Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

UBS CFO Tuckner: Reasonable To Expect A Phase-In For Capital Ordinance Measure, But Needs Confirmation By Swiss Government

[Reminder] U.K. Services PMI Final (Jan) has not been announced, and will be announced from time to time later

[Reminder] U.K. Composite PMI Final (Jan) has not been announced, and will be announced from time to time later

Venezuela Top Economic Advisor Ortega: Want Venezuela To Be Known As A Country With One Of The Highest Oil Production Levels

Swedish Central Bank Governor Thedeen:-, My Assessment Is That The Likelihoodof Very Restrictive Trade Barriers Is Nevertheless Limited

Swedish Central Bank Governor Thedeen:-The Greenland Crisis Hascreated Renewed Uncertainty Regarding The Rules That Will Apply To Our Economicexchanges With The United States

Swedish Central Bank's Seim: I Assess That The Increased Uncertainty Reduces The Risk Of Demand Driven Inflation In Sweden Somewhat

Swedish Central Bank's Deputy Governor Bunge: Will Probably Have To Monitor Both Whether The Strengthening Of The Krona Continues And Its Impact On Prices

Iceland's Central Bank: Further Decisions To Lower Interest Rates Will Depend On Clear Evidence That Inflation Is Falling Back To Bank's 2½% Inflation Target

Australia Overnight (Borrowing) Key Rate

Australia Overnight (Borrowing) Key RateA:--

F: --

P: --

RBA Rate Statement

RBA Rate Statement Japan 10-Year Note Auction Yield

Japan 10-Year Note Auction YieldA:--

F: --

P: --

The U.S. House of Representatives voted on a short-term spending bill to end the partial government shutdown.

The U.S. House of Representatives voted on a short-term spending bill to end the partial government shutdown. Saudi Arabia IHS Markit Composite PMI (Jan)

Saudi Arabia IHS Markit Composite PMI (Jan)A:--

F: --

P: --

RBA Press Conference

RBA Press Conference Turkey PPI YoY (Jan)

Turkey PPI YoY (Jan)A:--

F: --

P: --

Turkey CPI YoY (Jan)

Turkey CPI YoY (Jan)A:--

F: --

P: --

Turkey CPI YoY (Excl. Energy, Food, Beverage, Tobacco & Gold) (Jan)

Turkey CPI YoY (Excl. Energy, Food, Beverage, Tobacco & Gold) (Jan)A:--

F: --

P: --

U.K. 10-Year Note Auction Yield

U.K. 10-Year Note Auction YieldA:--

F: --

P: --

Richmond Federal Reserve President Barkin delivered a speech.

Richmond Federal Reserve President Barkin delivered a speech. U.S. Weekly Redbook Index YoY

U.S. Weekly Redbook Index YoYA:--

F: --

P: --

Mexico Manufacturing PMI (Jan)

Mexico Manufacturing PMI (Jan)A:--

F: --

P: --

U.S. API Weekly Refined Oil Stocks

U.S. API Weekly Refined Oil StocksA:--

F: --

P: --

U.S. API Weekly Gasoline Stocks

U.S. API Weekly Gasoline StocksA:--

F: --

P: --

U.S. API Weekly Cushing Crude Oil Stocks

U.S. API Weekly Cushing Crude Oil StocksA:--

F: --

P: --

U.S. API Weekly Crude Oil Stocks

U.S. API Weekly Crude Oil StocksA:--

F: --

P: --

Japan IHS Markit Services PMI (Jan)

Japan IHS Markit Services PMI (Jan)A:--

F: --

P: --

Japan IHS Markit Composite PMI (Jan)

Japan IHS Markit Composite PMI (Jan)A:--

F: --

P: --

China, Mainland Caixin Services PMI (Jan)

China, Mainland Caixin Services PMI (Jan)A:--

F: --

P: --

China, Mainland Caixin Composite PMI (Jan)

China, Mainland Caixin Composite PMI (Jan)A:--

F: --

P: --

India HSBC Services PMI Final (Jan)

India HSBC Services PMI Final (Jan)A:--

F: --

P: --

India IHS Markit Composite PMI (Jan)

India IHS Markit Composite PMI (Jan)A:--

F: --

P: --

Russia IHS Markit Services PMI (Jan)

Russia IHS Markit Services PMI (Jan)A:--

F: --

P: --

South Africa IHS Markit Composite PMI (SA) (Jan)

South Africa IHS Markit Composite PMI (SA) (Jan)A:--

F: --

P: --

Italy Services PMI (SA) (Jan)

Italy Services PMI (SA) (Jan)A:--

F: --

P: --

Italy Composite PMI (Jan)

Italy Composite PMI (Jan)A:--

F: --

P: --

Germany Composite PMI Final (SA) (Jan)

Germany Composite PMI Final (SA) (Jan)A:--

F: --

P: --

Euro Zone Composite PMI Final (Jan)

Euro Zone Composite PMI Final (Jan)A:--

F: --

P: --

Euro Zone Services PMI Final (Jan)

Euro Zone Services PMI Final (Jan)A:--

F: --

P: --

U.K. Composite PMI Final (Jan)

U.K. Composite PMI Final (Jan)--

F: --

P: --

U.K. Total Reserve Assets (Jan)

U.K. Total Reserve Assets (Jan)--

F: --

P: --

U.K. Services PMI Final (Jan)

U.K. Services PMI Final (Jan)--

F: --

P: --

U.K. Official Reserves Changes (Jan)

U.K. Official Reserves Changes (Jan)--

F: --

P: --

Euro Zone Core CPI Prelim YoY (Jan)

Euro Zone Core CPI Prelim YoY (Jan)--

F: --

P: --

Euro Zone Core HICP Prelim YoY (Jan)

Euro Zone Core HICP Prelim YoY (Jan)--

F: --

P: --

Euro Zone PPI MoM (Dec)

Euro Zone PPI MoM (Dec)--

F: --

P: --

Euro Zone HICP Prelim YoY (Jan)

Euro Zone HICP Prelim YoY (Jan)--

F: --

P: --

Euro Zone Core HICP Prelim MoM (Jan)

Euro Zone Core HICP Prelim MoM (Jan)--

F: --

P: --

Italy HICP Prelim YoY (Jan)

Italy HICP Prelim YoY (Jan)--

F: --

P: --

Euro Zone Core CPI Prelim MoM (Jan)

Euro Zone Core CPI Prelim MoM (Jan)--

F: --

P: --

Euro Zone PPI YoY (Dec)

Euro Zone PPI YoY (Dec)--

F: --

P: --

U.S. MBA Mortgage Application Activity Index WoW

U.S. MBA Mortgage Application Activity Index WoW--

F: --

P: --

Brazil IHS Markit Composite PMI (Jan)

Brazil IHS Markit Composite PMI (Jan)--

F: --

P: --

Brazil IHS Markit Services PMI (Jan)

Brazil IHS Markit Services PMI (Jan)--

F: --

P: --

U.S. ADP Employment (Jan)

U.S. ADP Employment (Jan)--

F: --

P: --

The U.S. Treasury Department released its quarterly refinancing statement.

The U.S. Treasury Department released its quarterly refinancing statement. U.S. IHS Markit Composite PMI Final (Jan)

U.S. IHS Markit Composite PMI Final (Jan)--

F: --

P: --

U.S. IHS Markit Services PMI Final (Jan)

U.S. IHS Markit Services PMI Final (Jan)--

F: --

P: --

U.S. ISM Non-Manufacturing Price Index (Jan)

U.S. ISM Non-Manufacturing Price Index (Jan)--

F: --

P: --

U.S. ISM Non-Manufacturing Employment Index (Jan)

U.S. ISM Non-Manufacturing Employment Index (Jan)--

F: --

P: --

U.S. ISM Non-Manufacturing New Orders Index (Jan)

U.S. ISM Non-Manufacturing New Orders Index (Jan)--

F: --

P: --

U.S. ISM Non-Manufacturing PMI (Jan)

U.S. ISM Non-Manufacturing PMI (Jan)--

F: --

P: --

U.S. ISM Non-Manufacturing Inventories Index (Jan)

U.S. ISM Non-Manufacturing Inventories Index (Jan)--

F: --

P: --

U.S. EIA Weekly Crude Oil Imports Changes

U.S. EIA Weekly Crude Oil Imports Changes--

F: --

P: --

U.S. EIA Weekly Crude Demand Projected by Production

U.S. EIA Weekly Crude Demand Projected by Production--

F: --

P: --

U.S. EIA Weekly Heating Oil Stock Changes

U.S. EIA Weekly Heating Oil Stock Changes--

F: --

P: --

U.S. EIA Weekly Gasoline Stocks Change

U.S. EIA Weekly Gasoline Stocks Change--

F: --

P: --

U.S. EIA Weekly Crude Stocks Change

U.S. EIA Weekly Crude Stocks Change--

F: --

P: --

U.S. EIA Weekly Cushing, Oklahoma Crude Oil Stocks Change

U.S. EIA Weekly Cushing, Oklahoma Crude Oil Stocks Change--

F: --

P: --

Australia Trade Balance (SA) (Dec)

Australia Trade Balance (SA) (Dec)--

F: --

P: --

No matching data

View All

No data

Zero net migration could shrink the UK economy by 2040, forcing tax hikes and expanding deficits, NIESR warns.

A future with zero net migration could shrink the UK economy by 3.6% by 2040, forcing the government to implement major tax increases to cover a ballooning budget deficit, according to a new forecast from the National Institute of Economic and Social Research (NIESR).

The think tank analyzed a scenario where falling UK birthrates are compounded by a complete halt in net migration, a trend that began to accelerate last year.

Under this projection, the UK's population growth would flatline around 70 million in 2030, up only slightly from the 69.3 million recorded in 2024.

"Net zero migration leaves the economy 3.6% smaller by 2040 and this reflects slower employment growth and a smaller workforce," stated Dr. Benjamin Caswell, a senior economist at NIESR.

The core issue is demographic drag. "Imagine it as like freezing the population where it is, and then just having a continually ageing population," Caswell explained.

While the headline figures are concerning, the report notes that the immediate economic effects wouldn't be entirely negative. Initially, a smaller labor pool would force companies to invest more in machinery and technology, boosting productivity.

This shift would lead to a rise in real wages and disposable income. NIESR projects that GDP per capita could increase by 2% by 2040 under this scenario.

However, these gains would be overshadowed by weaker overall economic growth. An aging and shrinking population generates less tax revenue, creating a widening gap between public spending and government income.

"In the short to medium term, it's not too detrimental," Caswell noted. "But over 20 years this gap [in spending and receipts] becomes continually larger and larger."

NIESR forecasts that the government would have to fill this fiscal hole with more borrowing. This would cause the budget deficit to swell by approximately 0.8% of GDP, equivalent to £37 billion, by the year 2040.

This forecast is built on the assumption that government spending and tax rates follow the path outlined by the Office for Budget Responsibility (OBR) until 2030, after which the share of government spending relative to GDP remains constant.

While some payments like child benefit or jobseeker's allowance would adjust to the demographic changes, the think tank believes government investment and consumption would not significantly alter.

Caswell concluded that unless the UK's fertility rate increases, a zero net migration scenario "would not be fiscally sustainable... unless there were significant tax rises, and significant tax rises could potentially choke off economic growth."

The NIESR analysis comes after net migration to the UK fell sharply in 2025, dropping from 649,000 to 204,000 in the year to June following a tightening of work visa requirements by the Conservative government.

The report adds that further measures from the Labour government concerning the recruitment of foreign workers in health and social care could push migration levels down even more. With the number of births and deaths in the UK now roughly equal, migration has become the primary driver of any change in the nation's population.

Mario Draghi, former head of the European Central Bank and a past Italian prime minister, has delivered a blunt ultimatum to the European Union: embrace a more federal structure or risk becoming irrelevant on the world stage. He warns that unless national governments surrender more power to Brussels, Europe faces a future of economic and geopolitical subordination.

Speaking in Belgium at KU Leuven, Draghi painted a grim picture of a world where power is consolidating around the United States and China, leaving Europe at risk of becoming "subordinated, divided, and deindustrialised at once." He argued that the collapse of the old economic world order is not the primary threat—the real danger lies in what might replace it.

According to Draghi, the EU has a fundamental decision to make. It can either remain a large but passive market subject to the priorities of global rivals or transform itself into a unified political force capable of defending its own interests.

"Of all those who today find themselves squeezed between the United States and China, only Europeans have the option of becoming a true power themselves," he stated. This call for "more Europe" echoes previous arguments made by EU leaders during times of economic or geopolitical crisis.

Draghi framed the choice in stark terms: "Do we simply remain a large market, subject to the priorities of others? Or do we take the necessary steps to become a power?"

Draghi contrasted the areas where the EU acts as a unified power with those where it remains fragmented and weak.

Successes in Centralized Policy

He argued that Europe commands global influence only when powers are centralized at the EU level. He pointed to specific examples where this model has proven effective:

• Trade policy

• Competition law

• The single market

• Monetary policy

"Where Europe has federated... we are respected as a power and negotiate as one," he said. However, many Europeans view these centralized functions as overly bureaucratic and responsible for imposing "one-size-fits-all" policies on diverse nations.

Weaknesses from Fragmentation

In contrast, Draghi claimed that fragmentation in key strategic areas leaves the bloc vulnerable. In defense, foreign policy, and industrial strategy, Europe's lack of unity means it is treated as "a loose assembly of middle-sized states to be divided and dealt with accordingly."

He further warned that economic strength is meaningless without military independence, noting that Europe’s reliance on the United States for security undermines its commercial power.

Draghi was critical of both Washington and Beijing, framing them as external forces applying pressure on a divided Europe.

He described a United States that now openly benefits from European political fragmentation, imposing tariffs and threatening EU interests. "For the first time," he said, the U.S. seems to "consider European political fragmentation to serve their own interests."

Meanwhile, he warned that China "controls critical nodes in global supply chains and is willing to exploit that leverage."

Draghi's call for deeper integration is likely to fuel criticism from Eurosceptic politicians and commentators. Their argument is the polar opposite: that Europe's economic stagnation and political tensions are caused by excessive centralization and regulation from Brussels, not a lack of it.

From their perspective, transferring more power away from national governments would only deepen voter alienation and further weaken democratic accountability across the bloc.

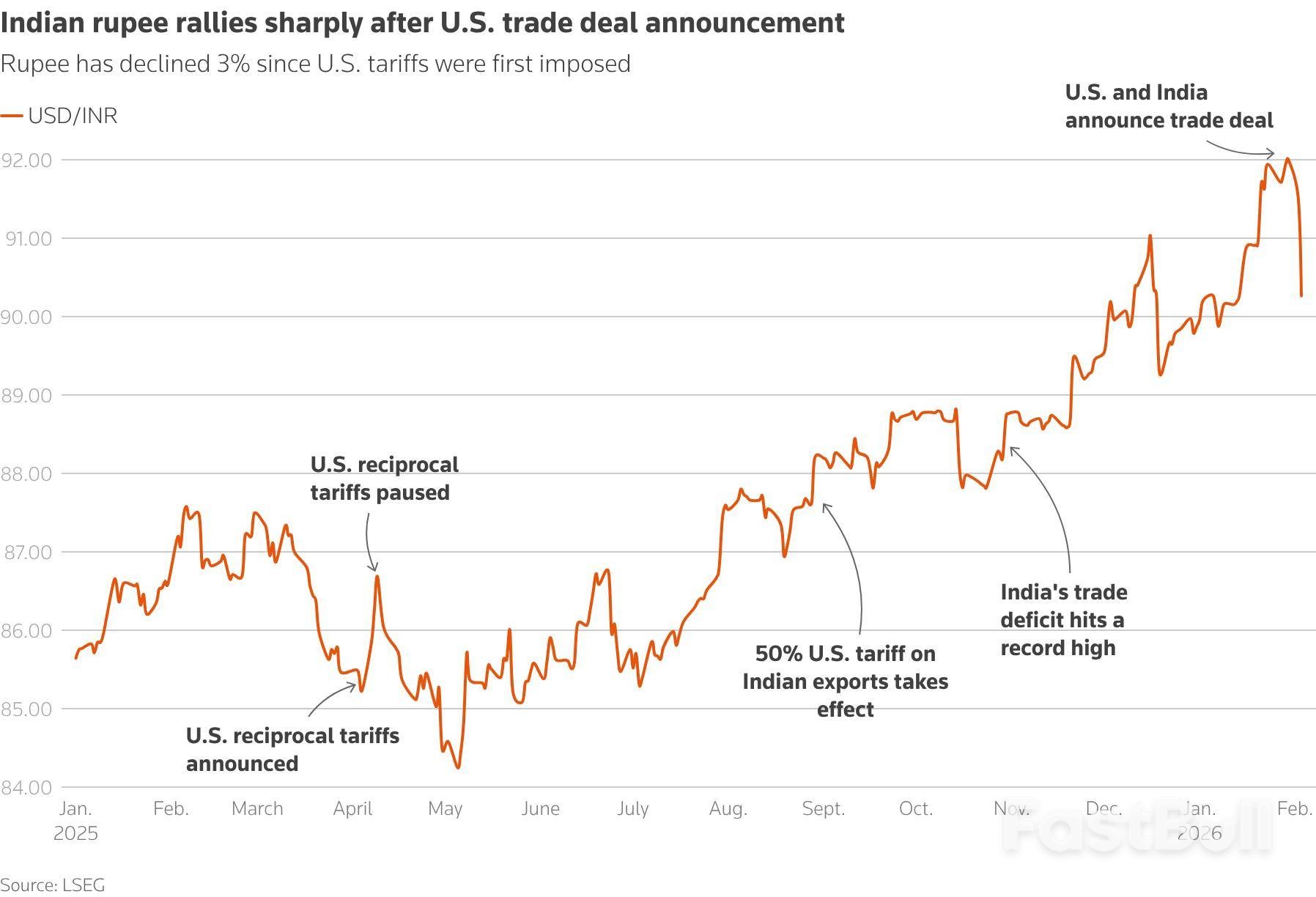

The Indian rupee just posted its strongest single-day gain in over seven years, and Bank of America believes the rally has further to run. Following a new trade agreement with the U.S., the bank has upgraded its forecast and expects the rupee to strengthen significantly by the end of March.

Vikas Jain, Bank of America's head of India fixed income, currencies, and commodities trading, stated in an interview that the bank now projects the rupee will reach 88.60-89.00 against the U.S. dollar. This represents a 2% upward revision from its previous forecast of 90.50-91.00.

The currency's sharp move was triggered by an announcement from U.S. President Donald Trump, who confirmed that tariffs on Indian goods would be reduced from 50% to 18%.

The market reacted immediately. The rupee surged 1.4% on Tuesday to 90.2650 from near-record lows, marking its biggest one-day jump since December 2018. By Wednesday, the currency was trading at 90.46.

Lingering uncertainty over the trade deal had been a major headwind for the rupee. In January alone, the currency weakened by 2% and hit a record low of 91.9875 as foreign investors pulled approximately $4 billion net from stock markets.

"Rupee was under pressure due to the outflows which we saw for the last month, and I think that should stop," Jain explained.

He added that a shift in exporter behavior could provide another layer of support. As the rupee fell, many exporters had reduced their currency hedging and held onto U.S. dollars overseas, expecting further weakness. With the outlook now improving, they are likely to increase hedging activity, which involves selling dollars and buying rupees.

As foreign capital potentially returns to India, Jain does not anticipate the Reserve Bank of India (RBI) will step in to aggressively buy U.S. dollars and build its foreign exchange reserves.

According to the latest data, the RBI sold nearly $30 billion between September and November. Despite this, India’s foreign exchange reserves reached a record high of $709 billion in the week ending January 23, boosted by rising gold prices and multiple FX swaps.

"I do not think RBI will be buying aggressively at the current level," Jain noted. "If the rupee stays around this level, the RBI might roll over their forward book and not intervene heavily."

Discounts on Russian oil for Indian refiners have widened significantly in the last ten days, posing a direct challenge to a recent trade understanding with the United States aimed at curbing these purchases.

Traders familiar with the transactions report that Russia's flagship Urals grade is now being offered at a discount of more than $10 per barrel below Brent crude. This price includes shipping and other associated costs.

According to market intelligence firm Argus, the current discount is around $11 a barrel. This marks a notable increase from the $9.15 figure recorded as recently as January 22. The current markdown is also at least three times higher than the levels quoted before the U.S. sanctioned Russian energy giants Rosneft PJSC and Lukoil PJSC in October. The final discount can vary based on payment conditions.

The growing price incentive from Russia coincides with new geopolitical pressure from Washington. President Donald Trump announced on Monday that the U.S. would lower import tariffs on Indian products. In exchange, India is expected to stop purchasing Russian oil.

While Prime Minister Narendra Modi acknowledged the agreement, he did not provide specific details, leaving the status of crude oil imports ambiguous. This lack of clarity has caused Indian refiners to pause their Russian oil purchases as they seek guidance from New Delhi.

India emerged as a major customer for Russian crude following the invasion of Ukraine in early 2022, drawn by the substantial discounts. While not traditionally a top buyer, India's imports surged, peaking at 2 million barrels per day.

Purchases have moderated in recent months but remained strong. According to data from Kpler, India imported an average of 1.2 million barrels per day in January.

Despite the political pressure, market analysts believe India's demand for Russian crude will persist. In a note on Tuesday, Kpler stated that India is "unlikely to fully disengage" from Russian oil in the near future.

The data intelligence firm projects that India's imports will hold steady in the range of 1.1 million to 1.3 million barrels per day through the first quarter and into the beginning of the second. Kpler estimates the current Urals discount to India at approximately $9 per barrel against ICE Brent, making it about $4 to $5 per barrel cheaper than comparable Venezuelan crude.

German Chancellor Friedrich Merz is leading a delegation to the Middle East this week in a strategic push to diversify energy supplies and lessen Germany's dependence on liquefied natural gas (LNG) from the United States.

The three-day trip begins Wednesday in Riyadh with a scheduled meeting with Crown Prince Mohammed bin Salman. The chancellor and accompanying corporate leaders will then travel to Qatar and the United Arab Emirates before returning to Berlin.

According to government officials, the visit is a core part of Germany's broader strategy to secure new global energy sources and find new markets for its industrial exports.

Germany's move is driven by growing concerns over its reliance on American energy. Following Russia's invasion of Ukraine, Germany banned Russian pipeline gas, which had previously accounted for over half of its natural gas imports. This forced a rapid pivot to other suppliers.

Today, LNG makes up about 13% of Germany's total gas imports, with a staggering 94% of that LNG coming from the U.S.

This heavy concentration is now viewed as a potential security risk, particularly after the Trump administration used energy as a bargaining chip in tariff negotiations. Last year, Europe pledged to purchase $750 billion in US energy through 2028. However, recent rhetoric from Trump has renewed fears in Berlin that this economic leverage could be used strategically.

"High dependency is a problem in view of the authoritarian development of the US government and the risk of geopolitical blackmail," explained Susanne Nies, an energy expert at the Helmholtz-Zentrum Berlin think tank. Nies suggested Germany should also explore alternatives like increased pipeline gas from Norway and LNG from Canada or Australia.

This effort follows a similar trip made by Merz's predecessor, Olaf Scholz, who visited the Gulf states in September 2022 to secure LNG deals immediately after the break with Russia. Merz's current visit aims to build on that foundation and further reduce exposure to any single supplier.

Beyond energy, the chancellor's agenda includes discussions on closer defense cooperation and the tense security situation in the region. The visit, however, is shadowed by concerns over potential renewed US attacks on Iran following a harsh crackdown on protestors in Tehran.

A significant challenge in pivoting to Gulf suppliers is a mismatch in timelines. Gulf LNG producers typically require buyers to sign long-term contracts of at least 20 years.

This conflicts with Germany's climate policy, which mandates a complete ban on all LNG imports from the end of 2043. This deadline gives German companies a strong incentive to continue using US export terminals, which offer greater contractual flexibility.

Claudia Kemfert, head of the energy department at the German Institute for Economic Research, highlighted the underlying issue. "The very high dependence on the US is problematic because it creates new geopolitical and price risks," she said. "The lesson to be learned from this is that Germany should reduce its overall dependence on fossil fuels and not just switch supplier countries."

South Korean officials are engaged in a high-stakes effort to prevent the United States from imposing a threatened 25% tariff hike, a move that could disrupt a trade agreement reached last year. The diplomatic scramble comes as lawmakers in Seoul work to pass a special bill needed to authorize investment funds pledged to the U.S.

To de-escalate the situation, South Korea's top diplomat, Cho Hyun, met with Secretary of State Marco Rubio in Washington on Tuesday. According to South Korea's Foreign Ministry, Minister Cho used the meeting to detail the country's domestic efforts to implement the tariff agreement and reaffirmed its investment commitments.

This visit follows a similar trip last week by Industry Minister Kim Jung-kwan, who held talks with Secretary of Commerce Howard Lutnick. During that meeting, Kim clarified that Seoul has no intention of delaying or failing to implement the trade deal. Cho stated before his departure that he would seek American understanding of South Korea's legislative process.

The diplomatic push was triggered after President Donald Trump announced last week that he would raise the levy on South Korean goods from 15% to 25%. Trump cited the failure of the country's legislature to formally codify the trade deal the two nations agreed upon last year.

That agreement, which took months to negotiate, was designed to lower threatened U.S. tariff rates in exchange for significant investment promises from South Korea. However, the latest threat highlights the persistent risks facing U.S. trading partners. While it remains unclear if or when Washington will formalize the tariff hike, officials in Seoul have indicated that the U.S. is holding internal discussions on the matter.

Back in South Korea, Finance Minister Koo Yun-cheol has been lobbying parliament for the swift passage of the "Special Law on Strategic Investment with the US." This legislation is crucial as it underpins South Korea's pledge to invest $350 billion in the United States.

Following a meeting with Minister Koo, the chair of the National Assembly's finance committee confirmed that they will push to hold a hearing on the law before this month's Lunar New Year holiday, signaling a potential path forward to resolving the impasse.

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

Log In

Sign Up