Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

MSCI's Nordic Countries Index Rose 0.3%, Marking Its Third Consecutive Day Of Gains, Closing At 394.43 Points. Among The Ten Sectors, The Nordic Industrials Sector Saw The Largest Increase. Boliden Ab Closed Up 5.3%, Leading The Pack Among Nordic Stocks

[Italian Banking Sector Hits Record Closing High] Germany's DAX 30 Index Closed Down 0.02% At 24,793.06 Points. France's Stock Index Closed Down 0.13%, Italy's Stock Index Closed Up 0.80% With The Banking Index Up 1.24%, And The UK Stock Index Closed Down 0.39%

[Bitcoin Falls Below $77,000, 24-Hour Decline Of 2.8%] February 4Th, According To Htx Market Data, Bitcoin Fell Below $77,000, Now Trading At $76,900, A 24-Hour Decrease Of 2.8%

Spot Gold Surged $302.83 During The Day, Currently Trading At $4,963.79 Per Ounce, A Gain Of 6.50%

Denmark's Forex Reserves 673.9 Billion DKK At End-January Versus 651.1 Billion At End-December

Fitch: Forecasts UK's Inflation Outlook To Be More Benign This Year And For Bank Of England To Respond With Three Rate Cuts In 2026

U.K. Manufacturing PMI Final (Jan)

U.K. Manufacturing PMI Final (Jan)A:--

F: --

P: --

Turkey Trade Balance (Jan)

Turkey Trade Balance (Jan)A:--

F: --

P: --

Brazil IHS Markit Manufacturing PMI (Jan)

Brazil IHS Markit Manufacturing PMI (Jan)A:--

F: --

P: --

Canada National Economic Confidence Index

Canada National Economic Confidence IndexA:--

F: --

P: --

Canada Manufacturing PMI (SA) (Jan)

Canada Manufacturing PMI (SA) (Jan)A:--

F: --

P: --

U.S. IHS Markit Manufacturing PMI Final (Jan)

U.S. IHS Markit Manufacturing PMI Final (Jan)A:--

F: --

P: --

U.S. ISM Output Index (Jan)

U.S. ISM Output Index (Jan)A:--

F: --

P: --

U.S. ISM Inventories Index (Jan)

U.S. ISM Inventories Index (Jan)A:--

F: --

P: --

U.S. ISM Manufacturing Employment Index (Jan)

U.S. ISM Manufacturing Employment Index (Jan)A:--

F: --

P: --

U.S. ISM Manufacturing New Orders Index (Jan)

U.S. ISM Manufacturing New Orders Index (Jan)A:--

F: --

P: --

U.S. ISM Manufacturing PMI (Jan)

U.S. ISM Manufacturing PMI (Jan)A:--

F: --

P: --

US President Trump delivered a speech

US President Trump delivered a speech South Korea CPI YoY (Jan)

South Korea CPI YoY (Jan)A:--

F: --

P: --

Japan Monetary Base YoY (SA) (Jan)

Japan Monetary Base YoY (SA) (Jan)A:--

F: --

P: --

Australia Building Approval Total YoY (Dec)

Australia Building Approval Total YoY (Dec)A:--

F: --

Australia Building Permits MoM (SA) (Dec)

Australia Building Permits MoM (SA) (Dec)A:--

F: --

Australia Building Permits YoY (SA) (Dec)

Australia Building Permits YoY (SA) (Dec)A:--

F: --

P: --

Australia Private Building Permits MoM (SA) (Dec)

Australia Private Building Permits MoM (SA) (Dec)A:--

F: --

Australia Overnight (Borrowing) Key Rate

Australia Overnight (Borrowing) Key RateA:--

F: --

P: --

RBA Rate Statement

RBA Rate Statement Japan 10-Year Note Auction Yield

Japan 10-Year Note Auction YieldA:--

F: --

P: --

The U.S. House of Representatives voted on a short-term spending bill to end the partial government shutdown.

The U.S. House of Representatives voted on a short-term spending bill to end the partial government shutdown. Saudi Arabia IHS Markit Composite PMI (Jan)

Saudi Arabia IHS Markit Composite PMI (Jan)A:--

F: --

P: --

RBA Press Conference

RBA Press Conference Turkey PPI YoY (Jan)

Turkey PPI YoY (Jan)A:--

F: --

P: --

Turkey CPI YoY (Jan)

Turkey CPI YoY (Jan)A:--

F: --

P: --

Turkey CPI YoY (Excl. Energy, Food, Beverage, Tobacco & Gold) (Jan)

Turkey CPI YoY (Excl. Energy, Food, Beverage, Tobacco & Gold) (Jan)A:--

F: --

P: --

U.K. 10-Year Note Auction Yield

U.K. 10-Year Note Auction YieldA:--

F: --

P: --

Richmond Federal Reserve President Barkin delivered a speech.

Richmond Federal Reserve President Barkin delivered a speech. U.S. Weekly Redbook Index YoY

U.S. Weekly Redbook Index YoYA:--

F: --

P: --

Mexico Manufacturing PMI (Jan)

Mexico Manufacturing PMI (Jan)A:--

F: --

P: --

U.S. API Weekly Refined Oil Stocks

U.S. API Weekly Refined Oil Stocks--

F: --

P: --

U.S. API Weekly Gasoline Stocks

U.S. API Weekly Gasoline Stocks--

F: --

P: --

U.S. API Weekly Cushing Crude Oil Stocks

U.S. API Weekly Cushing Crude Oil Stocks--

F: --

P: --

U.S. API Weekly Crude Oil Stocks

U.S. API Weekly Crude Oil Stocks--

F: --

P: --

Japan IHS Markit Services PMI (Jan)

Japan IHS Markit Services PMI (Jan)--

F: --

P: --

Japan IHS Markit Composite PMI (Jan)

Japan IHS Markit Composite PMI (Jan)--

F: --

P: --

China, Mainland Caixin Services PMI (Jan)

China, Mainland Caixin Services PMI (Jan)--

F: --

P: --

China, Mainland Caixin Composite PMI (Jan)

China, Mainland Caixin Composite PMI (Jan)--

F: --

P: --

India HSBC Services PMI Final (Jan)

India HSBC Services PMI Final (Jan)--

F: --

P: --

India IHS Markit Composite PMI (Jan)

India IHS Markit Composite PMI (Jan)--

F: --

P: --

Russia IHS Markit Services PMI (Jan)

Russia IHS Markit Services PMI (Jan)--

F: --

P: --

South Africa IHS Markit Composite PMI (SA) (Jan)

South Africa IHS Markit Composite PMI (SA) (Jan)--

F: --

P: --

Italy Services PMI (SA) (Jan)

Italy Services PMI (SA) (Jan)--

F: --

P: --

Italy Composite PMI (Jan)

Italy Composite PMI (Jan)--

F: --

P: --

Germany Composite PMI Final (SA) (Jan)

Germany Composite PMI Final (SA) (Jan)--

F: --

P: --

Euro Zone Composite PMI Final (Jan)

Euro Zone Composite PMI Final (Jan)--

F: --

P: --

Euro Zone Services PMI Final (Jan)

Euro Zone Services PMI Final (Jan)--

F: --

P: --

U.K. Composite PMI Final (Jan)

U.K. Composite PMI Final (Jan)--

F: --

P: --

U.K. Total Reserve Assets (Jan)

U.K. Total Reserve Assets (Jan)--

F: --

P: --

U.K. Services PMI Final (Jan)

U.K. Services PMI Final (Jan)--

F: --

P: --

U.K. Official Reserves Changes (Jan)

U.K. Official Reserves Changes (Jan)--

F: --

P: --

Euro Zone Core CPI Prelim YoY (Jan)

Euro Zone Core CPI Prelim YoY (Jan)--

F: --

P: --

Euro Zone Core HICP Prelim YoY (Jan)

Euro Zone Core HICP Prelim YoY (Jan)--

F: --

P: --

Euro Zone PPI MoM (Dec)

Euro Zone PPI MoM (Dec)--

F: --

P: --

Euro Zone HICP Prelim YoY (Jan)

Euro Zone HICP Prelim YoY (Jan)--

F: --

P: --

Euro Zone Core HICP Prelim MoM (Jan)

Euro Zone Core HICP Prelim MoM (Jan)--

F: --

P: --

Italy HICP Prelim YoY (Jan)

Italy HICP Prelim YoY (Jan)--

F: --

P: --

Euro Zone Core CPI Prelim MoM (Jan)

Euro Zone Core CPI Prelim MoM (Jan)--

F: --

P: --

Euro Zone PPI YoY (Dec)

Euro Zone PPI YoY (Dec)--

F: --

P: --

U.S. MBA Mortgage Application Activity Index WoW

U.S. MBA Mortgage Application Activity Index WoW--

F: --

P: --

No matching data

View All

No data

U.S. stocks edged higher on earnings momentum and easing rate fears, while sharp gold and silver rebounds and a cautious bitcoin pullback show markets moving together as investors reassess risk and AI-driven growth.

Daily Gold (XAU/USD)

Daily Gold (XAU/USD) Daily Bitcoin (BTCUSD)

Daily Bitcoin (BTCUSD)

According to Iran's Fars news agency, the U.S. aircraft carrier Abraham Lincoln has repositioned near Yemen, a move interpreted as a step toward de-escalating military tensions with Tehran and creating an opening for diplomacy.

The report claims the nuclear-powered carrier has withdrawn approximately 1,400 kilometers (870 miles) from the southern Iranian port of Chabahar. Its new operating area is said to be near the Gulf of Aden, east of Yemen's Socotra Island. This information has not yet been confirmed by the Pentagon. The carrier group is reportedly accompanied by its standard contingent of destroyers and submarines, typical for deployments in the CENTCOM region.

The apparent distancing of U.S. and Iranian forces is seen as a positive signal for planned dialogue. A meeting between U.S. envoy Steve Witkoff and Iranian Foreign Minister Abbas Araghchi is expected to take place in Istanbul on Friday to discuss a potential nuclear deal, according to a report from Axios.

While the meeting plans remain uncertain, the carrier's movement suggests that progress is being made toward what would be the first direct talks between the two sides since the June war.

Iranian officials have expressed cautious optimism about renewed direct contact with Washington. Foreign Minister Araghchi emphasized that while "Iran is ready for diplomacy," he also stated that "diplomacy is incompatible with pressure, intimidation, and force."

This sentiment was echoed by Iranian President Masoud Pezeshkian in a statement on Tuesday. He signaled conditional support for renewed talks, as regional intermediaries like Turkey, Egypt, and Qatar work to ease rising tensions. In a social media post, Pezeshkian voiced his backing for "fair and equitable negotiations" and confirmed he had instructed Araghchi to engage with U.S. officials, but only if "a suitable environment exists—one free from threats and unreasonable expectations."

Although Pezeshkian did not directly mention the Istanbul meeting, his comments reinforce Tehran's position that diplomacy is possible, but not under ultimatums.

Trita Parsi of the Quincy Institute has suggested that from Iran's perspective, attempting a high-stakes diplomatic effort is a logical move before any potential military confrontation. He argues that Iran sees itself as having little to lose.

"Direct talks between Iranian officials and Trump himself may appear completely unrealistic, but some of the main turning points in the US-Iran drama were caused by moves that most believe were completely impossible," Parsi wrote. "I don't see what the Iranians have to lose by trying this card."

The European Union is pushing for a strategic partnership with the United States to secure access to critical minerals, a move aimed directly at reducing dependence on China's control over global supply chains.

According to sources familiar with the plan, the EU is prepared to sign a memorandum of understanding that would launch a "Strategic Partnership Roadmap" with the US within three months. The core objective is to develop alternative sources for minerals essential to modern technology, bypassing China's current dominance.

For years, both the United States and the European Union have relied heavily on China's vast and low-cost mineral supplies. This dependency has given Beijing significant economic and political leverage over Western supply chains, creating a strategic vulnerability that both powers are now keen to address.

The proposed partnership seeks to fundamentally shift this dynamic by building a more resilient and independent mineral sourcing network.

The EU's proposal outlines a multi-pronged approach to decrease reliance on China and fortify their own markets. The plan includes several key initiatives:

• Joint Sourcing Projects: Collaborating on new projects to explore and develop critical mineral resources.

• Price Support Mechanisms: Establishing frameworks to ensure stable and predictable pricing for these essential materials.

• Market Protection: Implementing measures to shield US and EU markets from external mineral oversupply and other forms of market manipulation.

• Secure Supply Chains: Building robust and direct supply routes between the United States and the European Union.

A notable clause in the EU's proposal emphasizes that both parties must respect each other's territorial integrity. This point comes after past tensions related to former President Donald Trump's stated interest in purchasing Greenland, an autonomous territory of EU member state Denmark.

The EU's initiative also aligns with Washington's own priorities. The proposal surfaces as the Trump administration is actively working to establish its own global agreements on critical minerals, suggesting a potential convergence of strategic interests across the Atlantic.

Daily March WTI Crude Oil Futures

Daily March WTI Crude Oil Futures

Technical Analysis

Traders' Opinions

Remarks of Officials

Data Interpretation

Economic

Central Bank

Commodity

Daily News

Gold and silver prices surged on Tuesday, with gold on track for its largest single-day gain since November 2008 as investors rushed back into precious metals following a historic two-day sell-off.

Spot gold climbed 4.9% to trade at $4,895.69 an ounce by 1120 GMT, rebounding sharply from a low of $4,403.24 hit on Monday. The metal’s price remains below the recent historic peak of $5,594.82 per ounce reached last week. U.S. gold futures for April delivery also saw strong buying, rising 5.7% to $4,918.10 per ounce.

Silver experienced an even more dramatic recovery, surging 8.6% to $86.3 an ounce. The rally comes after the metal posted a record 27% one-day drop on Friday, followed by another 6% decline on Monday.

Analysts suggest the sharp recovery is a technical rebound after prices became oversold. "The market was oversold after the announcement of U.S. President Donald Trump to nominate Kevin Warsh as the next Federal Reserve chairman. What we see today is a rebound," said Peter Fertig, an analyst at Quantitative Commodity Research.

Fertig added that traders who had previously sold to lock in profits are now re-entering the market. "You also see investors who have sold on profit taking are now regarding the prices as attractive again for buying," he explained.

The initial price slump was driven by two key factors. While investors believe potential Fed chair Kevin Warsh would favor rate cuts, they also anticipate he will tighten the central bank's balance sheet—a policy move that typically supports the U.S. dollar and pressures gold.

Pressure on prices was amplified when the CME Group raised margin requirements on precious metal futures, making it more expensive to hold leveraged positions.

Despite the recent volatility, many analysts believe the long-term bull run for gold remains intact and expect the metal to hit new record highs later this year.

"Gold has now cleared its first retracement hurdle at $4,858, shifting focus toward $5,000 — the 50 per cent retracement of the latest slump," noted Ole Hansen, head of commodity strategy at Saxo Bank. For silver, Hansen identified the equivalent technical levels higher up at $90.58 and $96.52.

Adding a layer of uncertainty to the market, the U.S. Bureau of Labor Statistics announced on Monday that the January employment report, a critical economic indicator, would not be released this Friday due to the partial shutdown of the federal government.

Other precious metals also saw significant gains on Tuesday.

• Spot platinum climbed 5.1% to $2,228.84 per ounce, recovering from a slide after hitting a record high of $2,918.80 on January 26.

• Palladium rose 4.5% to trade at $1,796.44.

Donald Trump has intensified his campaign to force the Federal Reserve into cutting interest rates, but his focus has pivoted from the Fed's policy rate to the long-term borrowing costs that directly impact voters. This shift presents a major challenge for his Fed Chair nominee, Kevin Warsh, who may find it impossible to deliver.

The stakes are high for millions of Americans facing steep mortgage rates and for Trump himself, as his success in the November midterm elections could hinge on addressing the "affordability crisis." Treasury Secretary Scott Bessent has voiced a desire for a 10-year Treasury yield starting with a "3," a level only briefly seen during Trump's second term. The White House has consistently blamed current Fed Chair Jerome Powell for this, but that argument misses the mark.

The Federal Reserve’s direct power is primarily over the short-term Fed funds rate. While this rate serves as a foundation for credit card, auto, and business loans, it's the benchmark 10-year Treasury yield that truly dictates long-term borrowing costs like mortgages—and the Fed has very little control over it.

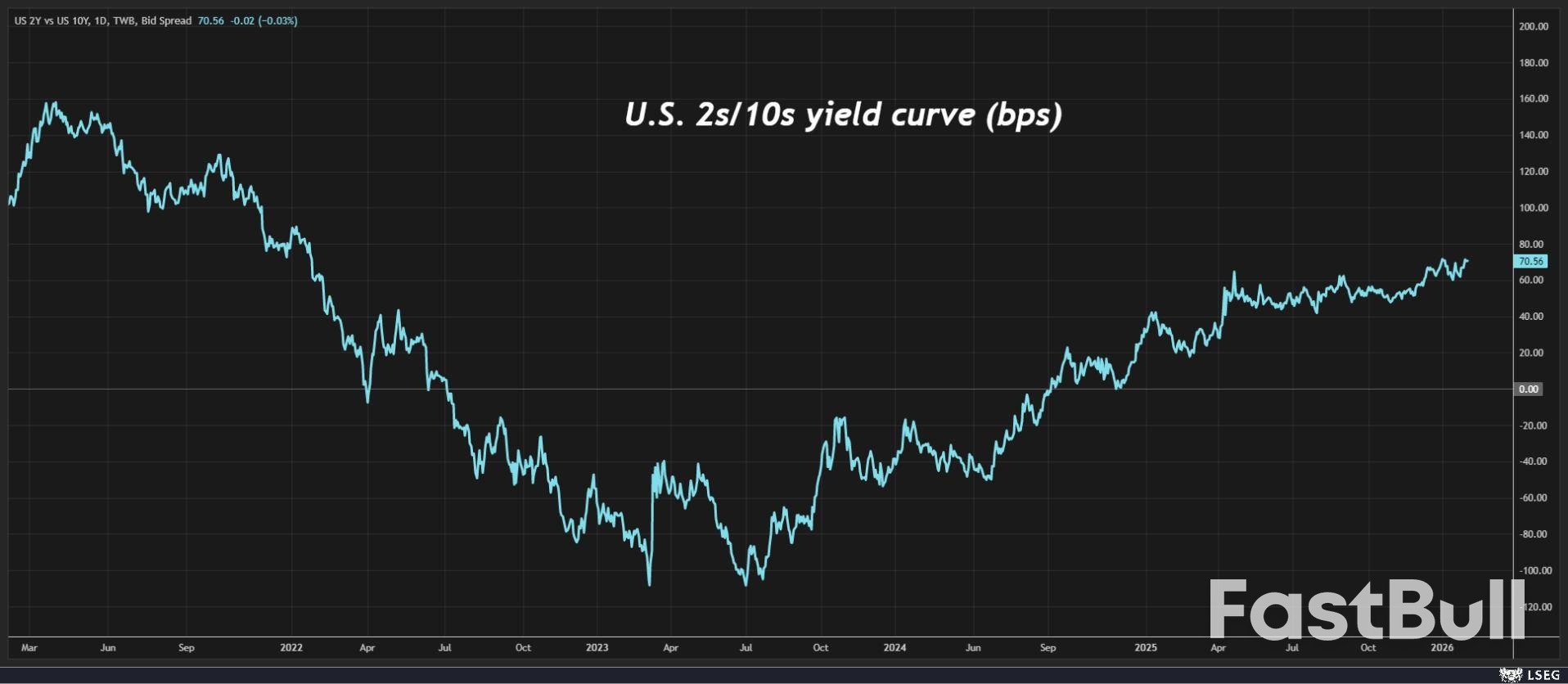

A clear example of this disconnect occurred late last year when Powell's Fed cut its policy rate by 75 basis points. Instead of falling, the 10-year Treasury yield actually climbed, now hovering around 4.30%. This has caused the yield curve to "steepen," widening the gap between short- and long-term yields to its largest in four years.

While a steeper curve can signal a healthy, normalizing economy, today's trend may point to a darker outlook for long-term inflation and interest rates.

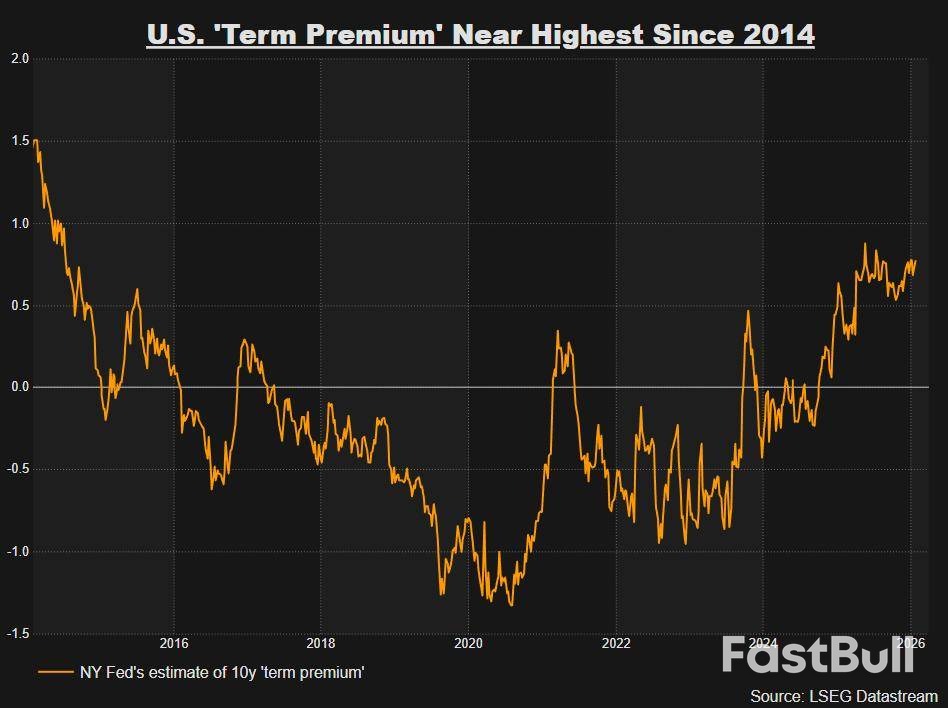

The stubbornness of long-term rates reflects a rising "term premium"—the extra compensation investors demand to hold long-term government bonds instead of rolling over short-term debt. This premium on 10-year Treasuries is now near its highest level in more than a decade.

Several factors are driving this increase:

• Sticky Inflation: Both current inflation and consumer expectations for future inflation remain elevated.

• Fiscal Worries: The long-term trajectory of U.S. public finances is a growing concern for investors.

• Central Bank Independence: Questions about the Fed's independence have not helped stabilize market sentiment.

Interest rate futures markets predict a Warsh-led Fed would cut the funds rate by 50 basis points this year, but there is little confidence that long-term rates would follow. Investors seem to be signaling a potential policy mistake: that further rate cuts now could ignite higher inflation and, consequently, higher rates down the road.

Warsh and Bessent believe they have a solution: an artificial intelligence-driven productivity boom. They argue that AI could lower inflation expectations and, ultimately, bring down long-term borrowing costs. Even Powell has acknowledged that such a scenario could help the Fed achieve its inflation target.

If this plays out, falling mortgage rates could revive the housing market and create a powerful "wealth effect" for consumers. Thirty-year mortgage rates have remained above 6% since mid-2022, a fact that Trump, a former real estate developer, is keenly aware of.

However, banking on an AI-powered bailout is a significant gamble. The productivity-enhancing effects of AI are still unproven, and it’s a stretch to assume they can counteract the powerful forces currently pushing yields higher.

Several key economic indicators suggest that long-term yields are unlikely to fall anytime soon.

• Strong Growth: The Atlanta Fed's GDPNow model estimates real economic growth is running at around 4%, implying nominal growth of nearly 7%.

• Loose Financial Conditions: According to Goldman Sachs, financial conditions are the loosest they have been in four years.

• Booming Markets: Wall Street continues to perform strongly.

None of these factors support the case for lower long-term yields or continued cuts to the Fed funds rate. Only a sharp economic downturn, a collapse in the labor market, or a major geopolitical shock would likely change this outlook—scenarios that aren't part of the Bessent-Warsh playbook.

Recognizing these limitations, Trump has started to target long-term rates more directly, threatening to cap credit card interest rates at 10% and directing the government to purchase more mortgage-backed securities. Yet he will almost certainly continue to pressure the next Fed Chair to lower rates. The fundamental problem remains: the Fed's power to control long-term borrowing costs is far more limited than the White House believes.

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

Log In

Sign Up