Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

Italy Retail Sales MoM (SA) (Oct)

Italy Retail Sales MoM (SA) (Oct)A:--

F: --

P: --

Euro Zone Employment YoY (SA) (Q3)

Euro Zone Employment YoY (SA) (Q3)A:--

F: --

P: --

Euro Zone GDP Final YoY (Q3)

Euro Zone GDP Final YoY (Q3)A:--

F: --

P: --

Euro Zone GDP Final QoQ (Q3)

Euro Zone GDP Final QoQ (Q3)A:--

F: --

P: --

Euro Zone Employment Final QoQ (SA) (Q3)

Euro Zone Employment Final QoQ (SA) (Q3)A:--

F: --

P: --

Euro Zone Employment Final (SA) (Q3)

Euro Zone Employment Final (SA) (Q3)A:--

F: --

Brazil PPI MoM (Oct)

Brazil PPI MoM (Oct)A:--

F: --

P: --

Mexico Consumer Confidence Index (Nov)

Mexico Consumer Confidence Index (Nov)A:--

F: --

P: --

Canada Unemployment Rate (SA) (Nov)

Canada Unemployment Rate (SA) (Nov)A:--

F: --

P: --

Canada Labor Force Participation Rate (SA) (Nov)

Canada Labor Force Participation Rate (SA) (Nov)A:--

F: --

P: --

Canada Employment (SA) (Nov)

Canada Employment (SA) (Nov)A:--

F: --

P: --

Canada Part-Time Employment (SA) (Nov)

Canada Part-Time Employment (SA) (Nov)A:--

F: --

P: --

Canada Full-time Employment (SA) (Nov)

Canada Full-time Employment (SA) (Nov)A:--

F: --

P: --

U.S. Personal Income MoM (Sept)

U.S. Personal Income MoM (Sept)A:--

F: --

P: --

U.S. PCE Price Index YoY (SA) (Sept)

U.S. PCE Price Index YoY (SA) (Sept)A:--

F: --

P: --

U.S. PCE Price Index MoM (Sept)

U.S. PCE Price Index MoM (Sept)A:--

F: --

P: --

U.S. Personal Outlays MoM (SA) (Sept)

U.S. Personal Outlays MoM (SA) (Sept)A:--

F: --

P: --

U.S. Core PCE Price Index MoM (Sept)

U.S. Core PCE Price Index MoM (Sept)A:--

F: --

P: --

U.S. Core PCE Price Index YoY (Sept)

U.S. Core PCE Price Index YoY (Sept)A:--

F: --

P: --

U.S. UMich 5-Year-Ahead Inflation Expectations Prelim YoY (Dec)

U.S. UMich 5-Year-Ahead Inflation Expectations Prelim YoY (Dec)A:--

F: --

P: --

U.S. Real Personal Consumption Expenditures MoM (Sept)

U.S. Real Personal Consumption Expenditures MoM (Sept)A:--

F: --

P: --

U.S. 5-10 Year-Ahead Inflation Expectations (Dec)

U.S. 5-10 Year-Ahead Inflation Expectations (Dec)A:--

F: --

P: --

U.S. UMich Current Economic Conditions Index Prelim (Dec)

U.S. UMich Current Economic Conditions Index Prelim (Dec)A:--

F: --

P: --

U.S. UMich Consumer Sentiment Index Prelim (Dec)

U.S. UMich Consumer Sentiment Index Prelim (Dec)A:--

F: --

P: --

U.S. UMich 1-Year-Ahead Inflation Expectations Prelim (Dec)

U.S. UMich 1-Year-Ahead Inflation Expectations Prelim (Dec)A:--

F: --

P: --

U.S. UMich Consumer Expectations Index Prelim (Dec)

U.S. UMich Consumer Expectations Index Prelim (Dec)A:--

F: --

P: --

U.S. Weekly Total Rig Count

U.S. Weekly Total Rig CountA:--

F: --

P: --

U.S. Weekly Total Oil Rig Count

U.S. Weekly Total Oil Rig CountA:--

F: --

P: --

U.S. Unit Labor Cost Prelim (SA) (Q3)

U.S. Unit Labor Cost Prelim (SA) (Q3)--

F: --

P: --

U.S. Consumer Credit (SA) (Oct)

U.S. Consumer Credit (SA) (Oct)A:--

F: --

P: --

RBA Rate Statement

RBA Rate Statement RBA Press Conference

RBA Press Conference EIA Monthly Short-Term Energy Outlook

EIA Monthly Short-Term Energy Outlook BOE Gov Bailey Speaks

BOE Gov Bailey Speaks ECB President Lagarde Speaks

ECB President Lagarde Speaks BOC Monetary Policy Report

BOC Monetary Policy Report U.S. Refinitiv/Ipsos Primary Consumer Sentiment Index (PCSI) (Dec)

U.S. Refinitiv/Ipsos Primary Consumer Sentiment Index (PCSI) (Dec)--

F: --

P: --

Russia CPI YoY (Nov)

Russia CPI YoY (Nov)--

F: --

P: --

U.S. Federal Funds Rate Projections-Longer Run (Q4)

U.S. Federal Funds Rate Projections-Longer Run (Q4)--

F: --

P: --

U.S. Federal Funds Rate Projections-2nd Year (Q4)

U.S. Federal Funds Rate Projections-2nd Year (Q4)--

F: --

P: --

U.S. Budget Balance (Nov)

U.S. Budget Balance (Nov)--

F: --

P: --

U.S. Target Federal Funds Rate Lower Limit (Overnight Reverse Repo Rate)

U.S. Target Federal Funds Rate Lower Limit (Overnight Reverse Repo Rate)--

F: --

P: --

U.S. Federal Funds Rate Projections-Current (Q4)

U.S. Federal Funds Rate Projections-Current (Q4)--

F: --

P: --

U.S. Interest Rate On Reserve Balances

U.S. Interest Rate On Reserve Balances--

F: --

P: --

U.S. Target Federal Funds Rate Upper Limit (Excess Reserves Ratio)

U.S. Target Federal Funds Rate Upper Limit (Excess Reserves Ratio)--

F: --

P: --

U.S. Federal Funds Rate Projections-1st Year (Q4)

U.S. Federal Funds Rate Projections-1st Year (Q4)--

F: --

P: --

U.S. Federal Funds Rate Projections-3rd Year (Q4)

U.S. Federal Funds Rate Projections-3rd Year (Q4)--

F: --

P: --

U.S. Federal Funds Rate Target

U.S. Federal Funds Rate Target--

F: --

P: --

FOMC Statement

FOMC Statement FOMC Press Conference

FOMC Press Conference Brazil Selic Interest Rate

Brazil Selic Interest Rate--

F: --

P: --

U.K. 3-Month RICS House Price Balance (Nov)

U.K. 3-Month RICS House Price Balance (Nov)--

F: --

P: --

Australia Employment (Nov)

Australia Employment (Nov)--

F: --

P: --

Australia Full-time Employment (SA) (Nov)

Australia Full-time Employment (SA) (Nov)--

F: --

P: --

Australia Labor Force Participation Rate (SA) (Nov)

Australia Labor Force Participation Rate (SA) (Nov)--

F: --

P: --

Australia Unemployment Rate (SA) (Nov)

Australia Unemployment Rate (SA) (Nov)--

F: --

P: --

Turkey Retail Sales YoY (Oct)

Turkey Retail Sales YoY (Oct)--

F: --

P: --

Italy Quarterly Unemployment Rate (SA) (Q3)

Italy Quarterly Unemployment Rate (SA) (Q3)--

F: --

P: --

IEA Oil Market Report

IEA Oil Market Report South Africa Gold Production YoY (Oct)

South Africa Gold Production YoY (Oct)--

F: --

P: --

South Africa Mining Output YoY (Oct)

South Africa Mining Output YoY (Oct)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

It's been months since the European Union started working on a legal framework to use frozen Russian assets for a €140 billion ($162 billion) loan to Ukraine to bolster its war effort.

It's been months since the European Union started working on a legal framework to use frozen Russian assets for a €140 billion ($162 billion) loan to Ukraine to bolster its war effort. The pressure to get it done is now ratcheting up as Donald Trump tries to persuade Volodymyr Zelenskiy to sign a peace deal the US came up with after talks with Moscow.

Investors bought into the prospect of US-led negotiations leading to an accord. Poland's zloty, the Hungarian forint and Czech koruna were among the world's best performing emerging-market currencies on Monday. But Ukraine's European allies were left scrambling to respond.

Washington's proposal not only included swathes of territory being given to Russia but limits on Ukraine's armed forces, too. The Trump administration has also recently revealed how it wants to use the frozen assets for joint investments with Russia as well as Ukraine's reconstruction.

The EU has been dragging its feet on the issue for a long time. Belgium, where most of the Russian funds are housed, has been worried about potential legal ramifications. But Ukraine's money supply is set to run dry in the coming months, and Europe's more nationalist political landscape makes it harder for governments to promise cash when taxpayers are feeling squeezed.

One piece of good news was that the International Monetary Fund agreed a new $8.2 billion financing program with Ukraine. It's contingent, though, on getting "assurance from donors" before it get full approval.

Meanwhile, a phone call last month between US presidential envoy Steve Witkoff and a senior Kremlin official offered direct insight into the recent tactics for negotiating with Russia, according to a Bloomberg exclusive. Witkoff is due in Moscow next week. Freeing up money for Ukraine might help strengthen Europe's hand when figuring out how to respond next.

Hungary: Prime Minister Viktor Orban and his top diplomat have been on a whirlwind tour with an eye to snapping up sanctioned Russian-owned refineries. Energy company Mol is in talks with Serbia about the country's sole refiner, NIS, which is controlled by Russia's Gazprom.

Romania: The government will set up a mechanism to place companies at risk of being hit by international sanctions under special oversight, such as the local unit of Russian state-owned Lukoil.

Poland: The country plans to start 2026 with a flurry of foreign-currency bond sales, expecting sufficient investor interest to fund the sovereign's growing borrowing needs, according to the Finance Ministry's public debt chief.

Slovenia: The regulator blocked an attempt by a government agency in neighboring Croatia to take over the Ljubljana Stock Exchange, citing a failure to meet "legal criteria."

Czech Republic: The three parties preparing to form the next government rejected the outgoing administration's draft budget for next year, saying the plan lacked financing for key spending areas.

Once overlooked, the Slovak capital has undergone a huge transformation in recent years, turning into a place with one of the highest GDPs per capita in the region. Its skyline has also reflected that change, Daniel Hornak reports for Bloomberg CityLab, thanks to more than $3 billion flowing into development projects. One area of the city center is now home to two-dozen new buildings, crowned by the first skyscraper over 150 meters.

"This time it's real," says Andreja Mladenovic. It's been joked about for years as something never going to happen, but the man ultimately in charge of building Belgrade's metro reckons the time has finally come for Europe's biggest capital city without a subway to get one. City officials say there are binding contracts signed with Chinese and French construction companies and bankers. The aim is for the first, €4.4 billion line to open in 2030 — almost a century since the city first tried to get an underground railway.

US President Donald Trump said Thursday that operations to curb Venezuelan drug trafficking "by land" would begin "very soon."

The warning comes amid escalating tensions with Caracas and with the military stepping up its activity in the Caribbean as part of what Washington says are efforts to stop transnational crime and drug smuggling.

Venezuela, however, says the military buildup and the US anti-narcotics campaign is really a covert effort to remove leftist leader Nicolas Maduro.

Washington views Maduro as an illegitimate ruler and accuses him of drug trafficking — allegations the Venezuelan president rejects.

Maduro's re-election last year was rejected by the international community as fraudulentImage: Cristian Hernandez/AP Photo/picture alliance

Maduro's re-election last year was rejected by the international community as fraudulentImage: Cristian Hernandez/AP Photo/picture allianceIn a video call to US service members from his Mar-a-Lago residence in Florida to mark Thanksgiving, Trump said the military campaign had meant there "aren't too many [Venezuelan drug traffickers] coming in by sea anymore."

"We've almost stopped — it's about 85% stopped by sea," Trump said.

"And we'll be starting to stop them by land also. The land is easier, but that's going to start very soon," he added.

Several of the military units Trump spoke with are directly involved in the anti-drug initiative, known as "Southern Spear."

The US has struck a number of boats in international waters in the Caribbean and the Pacific it says were smuggling illegal narcotics into the country. It has not provided evidence to support the claims.

At least 83 people have been killed in those strikes, according to a count of publicly available figures by the AFP news agency.

The assembled US military firepower, which includes an aircraft carrier strike group, far outweighs anything needed for anti-drug smuggling operations.

Indian government bonds are set to open flat to marginally lower on Friday, continuing from the previous session's moves as traders brace for fresh debt supply via weekly auction, which would be followed by the nation's economic growth data.

The benchmark 10-year yield (IN063335G=CC) is likely to hover between 6.50% and 6.52% till the debt auction, according to a trader at a private bank. It ended at 6.5082% on Thursday, which was its first rise in the last four sessions. Bond yields move inversely to prices.

New Delhi will sell bonds worth 320 billion rupees ($3.58 billion) later in the day, including a seven-year paper. At its previous auction on October 31, the central bank had rejected all bids for this note due to weak demand.

"The auction should go through today, as sentiment is tilted towards the bulls on hopes of a dovish monetary policy next week," the trader said.

"Still, 6.48% should act as a strong bottom for now."

India's July-September growth data is due at 4:00 p.m. IST. The economy likely grew 7.3% year-on-year during the period, according to a Reuters poll, after expanding 7.8% in April-June.

The Reserve Bank of India will likely cut its key interest rate by 25 basis points to 5.25% in its December 5 meeting, according to a majority of economists polled by Reuters, who also expect the rate to stay there through 2026.

Bond yields eased after RBI Governor Sanjay Malhotra said that there is scope to cut policy rates further, and the latest macroeconomic data has not indicated any reduction in the room for policy easing.

China complained to Malaysia and Cambodia about the trade deals they signed with the US last month, underscoring the delicate balance countries must strike in the rivalry between Beijing and Washington.

Beijing has "grave concerns" with certain portions of the US-Malaysia trade deal, Chinese Ministry of Commerce officials said in a meeting with Malaysia on Tuesday. "We hope Malaysia will fully consider and properly handle this matter in light of its long-term national interests."

The readout added officials from the Malaysia's Ministry of Investment, Trade and Industry explained and clarified the issues of China's concerns, without elaborating on what those are.

The meeting follows a similar sitdown between Chinese and Cambodian officials last Tuesday, where China's trade envoy Li Chenggang also urged Phnom Penh to handle concerns and the Cambodians clarified some issues.

China's Commerce Ministry didn't respond to a request for further details. Malaysia's trade ministry and Cambodia's government spokesperson didn't reply to a request for comment.

Both deals, signed last month during President Donald Trump's visit to Malaysia, include language that encourages the countries to align with Washington on national security issues, including export controls, investment screening and sanctions. Beijing has repeatedly warned countries against signing deals with the US that undermine its interests, but this appears to be the first instance of direct complaint.

The public criticisms demonstrate the tight space Southeast Asian nations navigate between the world's two largest economies. China is a key economic and trade partner, but Trump's tariff threats have forced countries to make more trade concessions and investment deals with the US.

The deals were part of a flurry of trade pacts unveiled last month during Trump's first Asia tour since he was reelected, including with Vietnam, and Thailand. As part of its deal, Kuala Lumpur will provide preferential access for US goods and services, while the White House exempted some Malaysian goods from Trump's 19% reciprocal tariffs.

But also under the agreement, Malaysia is expected to follow Washington's trade restrictions on countries for economic or national security reasons. It also commits Malaysia to align with US export controls and sanctions on sensitive technologies, and to prevent its companies from helping others circumvent those measures.

Malaysia should also explore a mechanism to review inbound investment for national security risks, including in relation to critical minerals and critical infrastructure.

For Cambodia, the pact affirms that the country will drop all tariffs on US food and agricultural imports, as well as industrial products. In exchange, the White House identified hundreds of goods it planned to exempt from its 19% tariff.

Similar to Malaysia, Cambodia is required to comply with the US export control regime and so-called entity list of banned firms. In addition, it will cooperate with any US request for information about investment activity by third countries.

Both Malaysia and Cambodia will also enhance defense trade with the US, and promise to crack down on transshipment of goods, the agreements show.

Switzerland has delayed implementing rules that would automatically exchange crypto account information with overseas tax agencies until 2027 and is still deciding which countries it will share data with.

Crypto-Asset Reporting Framework (CARF) rules will still be enshrined into law on Jan. 1, 2026, as originally planned, but will not be implemented until at least a year later, the Swiss Federal Council and State Secretariat for International Finance said on Wednesday.

It added that the Swiss government's tax committee "suspended deliberations on the partner states with which Switzerland intends to exchange data in accordance with the CARF," as the reason for the delay.

The Organisation for Economic Co-operation and Development (OECD) approved CARF in 2022 as part of a global push to share crypto account data with partnered governments in a bid to curb tax evasion via crypto platforms.

The Swiss government's announcement also highlighted a series of amendments to local crypto tax reporting laws, and transitional provisions "aimed at making it easier" for domestic crypto firms to comply with CARF rules.

In June, the Swiss Federal Council had moved forward with a bill to adopt the CARF rules in January 2026, and said at the time that the first exchange of crypto account data would happen in 2027, but it's now unclear when it plans to exchange information.

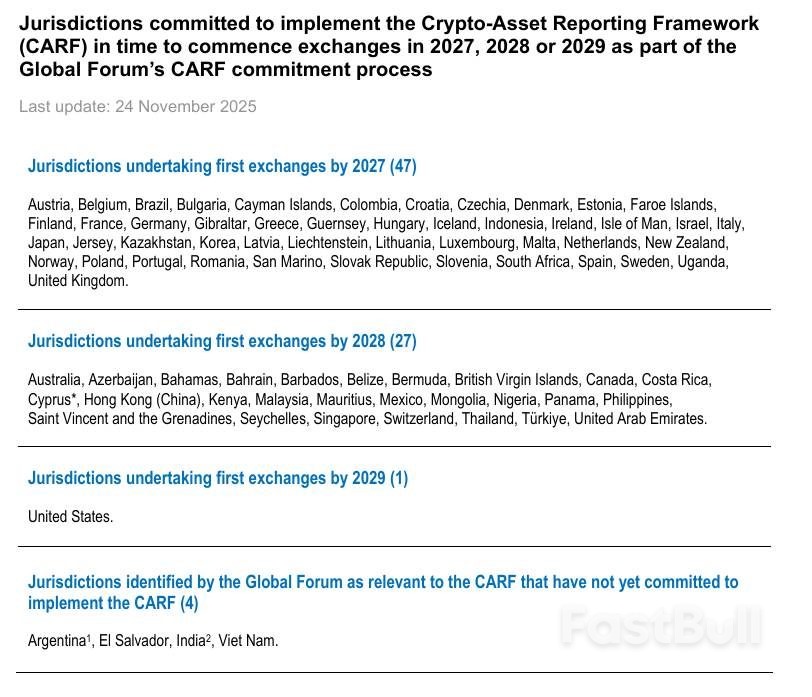

OECD documents show 75 countries, including Switzerland, that have signed on to enact CARF over the next two to four years.

Meanwhile, it has earmarked Argentina, El Salvador, Vietnam and India as countries that have yet to sign on.

List of jurisdictions implementing CARF. Source: OECD

List of jurisdictions implementing CARF. Source: OECDEarlier this month, Reuters reported that the Brazilian government was weighing up a tax on international crypto transfers as part of push to align domestic rules with CARF standards.

Meanwhile, the US White House also recently reviewed the Internal Revenue Service's proposal to join CARF as part of a push to enact more stringent capital gains tax reporting rules for American taxpayers using foreign exchanges.

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up