Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

U.S. Cleveland Fed CPI MoM (SA) (Dec)

U.S. Cleveland Fed CPI MoM (SA) (Dec)A:--

F: --

P: --

U.S. Cleveland Fed CPI MoM (Dec)

U.S. Cleveland Fed CPI MoM (Dec)A:--

F: --

P: --

China, Mainland M0 Money Supply YoY (Dec)

China, Mainland M0 Money Supply YoY (Dec)--

F: --

P: --

China, Mainland M1 Money Supply YoY (Dec)

China, Mainland M1 Money Supply YoY (Dec)--

F: --

P: --

China, Mainland M2 Money Supply YoY (Dec)

China, Mainland M2 Money Supply YoY (Dec)--

F: --

P: --

U.S. EIA Natural Gas Production Forecast For The Next Year (Jan)

U.S. EIA Natural Gas Production Forecast For The Next Year (Jan)A:--

F: --

P: --

U.S. EIA Short-Term Crude Production Forecast For The Next Year (Jan)

U.S. EIA Short-Term Crude Production Forecast For The Next Year (Jan)A:--

F: --

P: --

U.S. EIA Short-Term Crude Production Forecast For The Year (Jan)

U.S. EIA Short-Term Crude Production Forecast For The Year (Jan)A:--

F: --

P: --

EIA Monthly Short-Term Energy Outlook

EIA Monthly Short-Term Energy Outlook U.S. 30-Year Bond Auction Avg. Yield

U.S. 30-Year Bond Auction Avg. YieldA:--

F: --

P: --

Argentina 12-Month CPI (Dec)

Argentina 12-Month CPI (Dec)A:--

F: --

P: --

U.S. Budget Balance (Dec)

U.S. Budget Balance (Dec)A:--

F: --

P: --

Argentina CPI MoM (Dec)

Argentina CPI MoM (Dec)A:--

F: --

P: --

Argentina National CPI YoY (Dec)

Argentina National CPI YoY (Dec)A:--

F: --

P: --

Richmond Federal Reserve President Barkin delivered a speech.

Richmond Federal Reserve President Barkin delivered a speech. U.S. API Weekly Cushing Crude Oil Stocks

U.S. API Weekly Cushing Crude Oil StocksA:--

F: --

P: --

U.S. API Weekly Crude Oil Stocks

U.S. API Weekly Crude Oil StocksA:--

F: --

P: --

U.S. API Weekly Refined Oil Stocks

U.S. API Weekly Refined Oil StocksA:--

F: --

P: --

U.S. API Weekly Gasoline Stocks

U.S. API Weekly Gasoline StocksA:--

F: --

P: --

South Korea Unemployment Rate (SA) (Dec)

South Korea Unemployment Rate (SA) (Dec)A:--

F: --

P: --

Japan Reuters Tankan Non-Manufacturers Index (Jan)

Japan Reuters Tankan Non-Manufacturers Index (Jan)A:--

F: --

P: --

Japan Reuters Tankan Manufacturers Index (Jan)

Japan Reuters Tankan Manufacturers Index (Jan)A:--

F: --

P: --

China, Mainland Exports YoY (CNH) (Dec)

China, Mainland Exports YoY (CNH) (Dec)A:--

F: --

P: --

China, Mainland Trade Balance (USD) (Dec)

China, Mainland Trade Balance (USD) (Dec)A:--

F: --

P: --

China, Mainland Trade Balance (CNH) (Dec)

China, Mainland Trade Balance (CNH) (Dec)A:--

F: --

P: --

China, Mainland Exports (Dec)

China, Mainland Exports (Dec)A:--

F: --

P: --

China, Mainland Imports YoY (CNH) (Dec)

China, Mainland Imports YoY (CNH) (Dec)A:--

F: --

P: --

China, Mainland Imports (CNH) (Dec)

China, Mainland Imports (CNH) (Dec)A:--

F: --

P: --

China, Mainland Imports YoY (USD) (Dec)

China, Mainland Imports YoY (USD) (Dec)A:--

F: --

P: --

China, Mainland Exports YoY (USD) (Dec)

China, Mainland Exports YoY (USD) (Dec)A:--

F: --

P: --

China, Mainland Outstanding Loans Growth YoY (Dec)

China, Mainland Outstanding Loans Growth YoY (Dec)--

F: --

P: --

U.K. 10-Year Note Auction Yield

U.K. 10-Year Note Auction Yield--

F: --

P: --

Canada Leading Index MoM (Dec)

Canada Leading Index MoM (Dec)--

F: --

P: --

U.S. MBA Mortgage Application Activity Index WoW

U.S. MBA Mortgage Application Activity Index WoW--

F: --

P: --

U.S. Core PPI YoY (Nov)

U.S. Core PPI YoY (Nov)--

F: --

P: --

U.S. PPI MoM (SA) (Nov)

U.S. PPI MoM (SA) (Nov)--

F: --

P: --

U.S. PPI YoY (Nov)

U.S. PPI YoY (Nov)--

F: --

P: --

U.S. Current Account (Q3)

U.S. Current Account (Q3)--

F: --

P: --

U.S. Retail Sales YoY (Nov)

U.S. Retail Sales YoY (Nov)--

F: --

P: --

U.S. Retail Sales (Nov)

U.S. Retail Sales (Nov)--

F: --

P: --

U.S. Core Retail Sales MoM (Nov)

U.S. Core Retail Sales MoM (Nov)--

F: --

P: --

U.S. PPI YoY (Excl. Food, Energy & Trade) (Nov)

U.S. PPI YoY (Excl. Food, Energy & Trade) (Nov)--

F: --

P: --

U.S. PPI MoM Final (Excl. Food, Energy and Trade) (SA) (Nov)

U.S. PPI MoM Final (Excl. Food, Energy and Trade) (SA) (Nov)--

F: --

P: --

U.S. Core Retail Sales (Nov)

U.S. Core Retail Sales (Nov)--

F: --

P: --

U.S. Retail Sales MoM (Excl. Automobile) (SA) (Nov)

U.S. Retail Sales MoM (Excl. Automobile) (SA) (Nov)--

F: --

P: --

U.S. Retail Sales MoM (Nov)

U.S. Retail Sales MoM (Nov)--

F: --

P: --

U.S. Retail Sales MoM (Excl. Gas Stations & Vehicle Dealers) (SA) (Nov)

U.S. Retail Sales MoM (Excl. Gas Stations & Vehicle Dealers) (SA) (Nov)--

F: --

P: --

U.S. Core PPI MoM (SA) (Nov)

U.S. Core PPI MoM (SA) (Nov)--

F: --

P: --

Philadelphia Fed President Henry Paulson delivers a speech

Philadelphia Fed President Henry Paulson delivers a speech U.S. Commercial Inventory MoM (Oct)

U.S. Commercial Inventory MoM (Oct)--

F: --

P: --

U.S. Existing Home Sales Annualized Total (Dec)

U.S. Existing Home Sales Annualized Total (Dec)--

F: --

P: --

U.S. Existing Home Sales Annualized MoM (Dec)

U.S. Existing Home Sales Annualized MoM (Dec)--

F: --

P: --

U.S. EIA Weekly Cushing, Oklahoma Crude Oil Stocks Change

U.S. EIA Weekly Cushing, Oklahoma Crude Oil Stocks Change--

F: --

P: --

U.S. EIA Weekly Crude Stocks Change

U.S. EIA Weekly Crude Stocks Change--

F: --

P: --

U.S. EIA Weekly Gasoline Stocks Change

U.S. EIA Weekly Gasoline Stocks Change--

F: --

P: --

U.S. EIA Weekly Crude Demand Projected by Production

U.S. EIA Weekly Crude Demand Projected by Production--

F: --

P: --

U.S. EIA Weekly Crude Oil Imports Changes

U.S. EIA Weekly Crude Oil Imports Changes--

F: --

P: --

U.S. EIA Weekly Heating Oil Stock Changes

U.S. EIA Weekly Heating Oil Stock Changes--

F: --

P: --

U.S. Refinitiv/Ipsos Primary Consumer Sentiment Index (PCSI) (Jan)

U.S. Refinitiv/Ipsos Primary Consumer Sentiment Index (PCSI) (Jan)--

F: --

P: --

Japan Domestic Enterprise Commodity Price Index YoY (Dec)

Japan Domestic Enterprise Commodity Price Index YoY (Dec)--

F: --

P: --

Japan Domestic Enterprise Commodity Price Index MoM (Dec)

Japan Domestic Enterprise Commodity Price Index MoM (Dec)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

As deposit rates continue to climb in early 2026, banking experts warn that deteriorating asset quality and excessive leverage in real estate lending could turn banks from creditors into vulnerable debt holders if risk controls are not tightened...

Bank of Japan Governor Kazuo Ueda has affirmed his commitment to raising interest rates, signaling that intense speculation over a snap political election will not derail the central bank's monetary policy.

Speaking in Tokyo on Thursday, Ueda stated the BOJ's position clearly. "We will keep raising rates and adjust the degree of monetary easing in line with the improvement in the economy and inflation if our outlook materializes," he said at a conference hosted by the Regional Banks Association of Japan.

His remarks confirm that the market volatility triggered by political rumors has not forced the central bank to alter its course. Ueda’s speech closely mirrored his statements from last week, before talk of a potential national vote began to escalate.

Most economists are not expecting a policy change at the BOJ's upcoming meeting on January 23. The consensus points to a possible rate hike occurring around June.

The political speculation centers on Prime Minister Sanae Takaichi, who local media reports suggest may dissolve parliament next week to call a snap election. This would be her first time overseeing a national vote since taking office last October.

Financial markets reacted strongly to the news this week. Japanese stocks soared, while bonds and the yen weakened on expectations that a new electoral mandate could empower the prime minister to push for more expansionary fiscal measures.

The yen subsequently fell to its weakest level against the dollar since July 2024, the last time Japan's finance authorities intervened to support the currency. It traded at approximately 159.20 per dollar on Thursday afternoon in Tokyo.

A depreciating yen presents a significant challenge for the Bank of Japan by driving up the cost of imports and adding to broader inflationary pressures.

This dynamic complicates Governor Ueda's objective of achieving stable price growth. Japan’s key inflation gauge has already remained at or above the BOJ's 2% target for more than three and a half years.

Ueda noted that wages and prices are on a path of gradual increase. "Wages and inflation are likely to keep rising gradually," he said. "An appropriate adjustment of monetary easing will usher in the smooth achievement of our price target and longer-term growth in our economy."

The BOJ raised its benchmark interest rate to 0.75% last month, its highest point since 1995. While most observers anticipate a steady pace of hikes, roughly once every six months, some analysts believe a persistently weak yen could compel the central bank to act sooner.

The United States government has established new rules for selling high-performance AI chips to China, representing a significant policy change. These regulations directly impact companies like Nvidia and its advanced H200 chips, introducing a controlled process for exports that previously faced a complete block.

Under the revised framework, several conditions must be met before advanced AI chips can be shipped to Chinese buyers. This marks a departure from prior restrictions and introduces a multi-step approval process.

Key requirements now include:

• Performance Verification: All chips must undergo testing by an independent third-party lab to verify their AI capabilities.

• Supply Cap: Chinese customers cannot purchase more than 50% of the total chip volume sold to American customers.

• Domestic Availability: Nvidia is required to demonstrate it has a sufficient supply of H200 chips available in the United States.

• End-User Vetting: Chinese companies must prove they have adequate security measures in place and commit to not using the chips for military purposes.

These stipulations were not part of the previous export policy.

This move reverses the Biden administration's policy, which had blocked sales of advanced AI chips to China altogether. The Trump administration, with guidance from White House AI director David Sacks, argues that allowing controlled sales could discourage Chinese tech firms like Huawei from accelerating their own high-end chip design efforts to compete with Nvidia and AMD.

When he announced the policy shift last month, President Donald Trump stated the sales would proceed "under conditions that allow for continued strong National Security." This contrasts with an earlier proposal from Trump to permit sales in exchange for a 25% fee, a plan that drew criticism from both political parties over concerns it could bolster Beijing's military and undermine America's technological edge in AI.

Analysts and former officials have raised serious questions about the new policy's effectiveness and enforceability.

Jay Goldberg, a stock analyst at Seaport Research, called the export limits a "middle-ground solution" that may be difficult to monitor. He described the policy as a "Band-Aid" attempting to cover a significant gap among U.S. policymakers.

"As we have seen, companies have found ways to get access to those chips, and the U.S. government appears highly transactional in their approach to chip exports," Goldberg noted.

Saif Khan, a former director of technology and national security on the White House National Security Council under Joe Biden, warned that the rule would provide a major boost to China's AI programs. "The rule would allow about two million advanced AI chips like the H200 to China, an amount equal to the compute owned today by a typical U.S. frontier AI company," Khan said. He added that the administration will struggle to enforce requirements preventing Chinese cloud providers from supporting nefarious activities.

These enforcement challenges are significant, especially given past smuggling operations valued at $160 million.

The policy change comes as Chinese technology companies display an enormous appetite for advanced hardware. According to a report last month, Chinese firms have already placed orders for over 2 million Nvidia H200 chips, each costing around $27,000. This demand far exceeds Nvidia's current reported stock of 700,000 units.

At the Consumer Electronics Show, Nvidia CEO Jensen Huang confirmed that the company was ramping up H200 production. He cited strong demand from China and other nations as a key driver behind rising rental prices for H200 chips operating in cloud data centers.

While the U.S. has reportedly begun a review that could clear the first chip shipments to China, it remains uncertain whether the new restrictions will be effectively enforced or if Beijing will ultimately permit the sales domestically.

Poland's central bank is at a crossroads, with its recent streak of interest rate cuts likely coming to a halt. Analysts overwhelmingly expect the Monetary Policy Council (MPC) to hold its benchmark rate at 4% this week, but a surprisingly low inflation report has made the decision far from certain.

After cutting borrowing costs at its last five meetings, the central bank appears ready to shift to a wait-and-see approach. Governor Adam Glapinski has signaled a desire to evaluate the impact of the past easing, which saw rates lowered by a total of 175 basis points in six steps last year.

This view is supported by a Bloomberg survey, where 29 of 32 economists predicted that the MPC will keep rates on hold. Fellow panelist Henryk Wnorowski also suggested that the next potential cut would not occur until March at the earliest.

Despite the consensus for a pause, the decision is not a foregone conclusion. The primary reason for the uncertainty is an unexpected dip in inflation, which fell below the central bank’s 2.5% target in December. This development strengthens the argument for continued monetary easing.

The division among policymakers is clear. MPC member Ireneusz Dabrowski commented last week that another rate reduction was equally as likely as holding firm. Analysts at PKO Bank Polski SA are in the minority forecasting a quarter-point cut, stating in a note, "The outcome of the MPC meeting will remain uncertain until the very end."

Adding another layer of unpredictability is a change in the council's composition. This week’s meeting will be the first for Marcin Zarzecki, a new member appointed by President Karol Nawrocki. Zarzecki, whose views on monetary policy are not publicly known, replaces Cezary Kochalski, whose term concluded in December. His vote could prove decisive in what is expected to be a close call.

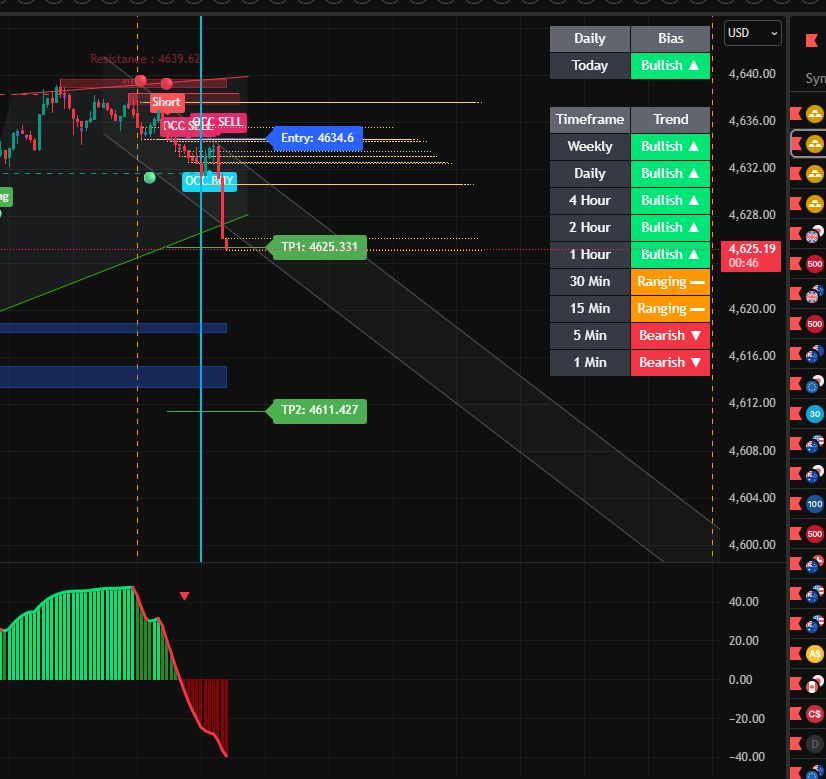

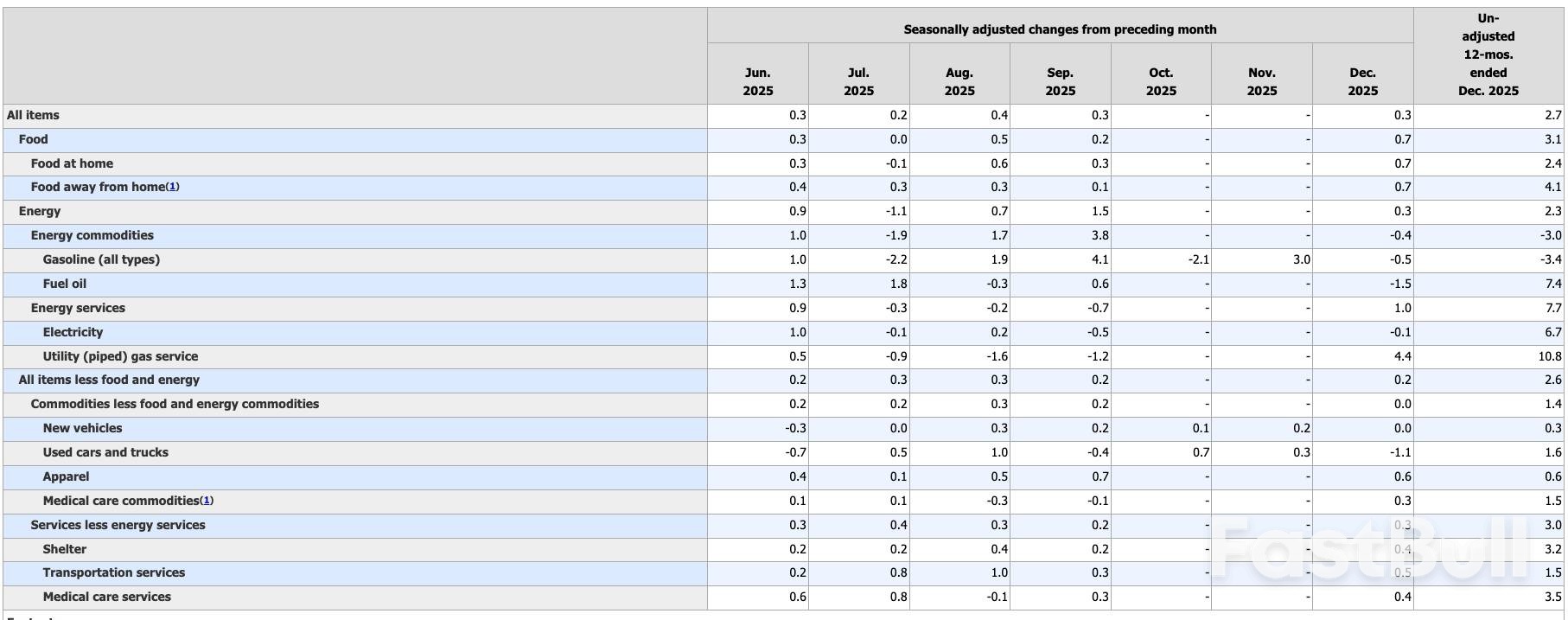

The December Consumer Price Index (CPI) report was as complex as analysts predicted, but the real story of inflation isn't in the headline numbers. A closer look at money supply and central bank activity reveals pressures that the official data may be missing.

At first glance, the December inflation data seemed to align with expectations, offering a sliver of optimism for markets hoping for future monetary easing.

The overall CPI rose 0.3% month-on-month, holding the annual inflation rate steady at 2.7%. When stripping out volatile food and energy costs, the core CPI increased by 0.2% for the month, with the annual rate unchanged at 2.6%. This slightly cooler-than-expected core reading fueled speculation that the Federal Reserve might continue easing monetary policy in 2026.

However, a persistent trend lies beneath the surface. Over the last six available readings, core CPI has posted increases of 0.2%, 0.3%, 0.3%, 0.2%, 0.2%, and 0.2%. This pattern annualizes to a rate of 2.8%, showing that core inflation has been stuck in this range for over a year.

A detailed breakdown of the December report shows specific price pressures:

• Shelter: Increased by 0.4%

• Food: Surged by 0.7%

• Energy: Rose by 0.3%, even as gasoline prices fell 0.4%

• Services: Grew by 0.3%

• Used Cars & Trucks: Posted the largest decline, falling 1.1%

It’s crucial to approach the CPI report with caution. The data's reliability has been questioned, particularly following a November report some critics described as heavily estimated.

Furthermore, the government's methodology for calculating CPI was revised in the 1990s, leading to a formula that many argue systematically understates the true rise in the cost of living. If the formula from the 1970s were still in use, today's official CPI figures would likely be closer to 6%.

Even based on the current official data, inflation remains well above the Federal Reserve's target. As Ellen Zentner, chief economic strategist at Morgan Stanley, noted, the situation feels familiar.

"We've seen this movie before—inflation isn't reheating, but it remains above target," Zentner stated. "Today's inflation report doesn't give the Fed what it needs to cut interest rates later this month."

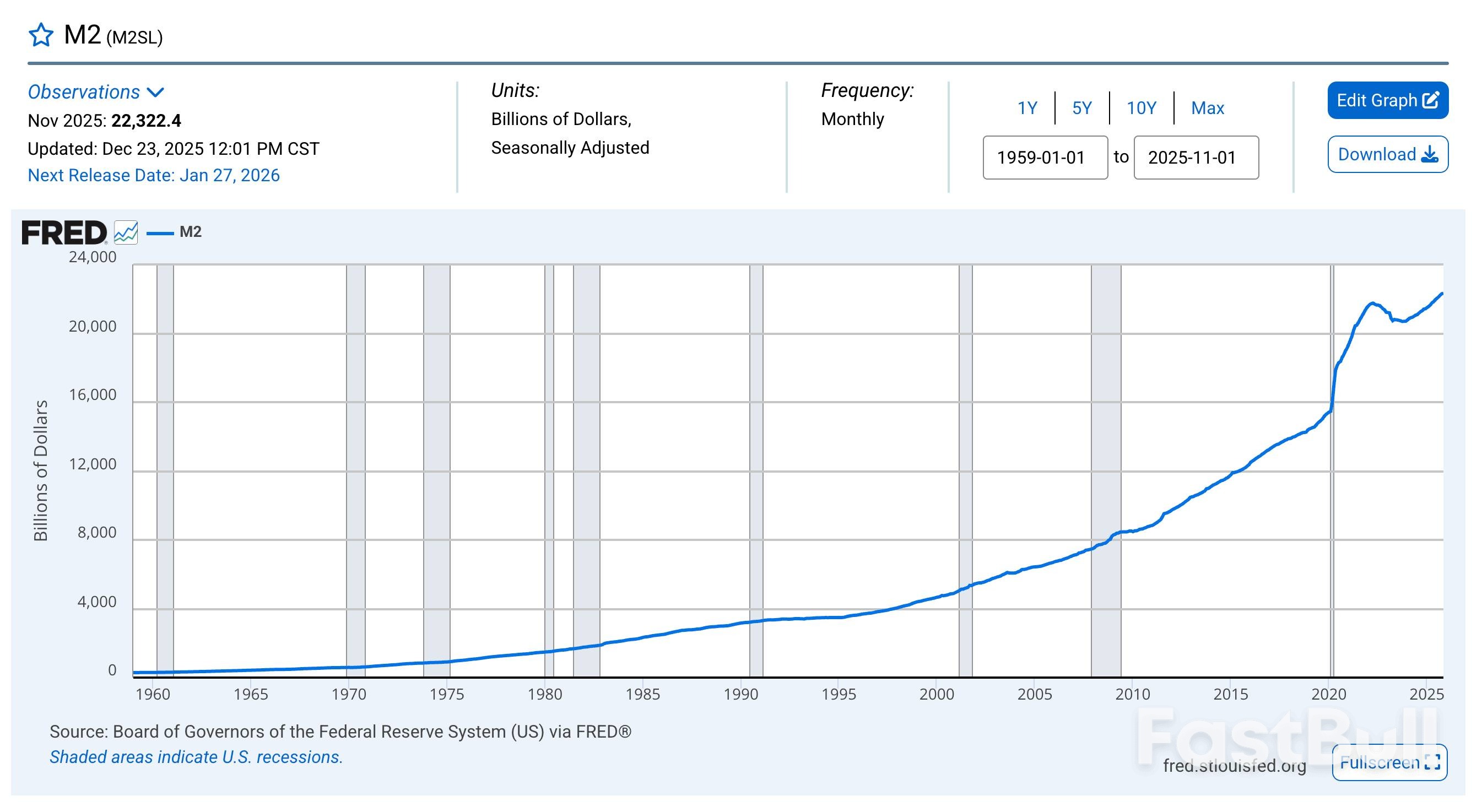

The CPI measures price changes in a specific basket of goods, but it only captures a symptom of inflation. Historically, economists defined inflation as an increase in the supply of money and credit. Rising prices are the consequence of this monetary expansion.

By this fundamental measure, inflation is not only present but accelerating. The M2 money supply is currently growing at its fastest rate since July 2022. After hitting a low in October 2023, the money supply has resumed its upward trajectory, now surpassing its pandemic-era peak as money creation has quickened in recent months.

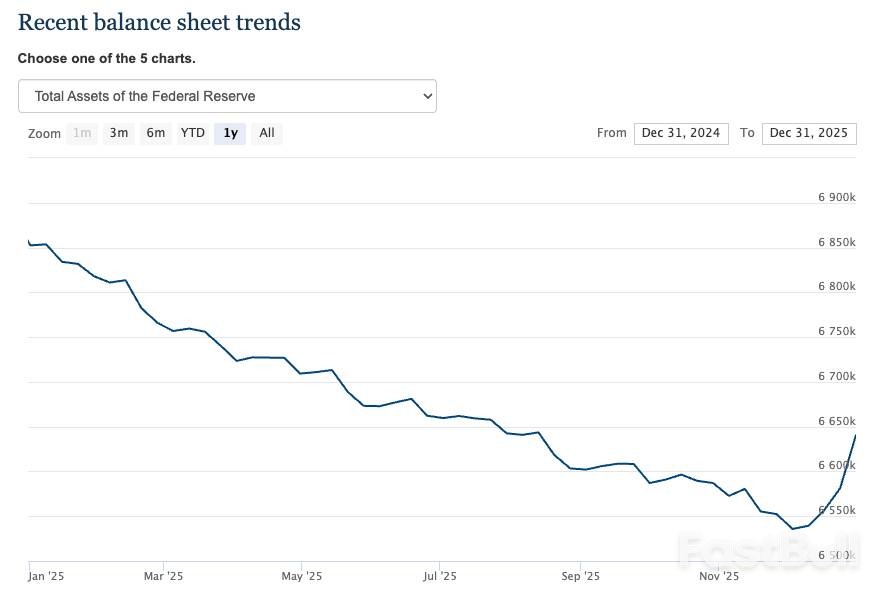

Further evidence of rising inflationary pressure comes from the Federal Reserve's balance sheet, which is once again expanding.

Last month, the central bank resumed purchasing U.S. Treasuries with newly created money, effectively restarting its quantitative easing (QE) program. This direct injection of liquidity into the financial system is, by definition, inflationary.

This leads to a fundamental conflict for the central bank. The Fed is caught in a Catch-22: it needs to loosen monetary policy through rate cuts and QE to support a debt-laden economy, but it also needs higher rates to bring price inflation back under control. It cannot do both at the same time.

Any "cooler than expected" CPI report provides political cover to prioritize easing, despite official rhetoric aimed at managing expectations. This dynamic ensures that even if official price metrics cool temporarily, the underlying inflationary forces are likely to grow stronger.

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up