Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

Canada Leading Index MoM (Dec)

Canada Leading Index MoM (Dec)A:--

F: --

U.S. MBA Mortgage Application Activity Index WoW

U.S. MBA Mortgage Application Activity Index WoWA:--

F: --

P: --

U.S. PPI YoY (Excl. Food, Energy & Trade) (Oct)

U.S. PPI YoY (Excl. Food, Energy & Trade) (Oct)A:--

F: --

U.S. PPI MoM Final (Excl. Food, Energy and Trade) (SA) (Oct)

U.S. PPI MoM Final (Excl. Food, Energy and Trade) (SA) (Oct)A:--

F: --

U.S. Core PPI YoY (Nov)

U.S. Core PPI YoY (Nov)A:--

F: --

U.S. PPI MoM (SA) (Nov)

U.S. PPI MoM (SA) (Nov)A:--

F: --

U.S. PPI YoY (Nov)

U.S. PPI YoY (Nov)A:--

F: --

U.S. Current Account (Q3)

U.S. Current Account (Q3)A:--

F: --

U.S. Retail Sales YoY (Nov)

U.S. Retail Sales YoY (Nov)A:--

F: --

P: --

U.S. Retail Sales (Nov)

U.S. Retail Sales (Nov)A:--

F: --

P: --

U.S. Core Retail Sales MoM (Nov)

U.S. Core Retail Sales MoM (Nov)A:--

F: --

U.S. Retail Sales MoM (Excl. Automobile) (SA) (Nov)

U.S. Retail Sales MoM (Excl. Automobile) (SA) (Nov)A:--

F: --

U.S. Core Retail Sales (Nov)

U.S. Core Retail Sales (Nov)A:--

F: --

P: --

U.S. Retail Sales MoM (Excl. Gas Stations & Vehicle Dealers) (SA) (Nov)

U.S. Retail Sales MoM (Excl. Gas Stations & Vehicle Dealers) (SA) (Nov)A:--

F: --

U.S. Retail Sales MoM (Nov)

U.S. Retail Sales MoM (Nov)A:--

F: --

U.S. Core PPI MoM (SA) (Nov)

U.S. Core PPI MoM (SA) (Nov)A:--

F: --

Philadelphia Fed President Henry Paulson delivers a speech

Philadelphia Fed President Henry Paulson delivers a speech U.S. Commercial Inventory MoM (Oct)

U.S. Commercial Inventory MoM (Oct)A:--

F: --

U.S. Existing Home Sales Annualized Total (Dec)

U.S. Existing Home Sales Annualized Total (Dec)A:--

F: --

U.S. Existing Home Sales Annualized MoM (Dec)

U.S. Existing Home Sales Annualized MoM (Dec)A:--

F: --

U.S. EIA Weekly Cushing, Oklahoma Crude Oil Stocks Change

U.S. EIA Weekly Cushing, Oklahoma Crude Oil Stocks ChangeA:--

F: --

P: --

U.S. EIA Weekly Crude Stocks Change

U.S. EIA Weekly Crude Stocks ChangeA:--

F: --

P: --

U.S. EIA Weekly Gasoline Stocks Change

U.S. EIA Weekly Gasoline Stocks ChangeA:--

F: --

P: --

U.S. EIA Weekly Crude Demand Projected by Production

U.S. EIA Weekly Crude Demand Projected by ProductionA:--

F: --

P: --

U.S. EIA Weekly Crude Oil Imports Changes

U.S. EIA Weekly Crude Oil Imports ChangesA:--

F: --

P: --

U.S. EIA Weekly Heating Oil Stock Changes

U.S. EIA Weekly Heating Oil Stock ChangesA:--

F: --

P: --

U.S. Refinitiv/Ipsos Primary Consumer Sentiment Index (PCSI) (Jan)

U.S. Refinitiv/Ipsos Primary Consumer Sentiment Index (PCSI) (Jan)A:--

F: --

P: --

China, Mainland M2 Money Supply YoY (Dec)

China, Mainland M2 Money Supply YoY (Dec)--

F: --

P: --

China, Mainland M0 Money Supply YoY (Dec)

China, Mainland M0 Money Supply YoY (Dec)--

F: --

P: --

China, Mainland M1 Money Supply YoY (Dec)

China, Mainland M1 Money Supply YoY (Dec)--

F: --

P: --

Japan Domestic Enterprise Commodity Price Index YoY (Dec)

Japan Domestic Enterprise Commodity Price Index YoY (Dec)--

F: --

P: --

Japan Domestic Enterprise Commodity Price Index MoM (Dec)

Japan Domestic Enterprise Commodity Price Index MoM (Dec)--

F: --

P: --

Japan PPI MoM (Dec)

Japan PPI MoM (Dec)--

F: --

P: --

Australia Consumer Inflation Expectations (Jan)

Australia Consumer Inflation Expectations (Jan)--

F: --

P: --

U.K. 3-Month RICS House Price Balance (Dec)

U.K. 3-Month RICS House Price Balance (Dec)--

F: --

P: --

South Korea Benchmark Interest Rate

South Korea Benchmark Interest Rate--

F: --

P: --

Saudi Arabia CPI YoY (Dec)

Saudi Arabia CPI YoY (Dec)--

F: --

P: --

U.K. Services Index MoM (SA) (Nov)

U.K. Services Index MoM (SA) (Nov)--

F: --

P: --

U.K. Services Index YoY (Nov)

U.K. Services Index YoY (Nov)--

F: --

P: --

U.K. Manufacturing Output MoM (Nov)

U.K. Manufacturing Output MoM (Nov)--

F: --

P: --

U.K. Trade Balance (Nov)

U.K. Trade Balance (Nov)--

F: --

P: --

U.K. Monthly GDP 3M/3M Change (Nov)

U.K. Monthly GDP 3M/3M Change (Nov)--

F: --

P: --

U.K. GDP MoM (Nov)

U.K. GDP MoM (Nov)--

F: --

P: --

U.K. Industrial Output MoM (Nov)

U.K. Industrial Output MoM (Nov)--

F: --

P: --

U.K. Trade Balance Non-EU (SA) (Nov)

U.K. Trade Balance Non-EU (SA) (Nov)--

F: --

P: --

U.K. Trade Balance (SA) (Nov)

U.K. Trade Balance (SA) (Nov)--

F: --

P: --

U.K. Manufacturing Output YoY (Nov)

U.K. Manufacturing Output YoY (Nov)--

F: --

P: --

U.K. Construction Output MoM (SA) (Nov)

U.K. Construction Output MoM (SA) (Nov)--

F: --

P: --

U.K. Industrial Output YoY (Nov)

U.K. Industrial Output YoY (Nov)--

F: --

P: --

U.K. Services Index MoM

U.K. Services Index MoM--

F: --

P: --

U.K. Construction Output YoY (Nov)

U.K. Construction Output YoY (Nov)--

F: --

P: --

U.K. GDP YoY (SA) (Nov)

U.K. GDP YoY (SA) (Nov)--

F: --

P: --

U.K. Trade Balance EU (SA) (Nov)

U.K. Trade Balance EU (SA) (Nov)--

F: --

P: --

France HICP Final MoM (Dec)

France HICP Final MoM (Dec)--

F: --

P: --

Germany Annual GDP Growth

Germany Annual GDP Growth--

F: --

Italy Industrial Output YoY (SA) (Nov)

Italy Industrial Output YoY (SA) (Nov)--

F: --

P: --

Canada Existing Home Sales MoM (Dec)

Canada Existing Home Sales MoM (Dec)--

F: --

P: --

Euro Zone Industrial Output MoM (Nov)

Euro Zone Industrial Output MoM (Nov)--

F: --

P: --

Euro Zone Trade Balance (SA) (Nov)

Euro Zone Trade Balance (SA) (Nov)--

F: --

P: --

Euro Zone Industrial Output YoY (Nov)

Euro Zone Industrial Output YoY (Nov)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

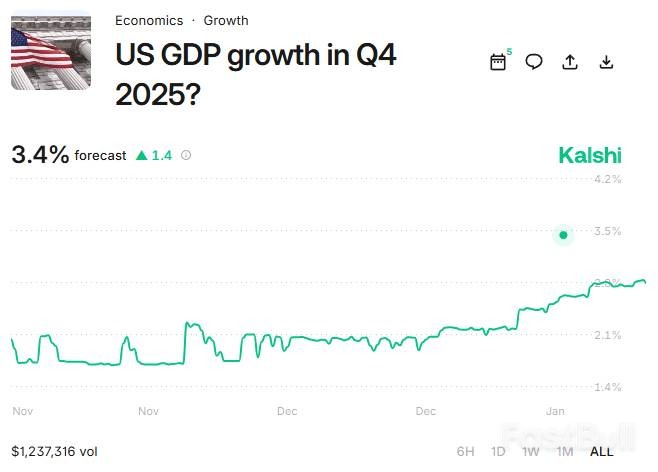

Q4 GDP forecasts show strong optimism, yet tariffs and a cooling labor market pose significant risks. The upcoming report is critical.

As 2025 draws to a close, prediction markets are betting on a strong finish for the U.S. economy. A growing consensus on platforms that track real-time economic data suggests that Q4 GDP growth could surpass 3.0%, signaling significant momentum heading into 2026.

However, a closer look reveals a split between this data-driven optimism and the considerable headwinds facing the economy. Let's break down the bull case, the bear case, and why the upcoming GDP report on January 29, 2026, is so critical for markets and policymakers.

Modern forecasting tools like prediction markets, where traders bet on economic outcomes, have become influential gauges of market sentiment. Platforms like Kalshi are showing strong positioning for Q4 GDP growth to exceed the 3.0% threshold.

This confidence is largely fueled by the Atlanta Fed's GDPNow model, a real-time tracker that estimates growth based on incoming economic data. As of January 9, 2026, the model projected a surprisingly robust 5.1% GDP growth for Q4 2025. While not an official forecast, the GDPNow model has a respectable track record, with an average absolute error of just 0.77 percentage points since its 2011 inception.

Several key factors are supporting the optimistic growth scenario:

• Resilient Consumer Spending: Personal consumption remains the engine of the U.S. economy, growing at a revised 3.0% rate in early Q4, according to GDPNow. Dallas Federal Reserve data shows that the top 20% of earners were responsible for about 57% of consumer spending through mid-2025.

• A Surge in Exports: Net exports provided a major boost, adding an estimated 1.97 percentage points to GDP. This reversal of earlier trade drags suggests strong foreign demand for American goods.

• The AI Investment Boom: Business investment in artificial intelligence continues at a rapid pace. Bureau of Economic Analysis data showed a 20.4% year-over-year jump in information-processing equipment investment and a 12.2% rise in software spending in Q2 2025.

• Steady Government Spending: Expenditures at both the federal and state levels rose in Q3, particularly in defense and local government spending, a trend that appears to have continued into Q4.

• A Strong Q3 Foundation: The economy entered the fourth quarter with solid momentum, having posted 4.3% annualized growth in Q3 2025, according to the BEA's initial estimate.

Despite the positive signals, significant risks could pull the final GDP number below 3.0%:

• Mounting Tariff Pressure: The average effective tariff rate rose from 2.5% at the start of 2025 to over 10% by August. Goldman Sachs estimated that this increase trimmed about 0.6% from GDP in the second half of the year. Separately, Yale's Budget Lab projects tariffs will reduce real GDP growth by 0.5 percentage points in 2025 and 0.4 percentage points in 2026.

• A Cooling Labor Market: The unemployment rate hit a four-year high of 4.6% in November 2025. Job growth has slowed significantly, averaging around 130,000 per month in late 2025 compared to 1.8 million in 2024. A weakening job market typically leads to reduced consumer spending.

• Inventory Adjustments: Businesses that front-loaded inventory purchases in early 2025 to avoid tariffs may now be drawing down those stockpiles. This reversal could create a drag on GDP, as inventory changes can cause large swings in quarterly figures.

• A Projected Consumer Slowdown: Forecasters anticipate a slowdown in spending. Deloitte’s Q4 economic forecast projects consumer spending growth will fall to 1.6% in 2026 from 2.6% in 2025. Morgan Stanley expects nominal spending growth to cool to 2.9% in 2026.

• Weakness in Housing: Real residential investment contracted sharply, dropping from 1.5% growth to -5.8% in the January 9 GDPNow update. With mortgage rates staying between 6.6% and 7% in late 2025, the housing sector remains a significant weak spot.

In contrast to the high GDPNow reading, traditional economic forecasts remain more conservative.

• The Federal Reserve Bank of Philadelphia's Survey of Professional Forecasters projects annual GDP growth of 1.9% for 2025 and 1.8% for 2026.

• Goldman Sachs forecasts 2.1% growth for 2025, citing larger-than-expected tariff impacts. For 2026, they expect 2.6% growth, helped by tax cuts and declining interest rates.

• Deloitte anticipates 1.9% growth in 2026, down from an estimated 2.0% in 2025, due to slowing consumer spending and tariff pressures.

The Q4 2025 GDP estimate, due on January 29, 2026, will offer the first clear picture of how the economy managed the dual pressures of high tariffs and a softer labor market.

More importantly, this report will heavily influence Federal Reserve policy in 2026. The Fed has already cut interest rates by 175 basis points since September 2024, bringing the federal funds rate to a range of 3.5%-3.75%. Any further cuts will depend on the trade-off between growth and inflation, making this GDP print a crucial data point for future monetary policy decisions.

While the Atlanta Fed's GDPNow model points to a strong possibility of growth exceeding 3.0%, its historical root-mean-squared error of 1.17 percentage points means the final figure could land in a wide range.

The prediction markets are betting that the economy's core strengths—AI investment and spending by high-income consumers—will overcome the drags from trade policy and a cooling job market. The upcoming report will reveal whether that bet pays off. For traders and investors, the key is not just to predict a single outcome but to manage risk across a range of possibilities.

Chicago Fed President Austan Goolsbee issued a stark warning on Wednesday, stating that political pressure on the U.S. central bank threatens its ability to control inflation. He identified the Trump administration's criminal probe into Federal Reserve Chair Jerome Powell as a direct challenge to the institution's autonomy.

"The independence of the Fed couldn't be more important for the long-run inflation rate in this country," Goolsbee told National Public Radio. He argued that historical precedent shows a clear link between political interference and rising prices, noting, "Any place where you don't have central bank independence, inflation comes roaring back."

Goolsbee stressed that undermining the Fed’s credibility could unravel years of difficult work to stabilize the economy. "We've spent the last five years fighting to get the inflation rate down—and that hasn't been easy," he said. "If you're attacking the independence of the Fed, that makes that problem worse."

Goolsbee's comments follow a move by the U.S. Justice Department to issue subpoenas to both the Federal Reserve and Chair Powell. The investigation stems from remarks Powell made to the Senate regarding cost overruns for a $2.5 billion renovation project at the central bank’s headquarters in Washington.

In a video statement on Sunday, Powell described the unprecedented action as a pretext. He connected the administration's threats directly to President Donald Trump's public demands for the Federal Reserve to implement sharply lower interest rates.

The administration's probe has triggered global condemnation from other major central banks and created political tension at home. Several Republican senators have threatened to block any nominee Trump puts forward to succeed Powell if the Justice Department's investigation remains active. Powell's current term as Fed Chair is scheduled to expire in May.

Goolsbee concluded with a strong personal endorsement of the current Fed leadership. "I consider Chair Powell to be a first-ballot hall-of-fame Fed chair," he said. "And if we're going to get into a circumstance where the independence—or even the integrity—of Chair Powell is in question, we're in a bad spot."

The United States has begun withdrawing personnel from key military bases in the Middle East as tensions with Iran reach a boiling point, a U.S. official confirmed. The move comes after a senior Iranian official warned that Tehran would attack American bases in the region if Washington intervenes in the nation's historic anti-government protests.

With the Islamic Republic facing its most significant domestic unrest since the 1979 revolution, Iran is attempting to deter U.S. President Donald Trump, who has repeatedly threatened to act in support of the demonstrators.

A U.S. official, speaking on the condition of anonymity, said the personnel drawdown was a precautionary measure amid the heightened regional friction. Britain is also reportedly pulling some staff from an air base in Qatar in anticipation of possible U.S. action, though the British defence ministry has not commented.

The situation remains highly volatile. "All the signals are that a U.S. attack is imminent, but that is also how this administration behaves to keep everyone on their toes," a Western military official told Reuters.

Two European officials suggested a U.S. military intervention could occur within 24 hours, and an Israeli official noted that it appeared Trump had decided to intervene, though the scale and timing were unknown.

Qatar confirmed that drawdowns at its Al Udeid air base—the largest U.S. base in the Middle East and home to the forward headquarters of Central Command—were a direct response to the current tensions.

As the U.S. weighs its options, Iran has delivered a stark message to its neighbors. A senior Iranian official stated that Tehran has informed regional countries, including Saudi Arabia, the UAE, and Turkey, that "U.S. bases in those countries will be attacked" if the U.S. military targets Iran.

In a further sign of deteriorating relations, the official added that direct contact between Iranian Foreign Minister Abbas Araqchi and U.S. Special Envoy Steve Witkoff has been suspended.

President Trump has openly threatened intervention for days. In a CBS News interview, he promised "very strong action" if Iran executes protesters and urged Iranians to continue their demonstrations, declaring that "help is on the way."

The crisis is unfolding against the backdrop of unprecedented domestic turmoil in Iran. The unrest began two weeks ago as demonstrations against the dire economy but quickly escalated into widespread calls against clerical rule.

The crackdown has been exceptionally violent, with both Iranian and Western officials describing it as the most severe wave of repression since the Islamic Revolution.

• An Iranian official has stated that more than 2,000 people have died.

• A separate rights group places the death toll at over 2,600.

• The U.S.-based HRANA rights group has verified 2,403 protester deaths and 147 deaths among government-affiliated individuals.

• HRANA also reported that 18,137 people have been arrested so far.

Iranian authorities have blamed the unrest on the U.S. and Israel, labeling the protesters as armed terrorists. Armed Forces Chief of Staff Abdolrahim Mousavi claimed Iran has "never faced this volume of destruction," attributing it to foreign enemies.

Despite the scale of the protests, Iran's government does not appear to be on the brink of collapse, according to one Western official. The state's security apparatus seems to remain in control, even as it was caught off guard by the intensity of the unrest.

The government has been working to project an image of public backing. State television has broadcast footage of large funeral processions and pro-government rallies in major cities, where participants waved flags and held signs with anti-riot slogans.

President Masoud Pezeshkian asserted that as long as the government maintains popular support, "all the enemies' efforts against the country will come to nothing."

Meanwhile, Iranian diplomats have been actively engaging with regional counterparts. Ali Larijani, head of Iran's top security body, spoke with Qatar's foreign minister, while Foreign Minister Araqchi held calls with officials in the UAE and Turkey. In a conversation with the UAE's foreign minister, Araqchi claimed that "calm has prevailed."

LONDON, Jan 13 (Reuters) - Dozens of commercial ships have dropped anchor at a distance outside Iran's port limits in recent days, according to data and shipping sources, as tensions with the United States grow.

Such movements were precautionary given the tensions amid ongoing protests in Iran, the shipping sources said. Port limits are significant because they run a higher risk of collateral damage in the event of air strikes on nearby infrastructure.

The U.S. is withdrawing some personnel from bases in the Middle East, a U.S. official said on Wednesday, after a senior Iranian official said Tehran had warned its neighbours that it would hit American bases if Washington strikes Iran.

The country relies on seaborne trade for imports using dry bulkers, general cargo and container ships as well as oil tankers for oil exports.

The number of tankers moving into Iran's exclusive economic zone (EEZ), a stretch of water along its Gulf and Caspian coasts that extends up to 24 miles and beyond local territorial limits of 12 nautical miles, jumped from 1 vessel to 36 tankers between January 6 and January 12, analysis by maritime intelligence solutions provider Pole Star Global shows.

At least 25 bulk carriers were stationary in Iran's EEZ off the major port of Bandar Imam Khomeini, data from ship tracking and maritime analytics provider MarineTraffic showed.

A further 25 ships including container and cargo vessels had dropped anchor further south off the port of Bandar Abbas, MarineTraffic data showed.

Israel launched air strikes in June 2025 on targets in Bandar Abbas, where at least 70 people were killed in unexplained blasts in April and authorities did not rule out sabotage.

As Iran's leadership tries to put down the worst unrest the Islamic Republic has faced, Tehran is seeking to deter U.S. President Donald Trump's repeated threats to intervene on behalf of anti-government protesters.

The level of interference with GNSS navigation systems, which included GPS, had increased to "substantial" in the Gulf and Strait of Hormuz area over the past week, the U.S. Navy's Combined Maritime Force said in a note on Monday.

"This is highly likely due to force protection measures being taken in relation to the ongoing political tensions in the region. Vessels transiting this area could be impacted," the note said.

Minneapolis Federal Reserve President Neel Kashkari delivered an optimistic forecast for the U.S. economy on Wednesday, anticipating continued growth even as inflation gradually declines.

"My outlook for the U.S. economy is one of pretty good growth going forward," Kashkari stated during a virtual event. While he believes inflation is on a downward path, the exact trajectory remains uncertain. "The question is, is it going to be two and a half percent by the end of the year, something short of that, or something above that? I don't know."

Kashkari described the overall economy as "quite resilient," noting that it "has not slowed as much as expected." He also characterized the current environment as a "K-shaped" recovery, pointing to uneven performance across different economic segments.

While acknowledging that inflation is still "too high," he emphasized that it is moving in the right direction and that the central bank does not expect a renewed surge. Kashkari expressed particular confidence that price pressures in housing-related sectors are set to ease. The Federal Reserve remains fully committed to its 2% inflation target.

Regarding the Fed's current strategy, Kashkari questioned just how restrictive monetary policy truly is at this stage.

He also clarified his stance on the Fed's balance sheet, stating that he sees no need for quantitative easing. Kashkari asserted that the central bank's current balance sheet expansion should not be mistaken for a new round of QE.

Kashkari addressed several key areas of the economy, weighing both risks and strengths.

On trade policy, he observed that tariffs have had less impact on consumer prices than initially anticipated. However, he cautioned that "another price bump related to tariffs could happen." While tariffs "haven't been the gut punch many feared," he noted their long-term effects are still unfolding.

From the consumer's perspective, Kashkari sees a stable picture. He described household balance sheets as "pretty good" and said he has not observed anything "very alarming" in borrowing patterns. He identified inflation as the primary cause of financial distress for households so far.

He also touched on the Fed's dual mandate of managing employment and price stability, describing the two goals as being "in tension." Kashkari welcomed the recent fall in unemployment but stressed the need to monitor both objectives carefully.

Kashkari also offered his perspective on several other trending topics:

• Artificial Intelligence: He believes most business applications of AI remain experimental and are not yet leading to significant layoffs.

• Cryptocurrency: He described digital currencies as "basically useless" for consumers.

• Housing Market: He identified supply constraints as the "biggest barrier" facing the housing sector.

Kashkari concluded by expressing confidence in the Fed's decision-making process and underscored the critical importance of central bank independence. "We all believe an independent central bank makes the best policy," he said.

The possibility of U.S. and Israeli airstrikes on Iran is growing, with escalating threats from President Donald Trump on social media and a stream of leaks from administration officials detailing preparations. Bolstered by perceived successes in Venezuela and previous strikes on Iran, the president appears to be dismissing experts who warn of the risks.

Reports suggest European allies have been consulted on potential targets, and some staff have been advised to leave U.S. bases in the Gulf. While an attack isn't guaranteed—sanctions and cyberattacks remain options—the signals are pointing toward military action.

So, why would the United States attack Iran now? The ongoing protests are a convenient trigger, but the motivation runs deeper.

Israel, led by Prime Minister Benjamin Netanyahu, has been pushing for military action against Iran's nuclear program, a case he reportedly made to Trump in a late December meeting. The protests and Iran's violent crackdown offer a timely pretext to pursue a decades-old policy goal shared by American and Israeli hawks: regime change. Many have convinced themselves that the Iranian government is on the verge of collapse and that a small military nudge could be all it takes to topple it.

This isn't about promoting democracy. President Trump's actions in Venezuela, Ukraine, and toward allies like the EU show little regard for democratic principles. While Iranians in the streets may desire democracy, they are unlikely to welcome a new leader installed by American bombs. Hawks may profess support for the Iranian people, but a fiercely nationalist public would likely reject any government that comes to power through foreign intervention.

If an attack happens, it could unfold in one of two ways, each with its own set of challenges and likely consequences.

1. The Decapitation Strike

Hawks in Washington and Tel Aviv dream of a precision strike that eliminates Supreme Leader Ayatollah Ali Khamenei and the senior leadership of both the Islamic Republic and the Islamic Revolutionary Guard Corps (IRGC). The model for this is Israel's successful 2024 attack that killed Hezbollah leader Hassan Nasrallah in Beirut.

However, replicating this success in Tehran would be difficult. Iranian leaders are well aware of this threat and have spent the last six months purging suspected spies and informants to prevent such an opportunity. Even if a strike succeeded, the most probable outcome isn't a democratic uprising but a new regime led by the hard-line IRGC and security forces.

2. The Degradation Campaign

A more likely scenario is a limited bombing campaign designed to weaken the IRGC and the Basij paramilitary force. The goal would be to reduce the state's ability to suppress dissent, creating an opening for protesters to overwhelm the remaining security apparatus.

In practice, this strategy is flawed. Regime forces are deployed where the protesters are, meaning any airstrikes would inevitably kill civilians and scatter the demonstrations. Bombing nuclear sites might advance counter-proliferation goals but would do little to embolden protesters. In fact, history shows that Iranians tend to rally around their government when attacked by the U.S. or Israel. Such a campaign would most likely suffocate the protest movement, not fuel it.

Beyond the strategic risks, there are significant logistical and geopolitical obstacles to a sustained bombing campaign against Iran.

Logistical Constraints:

• A large portion of American military assets is currently committed to the Venezuela campaign, leaving U.S. forces in the Gulf at a historic low.

• Stockpiles of critical munitions, including missile interceptors and smart bombs, are reportedly running low.

• Iran is unlikely to passively absorb an attack and could retaliate, risking a wider conflagration in the heart of the world's oil-producing region.

Geopolitical Opposition: Most Gulf states are seeking stability, not a conflict that could trigger state failure, refugee crises, and retaliatory attacks. Both Saudi Arabia and Qatar have publicly opposed an American strike on Iran.

Riyadh, in particular, has shifted its stance. The bloodlust for regime change that defined Crown Prince Mohammed bin Salman's early years has faded. The China-brokered diplomatic rapprochement between Saudi Arabia and Iran continues to hold, driven by the Saudi need for a stable environment to pursue economic development.

This desire for stability is amplified by growing Saudi concerns about an unchecked Israel, whose military actions are felt not just in Gaza but across the region. In response, Riyadh has turned sharply against the United Arab Emirates and is actively forming a new military alliance with Turkey, Pakistan, and Egypt to balance against this perceived threat. An attack on Iran would only intensify these regional anxieties.

Ultimately, U.S. military action against Iran is unlikely to achieve its stated goals of toppling the regime or protecting civilians. Even if the worst-case scenarios are avoided, the strikes would probably have little direct effect while generating significant negative consequences.

An attack would likely:

• Intensify fears of Israeli expansionism among Gulf nations.

• Delegitimize and demobilize the very protesters it claims to support.

• Further normalize military intervention without legal justification.

• Potentially undermine the global sanctions that contributed to the economic pressures fueling the protests in the first place.

The Trump administration has spent the last year aggressively reshaping the relationship between the U.S. government and private industry. This new approach involves a level of economic intervention rarely seen in modern American politics, from using tariffs and regulatory pressure to favor specific firms to taking direct ownership stakes in key companies.

This strategy marks a decisive turn toward state capitalism, a model more commonly associated with countries like China and Russia. The administration has directly negotiated for equity or a share of profits in nearly a dozen companies, funneling billions in taxpayer dollars to secure government influence. The trend appears set to accelerate, signaling a fundamental shift in U.S. economic policy.

Here is a breakdown of the companies where the Trump administration is now a significant investor.

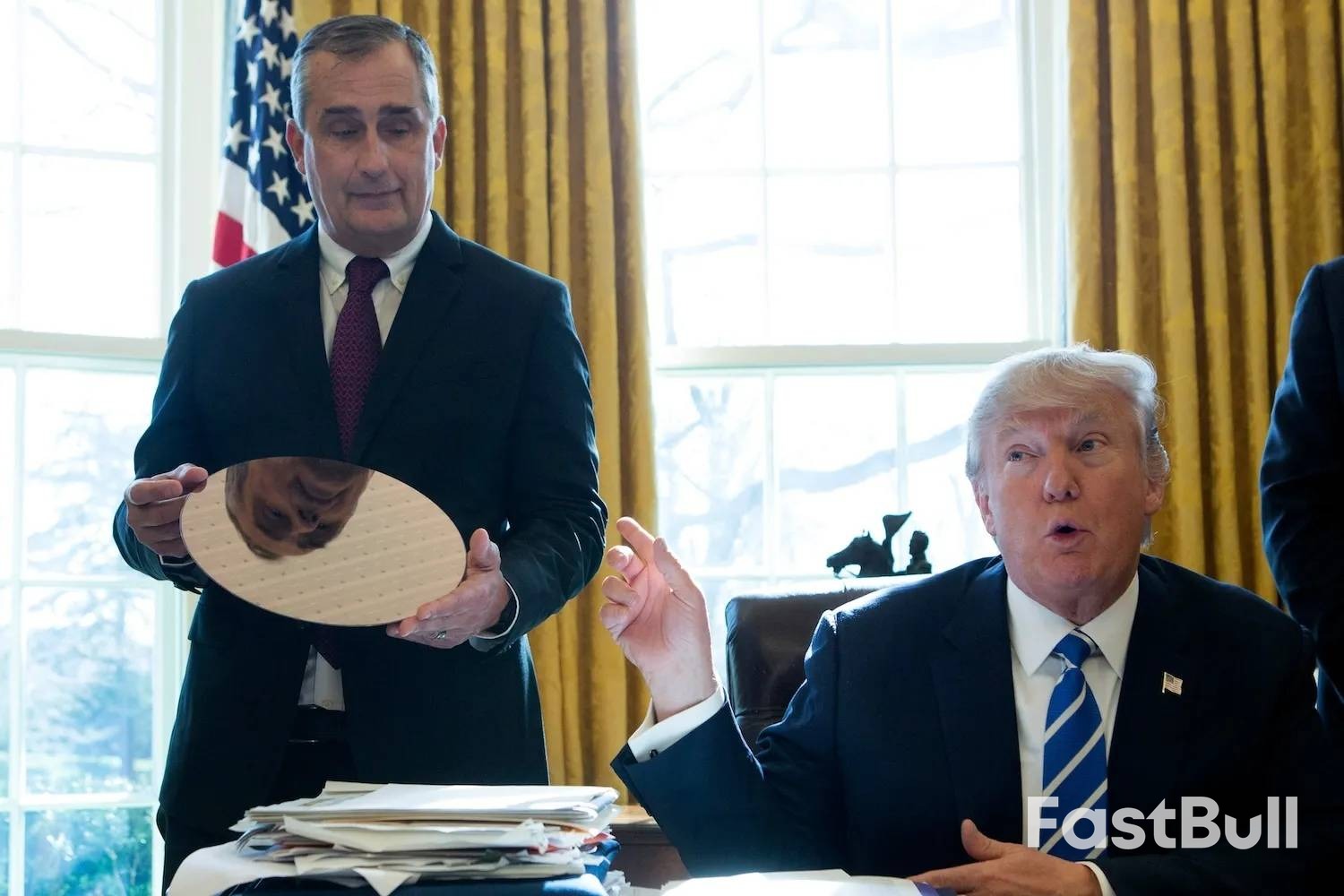

In the global race for technological supremacy, the administration has invested heavily to control the production of advanced semiconductors and AI technology.

Intel

In one of the most high-profile deals, the Trump administration acquired a nearly 10% stake in semiconductor giant Intel, valued at around $11 billion. This move made the U.S. government Intel's largest shareholder. While President Trump claimed the shares were acquired for "nothing," the deal was facilitated by grants approved under the Biden administration's CHIPS and Science Act, effectively trading taxpayer funds for government equity.

Nvidia

The administration has taken an unconventional approach with Nvidia, the world's most valuable chipmaker. In December, Trump reversed some of the Biden administration's export controls, allowing Nvidia to sell advanced chips to China. In return, the U.S. government will receive a 25% cut of all revenue from those sales. This deal expanded upon an earlier agreement for a 15% share of China-bound sales from both Nvidia and its competitor, AMD.

xLight

To bolster domestic semiconductor manufacturing capabilities, the administration took an equity stake in xLight, a Silicon Valley lithography startup. The Commerce Department has committed up to $150 million to the firm, which is developing advanced chipmaking processes. The exact size of the government's stake has not been disclosed.

A central pillar of the administration's industrial strategy is reducing America's reliance on foreign nations, particularly China, for essential raw materials. This has led to a series of government investments in mining and refining operations.

Atlantic Alumina Co. (ATALCO)

In January, the government announced a $150 million equity stake in ATALCO, a Louisiana-based gallium producer. Gallium is a critical component in chipmaking, and the U.S. currently has no domestic production. The investment aims to counter China's export restrictions on the metal, with ATALCO expected to eventually satisfy all of America's gallium demand.

Korea Zinc

The Trump administration secured a 40% equity stake in a new Tennessee refinery to be built by South Korean firm Korea Zinc. The deal also gives the U.S. government and American investors a 10% stake in the parent company. Set to open in 2029, the refinery is projected to produce 540,000 metric tons of critical minerals annually. Furthermore, Washington will gain priority access to Korea Zinc's global output starting in 2026.

Lithium Americas

The U.S. government now owns a stake in Lithium Americas, the company developing the Thacker Pass project—one of the nation's largest known lithium deposits. While the project received bipartisan support and a $2.3 billion federal loan under the Biden administration, the Trump administration re-evaluated the terms. The final deal involved releasing the loan funds in exchange for an equity stake for the government, aimed at reducing U.S. dependence on China for lithium processing.

MP Materials

To revive the domestic rare-earths industry, the administration struck a multibillion-dollar deal making the Defense Department the largest shareholder in MP Materials. The company operates the only active rare-earths mine in the United States. The agreement includes a 15% stake for the Pentagon, which will also purchase the output from a new rare-earth magnet factory and establish a price floor to guarantee its viability.

Trilogy Metals

In a push to expand domestic mining, the administration has invested tens of millions of dollars in Trilogy Metals, a Canadian firm behind a controversial copper and zinc project in Alaska. The project, which requires building a road through protected wilderness, was previously opposed by the Biden administration but is now moving forward with direct government backing.

Vulcan Elements & ReElement Technologies

As part of its rare-earths initiative, the administration has also taken stakes in two startups, Vulcan Elements and ReElement Technologies. The deal involves over $700 million in Defense Department loans and $50 million in federal incentives. In exchange, the Pentagon will receive warrants in both firms, and the Commerce Department will get a $50 million equity stake in Vulcan Elements. The companies aim to produce 10,000 metric tons of magnets annually.

The administration's intervention extends to traditional sectors like steel and nuclear energy, where it has asserted direct control over corporate decision-making.

U.S. Steel

The administration's first major foray into state capitalism involved the takeover of U.S. Steel by Japan's Nippon Steel. Instead of blocking the deal, Trump negotiated a "golden share," which grants the U.S. president veto power over the new company's investment and production decisions. Two Commerce Department officials were appointed to the board to represent the government's interests.

Westinghouse

To jump-start the civilian nuclear power industry, the U.S. government established a "strategic partnership" with Westinghouse Electric, the country's largest reactor manufacturer. The deal gives the government an option to take an 8% stake in the company, with the potential for a larger share if Westinghouse goes public. The partnership is designed to spur at least $80 billion in new investment in nuclear power.

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up