Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

U.K. Retail Sales MoM (SA) (Dec)

U.K. Retail Sales MoM (SA) (Dec)A:--

F: --

P: --

France Manufacturing PMI Prelim (Jan)

France Manufacturing PMI Prelim (Jan)A:--

F: --

P: --

France Services PMI Prelim (Jan)

France Services PMI Prelim (Jan)A:--

F: --

P: --

France Composite PMI Prelim (SA) (Jan)

France Composite PMI Prelim (SA) (Jan)A:--

F: --

P: --

Germany Manufacturing PMI Prelim (SA) (Jan)

Germany Manufacturing PMI Prelim (SA) (Jan)A:--

F: --

P: --

Germany Services PMI Prelim (SA) (Jan)

Germany Services PMI Prelim (SA) (Jan)A:--

F: --

P: --

Germany Composite PMI Prelim (SA) (Jan)

Germany Composite PMI Prelim (SA) (Jan)A:--

F: --

P: --

Euro Zone Composite PMI Prelim (SA) (Jan)

Euro Zone Composite PMI Prelim (SA) (Jan)A:--

F: --

P: --

Euro Zone Manufacturing PMI Prelim (SA) (Jan)

Euro Zone Manufacturing PMI Prelim (SA) (Jan)A:--

F: --

P: --

Euro Zone Services PMI Prelim (SA) (Jan)

Euro Zone Services PMI Prelim (SA) (Jan)A:--

F: --

P: --

U.K. Composite PMI Prelim (Jan)

U.K. Composite PMI Prelim (Jan)A:--

F: --

P: --

U.K. Manufacturing PMI Prelim (Jan)

U.K. Manufacturing PMI Prelim (Jan)A:--

F: --

P: --

U.K. Services PMI Prelim (Jan)

U.K. Services PMI Prelim (Jan)A:--

F: --

P: --

Mexico Economic Activity Index YoY (Nov)

Mexico Economic Activity Index YoY (Nov)A:--

F: --

P: --

Russia Trade Balance (Nov)

Russia Trade Balance (Nov)A:--

F: --

P: --

Canada Core Retail Sales MoM (SA) (Nov)

Canada Core Retail Sales MoM (SA) (Nov)A:--

F: --

P: --

Canada Retail Sales MoM (SA) (Nov)

Canada Retail Sales MoM (SA) (Nov)A:--

F: --

U.S. IHS Markit Manufacturing PMI Prelim (SA) (Jan)

U.S. IHS Markit Manufacturing PMI Prelim (SA) (Jan)A:--

F: --

P: --

U.S. IHS Markit Services PMI Prelim (SA) (Jan)

U.S. IHS Markit Services PMI Prelim (SA) (Jan)A:--

F: --

P: --

U.S. IHS Markit Composite PMI Prelim (SA) (Jan)

U.S. IHS Markit Composite PMI Prelim (SA) (Jan)A:--

F: --

P: --

U.S. UMich Consumer Sentiment Index Final (Jan)

U.S. UMich Consumer Sentiment Index Final (Jan)A:--

F: --

P: --

U.S. UMich Current Economic Conditions Index Final (Jan)

U.S. UMich Current Economic Conditions Index Final (Jan)A:--

F: --

P: --

U.S. UMich Consumer Expectations Index Final (Jan)

U.S. UMich Consumer Expectations Index Final (Jan)A:--

F: --

P: --

U.S. Conference Board Leading Economic Index MoM (Nov)

U.S. Conference Board Leading Economic Index MoM (Nov)A:--

F: --

P: --

U.S. Conference Board Coincident Economic Index MoM (Nov)

U.S. Conference Board Coincident Economic Index MoM (Nov)A:--

F: --

P: --

U.S. Conference Board Lagging Economic Index MoM (Nov)

U.S. Conference Board Lagging Economic Index MoM (Nov)A:--

F: --

P: --

U.S. UMich 1-Year-Ahead Inflation Expectations Final (Jan)

U.S. UMich 1-Year-Ahead Inflation Expectations Final (Jan)A:--

F: --

P: --

U.S. Conference Board Leading Economic Index (Nov)

U.S. Conference Board Leading Economic Index (Nov)A:--

F: --

P: --

U.S. Weekly Total Rig Count

U.S. Weekly Total Rig CountA:--

F: --

P: --

U.S. Weekly Total Oil Rig Count

U.S. Weekly Total Oil Rig CountA:--

F: --

P: --

Germany Ifo Business Expectations Index (SA) (Jan)

Germany Ifo Business Expectations Index (SA) (Jan)--

F: --

P: --

Germany IFO Business Climate Index (SA) (Jan)

Germany IFO Business Climate Index (SA) (Jan)--

F: --

P: --

Germany Ifo Current Business Situation Index (SA) (Jan)

Germany Ifo Current Business Situation Index (SA) (Jan)--

F: --

P: --

U.S. Dallas Fed PCE Price Index YoY (Nov)

U.S. Dallas Fed PCE Price Index YoY (Nov)--

F: --

P: --

Brazil Current Account (Dec)

Brazil Current Account (Dec)--

F: --

P: --

Mexico Unemployment Rate (Not SA) (Dec)

Mexico Unemployment Rate (Not SA) (Dec)A:--

F: --

P: --

Canada National Economic Confidence Index

Canada National Economic Confidence Index--

F: --

P: --

U.S. Non-Defense Capital Durable Goods Orders MoM (Excl. Aircraft) (Nov)

U.S. Non-Defense Capital Durable Goods Orders MoM (Excl. Aircraft) (Nov)--

F: --

P: --

U.S. Durable Goods Orders MoM (Excl. Defense) (SA) (Nov)

U.S. Durable Goods Orders MoM (Excl. Defense) (SA) (Nov)--

F: --

P: --

U.S. Durable Goods Orders MoM (Excl.Transport) (Nov)

U.S. Durable Goods Orders MoM (Excl.Transport) (Nov)--

F: --

P: --

U.S. Durable Goods Orders MoM (Nov)

U.S. Durable Goods Orders MoM (Nov)--

F: --

P: --

U.S. Chicago Fed National Activity Index (Nov)

U.S. Chicago Fed National Activity Index (Nov)--

F: --

P: --

U.S. Dallas Fed New Orders Index (Jan)

U.S. Dallas Fed New Orders Index (Jan)--

F: --

P: --

U.S. Dallas Fed General Business Activity Index (Jan)

U.S. Dallas Fed General Business Activity Index (Jan)--

F: --

P: --

U.K. BRC Shop Price Index YoY (Jan)

U.K. BRC Shop Price Index YoY (Jan)--

F: --

P: --

China, Mainland Industrial Profit YoY (YTD) (Dec)

China, Mainland Industrial Profit YoY (YTD) (Dec)--

F: --

P: --

Mexico Trade Balance (Dec)

Mexico Trade Balance (Dec)--

F: --

P: --

U.S. S&P/CS 20-City Home Price Index YoY (Not SA) (Nov)

U.S. S&P/CS 20-City Home Price Index YoY (Not SA) (Nov)--

F: --

P: --

U.S. S&P/CS 20-City Home Price Index MoM (SA) (Nov)

U.S. S&P/CS 20-City Home Price Index MoM (SA) (Nov)--

F: --

P: --

U.S. FHFA House Price Index MoM (Nov)

U.S. FHFA House Price Index MoM (Nov)--

F: --

P: --

U.S. FHFA House Price Index (Nov)

U.S. FHFA House Price Index (Nov)--

F: --

P: --

U.S. Richmond Fed Manufacturing Composite Index (Jan)

U.S. Richmond Fed Manufacturing Composite Index (Jan)--

F: --

P: --

U.S. Conference Board Present Situation Index (Jan)

U.S. Conference Board Present Situation Index (Jan)--

F: --

P: --

U.S. Conference Board Consumer Expectations Index (Jan)

U.S. Conference Board Consumer Expectations Index (Jan)--

F: --

P: --

U.S. Richmond Fed Manufacturing Shipments Index (Jan)

U.S. Richmond Fed Manufacturing Shipments Index (Jan)--

F: --

P: --

U.S. Richmond Fed Services Revenue Index (Jan)

U.S. Richmond Fed Services Revenue Index (Jan)--

F: --

P: --

U.S. Conference Board Consumer Confidence Index (Jan)

U.S. Conference Board Consumer Confidence Index (Jan)--

F: --

P: --

Australia RBA Trimmed Mean CPI YoY (Q4)

Australia RBA Trimmed Mean CPI YoY (Q4)--

F: --

P: --

Australia CPI YoY (Q4)

Australia CPI YoY (Q4)--

F: --

P: --

Australia CPI QoQ (Q4)

Australia CPI QoQ (Q4)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

A new Senate crypto bill proposes banning passive stablecoin yields, aiming to balance industry and banking interests.

U.S. senators are preparing to review a major piece of crypto legislation this week that could fundamentally change how stablecoin holders earn rewards. An amended draft of the Digital Asset Market Clarity Act proposes new rules that would directly impact interest and yield payments on these digital assets.

According to the draft released on Monday, the bill aims to restrict certain types of returns. The text states that "a digital asset service provider may not pay any form of interest or yield [...] solely in connection with the holding of a payment stablecoin." This language effectively targets and bars passive, deposit-like returns that users might earn simply for holding stablecoins in an account.

However, the proposal doesn't eliminate all forms of stablecoin rewards. The draft carves out exceptions for more structured and active participation in crypto ecosystems.

What Types of Rewards Are Still Allowed?

The bill clarifies that stablecoin rewards would not be prohibited under specific circumstances, including earnings derived from:

• Providing liquidity or collateral

• Governance activities

• Validation or staking

• Other forms of ecosystem participation

This distinction signals that lawmakers may be responding to industry criticism calling for clearer rules, while also addressing concerns from traditional finance. Some banking groups have lobbied against stablecoin rewards in other legislation, such as the GENIUS Act signed into law in July.

Nic Puckrin, co-founder of Coin Bureau, views the proposal as a compromise between crypto industry demands and pressure from banks.

"The Senate's compromise on stablecoin yield in the proposed amendments to the crypto market structure bill is a clear sign that the powers that be are committed to ensuring stablecoins remain attractive to end users, while placating banks that have lobbied heavily against such rewards," Puckrin stated.

He added that regardless of the outcome, the competitive dynamic is set. "Whichever way the chips fall, though, it's clear stablecoins will remain a competitor to bank deposits. Short of an outright ban on any form of rewards, there's little that can stop this, and this is a new reality banks will have to reckon with."

The legislative journey for the bill is complex. The Senate Banking Committee is scheduled to hold a markup on Thursday, a key step that could advance it for a full Senate vote. However, the Senate Agriculture Committee announced on Monday that it would not review its version of the bill until the end of January.

This split timeline creates significant risk. "If the bill fails in either committee, then market structure is likely to be dead for this session," said Eli Cohen, Chief Legal Officer at Centrifuge. He noted that even a partisan approval could keep the bill alive, stating, "If the bills pass by Republican party line vote, there would still be time to get Democrats onboard before the unified bill goes to the floor for a full Senate vote."

The debate over stablecoin yields is not the only obstacle. Other political factors could derail the bill's progress.

At least two Senate Democrats have reportedly pushed for the CLARITY Act to include safeguards preventing public officials, including presidents, from profiting from investments in digital asset firms.

Furthermore, the upcoming U.S. midterm elections in November could divert legislative attention. The Washington Research Group at TD Cowen speculated that the bill is more likely to pass in 2027, as Democrats consider a potential shift in congressional control after the midterms.

Despite these challenges, some remain optimistic. U.S. Securities and Exchange Commission (SEC) Chair Paul Atkins said Monday he expects Trump to sign the bill into law by the end of 2026. If passed, the legislation would establish a clear regulatory framework for the SEC and the Commodity Futures Trading Commission to oversee the digital asset market.

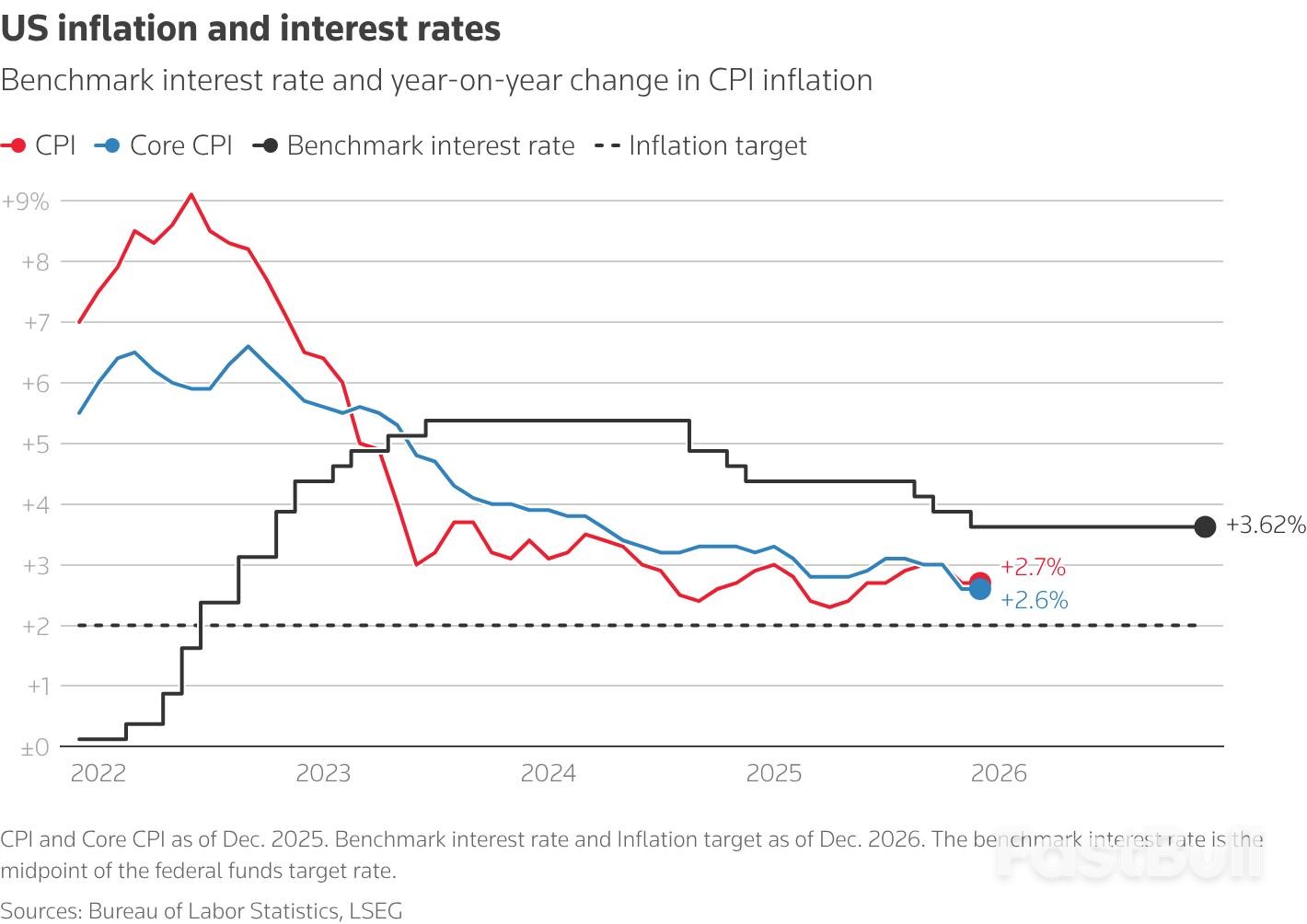

U.S. consumer prices climbed 0.3% in December, pushed higher by increasing costs for food and rent. The data cements expectations that the Federal Reserve will hold interest rates steady this month, though a moderate rise in underlying inflation keeps future rate cuts on the table.

The report from the Labor Department showed that some pricing distortions from a prior government shutdown have started to unwind. While economists are divided on whether inflation has peaked, the latest figures suggest that the pass-through effect of import tariffs on consumer prices may be slowing.

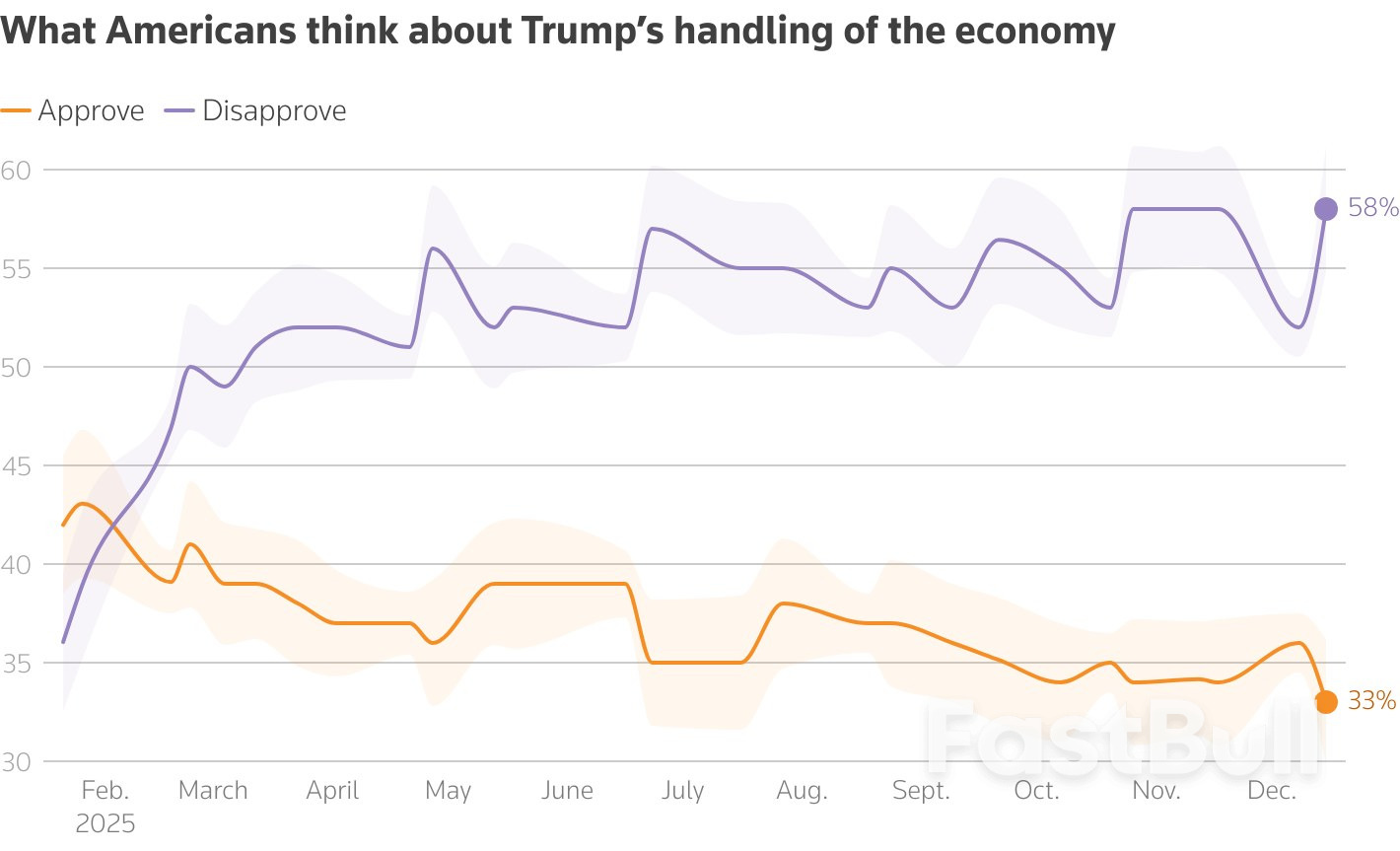

Still, the rising cost of living remains a significant challenge. The increases in essential goods have eroded consumer confidence and become a key political issue for President Donald Trump, whose administration's policies, including import tariffs, have been partly blamed for the affordability crunch.

The primary drivers of December's inflation were essentials that directly impact household budgets. The Consumer Price Index (CPI) was heavily influenced by a 0.4% increase in the cost of shelter, which includes rent.

Food prices saw a notable surge of 0.7%, marking the largest single-month gain since October 2022. Key price changes include:

• Beef: Rose 1.0%

• Steaks: Soared 3.1% (up 17.8% year-over-year)

• Coffee: Increased 1.9%

• Eggs: Decreased 8.2%

The cost of food at restaurants and other outlets also jumped 0.7%. Overall, food prices were up 3.1% compared to the previous year.

Energy prices also rose 0.3%, with a 4.4% surge in natural gas costs offsetting a 0.5% dip in gasoline prices. Electricity prices eased slightly by 0.1% for the month but remained up 6.7% year-over-year, partly reflecting higher demand from data centers powering the AI investment boom.

"Families may not closely track core inflation, but they see grocery prices and restaurant costs immediately," noted Sung Won Sohn, a finance and economics professor at Loyola Marymount University. "A renewed push in food prices is not merely a statistical detail, it can influence public perception, wage negotiations and ultimately economic behavior."

For the full 12 months through December, the CPI advanced 2.7%, matching the gain seen in November and aligning with economists' expectations.

When volatile food and energy components are excluded, the "core" CPI shows a more moderate picture, rising 0.2% in December. For the 12 months ending in December, core CPI increased 2.6%, the same pace as in November.

However, a closer look at the core components reveals mixed signals:

• Prices that rose: Owners' equivalent rent (+0.3%), hotel and motel rooms (+2.9%), airline fares (+5.2%), apparel (+0.6%), and healthcare (+0.4%).

• Prices that fell: Used cars and trucks (-1.1%), household furnishings (-0.5%), and wireless telephone services (-3.3%).

Economists believe that lingering distortions from a 43-day government shutdown, which prevented price collection in October, may have held down the annual CPI rate by at least a tenth of a percentage point.

The Federal Reserve is widely expected to keep its benchmark interest rate in the 3.50%-3.75% range at its January 27-28 meeting.

Analysts anticipate that core inflation could accelerate in January as businesses implement price increases for the new year. "It is worth noting that the core CPI has jumped by 0.4% and more in each of the past four Januarys," said Stephen Stanley, chief U.S. economist at Santander U.S. Capital Markets. "I would imagine that Fed officials are well aware of this history and are reserving judgment on inflation until they have a few more months of inflation data in hand."

Based on the latest CPI data, economists project that the core Personal Consumption Expenditures (PCE) price index—the Fed's preferred inflation gauge—rose 0.46% in December. This would bring the year-over-year core PCE rate to 2.9%, still above the central bank's 2% target.

Tensions between Federal Reserve Chair Jerome Powell and President Trump are adding another layer of complexity to the interest rate outlook. The Trump administration has initiated a criminal investigation into Powell, which the Fed chief has described as a "pretext" to influence monetary policy.

This political pressure has led most economists to believe a rate cut is unlikely before Powell's term as chair ends in May.

"Policymakers may lean more hawkish to signal institutional independence," said Gregory Daco, chief economist at EY-Parthenon. He also noted that the situation "raises the probability that Powell remains on the board after his term as chair ends in mid-May 2026," given his term as a governor runs through January 2028.

Political pressure on the world’s central banks is escalating, fueling concerns about their ability to manage economies without interference. The Trump administration’s move to open a criminal investigation into the Federal Reserve chair, Jerome Powell, has highlighted the vulnerability of the U.S. central bank, the primary policymaker for the world's largest economy.

President Donald Trump had previously criticized Powell and the Fed for not cutting interest rates more aggressively. In response to such pressures, top central bankers issued a joint statement affirming that their independence is a "cornerstone of price, financial and economic stability."

This clash is part of a larger, long-running debate. Here’s a breakdown of how central bank independence became a core principle of modern economics and why it’s being challenged today.

The U.S. Federal Reserve was a pioneer in establishing its autonomy. In 1951, rising inflation after World War Two made it clear that monetary policy could not remain focused on keeping government borrowing costs low. This realization led to the Fed being granted operational independence.

However, true freedom from political influence took another 25 years. The administration of President Richard Nixon is widely seen as having pressured the Fed to maintain low borrowing costs ahead of his 1972 re-election campaign. Many economists believe this interference, combined with a spike in oil prices, contributed to the runaway inflation that defined the latter half of the 1970s.

The economic damage caused by high inflation in the 1970s and early 1980s forced governments worldwide to rethink their approach. A new consensus emerged: taking interest rate decisions away from politicians and giving that power to independent officials tasked with one primary goal—keeping inflation low.

This model was adopted widely. According to the Bank of England, by the end of the 20th century, between 80% and 90% of the world's central banks had achieved operational independence.

While factors like the rise of low-cost manufacturing from China helped contain global prices over the past three decades, research has consistently shown a link between a central bank's degree of independence and a country's inflation level and volatility. This connection has solidified its status as a fundamental principle of economic policymaking.

For example, Andy Haldane, former chief economist at the Bank of England (BoE), noted in a 2020 speech that inflation uncertainty in Britain fell by about 75% in the two decades after the BoE became independent in 1997.

Widespread support for central bank independence began to erode during the 2007-09 global financial crisis. The crisis exposed regulatory failures by central banks and other oversight bodies.

In response, central banks globally slashed interest rates to near zero and launched massive bond-buying programs, known as quantitative easing (QE), to stimulate their economies. These unprecedented actions drew sharp political criticism. Ben Bernanke, the Fed chair at the time, was accused by Republican presidential contender Rick Perry of printing money for political reasons and was even likened to a traitor.

More recently, the Bank of England faced accusations from politicians that its QE program fueled inflation. This criticism intensified when inflation surged to 11% after Russia's full-scale invasion of Ukraine in early 2022 caused energy prices to soar.

Shortly before her brief tenure as UK prime minister, Liz Truss announced she would review the BoE's official mandate. While she never had the chance to follow through, public trust in the central bank plummeted to historic lows, according to its own surveys.

This trend extends beyond the U.S. and Britain. Governments in countries from Turkey to India have attempted to exert greater influence over their central banks. Similarly, Japan's prime minister has also historically favored a loose monetary policy, underscoring the persistent tension between political goals and independent economic management.

The Czech Republic's new government, led by populist Prime Minister Andrej Babiš, is facing a mandatory confidence vote in Parliament to approve an agenda that signals a significant shift away from supporting Ukraine and challenges key European Union policies.

Debate began Tuesday in the 200-seat lower house, where the new coalition government holds a comfortable majority of 108 seats. Winning this vote is a required step for any new administration to formally take power.

Babiš, who previously served as prime minister from 2017 to 2021, secured a decisive victory in the country's October election with his ANO (YES) movement. He has since formed a majority coalition with two smaller parties: the anti-migrant Freedom and Direct Democracy party and the right-wing Motorists for Themselves. Together, these parties, which share an admiration for former U.S. President Donald Trump, have formed a 16-member Cabinet.

The political comeback of Babiš and his new alliance is set to dramatically redefine the nation's foreign and domestic policies. In a speech to the lower house, Babiš underscored his administration's focus, stating, "I'd like to make it clear that the Czech Republic and Czech citizens will be first for our government."

This marks a sharp departure from the previous pro-Western government. Babiš has already rejected providing financial aid to Ukraine and has refused to guarantee EU loans for the country as it defends against the Russian invasion. This positions him alongside other regional leaders like Viktor Orbán of Hungary and Robert Fico of Slovakia.

A Pivot on Ukraine Support

While the government is ending direct financial support for Kyiv, it will not completely abandon all Ukraine-related initiatives. Babiš confirmed his administration would continue to administer a Czech-led program that successfully acquired approximately 1.8 million artillery shells for Ukraine from markets outside the EU last year. However, the Czech Republic's role will be limited to administration, with no financial contribution.

Challenging European Union Policies

The new coalition's junior partners are bringing their own Euroskeptic and nationalist platforms to the forefront.

• Freedom and Direct Democracy: The party sees no future for the Czech Republic in either the EU or NATO and has called for the expulsion of most of the 380,000 Ukrainian refugees currently in the country.

• Motorists for Themselves: This party, which now controls the environment and foreign ministries, has rejected the EU's Green Deal and is proposing a revival of the nation's coal industry.

Senior German cabinet members returned from Washington this week both empty-handed and alarmed after a mission to uncover the true motives behind President Donald Trump's threats to take control of Greenland. The trip failed to provide clarity, instead highlighting the growing divide in transatlantic relations.

Hoping to understand the strategy behind the White House's focus on the self-ruling Danish territory, German Foreign Minister Johann Wadephul met with U.S. Secretary of State Marco Rubio on Monday. According to sources familiar with the discussion, Wadephul proposed a new NATO mission in the Arctic specifically to protect Greenland, a move designed to test whether American security concerns were the genuine driver of its policy.

The plan did not succeed. "NATO is currently starting to work on concrete plans that will be discussed with our US partners," Wadephul stated at a press conference organized after the meeting. "We were still not able to do this today."

Despite the lack of progress, Wadephul noted that the meeting lasted 90 minutes instead of the scheduled 30, a point he later highlighted as an achievement on social media. He also sought to downplay the immediate risk, telling reporters there is "no indication that this is being seriously considered" when asked about Trump's threats.

The failed diplomatic effort underscores Europe's limited influence on conflicts that directly impact the continent. This struggle was also evident as European leaders found it difficult to weigh in on a proposed Ukraine peace deal being negotiated directly between Washington and Moscow.

German Finance Minister Lars Klingbeil, who was also in Washington for a Group of Seven meeting on rare earths, offered a more direct and pessimistic assessment than his colleague. He warned that the strategic rifts between the United States and Europe are growing wider.

"We see that the differences are getting bigger," Klingbeil said on Monday. "It's bad for the world if Europe and the US drift apart."

Crude oil prices rose about 3% on Tuesday, after U.S. President Donald Trump cancelled all meetings with Iranian officials and promised protesters that help is on the way.

U.S. crude oil rose $1.96, or 3.29%, to $61.46 per barrel by 11:42 a.m. ET. Global benchmark Brent was up $1.99, or 3.12%, to $65.86 per barrel.

The Islamic Republic's security forces have cracked down on large-scale demonstrations with hundreds of people reportedly dead. The government has cut off Internet access in Iran, making it difficult to verify how the situation is evolving on the ground.

Trump has repeatedly threatened to intervene if the Islamic Republic kills protestors.

"Iranian Patriots, KEEP PROTESTING - TAKE OVER YOUR INSTITUTIONS!!! Save the names of the killers and abusers," Trump said in a Truth Social post Tuesday.

"They will pay a big price," the president said. "I have cancelled all meetings with Iranian Officials until the senseless killing of protesters STOPS. HELP IS ON ITS WAY. MIGA!!!"

Iran is a member of OPEC and a major crude oil producer. The oil market is monitoring whether the unrest could lead to a disruption of oil supplies.

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

Log In

Sign Up