Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

U.S. Average Hourly Wage MoM (SA) (Dec)

U.S. Average Hourly Wage MoM (SA) (Dec)A:--

F: --

U.S. Average Weekly Working Hours (SA) (Dec)

U.S. Average Weekly Working Hours (SA) (Dec)A:--

F: --

P: --

U.S. New Housing Starts Annualized MoM (SA) (Oct)

U.S. New Housing Starts Annualized MoM (SA) (Oct)A:--

F: --

U.S. Total Building Permits (SA) (Oct)

U.S. Total Building Permits (SA) (Oct)A:--

F: --

P: --

U.S. Building Permits MoM (SA) (Oct)

U.S. Building Permits MoM (SA) (Oct)A:--

F: --

P: --

U.S. Annual New Housing Starts (SA) (Oct)

U.S. Annual New Housing Starts (SA) (Oct)A:--

F: --

U.S. U6 Unemployment Rate (SA) (Dec)

U.S. U6 Unemployment Rate (SA) (Dec)A:--

F: --

P: --

U.S. Manufacturing Employment (SA) (Dec)

U.S. Manufacturing Employment (SA) (Dec)A:--

F: --

U.S. Labor Force Participation Rate (SA) (Dec)

U.S. Labor Force Participation Rate (SA) (Dec)A:--

F: --

P: --

U.S. Private Nonfarm Payrolls (SA) (Dec)

U.S. Private Nonfarm Payrolls (SA) (Dec)A:--

F: --

U.S. Unemployment Rate (SA) (Dec)

U.S. Unemployment Rate (SA) (Dec)A:--

F: --

U.S. Nonfarm Payrolls (SA) (Dec)

U.S. Nonfarm Payrolls (SA) (Dec)A:--

F: --

U.S. Average Hourly Wage YoY (Dec)

U.S. Average Hourly Wage YoY (Dec)A:--

F: --

Canada Full-time Employment (SA) (Dec)

Canada Full-time Employment (SA) (Dec)A:--

F: --

P: --

Canada Part-Time Employment (SA) (Dec)

Canada Part-Time Employment (SA) (Dec)A:--

F: --

P: --

Canada Unemployment Rate (SA) (Dec)

Canada Unemployment Rate (SA) (Dec)A:--

F: --

P: --

Canada Labor Force Participation Rate (SA) (Dec)

Canada Labor Force Participation Rate (SA) (Dec)A:--

F: --

P: --

U.S. Government Employment (Dec)

U.S. Government Employment (Dec)A:--

F: --

P: --

Canada Employment (SA) (Dec)

Canada Employment (SA) (Dec)A:--

F: --

P: --

U.S. UMich Consumer Expectations Index Prelim (Jan)

U.S. UMich Consumer Expectations Index Prelim (Jan)A:--

F: --

P: --

U.S. UMich Consumer Sentiment Index Prelim (Jan)

U.S. UMich Consumer Sentiment Index Prelim (Jan)A:--

F: --

P: --

U.S. UMich Current Economic Conditions Index Prelim (Jan)

U.S. UMich Current Economic Conditions Index Prelim (Jan)A:--

F: --

P: --

U.S. UMich 1-Year-Ahead Inflation Expectations Prelim (Jan)

U.S. UMich 1-Year-Ahead Inflation Expectations Prelim (Jan)A:--

F: --

P: --

U.S. UMich 5-Year-Ahead Inflation Expectations Prelim YoY (Jan)

U.S. UMich 5-Year-Ahead Inflation Expectations Prelim YoY (Jan)A:--

F: --

P: --

U.S. 5-10 Year-Ahead Inflation Expectations (Jan)

U.S. 5-10 Year-Ahead Inflation Expectations (Jan)A:--

F: --

P: --

China, Mainland M1 Money Supply YoY (Dec)

China, Mainland M1 Money Supply YoY (Dec)--

F: --

P: --

China, Mainland M0 Money Supply YoY (Dec)

China, Mainland M0 Money Supply YoY (Dec)--

F: --

P: --

China, Mainland M2 Money Supply YoY (Dec)

China, Mainland M2 Money Supply YoY (Dec)--

F: --

P: --

U.S. Weekly Total Oil Rig Count

U.S. Weekly Total Oil Rig CountA:--

F: --

P: --

U.S. Weekly Total Rig Count

U.S. Weekly Total Rig CountA:--

F: --

P: --

Indonesia Retail Sales YoY (Nov)

Indonesia Retail Sales YoY (Nov)--

F: --

P: --

Euro Zone Sentix Investor Confidence Index (Jan)

Euro Zone Sentix Investor Confidence Index (Jan)--

F: --

P: --

India CPI YoY (Dec)

India CPI YoY (Dec)--

F: --

P: --

Germany Current Account (Not SA) (Nov)

Germany Current Account (Not SA) (Nov)--

F: --

P: --

Canada National Economic Confidence Index

Canada National Economic Confidence Index--

F: --

P: --

FOMC Member Barkin Speaks

FOMC Member Barkin Speaks U.S. 3-Year Note Auction Yield

U.S. 3-Year Note Auction Yield--

F: --

P: --

U.S. 10-Year Note Auction Avg. Yield

U.S. 10-Year Note Auction Avg. Yield--

F: --

P: --

Japan Trade Balance (Customs Data) (SA) (Nov)

Japan Trade Balance (Customs Data) (SA) (Nov)--

F: --

P: --

Japan Trade Balance (Nov)

Japan Trade Balance (Nov)--

F: --

P: --

U.K. BRC Overall Retail Sales YoY (Dec)

U.K. BRC Overall Retail Sales YoY (Dec)--

F: --

P: --

U.K. BRC Like-For-Like Retail Sales YoY (Dec)

U.K. BRC Like-For-Like Retail Sales YoY (Dec)--

F: --

P: --

Turkey Retail Sales YoY (Nov)

Turkey Retail Sales YoY (Nov)--

F: --

P: --

U.S. NFIB Small Business Optimism Index (SA) (Dec)

U.S. NFIB Small Business Optimism Index (SA) (Dec)--

F: --

P: --

Brazil Services Growth YoY (Nov)

Brazil Services Growth YoY (Nov)--

F: --

P: --

Canada Building Permits MoM (SA) (Nov)

Canada Building Permits MoM (SA) (Nov)--

F: --

P: --

U.S. CPI MoM (SA) (Dec)

U.S. CPI MoM (SA) (Dec)--

F: --

P: --

U.S. CPI YoY (Not SA) (Dec)

U.S. CPI YoY (Not SA) (Dec)--

F: --

P: --

U.S. Real Income MoM (SA) (Dec)

U.S. Real Income MoM (SA) (Dec)--

F: --

P: --

U.S. CPI MoM (Not SA) (Dec)

U.S. CPI MoM (Not SA) (Dec)--

F: --

P: --

U.S. Core CPI (SA) (Dec)

U.S. Core CPI (SA) (Dec)--

F: --

P: --

U.S. Core CPI YoY (Not SA) (Dec)

U.S. Core CPI YoY (Not SA) (Dec)--

F: --

P: --

U.S. Core CPI MoM (SA) (Dec)

U.S. Core CPI MoM (SA) (Dec)--

F: --

P: --

U.S. Weekly Redbook Index YoY

U.S. Weekly Redbook Index YoY--

F: --

P: --

U.S. New Home Sales Annualized MoM (Oct)

U.S. New Home Sales Annualized MoM (Oct)--

F: --

P: --

U.S. Annual Total New Home Sales (Oct)

U.S. Annual Total New Home Sales (Oct)--

F: --

P: --

U.S. Cleveland Fed CPI MoM (SA) (Dec)

U.S. Cleveland Fed CPI MoM (SA) (Dec)--

F: --

P: --

China, Mainland Imports YoY (CNH) (Dec)

China, Mainland Imports YoY (CNH) (Dec)--

F: --

P: --

China, Mainland Trade Balance (CNH) (Dec)

China, Mainland Trade Balance (CNH) (Dec)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

The Trump administration directed Fannie and Freddie to buy $200B in MBS, directly countering the Fed to ease housing affordability.

The Trump administration has directed mortgage finance giants Fannie Mae and Freddie Mac to purchase $200 billion in mortgage-backed securities (MBS). The move is a significant intervention aimed at tackling the persistent housing affordability crisis in the United States.

According to FHFA Director William Pulte, the Federal Housing Finance Agency—which oversees the two companies—has already initiated the program with a $3 billion round of purchases.

U.S. Treasury Secretary Scott Bessent clarified that the policy is designed to directly offset the Federal Reserve's ongoing reduction of its own bond holdings. The Fed has been allowing its massive $6.3 trillion bond portfolio to shrink, with MBS holdings declining by approximately $15 billion each month.

"What is happening is the Fed has about $15 billion of roll-off every month," Bessent explained in an interview with Reuters. "So I think the idea is to roughly match the Fed, which has been pushing the other way."

For over two years, the central bank has been steadily reducing its more than $2 trillion stash of MBS at a rate of $15 billion to $17 billion per month. Some analysts believe this process, a legacy of stimulus efforts during the global financial crisis and the pandemic, has prevented mortgage rates from falling more significantly.

The combination of high borrowing costs and elevated home prices has created a severe affordability problem, a key issue weighing on President Trump's approval ratings.

While the average rate on a 30-year fixed-rate mortgage has dropped to around 6.2% from a peak of nearly 8% in 2024, it remains far above the 3% levels seen during the pandemic.

Bessent noted that the new MBS purchases are not expected to lower mortgage rates directly. Instead, the goal is to achieve this indirectly by narrowing the yield spread between the securities issued by Fannie and Freddie and benchmark U.S. Treasuries.

Fannie Mae and Freddie Mac are central to the U.S. housing market. They buy home loans from banks and other lenders, package them into bonds, and sell them to investors. This process frees up capital for lenders to make new loans.

The new bond purchases will be funded from the two firms' own balance sheets. Amid ongoing discussions about reprivatizing the government-controlled entities, Bessent asserted that the move would not undermine their financial stability. He stated that both companies have sufficient cash and that the purchases could potentially increase their earnings.

Colombian President Gustavo Petro has renewed his sharp criticism of US policy, ending a brief diplomatic truce that followed a phone call with President Donald Trump earlier this week.

In a Thursday interview with the BBC, Petro accused Washington of treating other nations as part of a "US empire." He also leveled a severe charge against US Immigration and Customs Enforcement (ICE), comparing its agents to "Nazi brigades."

This return to a confrontational stance marks a sharp reversal from the tone struck just days ago, highlighting the volatile relationship between the two leaders.

The temporary de-escalation began after Petro and Trump held their first phone conversation. Petro described the call as an opportunity to address what he called the US president's "misconceptions" about drug trafficking.

The discussion appeared productive. Trump stated it was an honor to speak with Petro and that he appreciated his tone. Following the call, Petro told supporters in Bogota that he had intended to deliver a "tough" speech critical of Trump but would now soften his language.

However, for the firebrand former guerrilla, this moderation proved short-lived.

In his interview with the BBC, Petro's criticism was unambiguous. He claimed the threat of US military intervention in Colombia was real, citing a history of US violence against his country at the beginning of the 20th century.

His most pointed comments targeted US immigration enforcement, made in response to an ICE officer shooting and killing a woman in Minneapolis. The incident had already triggered demonstrations across the United States.

"For us, ICE operates the same way as the Nazi and Italian fascist brigades," Petro said. "They no longer just persecute Latin Americans in the streets, which for us is an affront, but they also kill US citizens."

In a separate, more measured interview with CBS News published Friday, Petro noted areas of alignment. He said that he and Trump share a similar vision for a power-sharing arrangement in Venezuela between the government of acting President Delcy Rodríguez and the opposition.

Still, he warned that a US attack on Colombia would be a "dumb policy" that could ignite a civil war. The two presidents are scheduled for a face-to-face meeting at the White House in the first week of February.

Petro's foreign policy approach, often characterized by combative late-night social media posts, sets him apart from other leftist presidents in Latin America. Leaders like Mexico's Claudia Sheinbaum and Brazil's Luiz Inácio Lula da Silva have generally adopted more measured tactics, seeking to avoid direct conflict with the Trump administration.

Petro's defiance was on full display last week. After Trump mentioned the possibility of military action against Colombia following the capture of Venezuelan President Nicolás Maduro, Petro called Trump senile and challenged him, saying, "Come and get me!"

The friction between the two leaders is rooted in long-standing issues beyond personality clashes. Trump has consistently complained about record levels of cocaine production in Colombia.

These tensions have led to significant diplomatic and economic consequences. Last year, the US government added Colombia to its list of rogue drug-trafficking nations. Washington also canceled Petro's visa after he urged Colombian troops to disobey orders from Trump.

In a more direct move, the US Treasury sanctioned Petro and members of his inner circle in October, effectively cutting him off from the US financial system.

Gold and silver have kicked off the new year with powerful momentum, testing critical resistance levels despite elevated market volatility. Bullish sentiment has driven gold to $4,500 an ounce, marking a nearly 4% gain since last Friday. Silver has performed even more strongly, nearing $80 an ounce for a weekly gain of almost 10%.

Silver's resilience is particularly noteworthy. The metal has bounced back effectively from a sharp drop last week, which followed a move by the CME Group to raise margin requirements in an effort to curb speculative activity.

Despite the strong start, both precious metals face a significant short-term headwind from the annual rebalancing of major commodity indexes.

Commodity indexes like the Bloomberg Commodity Index (BCOM) and the S&P GSCI Index are preparing for their annual rebalancing, an event that can create temporary selling pressure for top-performing assets.

These indexes hold a basket of commodities, with weightings determined by factors like liquidity and global production.

• Gold: Represents about 14% of BCOM and 3% to 4% of the S&P GSCI.

• Silver: Represents about 9% of BCOM and 1.5% of the GSCI.

Last year’s massive rallies—over 60% for gold and nearly 150% for silver—significantly increased their weightings within these indexes. To bring the allocations back in line, index managers must sell their overweight positions. According to some estimates, this rebalancing will force the sale of roughly $5 billion in gold and silver.

The good news for bulls is that this process is expected to conclude next week. Analysts widely believe that once this technical selling pressure is gone, the broader fundamentals supporting precious metals will reassert themselves, reinforcing the "buy the dip" strategy that proved effective last year.

Beyond temporary market mechanics, the fundamental outlook for silver appears exceptionally strong. A classic supply-demand squeeze is tightening its grip on the market as industrial consumption and investor demand compete for dwindling supplies.

The supply side is inelastic; new silver mines cannot be built in a few months to meet the demand surge. While moving silver stockpiles from the U.S. to other markets like London could improve liquidity, it doesn't solve the core problem: there isn't enough silver to satisfy persistent demand. In this environment, expectations are growing that silver prices could easily push past $100 an ounce.

Gold continues to perform its traditional role as the ultimate geopolitical safe-haven. Analysts note that a U.S. international policy of "might makes right" and the continued weaponization of the economy are pushing nations to diversify their reserves away from the U.S. dollar.

This trend underpins forecasts from many analysts who believe it is only a matter of time before gold prices reach $5,000 an ounce this year.

The final piece of the bullish puzzle for both gold and silver is the U.S. central bank's monetary policy. While markets do not anticipate the Federal Reserve will cut interest rates later this month, a cooling labor market suggests that rate cuts are inevitable.

For investors, the primary question is not if the cuts will happen, but how steep the decline in rates will be. As we move further into 2026, the one certainty is that it won't be a boring year. Judging by the first week, the volatility is here to stay.

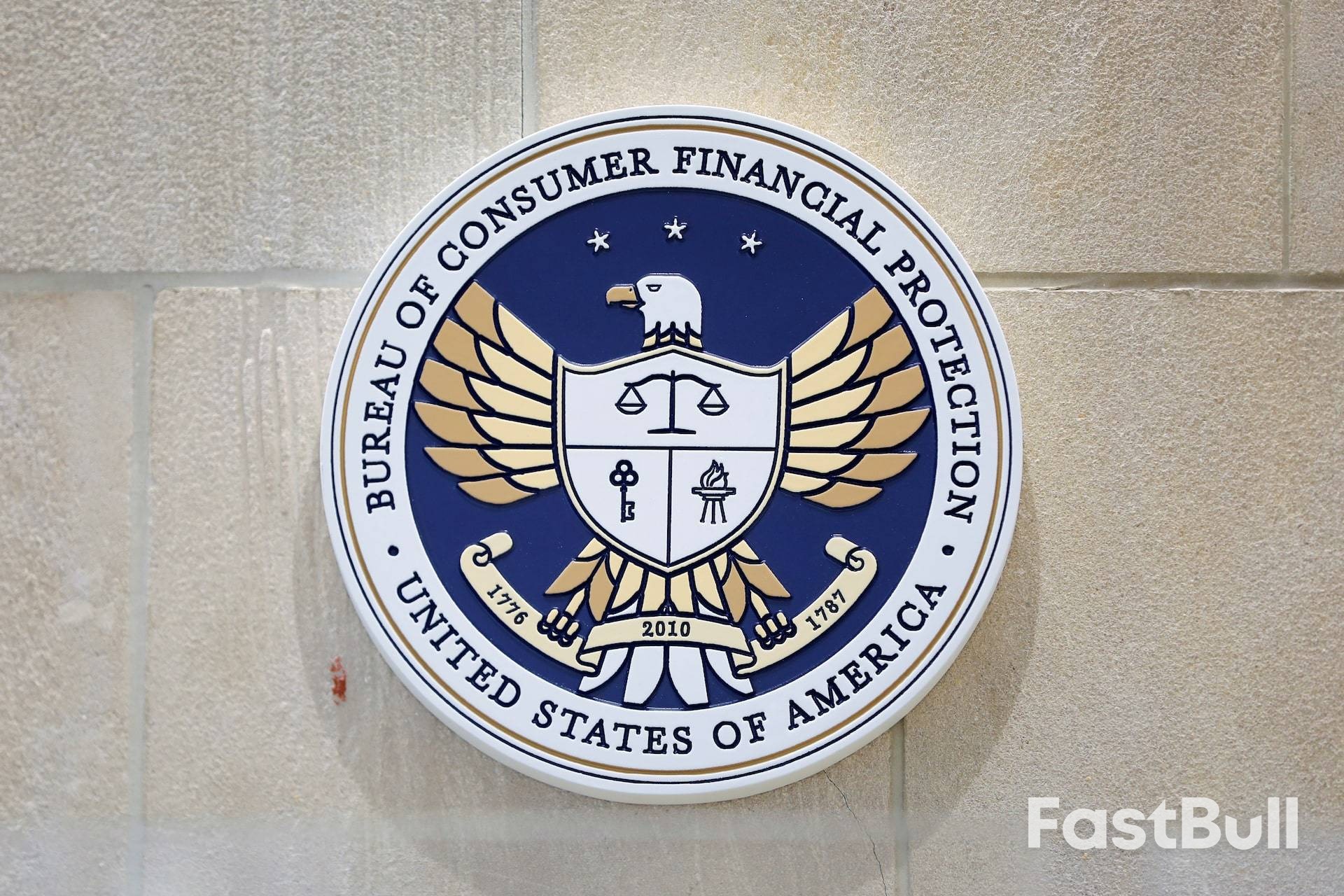

The Trump administration has reversed course on its 11-month effort to defund the Consumer Financial Protection Bureau (CFPB), requesting $145 million from the Federal Reserve to keep the consumer watchdog agency solvent. The move, disclosed in a court filing, comes after a federal judge mandated the funding.

According to a letter filed in federal court, President Trump's budget director, Russell Vought, has formally requested the funds from the Federal Reserve. This action follows a court decision a month ago that rejected the administration's argument that it was legally prohibited from drawing money from the central bank for the CFPB's budget.

Vought, who serves as both the head of the Office of Management and Budget and the acting CFPB director, stated in a letter to Fed Chair Jerome Powell that he disagreed with the court's order. However, he confirmed the $145 million would be sufficient to fund the CFPB's functions from January to March.

A spokesperson for the Federal Reserve declined to comment on the request. Historically, the Fed has always supplied the funding requested by the consumer agency.

This funding reversal marks a significant setback for the administration's campaign to dismantle the CFPB. Throughout the year, top officials have pursued strategies ranging from reducing the agency's size to shutting it down completely, accusing it of politicized enforcement that burdens free enterprise—claims that the agency's staff and supporters reject.

The decision is the administration's second recent defeat concerning the CFPB. Last month, an appeals court threw out a previous ruling that would have allowed the agency's leadership to proceed with mass firings.

The $145 million arrives as a critical lifeline for the CFPB, which was potentially just weeks away from insolvency. The agency had previously informed a judge it could not guarantee sufficient funding to cover its expenses beyond December 31.

The requested amount aligns with the CFPB's average quarterly funding draw over the last decade. While the agency had been drawing down its available finances for nearly a year, its costs are currently lower due to the suspension of most activities and an exodus of workers.

U.S. President Donald Trump has confirmed he will meet with Venezuelan opposition leader Maria Corina Machado next week, a pivotal discussion that comes as the U.S. navigates a complex power transition in Caracas.

The meeting is scheduled for January 13 or 14 in Washington, D.C. Speaking to U.S. oil executives on Friday about plans to rebuild Venezuela's oil industry, Trump noted Machado's upcoming visit.

"She's going to come in and pay her regards to our country, really to me, but I'm a representative of the country, nothing else," Trump said. He added that he would also meet with other "various representatives of Venezuela," though these meetings are still being arranged.

The meeting occurs against the backdrop of a significant shift in U.S. policy toward Venezuela. Trump and other officials have signaled they will allow Delcy Rodriguez, the former vice president, to remain as the country's interim president for at least 90 days after she took the oath of office this week.

This decision effectively sidelines Machado, whose opposition movement is widely considered the winner of Venezuela's 2025 presidential election over Nicolas Maduro. U.S. Secretary of State Marco Rubio explained the rationale, stating that much of Machado's movement "is no longer present inside of Venezuela."

The political maneuvering follows a dramatic U.S. operation on January 3, when special forces arrested former president Nicolas Maduro and his wife, transporting them to New York to face drug charges. Trump described his current relationship with the remaining officials in Venezuela as "very good."

The United States is actively rolling out a plan for heavy intervention in Venezuela's government and its critical oil sector.

Recent activity suggests a ramp-up of U.S. presence on the ground. Vehicle traffic has notably increased at the site of the U.S. embassy in Caracas, which has been officially suspended since 2019. A former embassy contractor reported being told the facility could reopen as early as next week.

Currently, U.S. diplomatic relations with Venezuela are being managed from Bogota, Colombia, by charge d'affaires John McNamara.

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up