Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

U.S. Average Hourly Wage MoM (SA) (Dec)

U.S. Average Hourly Wage MoM (SA) (Dec)A:--

F: --

U.S. Average Weekly Working Hours (SA) (Dec)

U.S. Average Weekly Working Hours (SA) (Dec)A:--

F: --

P: --

U.S. New Housing Starts Annualized MoM (SA) (Oct)

U.S. New Housing Starts Annualized MoM (SA) (Oct)A:--

F: --

U.S. Total Building Permits (SA) (Oct)

U.S. Total Building Permits (SA) (Oct)A:--

F: --

P: --

U.S. Building Permits MoM (SA) (Oct)

U.S. Building Permits MoM (SA) (Oct)A:--

F: --

P: --

U.S. Annual New Housing Starts (SA) (Oct)

U.S. Annual New Housing Starts (SA) (Oct)A:--

F: --

U.S. U6 Unemployment Rate (SA) (Dec)

U.S. U6 Unemployment Rate (SA) (Dec)A:--

F: --

P: --

U.S. Manufacturing Employment (SA) (Dec)

U.S. Manufacturing Employment (SA) (Dec)A:--

F: --

U.S. Labor Force Participation Rate (SA) (Dec)

U.S. Labor Force Participation Rate (SA) (Dec)A:--

F: --

P: --

U.S. Private Nonfarm Payrolls (SA) (Dec)

U.S. Private Nonfarm Payrolls (SA) (Dec)A:--

F: --

U.S. Unemployment Rate (SA) (Dec)

U.S. Unemployment Rate (SA) (Dec)A:--

F: --

U.S. Nonfarm Payrolls (SA) (Dec)

U.S. Nonfarm Payrolls (SA) (Dec)A:--

F: --

U.S. Average Hourly Wage YoY (Dec)

U.S. Average Hourly Wage YoY (Dec)A:--

F: --

Canada Full-time Employment (SA) (Dec)

Canada Full-time Employment (SA) (Dec)A:--

F: --

P: --

Canada Part-Time Employment (SA) (Dec)

Canada Part-Time Employment (SA) (Dec)A:--

F: --

P: --

Canada Unemployment Rate (SA) (Dec)

Canada Unemployment Rate (SA) (Dec)A:--

F: --

P: --

Canada Labor Force Participation Rate (SA) (Dec)

Canada Labor Force Participation Rate (SA) (Dec)A:--

F: --

P: --

U.S. Government Employment (Dec)

U.S. Government Employment (Dec)A:--

F: --

P: --

U.S. UMich Consumer Expectations Index Prelim (Jan)

U.S. UMich Consumer Expectations Index Prelim (Jan)A:--

F: --

P: --

U.S. UMich Consumer Sentiment Index Prelim (Jan)

U.S. UMich Consumer Sentiment Index Prelim (Jan)A:--

F: --

P: --

U.S. UMich Current Economic Conditions Index Prelim (Jan)

U.S. UMich Current Economic Conditions Index Prelim (Jan)A:--

F: --

P: --

U.S. UMich 1-Year-Ahead Inflation Expectations Prelim (Jan)

U.S. UMich 1-Year-Ahead Inflation Expectations Prelim (Jan)A:--

F: --

P: --

U.S. UMich 5-Year-Ahead Inflation Expectations Prelim YoY (Jan)

U.S. UMich 5-Year-Ahead Inflation Expectations Prelim YoY (Jan)A:--

F: --

P: --

U.S. 5-10 Year-Ahead Inflation Expectations (Jan)

U.S. 5-10 Year-Ahead Inflation Expectations (Jan)A:--

F: --

P: --

U.S. Weekly Total Oil Rig Count

U.S. Weekly Total Oil Rig CountA:--

F: --

P: --

U.S. Weekly Total Rig Count

U.S. Weekly Total Rig CountA:--

F: --

P: --

China, Mainland M0 Money Supply YoY (Dec)

China, Mainland M0 Money Supply YoY (Dec)--

F: --

P: --

China, Mainland M1 Money Supply YoY (Dec)

China, Mainland M1 Money Supply YoY (Dec)--

F: --

P: --

China, Mainland M2 Money Supply YoY (Dec)

China, Mainland M2 Money Supply YoY (Dec)--

F: --

P: --

Indonesia Retail Sales YoY (Nov)

Indonesia Retail Sales YoY (Nov)A:--

F: --

P: --

Euro Zone Sentix Investor Confidence Index (Jan)

Euro Zone Sentix Investor Confidence Index (Jan)--

F: --

P: --

India CPI YoY (Dec)

India CPI YoY (Dec)--

F: --

P: --

Germany Current Account (Not SA) (Nov)

Germany Current Account (Not SA) (Nov)--

F: --

P: --

Canada National Economic Confidence Index

Canada National Economic Confidence Index--

F: --

P: --

U.S. Conference Board Employment Trends Index (SA) (Dec)

U.S. Conference Board Employment Trends Index (SA) (Dec)--

F: --

P: --

Russia CPI YoY (Dec)

Russia CPI YoY (Dec)--

F: --

P: --

Richmond Federal Reserve President Barkin delivered a speech.

Richmond Federal Reserve President Barkin delivered a speech. U.S. 3-Year Note Auction Yield

U.S. 3-Year Note Auction Yield--

F: --

P: --

U.S. 10-Year Note Auction Avg. Yield

U.S. 10-Year Note Auction Avg. Yield--

F: --

P: --

New York Federal Reserve President Williams delivered a speech.

New York Federal Reserve President Williams delivered a speech. Japan Trade Balance (Customs Data) (SA) (Nov)

Japan Trade Balance (Customs Data) (SA) (Nov)--

F: --

P: --

Japan Trade Balance (Nov)

Japan Trade Balance (Nov)--

F: --

P: --

U.K. BRC Overall Retail Sales YoY (Dec)

U.K. BRC Overall Retail Sales YoY (Dec)--

F: --

P: --

U.K. BRC Like-For-Like Retail Sales YoY (Dec)

U.K. BRC Like-For-Like Retail Sales YoY (Dec)--

F: --

P: --

Turkey Retail Sales YoY (Nov)

Turkey Retail Sales YoY (Nov)--

F: --

P: --

U.S. NFIB Small Business Optimism Index (SA) (Dec)

U.S. NFIB Small Business Optimism Index (SA) (Dec)--

F: --

P: --

Brazil Services Growth YoY (Nov)

Brazil Services Growth YoY (Nov)--

F: --

P: --

Canada Building Permits MoM (SA) (Nov)

Canada Building Permits MoM (SA) (Nov)--

F: --

P: --

U.S. CPI MoM (SA) (Dec)

U.S. CPI MoM (SA) (Dec)--

F: --

P: --

U.S. CPI YoY (Not SA) (Dec)

U.S. CPI YoY (Not SA) (Dec)--

F: --

P: --

U.S. Real Income MoM (SA) (Dec)

U.S. Real Income MoM (SA) (Dec)--

F: --

P: --

U.S. CPI MoM (Not SA) (Dec)

U.S. CPI MoM (Not SA) (Dec)--

F: --

P: --

U.S. Core CPI (SA) (Dec)

U.S. Core CPI (SA) (Dec)--

F: --

P: --

U.S. Core CPI YoY (Not SA) (Dec)

U.S. Core CPI YoY (Not SA) (Dec)--

F: --

P: --

U.S. Core CPI MoM (SA) (Dec)

U.S. Core CPI MoM (SA) (Dec)--

F: --

P: --

U.S. Weekly Redbook Index YoY

U.S. Weekly Redbook Index YoY--

F: --

P: --

U.S. New Home Sales Annualized MoM (Oct)

U.S. New Home Sales Annualized MoM (Oct)--

F: --

P: --

U.S. Annual Total New Home Sales (Oct)

U.S. Annual Total New Home Sales (Oct)--

F: --

P: --

U.S. Cleveland Fed CPI MoM (SA) (Dec)

U.S. Cleveland Fed CPI MoM (SA) (Dec)--

F: --

P: --

China, Mainland Trade Balance (CNH) (Dec)

China, Mainland Trade Balance (CNH) (Dec)--

F: --

P: --

China, Mainland Imports YoY (USD) (Dec)

China, Mainland Imports YoY (USD) (Dec)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

Trump's controversial push to acquire Greenland, citing strategic necessity despite NATO concerns, faces strong European rejection.

Former U.S. President Donald Trump has declared his intention for the United States to acquire Greenland, dismissing concerns that such a move could disrupt the NATO alliance.

Speaking to reporters aboard Air Force One on Sunday, Trump framed the potential acquisition as a strategic necessity to block geopolitical rivals. "If we don't take Greenland, Russia or China will. And I'm not letting that happen," he stated, adding, "one way or another, we're going to have Greenland."

Trump also suggested that Greenland should be the one to propose a deal to Washington for a takeover.

When questioned about potential opposition from NATO allies, Trump was dismissive, asserting the alliance's dependence on the United States. He claimed the treaty would not exist without his presidency.

"If it affects NATO, then it affects NATO," Trump said. "But, you know, they need us much more than we need them. I will tell you that right now."

In recent weeks, Trump had intensified his calls for a U.S. takeover, arguing that possessing the island was crucial for strengthening American security against both Russia and China.

Concerns over U.S. intentions have reportedly grown, particularly after a U.S. incursion into Venezuela that led to the capture of President Nicolas Maduro.

The United States already maintains a military footprint in Greenland, but Trump has advocated for expanding this presence. The island, a self-governing territory within the Kingdom of Denmark, is home to nearly 60,000 people.

Reports last week indicated that Trump and White House officials were exploring several methods to gain control of the island, including:

• Potential military action.

• Lump-sum payments to Greenland's residents to persuade them to secede from Denmark.

Leaders in Denmark and across Europe have widely rejected Trump's demands.

South Korea's central bank is widely anticipated to hold its key interest rate steady this week as it balances pressures from a weakening currency and an unsettled real estate market.

An overwhelming consensus among economists points to the Bank of Korea (BOK) leaving its benchmark rate unchanged at 2.5% during its policy meeting on Thursday. A survey by Yonhap Infomax found that all 25 analysts polled expect a rate hold. A separate poll by Yonhap News Agency of six additional experts revealed the same unanimous expectation.

If confirmed, this would mark the fourth consecutive meeting where the BOK's Monetary Policy Board has kept the rate steady, despite having initiated an easing cycle in October 2024.

Analysts argue that the current economic environment is not conducive to rate cuts, citing persistent threats to financial stability.

"Factors undermining financial stability persist, including the weak won and overheated sentiment in the property market," noted Yoon Yeo-sam, an analyst at Meritz Securities.

The key considerations for policymakers include:

• Economic Growth: The economy is projected to expand above the 2% range this year.

• Inflation: Price growth is running at a manageable low-to-mid 2% range.

• Currency Weakness: The Korean won continues to hover near the critical 1,450 per dollar mark.

Yoon added that these conditions make the environment "unfavorable for rate cuts."

The depreciation of the won remains a primary focus for authorities. Despite various measures to support the currency, it has struggled to gain ground against the dollar.

On Monday, the won opened at 1,461.3 per dollar, representing a decline of 3.7 won from the previous session and underscoring the ongoing pressure that complicates the BOK's monetary policy decisions.

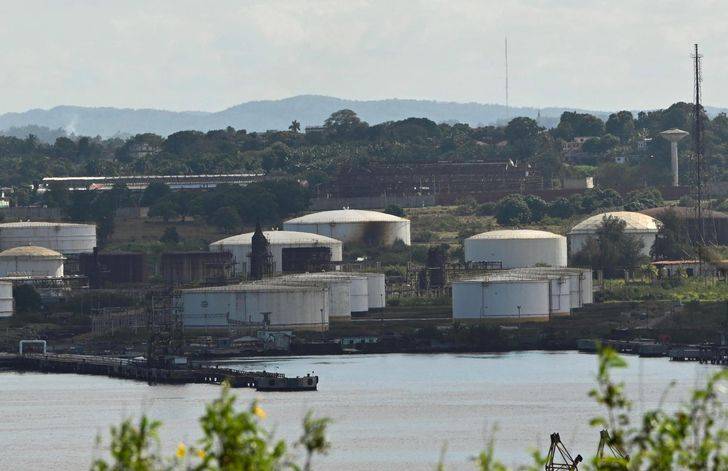

Former President Donald Trump issued a stern warning to Cuba's government on Sunday, signaling a major policy shift following the ousting of Venezuelan leader Nicolás Maduro. The move effectively cuts off Cuba, a long-time beneficiary of Venezuelan oil, from its primary energy supply.

U.S. forces have reportedly seized oil tankers to control the production and distribution of Venezuela's oil products, directly impacting the island nation.

In a social media post from his home in southern Florida, Trump declared that Cuba's era of benefiting from Venezuelan resources was over. He stated that Cuba had long provided security to Venezuela in exchange for oil and money, "BUT NOT ANYMORE!"

"THERE WILL BE NO MORE OIL OR MONEY GOING TO CUBA - ZERO!" Trump wrote. He urged the Cuban government to negotiate, adding, "I strongly suggest they make a deal, BEFORE IT IS TOO LATE," though he did not specify the terms of such a deal.

Cuban President Miguel Díaz-Canel quickly responded on the social media platform X, asserting that those who "turn everything into a business, even human lives, have no moral authority to point the finger at Cuba in any way."

Díaz-Canel defended his country's political model as a "sovereign decision" and criticized those who blame the "Revolution" for the island's severe economic shortages. He railed against the "draconian measures" imposed by the United States, which the Cuban government claims cost the country over $7.5 billion between March 2024 and February 2025.

The Cuban government also reported that 32 of its military personnel were killed during the American operation that captured Maduro. These personnel, from Cuba's two main security agencies, were stationed in Caracas under a bilateral agreement.

Trump framed the new dynamic as a form of liberation for Venezuela. "Venezuela doesn't need protection anymore from the thugs and extortionists who held them hostage for so many years," he said. "Venezuela now has the United States of America, the most powerful military in the World (by far!), to protect them, and protect them we will."

The Trump administration has consistently adopted an aggressive stance toward Cuba, which relied heavily on Venezuela for economic stability. Long before Maduro's capture, Cuba was already grappling with its worst economic crisis in decades, marked by severe blackouts and long lines at gas stations and supermarkets.

Trump has previously predicted that the Cuban economy, already strained by a long-standing American embargo, would collapse without Venezuelan support. "It's going down," he said of Cuba. "It's going down for the count."

In a separate social media interaction, Trump responded positively to a suggestion that his secretary of state, Marco Rubio, will become president of Cuba, saying, "Sounds good to me!"

The Federal Reserve appears ready to put its interest rate cuts on hold, with markets pricing in a near-zero chance of a reduction at the January 2026 FOMC meeting. Data from CME suggests only a 5% probability of a cut, signaling a significant shift in expectations after a series of monetary policy adjustments in 2025.

This potential pause comes after the Fed implemented three rate cuts during 2025. With unemployment data holding steady at 4.4%, policymakers seem to have enough room to step back and assess the economic landscape before committing to further easing.

Analysis from Guotai Haitong highlights that after the rate reductions in 2025, the central bank has the flexibility to pause. The December 2025 FOMC minutes hinted at this possibility, leading to a recalibration across financial markets.

A robust job market is a key factor supporting this decision. As Federal Reserve Chair Jerome Powell has stated, the central bank’s long-term goal is "to achieve maximum employment and inflation at the rate of 2 percent." Stable employment figures give the Fed less urgent cause to continue cutting rates. In response, treasury yields have risen as investors digest the reduced likelihood of immediate cuts.

Investor expectations have decisively shifted. The market consensus now points to rate cuts beginning in June 2026, a significant delay from previous forecasts. Projections have been revised to anticipate just two rate cuts for the entire year.

This new timeline reflects a broader reassessment of the Fed's trajectory, influenced by a combination of resilient economic data and the central bank's actions in late 2025.

The revised rate cut schedule has direct implications for global liquidity and the cryptocurrency market. A pause in cuts means that high-yield conditions will persist, which has historically created challenges for risk assets like Bitcoin (BTC) and Ethereum (ETH).

The expected timing of two cuts in 2026 will also influence the performance of DeFi protocols and modern Layer 1 platforms, which are highly sensitive to broader monetary conditions.

Adding another layer of complexity is the upcoming end of Chair Jerome Powell's term in May 2026. This leadership transition introduces uncertainty into the future direction of U.S. monetary policy, making long-term market forecasts even more challenging.

In a major policy shift, President Donald Trump has withdrawn the United States from the United Nations Framework Convention on Climate Change (UNFCCC) and 65 other international bodies focused on climate and social justice. The move mirrors a growing trend in the private sector, where major corporations have recently backed away from similar global environmental, social, and governance (ESG) alliances.

According to a White House statement, a January 7 executive order instructs all U.S. executive departments and agencies to halt participation and funding for 35 non-UN organizations and 31 UN entities. The administration stated these groups operate contrary to American national interests, security, and economic prosperity.

Following the order, the U.S. Treasury Department announced on January 8 that it would cease funding the Global Climate Fund, a key financial vehicle for UN climate initiatives. The United States had been a party to the UNFCCC since the Senate ratified the treaty in 1992, joining over 190 nations. Subsequent international accords, like the 1997 Kyoto Protocol and the 2015 Paris Agreement, were not ratified by the U.S. Senate.

The Trump administration's decision follows a significant unwinding of corporate "net-zero" alliances that once aligned the private sector with global climate goals. At their peak, these groups formed a powerful network under the U.N.-backed Glasgow Financial Alliance for Net Zero, a coalition managing trillions of dollars.

This network included influential subgroups like the Net Zero Banking Alliance, the Net Zero Insurance Alliance, and the Net Zero Asset Managers initiative. Their strategy focused on leveraging financial institutions, which act as both financiers and dominant shareholders, to influence corporate behavior across the economy.

Members included the world's largest asset managers—BlackRock, Vanguard, and State Street. Together, these three firms are the largest shareholders in over 40% of all publicly traded U.S. companies and 88% of the S&P 500, according to a study by George Mason University professors Sebahattin Demirkan and Ted Polat.

However, these alliances began to crumble under political and legal pressure. A backlash from conservative U.S. states led to boycotts and antitrust investigations, with lawmakers accusing financial firms of colluding against fossil fuel companies and violating their fiduciary duties.

Key departures included:

• Vanguard: Left the Net Zero Asset Managers initiative in 2022.

• BlackRock: Exited in January 2025, after which the group suspended its activities.

• Net Zero Insurance Alliance: Lost nearly half its members in 2023 amid antitrust concerns.

Supporters of the administration's move praised it as a crucial step to reclaim U.S. sovereignty and promote economic growth, particularly in the oil and gas sectors. Critics of the ESG movement argue that net-zero policies have driven up energy costs and lowered living standards without effectively controlling global temperatures.

Myron Ebell, a former advisor to the Trump Environmental Protection Agency transition team, stated the decision removes the U.S. from "a long list of harmful foreign entanglements," calling the UNFCCC the "international climate racket."

Sterling H. Burnett of The Heartland Institute described the order as "the biggest single step taken by any administration in my lifetime to advance U.S. sovereignty." He argued that many of these international agreements enrich political elites and unaccountable bureaucrats while failing to benefit ordinary people.

Advocates for net-zero policies condemned the decision, warning of severe consequences for American leadership and economic competitiveness.

"By choosing to run away from addressing some of the biggest environmental, economic, health, and security threats on the planet, the United States of America stands to lose a lot," said Yamide Dagnet of the Natural Resources Defense Council. She predicted the U.S. would miss out on job creation and innovation, "ceding scientific and technological leadership to other countries."

Similarly, the House of Representatives Sustainable Energy and Environment Coalition issued a statement claiming the order "sent a dangerous signal to the global community that America is withdrawing from its role as a world leader, leaving America weaker, poorer, and more unsafe than ever before."

The withdrawal of the United States, the world's largest economy and oil and gas producer, carries significant financial weight. Prior to Trump's 2024 reelection, the U.S. was responsible for 22% of the UNFCCC's €75 million ($87.2 million) budget. After Trump first halted these payments upon taking office in 2025, China increased its contribution from 15% to 20%, while Bloomberg Philanthropies stepped in to cover the remaining U.S. shortfall. The UNFCCC's budget was slated to increase to €81.6 million ($94.9 million) for 2026.

Australian household spending accelerated unexpectedly in November, signaling robust consumer confidence that could complicate the Reserve Bank of Australia's battle against inflation.

According to data released by the Australian Bureau of Statistics, consumer spending rose 1% from the previous month, easily surpassing economists' forecasts of a 0.6% increase. On an annual basis, spending was up 6.3%, also beating expectations.

This data is critical for monetary policy, as private consumption drives more than half of Australia's gross domestic product. The RBA has consistently identified consumer spending as a key area of uncertainty in its policy decisions.

The November strength wasn't just a fluke. "Household spending remained strong in November, continuing the strong rises in services and goods spending seen in October," noted Tom Lay, head of business statistics at the ABS.

Lay highlighted that spending on services climbed 1.2%, largely fueled by major events like concerts and sporting fixtures. This activity created a ripple effect, boosting spending in related areas such as catering, transport, and recreational activities.

The strong spending figures add to a growing debate over the RBA's future actions. In December, Governor Michele Bullock effectively ruled out rate cuts and suggested a hike could be the next move.

This has split market analysts:

• Commonwealth Bank of Australia and National Australia Bank are forecasting at least one more rate increase this year.

• Bank of America anticipates the RBA will remain on hold.

• Money markets are currently pricing in a high probability of a rate hike in May.

Expectations for tighter policy gained traction after third-quarter inflation data revealed broad-based price pressures across the economy. Subsequent monthly inflation reports have consistently shown figures above the RBA's 2-3% target range.

Last week, RBA Deputy Governor Andrew Hauser described inflation as "too high" and suggested the rate-cutting cycle that began last February is likely over. Despite this, he indicated the central bank is taking a "patient approach" to taming inflation ahead of its first meeting of the year on February 2-3.

The RBA has previously cut its policy rate by 75 basis points to 3.6%, the lowest level since April 2023.

Before the RBA board convenes in February, it will closely analyze two pivotal data releases.

First, the December employment figures will test the central bank's assessment of a tight labor market. Second, the fourth-quarter inflation report, due in late January, will be crucial in shaping interest rate expectations for the months ahead.

Federal Reserve Chair Jerome Powell is the subject of an investigation by U.S. prosecutors regarding the renovation of the central bank's Washington headquarters, according to a report from The New York Times.

Citing officials briefed on the matter, the report states that the U.S. attorney's office in the District of Columbia has opened the probe.

The investigation centers on whether Powell misled Congress about the full scope and cost of the renovation project. To determine this, prosecutors are reportedly analyzing Powell's public statements alongside the Federal Reserve's spending records.

This legal inquiry is widely viewed as a new form of pressure on Powell from the Donald Trump administration. The president has repeatedly attacked the Fed Chair for resisting demands for sharp interest rate cuts.

Previously, Trump had also raised the possibility of fraud connected to the Fed's headquarters renovation, an allegation that Powell denied.

The conflict over monetary policy saw the Fed cut interest rates by a cumulative 75 basis points in 2025, a significantly smaller reduction than Trump had called for. At the time, Powell cited caution over inflation and the economic impact of the administration's policies as reasons for the more measured cuts.

With Powell's term expiring in May, the Trump administration is expected to move quickly to announce his replacement. Last week, Trump told The New York Times he had already selected the next Fed Chair and would announce his decision soon.

The frontrunners for the position are believed to be White House economic advisor Kevin Hassett and former Fed governor Kevin Warsh. Both candidates are seen as supportive of President Trump's calls for lower interest rates.

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up