Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

U.K. Refinitiv/Ipsos Primary Consumer Sentiment Index (PCSI) (Jan)

U.K. Refinitiv/Ipsos Primary Consumer Sentiment Index (PCSI) (Jan)A:--

F: --

P: --

Brazil Retail Sales MoM (Nov)

Brazil Retail Sales MoM (Nov)A:--

F: --

P: --

U.S. NY Fed Manufacturing Prices Received Index (Jan)

U.S. NY Fed Manufacturing Prices Received Index (Jan)A:--

F: --

P: --

U.S. NY Fed Manufacturing New Orders Index (Jan)

U.S. NY Fed Manufacturing New Orders Index (Jan)A:--

F: --

P: --

U.S. NY Fed Manufacturing Employment Index (Jan)

U.S. NY Fed Manufacturing Employment Index (Jan)A:--

F: --

P: --

U.S. Export Price Index YoY (Nov)

U.S. Export Price Index YoY (Nov)A:--

F: --

P: --

U.S. NY Fed Manufacturing Index (Jan)

U.S. NY Fed Manufacturing Index (Jan)A:--

F: --

U.S. Initial Jobless Claims 4-Week Avg. (SA)

U.S. Initial Jobless Claims 4-Week Avg. (SA)A:--

F: --

U.S. Export Price Index MoM (Nov)

U.S. Export Price Index MoM (Nov)A:--

F: --

P: --

Canada Manufacturing Unfilled Orders MoM (Nov)

Canada Manufacturing Unfilled Orders MoM (Nov)A:--

F: --

P: --

Canada Manufacturing New Orders MoM (Nov)

Canada Manufacturing New Orders MoM (Nov)A:--

F: --

P: --

U.S. Philadelphia Fed Manufacturing Employment Index (Jan)

U.S. Philadelphia Fed Manufacturing Employment Index (Jan)A:--

F: --

P: --

Canada Wholesale Inventory YoY (Nov)

Canada Wholesale Inventory YoY (Nov)A:--

F: --

P: --

Canada Manufacturing Inventory MoM (Nov)

Canada Manufacturing Inventory MoM (Nov)A:--

F: --

P: --

Canada Wholesale Sales YoY (Nov)

Canada Wholesale Sales YoY (Nov)A:--

F: --

P: --

Canada Wholesale Inventory MoM (Nov)

Canada Wholesale Inventory MoM (Nov)A:--

F: --

P: --

U.S. Import Price Index YoY (Nov)

U.S. Import Price Index YoY (Nov)A:--

F: --

U.S. Import Price Index MoM (Nov)

U.S. Import Price Index MoM (Nov)A:--

F: --

P: --

U.S. Weekly Continued Jobless Claims (SA)

U.S. Weekly Continued Jobless Claims (SA)A:--

F: --

Canada Wholesale Sales MoM (SA) (Nov)

Canada Wholesale Sales MoM (SA) (Nov)A:--

F: --

P: --

U.S. Weekly Initial Jobless Claims (SA)

U.S. Weekly Initial Jobless Claims (SA)A:--

F: --

U.S. Philadelphia Fed Business Activity Index (SA) (Jan)

U.S. Philadelphia Fed Business Activity Index (SA) (Jan)A:--

F: --

P: --

U.S. EIA Weekly Natural Gas Stocks Change

U.S. EIA Weekly Natural Gas Stocks ChangeA:--

F: --

P: --

Richmond Federal Reserve President Barkin delivered a speech.

Richmond Federal Reserve President Barkin delivered a speech. U.S. Weekly Treasuries Held by Foreign Central Banks

U.S. Weekly Treasuries Held by Foreign Central BanksA:--

F: --

P: --

Germany CPI Final MoM (Dec)

Germany CPI Final MoM (Dec)A:--

F: --

P: --

Germany CPI Final YoY (Dec)

Germany CPI Final YoY (Dec)A:--

F: --

P: --

Germany HICP Final MoM (Dec)

Germany HICP Final MoM (Dec)A:--

F: --

P: --

Germany HICP Final YoY (Dec)

Germany HICP Final YoY (Dec)A:--

F: --

P: --

Brazil PPI MoM (Nov)

Brazil PPI MoM (Nov)A:--

F: --

P: --

Canada New Housing Starts (Dec)

Canada New Housing Starts (Dec)A:--

F: --

P: --

U.S. Capacity Utilization MoM (SA) (Dec)

U.S. Capacity Utilization MoM (SA) (Dec)--

F: --

P: --

U.S. Industrial Output YoY (Dec)

U.S. Industrial Output YoY (Dec)--

F: --

P: --

U.S. Manufacturing Capacity Utilization (Dec)

U.S. Manufacturing Capacity Utilization (Dec)--

F: --

P: --

U.S. Manufacturing Output MoM (SA) (Dec)

U.S. Manufacturing Output MoM (SA) (Dec)--

F: --

P: --

U.S. Industrial Output MoM (SA) (Dec)

U.S. Industrial Output MoM (SA) (Dec)--

F: --

P: --

U.S. NAHB Housing Market Index (Jan)

U.S. NAHB Housing Market Index (Jan)--

F: --

P: --

Russia CPI YoY (Dec)

Russia CPI YoY (Dec)--

F: --

P: --

U.S. Weekly Total Rig Count

U.S. Weekly Total Rig Count--

F: --

P: --

U.S. Weekly Total Oil Rig Count

U.S. Weekly Total Oil Rig Count--

F: --

P: --

Japan Core Machinery Orders YoY (Nov)

Japan Core Machinery Orders YoY (Nov)--

F: --

P: --

Japan Core Machinery Orders MoM (Nov)

Japan Core Machinery Orders MoM (Nov)--

F: --

P: --

U.K. Rightmove House Price Index YoY (Jan)

U.K. Rightmove House Price Index YoY (Jan)--

F: --

P: --

China, Mainland GDP YoY (YTD) (Q4)

China, Mainland GDP YoY (YTD) (Q4)--

F: --

P: --

China, Mainland Industrial Output YoY (YTD) (Dec)

China, Mainland Industrial Output YoY (YTD) (Dec)--

F: --

P: --

Japan Industrial Output Final MoM (Nov)

Japan Industrial Output Final MoM (Nov)--

F: --

P: --

Japan Industrial Output Final YoY (Nov)

Japan Industrial Output Final YoY (Nov)--

F: --

P: --

Euro Zone Core HICP Final MoM (Dec)

Euro Zone Core HICP Final MoM (Dec)--

F: --

P: --

Euro Zone HICP Final MoM (Dec)

Euro Zone HICP Final MoM (Dec)--

F: --

P: --

Euro Zone HICP Final YoY (Dec)

Euro Zone HICP Final YoY (Dec)--

F: --

P: --

Euro Zone HICP MoM (Excl. Food & Energy) (Dec)

Euro Zone HICP MoM (Excl. Food & Energy) (Dec)--

F: --

P: --

Euro Zone Core CPI Final YoY (Dec)

Euro Zone Core CPI Final YoY (Dec)--

F: --

P: --

Euro Zone Core HICP Final YoY (Dec)

Euro Zone Core HICP Final YoY (Dec)--

F: --

P: --

Euro Zone CPI YoY (Excl. Tobacco) (Dec)

Euro Zone CPI YoY (Excl. Tobacco) (Dec)--

F: --

P: --

Euro Zone Core CPI Final MoM (Dec)

Euro Zone Core CPI Final MoM (Dec)--

F: --

P: --

Canada National Economic Confidence Index

Canada National Economic Confidence Index--

F: --

P: --

Canada Trimmed CPI YoY (SA) (Dec)

Canada Trimmed CPI YoY (SA) (Dec)--

F: --

P: --

Canada CPI YoY (Dec)

Canada CPI YoY (Dec)--

F: --

P: --

Canada CPI MoM (Dec)

Canada CPI MoM (Dec)--

F: --

P: --

Canada Core CPI YoY (Dec)

Canada Core CPI YoY (Dec)--

F: --

P: --

Canada Core CPI MoM (Dec)

Canada Core CPI MoM (Dec)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

Trump's escalating pressure on the Fed could compel Powell to remain, risking a 'two popes' scenario and market confusion.

The Trump administration's legal challenge against the Federal Reserve is fueling speculation that Jerome Powell will remain on the Board of Governors after his term as chair expires in May. This sets the stage for a rival center of influence within the world's most powerful central bank, a dynamic Powell himself may not even want.

This unusual possibility gained momentum after the Department of Justice served the Fed with grand jury subpoenas last week. The move is widely seen as an unprecedented escalation of President Donald Trump's campaign to influence monetary policy.

While the legal outcome and Powell's final decision remain uncertain, those familiar with him believe he would only stay to protect the institution, not to act as a "shadow Fed chair."

Still, if Powell is provoked into staying, it would disrupt Trump's plan to fill the board with officials who favor his calls for aggressive interest-rate cuts. It would also establish a powerful counterweight to whoever the president selects as the next Fed chair.

While critics of the administration might welcome this development, analysts warn it could create significant confusion for investors trying to determine who truly holds sway over monetary policy.

"It really would set up, potentially, dynamics of having a 'two popes' situation where financial markets and the public may get a little confused about who's in charge," said Loretta Mester, former president of the Cleveland Fed.

Antulio Bomfim, a former adviser to Powell and now head of global macro at Northern Trust Asset Management, agrees that the optics would be unavoidable. He notes that a former chair with Powell's experience and record of defending the institution would inevitably be seen as an alternative voice.

"Knowing him, he would not aspire to be a shadow Fed Chair," Bomfim said. "But at the same time it is not under his control either."

Until recently, most Fed watchers expected Powell to leave the central bank when his term as chair ends in May. The subpoenas have dramatically changed that outlook.

In a sharply worded statement released on January 11, Powell confirmed the subpoenas were related to his congressional testimony about renovations at the Fed's headquarters. He then placed the legal action in a much wider context.

"This should be seen in the broader context of the administration's threats and ongoing pressure," Powell stated. "The threat of criminal charges is a consequence of the Federal Reserve setting interest rates based on our best assessment of what will serve the public, rather than following the preferences of the president."

It is this forceful defense of the Fed's independence that has convinced many that Powell now intends to stay on the board.

Powell was first nominated as Fed chair by Trump in 2018, but his underlying term as a Fed governor extends until January 2028. The president has already claimed to have chosen Powell's replacement, with front-runners rumored to be Kevin Hassett, director of the National Economic Council, and former Fed Governor Kevin Warsh.

Powell remaining on the board complicates these succession plans. Steven Kamin, a senior fellow at the American Enterprise Institute and a former Fed division director, noted that while the Federal Open Market Committee (FOMC) would likely try to cooperate with a new chair, a divisive appointee could change things.

"One could imagine that if the new chair were sufficiently divisive, a coalition of FOMC members could end up gravitating toward Powell," he said.

The political fallout is already visible. Senator Thom Tillis, a key Republican on the Banking Committee responsible for vetting Fed nominees, has pledged to oppose any of Trump's picks until the subpoena issue is resolved.

Administration officials and allies are also reportedly concerned that the escalation could galvanize sitting board members and regional Fed presidents, making it more difficult for a new chair to implement their policy agenda.

For now, the direct impact on monetary policy is limited. The Fed cut its benchmark interest rate three times last month but has since signaled a pause, citing a stabilizing labor market while awaiting more data.

The most immediate consequence of Powell staying is that it would delay Trump's ability to name another person to the seven-member board. The president has openly discussed his desire to have a majority on the board, which holds power over personnel, regulation, and other key decisions.

A board majority could also be used to remove the presidents of the regional Fed banks, who are not appointed by the president.

"If the FOMC is reluctant to do what the Trump-appointed chairman wants, and the presidents are the obstacle, then will President Trump start pressing the Board of Governors to fire one or more of the presidents?" asked David Wessel, director of the Hutchins Center on Fiscal and Monetary Policy at the Brookings Institution.

In a separate but related matter, Trump may find another path to reshape the board if he succeeds in firing Fed Governor Lisa Cook over allegations of mortgage fraud. That case, which could set a precedent for dismissing any Fed governor, is scheduled for arguments before the Supreme Court on January 21.

The European Central Bank sees no immediate need to debate interest rate changes, with its current policy settings seen as appropriate for the next several years. However, ECB Chief Economist Philip Lane has highlighted that potential shocks, particularly a deviation by the U.S. Federal Reserve from its mandate, could disrupt this stable outlook. A cyclical economic recovery is anticipated for the euro zone this year and next, assuming the bank's baseline scenario holds.

According to Lane, the ECB is not in a hurry to alter its policy. The central bank has kept rates on hold since concluding a rapid rate cut cycle in June. This decision is supported by surprisingly strong economic growth and inflation that appears to have stabilized around the 2% target for the foreseeable future.

A significant risk to Europe's benign economic outlook originates from the United States. President Donald Trump's ongoing efforts to influence interest rates and accelerate cuts to borrowing costs, faster than the Fed deems appropriate, introduce a major uncertainty.

In an interview with Italian newspaper La Stampa, Lane outlined the potential consequences. "It would be economically difficult for us if inflation in the U.S. did not return to target, or if financial conditions in the United States spilled over to a rising term premium," he said.

He also noted that a "reassessment of the future role of the dollar, could also constitute a kind of financial shock to the euro." Lane concluded, "So there are scenarios where, if the Federal Reserve departed from its mandate, that would create a problem."

The Fed operates under a dual mandate of promoting maximum employment and stable prices, defined as a 2% inflation rate. This differs from most central banks, which have a primary focus on inflation.

Despite these external risks, Lane expressed confidence in the Fed's policy direction. He reiterated that the ECB's December projections point to a sustained stabilization of inflation at the 2% target within the euro zone.

"In these circumstances, there is no near-term interest rate debate," Lane stated, dismissing questions about a potential rate hike. "The current level of the interest rate delivers the baseline for the next several years. But if we see developments in either direction, we will react."

Market sentiment aligns with this view. After a brief period of pricing in a possible rate hike for late 2026, investors now expect the deposit rate to remain steady at 2% throughout this year.

The economic backdrop includes the euro's sharp appreciation against the dollar last year, which was driven by investors moving out of dollar assets amid policy uncertainty. This strengthened euro has challenged European export competitiveness, compounding pressure from inexpensive Chinese goods that are already displacing European products in key markets.

Looking ahead, Lane anticipates a stronger cyclical recovery for the 21-nation euro zone in the coming year. However, he cautioned that the region's potential for long-term growth remains low and will require deep structural changes to shift into a higher gear.

Taiwan's government is publicly defending a landmark trade agreement with the United States after facing growing concerns that the deal could hollow out the island's world-leading technology sector. The debate intensifies as Taiwan Semiconductor Manufacturing Co. (TSMC), the nation's most critical company, continues its major expansion into the U.S.

Under the new agreement, Taiwanese firms have committed at least $250 billion in direct investment to boost American manufacturing in semiconductors, energy, and artificial intelligence. TSMC is leading this initiative, pouring significant capital into new fabrication plants and advanced packaging facilities in Arizona.

Addressing the criticism, Vice Premier Cheng Li-chiun framed the overseas investments as a strategic move. "This is not an industrial relocation, but instead an extension and expansion of Taiwan's technology industry," she stated, assuring that the government remains committed to supporting companies that maintain their home base and increase local investment.

Cheng also emphasized that the U.S. goal of building a secure domestic chip supply chain does not rely solely on Taiwan. She noted that Washington is collaborating with multiple international partners and domestic American chipmakers to achieve its objectives.

"Everyone is working together in the United States to revitalize the development of the AI industry," Cheng added. "It is not something Taiwan is expected to accomplish on its own."

Echoing this sentiment, Premier Cho Jung-tai praised the negotiators for securing the deal, highlighting the significant effort involved.

Despite official reassurances, some Taiwanese analysts and lawmakers are worried that the massive shift of capital and manufacturing capabilities abroad could erode the island's domestic high-tech ecosystem.

These fears were amplified after U.S. Commerce Secretary Howard Lutnick suggested relocating 40% of Taiwan's supply chain to America. The U.S. Commerce Department also noted that the agreement is designed to "drive massive reshoring of America's semiconductor sector."

For years, Taiwan's dominance in producing the world's most advanced chips has been considered a "silicon shield"—a strategic asset deterring potential military action from China. The opposition Kuomintang party has accused the ruling Democratic Progressive Party of jeopardizing this shield by making trade concessions to Washington.

TSMC, which is committing an additional $100 billion to its U.S. operations, has sought to calm these concerns. Company executives insist that their most advanced, leading-edge technologies will be developed and deployed in Taiwan for years before being transferred to overseas facilities.

Chief Financial Officer Wendell Huang explained the logic: "The most leading-edge technologies will be run in Taiwan because of practical reasons. When they get stabilized, then we can try to accelerate the technology to move overseas."

Speaking in Taipei, Economics Minister Kung Ming-hsin offered concrete projections on Taiwan's continued dominance in advanced chip manufacturing:

• By 2030: Taiwan is expected to hold approximately 85% of the global capacity for advanced chips (5 nanometers and below), with the U.S. accounting for about 15%.

• By 2036: Taiwan's share is projected to be around 80%, while the U.S. share will grow to roughly 20%.

According to analysis from Bloomberg, the trade agreement is expected to have only a modest direct influence on Taiwan's economy. However, it carries significant political weight, especially amid rising geopolitical pressure from China.

The deal, which includes a tariff reduction on Taiwanese goods from 20% to 15% in exchange for $500 billion in investment or financing, is also expected to significantly boost domestic semiconductor production in the United States over the next decade.

The Bank of Japan (BOJ) is expected to hold its policy rate steady at 0.75% during its upcoming two-day monetary policy meeting. Following a rate increase in December 2025, the central bank is now in an assessment phase, closely monitoring the effects of its monetary tightening on Japan's economy and inflation.

A key focus of the January meeting will be the release of the BOJ's quarterly "Outlook for Economic Activity and Prices." The central bank is preparing to revise its economic growth forecasts upward for fiscal years 2025 and 2026.

This marks a notable shift from the previous outlook report in October 2025, where the median forecast from board members projected real gross domestic product (GDP) growth at 0.7% for both fiscal years.

Key Drivers Behind the Forecast

The more optimistic growth projections are fueled by several positive factors:

• Government Stimulus: The government's supplementary budget is anticipated to stimulate household spending and corporate capital investment. Policymakers expect the most significant impact from these measures to occur in fiscal 2026.

• External Strength: A strong U.S. economy is providing a favorable external environment.

• Weak Yen Advantage: The depreciated yen continues to boost Japan's export performance.

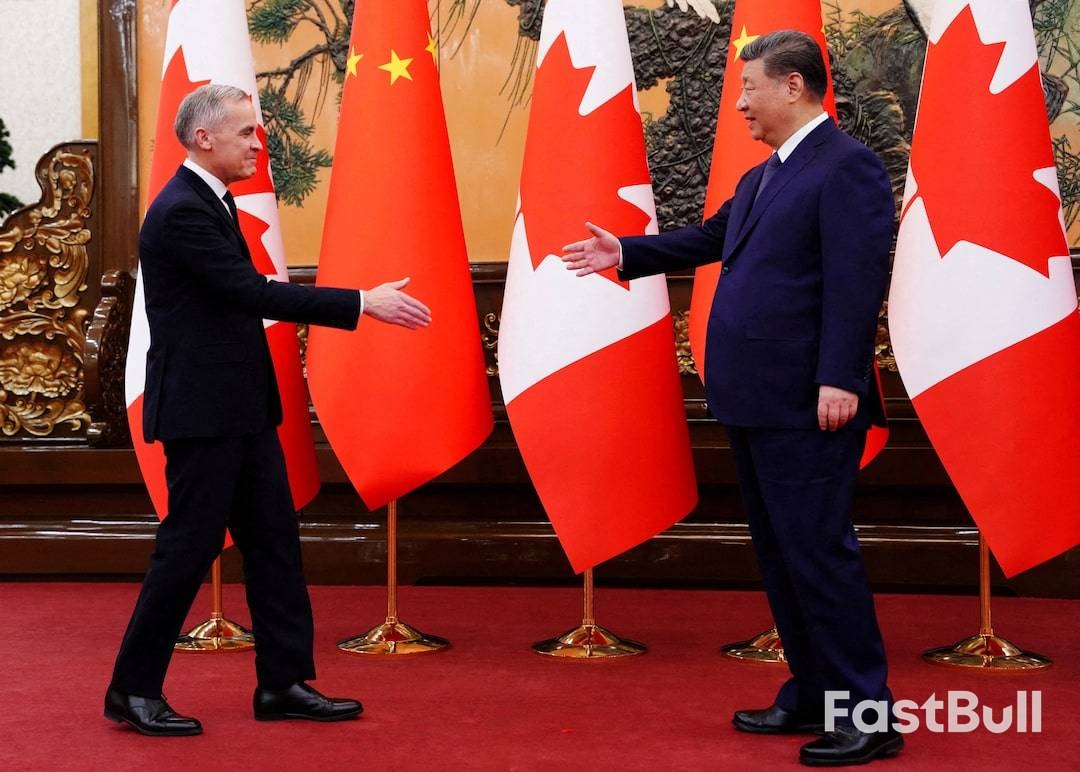

Canada and China have reached an initial trade agreement that dramatically lowers tariffs on Chinese electric vehicles and Canadian canola, signaling a major reset in economic relations. Prime Minister Mark Carney announced the deal on Friday in Beijing after meeting with Chinese leaders, including President Xi Jinping.

The agreement aims to dismantle trade barriers and establish new strategic partnerships, rebuilding a relationship that has been strained. Carney's visit is the first by a Canadian prime minister since 2017 and follows months of diplomatic efforts to restore ties with Canada's second-largest trading partner.

Under the new terms, Canada will allow up to 49,000 Chinese electric vehicles to be imported annually at a 6.1% tariff. This marks a sharp reversal from the 100% tariff imposed in 2024 by the former government of Justin Trudeau, which followed similar penalties enacted by the United States. In 2023, China exported 41,678 EVs to Canada.

"This is a return to levels prior to recent trade frictions, but under an agreement that promises much more for Canadians," Carney told reporters.

The Trudeau government had justified the high tariffs by citing an unfair global market advantage for Chinese manufacturers who benefited from state subsidies, which was seen as a threat to Canada's domestic auto industry.

However, Carney argued that a new approach is necessary. "For Canada to build its own competitive EV sector, we will need to learn from innovative partners, access their supply chains, and increase local demand," he said. The prime minister also stated he expects the agreement to attract "considerable" Chinese investment into Canada's auto sector, create high-quality jobs, and accelerate the country's transition to a net-zero economy through collaboration in clean energy.

The deal also provides a massive boost for Canadian farmers and fish harvesters, who were hit by retaliatory tariffs from China last year. In March 2025, after Trudeau's EV tariffs, China imposed duties on over $2.6 billion of Canadian agricultural products, which caused a 10.4% slump in Canadian goods imported by China that year.

Key agricultural concessions in the new agreement include:

• Canola Seed: Canada expects China to lower tariffs on its canola seed to a combined rate of approximately 15% by March 1. Carney described this as a "significant drop from current combined tariff levels of 84%" for a market worth $4 billion to Canada.

• Other Products: Anti-discrimination tariffs are expected to be removed from Canadian canola meal, lobsters, crabs, and peas starting March 1, lasting until at least the end of the year.

Carney projected that these changes will unlock nearly $3 billion in export orders for Canadian producers by allowing them to fully access the Chinese market.

The Canada-China pact comes as both nations navigate a complex global trade environment, particularly concerning relations with the United States. Under President Donald Trump, the U.S. has imposed tariffs on some Canadian goods, creating friction with its longtime ally. China has also faced significant U.S. tariffs since Trump's return to office.

When asked if China was now a more reliable partner than the United States, Carney emphasized the positive trajectory of the relationship.

"In terms of the way our relationship has progressed in recent months with China, it is more predictable, and you see results coming from that," he said. The deal positions Canada to deepen ties with the world's second-largest economy while diversifying its strategic partnerships.

France’s finance minister has issued a stark warning that a U.S. attempt to take control of Greenland could seriously damage trade relations with the European Union. Analysts suggest that any U.S. sanctions or tariffs aimed at pressuring Denmark could escalate into a full-blown trade war.

The controversy follows President Donald Trump's intensified discussions about annexing Greenland, the world's largest island. Recent talks on Wednesday involving the U.S., Denmark, and Greenland concluded without a diplomatic resolution.

French Finance Minister Roland Lescure stressed that economic ties between Washington and Brussels are at risk if the Trump administration pursues the self-governing Danish territory.

"Greenland is a sovereign part of a sovereign country that is part of the EU. That shouldn't be messed around with," Lescure told the Financial Times on Friday.

When asked if the EU would retaliate with economic sanctions against a U.S. invasion of Greenland, Lescure avoided a direct confirmation but signaled a major strategic shift. "If that happened, we would be in a totally new world for sure, and we would have to adapt accordingly," he said.

President Trump has framed the U.S. interest in Greenland as a matter of national security. According to analysts who spoke with CNBC, the move is also driven by a desire to secure emerging trade routes and gain access to critical minerals essential for industries like defense, keeping rivals at bay.

The heightened tensions come as a Democratic-led U.S. delegation prepares to meet with Danish lawmakers in Copenhagen.

Experts believe that aggressive economic measures by the U.S. would provoke a strong European response.

"Significant economic pressure in the form of tariffs or sanctions on Denmark by the U.S. could likely mean a significant E.U. pushback," said Dan Alamariu, chief geopolitical strategist at Alpine Macro. He warned that the EU could "respond in kind, leading to a sort of trade war with the U.S. as well as constant headline risks."

Alamariu added that such a conflict would "rattle markets" and challenge the integrity of NATO, although he noted that internal political and market pressure would likely restrain the Trump administration.

In a clear show of solidarity, European troops arrived in Greenland on Thursday for a joint military exercise. Maria Martisiute, a policy analyst at the European Policy Centre, told CNBC this demonstrates that Arctic defense is an "allied effort" and not solely dependent on the U.S.

"If we want to reinforce veterans and defense in Greenland or the wider Arctic, it's not up to the U.S. It can be done via allied efforts," Martisiute explained, adding that the exercise sends a "powerful message."

The EU is also bolstering its financial commitment. The European Commission, the bloc's executive body, has proposed doubling its spending on Greenland in its latest draft budget.

European Commission President Ursula von der Leyen affirmed this support on Thursday, stating, "What is clear is that Greenland can count on us — politically, economically, and financially and when it comes to its security."

Yesterday was refreshing in the sense that we briefly went back to the optimistic, euphoric mood of the past three years, with AI dominating headlines for the right reasons — strong numbers from TSMC and a very strong market reaction.

TSMC was relatively timid during the Asian session, likely reflecting uncertainty around reports that Nvidia could face tariffs of up to 25% on H200 chip exports to China. There were also lingering concerns over US-Taiwan trade negotiations, with Washington pushing TSMC to invest more heavily in US-based chip manufacturing. That demand is not only costly upfront — the company is committing around $165bn to build six fabs — but would also raise operating costs by an estimated 30–50% compared with production in Taiwan.

Those worries largely evaporated once Western markets stepped in. AI-related stocks ended the day firmly higher: TSMC rose more than 4% in New York, ASML jumped 6% to a fresh record in Amsterdam, and VanEck's Semiconductor ETF gained around 2%.

Optimism was further boosted by news of a trade agreement between the US and Taiwan, reportedly bringing the tariff rate to 15%. The S&P 500 closed near record levels.

That said, it's worth noting that most candlesticks on my daily charts were red, suggesting the session was not outright positive. Early strength faded into the close as investors spent much of the day trimming gains and reassessing the news flow. Is the news really that good?

As we dive into the heart of earnings season in the coming weeks, tech results will be scrutinised in far greater detail. Recall that last earnings season delivered blowout headline numbers from Big Tech, but in some cases those figures were wearing a bit of make-up. Think Meta offloading the bulk of its AI data-centre financing to private credit players such as Blue Owl and Pimco — and Nvidia booking revenues that have not yet turned into cash.

Concerns around circular AI deals, leverage and delayed returns on investment remain front of mind for investors. These are compounded by rising electricity and metals costs, higher memory-chip prices, and the risk of supply disruptions — including China's threats to restrict rare-earth exports amid geopolitical tensions involving Iran and Venezuela, where China has historically sourced oil.

All of this suggests that this earnings season may not be a walk in the park. These "details" — or elephants in the room — will matter just as much as the shiny headline figures. AI stocks are valued to perfection and leave no room for error. As we head into earnings, it increasingly feels as though Big Tech's ability to impress is diminishing, a risk that matters given its outsized weight in equity indices. Recently, the S&P 500 fell despite around 300 stocks closing higher — it was tech that dragged the index down.

If that dynamic persists, and tech earnings fail to reignite investor enthusiasm, the rotation trade is likely to continue. The equal-weighted S&P 500 has been playing catch-up with the market-cap-weighted, tech-heavy version, while US small caps have outperformed the S&P 500 for a tenth consecutive session — something we haven't seen in a long time. That trend should continue as long as risk appetite remains intact.

For now, risk appetite is being supported by renewed Federal Reserve (Fed) liquidity. A small but notable uptick in the Fed's balance sheet suggests the central bank is back in the market — not buying the same assets as before, but adding liquidity nonetheless. And liquidity always has to find a home.

Banks kicked off earnings season this week with broadly positive results. While price action earlier in the week failed to reflect those results — with markets focused on the White House's proposed 10% cap on credit-card interest rates — Goldman Sachs and Morgan Stanley reversed selling pressure yesterday with blockbuster numbers. Both posted record revenues, and both stocks hit all-time highs. Their long-term charts now make the 2008 drawdown look almost insignificant.

One of the biggest energy boosts for banks right now is AI — and we've been saying it all along: AI is not just a tech story. Goldman's CEO pointed to the "tremendous public and private capital" flowing into AI (surprised?), while Morgan Stanley's CFO noted that "the need for capital-markets and structuring expertise across the AI ecosystem is clearly there." Hell yeah —look at Meta, structuring debt in a way that makes its balance sheet look like a fresh sheet of paper.

The risk, however, is that investors now want returns — and they want them before AI infrastructure risks becoming outdated.

Zooming out briefly to macro data: the Philly Fed and Empire Manufacturing indices surprised to the upside yesterday, while US initial jobless claims fell last week. That combination suggests the Fed may be in no rush to cut rates further. The US 2-year yield, which captures rate expectations, climbed to a five-week high, pushing the dollar index toward the 100 mark. Crude oil fell sharply — around 4% — on signs of de-escalating tensions around Iran, while precious metals retreated. That said, the hammer formation in silver suggests dip-buyers remain active, and I still expect a move toward $100 per ounce before a more meaningful pullback.

There is little doubt that a 10–20% correction will hit at some point — the question is when. Over the medium term, the debasement trade should continue to weigh on the dollar and support metals prices.

Finally, for investors concerned about a commodity-led inflationary cycle, building exposure to commodities remains one of the most effective hedges.

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up