Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

Colombia Central Bank Technical Team Revises 2026 Economic Growth Projection To 2.6% From Previous 2.9%

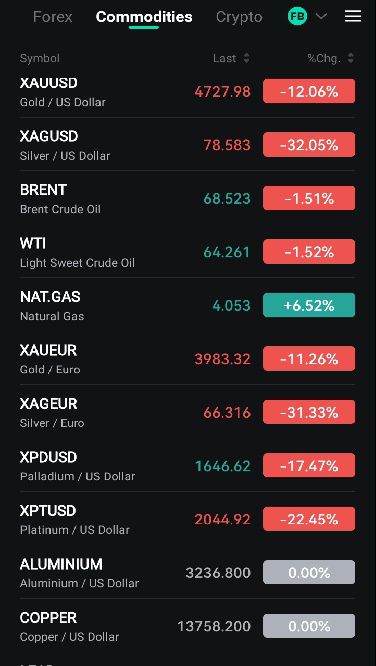

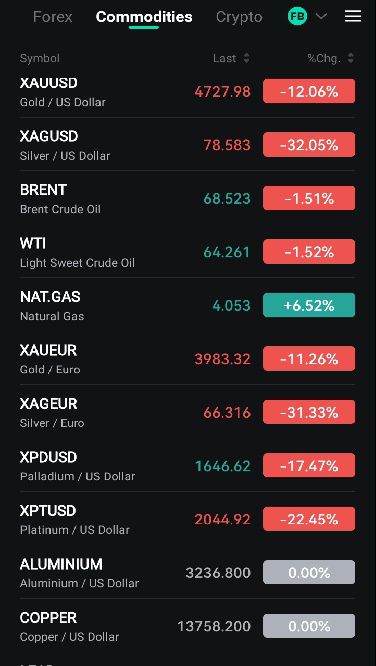

Spot Gold Fell 12.0% On The Day, To $4,725.64 Per Ounce. Spot Silver Fell 34.5% On The Day, To $75.25 Per Ounce

Spot Silver Fell 30.0% On The Day, Closing At $80.64 Per Ounce. New York Silver Fell 29.5% On The Day, Closing At $80.65 Per Ounce

Equipo Técnico Del Banco Central De Colombia Revisa Pronóstico De Crecimiento Económico Para 2025 A 2,9% Desde Previo De 2,6%

Colombia's Central Bank Hikes Interest Rate By 100 Basis Points To 10.25%, Surprising The Market

Baker Hughes - US Oil Drilling Rig Count Unchanged At 411 (Down 68 Versus Year Ago) In Week To Jan 30

Spot Gold Fell 10.5% On The Day, Its Biggest Drop In Decades, To $4,807.99 Per Ounce. New York Gold Fell 9.5% To $4,838.1 Per Ounce. Spot Silver Fell 26.0% To $85.06 Per Ounce. New York Silver Fell 25.5% To $85.17 Per Ounce

LME Copper Futures Closed Down $460 At $13,158 Per Tonne. LME Aluminum Futures Closed Down $74 At $3,144 Per Tonne. LME Zinc Futures Closed Down $10 At $3,402 Per Tonne. LME Lead Futures Closed Down $5 At $2,009 Per Tonne. LME Nickel Futures Closed Down $415 At $17,954 Per Tonne. LME Tin Futures Closed Down $3,129 At $51,955 Per Tonne. LME Cobalt Futures Closed Unchanged At $56,290 Per Tonne

Ukrainian Prime Minister Svyrydenko Says Russia Is Attacking Logistics, Launched Seven Attacks On Rail Facilities In Past 24 Hours

Ukraine President Zelenskiy: Ukraine Conducted No Strikes On Russian Energy Infrastructure On Friday

[German 10-year Bond Yields Fell More Than 6 Basis Points This Week And More Than 1 Basis Point In January] On Friday (January 30), In Late European Trading, The Yield On 10-year German Government Bonds Rose 0.3 Basis Points To 2.843%, A Cumulative Drop Of 6.3 Basis Points This Week, Continuing Its Overall Downward Trend. In January, It Fell 1.2 Basis Points, With An Overall Trading Range Of 2.910%-2.792%. The Yield On 2-year German Bonds Rose 0.5 Basis Points To 2.089%, A Cumulative Drop Of 4.1 Basis Points This Week And 3.2 Basis Points In January, Trading Within A Range Of 2.156%-2.048%. The Yield On 30-year German Bonds Rose 0.5 Basis Points To 3.494%, A Cumulative Increase Of 1.9 Basis Points In January. The Spread Between The 2-year And 10-year German Bond Yields Fell 0.163 Basis Points To +75.288 Basis Points, Down 2.147 Basis Points This Week And Up 2.142 Basis Points In January

U.K. M4 Money Supply (SA) (Dec)

U.K. M4 Money Supply (SA) (Dec)A:--

F: --

U.K. M4 Money Supply YoY (Dec)

U.K. M4 Money Supply YoY (Dec)A:--

F: --

P: --

U.K. M4 Money Supply MoM (Dec)

U.K. M4 Money Supply MoM (Dec)A:--

F: --

P: --

U.K. Mortgage Lending (Dec)

U.K. Mortgage Lending (Dec)A:--

F: --

U.K. Mortgage Approvals (Dec)

U.K. Mortgage Approvals (Dec)A:--

F: --

Italy Unemployment Rate (SA) (Dec)

Italy Unemployment Rate (SA) (Dec)A:--

F: --

P: --

Euro Zone Unemployment Rate (Dec)

Euro Zone Unemployment Rate (Dec)A:--

F: --

P: --

Euro Zone GDP Prelim QoQ (SA) (Q4)

Euro Zone GDP Prelim QoQ (SA) (Q4)A:--

F: --

P: --

Euro Zone GDP Prelim YoY (SA) (Q4)

Euro Zone GDP Prelim YoY (SA) (Q4)A:--

F: --

P: --

Italy PPI YoY (Dec)

Italy PPI YoY (Dec)A:--

F: --

P: --

Mexico GDP Prelim YoY (Q4)

Mexico GDP Prelim YoY (Q4)A:--

F: --

P: --

Brazil Unemployment Rate (Dec)

Brazil Unemployment Rate (Dec)A:--

F: --

P: --

South Africa Trade Balance (Dec)

South Africa Trade Balance (Dec)A:--

F: --

P: --

India Deposit Gowth YoY

India Deposit Gowth YoYA:--

F: --

P: --

Germany CPI Prelim YoY (Jan)

Germany CPI Prelim YoY (Jan)A:--

F: --

P: --

Germany CPI Prelim MoM (Jan)

Germany CPI Prelim MoM (Jan)A:--

F: --

P: --

Germany HICP Prelim YoY (Jan)

Germany HICP Prelim YoY (Jan)A:--

F: --

P: --

Germany HICP Prelim MoM (Jan)

Germany HICP Prelim MoM (Jan)A:--

F: --

P: --

U.S. Core PPI YoY (Dec)

U.S. Core PPI YoY (Dec)A:--

F: --

U.S. Core PPI MoM (SA) (Dec)

U.S. Core PPI MoM (SA) (Dec)A:--

F: --

P: --

U.S. PPI YoY (Dec)

U.S. PPI YoY (Dec)A:--

F: --

P: --

U.S. PPI MoM (SA) (Dec)

U.S. PPI MoM (SA) (Dec)A:--

F: --

P: --

Canada GDP MoM (SA) (Nov)

Canada GDP MoM (SA) (Nov)A:--

F: --

P: --

Canada GDP YoY (Nov)

Canada GDP YoY (Nov)A:--

F: --

P: --

U.S. PPI MoM Final (Excl. Food, Energy and Trade) (SA) (Dec)

U.S. PPI MoM Final (Excl. Food, Energy and Trade) (SA) (Dec)A:--

F: --

P: --

U.S. PPI YoY (Excl. Food, Energy & Trade) (Dec)

U.S. PPI YoY (Excl. Food, Energy & Trade) (Dec)A:--

F: --

P: --

U.S. Chicago PMI (Jan)

U.S. Chicago PMI (Jan)A:--

F: --

Canada Federal Government Budget Balance (Nov)

Canada Federal Government Budget Balance (Nov)A:--

F: --

P: --

U.S. Weekly Total Oil Rig Count

U.S. Weekly Total Oil Rig CountA:--

F: --

P: --

U.S. Weekly Total Rig Count

U.S. Weekly Total Rig CountA:--

F: --

P: --

China, Mainland NBS Manufacturing PMI (Jan)

China, Mainland NBS Manufacturing PMI (Jan)--

F: --

P: --

China, Mainland NBS Non-manufacturing PMI (Jan)

China, Mainland NBS Non-manufacturing PMI (Jan)--

F: --

P: --

China, Mainland Composite PMI (Jan)

China, Mainland Composite PMI (Jan)--

F: --

P: --

South Korea Trade Balance Prelim (Jan)

South Korea Trade Balance Prelim (Jan)--

F: --

Japan Manufacturing PMI Final (Jan)

Japan Manufacturing PMI Final (Jan)--

F: --

P: --

South Korea IHS Markit Manufacturing PMI (SA) (Jan)

South Korea IHS Markit Manufacturing PMI (SA) (Jan)--

F: --

P: --

Indonesia IHS Markit Manufacturing PMI (Jan)

Indonesia IHS Markit Manufacturing PMI (Jan)--

F: --

P: --

China, Mainland Caixin Manufacturing PMI (SA) (Jan)

China, Mainland Caixin Manufacturing PMI (SA) (Jan)--

F: --

P: --

Indonesia Trade Balance (Dec)

Indonesia Trade Balance (Dec)--

F: --

P: --

Indonesia Inflation Rate YoY (Jan)

Indonesia Inflation Rate YoY (Jan)--

F: --

P: --

Indonesia Core Inflation YoY (Jan)

Indonesia Core Inflation YoY (Jan)--

F: --

P: --

India HSBC Manufacturing PMI Final (Jan)

India HSBC Manufacturing PMI Final (Jan)--

F: --

P: --

Australia Commodity Price YoY (Jan)

Australia Commodity Price YoY (Jan)--

F: --

P: --

Russia IHS Markit Manufacturing PMI (Jan)

Russia IHS Markit Manufacturing PMI (Jan)--

F: --

P: --

Turkey Manufacturing PMI (Jan)

Turkey Manufacturing PMI (Jan)--

F: --

P: --

U.K. Nationwide House Price Index MoM (Jan)

U.K. Nationwide House Price Index MoM (Jan)--

F: --

P: --

U.K. Nationwide House Price Index YoY (Jan)

U.K. Nationwide House Price Index YoY (Jan)--

F: --

P: --

Germany Actual Retail Sales MoM (Dec)

Germany Actual Retail Sales MoM (Dec)--

F: --

Italy Manufacturing PMI (SA) (Jan)

Italy Manufacturing PMI (SA) (Jan)--

F: --

P: --

South Africa Manufacturing PMI (Jan)

South Africa Manufacturing PMI (Jan)--

F: --

P: --

Euro Zone Manufacturing PMI Final (Jan)

Euro Zone Manufacturing PMI Final (Jan)--

F: --

P: --

U.K. Manufacturing PMI Final (Jan)

U.K. Manufacturing PMI Final (Jan)--

F: --

P: --

Brazil IHS Markit Manufacturing PMI (Jan)

Brazil IHS Markit Manufacturing PMI (Jan)--

F: --

P: --

Canada National Economic Confidence Index

Canada National Economic Confidence Index--

F: --

P: --

Canada Manufacturing PMI (SA) (Jan)

Canada Manufacturing PMI (SA) (Jan)--

F: --

P: --

U.S. IHS Markit Manufacturing PMI Final (Jan)

U.S. IHS Markit Manufacturing PMI Final (Jan)--

F: --

P: --

U.S. ISM Output Index (Jan)

U.S. ISM Output Index (Jan)--

F: --

P: --

U.S. ISM Manufacturing Employment Index (Jan)

U.S. ISM Manufacturing Employment Index (Jan)--

F: --

P: --

U.S. ISM Manufacturing New Orders Index (Jan)

U.S. ISM Manufacturing New Orders Index (Jan)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

Trump's ultimatum demands Iran's full capitulation or military action, intensifying fears of a looming regional conflict.

President Donald Trump is pursuing a dual strategy with Iran, pairing the threat of military strikes with repeated calls for Tehran to negotiate a new agreement. The administration's message is clear: accept Washington's terms or face severe consequences.

At the heart of Trump's demands is a complete overhaul of Iran's strategic posture. In exchange for the removal of crippling sanctions and a promise of no military action, Tehran would be required to:

• End its nuclear program entirely.

• Accept limits on its ballistic missile capabilities.

• Cut all ties with its armed proxy groups across the Middle East.

Should Iran refuse, Trump has warned of consequences "far worse" than those of the previous year, when the United States and Israel reportedly bombed Iranian nuclear sites. However, experts believe Tehran is unlikely to accept what it considers maximalist demands, viewing them as a call for total capitulation that would reverse decades of established policy.

The White House has reinforced its hardline stance, urging Tehran to negotiate "before it is too late." In a written statement to RFE/RL, an official noted that Trump "hopes that no action will be necessary" but pointed to past military operations as proof of his resolve. The official cited "Operation Midnight Hammer" and "Operation Absolute Resolve"—the June 2025 strikes on Iran's nuclear facilities and the January 3 ousting of Venezuelan leader Nicolas Maduro, respectively—as evidence that the president "means what he says."

The rhetoric is backed by significant military and economic pressure. The U.S. has recently deployed an aircraft carrier and additional bombers to the region. Economically, Trump has announced a new 25 percent tariff on any country conducting business with Iran, alongside fresh sanctions. This escalation follows nationwide protests in Iran in late December 2025, which were met with a violent government crackdown that resulted in thousands of deaths.

Experts are split on whether Trump's strategy will lead to a deal or a conflict. The key variables are Iran's internal instability and Washington's appetite for risk.

The Case for Imminent Military Action

Jason Brodsky, policy director at United Against Nuclear Iran, argues that military action is "very likely." He points to the administration's pattern of alternating between confrontational and conciliatory statements—a tactic he says is designed to keep the Iranian regime off-balance and was previously seen before the military actions in June and in Venezuela.

According to Brodsky, the objectives of a strike would be to hold Iran accountable for its crackdown on protesters, deter its regional activities, and degrade its military capabilities. He suggests that President Trump might see "further military action as the prelude to an eventual deal down the line."

The Risks of Regional Escalation

Other analysts see the situation as a high-stakes diplomatic maneuver. Alex Vatanka, director of the Iran program at the Middle East Institute, notes that U.S. officials view Iran's current weakness as a strategic opportunity. The clerical establishment is grappling with a severe economic crisis and the aftermath of major protests, while its regional allies—including Hezbollah, the Houthi rebels, and Hamas—have seen their military capabilities weakened by Israel.

Despite this, Vatanka offers a more cautious assessment, arguing there are "still reasons for the United States to think twice." He emphasizes that "the Pentagon knows any strike could trigger a regional chain reaction" involving Iran's network of allied militias. From this perspective, the U.S. military buildup could be a defensive measure or a tool to force diplomatic concessions rather than a prelude to regime change.

Iranian officials, including Foreign Minister Abbas Araqchi and parliament speaker Mohammad Baqer Qalibaf, have publicly stated that Tehran is open to talks. However, they have also accused Washington of not being interested in a fair agreement.

The core challenge remains the nature of the U.S. demands. According to Brodsky, Iran's Supreme Leader Ayatollah Ali Khamenei would be "very skeptical and resistant to accept" Trump's terms. He would likely perceive any concession on core national security issues as a move that could "pave the way for the collapse of the Islamic republic." This fundamental disagreement leaves both sides locked in a standoff, with the potential for either diplomacy or conflict remaining on the table.

India's economy is on track to expand by over 7% this fiscal year, but its future outlook is clouded by global headwinds. In a key report released just days before the annual federal budget, officials outlined a path to sustained growth while warning that international market turmoil and geopolitical tensions pose significant risks.

The Finance Ministry's economic survey, presented to parliament on Thursday, forecasts growth between 6.8% and 7.2% for the next fiscal year. The report also upgraded India's medium-term potential growth rate from 6.5% to approximately 7%, attributing the stronger outlook to reforms and public investment.

Finance Minister Nirmala Sitharaman is set to present the 2026-27 budget on Sunday. The announcement is widely expected to include policy measures designed to maintain India's rapid economic expansion and insulate it from external shocks.

According to Chief Economic Adviser V. Anantha Nageswaran, achieving the upper end of the growth projection is possible, but it depends heavily on external factors.

"If global financial markets and the political situation do not deteriorate to the extent that sentiment gets affected... then I think the upper end is well within reach," Nageswaran stated in a Friday interview with Reuters.

However, he cautioned that several factors could push growth toward the lower end of the 6.8% forecast:

• Financial Market Volatility: A significant or prolonged correction in global financial markets could dampen sentiment.

• Geopolitical Conflicts: Events that disrupt commodity movements and global supply chains remain a major concern.

• Rising Oil Prices: Recent tensions in the Middle East have driven up crude oil prices, creating another external risk for India's economy.

These warnings come as Indian equity markets posted their sharpest monthly decline in nearly a year this January, driven by sustained selling from foreign investors amid trade uncertainty. The Indian rupee also fell to a record low, marking its worst month in over three years.

To counter these external pressures, India is banking on new trade agreements and a resolution to existing tariff disputes. Nageswaran noted that easing trade tensions, particularly with the United States, would provide a significant boost to investor confidence.

Resolving tariff issues would "add to a sense of relief, and therefore willingness to commit more investments on the ground by Indian and foreign businesses," he explained. This follows President Donald Trump's move in late August to impose a 50% tariff on certain Indian goods.

Furthermore, new free trade agreements are expected to open up crucial market access and cushion the economy. India recently concluded trade negotiations with the European Union and has signed pacts with the UK and Oman. These agreements are particularly beneficial for labor-intensive sectors, which stand to gain from lower or zero duties.

"As and when they become operational, Indian businesses have a good shot at supplying these markets," Nageswaran added.

While global factors remain a primary focus, the government also recognizes the importance of domestic economic drivers. Nageswaran emphasized that private investment is ultimately more responsive to underlying demand in the economy than to policy incentives like tax cuts.

He pointed to early indicators suggesting that a pickup in private investment is already underway. When asked about specific priorities for the upcoming budget, Nageswaran declined to comment publicly.

Daily March E-mini Nasdaq 100 Index Futures

Daily March E-mini Nasdaq 100 Index FuturesRussia has agreed to pause airstrikes on Kyiv’s energy infrastructure until February 1, following a direct request from U.S. President Donald Trump. Ukraine has indicated it is prepared to reciprocate, creating a narrow window for diplomacy as Washington attempts to broker a solution to the war.

The temporary halt comes as Kyiv braces for a severe cold snap, with temperatures expected to drop to minus 26 degrees Celsius. Despite the de-escalation, Ukrainian President Volodymyr Zelenskiy clarified on Friday that this does not constitute a formal truce, noting that Russia has already shifted its focus to attacking Ukrainian logistics facilities.

The Kremlin confirmed that President Vladimir Putin accepted Trump's appeal to suspend the bombardment of Kyiv to establish "favourable conditions" for peace negotiations.

In recent weeks, relentless Russian strikes on Kyiv's energy grid have left hundreds of thousands without heat in temperatures that have already fallen below minus 15 degrees Celsius.

Kremlin spokesman Dmitry Peskov confirmed the details of the arrangement. "President Trump did indeed make a personal request to President Putin to refrain from striking Kyiv for a week until February 1 in order to create favourable conditions for negotiations," he stated, adding that Putin had agreed.

In response, Zelenskiy announced Ukraine would halt its own attacks on Russian refinery infrastructure, framing the move as "an opportunity rather than an agreement." He confirmed via Telegram that no strikes on Ukrainian energy facilities occurred overnight.

While the attacks on energy systems have paused, military operations continue elsewhere. Russia launched a ballistic missile and 111 drones in its latest overnight assault. Zelenskiy reported that the missile damaged warehouses belonging to a U.S. company in the Kharkiv region.

Meanwhile, the Ukrainian military said it successfully targeted several Russian logistics facilities in the occupied Zaporizhzhia region. Russia’s Defence Ministry reported a decrease in downed Ukrainian drones, from 168 on New Year's night to 18 in the latest count.

Zelenskiy also revealed that Ukraine's air defenses have been weakened because European allies delayed payments to the U.S. under the PURL weapons purchase program. This delay, he said, meant that crucial U.S. Patriot air defense missiles did not arrive before recent Russian airstrikes knocked out power across large parts of the capital.

Residents in Kyiv remain doubtful that the short-term energy truce will lead to lasting peace. For many, enduring the coldest winter of the nearly four-year war feels like the only option.

"I trust neither Putin nor Trump, so I think that even if he (Putin) complies now, he will stockpile missiles and will still keep firing," said Kostiantyn, a 61-year-old pensioner in Kyiv. "Putin's goal is the destruction of Ukraine, and all we can do is resist."

The humanitarian situation remains critical. As of Friday, 378 residential high-rise buildings in the capital were still without heating, with forecasters predicting temperatures will plunge to minus 26 degrees Celsius starting Sunday.

The temporary halt in strikes was first proposed by the U.S. during talks in Abu Dhabi last weekend. However, the path forward for negotiations is uncertain. Zelenskiy noted that the date and location for the next round of talks, tentatively scheduled for this Sunday in the United Arab Emirates, could change.

"Something is happening in the situation between the United States and Iran," Zelenskiy explained. "And those developments could likely affect the timing." He stressed the importance of having the same negotiators attend the next round to ensure continuity.

However, U.S. Secretary of State Marco Rubio said on Wednesday that Trump's lead envoys, Steve Witkoff and Jared Kushner, would not participate in the upcoming Abu Dhabi meeting. While U.S. officials claimed progress was made in the last round, both Russia and Ukraine have confirmed there has been no compromise on the core issue of territory.

The primary obstacle remains Putin's demand that Ukraine cede the 20% of Donetsk it still controls—approximately 5,000 square kilometers. Zelenskiy has consistently rejected any settlement that involves surrendering territory defended with Ukrainian blood.

(Kitco News) - Gold and silver prices are strongly lower Friday morning, in the aftermath of a new Federal Reserve chair that may not lean quite so easy on U.S. monetary policy than many were expecting. Profit taking and weak long liquidation from the shorter-term futures traders are featured in gold and silver today. April gold was last down $242.60 at $5,112.50. March silver prices were down $15.63 at $99.08.

Kevin Warsh Trump's choice for next Fed chair; markets react. President Trump has selected Kevin Warsh to be the next Federal Reserve chair, Trump announced on social media this morning. Warsh visited the White House Thursday. Reports surfaced late Thursday that Warsh would be Trump's new Fed chair nominee. U.S. stocks dropped sharply and U.S. Treasury yields pushed higher, while gold and silver prices posted strong losses, following the Warsh news, while the U.S. dollar index rose. These markets' reactions reflected speculation Warsh may be less enthusiastic to cut interest rates than other Fed chair candidates, given his past warnings of inflation risks and more recent calls for the Fed to reduce its balance sheet. However, Warsh has more recently echoed Trump's criticism of the Fed for being too slow to ease its monetary policy. "He's a hawk," said CNBC commentator Joe Kernen, regarding Warsh's stance on U.S. monetary policy. "That's good for the stock market longer-term, but not right now," Kernen said.

In other news, the London Metal Exchange suffered a one-hour delay to the start of trading on Friday due to a potential technical issue. The delay came after a week of intense volatility and price gains, with LME copper jumping 11% on Thursday to hit a record above $14,500 a ton. The LME said "the market is now operating normally" after electronic trading got underway at 10:00 a.m. Hong Kong time, with copper falling as much as 3.9% after the opening.

Major U.S. government shutdown averted. President Trump and U.S. Senate Democrats have reached a tentative deal to avoid a disruptive federal government shutdown as the White House continues to negotiate with the Democrats on placing new limits on immigration enforcement policy. "Trump announced that an agreement had been reached and urged both parties to vote for it. However, lawmakers are almost certain to fail to enact the measure before a Friday night deadline. While a short funding lapse and partial government shutdown is now seen as the most likely scenario, the effect on federal operations would be minimal if it's swiftly resolved within a couple days," Bloomberg reported. The deal between Trump and Democrats makes it more likely that lawmakers would be able to avoid a long shutdown, which occurred last year.

Crude oil prices hit six-month highs Thursday. Nymex WTI crude oil futures on Thursday rose more than 3.5% to around $65.50 a barrel, the highest intraday level since last September and nearing the strongest close since last August, as geopolitical risk premiums increased following renewed U.S. threats against Iran. Prices backed off a bit overnight. President Trump warned Tehran to agree to a nuclear deal or face military strikes, saying U.S. naval forces in the region were prepared to act if necessary. The prospect of a U.S. strike against Iran raised concerns over potential disruptions to Middle Eastern crude oil flows, which account for roughly one-third of the global oil supply, while any Iranian retaliation could threaten shipping through the Strait of Hormuz, a key route for oil and liquified natural gas. Oil prices have risen this early year despite expectations of oversupply and forecasts late last year for a global crude oil glut in 2026.

The key outside markets today see crude oil prices weaker and trading around $65.00 a barrel. The U.S. dollar index is slightly up and the U.S. 10-year Treasury note yield is presently 4.25%.

Note: The gold market operates through two primary pricing mechanisms. The first is the spot market, which quotes prices for on-the-spot purchase and immediate delivery. The second is the futures market, which sets prices for delivery at a future date. Due to year-end positioning market liquidity, the December gold futures contract is currently the most actively traded on the CME.

Technically, price action late this week in April gold futures has formed a bearish "key reversal" down on the daily bar chart, which is one chart clue that a market top is in place. Bulls' next upside price objective is to produce a close above solid resistance at the record high of $5,626.80. Bears' next near-term downside price objective is pushing futures prices below solid technical support at $4,750.00. First resistance is seen at $5,200.00 and then at $5,250.00. First support is seen at the overnight low of $4,962.70 and then at $4,900.00. Wyckoff's Market Rating: 8.0.

March silver futures bulls are also fading. The next upside price objective is closing prices above solid technical resistance at the record high of $121.785. The next downside price objective for the bears is closing prices below solid support at $90.00. First resistance is seen at $102.50 and then at $105.00. Next support is seen at the overnight low of $95.12 and then at $92.50. Wyckoff's Market Rating: 8.0.

The China policies of both the European Union and the United States are stalled. While both sides of the Atlantic have moved too far into a competitive stance to revert to an era of friendly commerce, neither has a clear strategy for managing the complex challenge Beijing presents. A recent crisis in transatlantic relations has only worsened the situation, dimming hopes for even modest cooperation.

Instead of uniting, a growing number of EU governments appear to be exploring closer ties with China as a way to "de-risk" from an unpredictable United States. As a result, transatlantic China policy is likely to fragment, limited to a few narrow areas of cooperation where success is far from guaranteed.

Deep dysfunction within and between the United States and Europe is crippling their ability to compete effectively with China. In stark contrast, China's own domestic issues—specifically its industrial overcapacity—are paradoxically strengthening its global leverage. While Beijing likely recognizes the international friction caused by its economic model, it shows no interest in addressing the root cause. This commitment was clear in October 2025, when China’s leaders reaffirmed their industrial policies in the recommendations for the country's next five-year plan.

Meanwhile, the space for coordinated action against China has shrunk. After backing down from its trade war, the Trump administration shifted its focus from competing with Beijing to appeasing it—a trend that accelerated after President Donald Trump's meeting with Chinese President Xi Jinping in South Korea. The administration's 2025 National Security Strategy even expressed more hostility toward European allies than toward China.

European leaders seem to grasp the nature of the China challenge. French President Emmanuel Macron has openly acknowledged the economic security threat posed by China and has threatened consequences if Beijing fails to act.

However, the core problem for both Europe and Washington is not diagnosis but implementation. The desire among many EU member states to diversify away from the United States has made tackling the China issue even more difficult. European leaders have recently spent more time debating economic penalties against the U.S. over its threats to Greenland than on formulating a response to China.

Can the EU's "Economic Bazooka" Work?

Even if the EU musters the political will to deploy its powerful Anti-Coercion Instrument against Beijing, it's uncertain whether these measures could force a change in China's behavior. There are at least three reasons to be skeptical:

1. Persistent Demand: Many economists believe strong U.S. and European demand will continue to fuel China's export machine, regardless of tariffs. For instance, even after the EU imposed anti-subsidy tariffs on Chinese electric vehicles in 2024, Chinese firms like BYD still managed to increase their market share in 2025.

2. China's Trade War Playbook: Beijing learned valuable lessons from its second trade war with the U.S. It now knows it can withstand an embargo and, more importantly, leverage its control over critical supply chains to pressure a divided EU and the U.S. to back down.

3. Unintended Consequences: Aggressive protectionist barriers could backfire, making European companies less competitive internationally by shielding them from intense Chinese competition at home.

These challenges suggest that U.S. and European economic tools will only be effective if they are deployed in concert with other major economies. U.S. Treasury Secretary Scott Bessent has advocated for such a strategy, which briefly gained traction in late 2025 when Mexico announced 50% tariffs on a range of Asian goods. However, that momentum was quickly lost when Canada decided to lower its tariffs on Chinese electric vehicles.

So far, the Trump administration has shown little willingness to cooperate with European allies on China's overcapacity. The U.S.-EU trade arrangement from last summer remains unimplemented, with each side accusing the other of violations. Forthcoming trips to Beijing by German Chancellor Friedrich Merz in February and an expected Trump summit in April will likely see leaders avoid contentious issues to secure bilateral deals, further undermining a unified stance.

The outlook for collaboration in other key areas identified by analysts like Zack Cooper is equally bleak.

High-Tech Export Controls in Tatters

In the high-tech sector, the Trump administration appears to be pivoting from export controls to export promotion. The decision to allow Nvidia to sell its second-most powerful AI chip to China highlights this shift. The entire U.S. export control regime against China is now in a precarious position and could disintegrate further if European firms follow America's lead.

Russia-Ukraine Coordination Stalls

While dissuading China from supporting Russia’s war in Ukraine could be an area for coordination, prospects are dim. Early talk of a "reverse Kissinger" strategy to break the Sino-Russian partnership has collapsed against the reality of their deepening ties. The administration's diplomacy with Beijing has remained focused on trade, leaving little room to coordinate with the EU on long-term security issues.

By process of elimination, only two areas remain promising for transatlantic cooperation.

Securing Critical Supply Chains

The Trump administration has taken positive steps to enhance U.S. access to critical minerals. This is an area where U.S.-EU cooperation is essential; otherwise, they risk competing for the same finite resources, such as rare earth elements, that exist outside of China. The G7 has taken up the issue, and the administration's Pax Silica initiative offers another venue for collaboration.

Bolstering the Defense Industry

As EU defense investments have climbed over 60% since 2020 to approximately 381 billion euros ($450 billion) in 2025, President Trump is likely to welcome increased European purchases of U.S. military equipment. The dilemma for European governments, however, is whether expanding their dependence on an increasingly hostile Washington is a sustainable long-term strategy.

These dynamics highlight Europe's profound strategic isolation. It is caught between great powers whose attitudes range from belligerence (Russia) and contempt (United States) to uncompromising competition (China). The common thread among Moscow, Washington, and Beijing is a shared belief that a unified, coherent Europe is not in their strategic interest.

After Trump's Liberation Day tariffs last spring, many expected a Chinese "charm offensive" toward Europe. Instead, Beijing chose to intensify Europe's dilemmas, likely calculating that a tougher line would prevent a unified European response. The recent shift in rhetoric from key EU leaders suggests Beijing's strategy may be paying off.

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

Log In

Sign Up