Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

U.K. CPI MoM (Dec)

U.K. CPI MoM (Dec)A:--

F: --

P: --

U.K. Input PPI MoM (Not SA) (Dec)

U.K. Input PPI MoM (Not SA) (Dec)A:--

F: --

U.K. Core CPI MoM (Dec)

U.K. Core CPI MoM (Dec)A:--

F: --

P: --

U.K. Retail Prices Index MoM (Dec)

U.K. Retail Prices Index MoM (Dec)A:--

F: --

P: --

U.K. Input PPI YoY (Not SA) (Dec)

U.K. Input PPI YoY (Not SA) (Dec)A:--

F: --

P: --

U.K. CPI YoY (Dec)

U.K. CPI YoY (Dec)A:--

F: --

P: --

U.K. Output PPI MoM (Not SA) (Dec)

U.K. Output PPI MoM (Not SA) (Dec)A:--

F: --

P: --

U.K. Output PPI YoY (Not SA) (Dec)

U.K. Output PPI YoY (Not SA) (Dec)A:--

F: --

P: --

U.K. Core Retail Prices Index YoY (Dec)

U.K. Core Retail Prices Index YoY (Dec)A:--

F: --

P: --

U.K. Core CPI YoY (Dec)

U.K. Core CPI YoY (Dec)A:--

F: --

P: --

U.K. Retail Prices Index YoY (Dec)

U.K. Retail Prices Index YoY (Dec)A:--

F: --

P: --

Indonesia 7-Day Reverse Repo Rate

Indonesia 7-Day Reverse Repo RateA:--

F: --

P: --

Indonesia Loan Growth YoY (Dec)

Indonesia Loan Growth YoY (Dec)A:--

F: --

P: --

Indonesia Deposit Facility Rate (Jan)

Indonesia Deposit Facility Rate (Jan)A:--

F: --

P: --

Indonesia Lending Facility Rate (Jan)

Indonesia Lending Facility Rate (Jan)A:--

F: --

P: --

South Africa Core CPI YoY (Dec)

South Africa Core CPI YoY (Dec)A:--

F: --

P: --

South Africa CPI YoY (Dec)

South Africa CPI YoY (Dec)A:--

F: --

P: --

IEA Oil Market Report

IEA Oil Market Report U.K. CBI Industrial Output Expectations (Jan)

U.K. CBI Industrial Output Expectations (Jan)A:--

F: --

U.K. CBI Industrial Prices Expectations (Jan)

U.K. CBI Industrial Prices Expectations (Jan)A:--

F: --

P: --

South Africa Retail Sales YoY (Nov)

South Africa Retail Sales YoY (Nov)A:--

F: --

P: --

U.K. CBI Industrial Trends - Orders (Jan)

U.K. CBI Industrial Trends - Orders (Jan)A:--

F: --

P: --

Mexico Retail Sales MoM (Nov)

Mexico Retail Sales MoM (Nov)A:--

F: --

P: --

U.S. MBA Mortgage Application Activity Index WoW

U.S. MBA Mortgage Application Activity Index WoWA:--

F: --

P: --

Canada Industrial Product Price Index YoY (Dec)

Canada Industrial Product Price Index YoY (Dec)A:--

F: --

Canada Industrial Product Price Index MoM (Dec)

Canada Industrial Product Price Index MoM (Dec)A:--

F: --

U.S. Weekly Redbook Index YoY

U.S. Weekly Redbook Index YoYA:--

F: --

P: --

U.S. Pending Home Sales Index YoY (Dec)

U.S. Pending Home Sales Index YoY (Dec)A:--

F: --

P: --

U.S. Pending Home Sales Index MoM (SA) (Dec)

U.S. Pending Home Sales Index MoM (SA) (Dec)A:--

F: --

P: --

U.S. Construction Spending MoM (Oct)

U.S. Construction Spending MoM (Oct)A:--

F: --

U.S. Pending Home Sales Index (Dec)

U.S. Pending Home Sales Index (Dec)A:--

F: --

P: --

U.S. API Weekly Refined Oil Stocks

U.S. API Weekly Refined Oil Stocks--

F: --

P: --

U.S. API Weekly Gasoline Stocks

U.S. API Weekly Gasoline Stocks--

F: --

P: --

U.S. API Weekly Cushing Crude Oil Stocks

U.S. API Weekly Cushing Crude Oil Stocks--

F: --

P: --

U.S. API Weekly Crude Oil Stocks

U.S. API Weekly Crude Oil Stocks--

F: --

P: --

South Korea GDP Prelim YoY (SA) (Q4)

South Korea GDP Prelim YoY (SA) (Q4)--

F: --

P: --

South Korea GDP Prelim QoQ (SA) (Q4)

South Korea GDP Prelim QoQ (SA) (Q4)--

F: --

P: --

Japan Imports YoY (Dec)

Japan Imports YoY (Dec)--

F: --

P: --

Japan Exports YoY (Dec)

Japan Exports YoY (Dec)--

F: --

P: --

Japan Goods Trade Balance (SA) (Dec)

Japan Goods Trade Balance (SA) (Dec)--

F: --

P: --

Japan Trade Balance (Not SA) (Dec)

Japan Trade Balance (Not SA) (Dec)--

F: --

Australia Employment (Dec)

Australia Employment (Dec)--

F: --

P: --

Australia Labor Force Participation Rate (SA) (Dec)

Australia Labor Force Participation Rate (SA) (Dec)--

F: --

P: --

Australia Unemployment Rate (SA) (Dec)

Australia Unemployment Rate (SA) (Dec)--

F: --

P: --

Australia Full-time Employment (SA) (Dec)

Australia Full-time Employment (SA) (Dec)--

F: --

P: --

Turkey Consumer Confidence Index (Jan)

Turkey Consumer Confidence Index (Jan)--

F: --

P: --

Turkey Capacity Utilization (Jan)

Turkey Capacity Utilization (Jan)--

F: --

P: --

Turkey Late Liquidity Window Rate (LON) (Jan)

Turkey Late Liquidity Window Rate (LON) (Jan)--

F: --

P: --

Turkey Overnight Lending Rate (O/N) (Jan)

Turkey Overnight Lending Rate (O/N) (Jan)--

F: --

P: --

Turkey 1-Week Repo Rate

Turkey 1-Week Repo Rate--

F: --

P: --

U.K. CBI Distributive Trades (Jan)

U.K. CBI Distributive Trades (Jan)--

F: --

P: --

U.K. CBI Retail Sales Expectations Index (Jan)

U.K. CBI Retail Sales Expectations Index (Jan)--

F: --

P: --

U.S. Weekly Continued Jobless Claims (SA)

U.S. Weekly Continued Jobless Claims (SA)--

F: --

P: --

U.S. Initial Jobless Claims 4-Week Avg. (SA)

U.S. Initial Jobless Claims 4-Week Avg. (SA)--

F: --

P: --

U.S. Real Personal Consumption Expenditures Final QoQ (Q3)

U.S. Real Personal Consumption Expenditures Final QoQ (Q3)--

F: --

P: --

Canada New Housing Price Index MoM (Dec)

Canada New Housing Price Index MoM (Dec)--

F: --

P: --

U.S. Weekly Initial Jobless Claims (SA)

U.S. Weekly Initial Jobless Claims (SA)--

F: --

P: --

U.S. Real GDP Annualized QoQ Final (Q3)

U.S. Real GDP Annualized QoQ Final (Q3)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

Swiss National Bank defends central bank independence; a soaring franc challenges its asset strategy amid global turmoil.

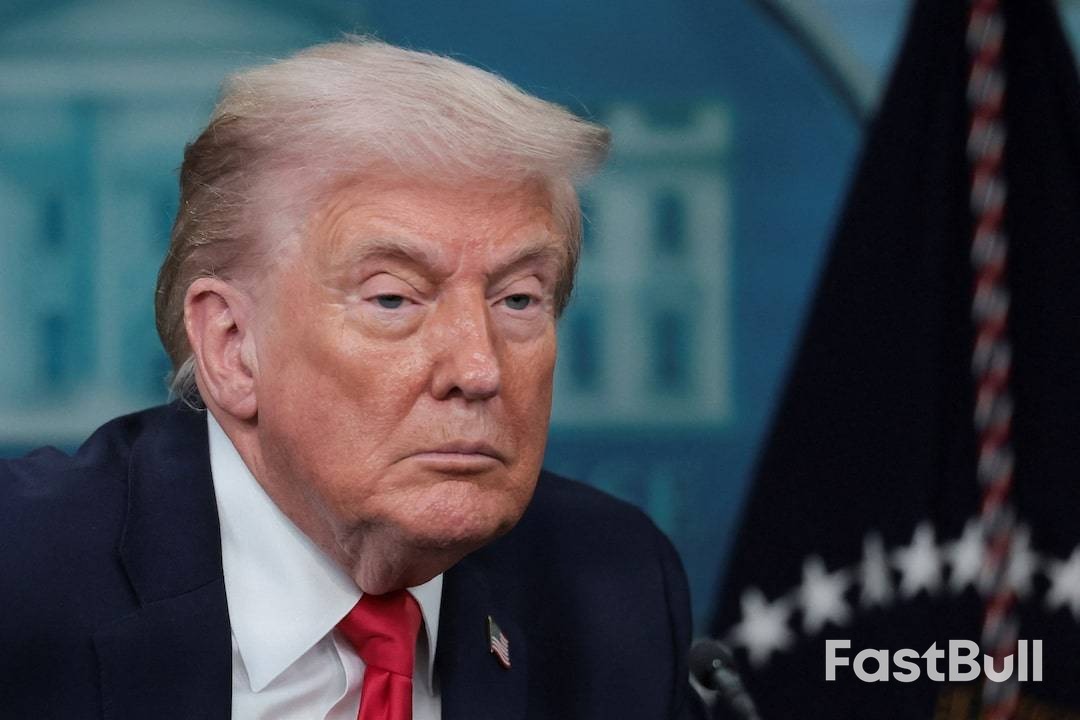

Swiss National Bank Chairman Martin Schlegel on Wednesday stressed that central bank independence is essential for controlling inflation, a statement made amid mounting political pressure on the U.S. Federal Reserve and its chair, Jerome Powell.

The SNB joined other central banks last week in supporting Powell after the U.S. Justice Department, under President Donald Trump, threatened him with a criminal investigation. Powell has described the probe, which concerns renovations at two Fed buildings, as a pretext to pressure the central bank into cutting interest rates—a move Trump has repeatedly demanded.

"Central bank independence is very important," Schlegel told Reuters during the World Economic Forum in Davos. "A central bank needs to be independent to fulfil its mandate, which is price stability."

He highlighted the global significance of the Fed's autonomy, adding, "It's really important that the Fed is independent. Typically, when a central bank is not independent, inflation is higher."

Schlegel noted that recent global political turbulence has driven up the value of the Swiss franc, which investors traditionally view as a safe-haven asset.

The franc recorded its strongest annual performance since 2002 last year, gaining nearly 14.5% against the dollar as President Trump's global tariff offensive disrupted trade and unsettled investors. Renewed fears of a trade war with Europe have fueled further gains, with the franc climbing 1.4% this week after remaining stable for most of January.

The franc's appreciation directly impacts the SNB's balance sheet, reducing the value of its dollar-denominated assets. U.S. dollar holdings constitute approximately 36% of the central bank's 765 billion Swiss francs ($966 billion) in foreign currency reserves.

While Schlegel did not comment on whether the SNB would reduce its dollar holdings, he emphasized that the bank's strategy is built on diversification and liquidity.

"What's important for us is diversification, with currencies, so U.S. dollars, euro, and so on, but also in other instruments, government bonds, corporate bonds, and also equities," he explained. "We are looking at our investment universe constantly, and we are able to make decisions if necessary."

Despite a 36.3-billion-franc profit from its gold holdings last year, driven by investors seeking refuge from economic turmoil, Schlegel confirmed the SNB has no intention of altering its position.

"We have no plan to buy or sell gold," he stated, referring to the bank's 1,040 metric tons of reserves.

The SNB also remains unconcerned by recent low inflation figures. Switzerland's annual inflation rate was 0.1% in December, sitting at the bottom of the bank's 0%-2% target range. Schlegel said the SNB expects inflation to rise but is prepared for some months of negative inflation.

"If we have some negative prints this year, for example, this is not a problem with the Swiss National Bank," he said, "because we look at the medium-term price stability."

($1 = 0.7917 Swiss francs)

Economists have hit the brakes on their rate cut predictions for the U.S. Federal Reserve. A new Reuters poll indicates a significant shift in expectations, with a majority now forecasting that the central bank will hold its key interest rate steady through the first quarter.

Just a month ago, most experts anticipated at least one rate reduction by March. Now, the consensus suggests that any policy easing is unlikely until Fed Chair Jerome Powell's term concludes in May. This pivot is driven by a surprisingly resilient U.S. economy and escalating political pressures on the central bank's independence.

The January 16-21 poll of 100 economists shows a unified front for the short term. Every respondent expects the Fed to keep rates in the 3.50%-3.75% range at its upcoming meeting on January 27-28.

Furthermore, 58% of those surveyed foresee no change for the entire quarter. This marks a stark reversal from the previous month's poll, where a rate cut was the prevailing view.

Looking beyond the first quarter, the outlook remains uncertain. However, a slight majority of 55 economists believe rate cuts could resume once Powell's tenure ends in May, highlighting the critical role of the Fed's future leadership in shaping monetary policy.

Jeremy Schwartz, a senior U.S. economist at Nomura, noted the complexity of the situation. "The economic outlook on the surface suggests the Fed should remain on hold, maybe even consider putting hikes on the table sometime later this year or next year," he said. "In reality, though, we think the Fed will remain on hold for the remainder of Powell's term through May, but we suspect the new leadership will likely manage to get another 50 basis points of rate cuts later in the year."

The Fed's policy path is complicated by mounting political interference. President Donald Trump has consistently criticized Chair Powell for not cutting rates more aggressively.

These tensions have intensified recently, with the Justice Department bringing criminal charges against Powell concerning renovations at the Fed's headquarters. Concurrently, an attempt by Trump to remove Fed Governor Lisa Cook is awaiting a Supreme Court hearing.

This contentious environment is expected to impact the selection of the next Fed chair, a decision Treasury Secretary Scott Bessent suggested could come as early as next week.

"There's going to be more pushback than ever on the selection of the next chair, all because of the criminal investigation," said Bernard Yaros, lead U.S. economist at Oxford Economics. "I don't expect Trump to be able to really fill the Fed with people who will cut interest rates."

Underlying the delayed rate-cut expectations is the sheer strength of the U.S. economy. After expanding at a robust 4.3% pace in the third quarter, growth is now projected to hit 2.3% this year, an upgrade from the 2.0% predicted last month. This forecast is well above the 1.8% level the Fed considers non-inflationary.

Economists at Oxford Economics are even more bullish, forecasting 2.8% growth in 2026. "We are looking for a very strong U.S. GDP growth in 2026 due to further investments in AI, but even more because of the tax cuts under the fiscal bill," Yaros explained. He estimates the bill will add six-tenths of a percentage point to annual GDP growth this year alone.

This sustained economic momentum reduces the urgency for the Fed to stimulate activity with lower interest rates.

A consequence of strong economic growth is that inflation is likely to remain elevated. According to the poll, the Personal Consumption Expenditures (PCE) index—the Fed's preferred inflation gauge—is expected to stay above the 2% target for the rest of this year and through 2028.

Meanwhile, the labor market remains stable, with the unemployment rate projected to average 4.5% this year. With solid growth, a tight job market, and persistent inflation, the economic argument for holding interest rates steady appears compelling.

Remarks of Officials

Middle East Situation

Latest news on the Israeli-Palestinian conflict

Palestinian-Israeli conflict

Political

A fragile U.S.-brokered ceasefire in Gaza is under severe pressure as fresh violence erupts, stalling a 20-point peace plan championed by President Donald Trump. Israeli fire has killed five Palestinians, including two boys, according to local health officials, highlighting the repeated violations that have plagued the truce since it began in October.

The agreement, intended to de-escalate a two-year war that has devastated the region, is struggling to move beyond its initial phase.

In central Gaza, Palestinian medics reported that Israeli tank shelling east of Deir Al-Balah resulted in the deaths of three people, one of whom was a 10-year-old boy. Two other Palestinians, a 13-year-old boy and a woman, were killed in separate shooting incidents in eastern Khan Younis, located in the southern part of the enclave.

Local residents stated these incidents occurred in areas controlled by Palestinians. While the ceasefire involved a partial Israeli military withdrawal, Israeli forces still hold approximately 53% of Gaza and have been gradually expanding their presence, leading to further displacement of Palestinian families.

Earlier on Wednesday, the Israeli military announced its forces had killed a "terrorist" who posed an imminent threat after crossing into an area under their control.

The October deal has not progressed past its first stage, which involved a cessation of major fighting, a partial Israeli pullback, and an exchange of Hamas-held hostages for Palestinian detainees and prisoners.

Future phases of the plan remain stalled, with no timetable set for their implementation. These steps are supposed to include:

• The disarmament of Hamas.

• A further withdrawal of Israeli forces.

• The installation of an internationally supported administration to oversee the reconstruction of Gaza.

On Thursday, President Trump is scheduled to preside over a ceremony for the Board of Peace, a group he established with the stated aim of redeveloping the coastal territory.

Disputes Over Hostages and Disarmament

Progress is deadlocked over key disagreements. Israel insists it will only proceed to the second phase after Hamas returns the remains of the last Israeli hostage.

In response, Hamas Gaza spokesperson Hazem Qassem said on Wednesday that the group has shared all available information about the body and that its search efforts were unsuccessful, blaming what he termed obstruction by the Israeli military.

Since the ceasefire took effect, more than 460 Palestinians and three Israeli soldiers have been reported killed in clashes. The wider conflict began after a Hamas-led attack on October 7, 2023, which killed 1,200 people, according to Israeli data. Israel's subsequent air and ground assault has killed 71,000 Palestinians, according to Gaza's health authorities.

The European Union has officially decided against forcing the world's largest tech companies to help pay for overhauling Europe's telecommunications infrastructure, ending a long-running and contentious debate.

Brussels announced on Wednesday that instead of mandating "fair share" payments from tech giants like Netflix for their high bandwidth usage, it will pursue a voluntary system. The decision is a setback for European telecom providers, who have long argued that Big Tech should contribute financially to network maintenance and upgrades.

Tech firms have consistently opposed these proposals, warning that such fees would ultimately force consumers to pay twice—first for their internet access and again through higher subscription costs for streaming and cloud services.

The European Commission is now proposing a "voluntary cooperation mechanism" between connectivity providers and major content and cloud companies. This approach sidesteps direct regulation and aligns with a tariff agreement made last year between the EU and the United States, in which Brussels promised "not to adopt or maintain network usage fees."

"We shouldn't come with very strict rules from the commission," EU tech chief Henna Virkkunen told reporters in Strasbourg.

Despite the EU's lighter touch, both the tech and telecom industries expressed disappointment with the new plan.

Big Tech Remains Wary of "Ambiguous" Plan

The tech sector voiced immediate concern over the proposal's wording, fearing it could still lead to new fees.

"We are deeply concerned by the proposal's ambiguous language," stated Maria Teresa Stecher of the tech lobby group CCIA Europe. "The ecosystem is functioning well, yet this unnecessary mechanism has been introduced, clearly opening the door to network usage fees."

Telecom Industry Laments Lack of Bold Action

Meanwhile, telecom operators argued that the plan fails to address the core issue of funding future investments.

Connect Europe, a group representing European connectivity providers, described the draft law as a "continuation of the status quo." The group added that, "apart from spectrum, [it is] lacking transformative proposals to foster much-needed investment."

The announcement is part of the EU executive's wider "Digital Networks Act," a legislative package designed to modernize and strengthen Europe's fragmented telecom market. The EU estimates that over €200 billion ($234 billion) is required for this modernization.

Key proposals within the act include:

• Simplified Operations: Allowing companies to register in just one member state to provide services across the entire bloc.

• Predictable Licensing: Granting telecoms longer radio spectrum licenses, currently set for at least 20 years, and making them renewable by default to increase predictability for operators.

As part of the long-term vision, Brussels is also proposing a deadline of 2035 for member states to transition their infrastructure from older copper networks to faster fibre technology. The proposed legislation will now move to the European Parliament and member states for discussion before it can become law.

Major Wall Street banks are in talks with the Trump administration to shape policies aimed at tackling the rising cost of living, a critical issue for voters heading into the midterm elections. While engaging with the White House, financial leaders are expressing skepticism about some of President Trump’s key proposals and suggesting alternative strategies, according to sources familiar with the discussions in Davos, Switzerland.

The central conflict revolves around the effectiveness of the administration's ideas. Economic challenges, particularly the high cost of essentials like housing and groceries, were a major factor in Trump's 2024 election win. Although inflation has cooled since its post-pandemic peak, persistent high prices threaten the Republican party's standing in the upcoming November elections.

President Trump has floated several proposals designed to provide financial relief to Americans. Among the most prominent are plans to cap credit card interest rates and to allow people to use 401(k) retirement funds for a down payment on a home.

However, these ideas have been met with resistance from the financial sector. The proposal to cap credit card rates, in particular, has caused concern, leading to a drop in major bank shares. Banks argue that such a move would be counterproductive, while investors have questioned whether tapping retirement accounts would solve the core issue in the housing market, which they identify as a lack of supply.

Banking executives are publicly and privately pushing back against the idea of interest rate caps. Speaking from Davos, Citigroup CEO Jane Fraser told CNBC that while "the President is right in focusing on affordability," she does not expect Congress to approve the caps. She added that such a policy "would not be good for the U.S. economy."

According to sources, banks argue that price caps would directly impact the availability and pricing of credit. One potential response, an executive noted, would be to substantially reduce the credit lines offered to customers to mitigate potential losses.

While the financial industry is resistant, U.S. Treasury Secretary Scott Bessent stated on Tuesday that it was "not unreasonable" to have a discussion about the practices of credit card companies, suggesting various options could be considered.

Instead of measures they see as disruptive, Wall Street is proposing a different set of solutions to the White House. One senior U.S. banking executive framed the industry's approach as collaborative, stating, "We're saying, 'What are you trying to achieve? Let's figure out ways to help you.'"

The alternative ideas from the banking sector include:

• Encouraging higher rates of retirement savings.

• Incentivizing the earlier transfer of wealth from parents and grandparents to their children.

• Modifying the 401(k) proposal to allow parents and grandparents, who typically have larger retirement balances, to tap their funds for their children's housing down payments.

On the housing front, banks acknowledge that increasing purchasing power without addressing supply could drive prices even higher. To boost supply, one source suggested allowing older Americans to sell their homes tax-free.

Despite the ongoing dialogue, there is a consensus that none of the proposed policies—from either the administration or the banks—are likely to have a meaningful impact on American household budgets before the November elections.

One source noted that fixing the housing market, for example, requires "patience that no one has." The Trump administration is reportedly listening to these alternative ideas, with "smart people in there working hard at this stuff." However, with policy details still unclear, Wall Street remains in a holding pattern, waiting for a clear direction before taking any action.

Collecting snow for water at home; sleeping in gloves, coats and hats; heating bricks on gas stoves for warmth; erecting tents indoors - Kyiv residents are doing everything they can to survive the coldest, darkest winter of the war.

"When there is no electricity, there is no heating: it means the apartment freezes," said Anton Rybikov, father of three-year-old David and two-year-old Matvii, speaking to Reuters in their home, where he and his wife Marina have stocked up on backup batteries and sleeping bags.

The 39-year-old military chaplain said one of his sons recently contracted pneumonia after temperatures in the apartment fell to 9 degrees Celsius (48 Fahrenheit) during a power blackout of more than 19 hours following Russian airstrikes.

"It's emotionally very difficult. There is constant worry," Rybikov added, as he prepared to heat water in a metal milk churn. "This winter is the hardest."

Russia has intensified its attacks on Ukraine's energy infrastructure in recent months, concentrating missile and drone strikes on the cities of Kyiv, Kharkiv and Dnipro.

British military intelligence estimated that Russia launched 55,000 unmanned aerial systems at Ukraine last year, around five times the number in 2024, according to one of its regular reports on the war posted on X.

Ukraine has called for more Western air defences to cope with the drone and missile barrages.

With temperatures plunging to minus 18 degrees Celsius across snow-covered Kyiv, the attacks mean hundreds of thousands of the capital's three million residents are struggling with lengthy interruptions to power and water supplies.

On Tuesday, after a major Russian strike overnight, President Volodymyr Zelenskiy said more than a million households in the city had no power.

Simple routines like showering and cooking are now a challenge. For the first time since the full-scale Russian invasion nearly four years ago, the government last week declared a state of emergency related to the energy crisis.

Russia says its attacks on Ukraine are designed to degrade its military and denies targeting civilians.

Kyiv mayor Vitali Klitschko told Reuters that the strikes on the capital were meant to "break resistance, break the Ukrainians' spirit, to do everything for people to become depressed and pack their bags and vacate the territory."

"Kyiv has always been and remains the target for the aggressor," he said in an interview in his office.

Across the city, thousands of people now gather in schools and at makeshift street "invincibility points" where generators allow them to warm up, charge their phones and connect to the internet.

At a food distribution point in Kyiv run by World Central Kitchen, 66-year-old pensioner Valentyna Kiriiakova queued for hot food along with her granddaughter, Yeva Teplova.

"We don't complain," said Kiriiakova, whose high-rise apartment had no power, leaving her unable to cook. "We understand that there is a war going on and we have to endure. We have to survive."

Russia's onslaught on Ukraine's energy system has led to power and water outages in Kyiv that typically last three to four times longer than previous winters.

Economy Minister Oleksii Sobolev said that since October, Russia had damaged 8.5 gigawatts of Ukraine's generation capacity — nearly half of typical power consumption — forcing record electricity imports.

Russia has also struck Ukrainian gas production facilities, said energy company Naftogaz. The central bank governor said late last year that Ukraine lost about a half of its gas output, forcing it to spend more on imports.

"Ukraine's energy system is not broken, but it is operating in a mode of constant degradation," said Olena Lapenko, general director for safety and resilience at energy think-tank Dixi Group.

Schools and universities have extended their winter holidays, and many companies have moved to remote work or reduced their operating hours.

Dozens of repair teams hurry across Kyiv from site-to-site to patch up the damage caused by Russian strikes.

"There is a lot of work. The grids cannot withstand such pressure all at once," said Hennadii Barulin, 55, a digger operator, as his team worked to restore power to residents.

"This is a real winter. It is very difficult to break through the ground, through the asphalt, through everything."

Sobolev said Ukraine's stocks of energy equipment had been depleted and that urgent financial support of about $1 billion was required to deal with the current emergency.

Ukraine's Western partners rushed in hundreds of generators, powerful batteries and industrial boilers to help cover some gaps, according to the foreign ministry.

Newly appointed Energy Minister Denys Shmyhal said Ukraine has made some progress installing small, independent generation capacity to reduce reliance on the heavily centralised, Soviet-era system. He said 762 megawatts were installed in 2025, compared with 225 megawatts in 2024.

"Given the critical state of the energy sector, such pace is clearly insufficient."

Shmyhal also said Kyiv lagged behind other Ukrainian cities in installing independent generation capacity - criticism the mayor rejected.

With freezing temperatures forecast for several more weeks and further Russian strikes expected, energy experts say the situation is unlikely to improve soon.

Rybikov said he would consider sending his sons out of Kyiv if the blackouts worsen.

"We need the warmth so that the children do not freeze. The rest we will get through," he said. "If there is a blackout, I will send the children away."

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up