Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

U.S. NY Fed Manufacturing Prices Received Index (Jan)

U.S. NY Fed Manufacturing Prices Received Index (Jan)A:--

F: --

P: --

U.S. NY Fed Manufacturing New Orders Index (Jan)

U.S. NY Fed Manufacturing New Orders Index (Jan)A:--

F: --

P: --

U.S. NY Fed Manufacturing Employment Index (Jan)

U.S. NY Fed Manufacturing Employment Index (Jan)A:--

F: --

P: --

U.S. Export Price Index YoY (Nov)

U.S. Export Price Index YoY (Nov)A:--

F: --

P: --

U.S. NY Fed Manufacturing Index (Jan)

U.S. NY Fed Manufacturing Index (Jan)A:--

F: --

U.S. Initial Jobless Claims 4-Week Avg. (SA)

U.S. Initial Jobless Claims 4-Week Avg. (SA)A:--

F: --

U.S. Export Price Index MoM (Nov)

U.S. Export Price Index MoM (Nov)A:--

F: --

P: --

Canada Manufacturing Unfilled Orders MoM (Nov)

Canada Manufacturing Unfilled Orders MoM (Nov)A:--

F: --

P: --

Canada Manufacturing New Orders MoM (Nov)

Canada Manufacturing New Orders MoM (Nov)A:--

F: --

P: --

U.S. Philadelphia Fed Manufacturing Employment Index (Jan)

U.S. Philadelphia Fed Manufacturing Employment Index (Jan)A:--

F: --

P: --

Canada Wholesale Sales YoY (Nov)

Canada Wholesale Sales YoY (Nov)A:--

F: --

P: --

Canada Wholesale Inventory MoM (Nov)

Canada Wholesale Inventory MoM (Nov)A:--

F: --

P: --

U.S. Philadelphia Fed Business Activity Index (SA) (Jan)

U.S. Philadelphia Fed Business Activity Index (SA) (Jan)A:--

F: --

P: --

U.S. EIA Weekly Natural Gas Stocks Change

U.S. EIA Weekly Natural Gas Stocks ChangeA:--

F: --

P: --

Richmond Federal Reserve President Barkin delivered a speech.

Richmond Federal Reserve President Barkin delivered a speech. U.S. Weekly Treasuries Held by Foreign Central Banks

U.S. Weekly Treasuries Held by Foreign Central BanksA:--

F: --

P: --

Germany CPI Final MoM (Dec)

Germany CPI Final MoM (Dec)A:--

F: --

P: --

Germany CPI Final YoY (Dec)

Germany CPI Final YoY (Dec)A:--

F: --

P: --

Germany HICP Final MoM (Dec)

Germany HICP Final MoM (Dec)A:--

F: --

P: --

Germany HICP Final YoY (Dec)

Germany HICP Final YoY (Dec)A:--

F: --

P: --

Brazil PPI MoM (Nov)

Brazil PPI MoM (Nov)A:--

F: --

P: --

Canada New Housing Starts (Dec)

Canada New Housing Starts (Dec)A:--

F: --

U.S. Capacity Utilization MoM (SA) (Dec)

U.S. Capacity Utilization MoM (SA) (Dec)A:--

F: --

U.S. Industrial Output YoY (Dec)

U.S. Industrial Output YoY (Dec)A:--

F: --

P: --

U.S. Manufacturing Capacity Utilization (Dec)

U.S. Manufacturing Capacity Utilization (Dec)A:--

F: --

P: --

U.S. Manufacturing Output MoM (SA) (Dec)

U.S. Manufacturing Output MoM (SA) (Dec)A:--

F: --

U.S. Industrial Output MoM (SA) (Dec)

U.S. Industrial Output MoM (SA) (Dec)A:--

F: --

U.S. NAHB Housing Market Index (Jan)

U.S. NAHB Housing Market Index (Jan)A:--

F: --

P: --

Russia CPI YoY (Dec)

Russia CPI YoY (Dec)A:--

F: --

P: --

U.S. Weekly Total Rig Count

U.S. Weekly Total Rig CountA:--

F: --

P: --

U.S. Weekly Total Oil Rig Count

U.S. Weekly Total Oil Rig CountA:--

F: --

P: --

Japan Core Machinery Orders YoY (Nov)

Japan Core Machinery Orders YoY (Nov)--

F: --

P: --

Japan Core Machinery Orders MoM (Nov)

Japan Core Machinery Orders MoM (Nov)--

F: --

P: --

U.K. Rightmove House Price Index YoY (Jan)

U.K. Rightmove House Price Index YoY (Jan)--

F: --

P: --

China, Mainland GDP YoY (YTD) (Q4)

China, Mainland GDP YoY (YTD) (Q4)--

F: --

P: --

China, Mainland Industrial Output YoY (YTD) (Dec)

China, Mainland Industrial Output YoY (YTD) (Dec)--

F: --

P: --

Japan Industrial Output Final MoM (Nov)

Japan Industrial Output Final MoM (Nov)--

F: --

P: --

Japan Industrial Output Final YoY (Nov)

Japan Industrial Output Final YoY (Nov)--

F: --

P: --

Euro Zone Core HICP Final MoM (Dec)

Euro Zone Core HICP Final MoM (Dec)--

F: --

P: --

Euro Zone HICP Final MoM (Dec)

Euro Zone HICP Final MoM (Dec)--

F: --

P: --

Euro Zone HICP Final YoY (Dec)

Euro Zone HICP Final YoY (Dec)--

F: --

P: --

Euro Zone HICP MoM (Excl. Food & Energy) (Dec)

Euro Zone HICP MoM (Excl. Food & Energy) (Dec)--

F: --

P: --

Euro Zone Core CPI Final YoY (Dec)

Euro Zone Core CPI Final YoY (Dec)--

F: --

P: --

Euro Zone Core HICP Final YoY (Dec)

Euro Zone Core HICP Final YoY (Dec)--

F: --

P: --

Euro Zone CPI YoY (Excl. Tobacco) (Dec)

Euro Zone CPI YoY (Excl. Tobacco) (Dec)--

F: --

P: --

Euro Zone Core CPI Final MoM (Dec)

Euro Zone Core CPI Final MoM (Dec)--

F: --

P: --

Canada National Economic Confidence Index

Canada National Economic Confidence Index--

F: --

P: --

Canada CPI MoM (SA) (Dec)

Canada CPI MoM (SA) (Dec)--

F: --

P: --

Canada Core CPI MoM (SA) (Dec)

Canada Core CPI MoM (SA) (Dec)--

F: --

P: --

Canada CPI YoY (SA) (Dec)

Canada CPI YoY (SA) (Dec)--

F: --

P: --

Canada Trimmed CPI YoY (SA) (Dec)

Canada Trimmed CPI YoY (SA) (Dec)--

F: --

P: --

Canada CPI YoY (Dec)

Canada CPI YoY (Dec)--

F: --

P: --

Canada CPI MoM (Dec)

Canada CPI MoM (Dec)--

F: --

P: --

Canada Core CPI YoY (Dec)

Canada Core CPI YoY (Dec)--

F: --

P: --

Canada Core CPI MoM (Dec)

Canada Core CPI MoM (Dec)--

F: --

P: --

South Korea PPI MoM (Dec)

South Korea PPI MoM (Dec)--

F: --

P: --

China, Mainland 1-Year Loan Prime Rate (LPR)

China, Mainland 1-Year Loan Prime Rate (LPR)--

F: --

P: --

China, Mainland 5-Year Loan Prime Rate

China, Mainland 5-Year Loan Prime Rate--

F: --

P: --

Germany PPI YoY (Dec)

Germany PPI YoY (Dec)--

F: --

P: --

Germany PPI MoM (Dec)

Germany PPI MoM (Dec)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

President Donald Trump said Friday he may impose tariffs on countries "if they don't go along with Greenland."

President Donald Trump said Friday he may impose tariffs on countries "if they don't go along with Greenland."

"We need Greenland for national security. So I may do that," Trump said at the White House.

The comments show Trump considering applying tariffs, one of his favorite tools for leveraging his executive power over foreign countries, to his increasingly aggressive efforts to acquire Greenland for the United States.

The White House did not immediately respond to CNBC's request for additional information on Trump's remarks.

President Donald Trump is urging Republican lawmakers to fast-track a new White House healthcare plan, aiming to reshape a debate that puts his party at risk with millions of Americans facing higher insurance costs and potential coverage loss.

"I think we can make healthcare into a Republican issue because the Republicans are going to be close to unanimous on this," Trump declared during a White House roundtable on rural healthcare.

The president’s push highlights a growing urgency to address household economic concerns, particularly healthcare access and affordability, which have fueled public skepticism about his administration's economic agenda. Trump renewed his attacks on the Affordable Care Act (ACA), also known as Obamacare, arguing his replacement plan would lower consumer costs instead of enriching insurance companies.

"Obama didn't care about the rural community, to be totally blunt," Trump said. "What he did care about is insurance companies. And this was a bill to make insurance companies wealthy. And they did."

Despite the president's call for unity, securing widespread Republican support remains a significant challenge. The party has long been fractured over the best strategy to dismantle a law that millions of Americans depend on for their health coverage.

This internal division was on full display during the roundtable. Trump directly pressed Republican Senator Dan Sullivan of Alaska on whether his colleague, Senator Lisa Murkowski, would support the new reforms. Murkowski has previously opposed efforts to repeal the ACA.

"Will you get Lisa Murkowski to vote for it?" Trump asked.

"We'll work on it, sir," Sullivan replied.

The White House faces an immediate healthcare challenge as premiums are expected to rise for over 20 million Americans. With the ACA's open enrollment period having just ended, early data shows that sign-ups have dropped by more than a million people.

Experts warn this decline could worsen as consumers begin to pay premiums that are projected to double on average. The spike is a direct result of subsidies that lapsed at the beginning of the year after lawmakers failed to extend the tax credits.

That legislative stalemate was partially influenced by Trump himself, who had vowed to reject any bill that renewed subsidies for the ACA. Democrats have capitalized on the looming premium hikes in their messaging ahead of the November elections. The issue is especially potent because the tax credits largely benefited consumers in Republican-led states, adding pressure on GOP lawmakers fighting to maintain their majority.

In response, Trump has unveiled a proposal he calls the "Great Healthcare Plan," urging Congress to pass it without delay. While the White House describes the plan as "comprehensive," it lacks many of the details lawmakers will need to evaluate it.

The framework includes several key pillars:

• Lowering Drug Prices: It would codify voluntary agreements the president has made with pharmaceutical companies to reduce the cost of some drugs and increase the availability of over-the-counter medicines.

• Targeting Middlemen: The plan vows to "end the kickbacks" paid to large brokerage middlemen that it claims deceptively increase health insurance costs.

• Direct Subsidies: It proposes sending billions in subsidies directly to consumers to purchase health insurance, rather than to the insurance companies. Health experts note this proposal could be difficult to implement and does not guarantee better health outcomes.

The administration's renewed focus on healthcare is also fueled by the consequences of its signature tax-and-spending package from the previous year. That legislation included cuts to Medicaid, the public insurance program for low-income and disabled individuals.

Those reductions are projected to cause 11.8 million people in the U.S. to lose their health insurance over the next 10 years. To help soften the impact, the administration announced in December that it would award funds to states from a rural health fund.

Russia and China are negotiating the resumption of electricity exports after Beijing reportedly halted all imports on January 1, 2026. The impasse stems from a price dispute, with Russian export costs rising above China's domestic power rates.

According to a report from Russian business daily Kommersant, China stopped purchasing electricity from Russia at the start of the year. The reason, sources told the paper, is that Russian export prices topped domestic power prices in China for the first time.

This price inversion made the imports uneconomical for Beijing. The report suggests that electricity exports are unlikely to resume in 2026 unless the pricing structure changes.

Russia's Energy Ministry confirmed to Reuters that it is ready to restart supply if requested by Beijing and if "mutually beneficial" terms can be reached. However, the ministry stressed that its immediate priority is meeting the growing electricity demand in Russia's Far East regions.

Despite the halt, the underlying supply contract between the two nations, which is valid until 2037, has not been terminated. InterRAO, the Russian supplier, stated that neither side is seeking to end the deal. "At present, the parties are actively exploring opportunities for electricity trade," the company said.

This is not the first time the two partners have clashed over energy pricing. A prominent example is the planned Power of Siberia 2 gas pipeline, a massive project intended to ship Russian gas to China via Mongolia.

A final agreement on the pipeline has been held up by several sticking points, chief among them the price at which Russia's Gazprom would sell the gas. These instances highlight pricing as a recurring point of friction in the broader Russia-China energy relationship.

Bitcoin has experienced a sharp dip, slipping below the $95,000 mark and hovering precariously around $94,000 — a level considered crucial for its short-term future. The recent descent in Bitcoin's price is partly attributed to remarks by former President Donald Trump on the Federal Reserve's future, stirring anxiety in the crypto markets.

The Federal Reserve is anticipated to announce its new Chair soon, a selection that Trump has alluded to. With two main contenders in sight, Trump's recent meeting with Kevin Warsh seems to have tipped the scales. However, Jared Hassett's once strong candidacy appears to be waning after Trump's latest remarks.

In his statement, Trump hinted at the possibility of assigning Hassett elsewhere, indicating,

"Hassett was good on TV, and I may want to keep him as the NEC Director. We will see how the review process for Hassett's potential appointment as the Fed Chair unfolds. Fed officials do not speak much. Hassett is good at speaking."

The current political dynamics and looming policy shifts are poised to render the cryptocurrency landscape more volatile. The influence of political leaders, like Trump, underscores the persistent vulnerability of digital assets to external policy maneuvers.

As Bitcoin wavers, altcoins face heightened risk due to their tendency to shadow Bitcoin's movements. A further descent in Bitcoin could precipitate significant losses across various altcoins, necessitating prudent behavior from those involved in crypto trading.

In light of these challenges, market participants are urged to be vigilant and stay informed. High-impact decisions from figures like Trump can incite swift and substantial market shifts.

Key takeaways include:

Navigating these uncertain terrains demands a thorough understanding and strategic foresight. Crypto enthusiasts must brace for fluctuations while keeping a keen eye on policy-related developments that could redefine market landscapes.

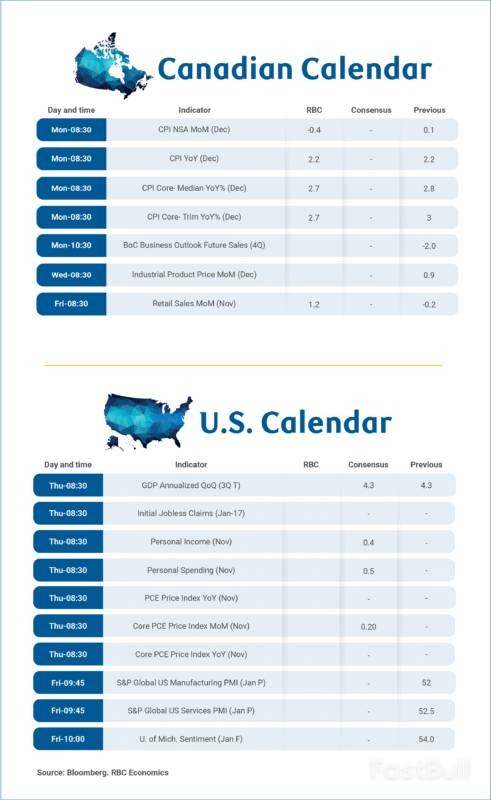

A critical week of Canadian economic data is ahead, featuring the final monthly inflation report for 2025 and the Bank of Canada's (BoC) Q4 Business Outlook Survey on Monday, followed by November's retail sales figures on Friday. These releases will offer crucial insights into the country's economic trajectory heading into the new year.

Headline inflation for December is expected to remain largely unchanged, holding steady at the 2.2% year-over-year rate seen in November. Core price growth trends are also anticipated to show little movement, leaving inflation running moderately above the Bank of Canada's 2% target.

Conflicting Price Pressures

Two key components are pulling the headline number in opposite directions:

• Energy Prices: A significant 8% drop in gasoline prices during December should drag overall energy costs further below last year's levels.

• Food Prices: Food inflation has remained high throughout 2025 after a brief easing in late 2024. Price growth is forecast to climb above 5% in December. This is partly due to base effects from a temporary GST/HST tax holiday on restaurant meals a year prior, but high grocery price inflation, which stood at 4.7% in November, continues to be a major driver.

Core Inflation Remains a Concern

When volatile food and energy products are excluded, inflation is projected to edge down to 2.3% from 2.4% in November. While this would be the second consecutive month of improvement, it's not enough to bring inflation back to the central bank's comfort zone.

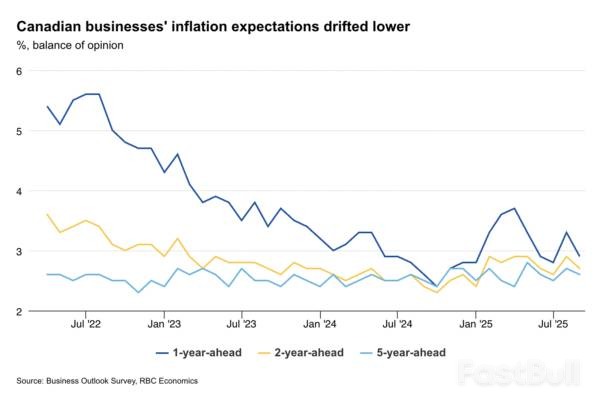

The BoC's preferred measures—the median and trim CPI—both registered 2.8% year-over-year increases in November, highlighting persistent underlying price pressures that remain well above the 2% target.

How Tax Policies Skew the Numbers

Year-over-year inflation figures continue to be distorted by government policy changes. The removal of the consumer carbon tax in most provinces last April is still suppressing annual energy price growth. Conversely, the temporary GST/HST tax break that ran from mid-December 2024 to mid-February 2025 will artificially inflate the annual price growth figure for December, though this impact may be limited by an offsetting rise in pre-tax prices a year ago.

The Q4 Business Outlook Survey, released just ahead of the BoC's next interest rate decision, is expected to paint a familiar picture. The Q3 survey pointed to an economy stabilizing at a subdued level, and the upcoming report will likely show more of the same: muted demand, cautious pricing behavior, and restrained hiring plans among Canadian firms.

Despite some weaknesses, the Bank of Canada likely remains cautiously optimistic. While heavily trade-exposed sectors have underperformed, the worst-case international trade scenarios feared earlier in the year have not materialized.

Furthermore, domestic consumer demand appears resilient. The upcoming retail sales report for November is expected to reinforce this, with Statistics Canada's advance estimate pointing to a strong 1.2% monthly increase. Data from our cardholder spending tracker also showed domestic purchases firming up through the holiday season.

Given this backdrop, the forecast is for the Bank of Canada to leave its overnight rate unchanged throughout 2026. The next policy move is more likely to be a hike, but that is not expected to occur until 2027.

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up