Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

U.S. NY Fed Manufacturing New Orders Index (Jan)

U.S. NY Fed Manufacturing New Orders Index (Jan)A:--

F: --

P: --

U.S. NY Fed Manufacturing Employment Index (Jan)

U.S. NY Fed Manufacturing Employment Index (Jan)A:--

F: --

P: --

U.S. Export Price Index YoY (Nov)

U.S. Export Price Index YoY (Nov)A:--

F: --

P: --

U.S. NY Fed Manufacturing Index (Jan)

U.S. NY Fed Manufacturing Index (Jan)A:--

F: --

U.S. Initial Jobless Claims 4-Week Avg. (SA)

U.S. Initial Jobless Claims 4-Week Avg. (SA)A:--

F: --

U.S. Export Price Index MoM (Nov)

U.S. Export Price Index MoM (Nov)A:--

F: --

P: --

Canada Manufacturing Unfilled Orders MoM (Nov)

Canada Manufacturing Unfilled Orders MoM (Nov)A:--

F: --

P: --

Canada Manufacturing New Orders MoM (Nov)

Canada Manufacturing New Orders MoM (Nov)A:--

F: --

P: --

U.S. Philadelphia Fed Manufacturing Employment Index (Jan)

U.S. Philadelphia Fed Manufacturing Employment Index (Jan)A:--

F: --

P: --

Canada Wholesale Sales YoY (Nov)

Canada Wholesale Sales YoY (Nov)A:--

F: --

P: --

Canada Wholesale Inventory MoM (Nov)

Canada Wholesale Inventory MoM (Nov)A:--

F: --

P: --

U.S. Philadelphia Fed Business Activity Index (SA) (Jan)

U.S. Philadelphia Fed Business Activity Index (SA) (Jan)A:--

F: --

P: --

U.S. EIA Weekly Natural Gas Stocks Change

U.S. EIA Weekly Natural Gas Stocks ChangeA:--

F: --

P: --

Richmond Federal Reserve President Barkin delivered a speech.

Richmond Federal Reserve President Barkin delivered a speech. U.S. Weekly Treasuries Held by Foreign Central Banks

U.S. Weekly Treasuries Held by Foreign Central BanksA:--

F: --

P: --

Germany CPI Final MoM (Dec)

Germany CPI Final MoM (Dec)A:--

F: --

P: --

Germany CPI Final YoY (Dec)

Germany CPI Final YoY (Dec)A:--

F: --

P: --

Germany HICP Final MoM (Dec)

Germany HICP Final MoM (Dec)A:--

F: --

P: --

Germany HICP Final YoY (Dec)

Germany HICP Final YoY (Dec)A:--

F: --

P: --

Brazil PPI MoM (Nov)

Brazil PPI MoM (Nov)A:--

F: --

P: --

Canada New Housing Starts (Dec)

Canada New Housing Starts (Dec)A:--

F: --

U.S. Capacity Utilization MoM (SA) (Dec)

U.S. Capacity Utilization MoM (SA) (Dec)A:--

F: --

U.S. Industrial Output YoY (Dec)

U.S. Industrial Output YoY (Dec)A:--

F: --

P: --

U.S. Manufacturing Capacity Utilization (Dec)

U.S. Manufacturing Capacity Utilization (Dec)A:--

F: --

P: --

U.S. Manufacturing Output MoM (SA) (Dec)

U.S. Manufacturing Output MoM (SA) (Dec)A:--

F: --

U.S. Industrial Output MoM (SA) (Dec)

U.S. Industrial Output MoM (SA) (Dec)A:--

F: --

U.S. NAHB Housing Market Index (Jan)

U.S. NAHB Housing Market Index (Jan)A:--

F: --

P: --

Russia CPI YoY (Dec)

Russia CPI YoY (Dec)A:--

F: --

P: --

U.S. Weekly Total Rig Count

U.S. Weekly Total Rig CountA:--

F: --

P: --

U.S. Weekly Total Oil Rig Count

U.S. Weekly Total Oil Rig CountA:--

F: --

P: --

Japan Core Machinery Orders YoY (Nov)

Japan Core Machinery Orders YoY (Nov)--

F: --

P: --

Japan Core Machinery Orders MoM (Nov)

Japan Core Machinery Orders MoM (Nov)--

F: --

P: --

U.K. Rightmove House Price Index YoY (Jan)

U.K. Rightmove House Price Index YoY (Jan)--

F: --

P: --

China, Mainland GDP YoY (YTD) (Q4)

China, Mainland GDP YoY (YTD) (Q4)--

F: --

P: --

China, Mainland Industrial Output YoY (YTD) (Dec)

China, Mainland Industrial Output YoY (YTD) (Dec)--

F: --

P: --

Japan Industrial Output Final MoM (Nov)

Japan Industrial Output Final MoM (Nov)--

F: --

P: --

Japan Industrial Output Final YoY (Nov)

Japan Industrial Output Final YoY (Nov)--

F: --

P: --

Euro Zone Core HICP Final MoM (Dec)

Euro Zone Core HICP Final MoM (Dec)--

F: --

P: --

Euro Zone HICP Final MoM (Dec)

Euro Zone HICP Final MoM (Dec)--

F: --

P: --

Euro Zone HICP Final YoY (Dec)

Euro Zone HICP Final YoY (Dec)--

F: --

P: --

Euro Zone HICP MoM (Excl. Food & Energy) (Dec)

Euro Zone HICP MoM (Excl. Food & Energy) (Dec)--

F: --

P: --

Euro Zone Core CPI Final YoY (Dec)

Euro Zone Core CPI Final YoY (Dec)--

F: --

P: --

Euro Zone Core HICP Final YoY (Dec)

Euro Zone Core HICP Final YoY (Dec)--

F: --

P: --

Euro Zone CPI YoY (Excl. Tobacco) (Dec)

Euro Zone CPI YoY (Excl. Tobacco) (Dec)--

F: --

P: --

Euro Zone Core CPI Final MoM (Dec)

Euro Zone Core CPI Final MoM (Dec)--

F: --

P: --

Canada National Economic Confidence Index

Canada National Economic Confidence Index--

F: --

P: --

Canada CPI MoM (SA) (Dec)

Canada CPI MoM (SA) (Dec)--

F: --

P: --

Canada Core CPI MoM (SA) (Dec)

Canada Core CPI MoM (SA) (Dec)--

F: --

P: --

Canada CPI YoY (SA) (Dec)

Canada CPI YoY (SA) (Dec)--

F: --

P: --

Canada Trimmed CPI YoY (SA) (Dec)

Canada Trimmed CPI YoY (SA) (Dec)--

F: --

P: --

Canada CPI YoY (Dec)

Canada CPI YoY (Dec)--

F: --

P: --

Canada CPI MoM (Dec)

Canada CPI MoM (Dec)--

F: --

P: --

Canada Core CPI YoY (Dec)

Canada Core CPI YoY (Dec)--

F: --

P: --

Canada Core CPI MoM (Dec)

Canada Core CPI MoM (Dec)--

F: --

P: --

South Korea PPI MoM (Dec)

South Korea PPI MoM (Dec)--

F: --

P: --

China, Mainland 1-Year Loan Prime Rate (LPR)

China, Mainland 1-Year Loan Prime Rate (LPR)--

F: --

P: --

China, Mainland 5-Year Loan Prime Rate

China, Mainland 5-Year Loan Prime Rate--

F: --

P: --

Germany PPI YoY (Dec)

Germany PPI YoY (Dec)--

F: --

P: --

Germany PPI MoM (Dec)

Germany PPI MoM (Dec)--

F: --

P: --

U.K. 3-Month ILO Unemployment Rate (Nov)

U.K. 3-Month ILO Unemployment Rate (Nov)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

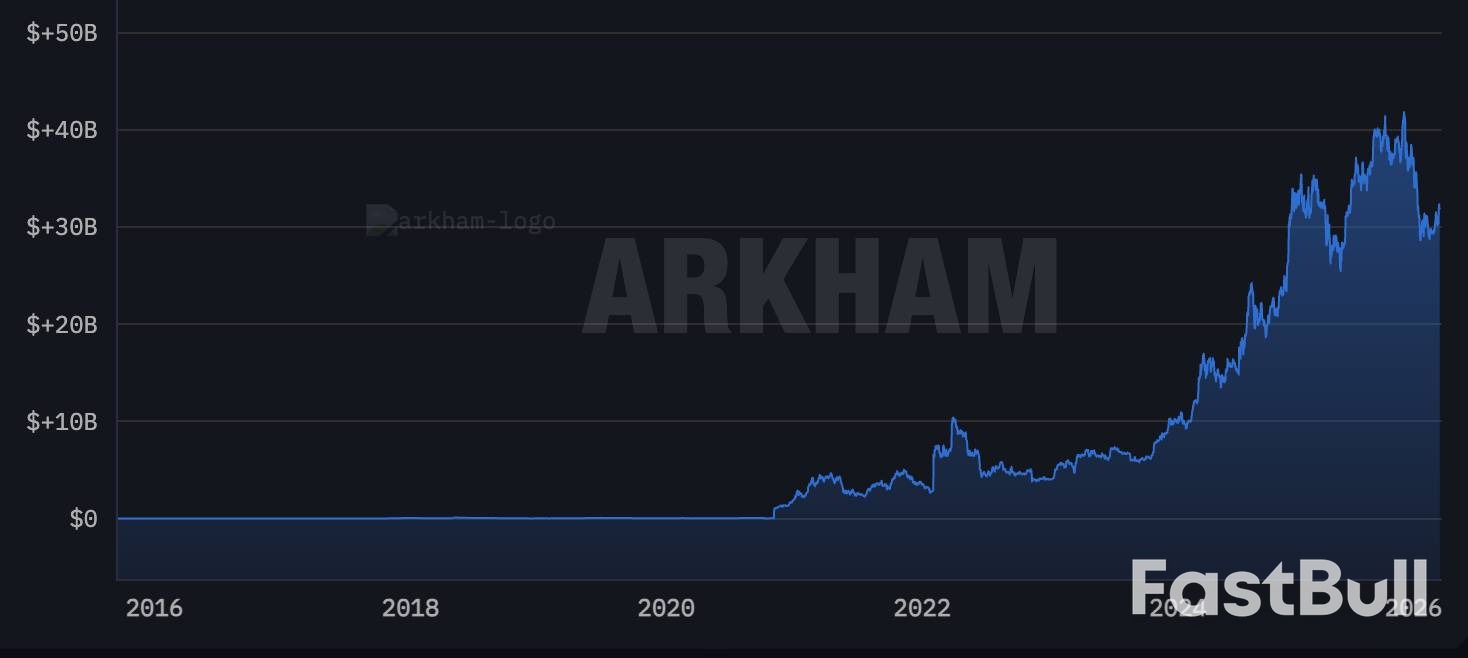

The US strategic Bitcoin reserve faces obscure legal hurdles and criticism for its limited growth, prompting new acquisition strategies.

The United States is facing "obscure" legal hurdles in its plan to establish a strategic Bitcoin reserve, according to Patrick Witt, director of the White House Crypto Council. The initiative, designed to create a national stockpile of digital assets, is currently navigating a complex regulatory landscape.

Speaking on the Crypto in America podcast, Witt confirmed that multiple government agencies, including the Department of Justice (DOJ) and the Office of Legal Counsel (OLC), are actively discussing the legal framework for the reserve.

"It seems straightforward, but then you get into some obscure legal provisions, and why this agency can't do it, but actually, this other agency could," Witt explained. "We're continuing to push on that. It is certainly still on the priority list right now."

The push for a national crypto reserve gained momentum in March 2025 when President Donald Trump signed an executive order to create a Strategic Bitcoin Reserve and a broader "Digital Asset Stockpile" that includes various altcoins.

While the move was seen as a landmark moment, its practical limitations quickly drew criticism. The order stipulated that the U.S. government would not sell its existing Bitcoin holdings. Crucially, it only allows the reserve to grow through BTC seized in asset forfeiture cases, prohibiting the government from purchasing Bitcoin or other digital assets on the open market.

The restrictions outlined in the executive order led many in the Bitcoin community to feel that the Trump administration had underdelivered on its promises. The inability to actively acquire BTC was seen as a major flaw.

Bitcoin maximalist Justin Bechler dismissed the effort, stating, "The belief that the federal government will one day build a Strategic Bitcoin Reserve requires a complete detachment from reality."

He added, "There is no movement toward a Bitcoin reserve. There is no intention to acquire a fixed-supply asset in good faith. There are only empty speeches, vague references and opportunistic pandering from Washington politicians."

Further backlash followed in July 2025 when the Trump administration released a long-awaited report on digital asset policy that failed to provide any new details about the strategic BTC reserve.

Despite the setbacks and criticism, discussions about growing the reserve continue. In August 2025, U.S. Treasury Secretary Scott Bessent renewed hope by suggesting the government could acquire BTC through "budget-neutral strategies" that would not increase the annual budget deficit.

This proposal opened the door to the possibility of the U.S. government actively buying Bitcoin on the open market. Potential strategies include converting portions of other reserve assets into BTC or using gains from revaluing the nation's precious metals holdings to fund Bitcoin acquisitions.

Former U.S. President Donald Trump has threatened to impose escalating tariffs on several key European allies unless Denmark agrees to sell Greenland to the United States. The ultimatum sharply intensifies a dispute over the Arctic territory and has already sparked protests in both Denmark and Greenland, with demonstrators demanding the island retain its right to self-determination.

In a post on Truth Social, Trump detailed his plan to levy an additional 10% import tariff starting February 1 on goods from Denmark, Norway, Sweden, France, Germany, the Netherlands, Finland, and Great Britain. These nations are already subject to tariffs previously imposed by his administration.

He added that the new tariffs would increase to 25% on June 1 and would not be lifted until the U.S. is able to purchase Greenland.

Trump has consistently framed the acquisition of Greenland as a matter of U.S. national security, pointing to its strategic Arctic location and significant mineral resources. He has not ruled out using force to achieve this goal.

Tensions have been rising, underscored by the recent deployment of European military personnel to the island at Denmark's request.

"These Countries, who are playing this very dangerous game, have put a level of risk in play that is not tenable or sustainable," Trump wrote. He stated that the U.S. was "immediately open to negotiation," citing America's decades-long role in providing security for Europe.

Analysts at Bernstein offered another perspective in a recent note. "Greenland was probably never really about just buying land or oil," they wrote. "We think it is about control of the Western Hemisphere."

In separate statements, Trump addressed reports concerning JPMorgan CEO Jamie Dimon. He forcefully denied a Wall Street Journal story claiming he had offered Dimon the position of Federal Reserve chair.

Trump also announced his intention to sue JPMorgan within the next two weeks. He accused the bank of "debanking" him after the January 6, 2021, attack on the U.S. Capitol.

Donald Trump has threatened to sue JPMorgan Chase & Co., accusing the banking giant and its CEO Jamie Dimon of "debanking" him following the Capitol riot on January 6, 2021.

The former president’s statement, made in a social media post on Saturday, was a direct response to a Wall Street Journal story. The report claimed Trump had offered Dimon the position of Federal Reserve chief several months ago, an offer Dimon reportedly interpreted as a joke.

"There was never such an offer," Trump wrote. "In fact, I'll be suing JPMorgan Chase over the next two weeks for incorrectly and inappropriately DEBANKING me after the January 6th Protest."

Trump did not provide further details on the planned lawsuit. JPMorgan did not immediately issue a comment on the matter.

This isn't the first time Trump has leveled these accusations against the bank. In August, he claimed JPMorgan "discriminated against me very badly," alleging the firm asked him to close accounts he had maintained for decades. Trump asserted that this action was linked to his supporters storming the Capitol to prevent the certification of Joe Biden’s 2021 election victory.

JPMorgan has previously acknowledged it is facing reviews, investigations, and legal proceedings connected to the broader political fight over "debanking."

In the past, Dimon has directly pushed back against claims that the bank's decisions are politically biased. "We do not debank people's religious or political affiliations," he told Fox Business in December.

Jamie Dimon has made his own position on a potential government role clear. When asked about leading the central bank at a U.S. Chamber of Commerce event on Thursday, Dimon was unequivocal.

"Chairman of the Fed, I'd put in the absolutely, positively no chance, no way, no how, for any reason," he stated.

However, he expressed openness to a different cabinet position, noting that if offered the job of running the Treasury, "I would take the call."

The public exchange highlights ongoing friction over the Federal Reserve's independence. Dimon recently criticized attacks on the institution, warning that "chipping away at Fed independence is not a great idea" and could ultimately result in higher inflation and interest rates. His comments followed actions by the Justice Department, including criminal subpoenas related to the renovation of the Fed's headquarters.

Meanwhile, the question of who would lead the central bank under a new Trump administration remains open. Fed Chair Jerome Powell's term ends in May. On Friday, Trump confirmed he has a successor in mind but declined to name the individual.

Canada is launching a bold new auto strategy designed to counter the impact of Donald Trump's protectionist trade policies, which have threatened to pull car manufacturing back to the United States. The plan, spearheaded by Prime Minister Mark Carney, aims to make Canada a more attractive place for automakers to build vehicles by offering better access to the domestic market.

The full strategy is expected to be unveiled in February by Industry Minister Melanie Joly. However, details emerging from government officials reveal a clear objective: to reverse the trend of plant closures and job losses that have hit the sector since the U.S. imposed tariffs on foreign cars.

Recent high-profile losses include the closure of a General Motors facility in Ontario and Stellantis's decision to build a new Jeep plant in Illinois instead of near Toronto. The new policy is Canada's direct response to these pressures.

In a significant policy shift, Canada will permit Chinese auto companies to assemble vehicles within its borders for the first time. This access, however, comes with strict conditions aimed at integrating these new players into the Canadian economy and managing security risks.

According to a government source, Chinese firms will be required to partner with local companies and utilize Canadian-made software. This requirement highlights a potential role for companies like BlackBerry in providing secure platforms for in-car technology. National security remains a core consideration, with officials emphasizing the need to prevent technology-related vulnerabilities.

The strategy extends beyond attracting traditional manufacturing. It includes a major push into the electric vehicle (EV) market through sales mandates and new buyer incentives. The ultimate goal is to diversify Canada's trade relationships and reduce its heavy reliance on the U.S. market, leveraging existing free trade agreements with Europe and Asia.

Currently, five major manufacturers—GM, Stellantis, Ford, Toyota, and Honda—operate assembly plants in Canada. Most of their output is exported to the United States. Meanwhile, major brands like Tesla, Nissan, and Kia serve the Canadian market, which saw 1.9 million new car sales last year, entirely through imports.

A recent trip to Beijing by Prime Minister Carney has already produced a concrete agreement with President Xi Jinping. This trade truce sets the stage for the new auto policy and includes several key provisions:

• EV Quotas: Canada will allow approximately 49,000 Chinese-made EVs to enter the country annually under a low 6% tariff. This is a dramatic reduction from the 100% surtax imposed in 2024.

• Reciprocal Benefits: In return, China has agreed to lower tariffs on Canadian agricultural exports and grant visa-free travel to Canadian citizens.

• Investment Commitment: During the same visit, Minister Joly secured a tentative agreement with automakers BYD and Chery, along with Canadian parts manufacturer Magna. Chinese firms gain immediate market access but must explore significant investment in Canadian production facilities within three years. Failure to do so could void the deal.

A crucial part of the agreement is a price cap, which mandates that a portion of the EV import quota must consist of vehicles priced at C$35,000 or less. This condition largely favors Chinese brands, which are already leaders in producing affordable EVs.

While the deal caught some in Washington by surprise, President Trump appeared unconcerned. When asked about the Carney-Xi agreement, he told reporters, "That's OK, that's what he should be doing. If you can get a deal with China you should do that."

Despite this reaction, the strategy carries risks. The agreement with China could introduce friction as Canada, the U.S., and Mexico prepare to review their trilateral trade pact. To mitigate potential surprises, the Canadian government stated it had briefed U.S. Trade Representative Jamieson Greer before the deal was finalized. Ultimately, the move underscores a broader ambition for Canada: to forge a more independent economic path, less reliant on its southern neighbor.

Political

Latest news on the Israeli-Palestinian conflict

Remarks of Officials

Palestinian-Israeli conflict

Middle East Situation

The White House has formally invited leaders from several countries to join a U.S.-led "Board of Peace" initiative, a plan designed to first manage the post-conflict governance of Gaza before expanding to address global conflicts. The move follows a fragile ceasefire in Gaza that has been in place since October.

According to a plan unveiled by the Trump administration, this international board will supervise a Palestinian technocratic administration during a transitional period. Both Israel and the Palestinian militant group Hamas have reportedly signed off on the framework.

The White House announced several members of the board, which is intended to outlive its initial role in Gaza. President Donald Trump will serve as the board's chair.

Key members named to the "Board of Peace" include:

• Marco Rubio, U.S. Secretary of State

• Steve Witkoff, Trump's special envoy

• Tony Blair, former British prime minister

• Jared Kushner, Trump's son-in-law

• Marc Rowan, private equity executive

• Ajay Banga, World Bank President

• Robert Gabriel, Trump adviser

Nikolay Mladenov, a former U.N. Middle East envoy, was named high representative for Gaza. Additionally, Army Major General Jasper Jeffers, a U.S. special operations commander, was appointed to lead the International Stabilization Force. This force was authorized by a U.N. Security Council resolution in mid-November.

The White House confirmed more members will be announced in the coming weeks but did not detail the specific responsibilities of each appointee. Notably, the current list does not include any Palestinian members.

In a related move, the White House also announced an 11-member "Gaza Executive Board" to support the technocratic body. This group includes Turkish Foreign Minister Hakan Fidan, U.N. Middle East peace coordinator Sigrid Kaag, UAE International Cooperation Minister Reem Al-Hashimy, and Israeli-Cypriot billionaire Yakir Gabay.

However, the office of Israeli Prime Minister Benjamin Netanyahu stated that the composition of this executive board was not coordinated with Israel and contradicts its policy. The objection may be related to the inclusion of Turkey's Hakan Fidan, as Israel has opposed Turkish involvement.

President Trump has indicated that the board's mandate will extend far beyond the Middle East. "It's going to, in my opinion, start with Gaza and then do conflicts as they arise," Trump told Reuters, adding that its objective would be to address "other countries that are going to war with each other."

Invitations to join the Board of Peace have been sent to the leaders of France, Germany, Australia, and Canada, according to four sources. The offices of the Egyptian and Turkish presidents confirmed receiving invitations, and an EU official stated that European Commission President Ursula von der Leyen was invited to represent the European Union.

The initiative has drawn criticism from rights experts, who have described the structure as resembling a colonial framework. The involvement of Tony Blair has also been criticized due to his role in the Iraq war. One diplomat familiar with the invitation letter called the board a "bold new approach to resolving Global Conflict" and described it as a "'Trump United Nations' that ignores the fundamentals of the U.N. charter."

The fragile ceasefire has been marked by accusations of violations from both Israel and Hamas. During the truce, over 450 Palestinians, including more than 100 children, and three Israeli soldiers have been reported killed.

Israel's military assault on Gaza, which began in October 2023, has killed tens of thousands, triggered a hunger crisis, and internally displaced the entire population. Numerous rights experts, scholars, and a U.N. inquiry have concluded that the actions amount to genocide. Israel maintains it acted in self-defense following an attack by Hamas-led militants in late 2023 that killed 1,200 people and resulted in over 250 hostages being taken.

The European Union and the South American bloc Mercosur have officially signed one of the world's largest free trade agreements, concluding a negotiation process that spanned more than two decades.

The historic pact was signed in Asunción, Paraguay, by European Commission President Ursula von der Leyen and European Council head Antonio Costa. This milestone comes just a week after the EU gave its final approval to the deal with Mercosur, which includes Brazil, Argentina, Uruguay, and Paraguay.

The agreement establishes an integrated market of 780 million consumers and is poised to significantly strengthen Europe's economic presence in a resource-rich region where the United States and China are also competing for influence. Leaders like von der Leyen and Brazil's Luiz Inacio Lula da Silva have framed the deal as a declaration of independence from the two global superpowers.

"This moment is about connecting continents," von der Leyen stated at the signing ceremony. "We choose fair trade over tariffs; we choose a productive long-term partnership over isolation."

The agreement promises substantial economic benefits by systematically eliminating tariffs. South America's agricultural giants are expected to gain from easier access to European markets, while European industrial sectors—including cars and machinery—will benefit from the removal of import levies.

• Combined Economy: The two blocs represent a combined economy valued at $22 trillion.

• GDP Growth: Bloomberg Economics estimates the deal could boost the Mercosur economy by up to 0.7% by 2040 and the EU's economy by 0.1% after 15 years.

"That will help the region to be better integrated to the global economy," said Tatiana Prazeres, Brazil's foreign trade secretary.

The deal is a major strategic move for the EU, expanding its trade network to cover 97% of Latin America's economy, according to Banco Santander SA. This far surpasses the economic reach of the US (44%) and China (14%) in the region.

The EU's share of trade with Mercosur had previously declined from 23% in 2001 to 14%, making this agreement a critical tool for reversing that trend. The pact arrives as the US shows renewed policy interest in South America, highlighted by the Trump administration's recent national security document and the arrest of Venezuelan leader Nicolas Maduro.

For Europe, this agreement offers a way to navigate its complex trade relationships with both the US and China, especially after a year marked by trade disputes in 2025. It positions Europe as a credible economic partner for South America, particularly as it seeks investment to develop reserves of metals and minerals essential for its green and digital transitions.

Securing Critical Raw Materials

In a related development, von der Leyen confirmed that Europe and Brazil are negotiating a separate agreement focused on critical metals. This deal aims to frame cooperation on joint investment projects in lithium, nickel, and rare earths.

She emphasized that such a partnership would promote strategic independence "in a world where minerals tend to become an instrument of coercion."

The final signing ceremony was attended by Argentine President Javier Milei, Uruguay's Yamandu Orsi, and Paraguay's Santiago Pena. Brazilian President Lula, who has been involved in the talks since his first term in 2003, met with von der Leyen separately in Rio de Janeiro.

The deal nearly collapsed in December due to strong opposition from major agricultural nations like France and Italy. However, the inclusion of safeguard measures for European farmers successfully brought Italian Prime Minister Giorgia Meloni on board. This left French President Emmanuel Macron without enough support to block the agreement.

Despite the signing, the pact still requires final ratification by the European Parliament before it can be fully implemented.

Egypt is setting the stage for a major expansion of its energy sector, backed by recent oil discoveries and an ambitious strategy to scale its renewable energy capacity. The country kicked off the year by signing $1.8 billion in renewable energy agreements, signaling a serious commitment to its clean energy goals.

These new deals, which include contracts with Norwegian developer Scatec and China's Sungrow, are a cornerstone of Egypt's plan to have renewable sources account for 42% of its electricity generation by 2030.

The first major project underway is a Scatec solar energy plant in Upper Egypt's Minya Governorate. According to an Egyptian cabinet statement, this facility will not only produce clean electricity but will also feature integrated energy storage stations. The solar plant is designed for a total capacity of 1.7 GW, complemented by 4 GW-hours of battery storage.

In a related move, the Egyptian government has finalized a power purchase agreement (PPA) with Scatec for 1.95 GW of clean power and 3.9 GW-hours of battery storage. Scatec noted in a statement that these agreements highlight a growing market demand for reliable clean power and sophisticated storage solutions.

Alongside generation projects, Egypt is focused on developing local manufacturing capabilities. Sungrow plans to construct a factory in the Suez Canal Economic Zone dedicated to producing energy storage batteries.

A portion of the factory's output will supply the new Scatec solar plant, while the rest will be targeted for regional export and to meet rising domestic demand. This initiative aligns with the government's strategy to bolster supply chain security through local production.

This aggressive push into renewables is a direct response to the severe energy shortages Egypt has faced in recent years. The country's economy was particularly affected by shortfalls in natural gas production from its giant offshore Zohr field.

To counter this, Egypt began courting foreign investment in green energy last year, aiming to secure over $10 billion in private funding for wind and solar projects. By the end of 2024, it had attracted $4 billion. To draw in more capital, the government has been offering a suite of incentives, including tax breaks, free land, and cash rebates. However, experts have noted that improvements to national energy policies are also essential to attract the desired level of investment.

By 2024, Egypt's installed renewable energy capacity, including hydropower, wind, and solar, was nearly 7.8 GW. Solar capacity alone saw a dramatic rise from just 35 MW in 2012 to almost 2.6 GW in 2024. The New and Renewable Energy Authority reported that the country's total renewable installed capacity reached about 8.6 GW last year.

Looking ahead, Egypt is also positioning itself as a key player in the green hydrogen market. Last year, the government announced investment incentive packages designed to capture 8% of the global green hydrogen share, equivalent to 10 million tonnes per year.

Egypt's strategic location, connecting Africa, Europe, and the Middle East, combined with its abundant sunlight, makes it an ideal hub for green hydrogen production and export. The Suez Canal is expected to become a critical artery in the global clean energy supply chain.

A tangible project in this area is the expansion of green ammonia production at the Misr Fertilisers Production Company complex in Damietta. In partnership with Scatec and Yara International, the project will use 480 MW of solar and wind energy to produce 150,000 tonnes of green ammonia annually, with production slated to begin in 2027.

While these new projects are promising, the government acknowledges that more international support is needed to hit its 2030 energy mix target. Investors have previously been hesitant due to a lack of clarity on long-term power pricing. However, the new PPA-based deal with Scatec suggests a shift towards more favorable contracts designed to attract foreign developers.

Azza Ghanem, an Energy and Environmental Economist, noted the significant progress. "Egypt has successfully integrated more than 2,000 MW of wind power and over 2,500 MW of solar power into the national grid—a significant shift compared to the situation a decade ago," she said. Ghanem emphasized that public-private partnerships and long-term PPAs have been crucial for driving investment, helping to reduce fossil fuel reliance and support Egypt's climate objectives.

To realize its full green energy potential, Egypt must continue to refine its policies and successfully attract higher levels of international investment across the entire clean energy spectrum.

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up