Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

Mexico Unemployment Rate (Not SA) (Dec)

Mexico Unemployment Rate (Not SA) (Dec)A:--

F: --

P: --

Canada National Economic Confidence Index

Canada National Economic Confidence IndexA:--

F: --

P: --

U.S. Non-Defense Capital Durable Goods Orders MoM (Excl. Aircraft) (Nov)

U.S. Non-Defense Capital Durable Goods Orders MoM (Excl. Aircraft) (Nov)A:--

F: --

U.S. Durable Goods Orders MoM (Excl. Defense) (SA) (Nov)

U.S. Durable Goods Orders MoM (Excl. Defense) (SA) (Nov)A:--

F: --

U.S. Durable Goods Orders MoM (Excl.Transport) (Nov)

U.S. Durable Goods Orders MoM (Excl.Transport) (Nov)A:--

F: --

P: --

U.S. Durable Goods Orders MoM (Nov)

U.S. Durable Goods Orders MoM (Nov)A:--

F: --

U.S. Chicago Fed National Activity Index (Nov)

U.S. Chicago Fed National Activity Index (Nov)A:--

F: --

U.S. Dallas Fed New Orders Index (Jan)

U.S. Dallas Fed New Orders Index (Jan)A:--

F: --

P: --

U.S. Dallas Fed General Business Activity Index (Jan)

U.S. Dallas Fed General Business Activity Index (Jan)A:--

F: --

U.S. 2-Year Note Auction Avg. Yield

U.S. 2-Year Note Auction Avg. YieldA:--

F: --

P: --

U.K. BRC Shop Price Index YoY (Jan)

U.K. BRC Shop Price Index YoY (Jan)A:--

F: --

P: --

China, Mainland Industrial Profit YoY (YTD) (Dec)

China, Mainland Industrial Profit YoY (YTD) (Dec)A:--

F: --

P: --

Germany 2-Year Schatz Auction Avg. Yield

Germany 2-Year Schatz Auction Avg. YieldA:--

F: --

P: --

Mexico Trade Balance (Dec)

Mexico Trade Balance (Dec)A:--

F: --

P: --

U.S. Weekly Redbook Index YoY

U.S. Weekly Redbook Index YoYA:--

F: --

P: --

U.S. S&P/CS 20-City Home Price Index YoY (Not SA) (Nov)

U.S. S&P/CS 20-City Home Price Index YoY (Not SA) (Nov)A:--

F: --

P: --

U.S. S&P/CS 20-City Home Price Index MoM (SA) (Nov)

U.S. S&P/CS 20-City Home Price Index MoM (SA) (Nov)A:--

F: --

U.S. FHFA House Price Index MoM (Nov)

U.S. FHFA House Price Index MoM (Nov)A:--

F: --

P: --

U.S. FHFA House Price Index (Nov)

U.S. FHFA House Price Index (Nov)A:--

F: --

P: --

U.S. FHFA House Price Index YoY (Nov)

U.S. FHFA House Price Index YoY (Nov)A:--

F: --

U.S. S&P/CS 10-City Home Price Index YoY (Nov)

U.S. S&P/CS 10-City Home Price Index YoY (Nov)A:--

F: --

P: --

U.S. S&P/CS 10-City Home Price Index MoM (Not SA) (Nov)

U.S. S&P/CS 10-City Home Price Index MoM (Not SA) (Nov)A:--

F: --

P: --

U.S. S&P/CS 20-City Home Price Index (Not SA) (Nov)

U.S. S&P/CS 20-City Home Price Index (Not SA) (Nov)A:--

F: --

P: --

U.S. S&P/CS 20-City Home Price Index MoM (Not SA) (Nov)

U.S. S&P/CS 20-City Home Price Index MoM (Not SA) (Nov)A:--

F: --

P: --

U.S. Richmond Fed Manufacturing Composite Index (Jan)

U.S. Richmond Fed Manufacturing Composite Index (Jan)A:--

F: --

P: --

U.S. Conference Board Present Situation Index (Jan)

U.S. Conference Board Present Situation Index (Jan)--

F: --

P: --

U.S. Conference Board Consumer Expectations Index (Jan)

U.S. Conference Board Consumer Expectations Index (Jan)--

F: --

P: --

U.S. Richmond Fed Manufacturing Shipments Index (Jan)

U.S. Richmond Fed Manufacturing Shipments Index (Jan)A:--

F: --

P: --

U.S. Richmond Fed Services Revenue Index (Jan)

U.S. Richmond Fed Services Revenue Index (Jan)--

F: --

P: --

U.S. Conference Board Consumer Confidence Index (Jan)

U.S. Conference Board Consumer Confidence Index (Jan)A:--

F: --

P: --

U.S. 5-Year Note Auction Avg. Yield

U.S. 5-Year Note Auction Avg. Yield--

F: --

P: --

U.S. API Weekly Refined Oil Stocks

U.S. API Weekly Refined Oil Stocks--

F: --

P: --

U.S. API Weekly Crude Oil Stocks

U.S. API Weekly Crude Oil Stocks--

F: --

P: --

U.S. API Weekly Gasoline Stocks

U.S. API Weekly Gasoline Stocks--

F: --

P: --

U.S. API Weekly Cushing Crude Oil Stocks

U.S. API Weekly Cushing Crude Oil Stocks--

F: --

P: --

Australia RBA Trimmed Mean CPI YoY (Q4)

Australia RBA Trimmed Mean CPI YoY (Q4)--

F: --

P: --

Australia CPI YoY (Q4)

Australia CPI YoY (Q4)--

F: --

P: --

Australia CPI QoQ (Q4)

Australia CPI QoQ (Q4)--

F: --

P: --

Germany GfK Consumer Confidence Index (SA) (Feb)

Germany GfK Consumer Confidence Index (SA) (Feb)--

F: --

P: --

Germany 10-Year Bund Auction Avg. Yield

Germany 10-Year Bund Auction Avg. Yield--

F: --

P: --

India Industrial Production Index YoY (Dec)

India Industrial Production Index YoY (Dec)--

F: --

P: --

India Manufacturing Output MoM (Dec)

India Manufacturing Output MoM (Dec)--

F: --

P: --

U.S. MBA Mortgage Application Activity Index WoW

U.S. MBA Mortgage Application Activity Index WoW--

F: --

P: --

Canada Overnight Target Rate

Canada Overnight Target Rate--

F: --

P: --

BOC Monetary Policy Report

BOC Monetary Policy Report U.S. EIA Weekly Crude Stocks Change

U.S. EIA Weekly Crude Stocks Change--

F: --

P: --

U.S. EIA Weekly Cushing, Oklahoma Crude Oil Stocks Change

U.S. EIA Weekly Cushing, Oklahoma Crude Oil Stocks Change--

F: --

P: --

U.S. EIA Weekly Crude Demand Projected by Production

U.S. EIA Weekly Crude Demand Projected by Production--

F: --

P: --

U.S. EIA Weekly Crude Oil Imports Changes

U.S. EIA Weekly Crude Oil Imports Changes--

F: --

P: --

U.S. EIA Weekly Heating Oil Stock Changes

U.S. EIA Weekly Heating Oil Stock Changes--

F: --

P: --

U.S. EIA Weekly Gasoline Stocks Change

U.S. EIA Weekly Gasoline Stocks Change--

F: --

P: --

BOC Press Conference

BOC Press Conference Russia PPI MoM (Dec)

Russia PPI MoM (Dec)--

F: --

P: --

Russia PPI YoY (Dec)

Russia PPI YoY (Dec)--

F: --

P: --

U.S. Target Federal Funds Rate Lower Limit (Overnight Reverse Repo Rate)

U.S. Target Federal Funds Rate Lower Limit (Overnight Reverse Repo Rate)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

Aramco's $4B bond sale amid weak oil prices underscores growing financial strain for the oil giant and Saudi Arabia.

Saudi Arabia's state-owned oil giant, Aramco, has successfully issued a $4 billion bond, marking its first entry into the debt market this year. The move comes as global oil prices remain weak, hovering in the low $60s per barrel range.

The company, which is the world's largest crude exporter, initially announced its plan to issue U.S. dollar-denominated international bonds under its Global Medium Term Note Programme, stating the final amount would depend on market conditions.

The offering ultimately raised $4 billion through a four-tranche bond that attracted more than $21 billion in orders from investors.

This exceptionally high demand allowed Aramco to secure more favorable terms. According to market sources, the company was able to offer lower yields compared to benchmark U.S. Treasuries than it had initially guided, reducing its borrowing costs.

While this is Aramco's first bond sale of the year, it represents the company's second debt issuance in the last five months, highlighting a growing trend. In September 2025, the oil firm offered Islamic bonds, known as sukuk, with five and ten-year maturities.

The turn to debt markets follows a period of financial pressure caused by declining oil prices. Lower prices have already reduced Aramco's cash flows, with Q1 figures showing a decline and Q2 results revealing an even larger drop in both cash flow and profits as prices slumped.

Aramco's recent bond sale is part of a broader pattern of increased borrowing by Saudi Arabia as the Kingdom grapples with the financial impact of lower oil revenue. This trend suggests that the country's finances are under strain.

Other recent debt activities include:

• Saudi Arabia: The Kingdom sold $5.5 billion in Islamic bonds, which received orders totaling $17.5 billion.

• Public Investment Fund (PIF): The nation's sovereign wealth fund raised $2 billion by selling 10-year dollar bonds to help finance its investment plans.

Saudi Arabia’s budget deficit expanded last year as oil prices have remained well below the estimated $90 per barrel the Kingdom needs to balance its budget, prompting both the government and its flagship company to increasingly tap debt markets for funding.

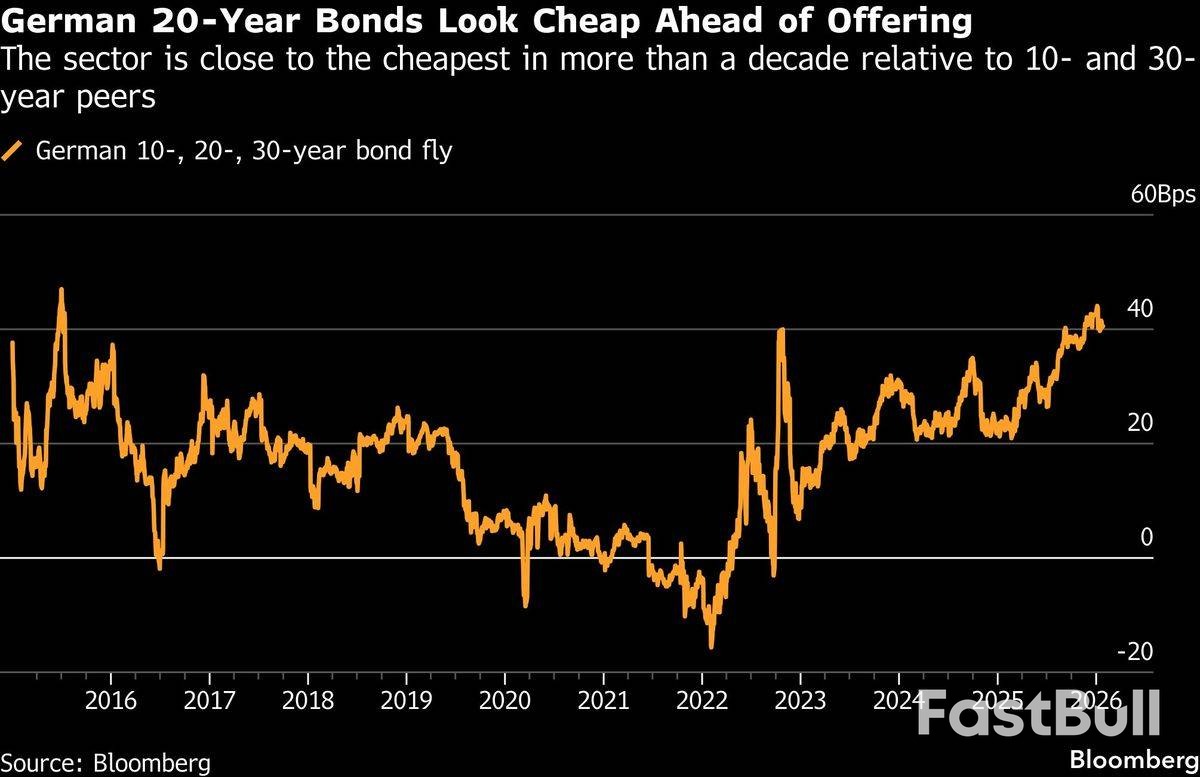

Germany has successfully raised €6.5 billion from its first-ever sale of new 20-year government bonds, attracting a near-record flood of investor orders that signals intense appetite for sovereign debt.

The offering for the new May 2047 note drew orders exceeding €72 billion, just shy of the national record set for a 30-year bond two years ago. According to sources familiar with the deal, the final price was set at two basis points over comparable bonds, slightly tighter than the initial guidance.

This landmark sale is part of a broader government strategy to increase its debt offerings and expand its range of maturities. The move follows the loosening of strict borrowing limits last year, an effort aimed at revitalizing Europe's largest economy.

The successful German offering highlights a historically busy start to the year for global bond sales, as borrowers capitalize on strong investor demand. Other European nations, including Italy and Portugal, have also recently seen record-breaking orders for their debt issues.

Financial authorities anticipated strong interest, partly due to an overhaul of the Dutch pension system—the largest in the region—which has dampened appetite for longer-term 30-year bonds and shifted focus to intermediate maturities.

"It's been a very good start of the year for all these syndications," said Evelyne Gomez-Liechti, a strategist at Mizuho International plc. "Investors are happy to have German risk at current yield levels."

A key driver of the high demand is the attractiveness of current yields. German 20-year yields are trading around 3.39%, close to a 14-year high reached last month.

Furthermore, this particular bond maturity is considered relatively cheap. When compared to its 10- and 30-year peers, the 20-year sector is trading near its most affordable level in over a decade, making it a compelling opportunity for investors.

While Germany has occasionally sold debt with this maturity in the past decade, those were bonds originally issued with longer terms that had shortened over time. This sale marks the first new issuance specifically targeting the 20-year segment.

"The 20-year segment is being developed to meet demand," noted Tammo Diemer, co-director of Germany's finance agency, when the plan was first announced last month.

The decision to launch a new 20-year bond comes with historical context. Five years ago, the United States struggled to find consistent buyers when it reintroduced its own 20-year bonds. A notably poor auction in May of that year even triggered a wider market selloff.

Steven Mnuchin, who served as Treasury Secretary under President Donald Trump and brought the bond back, later admitted the move was "costly to the taxpayer."

However, market appetite appears to have evolved. A recent US sale of 20-year bonds was oversubscribed by the second-highest margin on record, indicating that investor demand for this maturity is improving.

Germany opted for a debt syndication, a method that is typically more expensive than a conventional auction but allows governments to raise large sums quickly while diversifying their investor base. The bookrunners for the deal included Barclays plc, BNP Paribas SA, Citigroup Inc, Deutsche Bank AG, JPMorgan Chase & Co, and Morgan Stanley.

The strong demand for German debt was not limited to this offering. On Tuesday, the finance agency also sold new two-year notes through a standard auction, which was similarly met with robust investor interest.

The Czech National Bank (CNB) may consider a small interest rate cut at its upcoming policy meeting, driven primarily by economic shifts happening outside the country, according to Vice-Governor Jan Frait.

In an interview on Monday, Frait suggested that external pressures, such as potential rate cuts by other major central banks, are now a central consideration for the CNB's board.

"In my view the external forces are exactly what the meeting will be and should be about," Frait said, describing them as a "very, very strong set of factors."

This focus on international trends marks a significant pivot, as the Czech Republic's domestic economy shows signs that would typically support maintaining higher interest rates. Frait acknowledged that a domestic recovery, a tight labor market, rising wages, and a loose fiscal policy all argue against monetary easing.

"Labour market and wage developments were truly an argument for maintaining relatively higher interest rates," he stated.

Despite these strong local indicators, the vice-governor projected that rates would likely remain stable or fall by a maximum of 50 basis points over the course of the year.

The central bank's last policy move was in May 2025, when it cut its main repo rate by half to 3.50% before pausing.

Initially, the CNB had signaled that its next adjustment would likely be a rate hike. However, the board altered its perspective in December, changing its official risk assessment for meeting its 2% inflation target from "inflationary" to "neutral." This adjustment opened the door for discussions about potential rate cuts.

The bank’s next meeting on February 5 will be crucial, as board members will review new economic forecasts alongside their rate decision. Frait underscored the importance of pre-emptive policymaking but did not reveal how he intends to vote.

Prime Minister Narendra Modi announced an ambitious plan to attract US$100 billion (RM395.45 billion) in investment into India's oil and gas sector by the end of the decade. Speaking via video at the India Energy Week conference, Modi outlined a strategy centered on expanding drilling into previously restricted territories.

To support this push, India also plans to increase its refining capacity by one million barrels per day, reaching a total of six million. This move signals a long-term commitment to domestic energy processing and provides a stable demand outlook for potential explorers.

The new initiative aims to address a long-standing economic vulnerability. For decades, India's own oil production has failed to keep pace with its surging demand, forcing the country to import 90% of its crude oil and half of its natural gas needs.

This heavy reliance on foreign energy is a significant drain on the nation's foreign exchange reserves. In December alone, oil and gas imports comprised 17% of the total value of goods shipped from overseas.

Currently, India's domestic oil output averages just 550,000 barrels a day—comparable to the combined production of OPEC members Congo and Gabon, but only a small fraction of the country's total consumption.

To reverse this trend, India is opening nearly one million square kilometers of previously ring-fenced areas to oil and gas exploration. This new territory is in addition to the 170 blocks already available for drilling.

A key component of this strategy is the National Deepwater Exploration Mission, which was launched last August. The mission's goals include:

• Unlocking between 600 million and 1,200 million tonnes of oil and gas reserves.

• Drilling 40 new wildcat wells to discover new fields.

• Doubling the country's reserves by 2032.

• Tripling domestic output by 2047.

• Ultimately slashing import dependency by 88%.

Indian government bond yields surged to a nearly 11-month high on Tuesday, as concerns over heavy government borrowing and tight liquidity overshadowed central bank support.

The benchmark 10-year 6.48% 2035 bond yield settled at 6.7194%, its highest level since March 4. This was a notable increase from the previous close of 6.6635% on Friday, following a market holiday on Monday.

A key driver of the sell-off was a significant supply of new debt from state governments. States sold 398 billion rupees in bonds at slightly elevated yields, contributing to market pressure.

This is part of a broader trend, as states have announced a record borrowing plan of 5 trillion rupees for the January-March quarter. Adding to investor concerns, the central government is expected to announce its own record gross borrowing plan for the next fiscal year, estimated to be between 16 trillion and 17.5 trillion rupees. Traders fear this supply glut will continue to weigh on bond prices.

The rising yields occurred despite a recent announcement from the Reserve Bank of India (RBI). After market hours on Friday, the central bank said it would inject over $23 billion of liquidity into the banking system.

However, the positive impact of this announcement was eclipsed by the immediate and substantial supply of new debt hitting the market.

Indian bond yields have been rising for weeks, even though the RBI has already cut interest rates by 100 basis points this year and engaged in record bond purchases. This reflects a difficult dynamic where debt supply is outpacing demand.

The situation has been made worse by persistently tight liquidity in the banking system, which has blunted the effect of the RBI's rate cuts.

In a note, an economist at BofA Securities observed, "Despite the RBI resuming its rate cutting cycle in December, the rate transmission has stalled meaningfully thanks to tight liquidity conditions."

Data shows India's average bank liquidity surplus was only 0.2% of bank deposits in January, with a daily average of 569 billion rupees. This is well below the RBI's stated goal of keeping the surplus within the 0.6% to 1% range, as mentioned by Governor Sanjay Malhotra.

The impact of tight liquidity was also visible in the overnight index swap (OIS) market, where the curve steepened.

• The one-year OIS was slightly down at 5.5925%.

• The two-year OIS rate rose 3.25 basis points to 5.76%.

• The five-year OIS rate climbed 4.25 basis points to 6.18%.

North Korea launched multiple ballistic missiles toward the sea on Tuesday in a move that coincided with high-level defense talks between the United States and South Korea. Officials in Seoul and Tokyo identified the projectiles as likely being short-range missiles, continuing Pyongyang's pattern of weapons testing.

The launch underscores regional tensions as Washington and Seoul work to modernize their military alliance and redefine the U.S. role in deterring North Korean threats.

South Korea's Joint Chiefs of Staff reported that the missiles were fired from an area near Pyongyang at approximately 3:50 p.m. local time. The projectiles traveled about 350 kilometers (217 miles) before landing in the sea off North Korea's east coast.

Japanese authorities provided further details, with Japan's coast guard detecting the missile launch and noting a maximum altitude of 80 km. Prime Minister Sanae Takaichi confirmed the missiles would not have an impact on Japan.

Both South Korea and Japan swiftly condemned the launch as a violation of international agreements.

• South Korea: The Office of National Security labeled the test a "provocative activity" and urged North Korea to immediately stop its ballistic missile launches, which defy U.N. Security Council resolutions.

• Japan: The Japanese government issued a statement calling the repeated launches a threat to the peace and security of Japan, the region, and the international community. Tokyo lodged a strong protest with Pyongyang, describing the action as a grave issue affecting public safety.

The missile test occurred as a senior U.S. Defense Department official was visiting South Korea to discuss the future of the two countries' combined defense posture. The talks have focused on modernizing their alliance, with Washington reportedly exploring a more limited role in direct defense efforts against North Korea.

In recent months, North Korea has frequently tested short-range missiles and multiple-launch rockets, which it claims are essential for its tactical nuclear arsenal.

Global interest in Pyongyang's short-range ballistic missiles and artillery has intensified after it began supplying these weapons to Russia. Under a 2024 mutual defense pact, North Korean arms have been used in the war against Ukraine, raising the stakes of its continued weapons development.

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

Log In

Sign Up