Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

Stats Office - Swiss December Retail Sales +2.9% Year-On-Year Versus Revised +1.7% In Previous Month

Iran's Foreign Ministry Spokesperson Baghaei Says Tehran Is Examining Details Of Various Diplomatic Processes, Hopes For Results In Coming Days

FAA Head Says Concerned Other Countries Aren't Putting Enough Resources Into Certifying USA Aircraft

German Dec Retail Sales +1.5 Percent Year-On-Year (Versus Reuters Consensus Forecast For +1.1 Percent)

Russian Security Committee's Vice Chairman Medvedev: Russia Will Not Accept NATO-Member Forces In Ukraine

Russian Security Committee's Vice Chairman Medvedev: Nuclear Arms Control For Past 60 Years Helped Verify Intentions And Build Trust

Russian Security Committee's Vice Chairman Medvedev: The Territorial Issue In Ukraine Talks Is Most Complicated

Russian Security Committee's Vice Chairman Medvedev: If New Start Expires It Does Not Necessarily Mean A Catastrophe But It Should Alarm Everyone

Russian Security Committee's Vice Chairman Medvedev: Our Proposal To USA On Extending The Limits Of New Start Remains On The Table

Kazakhstan's Central Bank Says It Sold Foreign Currency Worth 350 Billion Tenge In January To Mirror Gold Purchases, Will Sell Foreign Currency Worth 350 Billion In February

U.S. Core PPI YoY (Dec)

U.S. Core PPI YoY (Dec)A:--

F: --

U.S. Core PPI MoM (SA) (Dec)

U.S. Core PPI MoM (SA) (Dec)A:--

F: --

P: --

U.S. PPI YoY (Dec)

U.S. PPI YoY (Dec)A:--

F: --

P: --

U.S. PPI MoM (SA) (Dec)

U.S. PPI MoM (SA) (Dec)A:--

F: --

P: --

Canada GDP MoM (SA) (Nov)

Canada GDP MoM (SA) (Nov)A:--

F: --

P: --

Canada GDP YoY (Nov)

Canada GDP YoY (Nov)A:--

F: --

P: --

U.S. PPI MoM Final (Excl. Food, Energy and Trade) (SA) (Dec)

U.S. PPI MoM Final (Excl. Food, Energy and Trade) (SA) (Dec)A:--

F: --

P: --

U.S. PPI YoY (Excl. Food, Energy & Trade) (Dec)

U.S. PPI YoY (Excl. Food, Energy & Trade) (Dec)A:--

F: --

P: --

U.S. Chicago PMI (Jan)

U.S. Chicago PMI (Jan)A:--

F: --

Canada Federal Government Budget Balance (Nov)

Canada Federal Government Budget Balance (Nov)A:--

F: --

P: --

U.S. Weekly Total Oil Rig Count

U.S. Weekly Total Oil Rig CountA:--

F: --

P: --

U.S. Weekly Total Rig Count

U.S. Weekly Total Rig CountA:--

F: --

P: --

China, Mainland NBS Manufacturing PMI (Jan)

China, Mainland NBS Manufacturing PMI (Jan)A:--

F: --

P: --

China, Mainland NBS Non-manufacturing PMI (Jan)

China, Mainland NBS Non-manufacturing PMI (Jan)A:--

F: --

P: --

China, Mainland Composite PMI (Jan)

China, Mainland Composite PMI (Jan)A:--

F: --

P: --

South Korea Trade Balance Prelim (Jan)

South Korea Trade Balance Prelim (Jan)A:--

F: --

Japan Manufacturing PMI Final (Jan)

Japan Manufacturing PMI Final (Jan)A:--

F: --

P: --

South Korea IHS Markit Manufacturing PMI (SA) (Jan)

South Korea IHS Markit Manufacturing PMI (SA) (Jan)A:--

F: --

P: --

Indonesia IHS Markit Manufacturing PMI (Jan)

Indonesia IHS Markit Manufacturing PMI (Jan)A:--

F: --

P: --

China, Mainland Caixin Manufacturing PMI (SA) (Jan)

China, Mainland Caixin Manufacturing PMI (SA) (Jan)A:--

F: --

P: --

Indonesia Trade Balance (Dec)

Indonesia Trade Balance (Dec)A:--

F: --

P: --

Indonesia Inflation Rate YoY (Jan)

Indonesia Inflation Rate YoY (Jan)A:--

F: --

P: --

Indonesia Core Inflation YoY (Jan)

Indonesia Core Inflation YoY (Jan)A:--

F: --

P: --

India HSBC Manufacturing PMI Final (Jan)

India HSBC Manufacturing PMI Final (Jan)A:--

F: --

P: --

Australia Commodity Price YoY (Jan)

Australia Commodity Price YoY (Jan)A:--

F: --

P: --

Russia IHS Markit Manufacturing PMI (Jan)

Russia IHS Markit Manufacturing PMI (Jan)A:--

F: --

P: --

Turkey Manufacturing PMI (Jan)

Turkey Manufacturing PMI (Jan)A:--

F: --

P: --

U.K. Nationwide House Price Index MoM (Jan)

U.K. Nationwide House Price Index MoM (Jan)A:--

F: --

P: --

U.K. Nationwide House Price Index YoY (Jan)

U.K. Nationwide House Price Index YoY (Jan)A:--

F: --

P: --

Germany Actual Retail Sales MoM (Dec)

Germany Actual Retail Sales MoM (Dec)A:--

F: --

Italy Manufacturing PMI (SA) (Jan)

Italy Manufacturing PMI (SA) (Jan)--

F: --

P: --

South Africa Manufacturing PMI (Jan)

South Africa Manufacturing PMI (Jan)--

F: --

P: --

Euro Zone Manufacturing PMI Final (Jan)

Euro Zone Manufacturing PMI Final (Jan)--

F: --

P: --

U.K. Manufacturing PMI Final (Jan)

U.K. Manufacturing PMI Final (Jan)--

F: --

P: --

Brazil IHS Markit Manufacturing PMI (Jan)

Brazil IHS Markit Manufacturing PMI (Jan)--

F: --

P: --

Canada National Economic Confidence Index

Canada National Economic Confidence Index--

F: --

P: --

Canada Manufacturing PMI (SA) (Jan)

Canada Manufacturing PMI (SA) (Jan)--

F: --

P: --

U.S. IHS Markit Manufacturing PMI Final (Jan)

U.S. IHS Markit Manufacturing PMI Final (Jan)--

F: --

P: --

U.S. ISM Output Index (Jan)

U.S. ISM Output Index (Jan)--

F: --

P: --

U.S. ISM Inventories Index (Jan)

U.S. ISM Inventories Index (Jan)--

F: --

P: --

U.S. ISM Manufacturing Employment Index (Jan)

U.S. ISM Manufacturing Employment Index (Jan)--

F: --

P: --

U.S. ISM Manufacturing New Orders Index (Jan)

U.S. ISM Manufacturing New Orders Index (Jan)--

F: --

P: --

U.S. ISM Manufacturing PMI (Jan)

U.S. ISM Manufacturing PMI (Jan)--

F: --

P: --

South Korea CPI YoY (Jan)

South Korea CPI YoY (Jan)--

F: --

P: --

Japan Monetary Base YoY (SA) (Jan)

Japan Monetary Base YoY (SA) (Jan)--

F: --

P: --

Australia Building Approval Total YoY (Dec)

Australia Building Approval Total YoY (Dec)--

F: --

P: --

Australia Building Permits MoM (SA) (Dec)

Australia Building Permits MoM (SA) (Dec)--

F: --

P: --

Australia Building Permits YoY (SA) (Dec)

Australia Building Permits YoY (SA) (Dec)--

F: --

P: --

Australia Private Building Permits MoM (SA) (Dec)

Australia Private Building Permits MoM (SA) (Dec)--

F: --

P: --

Australia Overnight (Borrowing) Key Rate

Australia Overnight (Borrowing) Key Rate--

F: --

P: --

RBA Rate Statement

RBA Rate Statement Japan 10-Year Note Auction Yield

Japan 10-Year Note Auction Yield--

F: --

P: --

Saudi Arabia IHS Markit Composite PMI (Jan)

Saudi Arabia IHS Markit Composite PMI (Jan)--

F: --

P: --

RBA Press Conference

RBA Press Conference Turkey PPI YoY (Jan)

Turkey PPI YoY (Jan)--

F: --

P: --

Turkey CPI YoY (Jan)

Turkey CPI YoY (Jan)--

F: --

P: --

Turkey CPI YoY (Excl. Energy, Food, Beverage, Tobacco & Gold) (Jan)

Turkey CPI YoY (Excl. Energy, Food, Beverage, Tobacco & Gold) (Jan)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

After agreeing to US President Donald Trump’s request to pause attacks on Ukraine’s energy infrastructure, Russia has adjusted its military strategy by redirecting strikes toward logistics targets...

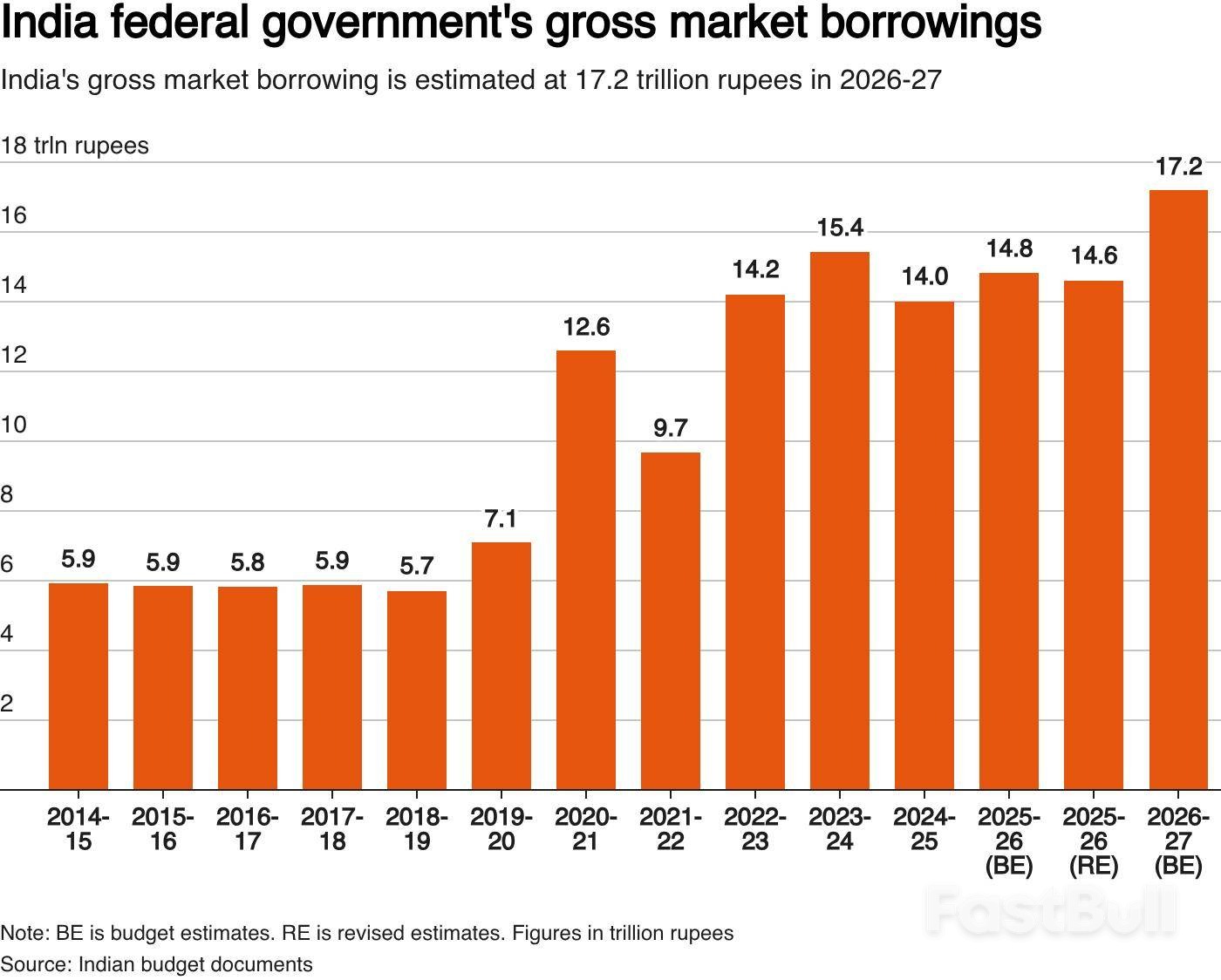

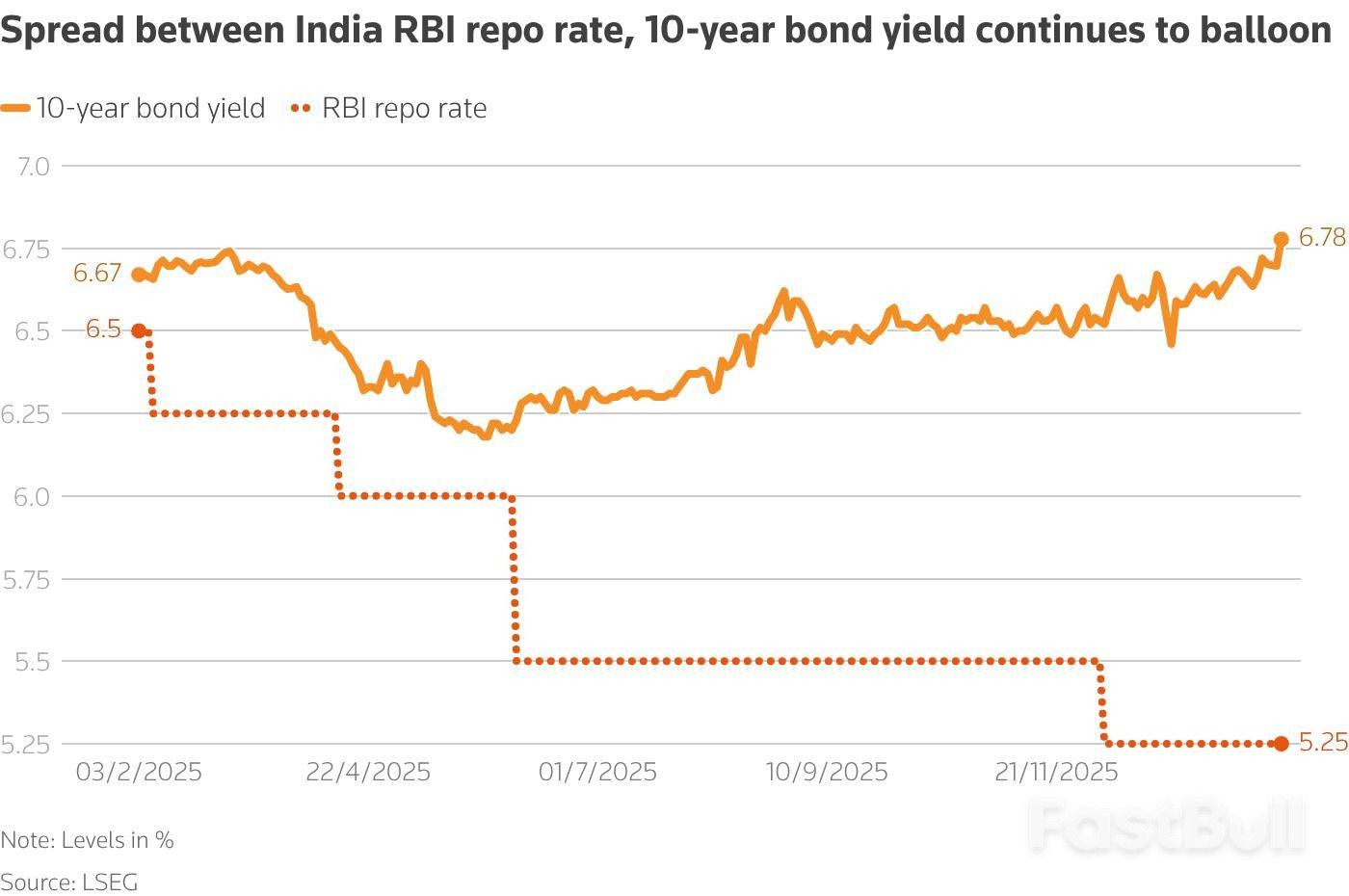

Indian government bonds sold off sharply following the federal budget, with the 10-year benchmark yield hitting its highest level in nearly a year. The market slump was driven by the government's announcement of a record-high borrowing program, which has weakened already fragile investor sentiment.

The government plans to borrow a gross 17.2 trillion rupees ($187.5 billion) in the next fiscal year, which runs from April through March. This news immediately pushed bond prices down and yields up.

The yield on the benchmark 6.48% 2035 bond jumped 8 basis points to 6.78% on Monday, a peak not seen since last March. This move comes as the market grapples with a lack of investor appetite and recent losses on trading portfolios.

Even before the budget announcement, the market showed signs of stress. The 10-year benchmark yield had already risen by around 20 basis points between December and January, despite a 25 basis point policy rate cut and significant debt purchases by the central bank.

The 10-year government bond yield is a crucial economic indicator because it serves as a benchmark for borrowing costs across the country. When this yield rises, it creates several challenges:

• Higher Costs for Companies and States: Both corporate and state-level borrowing becomes more expensive, as their loan rates are priced relative to government bonds.

• Increased Government Debt Burden: The government itself must pay more to finance its operations, straining public finances.

• Complicates Central Bank Policy: The Reserve Bank of India (RBI) has been cutting policy rates to support economic growth. Rising market yields work against these efforts, making monetary policy less effective.

Market analysts are now expressing caution and looking to the central bank for support.

"We remain cautious on bonds, (and) despite the recent cheapening, we do not advocate long positions here and think the 10-year can push closer to 7% near term," said Nathan Sribalasundaram, Asia rates strategist at Nomura. He noted that while the RBI remains the "marginal buyer," the central bank has a low bar for announcing further bond purchases through Open Market Operations (OMOs).

Dhiraj Nim, an economist at ANZ, shared a similar view on the RBI's role. "With macro factors likely to dampen the private sector's bond demand, the RBI is expected to use open market operations to boost liquidity and manage borrowing costs simultaneously," he said.

With the market under pressure, all eyes are on the Reserve Bank of India's monetary policy decision this Friday. While another rate change is not expected, traders and investors are anxiously awaiting any announcements about liquidity injections or new bond-buying programs designed to stabilize the market.

Copper prices continued their sharp decline from a record high, leaving traders to debate whether bullish Chinese investors will step back in after several days of chaotic trading rocked global metals markets.

The intense volatility has some seasoned market observers stepping back, citing heightened risks and a disconnect between financial speculation and softening physical demand. Yet, conversations among traders in China suggest a strong appetite to buy the dip, with analysts unwilling to rule out another major swing higher.

On the London Metal Exchange (LME), the industrial metal sank by as much as 4.2% to $12,600 per ton. This followed a dramatic week where prices first soared to a record above $14,500 last Thursday before crashing below $13,000 in intraday trading on Friday. Other metals, including aluminum, tin, nickel, and silver, also posted steep declines.

The extreme moves capped a strong period for copper, which saw futures gain over 40% in 2025 amid mine disruptions, speculation on demand from the energy transition, and the potential for new U.S. import tariffs.

The recent rally in both base and precious metals was initially driven by a surge of interest from investors in China, where funds have been rotating into commodities amid doubts about the U.S. dollar and a shift away from currencies and sovereign bonds.

However, Friday's selloff was sparked by news that U.S. President Donald Trump named Kevin Warsh, known as a tough inflation fighter, to head the Federal Reserve.

Despite the turbulence, January was the busiest month ever for metals trading on the Shanghai Futures Exchange (SHFE), with copper volumes hitting a record during Friday's downturn.

"Some funds are exiting ahead of the Lunar New Year to avoid risk amid such high volatility," noted Gao Yin, an analyst at Shuohe Asset Management Co. "But the medium- to long-term logic behind this round of rally remains intact. There is a unanimous, bullish consensus among Chinese investors."

The frenzy in financial markets contrasts sharply with softening physical demand. Traders familiar with the industry report that buying from fabricators has been muted, even with the price drop. Many industrial users are also winding down operations ahead of the Lunar New Year holiday.

This disconnect was further highlighted by data showing China's factory activity unexpectedly stalled in December. Copper bulls appear to be looking past weak immediate consumption, focusing instead on broader macro trends like easier global monetary policy, a softer dollar, and increased fiscal spending in developed economies.

Some analysts believe the current pullback is a strategic entry point.

"The near-term correction will provide a good window to buy," wrote Li Yaoyao, an analyst at Xinhu Futures Co., in a note. The firm suggested copper is entering a "supercycle" of sustained high prices and could trade between 100,000 yuan ($14,385) and 150,000 yuan per ton in Shanghai this year.

As of the latest trading, copper on the SHFE was down 3.4% at 100,110 yuan a ton. In London, LME copper fell 4.2% to $12,601.50 a ton at 12:05 p.m. Singapore time, after closing 3.4% lower on Friday. Other industrial metals also declined, with aluminum losing 2.8% and tin falling by more than 8%. Iron ore in Singapore dipped 0.3% to $103.35 a ton.

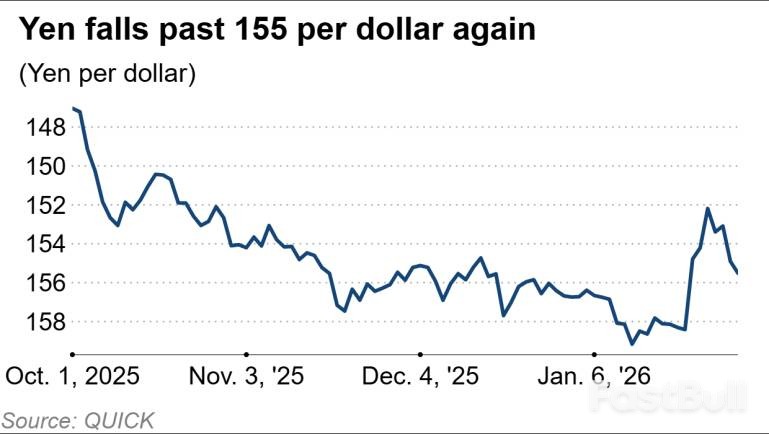

The Japanese yen weakened significantly on Monday, sliding past the key 155 level against the U.S. dollar. The move was triggered by comments from Prime Minister Sanae Takaichi that markets interpreted as an endorsement of a weaker currency, compounded by a strengthening greenback.

Over the weekend, Prime Minister Takaichi highlighted the advantages of a weaker yen during a campaign speech for a lower house election scheduled for February 8. She argued that a strong yen hurts exporters' competitiveness and that the current currency weakness represents "a big opportunity for export industries."

Takaichi also noted that Japan's Foreign Exchange Fund Special Account has "coffers that are brimming now," a remark that further fueled market speculation.

Analysts suggested that these comments, especially when combined with U.S. Treasury Secretary Scott Bessent's recent statement that Washington would "absolutely not" intervene in currency markets, were likely to accelerate speculative yen selling.

In response to the market reaction, Takaichi attempted to clarify her position on social media, stating that the press had misunderstood her. "My intention was not to say whether yen appreciation or yen depreciation is good or bad, but to note that 'we want to build a strong economy that is resilient to exchange rate fluctuations,'" she explained.

Despite her clarification, the yen continued its slide. The decline was further supported by a Finance Ministry announcement confirming that Japan had not conducted any foreign exchange interventions in the past few weeks.

The yen's fall was not just a story of local politics; it was also driven by strong investor demand for the U.S. dollar.

On Friday, U.S. President Donald Trump announced his intention to nominate Kevin Warsh as the next Federal Reserve chair, succeeding Jerome Powell. This news prompted a dollar recovery after a sharp sell-off last week.

Michael Wan, a senior currency analyst at MUFG Bank, described Warsh as a hawk. "History would suggest he is a hawk with a predisposition to focus on inflation," Wan wrote in a note. He added that Warsh has historically been critical of the Fed expanding its balance sheet and believes the central bank has overstepped its mandate.

While Warsh has more recently voiced support for interest rate cuts, his nomination has led the market to anticipate less aggressive monetary easing from the Fed, strengthening the dollar.

The yen's depreciation initially provided a boost to the Japanese stock market. Shares of major exporters like Toyota Motor and Subaru rose as a weaker currency makes their products more competitive abroad.

The benchmark Nikkei Stock Average reflected this optimism, at one point climbing over 900 points, a gain of 1.7%.

However, the rally was short-lived. The stock market quickly lost momentum and turned lower as a tumble in major technology stocks erased the early gains.

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

Log In

Sign Up