Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

On Thursday (January 29) At The Close Of Trading In New York (05:59 Beijing Time On Friday), The Offshore Yuan (CNH) Was Quoted At 6.9447 Against The US Dollar, Down 10 Points From The Close Of Trading In New York On Wednesday. The Yuan Traded In The Range Of 6.9382-6.9547 During The Day

[Airline ETFs Rise Over 2.6%, Leading US Sector ETFs; S&P Technology Sector Falls Over 1.8%] On Thursday (January 29), The Global Airline ETF Rose 2.64%, Regional Bank ETFs And Banking ETFs Rose Up To 1.84%, The Energy ETF Rose 0.92%, The Semiconductor ETF Rose 0.21%, The Internet Stock Index ETF And Consumer Discretionary ETF Fell Up To 0.48%, The Technology Sector ETF Fell 1.58%, And The Global Technology Stock Index ETF Fell 1.76%. Among The 11 Sectors Of The S&P 500, The Information Technology/technology Sector Fell 1.86%, The Consumer Discretionary Sector Fell 0.64%, The Energy Sector Rose 1.08%, The Real Estate Sector Rose 1.42%, And The Telecommunications Sector Rose 2.92%

On Thursday (January 29), Spot Silver Fell 0.61% To $116.0075 Per Ounce In Late New York Trading, Trading Between $121.6540 And $106.8954. Comex Silver Futures Rose 2.87% To $116.790 Per Ounce. Comex Copper Futures Rose 0.78% To $6.2855 Per Pound, Having Reached $6.5830 At 22:31 Beijing Time. Spot Platinum Fell 2.65%, And Spot Palladium Fell 2.34%

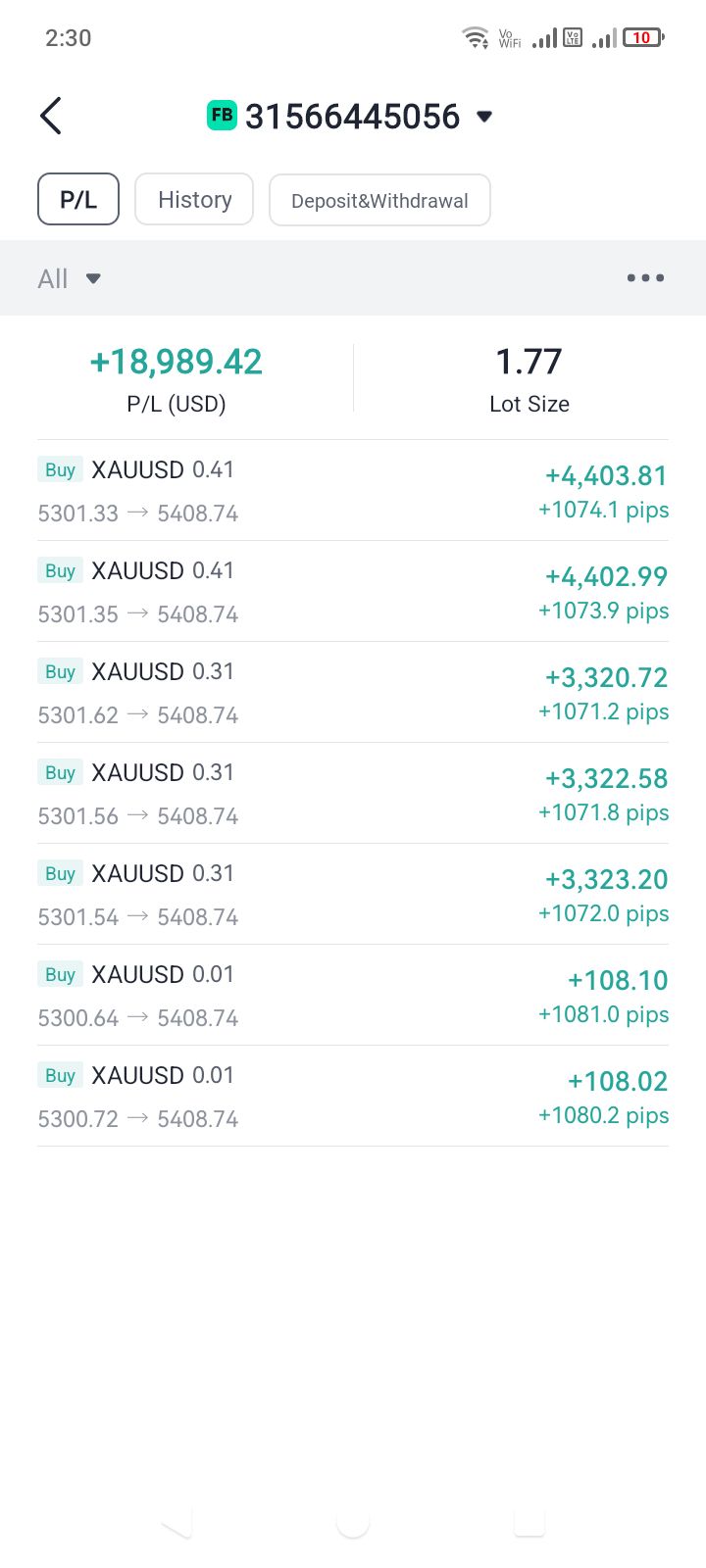

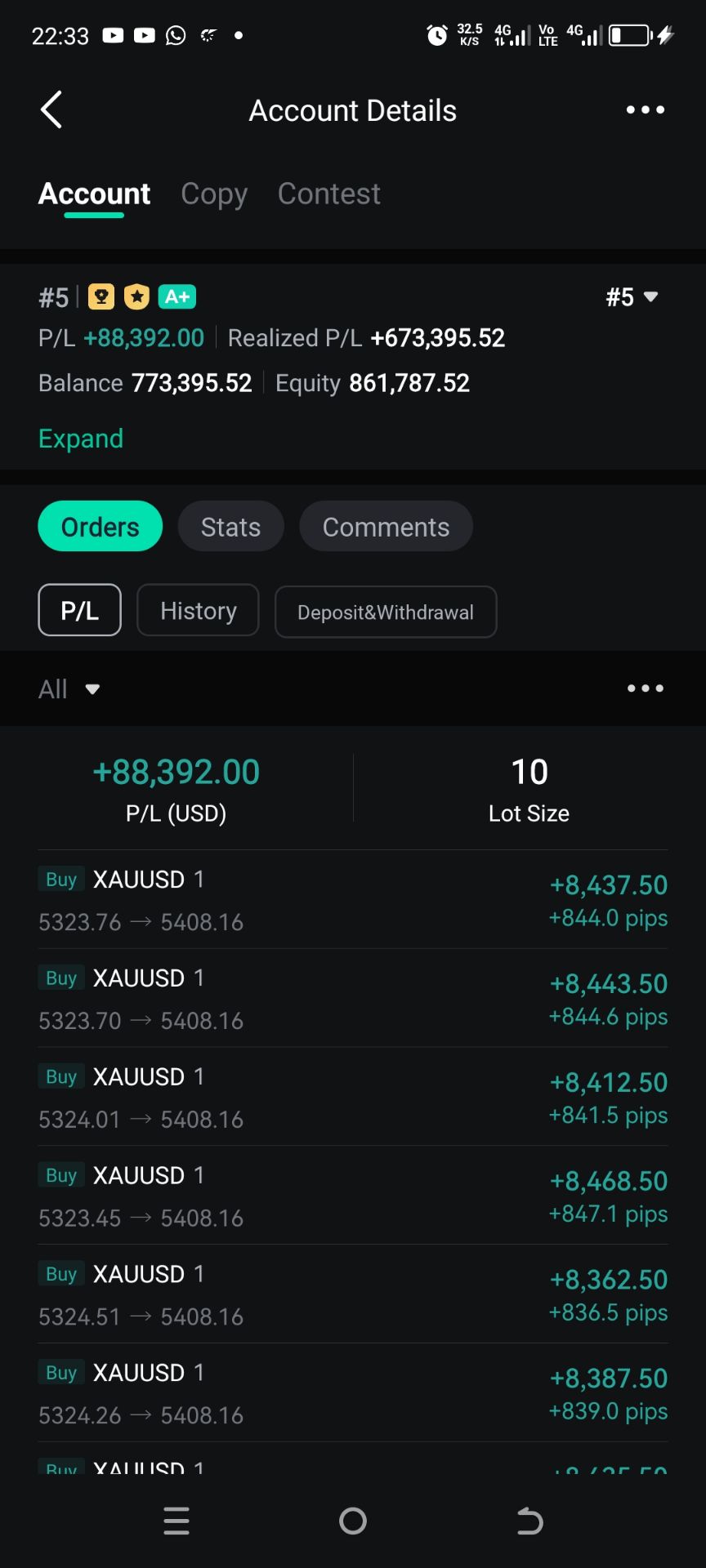

On Thursday (January 29), Spot Gold Rose 0.43% To $5,394.00 Per Ounce In Late New York Trading. At 14:23 Beijing Time, It Reached $5,595.47, Continuing To Set New Historical Highs. A Short-term Plunge Began At 23:00, Hitting A Daily Low Of $5,459.31 At 23:36. Comex Gold Futures Rose 1.97% To $5,408.30 Per Ounce, Having Reached $5,586.20 At 14:22

Stryker: Foreign Exchange Is Expected Slightly Positive Impact On Sales & Adj Net Eps Should Rates Hold Near Year-To-Date Levels For 2026

Bank Of Canada: Canada Government Will Participate In All Fixed-Rate Cmb Syndications Proposed For 2026

Toronto Stock Index .GSPTSE Unofficially Closes Down 159.94 Points, Or 0.48 Percent, At 33016.13

The S&P 500 Initially Closed Down 0.1%, With The Technology Sector Down 2%, Consumer Discretionary Down 0.6%, Energy Up 1.1%, And Telecoms Up 3%. The NASDAQ 100 Initially Closed Down 0.5%, With Atlassian, Microsoft, And Strategy Technology Among The Worst Performers, All Down Approximately 10%. Synopsys Fell 6%, Cadence Fell 5.7%, ASML Rose 2%, And Meta Rose 10.8%. Salesforce Initially Closed Down 6.3%, Boeing Fell 3%, And Microsoft Led The Decline Among Dow Jones Components. JPMorgan Chase Rose 1.6%, Honeywell Rose 4.9%, And IBM Rose Approximately 5%

The Nasdaq Golden Dragon China Index Closed Up 0.3% Initially. Among Popular Chinese Concept Stocks, NIO Closed Up 3.8%, Yum China Rose 1%, Tencent, New Oriental, Li Auto, Xiaomi, And Meituan Rose By More Than 0.9%, Alibaba Fell 0.7%, NetEase Fell 1.3%, WeRide Fell 4.5%, And Pony.ai Fell 7.9%. In The ETF Market, Ashr Rose 0.9%, Kweb Rose 0.5%, And Cqqq Fell 1.5%

ANZ - Roy Morgan New Zealand Consumer Confidence Index 107.2 In January From 101.5 Previous Month

USA Treasury: Thailand Added To Monitoring List Of Trading Partners Whose Currency Practices 'Merit Close Attention' Due To Its Growing Current Account Surplus And Trade Surplus With USA

USA Treasury: No Major Trading Partners Met All Three Criteria For Enhanced Analysis During Review Period

USA Treasury: Now Monitoring More Broadly Whether Countries That Smooth Exchange Rate Movements Do So To Resist Depreciation Pressures

USA Treasury Official Says New Criteria Not Aimed At Any Specific Country On Monitoring List But Will Aid Future Analysis During A Period Of Relative Dollar Depreciation

USA Treasury: Monitoring Trading Partners' Use Of Capital Controls, Macroprudential Measures, Government Investment Vehicles To Influence Foreign Exchange Markets

South Africa PPI YoY (Dec)

South Africa PPI YoY (Dec)A:--

F: --

P: --

Euro Zone Consumer Confidence Index Final (Jan)

Euro Zone Consumer Confidence Index Final (Jan)A:--

F: --

P: --

Euro Zone Selling Price Expectations (Jan)

Euro Zone Selling Price Expectations (Jan)A:--

F: --

P: --

Euro Zone Industrial Climate Index (Jan)

Euro Zone Industrial Climate Index (Jan)A:--

F: --

Euro Zone Services Sentiment Index (Jan)

Euro Zone Services Sentiment Index (Jan)A:--

F: --

Euro Zone Economic Sentiment Indicator (Jan)

Euro Zone Economic Sentiment Indicator (Jan)A:--

F: --

Euro Zone Consumer Inflation Expectations (Jan)

Euro Zone Consumer Inflation Expectations (Jan)A:--

F: --

P: --

Italy 5-Year BTP Bond Auction Avg. Yield

Italy 5-Year BTP Bond Auction Avg. YieldA:--

F: --

P: --

Italy 10-Year BTP Bond Auction Avg. Yield

Italy 10-Year BTP Bond Auction Avg. YieldA:--

F: --

P: --

France Unemployment Class-A (Dec)

France Unemployment Class-A (Dec)A:--

F: --

P: --

South Africa Repo Rate (Jan)

South Africa Repo Rate (Jan)A:--

F: --

P: --

Canada Average Weekly Earnings YoY (Nov)

Canada Average Weekly Earnings YoY (Nov)A:--

F: --

U.S. Nonfarm Unit Labor Cost Final (Q3)

U.S. Nonfarm Unit Labor Cost Final (Q3)A:--

F: --

P: --

U.S. Initial Jobless Claims 4-Week Avg. (SA)

U.S. Initial Jobless Claims 4-Week Avg. (SA)A:--

F: --

U.S. Weekly Continued Jobless Claims (SA)

U.S. Weekly Continued Jobless Claims (SA)A:--

F: --

U.S. Trade Balance (Nov)

U.S. Trade Balance (Nov)A:--

F: --

U.S. Weekly Initial Jobless Claims (SA)

U.S. Weekly Initial Jobless Claims (SA)A:--

F: --

Canada Trade Balance (SA) (Nov)

Canada Trade Balance (SA) (Nov)A:--

F: --

U.S. Exports (Nov)

U.S. Exports (Nov)A:--

F: --

P: --

Canada Imports (SA) (Nov)

Canada Imports (SA) (Nov)A:--

F: --

Canada Exports (SA) (Nov)

Canada Exports (SA) (Nov)A:--

F: --

U.S. Unit Labor Cost Revised MoM (SA) (Q3)

U.S. Unit Labor Cost Revised MoM (SA) (Q3)A:--

F: --

U.S. Factory Orders MoM (Excl. Defense) (Nov)

U.S. Factory Orders MoM (Excl. Defense) (Nov)A:--

F: --

P: --

U.S. Factory Orders MoM (Nov)

U.S. Factory Orders MoM (Nov)A:--

F: --

U.S. Wholesale Sales MoM (SA) (Nov)

U.S. Wholesale Sales MoM (SA) (Nov)A:--

F: --

P: --

U.S. Factory Orders MoM (Excl. Transport) (Nov)

U.S. Factory Orders MoM (Excl. Transport) (Nov)A:--

F: --

U.S. Non-Defense Capital Durable Goods Orders Revised MoM (Excl. Aircraft) (SA) (Nov)

U.S. Non-Defense Capital Durable Goods Orders Revised MoM (Excl. Aircraft) (SA) (Nov)A:--

F: --

U.S. EIA Weekly Natural Gas Stocks Change

U.S. EIA Weekly Natural Gas Stocks ChangeA:--

F: --

P: --

Brazil CAGED Net Payroll Jobs (Dec)

Brazil CAGED Net Payroll Jobs (Dec)A:--

F: --

P: --

U.S. Weekly Treasuries Held by Foreign Central Banks

U.S. Weekly Treasuries Held by Foreign Central BanksA:--

F: --

P: --

South Korea Services Output MoM (Dec)

South Korea Services Output MoM (Dec)--

F: --

P: --

South Korea Industrial Output MoM (SA) (Dec)

South Korea Industrial Output MoM (SA) (Dec)--

F: --

P: --

South Korea Retail Sales MoM (Dec)

South Korea Retail Sales MoM (Dec)--

F: --

P: --

Japan Tokyo CPI YoY (Excl. Food & Energy) (Jan)

Japan Tokyo CPI YoY (Excl. Food & Energy) (Jan)--

F: --

P: --

Japan Tokyo CPI MoM (Excl. Food & Energy) (Jan)

Japan Tokyo CPI MoM (Excl. Food & Energy) (Jan)--

F: --

P: --

Japan Unemployment Rate (Dec)

Japan Unemployment Rate (Dec)--

F: --

P: --

Japan Tokyo CPI YoY (Jan)

Japan Tokyo CPI YoY (Jan)--

F: --

P: --

Japan Jobs to Applicants Ratio (Dec)

Japan Jobs to Applicants Ratio (Dec)--

F: --

P: --

Japan Tokyo CPI MoM (Jan)

Japan Tokyo CPI MoM (Jan)--

F: --

P: --

Japan Tokyo Core CPI YoY (Jan)

Japan Tokyo Core CPI YoY (Jan)--

F: --

P: --

Japan Retail Sales YoY (Dec)

Japan Retail Sales YoY (Dec)--

F: --

Japan Industrial Inventory MoM (Dec)

Japan Industrial Inventory MoM (Dec)--

F: --

P: --

Japan Retail Sales (Dec)

Japan Retail Sales (Dec)--

F: --

P: --

Japan Retail Sales MoM (SA) (Dec)

Japan Retail Sales MoM (SA) (Dec)--

F: --

Japan Large-Scale Retail Sales YoY (Dec)

Japan Large-Scale Retail Sales YoY (Dec)--

F: --

P: --

Japan Industrial Output Prelim MoM (Dec)

Japan Industrial Output Prelim MoM (Dec)--

F: --

P: --

Japan Industrial Output Prelim YoY (Dec)

Japan Industrial Output Prelim YoY (Dec)--

F: --

P: --

Australia PPI YoY (Q4)

Australia PPI YoY (Q4)--

F: --

P: --

Australia PPI QoQ (Q4)

Australia PPI QoQ (Q4)--

F: --

P: --

Japan Construction Orders YoY (Dec)

Japan Construction Orders YoY (Dec)--

F: --

P: --

Japan New Housing Starts YoY (Dec)

Japan New Housing Starts YoY (Dec)--

F: --

P: --

France GDP Prelim YoY (SA) (Q4)

France GDP Prelim YoY (SA) (Q4)--

F: --

P: --

Turkey Trade Balance (Dec)

Turkey Trade Balance (Dec)--

F: --

P: --

France PPI MoM (Dec)

France PPI MoM (Dec)--

F: --

P: --

Germany Unemployment Rate (SA) (Jan)

Germany Unemployment Rate (SA) (Jan)--

F: --

P: --

Germany GDP Prelim YoY (Not SA) (Q4)

Germany GDP Prelim YoY (Not SA) (Q4)--

F: --

P: --

Germany GDP Prelim QoQ (SA) (Q4)

Germany GDP Prelim QoQ (SA) (Q4)--

F: --

P: --

Germany GDP Prelim YoY (Working-day Adjusted) (Q4)

Germany GDP Prelim YoY (Working-day Adjusted) (Q4)--

F: --

P: --

Italy GDP Prelim YoY (SA) (Q4)

Italy GDP Prelim YoY (SA) (Q4)--

F: --

P: --

U.K. Mortgage Approvals (Dec)

U.K. Mortgage Approvals (Dec)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

President Trump issues a stark ultimatum to Iran: negotiate a political settlement or face potential military strikes, as a formidable US armada takes position.

President Donald Trump issued a direct warning to Iran on Wednesday via social media, signaling that military strikes are on the table unless the nation's leaders agree to a comprehensive political settlement. The message comes as the United States military concentrates a formidable force for a potential operation against Iran.

Dozens of warships, including a nuclear-powered aircraft carrier, alongside hundreds of combat aircraft, are now positioned to attack if ordered.

The U.S. has assembled a powerful air and naval armada to back up its diplomatic pressure on Iran. All information regarding this deployment is based on open-source intelligence from outlets including the Pentagon and the White House.

Naval Power in the Region

The centerpiece of the naval deployment is the USS Abraham Lincoln aircraft carrier strike group, which is moving into the area from the Indo-Pacific. The deployment includes a massive concentration of firepower:

• Aircraft Carrier: The nuclear-powered USS Abraham Lincoln carries nine air squadrons, including F-35C Lightning II stealth fighters, F/A-18E/F Super Hornet jets, and EA-18G Electronic Warfare aircraft.

• Escort Fleet: The carrier is escorted by three Arleigh Burke-class guided-missile destroyers, each capable of launching dozens of Tomahawk land-attack cruise missiles.

• Additional Forces: Beyond the Lincoln's immediate group, another six Arleigh Burke-class destroyers are operating in the Arabian Sea, Red Sea, and Mediterranean Sea. It is also highly probable that U.S. Navy guided-missile submarines, armed with Tomahawks, are in the region.

Air Force Assets on High Alert

Significant U.S. Air Force assets are also stationed at bases across the Middle East and Europe, ready to support any potential action.

• European Bases: RAF Lakenheath in the United Kingdom houses approximately 54 F-35A Lightning II stealth fighters and 35 F-15E Strike Eagles. At least one squadron of F-16 Fighting Falcons is based in Italy.

• Middle Eastern Bases: In Jordan, the Muwaffaq Salti Air Base hosts 37 F-15E Strike Eagles and two squadrons of A-10 Thunderbolt attack jets.

• Strategic Bombers: The Air Force has dozens of B-1 Lancer, B-2 Spirit, and B-52 Stratofortress strategic bombers on standby in the continental U.S. for long-range precision strikes. Transport aircraft have also been observed making regular flights to the Middle East.

In a post on his Truth Social platform, President Trump detailed the military presence with a direct message to Tehran.

"A massive Armada is heading to Iran. It is moving quickly, with great power, enthusiasm, and purpose," Trump stated, noting it was a larger force than the one sent to Venezuela. He emphasized that the U.S. military is "ready, willing, and able to rapidly fulfill [their] mission, with speed and violence, if necessary."

However, Trump framed the deployment as leverage for diplomacy. He urged Iran to "quickly come to the table" and negotiate a resolution to longstanding issues with the West, specifically its nuclear weapons program. The president’s message suggests the military buildup aims to force a permanent solution, whether through negotiation or direct action.

To underscore his point, Trump reminded the Iranian regime of a past military operation, noting their previous failure to make a deal led to Operation Midnight Hammer. During that operation, the U.S. military used B-2 Spirit stealth bombers and Tomahawk missiles to conduct precision strikes against several of Iran's nuclear facilities.

"Time is running out, it is truly of the essence!" Trump concluded. "The next attack will be far worse! Don't make that happen again."

Beneath the public clash over interest rates, a surprising consensus is forming between the Trump administration and the U.S. Federal Reserve on the near-term economic outlook.

While President Donald Trump has loudly called for deep rate cuts, both his economics team and officials at the central bank now largely agree on several key points: a potential productivity boom could boost the economy without fanning inflation, tariffs are unlikely to cause persistent price pressures, and overall economic growth remains solid.

The alignment isn't perfect. The crucial divide lies in how to manage risk. The administration wants an aggressive bet on productivity to justify immediate rate cuts. The Fed, on the other hand, is demanding more proof, particularly as inflation has remained above its 2% target for the past year.

Fed Chair Jerome Powell, speaking after the central bank held its benchmark interest rate steady in the 3.50% to 3.75% range, sketched an optimistic view of the economy. This marks a significant shift from a year ago when concerns about slowing growth and trade wars dominated the policy debate.

While Powell’s tone was measured, his outlook shared key themes with top administration officials, even as the Fed resists calls for rapid rate reductions.

The decision to hold rates was not unanimous. Two policymakers, Governor Christopher Waller and Governor Stephen Miran, both Trump appointees, dissented in favor of a rate cut at the January meeting. However, Powell described the sentiment to hold rates steady for now as "broad" among the Federal Open Market Committee’s 19 members.

The current pause on rates is less about a fundamental disagreement on the economy's direction and more about how to weigh the forces shaping it.

Both sides are closely watching productivity and the impact of tariffs, seeing them as central to the economic forecast.

Tariffs as a One-Time Price Shock

On tariffs, the Fed’s view is that while they have pushed up some prices, the effect is temporary.

"Ultimately, we think those will not result in inflation as opposed to a one-time price increase," Powell said, adding that there's an "expectation that sometime in the middle quarters of the year we'll see tariff inflation topping out." Administration officials also believe any price impact from tariffs will be temporary and that inflation is set to decline.

The Productivity Puzzle

On the topic of productivity, the administration, led by chief economic adviser Kevin Hassett, argues that an emerging surge warrants looser monetary policy, much like the approach then-Chair Alan Greenspan took during the 1990s tech boom.

Powell acknowledged the Fed is watching this closely. "We're all over that," he stated. "No one's sitting here unaware of the possibility of higher productivity... We are well aware that higher productivity means higher potential output, and it changes the way you think about, potentially, inflation, growth, labor market."

However, he added a note of caution that defines the Fed’s current stance: "We're very clear-eyed about the possibility that this higher productivity may persist, and also that it may not." This uncertainty makes the central bank hesitant to move policy too quickly.

After a year dominated by uncertainty, Powell noted that "the economy has once again surprised us with its strength." The Fed's latest policy statement upgraded its assessment of growth, a view that contrasts with Trump's more boisterous descriptions of the U.S. as the "hottest" economy in the world but still points to a positive trajectory.

Powell said that strong consumption and business investment mean "this year starts off on a solid footing for growth." He also pointed to a curious trend: consumers are expressing negative views in surveys but continuing to spend, suggesting a disconnect between sentiment and behavior.

Despite the shared economic views, tension over interest rates is unlikely to disappear. While the long-term expectation is for rates to eventually move lower, a cut in the near future would likely signal that something has gone wrong.

"If they are easing before June, something bad has happened in the economy," said Neil Dutta, head of economics at Renaissance Macro Research.

Powell noted that the current 4.4% unemployment rate appears to be "stabilizing," with risks to the job market diminishing compared to last year. According to Dutta, a few main scenarios are in play for the Fed's next moves:

• No Cuts This Year: If growth and the job market outperform expectations while inflation remains stuck, the Fed might not cut rates at all.

• Gradual Cuts: If inflation slows as policymakers anticipate, the Fed could begin a series of gradual rate cuts.

• Quicker Cuts: If growth falters and the unemployment rate rises, the Fed would likely respond with faster rate reductions.

The next major data point will be the January jobs report. "Corporate labor market news does not feel great at the moment," Dutta cautioned, noting a recent slide in consumer confidence about the job market. "When consumers say labor market conditions are worsening, it usually pays to believe them."

U.S. President Donald Trump issued a warning on Thursday that tariffs on trading partners could become "much steeper," even as he claimed his administration has been "very nice" in its implementation of the policy so far.

The remarks were made during a White House Cabinet meeting, highlighting the administration's firm stance on trade amid a high-stakes legal review.

"The tariffs are very ... you know ... steep. They could be much steeper," Trump said. "We've been actually very nice about it, but even being nice about it, we've taken in hundreds of billions of dollars."

The president reiterated his long-held argument that tariffs have generated "tremendous" national security and strength for the United States.

He also directed criticism at those challenging the policy, labeling them "China-centric."

"These are people that are China (centric), but they are also outside of the United States," Trump stated. "These are countries that have ripped us off for years and years, charging us tariffs."

Trump's defense of his tariff strategy comes as the U.S. Supreme Court deliberates the legality of specific tariffs imposed under the 1977 International Emergency Economic Powers Act (IEEPA). The court is expected to issue a ruling on these country-specific measures in the coming months.

A ruling against the administration could trigger calls for significant tariff refunds. However, the administration is widely expected to seek legal workarounds or alternative measures to maintain its tariff framework.

It is important to note that the court's review does not affect all of Trump's tariffs, such as the sector-wide duties imposed on autos and other items.

The administration has consistently framed its use of tariffs as a strategic tool to reshape the U.S. economy. The primary stated objectives include:

• Reducing the U.S. trade deficit.

• Increasing federal revenue.

• Boosting foreign investment and domestic manufacturing.

The Federal Reserve is holding interest rates steady, signaling that policymakers aren't ready to declare victory over inflation. For traders and investors, this means the focus is shifting away from Fed announcements and squarely onto hard economic data for market direction.

Analysts suggest the Fed's decision reflects a cautious confidence. While restrictive policy has successfully cooled demand without causing significant job losses, the progress on inflation isn't yet enough to warrant a rate cut.

Iliya Kalchev of Nexo Dispatch noted that officials seem comfortable maintaining tight financial conditions until the economy shows more definitive signs of slowing. He pointed to steady jobless claims and resilient consumer spending as evidence that the current policy is moderating demand "without triggering meaningful job losses," aligning with the central bank's goal of a soft landing.

This wait-and-see approach means markets will likely react more to major economic data releases—like inflation and employment reports—than to the Fed's own guidance in the coming months.

For the digital asset market, the Fed's decision to hold rates was widely anticipated and already priced in. As a result, market sentiment now hinges on clues about when easier financial conditions might finally arrive.

Javed Khattak, co-founder of cheqd.io, explained that attention has moved beyond the decision itself to the message behind it. "The Fed holding rates was expected and fully priced in," he said, adding that investors are now seeking clarity on whether policymakers are leaning toward looser conditions later this year.

Ryan Lee of Bitget Research added that steady rates help maintain supportive liquidity conditions for risk assets, which sustains appetite for equities, commodities, and crypto.

Bitcoin Struggles for Momentum

Despite the stable policy environment, market dynamics remain cautious. A report from Bitfinex Alpha highlighted that Bitcoin (BTC) and the wider crypto market have struggled to break higher. The primary obstacles are weakening spot demand and outflows from exchange-traded funds (ETFs), which are limiting upward momentum.

The report notes that Bitcoin remains range-bound as institutional flows have slowed. This situation leaves prices dependent on fresh demand catalysts before a sustained rally can materialize and helps explain the muted market reaction to the Fed's announcement.

Speaking after the decision, Fed Chair Jerome Powell remarked that recent economic performance makes it difficult to label the current policy as clearly restrictive.

"It's hard to look at the incoming data and say that policy is significantly restrictive at this time," Powell stated. He suggested that the Fed's policy might now be "sort of loosely neutral or it may be somewhat restrictive."

Powell pointed to several key indicators:

• Economic growth remains resilient.

• Labor market conditions appear to be stabilizing, with unemployment at 4.4% in December.

• Core PCE inflation, while down from its 2022 peak, is still running at 3.0% annually—above the Fed's 2% target.

This backdrop reinforces the view that investors should watch the data, as the Fed will be waiting for clearer economic signals before making its next move.

U.S. President Donald Trump announced Thursday that he secured a one-week pause in Russian attacks on Kyiv and other Ukrainian cities from President Vladimir Putin, citing the region's severe cold temperatures. The Kremlin has yet to confirm any such agreement.

The announcement comes as Russia continues its campaign of targeting Ukraine's critical infrastructure, a strategy designed to weaken public resolve by cutting off heat and power during the coldest months of winter.

Speaking at a White House Cabinet meeting, Trump said he personally requested the pause from the Russian leader.

"I personally asked President Putin not to fire on Kyiv and the cities and towns for a week during this ... extraordinary cold," Trump stated, adding that Putin "agreed to that."

The Republican president expressed satisfaction with the outcome. "A lot of people said, 'Don't waste the call. You're not going to get that,'" Trump remarked. "And he did it. And we're very happy that they did it."

However, details about the timing and scope of this limited ceasefire in the nearly four-year war remain unclear. Trump did not specify when his call with Putin occurred or when the pause would begin, and the White House did not immediately provide further information.

Ukrainian President Volodymyr Zelenskyy had warned late Wednesday that intelligence suggested Moscow was preparing for another major barrage, casting doubt on the pause just as U.S.-brokered peace talks are scheduled for the weekend.

From Moscow, Kremlin spokesman Dmitry Peskov declined to comment when asked earlier on Thursday if a mutual halt on strikes against energy facilities was under discussion.

Ukraine is bracing for a brutal cold front, with temperatures expected to drop as low as minus 30 degrees Celsius (minus 22 Fahrenheit) in some areas starting Friday, according to the State Emergency Service. Ukrainian officials have consistently described Russia's strategy of targeting civilian infrastructure during winter as "weaponizing winter."

The ongoing attacks continue to discredit the peace process, according to Zelenskyy. "Every single Russian strike does," he said Wednesday.

Last year was the deadliest for civilians in Ukraine since Russia's full-scale invasion on February 24, 2022. The U.N. Human Rights Monitoring Mission reported that intensified Russian aerial attacks behind the front line killed 2,514 civilians and injured 12,142, a 31% increase from 2024.

The daily bombardments persist. Overnight, a Russian drone attack in the southern Zaporizhzhia region killed three people and started a large fire in an apartment building. In the central Dnipropetrovsk region, two people were injured as firefighters battled blazes caused by strikes.

While diplomatic efforts continue, international partners remain wary of Russia's commitment. The European Union's top diplomat, Kaja Kallas, accused Russia of not taking the negotiations seriously and called for increased pressure on Moscow.

"We see them increasing their attacks on Ukraine because they can't make moves on the battlefield. So, they are attacking civilians," Kallas said Thursday in Brussels. She insisted that Europe must be fully involved in any talks, expressing concern that European security interests might be overlooked in a settlement process led primarily by the Trump administration.

In contrast, Trump's special envoy, Steve Witkoff, expressed optimism. He noted that "a lot of progress" was made in recent talks and anticipates more headway in the coming days. "I think the people of Ukraine are now hopeful and expecting that we are going to deliver a peace deal sometime soon," Witkoff said.

An international think tank report published Tuesday projected a grim milestone, estimating that the total number of soldiers killed, injured, or missing on both sides could reach 2 million by spring.

The conflict is also being fought on a technological front. Ukrainian Defense Minister Mykhailo Fedorov confirmed Thursday that Ukraine is working with SpaceX to address Russia's reported use of the Starlink satellite service for its attack drones.

Fedorov said on Telegram that his team had contacted the aerospace company run by Elon Musk and "proposed ways to resolve the issue." He thanked Musk and SpaceX President Gwynne Shotwell for their "swift response."

SpaceX has navigated a complex position throughout the war. A year after the invasion, Shotwell stated the company was happy to provide connectivity to Ukrainians but also sought to restrict the use of Starlink for military purposes.

U.S. Defense Secretary Pete Hegseth is expected to miss the upcoming NATO defense ministers' meeting in Brussels, a move that is fueling concerns about the United States' commitment to the military alliance. This marks the second consecutive time a top official from the Trump administration has skipped a key NATO gathering, deepening worries among European allies.

The expected absence comes at a time of strained transatlantic relations, recently tested by President Donald Trump's stated desire to acquire Greenland from Denmark, a fellow NATO member.

Hegseth's decision to miss the February 12 meeting follows U.S. Secretary of State Marco Rubio’s failure to attend the NATO foreign ministers' summit in December. While the Pentagon and NATO have declined to comment, the back-to-back no-shows signal a significant shift in U.S. engagement.

Historically, the absence of a top U.S. cabinet official from a NATO ministerial meeting was highly unusual. As the alliance's primary military and political power, consistent high-level participation from the United States has long been considered standard practice.

Oana Lungescu, a former NATO spokesperson now at the RUSI think tank, warned that the move would have consequences. "If confirmed, it will send a bad signal at a very tense time in transatlantic relations, and will only deepen the concerns of other allies about the U.S. commitment to NATO," she said.

The news also surfaced as the Trump administration weighs military options against Iran, a scenario where close coordination with NATO allies would typically be paramount.

This apparent disengagement aligns with a new National Defense Strategy published by the Trump administration last week. The document explicitly redefines America's role, signaling a pivot away from its traditional security posture in Europe.

The strategy states: "In Europe and other theaters, allies will take the lead against threats that are less severe for us but more so for them, with critical but more limited support from the United States."

In place of Hegseth, diplomats expect Elbridge Colby to attend the Brussels meeting. As the Pentagon's policy chief, Colby was a key architect of the new defense strategy.

Experts argue that Hegseth's absence is a missed chance to repair and strengthen the alliance at a critical moment. Jamie Shea, a former senior NATO official and a fellow at the Friends of Europe think tank, noted that the timing is particularly poor. Trump and NATO chief Mark Rutte had recently agreed that the alliance should take on a greater role in Arctic security, partly to ease the tensions over Greenland.

"It has to be recognised that Hegseth has criticised NATO more than he has shown a desire to lead it," said Shea. "At a time when transatlantic security consultations at high level are more needed than ever, this is another missed opportunity for the U.S. to show leadership and initiative in the alliance."

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

Log In

Sign Up