Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

U.S. Average Hourly Wage MoM (SA) (Dec)

U.S. Average Hourly Wage MoM (SA) (Dec)A:--

F: --

U.S. Average Weekly Working Hours (SA) (Dec)

U.S. Average Weekly Working Hours (SA) (Dec)A:--

F: --

P: --

U.S. New Housing Starts Annualized MoM (SA) (Oct)

U.S. New Housing Starts Annualized MoM (SA) (Oct)A:--

F: --

U.S. Total Building Permits (SA) (Oct)

U.S. Total Building Permits (SA) (Oct)A:--

F: --

P: --

U.S. Building Permits MoM (SA) (Oct)

U.S. Building Permits MoM (SA) (Oct)A:--

F: --

P: --

U.S. Annual New Housing Starts (SA) (Oct)

U.S. Annual New Housing Starts (SA) (Oct)A:--

F: --

U.S. U6 Unemployment Rate (SA) (Dec)

U.S. U6 Unemployment Rate (SA) (Dec)A:--

F: --

P: --

U.S. Manufacturing Employment (SA) (Dec)

U.S. Manufacturing Employment (SA) (Dec)A:--

F: --

U.S. Labor Force Participation Rate (SA) (Dec)

U.S. Labor Force Participation Rate (SA) (Dec)A:--

F: --

P: --

U.S. Private Nonfarm Payrolls (SA) (Dec)

U.S. Private Nonfarm Payrolls (SA) (Dec)A:--

F: --

U.S. Unemployment Rate (SA) (Dec)

U.S. Unemployment Rate (SA) (Dec)A:--

F: --

U.S. Nonfarm Payrolls (SA) (Dec)

U.S. Nonfarm Payrolls (SA) (Dec)A:--

F: --

U.S. Average Hourly Wage YoY (Dec)

U.S. Average Hourly Wage YoY (Dec)A:--

F: --

Canada Part-Time Employment (SA) (Dec)

Canada Part-Time Employment (SA) (Dec)A:--

F: --

P: --

Canada Unemployment Rate (SA) (Dec)

Canada Unemployment Rate (SA) (Dec)A:--

F: --

P: --

Canada Labor Force Participation Rate (SA) (Dec)

Canada Labor Force Participation Rate (SA) (Dec)A:--

F: --

P: --

U.S. Government Employment (Dec)

U.S. Government Employment (Dec)A:--

F: --

P: --

U.S. UMich Consumer Expectations Index Prelim (Jan)

U.S. UMich Consumer Expectations Index Prelim (Jan)A:--

F: --

P: --

U.S. UMich Consumer Sentiment Index Prelim (Jan)

U.S. UMich Consumer Sentiment Index Prelim (Jan)A:--

F: --

P: --

U.S. UMich Current Economic Conditions Index Prelim (Jan)

U.S. UMich Current Economic Conditions Index Prelim (Jan)A:--

F: --

P: --

U.S. UMich 1-Year-Ahead Inflation Expectations Prelim (Jan)

U.S. UMich 1-Year-Ahead Inflation Expectations Prelim (Jan)A:--

F: --

P: --

U.S. UMich 5-Year-Ahead Inflation Expectations Prelim YoY (Jan)

U.S. UMich 5-Year-Ahead Inflation Expectations Prelim YoY (Jan)A:--

F: --

P: --

U.S. 5-10 Year-Ahead Inflation Expectations (Jan)

U.S. 5-10 Year-Ahead Inflation Expectations (Jan)A:--

F: --

P: --

U.S. Weekly Total Oil Rig Count

U.S. Weekly Total Oil Rig CountA:--

F: --

P: --

U.S. Weekly Total Rig Count

U.S. Weekly Total Rig CountA:--

F: --

P: --

China, Mainland M0 Money Supply YoY (Dec)

China, Mainland M0 Money Supply YoY (Dec)--

F: --

P: --

China, Mainland M1 Money Supply YoY (Dec)

China, Mainland M1 Money Supply YoY (Dec)--

F: --

P: --

China, Mainland M2 Money Supply YoY (Dec)

China, Mainland M2 Money Supply YoY (Dec)--

F: --

P: --

Indonesia Retail Sales YoY (Nov)

Indonesia Retail Sales YoY (Nov)A:--

F: --

P: --

Euro Zone Sentix Investor Confidence Index (Jan)

Euro Zone Sentix Investor Confidence Index (Jan)A:--

F: --

P: --

India CPI YoY (Dec)

India CPI YoY (Dec)--

F: --

P: --

Germany Current Account (Not SA) (Nov)

Germany Current Account (Not SA) (Nov)--

F: --

P: --

Canada National Economic Confidence Index

Canada National Economic Confidence Index--

F: --

P: --

U.S. Conference Board Employment Trends Index (SA) (Dec)

U.S. Conference Board Employment Trends Index (SA) (Dec)--

F: --

P: --

Russia CPI YoY (Dec)

Russia CPI YoY (Dec)--

F: --

P: --

Richmond Federal Reserve President Barkin delivered a speech.

Richmond Federal Reserve President Barkin delivered a speech. U.S. 3-Year Note Auction Yield

U.S. 3-Year Note Auction Yield--

F: --

P: --

U.S. 10-Year Note Auction Avg. Yield

U.S. 10-Year Note Auction Avg. Yield--

F: --

P: --

New York Federal Reserve President Williams delivered a speech.

New York Federal Reserve President Williams delivered a speech. Japan Trade Balance (Customs Data) (SA) (Nov)

Japan Trade Balance (Customs Data) (SA) (Nov)--

F: --

P: --

Japan Trade Balance (Nov)

Japan Trade Balance (Nov)--

F: --

P: --

U.K. BRC Overall Retail Sales YoY (Dec)

U.K. BRC Overall Retail Sales YoY (Dec)--

F: --

P: --

U.K. BRC Like-For-Like Retail Sales YoY (Dec)

U.K. BRC Like-For-Like Retail Sales YoY (Dec)--

F: --

P: --

Turkey Retail Sales YoY (Nov)

Turkey Retail Sales YoY (Nov)--

F: --

P: --

U.S. NFIB Small Business Optimism Index (SA) (Dec)

U.S. NFIB Small Business Optimism Index (SA) (Dec)--

F: --

P: --

Brazil Services Growth YoY (Nov)

Brazil Services Growth YoY (Nov)--

F: --

P: --

Canada Building Permits MoM (SA) (Nov)

Canada Building Permits MoM (SA) (Nov)--

F: --

P: --

U.S. CPI MoM (SA) (Dec)

U.S. CPI MoM (SA) (Dec)--

F: --

P: --

U.S. CPI YoY (Not SA) (Dec)

U.S. CPI YoY (Not SA) (Dec)--

F: --

P: --

U.S. Real Income MoM (SA) (Dec)

U.S. Real Income MoM (SA) (Dec)--

F: --

P: --

U.S. CPI MoM (Not SA) (Dec)

U.S. CPI MoM (Not SA) (Dec)--

F: --

P: --

U.S. Core CPI (SA) (Dec)

U.S. Core CPI (SA) (Dec)--

F: --

P: --

U.S. Core CPI YoY (Not SA) (Dec)

U.S. Core CPI YoY (Not SA) (Dec)--

F: --

P: --

U.S. Core CPI MoM (SA) (Dec)

U.S. Core CPI MoM (SA) (Dec)--

F: --

P: --

U.S. Weekly Redbook Index YoY

U.S. Weekly Redbook Index YoY--

F: --

P: --

U.S. New Home Sales Annualized MoM (Oct)

U.S. New Home Sales Annualized MoM (Oct)--

F: --

P: --

U.S. Annual Total New Home Sales (Oct)

U.S. Annual Total New Home Sales (Oct)--

F: --

P: --

U.S. Cleveland Fed CPI MoM (SA) (Dec)

U.S. Cleveland Fed CPI MoM (SA) (Dec)--

F: --

P: --

China, Mainland Imports YoY (CNH) (Dec)

China, Mainland Imports YoY (CNH) (Dec)--

F: --

P: --

China, Mainland Trade Balance (CNH) (Dec)

China, Mainland Trade Balance (CNH) (Dec)--

F: --

P: --

China, Mainland Imports YoY (USD) (Dec)

China, Mainland Imports YoY (USD) (Dec)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

President Trump is reportedly evaluating military, cyber, and economic actions against Iran amid widening protests, triggering market anxiety over potential oil supply disruptions and regional conflict....

France's fragile government has been handed a crucial lifeline after the Socialist party announced it would not support two no-confidence motions filed by far-right and far-left opposition parties. The decision provides critical breathing room for the administration as it navigates intense political pressure over the EU-Mercosur trade deal.

Socialist party leader Olivier Faure made his position clear on Sunday, telling BFM TV that his party would not vote in favor of the motions. The proposed censure votes were aimed at the government's failure to block a landmark trade agreement between the European Union and the Mercosur group of South American nations, a deal that has been 25 years in the making.

"It would be absurd to censure the government on Mercosur," Faure stated, effectively neutralizing the immediate threat.

While analysts had already assessed the motions' chances of success as slim—particularly the one filed by the far-right National Rally (RN)—the political maneuvering highlights the precarious position of President Macron's government. With the 2027 presidential election on the horizon, polls suggest the RN has a credible path to victory, making every political challenge a high-stakes test.

Prime Minister Sebastien Lecornu has emphasized his commitment to stability, stating he wants to avoid both a government censure and a dissolution of the National Assembly. In an interview with Le Parisien newspaper on Saturday, Lecornu stressed, "My fight is for stability and to ward off disorder."

Despite this, his office has reportedly asked the Interior Ministry to prepare for potential legislative elections on March 15 and 22, signaling that the government is ready for a collapse if necessary.

Lecornu criticized the no-confidence motions as "cynical partisan posturing" in a message on X and warned that they send a "dramatic signal" internationally, especially at a time when the government is seeking compromise. The votes on the motions are scheduled for early next week.

The political drama unfolds as the government faces a separate, critical battle over its budget. Budget talks are set to resume Tuesday, but a parliamentary committee has already rejected the bill in its current form, underscoring the tough negotiations ahead.

In a last-resort effort to find a path forward, the government has invited political parties to a meeting at the finance ministry. However, the invitation notably excludes the far-right National Rally and the hard-left France Unbowed, the very parties pushing for the no-confidence vote.

Confirming his party's attendance, Faure expressed cautious optimism. "There is a meeting tomorrow... with those who are willing to discuss," he said. "I hope for a compromise."

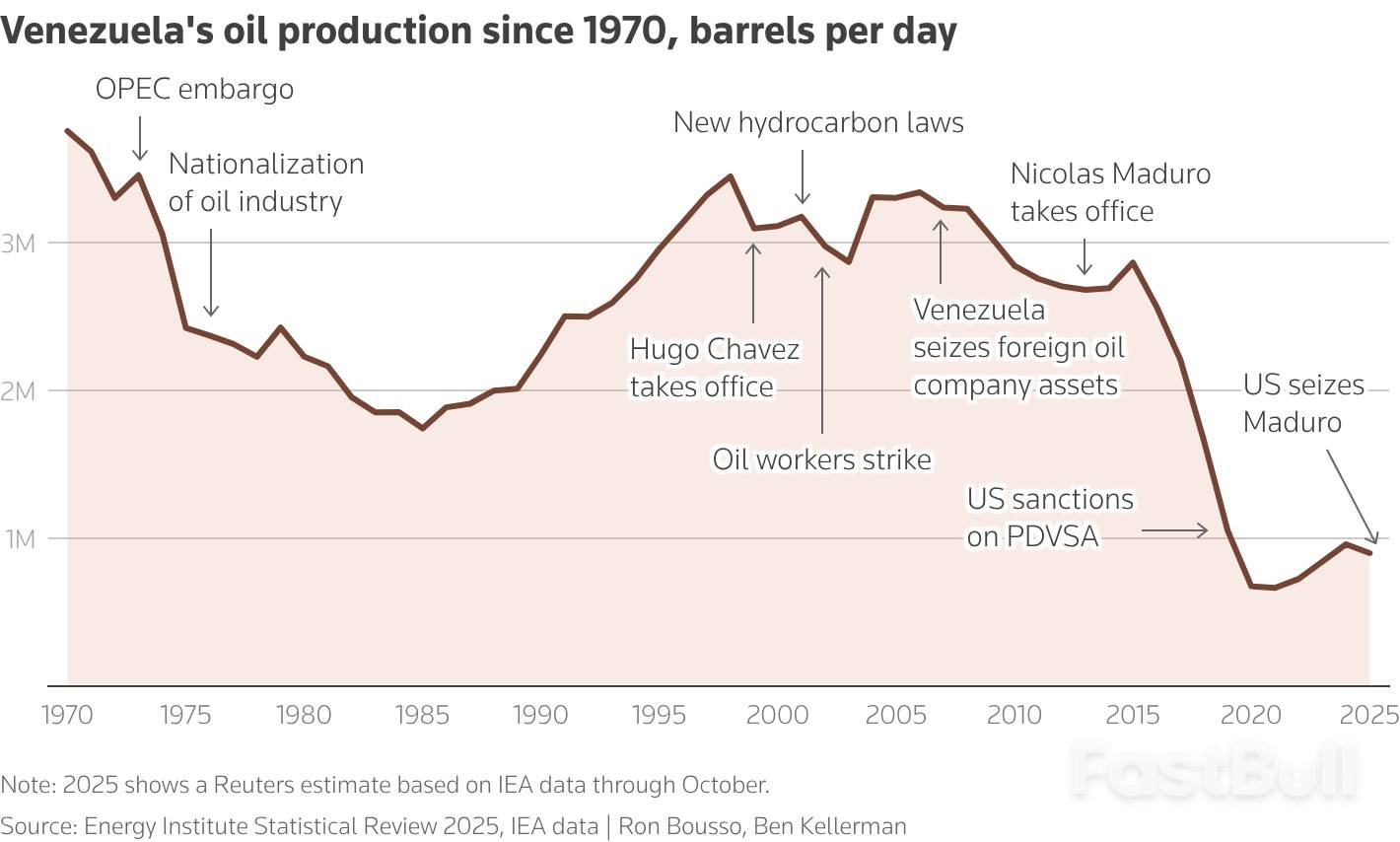

Major oil companies are hitting the brakes on President Donald Trump's ambitious plan for a rapid, multi-billion dollar investment into Venezuela, citing a wall of security, commercial, and legal hurdles that make the country's oil sector a non-starter for now.

While a televised White House meeting on Friday with top U.S. and European energy executives appeared to be a public relations victory for the president, the conversation revealed a deep disconnect between political ambition and market reality. Despite praise from some executives, the industry delivered a dose of realism to Trump's goal of pouring $100 billion into Venezuela to boost its oil production from the current 900,000 barrels per day.

Exxon Mobil CEO Darren Woods was blunt, stating that from a commercial and legal standpoint, the Latin American nation is currently "un-investible."

Woods' assessment reflects a grim reality shaped by nearly a decade of U.S. sanctions and decades of internal corruption and mismanagement. Turning this around would be a monumental task, requiring a stable government that can guarantee physical security and provide fiscal confidence—a process that could take months, if not years.

The Trump administration is trying to move quickly. Treasury Secretary Scott Bessent confirmed on Saturday that Washington is working on lifting some sanctions to help stabilize Venezuela's economy and facilitate oil sales.

However, a partial rollback is not enough. According to Carlos Bellorin, an analyst at consultancy Welligence, more significant sanctions relief is needed to allow oil companies to legally engage with the national oil company, PDVSA. It would also be essential for major oil service providers like SLB and Halliburton to bring in critical drilling equipment.

Removing key restrictions could unlock investment in so-called "low-hanging" barrels. This includes funding to revive abandoned wellheads and overhaul basic infrastructure like pipelines and port facilities.

Some immediate, albeit modest, gains are possible:

• Chevron: The only U.S. company still operating in Venezuela under a special license, could increase its output by 50% from 240,000 barrels per day within two years by upgrading existing equipment, said Vice Chairman Mark Nelson.

• Repsol: The Spanish oil firm could triple its production of 45,000 barrels per day over two to three years, according to CEO Josu Jon Imaz.

Even with these gains, the total production increase would likely be less than 200,000 barrels per day over the next year—a fraction of the administration's vision.

A long and painful history haunts any potential new investment. Most international oil majors have been burned before in Venezuela, particularly during two waves of industry nationalization in the 1970s and 2000s that forced them out and left behind massive, unrecovered losses.

This history of expropriation creates a major trust deficit. "Oilfield service providers could be reluctant to commit resources in Venezuela because they're still owed massive amount of money," noted Bellorin. He added that a commitment from Venezuela to repay old debts would be a necessary first step.

President Trump, however, seemed to suggest the opposite. When ConocoPhillips CEO Ryan Lance mentioned his company is still owed about $12 billion from the 2007 nationalization, Trump proposed that Conoco could simply write off the debt, despite years of legal battles. Lance's proposal to involve the U.S. Export-Import Bank (EXIM) to restructure the debt was also seemingly rejected by the president.

To truly unlock Venezuela's potential—which peaked above 3.5 million barrels per day in the 1990s—requires rewriting the country's fundamental hydrocarbon laws.

Key structural reforms would include:

• Revisiting the requirement for mandatory state participation of over 50% in upstream joint ventures.

• Reducing the oil industry's high royalty (30%) and income tax (50%) rates.

• Modifying PDVSA's monopoly on marketing the country's oil.

Beyond the legal framework, geological and geopolitical challenges remain. Venezuela holds the world's largest proven reserves, but most of it is heavy oil, which is more expensive to extract. Furthermore, many of these reserves are tied up in joint ventures with Chinese and Russian companies.

For publicly traded companies with a duty to their shareholders, verbal assurances from the White House are not enough. As Exxon's Woods explained, "We take a very long-term perspective. The investments that we make span decades and decades. So, we do not go into any opportunity with a short-term mindset."

Despite their reservations, oil executives find themselves in a difficult position. Openly refusing to invest in Venezuela could draw the ire of an administration known for playing hardball with businesses it sees as uncooperative, as seen with its recent actions toward law firms and defense contractors.

Faced with this political pressure, some energy boards might decide that a modest investment in Venezuela is a pragmatic choice to avoid potential blowback, even if the financial case is weak.

But even a flurry of politically motivated activity is unlikely to restore Venezuela's oil industry to its former glory. For that to happen, the country will need concrete action and fundamental reforms, not just presidential promises.

Goldman Sachs energy analysts are projecting a sharp decline in oil prices, warning that West Texas Intermediate (WTI) could fall to $50 per barrel by the end of this year. In a recent note, the investment bank cited an expected market imbalance driven by excess supply as the primary factor that will pressure global benchmarks.

However, analysts also acknowledged that geopolitical tensions could act as a significant counterweight, potentially supporting prices against a broader bearish trend.

Goldman's forecast points to a substantial 2.3 million barrel-per-day (mb/d) surplus in the global oil market by 2026. This oversupply, combined with rising global oil stocks, is expected to force prices lower to rebalance the market.

According to the bank, lower prices would be necessary to slow down supply growth from non-OPEC producers while simultaneously supporting solid growth in demand. This outlook assumes no major supply disruptions or significant production cuts from OPEC.

While the supply-side outlook appears bearish, immediate geopolitical risks could disrupt the narrative. Analysts at ANZ have highlighted the potential for supply disruptions stemming from protests in Iran, where demonstrators have called on oil industry workers to join them.

"The situation puts at least 1.9 million barrels per day of oil exports at risk of disruption," ANZ noted, introducing a key variable that could tighten the market unexpectedly.

Looking further ahead, Goldman Sachs anticipates the market will swing back into a deficit by 2027. This shift is expected to be caused by a reversal in production growth among non-OPEC countries, likely in response to the current price environment, coupled with a slowdown in OPEC production.

Despite this projected deficit, the bank revised its price estimate for 2027 downward. It now projects Brent crude will trade between $54 and $58 per barrel that year, a $5 reduction from its previous forecast.

Goldman's long-term view is considerably more bullish. Analysts see robust oil demand supporting prices all the way to 2040, a trend that could spur a new wave of investment after years of industry frugality. The bank's model suggests that persistent demand will challenge the "peak oil" narratives that have emerged from net-zero forecasting.

By 2035, Goldman predicts Brent crude could surpass $70 per barrel. Even this long-term forecast represents a downward revision, having been lowered by 45 per barrel from an earlier projection.

Sunday brought news that the Trump administration, through the Justice Department, was investigating Federal Reserve Chair Jerome Powell over testimony surrounding renovations of the Fed's headquarters in Washington, D.C.

In an extremely unusual development, Powell released a statement and a video explicitly condemning the move by the administration as a pretext for forcing the Fed to lower interest rates.

"The threat of criminal charges is a consequence of the Federal Reserve setting interest rates based on our best assessment of what will serve the public, rather than following the preferences of the president," Powell said. "This is about whether the Fed will be able to continue to set interest rates based on evidence and economic conditions—or whether instead monetary policy will be directed by political pressure or intimidation," Powell said.

The move by the Trump administration comes as markets are awaiting word on who the president will nominate to be the next Fed chair. Even before Sunday's events there were widespread questions about how independent President Donald Trump's nominee will be. Powell's term as chair ends May 15.

The initial overnight reaction in global markets was to push stock futures lower. But beyond any short-term response, the critical question will be the verdict among investors on the growing risks to the Fed independence, what that would mean for the inflation outlook, and ultimately the credibility of the US central bank.

The new year is kicking into high gear. Last Friday saw the release of the December employment report, which confirmed that the jobs market closed 2025 on a soggy note. While the report did little to shift the immediate outlook for Federal Reserve policy—no change in interest rates is expected this month—Tuesday's Consumer Price Index report could be more important in shaping the long-term outlook.

A big question is whether the inflation data will be clean enough to draw any conclusions from. The November report showed inflation that unexpectedly cooled, but the federal government shutdown is believed to have distorted the data.

The hope is that Tuesday's data for December will provide a somewhat clearer picture of inflation trends. Economists aren't sure if that will be the case. Broadly, forecasts call for an uptick in inflation from the shutdown-affected November readings, thanks largely to the lingering impact of Trump's tariffs and the reversals of shutdown impacts.

Wednesday could bring a critical decision from the Supreme Court on the legality of Trump's tariffs under the International Emergency Economic Powers Act. (The court doesn't say whether any rulings are forthcoming, just that there will be news.)

Press reports suggest that the justices seem skeptical of the administration's use of emergency powers to impose tariffs. But should the court rule against Trump, it wouldn't mean tariffs would go back to their pre-2025 levels, as we explain in "Watch These 6 Signals for Clues on Where Markets Will Go In 2026."

Mortgage-backed securities are also now on the radar. While most mainstream investors don't follow the goings-on in the MBS market, it's a critical part of mortgage rates and home-buying. Last week, President Trump announced on social media that he was instructing "representatives"— expected to be the government-sponsored agencies Fannie Mae and Freddie Mac—to buy $200 billion worth of mortgage-backed bonds.

The idea is that this would lower mortgage rates and make buying a home more affordable. Dominic Pappalardo, chief multi-asset strategist at Morningstar Wealth, notes that the announcement appeared to have an impact, with mortgage rates falling in the past week.

Then there's the question of whether Trump's plan will have a meaningful impact beyond the knee-jerk market reaction.

The other big event this coming week is the kickoff of the fourth-quarter earnings season. First up are the big banks, with JP Morgan JPM reporting on Tuesday and Wells Fargo WFC, Bank of America BAC, and Citigroup C on Wednesday.

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up