Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

WTI Crude Oil Futures For March Delivery Closed At $63.21 Per Barrel. Nymex Gasoline Futures For February Delivery Closed At $1.8923 Per Gallon, And Nymex Heating Oil Futures For February Delivery Closed At $2.6661 Per Gallon

Powell: Slowing Job Growth Reflects Decline In Labor Force, Though Labor Demand Has Clearly Softened As Well

National Fuel Gas: If Approved, Average Residential Customer's Monthly Bill For Using 80 Hundred Cubic Feet Of Natural Gas Per Year Would Rise By $4.95

[Powell Will Hold A Monetary Policy Press Conference In Five Minutes] January 29, Federal Reserve Chair Powell Will Hold A Monetary Policy Press Conference In Five Minutes

[Powell Expected To Sidestep Exchange Rate Issue, Maintain Non-Intervention Stance] January 29Th, Former Fed Vice Chair Richard Clarida Said He Expects Powell Not To Touch On The Dollar Issue In Today'S Q&Amp;A Session. He Said, "The Fed Is Trying To Steer Clear Of Any And All Discussion On Exchange Rates."

U.S. Richmond Fed Services Revenue Index (Jan)

U.S. Richmond Fed Services Revenue Index (Jan)A:--

F: --

P: --

U.S. 5-Year Note Auction Avg. Yield

U.S. 5-Year Note Auction Avg. YieldA:--

F: --

P: --

U.S. API Weekly Refined Oil Stocks

U.S. API Weekly Refined Oil StocksA:--

F: --

P: --

U.S. API Weekly Crude Oil Stocks

U.S. API Weekly Crude Oil StocksA:--

F: --

P: --

U.S. API Weekly Gasoline Stocks

U.S. API Weekly Gasoline StocksA:--

F: --

P: --

U.S. API Weekly Cushing Crude Oil Stocks

U.S. API Weekly Cushing Crude Oil StocksA:--

F: --

P: --

Australia RBA Trimmed Mean CPI YoY (Q4)

Australia RBA Trimmed Mean CPI YoY (Q4)A:--

F: --

P: --

Australia CPI YoY (Q4)

Australia CPI YoY (Q4)A:--

F: --

P: --

Australia CPI QoQ (Q4)

Australia CPI QoQ (Q4)A:--

F: --

P: --

Germany GfK Consumer Confidence Index (SA) (Feb)

Germany GfK Consumer Confidence Index (SA) (Feb)A:--

F: --

P: --

Germany 10-Year Bund Auction Avg. Yield

Germany 10-Year Bund Auction Avg. YieldA:--

F: --

P: --

India Industrial Production Index YoY (Dec)

India Industrial Production Index YoY (Dec)A:--

F: --

P: --

India Manufacturing Output MoM (Dec)

India Manufacturing Output MoM (Dec)A:--

F: --

P: --

U.S. MBA Mortgage Application Activity Index WoW

U.S. MBA Mortgage Application Activity Index WoWA:--

F: --

P: --

Canada Overnight Target Rate

Canada Overnight Target RateA:--

F: --

P: --

BOC Monetary Policy Report

BOC Monetary Policy Report U.S. EIA Weekly Crude Stocks Change

U.S. EIA Weekly Crude Stocks ChangeA:--

F: --

P: --

U.S. EIA Weekly Cushing, Oklahoma Crude Oil Stocks Change

U.S. EIA Weekly Cushing, Oklahoma Crude Oil Stocks ChangeA:--

F: --

P: --

U.S. EIA Weekly Crude Demand Projected by Production

U.S. EIA Weekly Crude Demand Projected by ProductionA:--

F: --

P: --

U.S. EIA Weekly Crude Oil Imports Changes

U.S. EIA Weekly Crude Oil Imports ChangesA:--

F: --

P: --

U.S. EIA Weekly Heating Oil Stock Changes

U.S. EIA Weekly Heating Oil Stock ChangesA:--

F: --

P: --

U.S. EIA Weekly Gasoline Stocks Change

U.S. EIA Weekly Gasoline Stocks ChangeA:--

F: --

P: --

BOC Press Conference

BOC Press Conference Russia PPI MoM (Dec)

Russia PPI MoM (Dec)A:--

F: --

P: --

Russia PPI YoY (Dec)

Russia PPI YoY (Dec)A:--

F: --

P: --

U.S. Interest Rate On Reserve Balances

U.S. Interest Rate On Reserve BalancesA:--

F: --

P: --

U.S. Target Federal Funds Rate Lower Limit (Overnight Reverse Repo Rate)

U.S. Target Federal Funds Rate Lower Limit (Overnight Reverse Repo Rate)A:--

F: --

P: --

U.S. Federal Funds Rate Target

U.S. Federal Funds Rate TargetA:--

F: --

P: --

U.S. Target Federal Funds Rate Upper Limit (Excess Reserves Ratio)

U.S. Target Federal Funds Rate Upper Limit (Excess Reserves Ratio)A:--

F: --

P: --

FOMC Statement

FOMC Statement FOMC Press Conference

FOMC Press Conference Brazil Selic Interest Rate

Brazil Selic Interest Rate--

F: --

P: --

Australia Import Price Index YoY (Q4)

Australia Import Price Index YoY (Q4)--

F: --

P: --

Japan Household Consumer Confidence Index (Jan)

Japan Household Consumer Confidence Index (Jan)--

F: --

P: --

Turkey Economic Sentiment Indicator (Jan)

Turkey Economic Sentiment Indicator (Jan)--

F: --

P: --

Euro Zone M3 Money Supply (SA) (Dec)

Euro Zone M3 Money Supply (SA) (Dec)--

F: --

P: --

Euro Zone Private Sector Credit YoY (Dec)

Euro Zone Private Sector Credit YoY (Dec)--

F: --

P: --

Euro Zone M3 Money Supply YoY (Dec)

Euro Zone M3 Money Supply YoY (Dec)--

F: --

P: --

Euro Zone 3-Month M3 Money Supply YoY (Dec)

Euro Zone 3-Month M3 Money Supply YoY (Dec)--

F: --

P: --

South Africa PPI YoY (Dec)

South Africa PPI YoY (Dec)--

F: --

P: --

Euro Zone Consumer Confidence Index Final (Jan)

Euro Zone Consumer Confidence Index Final (Jan)--

F: --

P: --

Euro Zone Selling Price Expectations (Jan)

Euro Zone Selling Price Expectations (Jan)--

F: --

P: --

Euro Zone Industrial Climate Index (Jan)

Euro Zone Industrial Climate Index (Jan)--

F: --

P: --

Euro Zone Services Sentiment Index (Jan)

Euro Zone Services Sentiment Index (Jan)--

F: --

P: --

Euro Zone Economic Sentiment Indicator (Jan)

Euro Zone Economic Sentiment Indicator (Jan)--

F: --

P: --

Euro Zone Consumer Inflation Expectations (Jan)

Euro Zone Consumer Inflation Expectations (Jan)--

F: --

P: --

Italy 5-Year BTP Bond Auction Avg. Yield

Italy 5-Year BTP Bond Auction Avg. Yield--

F: --

P: --

Italy 10-Year BTP Bond Auction Avg. Yield

Italy 10-Year BTP Bond Auction Avg. Yield--

F: --

P: --

France Unemployment Class-A (Dec)

France Unemployment Class-A (Dec)--

F: --

P: --

South Africa Repo Rate (Jan)

South Africa Repo Rate (Jan)--

F: --

P: --

Canada Average Weekly Earnings YoY (Nov)

Canada Average Weekly Earnings YoY (Nov)--

F: --

P: --

U.S. Nonfarm Unit Labor Cost Final (Q3)

U.S. Nonfarm Unit Labor Cost Final (Q3)--

F: --

P: --

U.S. Initial Jobless Claims 4-Week Avg. (SA)

U.S. Initial Jobless Claims 4-Week Avg. (SA)--

F: --

P: --

U.S. Weekly Continued Jobless Claims (SA)

U.S. Weekly Continued Jobless Claims (SA)--

F: --

P: --

U.S. Trade Balance (Nov)

U.S. Trade Balance (Nov)--

F: --

P: --

U.S. Weekly Initial Jobless Claims (SA)

U.S. Weekly Initial Jobless Claims (SA)--

F: --

P: --

Canada Trade Balance (SA) (Nov)

Canada Trade Balance (SA) (Nov)--

F: --

P: --

U.S. Exports (Nov)

U.S. Exports (Nov)--

F: --

P: --

Canada Imports (SA) (Nov)

Canada Imports (SA) (Nov)--

F: --

P: --

Canada Exports (SA) (Nov)

Canada Exports (SA) (Nov)--

F: --

P: --

U.S. Unit Labor Cost Revised MoM (SA) (Q3)

U.S. Unit Labor Cost Revised MoM (SA) (Q3)--

F: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

UK Prime Minister Keir Starmer visits Beijing, aiming for an economic reset with China while balancing security concerns and shifting US relations.

British Prime Minister Keir Starmer is heading to Beijing in a landmark visit aimed at recalibrating the UK's political and business relationship with China. The trip, the first by a British leader since 2018, comes as Western nations navigate an increasingly volatile relationship with the United States.

On the flight to China, Starmer emphasized that Britain cannot ignore the economic opportunities offered by the world's second-largest economy, but must also manage potential security threats.

"It doesn't make sense to stick our head in the ground and bury it in the sand when it comes to China; it's in our interests to engage," he stated. "It's going to be a really important trip for us and we'll make some real progress."

Starmer is accompanied by a delegation of over 50 business leaders. His agenda includes meetings with President Xi Jinping and Premier Li Qiang in Beijing on Thursday, followed by discussions with local executives in Shanghai on Friday.

This visit could mark a significant turning point for UK-China ties, which have been strained for years. Key points of friction have included Beijing's security crackdown in Hong Kong, its support for Russia in the Ukraine war, and allegations from British security services of Chinese espionage targeting UK officials.

For Beijing, the visit provides an opportunity to position itself as a stable and dependable international partner amidst global uncertainty.

The trip is part of a broader trend of Western diplomacy with China, as countries hedge against the unpredictability of the United States.

Starmer's mission unfolds against a backdrop of recent tensions with former U.S. President Trump. These include his threats over Greenland, criticism of a UK deal to cede the Chagos Archipelago to Mauritius, and comments about NATO allies' combat roles in Afghanistan. Just days before Starmer's arrival, Trump threatened to impose a 100% tariff on Canadian goods if Prime Minister Mark Carney finalized a trade deal with China.

Despite this, Starmer expressed confidence that Britain could deepen its economic relationship with China without alienating Washington, citing the UK's historically close partnership with the U.S. on defense, security, intelligence, and trade.

When questioned about his agenda, Starmer was reluctant to detail his planned discussions with Chinese leaders, including whether he would raise the case of Hong Kong media tycoon Jimmy Lai or press China to influence Russia over the Ukraine war. However, he indicated he hoped to make "progress" on securing more visa-free travel between the two countries.

Starmer's strategy has drawn sharp criticism from some politicians in both the UK and the U.S., who argue that he is underestimating the security risks posed by China. He has consistently defended the visit as essential to his plan to drive economic growth and improve living standards in Britain.

The Prime Minister also distanced himself from recent comments by Canada's Mark Carney, who suggested at the World Economic Forum in Davos that the rules-based global order was over. Carney had called for middle powers to unite against American hegemony.

"I'm a pragmatist, a British pragmatist applying common sense," Starmer said, rejecting the notion that his government must choose between the U.S. and Europe.

The Trump administration has told global vaccine group Gavi to phase out shots containing the preservative thimerosal as a condition of providing the group with funding, a U.S. official and a Gavi spokesperson told Reuters.

The request, which Reuters is the first to report, is the latest sign of efforts by the administration of President Donald Trump to influence health policy globally.

Anti-vaccine groups, including one founded by U.S. Health Secretary Robert F. Kennedy Jr., have for decades claimed that thimerosal, a mercury-based preservative used in vaccines, is linked to autism and other neurodevelopmental disorders, despite many studies showing no related safety issues.

In June last year, Kennedy cut $300 million in annual funding for Gavi, which helps the world's poorest and lower-income countries buy vaccines to prevent diseases such as measles and diphtheria.

Kennedy, who has long promoted anti-vaccine views contrary to scientific evidence, says the group ignores safety issues with the immunizations it provides. Gavi says vaccine safety is its utmost concern.

"Until a plan for removal of thimerosal-containing vaccines is developed and the plan initiated, the United States will withhold future new funding," an official for the U.S. Department of Health and Human Services told Reuters.

The official would not comment on when the request was made, but claimed Gavi has so far refused to develop such a plan. A Gavi spokesperson confirmed the request to remove thimerosal from its portfolio, and said the group remained in contact with the U.S. government on the subject.

"While we very much hope to find a pathway to welcoming the U.S. back as a donor, any decision related to Gavi's portfolio would require a decision by Gavi's board and input from preceding governance committees, which will be guided by scientific consensus," the spokesperson said.

Thimerosal is mainly used to ensure vaccines in multi-dose vials remain stable. That helps immunization campaigns in low- and middle-income countries because multi-dose vials are cheaper and simpler to distribute, Gavi and the World Health Organization say.

The preservative has largely been phased out in high-income countries, where vaccines usually come in a single-use format, although its use is not prohibited. Under Kennedy, the U.S. moved last summer to stop use of influenza vaccines containing thimerosal, representing around 5% of flu shots given in the country, despite U.S. health agencies having declared them safe.

The U.S. official said the request of Gavi aims to bring its policies in low- and middle-income countries in line with the U.S., Canada, and most European nations.

The safety of thimerosal has been studied for decades, after concerns were raised in the 1990s about exposure to mercury in vaccines, according to the WHO.

No compelling scientific evidence has been found to suggest that there is a risk, particularly when compared to the dangers of keeping children unprotected against deadly diseases, the WHO says.

The U.S. request applies both to the remaining $300 million that the Biden administration had pledged to Gavi with Congressional approval, but which is still outstanding, and to any future funding, the official said.

The U.S. previously contributed around 13% of Gavi's funding, and the organization has embarked on a series of cost-cutting measures to try to address the shortfall, which has been exacerbated by cuts from other high-income nations.

The Trump administration has cut billions of dollars in health funding internationally and withdrawn from the WHO.

The U.S. government has said it is still committed to global health and is pursuing bilateral agreements with countries under Trump's 'America First' agenda.

Last week, the U.S. health department said a hepatitis B vaccine study in Guinea Bissau would help inform global policy.

The study, funded by the U.S. Centers for Disease Control and Prevention, is now undergoing further ethical review after international criticism.

The U.S. CDC last month withdrew its longstanding recommendation that all newborns should get the hepatitis B vaccine, drawing a swift rebuke from vaccine experts.

Behind the headlines of the U.S.-China trade war, a quieter battle over currency management is sending shockwaves through global finance—with a direct impact on Bitcoin.

While President Trump's aggressive tariff policy dominates discussions, China's strategic response is subtly reshaping international cash flows and creating volatility for crypto investors.

Since 2023, the Trump administration has imposed heavy tariffs on nearly all goods imported from China. As of January 2026, the average U.S. tariff on Chinese products stands at approximately 29.3%.

In response, Beijing has leaned on a crucial tool: tight control over the yuan's exchange rate. According to a recent analysis by JPMorgan, this strategy has been pivotal to China's economic resilience. It not only helps preserve the competitiveness of Chinese exports and combat deflation but also has a powerful side effect: it amplifies dollar-led liquidity cycles during periods of trade stress.

Simply put, when trade tensions escalate, China's currency management acts like a multiplier, intensifying the squeeze on global dollar liquidity.

As a macro-sensitive asset, Bitcoin's price is highly responsive to these global liquidity shifts.

The pattern is clear:

• When tariffs escalate, risk-off sentiment spreads and dollar liquidity becomes scarce, causing Bitcoin's price to fall.

• When tensions ease, liquidity returns to the market, and Bitcoin tends to rebound.

This dynamic was on full display in March and April of last year, when Bitcoin’s performance directly mirrored the ebb and flow of trade hostilities. This reveals a fundamental difference in how each country influences crypto. The U.S. impact is often direct, flowing from capital movements in vehicles like ETFs. China's influence, however, is indirect but equally powerful, operating through its management of the yuan and its effect on global financial plumbing.

This interpretation aligns with arguments from market commentator Arthur Hayes, who has long suggested that U.S.-China trade deals are often more performative than substantive. He emphasizes that the real economic adjustments happen through less visible channels.

In his view, while tariffs and negotiations create the political narrative, the actual market outcomes are dictated by FX policy, capital controls, and liquidity management. JPMorgan's outlook reinforces this logic, suggesting that even if China prevents the yuan from strengthening significantly, the interplay between tariffs and currency management will continue to define the macro environment where Bitcoin trades.

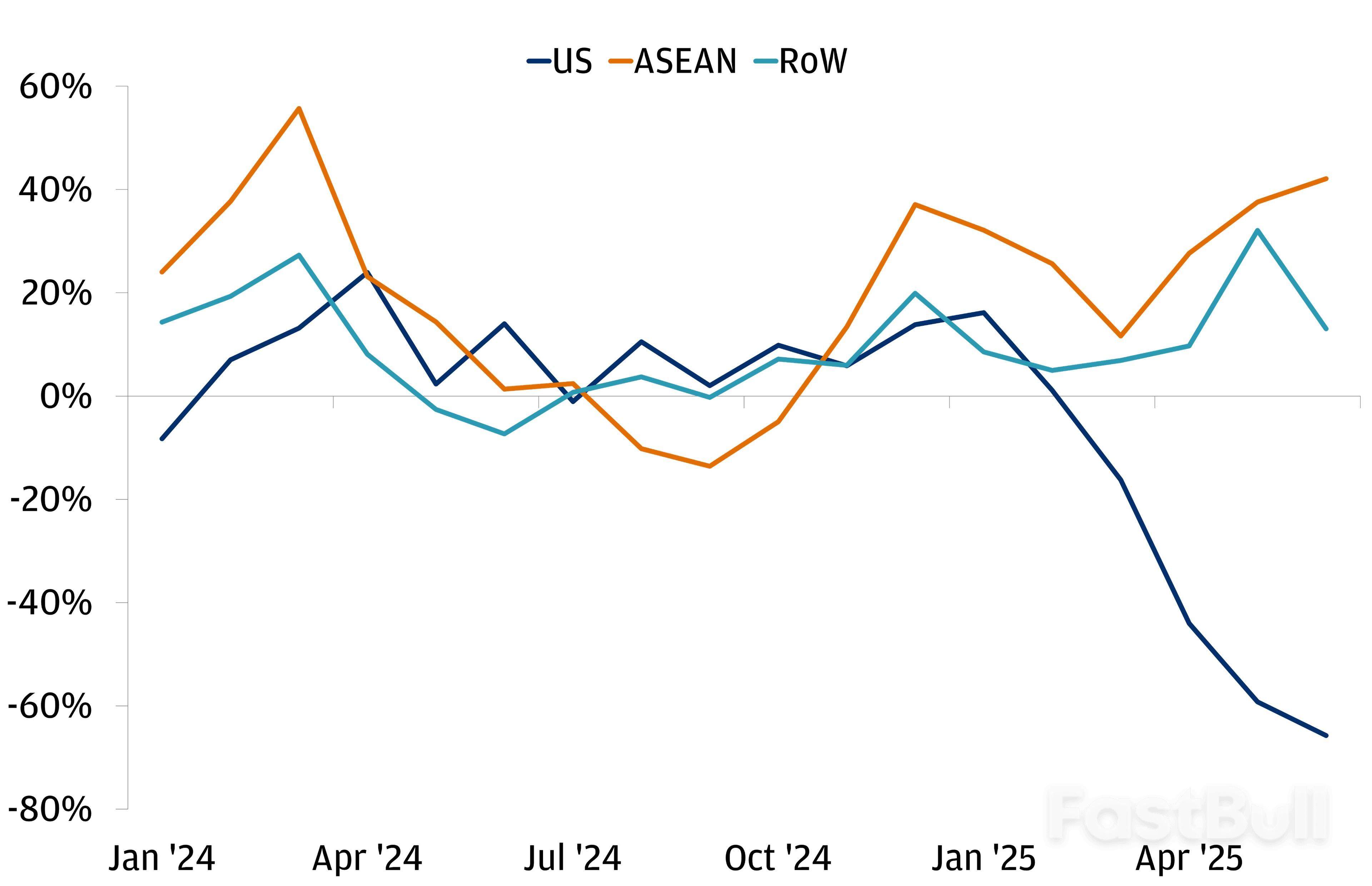

Despite the pressure from U.S. tariffs, China's export engine has proven remarkably durable. According to JPMorgan Private Bank's latest Asia outlook, China’s real exports are on track to grow by about 8% in 2025, with its global market share expanding to roughly 15%. This has occurred even as its U.S.-bound exports have fallen to less than 10% of its total.

This resilience is fueled by two key factors: a successful diversification of trade toward ASEAN and other regions, and the deliberate policy of tightly managing the yuan instead of allowing it to appreciate.

A Closer Look at the Yuan's Trajectory

While the Chinese yuan has strengthened about 4% from its 2023 lows, its performance against the dollar in 2025 has been marginal. This highlights just how tightly managed and range-bound the currency remains.

JPMorgan analysts argue that any recent yuan strength is likely seasonal. The medium-term outlook points to a stable trajectory, as Chinese policymakers prioritize export competitiveness to combat persistent deflationary pressures. The bank cautioned that the bar for any meaningful appreciation of the yuan is high, describing its movements as largely dictated by the dollar within a low-volatility framework.

For crypto markets, the key takeaway is that a sustained rally in the yuan is not the primary factor to watch. Instead, the focus should be on liquidity transmission.

China’s currency framework is a mechanism for transmitting trade-related shocks through the global dollar system. It is this dynamic—not the direct strength of the yuan—that shapes the macro currents steering Bitcoin and other digital assets.

A South Korean court on Wednesday sentenced former First Lady Kim Keon Hee to one year and eight months in jail after finding her guilty of accepting bribes from Unification Church officials in return for political favours.

The court cleared Kim, who is the wife of ex-President Yoon Suk Yeol who was ousted from office last year, on charges of stock price manipulation and violating the political funds act.

The ruling, which can be appealed by the former first lady or prosecutors, comes amid a series of trials following investigations into Yoon's brief imposition of martial law in 2024 and related scandals involving the once-powerful couple.

Prosecutors had demanded 15 years in jail and fines of 2.9 billion won ($2 million) over accusations that include accepting luxury Chanel bags and a diamond necklace from South Korea's Unification Church in return for political favours.

The court found there was not sufficient evidence to conclude Kim was guilty of manipulating stock prices and violating political funding laws, by receiving opinion polls from a power broker in return for influencing the choice of poll candidates.

Kim had denied all the charges. Her lawyer said the team would review the ruling and decide whether to appeal the bribery conviction.

Kim walked into the courtroom at the Seoul Central District Court clad in a dark suit and wearing a face mask, and sat quietly as the lead judge of a three-justice bench delivered the verdict.

The Unification Church said the gifts were delivered to her without expecting anything. Its leader Han Hak-ja, who is also on trial, has denied that she directed it to bribe Kim.

Yoon, who was ousted from power last April, also faces eight trials on charges including insurrection, after his failed bid to impose martial law in December 2024.

He has appealed against a five-year jail term handed to him this month for obstructing attempts to arrest him after his martial law decree.

($1=1,431.8000 won)

Bitcoin (BTC) traders are watching the US dollar hover at a level that previously aligned with two of its biggest cycle rallies.

The US Dollar Index (DXY) trades near 96.3, extending a broader downtrend that has accelerated during bouts of macro stress. Traders have linked the softness to shifting global flows as markets reassess tariff risks, growth expectations, and cross-asset positioning tied to Japan.

US dollar index two-week chart. Source: TradingView

US dollar index two-week chart. Source: TradingViewA stronger yen and periodic "yen carry trade unwind" dynamics can tighten global risk conditions and force position cleanups across FX and equities, moves that often spill into the dollar market.

Against that backdrop, DXY now sits within striking distance of 96, a level that acted as a major inflection point in prior cycles.

When DXY last broke below 96, Bitcoin surged from roughly $2,000 to $20,000 within six months in 2017. In 2020, a similar dollar breakdown preceded BTC's run from about $10,000 to $64,000 over nine months, an upside move of about 540%.

DXY monthly performance chart. Source: TradingView/Matthew Hyland

DXY monthly performance chart. Source: TradingView/Matthew HylandIn 2020, near-zero interest rates, massive quantitative easing, and huge fiscal stimulus pushed real yields down and revived the "fiat debasement" trade, lifting BTC alongside broader risk assets.

In comparison, the current macro backdrop is tighter. Rates and real yields are higher, and yen carry unwind/tariff shocks can turn markets risk-off.

Still, ETFs and institutional demand for BTC may offset some of that if the Federal Reserve policy expectations pivot toward easing. That could trigger capital flows toward the Bitcoin market, raising its odds of hitting $150,000 in 2026, as our special annual outlook on BTC suggested.

Traders are also tracking Bitcoin's performance against gold, a ratio some view as a cleaner long-term cycle gauge than BTC/USD.

When priced in gold, the BTC/XAU ratio has historically gravitated back to its 200-2W moving average about once every four years.

The pair is drifting toward that benchmark again, reviving comparisons to prior "reset" phases in which Bitcoin's underperformance versus gold slowed before BTC entered a new expansion leg.

BTC/XAU ratio vs. BTC/USD two-week performance. Source: TradingView

BTC/XAU ratio vs. BTC/USD two-week performance. Source: TradingViewIn my view, market participants typically treat a test of the 200-2W average as a confirmation-heavy zone rather than an immediate buy signal, since the ratio can remain depressed for extended periods.

Still, the repeated timing of the revisits has kept the level on traders' radar as a potential macro pivot.

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

Log In

Sign Up