Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

U.K. CPI MoM (Dec)

U.K. CPI MoM (Dec)A:--

F: --

P: --

U.K. Input PPI MoM (Not SA) (Dec)

U.K. Input PPI MoM (Not SA) (Dec)A:--

F: --

U.K. Core CPI MoM (Dec)

U.K. Core CPI MoM (Dec)A:--

F: --

P: --

U.K. Retail Prices Index MoM (Dec)

U.K. Retail Prices Index MoM (Dec)A:--

F: --

P: --

U.K. Input PPI YoY (Not SA) (Dec)

U.K. Input PPI YoY (Not SA) (Dec)A:--

F: --

P: --

U.K. CPI YoY (Dec)

U.K. CPI YoY (Dec)A:--

F: --

P: --

U.K. Output PPI MoM (Not SA) (Dec)

U.K. Output PPI MoM (Not SA) (Dec)A:--

F: --

P: --

U.K. Output PPI YoY (Not SA) (Dec)

U.K. Output PPI YoY (Not SA) (Dec)A:--

F: --

P: --

U.K. Core Retail Prices Index YoY (Dec)

U.K. Core Retail Prices Index YoY (Dec)A:--

F: --

P: --

U.K. Core CPI YoY (Dec)

U.K. Core CPI YoY (Dec)A:--

F: --

P: --

U.K. Retail Prices Index YoY (Dec)

U.K. Retail Prices Index YoY (Dec)A:--

F: --

P: --

Indonesia 7-Day Reverse Repo Rate

Indonesia 7-Day Reverse Repo RateA:--

F: --

P: --

Indonesia Loan Growth YoY (Dec)

Indonesia Loan Growth YoY (Dec)A:--

F: --

P: --

Indonesia Deposit Facility Rate (Jan)

Indonesia Deposit Facility Rate (Jan)A:--

F: --

P: --

Indonesia Lending Facility Rate (Jan)

Indonesia Lending Facility Rate (Jan)A:--

F: --

P: --

South Africa Core CPI YoY (Dec)

South Africa Core CPI YoY (Dec)A:--

F: --

P: --

South Africa CPI YoY (Dec)

South Africa CPI YoY (Dec)A:--

F: --

P: --

IEA Oil Market Report

IEA Oil Market Report U.K. CBI Industrial Output Expectations (Jan)

U.K. CBI Industrial Output Expectations (Jan)A:--

F: --

U.K. CBI Industrial Prices Expectations (Jan)

U.K. CBI Industrial Prices Expectations (Jan)A:--

F: --

P: --

South Africa Retail Sales YoY (Nov)

South Africa Retail Sales YoY (Nov)A:--

F: --

P: --

U.K. CBI Industrial Trends - Orders (Jan)

U.K. CBI Industrial Trends - Orders (Jan)A:--

F: --

P: --

Mexico Retail Sales MoM (Nov)

Mexico Retail Sales MoM (Nov)A:--

F: --

P: --

U.S. MBA Mortgage Application Activity Index WoW

U.S. MBA Mortgage Application Activity Index WoWA:--

F: --

P: --

Canada Industrial Product Price Index YoY (Dec)

Canada Industrial Product Price Index YoY (Dec)A:--

F: --

Canada Industrial Product Price Index MoM (Dec)

Canada Industrial Product Price Index MoM (Dec)A:--

F: --

U.S. Weekly Redbook Index YoY

U.S. Weekly Redbook Index YoYA:--

F: --

P: --

U.S. Pending Home Sales Index YoY (Dec)

U.S. Pending Home Sales Index YoY (Dec)A:--

F: --

P: --

U.S. Pending Home Sales Index MoM (SA) (Dec)

U.S. Pending Home Sales Index MoM (SA) (Dec)A:--

F: --

P: --

U.S. Construction Spending MoM (Oct)

U.S. Construction Spending MoM (Oct)A:--

F: --

U.S. Pending Home Sales Index (Dec)

U.S. Pending Home Sales Index (Dec)A:--

F: --

P: --

U.S. API Weekly Refined Oil Stocks

U.S. API Weekly Refined Oil Stocks--

F: --

P: --

U.S. API Weekly Gasoline Stocks

U.S. API Weekly Gasoline Stocks--

F: --

P: --

U.S. API Weekly Cushing Crude Oil Stocks

U.S. API Weekly Cushing Crude Oil Stocks--

F: --

P: --

U.S. API Weekly Crude Oil Stocks

U.S. API Weekly Crude Oil Stocks--

F: --

P: --

South Korea GDP Prelim YoY (SA) (Q4)

South Korea GDP Prelim YoY (SA) (Q4)--

F: --

P: --

South Korea GDP Prelim QoQ (SA) (Q4)

South Korea GDP Prelim QoQ (SA) (Q4)--

F: --

P: --

Japan Imports YoY (Dec)

Japan Imports YoY (Dec)--

F: --

P: --

Japan Exports YoY (Dec)

Japan Exports YoY (Dec)--

F: --

P: --

Japan Goods Trade Balance (SA) (Dec)

Japan Goods Trade Balance (SA) (Dec)--

F: --

P: --

Japan Trade Balance (Not SA) (Dec)

Japan Trade Balance (Not SA) (Dec)--

F: --

Australia Employment (Dec)

Australia Employment (Dec)--

F: --

P: --

Australia Labor Force Participation Rate (SA) (Dec)

Australia Labor Force Participation Rate (SA) (Dec)--

F: --

P: --

Australia Unemployment Rate (SA) (Dec)

Australia Unemployment Rate (SA) (Dec)--

F: --

P: --

Australia Full-time Employment (SA) (Dec)

Australia Full-time Employment (SA) (Dec)--

F: --

P: --

Turkey Consumer Confidence Index (Jan)

Turkey Consumer Confidence Index (Jan)--

F: --

P: --

Turkey Capacity Utilization (Jan)

Turkey Capacity Utilization (Jan)--

F: --

P: --

Turkey Late Liquidity Window Rate (LON) (Jan)

Turkey Late Liquidity Window Rate (LON) (Jan)--

F: --

P: --

Turkey Overnight Lending Rate (O/N) (Jan)

Turkey Overnight Lending Rate (O/N) (Jan)--

F: --

P: --

Turkey 1-Week Repo Rate

Turkey 1-Week Repo Rate--

F: --

P: --

U.K. CBI Distributive Trades (Jan)

U.K. CBI Distributive Trades (Jan)--

F: --

P: --

U.K. CBI Retail Sales Expectations Index (Jan)

U.K. CBI Retail Sales Expectations Index (Jan)--

F: --

P: --

U.S. Weekly Continued Jobless Claims (SA)

U.S. Weekly Continued Jobless Claims (SA)--

F: --

P: --

U.S. Initial Jobless Claims 4-Week Avg. (SA)

U.S. Initial Jobless Claims 4-Week Avg. (SA)--

F: --

P: --

U.S. Real Personal Consumption Expenditures Final QoQ (Q3)

U.S. Real Personal Consumption Expenditures Final QoQ (Q3)--

F: --

P: --

Canada New Housing Price Index MoM (Dec)

Canada New Housing Price Index MoM (Dec)--

F: --

P: --

U.S. Weekly Initial Jobless Claims (SA)

U.S. Weekly Initial Jobless Claims (SA)--

F: --

P: --

U.S. Real GDP Annualized QoQ Final (Q3)

U.S. Real GDP Annualized QoQ Final (Q3)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

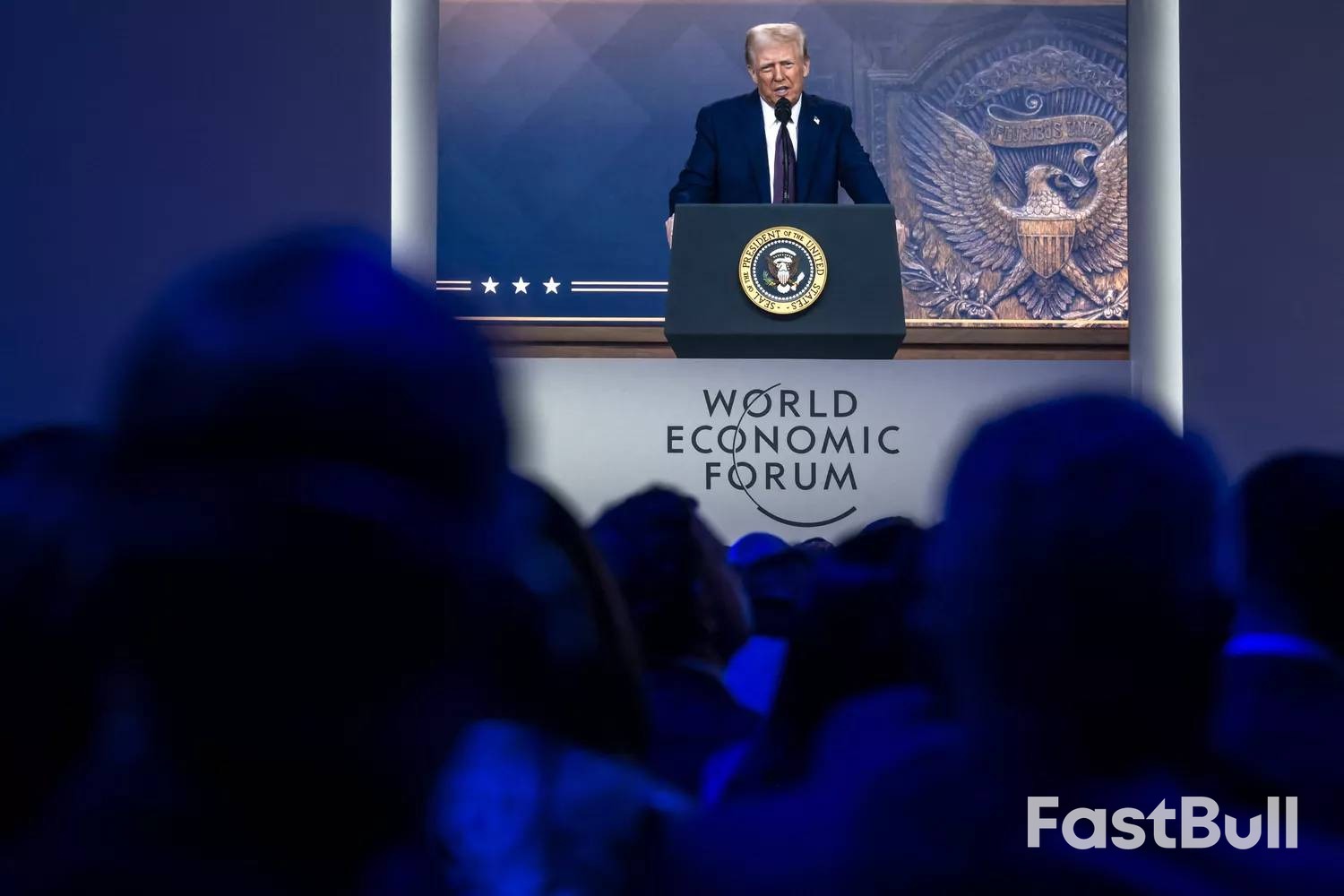

President Trump's Davos agenda unveils aggressive housing reforms, from 401(k) access to curbing corporate buyers and reshaping mortgages.

President Donald Trump is set to unveil a series of "aggressive" reforms for the U.S. housing market this week during his speech at the World Economic Forum's annual meeting in Davos, Switzerland. With housing affordability a persistent challenge for the American economy, Trump and his advisors have indicated the new plans could significantly alter the landscape for mortgages and homeownership.

These potential policy shifts have broad implications. Changes to borrowing costs, housing supply, and the rules for using retirement savings can directly impact household budgets, consumer spending, and long-term financial security for millions of Americans, particularly first-time buyers.

Here's a breakdown of the key proposals expected to be announced.

A central component of Trump's plan is a proposal to allow Americans to use their 401(k) retirement funds for housing purchases. National Economic Council Director Kevin Hassett confirmed this on Fox Business, highlighting it as a way to address soaring homeownership costs.

Currently, the government permits penalty-free withdrawals of up to $10,000 from Individual Retirement Accounts (IRAs) for this purpose, but not from 401(k)s, which are a primary workplace retirement vehicle.

"The typical monthly payment about doubled for an ordinary family buying an ordinary home," Hassett noted. "And the down payment they needed to buy a home went from about $15,000, to about $32,000. And so there's a real lot of room to make up."

Trump has already floated a proposal to ban large institutional investors from purchasing single-family homes. The move is aimed at increasing the housing inventory available to individual buyers.

"People live in homes, not corporations," Trump stated on social media in early January. However, industry experts suggest that if the ban is targeted specifically at larger institutional players, most investors currently buying homes would likely not be affected.

Another initiative involves directing government-backed lenders Fannie Mae and Freddie Mac to purchase $200 billion in mortgage bonds. This strategy is designed to put downward pressure on mortgage rates, making loans more affordable for homebuyers.

The policy may already be working. Analysts at Goldman Sachs observed that mortgage rates fell by 15 basis points following the announcement. "This should improve affordability and improve sentiment in the housing market ahead of the key spring homebuying season," wrote Goldman Sachs analyst Arun Manohar, who projected the move could boost home sales by 5% to 7% in 2026.

Two other concepts may feature in Trump's Davos speech: 50-year mortgages and portable mortgages.

• 50-Year Mortgages: Extending loan terms to 50 years could lower monthly payments for borrowers. The trade-off, however, would be a significant increase in the total interest paid over the life of the loan.

• Portable Mortgages: This idea would allow a borrower to transfer their existing mortgage to a new home. Proponents, including some leading Senate Democrats, argue it could solve the "lock-in" effect, where homeowners with low-rate mortgages are hesitant to sell.

Critics, however, are skeptical. Realtor.com Senior Economist Jake Krimmel argued, "Portability isn't compatible with the architecture of U.S. mortgage finance, and even if it were, it wouldn't fix the broader affordability problems facing the housing market today."

French Premier Sebastien Lecornu is moving to pass the 2026 budget by invoking a special constitutional power, Article 49.3, which allows the government to enact legislation without a parliamentary vote. The decision comes after months of stalled negotiations with opposition parties in the National Assembly.

While Lecornu’s office has not officially commented, French media reports indicate the move is imminent. This strategic maneuver suggests the government is confident it can withstand the no-confidence motions that are certain to follow.

Article 49.3 is a powerful but politically risky tool. Lecornu had previously stated he would avoid using the mechanism, which is deeply unpopular with opposition lawmakers. Its use has led to the ouster of his two predecessors amid intense feuds over the national budget.

Once the article is invoked, opposition parties can trigger no-confidence votes. However, this time, the government appears to have secured the necessary backing to survive such a challenge.

The key to Lecornu's strategy lies in a series of crucial concessions made last week, which appear to have won over the Socialist party. These lawmakers hold the deciding votes in any censure ballot.

The government's revised budget plan includes several measures aimed at securing their support:

• No new tax increases for households.

• A boost to incomes for those earning near the minimum wage.

• The reversal of planned cuts to certain benefits.

• An agreement to extend a temporary tax on large corporations for another year.

Boris Vallaud, who leads the center-left group in the National Assembly, confirmed his party's position. Speaking on RTL radio, he stated that the government had provided sufficient guarantees and that his party now views the use of Article 49.3 as the preferred path forward.

This development offers a clear route for France to adopt a budget and avoid a government shutdown at the start of 2026. The country has been navigating political instability since President Emmanuel Macron’s 2024 snap election resulted in a hung parliament, splitting the lower house into opposing factions.

Over the past 18 months, successive government collapses and setbacks in reining in the euro area's largest deficit have shaken investor confidence. This uncertainty triggered market sell-offs that pushed France's bond yields higher compared to its European peers.

The news of a decisive path for the budget brought immediate relief to the markets. On Monday, the yield spread on French 10-year bonds over their German equivalents narrowed to about 65 basis points, its lowest level since July.

As Europe strategizes its response to new threats from US President Donald Trump over Greenland, a controversial countermeasure is sparking debate among investors: the "weaponization of capital."

European nations and their financial institutions hold trillions of dollars in US bonds and stocks. This has fueled speculation that, in retaliation for Trump's tariff policies, they could begin selling these assets. Such a move could drive up US borrowing costs and send equity markets tumbling, striking at the American economy’s reliance on foreign capital.

The idea of a coordinated sell-off is not just idle chatter. The chief global currency strategist at Deutsche Bank AG is openly discussing the "weaponization of capital," signaling that this scenario is becoming a tail risk for markets. With over $10 trillion in US assets held within the European Union, plus more in countries like the UK and Norway, the potential leverage is enormous.

George Saravelos, Deutsche Bank's global head of currency research, identified the core vulnerability. "For all its military and economic strength, the US has one key weakness: it relies on others to pay its bills via large external deficits," he explained. "In an environment where the geoeconomic stability of the western alliance is being disrupted existentially, it is not clear why Europeans would be as willing to play this part."

However, executing such a financial maneuver would be extremely difficult.

Despite the theoretical power Europe holds, most strategists see a low probability of this financial weapon ever being used. The obstacles are both practical and political.

The Self-Harm Problem

A massive sale of US assets would likely hurt European investors just as much as their American counterparts. Dumping bonds and stocks would crash their value, inflicting heavy losses on the very funds holding them.

"The US net international investment deficit is huge, and a potential threat to the dollar, but only if foreign holders of US assets are willing to suffer financially," said Kit Juckes, chief currency strategist at Societe Generale SA. He believes the situation would need to escalate significantly "before they damage their investment performance for political purposes."

Private vs. Public Control

The bulk of these assets are held by private investment funds, not governments. European policymakers have limited to no control over these private decisions.

"There is very little the EU could do to force European private sector investors to sell US dollar assets," noted a research team from ING Groep NV led by Carsten Brzeski. The most they could do is "try to incentivize investments in euro assets."

Furthermore, a significant portion of US securities domiciled in Europe are ultimately owned by investors from outside the region, complicating any coordinated regional action.

Even without a full-blown financial conflict, the escalating tensions are already affecting markets. US equity futures, European stocks, and the dollar have all felt the pressure, while safe-haven assets like gold, the Swiss franc, and the euro have benefited.

This market reaction echoes the "Sell America" trade that emerged after Trump's tariffs last April, suggesting investors are once again growing wary. Some analysts argue that a rebalancing may have already occurred. Jane Foley, head of currency strategy at Rabobank, suggested that investors concerned about Trump's policies may have already trimmed their exposure, which could "protect it from another bout of market jitters."

Despite the dollar's struggles after last year's tariffs, US Treasuries had their best year since 2020, and American stocks continue to hit new highs, showcasing the resilience of US markets.

For now, the European Union's response remains grounded in traditional trade policy, not financial warfare. The most concrete actions being considered include:

• Halting the approval of its July trade deal with the US.

• Imposing tariffs on €93 billion ($108 billion) of American goods.

Germany's finance chief has already called on Europe to prepare its strongest possible trade countermeasures. While a far cry from weaponizing trillions in capital, these steps show that the simmering trade war, which investors largely ignored last year, is threatening to escalate into a more direct conflict.

Brazil's government is considering a significant shift in financial oversight, with Finance Minister Fernando Haddad proposing to give the central bank the power to regulate investment funds. This role is currently handled by the country's securities regulator, CVM.

In an interview with local news outlet UOL, Haddad confirmed the proposal is under active discussion. The talks involve key government bodies, including the central bank, the Management Ministry, and the solicitor general's office (AGU).

The push for new regulation follows a federal police investigation into alleged irregularities at Banco Master, which was liquidated by the central bank in November. Investigators highlighted the use of investment funds with "cascading structures" in the case.

Haddad acknowledged that the issues surrounding Banco Master are significant but reassured that the situation does not pose a systemic risk to Brazil's broader financial system.

As of the announcement, CVM, the AGU, the central bank, and the Management Ministry had not issued an immediate comment on the proposal.

The finance minister framed some of the country's current economic challenges as legacy issues. He stated that the current Central Bank Governor, Gabriel Galipolo, inherited a series of problems from his predecessor, Roberto Campos Neto.

Haddad specifically cited issues tied to Banco Master and the unanchoring of inflation expectations, which he attributed largely to statements made by the central bank's prior leadership.

Galipolo is an appointee of President Luiz Inacio Lula da Silva and took office in January 2025. Campos Neto was appointed by former President Jair Bolsonaro and is now the vice chairman at digital lender Nubank. Campos Neto did not immediately respond to a request for comment.

Beyond regulatory reform, Haddad also commented on monetary policy, stating his belief that there is room for the central bank to cut interest rates. The benchmark rate has remained at a near-20-year high of 15% since July as part of an effort to control persistent inflation.

The finance minister also noted that the central bank is actively rebuilding its foreign exchange reserves and working to diversify those holdings.

Donald Trump is set to meet with global business leaders in Davos this Wednesday, an event that is casting a long shadow over the World Economic Forum's annual gathering in Switzerland. The U.S. President's arrival comes amid heightened geopolitical tensions, with his recent policy proposals dominating conversations among the global elite.

According to sources familiar with the plans, the White House has invited chief executives from sectors including financial services, crypto, and consulting to a reception following Trump's special address at the forum.

One CEO's schedule simply noted "a reception in honour of President Donald J Trump," while another confirmed that the invitations were extended to global CEOs, not just those from the United States. The specific agenda for the meeting remains unclear.

Anthony Scaramucci, who briefly served as Trump's communications director, confirmed his awareness of the meeting. "I'm not going," Scaramucci stated. "I'm not sure I'm invited, but even if I were, I wouldn't want to be a side show."

Several senior U.S. officials, including Treasury Secretary Scott Bessent, are accompanying the president.

Meanwhile, China is being represented by Vice Premier He Lifeng, who is scheduled to deliver his own special address on Tuesday. A source confirmed that He will also host a reception with CEOs and founders of global companies, creating a parallel track of high-level business diplomacy.

China's Ministry of Foreign Affairs did not provide an immediate comment when contacted outside of business hours.

The formal agenda of the World Economic Forum, which is expected to draw over 3,000 delegates from more than 130 countries, appears to be overshadowed by recent U.S. policy actions, including Trump's demand that the United States acquire Greenland.

National security advisers from several countries are scheduled to meet on the sidelines of the event Monday, with Greenland now on the agenda, according to diplomatic sources. A European diplomat noted that the topic was added after Trump threatened to impose additional tariffs on eight European nations unless the U.S. is permitted to purchase the Arctic island.

In another diplomatic development, Russian President Vladimir Putin's special envoy, Kirill Dmitriev, is also set to travel to Davos and hold meetings with members of the U.S. delegation, according to two sources with knowledge of the visit.

Speaking from Davos, U.S. Treasury Secretary Scott Bessent issued a clear warning to European governments, urging them not to retaliate against American trade measures.

"I think it would be very unwise," Bessent told reporters when asked about potential retaliatory actions. He emphasized that European leaders should not underestimate Trump's resolve regarding Greenland. "I spoke to President Trump and evidently there are a lot of inbounds, and I think everyone should take the president at his word."

Jenny Johnson, CEO of asset manager Franklin Templeton, characterized Trump's actions as a negotiating style that, while unsettling, serves U.S. interests.

"We all know his style. His style is, 'I'm going to come out with a hammer, and then I'll negotiate with you,'" Johnson explained in an interview. "But his instinct about trying to figure out longer-term positions for the U.S. is the right instinct."

The United Arab Emirates and India are deepening their strategic partnership with a major investment deal in western India and an ambitious goal to double their bilateral trade to $200 billion by 2032. The move signals a mutual desire for closer economic ties amid rising global geopolitical uncertainties.

The new agreements were finalized during a bilateral meeting between Indian Prime Minister Narendra Modi and UAE President Sheikh Mohamed bin Zayed Al Nahyan, who made his third visit to New Delhi since taking office.

At the core of the "mega partnership" is a UAE-backed plan to develop the Dholera Special Investment Region in India. According to Indian diplomat Vikram Misri, the investment will fund the creation of several key infrastructure projects:

• An international airport

• An aircraft maintenance and refurbishment facility

• Expanded rail connectivity

• A new pilot training school

This comprehensive development aims to establish a significant economic hub, boosting regional growth and connectivity.

The partnership also extends into the critical energy sector. Adnoc Gas has agreed to supply India's Hindustan Petroleum Corp. with 0.5 million metric tons of liquefied natural gas (LNG) annually for 10 years, with deliveries starting in 2028. Adnoc valued the LNG supply contract at between $2.5 billion and $3 billion.

On the financial front, the two nations have agreed to link India's unified payments platform (UPI). Further integration is underway as the UAE's First Abu Dhabi Bank and DP World are establishing operations in the Gujarat International Finance Tec-City (GIFT City).

Discussions also focused on enhancing security cooperation. Both leaders agreed to strengthen defense ties through joint weapons production and closer military collaboration.

Beyond traditional sectors, the partnership is set to explore emerging fields of cooperation, with a specific focus on Artificial Intelligence (AI).

The push for a deeper relationship is taking place against a backdrop of global instability. The return of US President Donald Trump has reportedly added a sense of urgency to solidifying the India-UAE alliance.

The leaders also discussed several sensitive regional issues, including the conflicts in Yemen and Gaza, the situation in Iran, and Trump's proposed "Board of Peace for Gaza," an initiative the UAE has welcomed and to which India has been invited. While Misri confirmed these topics were discussed in detail, he did not elaborate on the specifics of the conversations.

Australia's parliament returned early on Monday with speeches and a moment of silence for those killed in the Bondi Beach mass shooting, as victims' families watched from the public gallery.

Two gunmen who police allege were inspired by Islamic State opened fire at a Jewish Hanukkah event on the city's iconic Bondi Beach last month, killing 15 people in the country's worst such incident in decades.

The attack shocked the nation and led to calls for tougher action on antisemitism and gun control, with Prime Minister Anthony Albanese pledging tougher action on both.

"As we offer our love, sympathy and solidarity to everyone bearing the weight of trauma and loss, we make it clear to every Jewish Australian, you are not alone," Albanese told parliament on Monday, following a moment of silence for those killed in the attack, as first responders and victims' families watched on.

Lawmakers had been due to return from their Southern Hemisphere summer break next month, but Albanese recalled parliament two weeks early to commemorate victims and begin debate on gun control and hate speech reforms.

Albanese said on Saturday he would amend proposed hate speech laws and move gun control reforms into a separate piece of legislation, after conservative opposition and Greens parties said they would opposed a combined bill.

"The gun laws will be separate and then the laws on hate crimes and migration will proceed. But we will not be proceeding with the racial vilification provisions because it's clear that that will not have support," he told reporters.

Opposition Liberal Party leader Sussan Ley said last week the proposed clause on racial vilification threatened free speech.

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up