" missile defense program and has cited threats from Russian and Chinese ships as justification for U.S. control.

However, some residents dismiss these claims. "The only Chinese I see is when I go to the fast food market," said heating engineer Lars Vintner, who added that he has never seen Russian or Chinese ships while sailing or hunting. His friend, Hans Nørgaard, agreed, calling Trump's statements about foreign ships "just fantasy."

Vintner suggested security is merely a "cover," arguing that Trump's true motive is to profit from the island's natural resources. Denmark has already affirmed that the U.S. can expand its military footprint on the island under a 1951 treaty that grants it broad rights to establish bases with Danish and Greenlandic consent.

The dispute has drawn attention from other international allies. French Foreign Minister Jean-Noël Barrot announced that France intends to open a consulate in Greenland on February 6. Speaking to RTL radio, Barrot criticized the U.S. position, stating, "Attacking another NATO member would make no sense; it would even be contrary to the interests of the United States... So this blackmail must obviously stop."

Meanwhile, a bipartisan delegation of U.S. lawmakers is scheduled to travel to Copenhagen to meet with Danish and Greenlandic officials, indicating that diplomatic channels remain active as the crisis unfolds.

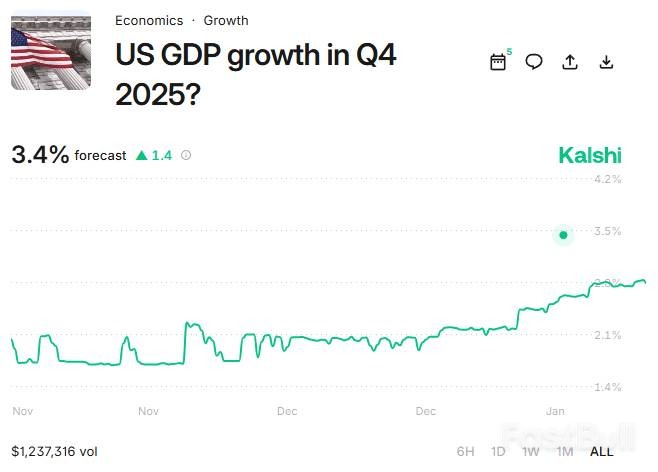

As 2025 draws to a close, prediction markets are betting on a strong finish for the U.S. economy. A growing consensus on platforms that track real-time economic data suggests that Q4 GDP growth could surpass 3.0%, signaling significant momentum heading into 2026.

However, a closer look reveals a split between this data-driven optimism and the considerable headwinds facing the economy. Let's break down the bull case, the bear case, and why the upcoming GDP report on January 29, 2026, is so critical for markets and policymakers.

Modern forecasting tools like prediction markets, where traders bet on economic outcomes, have become influential gauges of market sentiment. Platforms like Kalshi are showing strong positioning for Q4 GDP growth to exceed the 3.0% threshold.

This confidence is largely fueled by the Atlanta Fed's GDPNow model, a real-time tracker that estimates growth based on incoming economic data. As of January 9, 2026, the model projected a surprisingly robust 5.1% GDP growth for Q4 2025. While not an official forecast, the GDPNow model has a respectable track record, with an average absolute error of just 0.77 percentage points since its 2011 inception.

Several key factors are supporting the optimistic growth scenario:

• Resilient Consumer Spending: Personal consumption remains the engine of the U.S. economy, growing at a revised 3.0% rate in early Q4, according to GDPNow. Dallas Federal Reserve data shows that the top 20% of earners were responsible for about 57% of consumer spending through mid-2025.

• A Surge in Exports: Net exports provided a major boost, adding an estimated 1.97 percentage points to GDP. This reversal of earlier trade drags suggests strong foreign demand for American goods.

• The AI Investment Boom: Business investment in artificial intelligence continues at a rapid pace. Bureau of Economic Analysis data showed a 20.4% year-over-year jump in information-processing equipment investment and a 12.2% rise in software spending in Q2 2025.

• Steady Government Spending: Expenditures at both the federal and state levels rose in Q3, particularly in defense and local government spending, a trend that appears to have continued into Q4.

• A Strong Q3 Foundation: The economy entered the fourth quarter with solid momentum, having posted 4.3% annualized growth in Q3 2025, according to the BEA's initial estimate.

Despite the positive signals, significant risks could pull the final GDP number below 3.0%:

• Mounting Tariff Pressure: The average effective tariff rate rose from 2.5% at the start of 2025 to over 10% by August. Goldman Sachs estimated that this increase trimmed about 0.6% from GDP in the second half of the year. Separately, Yale's Budget Lab projects tariffs will reduce real GDP growth by 0.5 percentage points in 2025 and 0.4 percentage points in 2026.

• A Cooling Labor Market: The unemployment rate hit a four-year high of 4.6% in November 2025. Job growth has slowed significantly, averaging around 130,000 per month in late 2025 compared to 1.8 million in 2024. A weakening job market typically leads to reduced consumer spending.

• Inventory Adjustments: Businesses that front-loaded inventory purchases in early 2025 to avoid tariffs may now be drawing down those stockpiles. This reversal could create a drag on GDP, as inventory changes can cause large swings in quarterly figures.

• A Projected Consumer Slowdown: Forecasters anticipate a slowdown in spending. Deloitte’s Q4 economic forecast projects consumer spending growth will fall to 1.6% in 2026 from 2.6% in 2025. Morgan Stanley expects nominal spending growth to cool to 2.9% in 2026.

• Weakness in Housing: Real residential investment contracted sharply, dropping from 1.5% growth to -5.8% in the January 9 GDPNow update. With mortgage rates staying between 6.6% and 7% in late 2025, the housing sector remains a significant weak spot.

In contrast to the high GDPNow reading, traditional economic forecasts remain more conservative.

• The Federal Reserve Bank of Philadelphia's Survey of Professional Forecasters projects annual GDP growth of 1.9% for 2025 and 1.8% for 2026.

• Goldman Sachs forecasts 2.1% growth for 2025, citing larger-than-expected tariff impacts. For 2026, they expect 2.6% growth, helped by tax cuts and declining interest rates.

• Deloitte anticipates 1.9% growth in 2026, down from an estimated 2.0% in 2025, due to slowing consumer spending and tariff pressures.

The Q4 2025 GDP estimate, due on January 29, 2026, will offer the first clear picture of how the economy managed the dual pressures of high tariffs and a softer labor market.

More importantly, this report will heavily influence Federal Reserve policy in 2026. The Fed has already cut interest rates by 175 basis points since September 2024, bringing the federal funds rate to a range of 3.5%-3.75%. Any further cuts will depend on the trade-off between growth and inflation, making this GDP print a crucial data point for future monetary policy decisions.

While the Atlanta Fed's GDPNow model points to a strong possibility of growth exceeding 3.0%, its historical root-mean-squared error of 1.17 percentage points means the final figure could land in a wide range.

The prediction markets are betting that the economy's core strengths—AI investment and spending by high-income consumers—will overcome the drags from trade policy and a cooling job market. The upcoming report will reveal whether that bet pays off. For traders and investors, the key is not just to predict a single outcome but to manage risk across a range of possibilities.

Chicago Fed President Austan Goolsbee issued a stark warning on Wednesday, stating that political pressure on the U.S. central bank threatens its ability to control inflation. He identified the Trump administration's criminal probe into Federal Reserve Chair Jerome Powell as a direct challenge to the institution's autonomy.

"The independence of the Fed couldn't be more important for the long-run inflation rate in this country," Goolsbee told National Public Radio. He argued that historical precedent shows a clear link between political interference and rising prices, noting, "Any place where you don't have central bank independence, inflation comes roaring back."

Goolsbee stressed that undermining the Fed’s credibility could unravel years of difficult work to stabilize the economy. "We've spent the last five years fighting to get the inflation rate down—and that hasn't been easy," he said. "If you're attacking the independence of the Fed, that makes that problem worse."

Goolsbee's comments follow a move by the U.S. Justice Department to issue subpoenas to both the Federal Reserve and Chair Powell. The investigation stems from remarks Powell made to the Senate regarding cost overruns for a $2.5 billion renovation project at the central bank’s headquarters in Washington.

In a video statement on Sunday, Powell described the unprecedented action as a pretext. He connected the administration's threats directly to President Donald Trump's public demands for the Federal Reserve to implement sharply lower interest rates.

The administration's probe has triggered global condemnation from other major central banks and created political tension at home. Several Republican senators have threatened to block any nominee Trump puts forward to succeed Powell if the Justice Department's investigation remains active. Powell's current term as Fed Chair is scheduled to expire in May.

Goolsbee concluded with a strong personal endorsement of the current Fed leadership. "I consider Chair Powell to be a first-ballot hall-of-fame Fed chair," he said. "And if we're going to get into a circumstance where the independence—or even the integrity—of Chair Powell is in question, we're in a bad spot."

The United States has begun withdrawing personnel from key military bases in the Middle East as tensions with Iran reach a boiling point, a U.S. official confirmed. The move comes after a senior Iranian official warned that Tehran would attack American bases in the region if Washington intervenes in the nation's historic anti-government protests.

With the Islamic Republic facing its most significant domestic unrest since the 1979 revolution, Iran is attempting to deter U.S. President Donald Trump, who has repeatedly threatened to act in support of the demonstrators.

A U.S. official, speaking on the condition of anonymity, said the personnel drawdown was a precautionary measure amid the heightened regional friction. Britain is also reportedly pulling some staff from an air base in Qatar in anticipation of possible U.S. action, though the British defence ministry has not commented.

The situation remains highly volatile. "All the signals are that a U.S. attack is imminent, but that is also how this administration behaves to keep everyone on their toes," a Western military official told Reuters.

Two European officials suggested a U.S. military intervention could occur within 24 hours, and an Israeli official noted that it appeared Trump had decided to intervene, though the scale and timing were unknown.

Qatar confirmed that drawdowns at its Al Udeid air base—the largest U.S. base in the Middle East and home to the forward headquarters of Central Command—were a direct response to the current tensions.

As the U.S. weighs its options, Iran has delivered a stark message to its neighbors. A senior Iranian official stated that Tehran has informed regional countries, including Saudi Arabia, the UAE, and Turkey, that "U.S. bases in those countries will be attacked" if the U.S. military targets Iran.

In a further sign of deteriorating relations, the official added that direct contact between Iranian Foreign Minister Abbas Araqchi and U.S. Special Envoy Steve Witkoff has been suspended.

President Trump has openly threatened intervention for days. In a CBS News interview, he promised "very strong action" if Iran executes protesters and urged Iranians to continue their demonstrations, declaring that "help is on the way."

The crisis is unfolding against the backdrop of unprecedented domestic turmoil in Iran. The unrest began two weeks ago as demonstrations against the dire economy but quickly escalated into widespread calls against clerical rule.

The crackdown has been exceptionally violent, with both Iranian and Western officials describing it as the most severe wave of repression since the Islamic Revolution.

• An Iranian official has stated that more than 2,000 people have died.

• A separate rights group places the death toll at over 2,600.

• The U.S.-based HRANA rights group has verified 2,403 protester deaths and 147 deaths among government-affiliated individuals.

• HRANA also reported that 18,137 people have been arrested so far.

Iranian authorities have blamed the unrest on the U.S. and Israel, labeling the protesters as armed terrorists. Armed Forces Chief of Staff Abdolrahim Mousavi claimed Iran has "never faced this volume of destruction," attributing it to foreign enemies.

Despite the scale of the protests, Iran's government does not appear to be on the brink of collapse, according to one Western official. The state's security apparatus seems to remain in control, even as it was caught off guard by the intensity of the unrest.

The government has been working to project an image of public backing. State television has broadcast footage of large funeral processions and pro-government rallies in major cities, where participants waved flags and held signs with anti-riot slogans.

President Masoud Pezeshkian asserted that as long as the government maintains popular support, "all the enemies' efforts against the country will come to nothing."

Meanwhile, Iranian diplomats have been actively engaging with regional counterparts. Ali Larijani, head of Iran's top security body, spoke with Qatar's foreign minister, while Foreign Minister Araqchi held calls with officials in the UAE and Turkey. In a conversation with the UAE's foreign minister, Araqchi claimed that "calm has prevailed."

LONDON, Jan 13 (Reuters) - Dozens of commercial ships have dropped anchor at a distance outside Iran's port limits in recent days, according to data and shipping sources, as tensions with the United States grow.

Such movements were precautionary given the tensions amid ongoing protests in Iran, the shipping sources said. Port limits are significant because they run a higher risk of collateral damage in the event of air strikes on nearby infrastructure.

The U.S. is withdrawing some personnel from bases in the Middle East, a U.S. official said on Wednesday, after a senior Iranian official said Tehran had warned its neighbours that it would hit American bases if Washington strikes Iran.

The country relies on seaborne trade for imports using dry bulkers, general cargo and container ships as well as oil tankers for oil exports.

The number of tankers moving into Iran's exclusive economic zone (EEZ), a stretch of water along its Gulf and Caspian coasts that extends up to 24 miles and beyond local territorial limits of 12 nautical miles, jumped from 1 vessel to 36 tankers between January 6 and January 12, analysis by maritime intelligence solutions provider Pole Star Global shows.

At least 25 bulk carriers were stationary in Iran's EEZ off the major port of Bandar Imam Khomeini, data from ship tracking and maritime analytics provider MarineTraffic showed.

A further 25 ships including container and cargo vessels had dropped anchor further south off the port of Bandar Abbas, MarineTraffic data showed.

Israel launched air strikes in June 2025 on targets in Bandar Abbas, where at least 70 people were killed in unexplained blasts in April and authorities did not rule out sabotage.

As Iran's leadership tries to put down the worst unrest the Islamic Republic has faced, Tehran is seeking to deter U.S. President Donald Trump's repeated threats to intervene on behalf of anti-government protesters.

The level of interference with GNSS navigation systems, which included GPS, had increased to "substantial" in the Gulf and Strait of Hormuz area over the past week, the U.S. Navy's Combined Maritime Force said in a note on Monday.

"This is highly likely due to force protection measures being taken in relation to the ongoing political tensions in the region. Vessels transiting this area could be impacted," the note said.

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up