Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

Ukrainian Power Company Dtek Says Overnight Russian Air Attack Was The Biggest On Energy System Since Start Of 2026

China's Central Bank: Net Injected 64.1 Billion Yuan Via Other Structural Monetary Policy Tools In January

China's Central Bank: Conducted Net Purchase Of Sovereign Bonds Worth 100 Billion Yuan In January On The Open Market

Russian Deputy Prime Minister Novak On India Possibly Cutting Russian Oil Imports: We Have Only Seen Public Statements

Russian Deputy Prime Minister Novak On Expectations Of OPEC+ Actions In April: We Are Seeing Oil Demand And Supply Balance

Qatar's Foreign Ministry Spokesperson On Iran: There Are Regional Collaboration And Ongoing Efforts In Order To Ensure Deescalation

Russian Investment In Northern Fleet, In Particular Subsurface Capabilities Is Undiminished - Royal Navy First Sea Lord

French Finance Minister Lescure: Forex Volatility Is A Subject That I Can Put On The G7 Agenda Depending On Develeopments

French Finance Minister Lescure: Joint Instruments Can Have A Sectoral Focus, Such As Rare Earths

China - Uruguay Joint Declaration: Both Sides Hope To Begin Negotiations On Free Trade Agreement Between China And MERCOSUR As Soon As Possible

Dubai - Bridgewater Associates Founder Ray Dalio: Change Of Regime In Iran Would Make Middle East Region More Investable

China - Uruguay Joint Declaration: Uruguay Approves Of Participation Of Chinese Companies In Uruguay's 5G Network

Kremlin On New Start: Putin's Offer Is Still On The Table But We Have Received No Response From The US

Italy Manufacturing PMI (SA) (Jan)

Italy Manufacturing PMI (SA) (Jan)A:--

F: --

P: --

South Africa Manufacturing PMI (Jan)

South Africa Manufacturing PMI (Jan)A:--

F: --

P: --

Euro Zone Manufacturing PMI Final (Jan)

Euro Zone Manufacturing PMI Final (Jan)A:--

F: --

P: --

U.K. Manufacturing PMI Final (Jan)

U.K. Manufacturing PMI Final (Jan)A:--

F: --

P: --

Turkey Trade Balance (Jan)

Turkey Trade Balance (Jan)A:--

F: --

P: --

Brazil IHS Markit Manufacturing PMI (Jan)

Brazil IHS Markit Manufacturing PMI (Jan)A:--

F: --

P: --

Canada National Economic Confidence Index

Canada National Economic Confidence IndexA:--

F: --

P: --

Canada Manufacturing PMI (SA) (Jan)

Canada Manufacturing PMI (SA) (Jan)A:--

F: --

P: --

U.S. IHS Markit Manufacturing PMI Final (Jan)

U.S. IHS Markit Manufacturing PMI Final (Jan)A:--

F: --

P: --

U.S. ISM Output Index (Jan)

U.S. ISM Output Index (Jan)A:--

F: --

P: --

U.S. ISM Inventories Index (Jan)

U.S. ISM Inventories Index (Jan)A:--

F: --

P: --

U.S. ISM Manufacturing Employment Index (Jan)

U.S. ISM Manufacturing Employment Index (Jan)A:--

F: --

P: --

U.S. ISM Manufacturing New Orders Index (Jan)

U.S. ISM Manufacturing New Orders Index (Jan)A:--

F: --

P: --

U.S. ISM Manufacturing PMI (Jan)

U.S. ISM Manufacturing PMI (Jan)A:--

F: --

P: --

US President Trump delivered a speech

US President Trump delivered a speech South Korea CPI YoY (Jan)

South Korea CPI YoY (Jan)A:--

F: --

P: --

Japan Monetary Base YoY (SA) (Jan)

Japan Monetary Base YoY (SA) (Jan)A:--

F: --

P: --

Australia Building Approval Total YoY (Dec)

Australia Building Approval Total YoY (Dec)A:--

F: --

Australia Building Permits MoM (SA) (Dec)

Australia Building Permits MoM (SA) (Dec)A:--

F: --

Australia Building Permits YoY (SA) (Dec)

Australia Building Permits YoY (SA) (Dec)A:--

F: --

P: --

Australia Private Building Permits MoM (SA) (Dec)

Australia Private Building Permits MoM (SA) (Dec)A:--

F: --

Australia Overnight (Borrowing) Key Rate

Australia Overnight (Borrowing) Key RateA:--

F: --

P: --

RBA Rate Statement

RBA Rate Statement Japan 10-Year Note Auction Yield

Japan 10-Year Note Auction YieldA:--

F: --

P: --

The U.S. House of Representatives voted on a short-term spending bill to end the partial government shutdown.

The U.S. House of Representatives voted on a short-term spending bill to end the partial government shutdown. Saudi Arabia IHS Markit Composite PMI (Jan)

Saudi Arabia IHS Markit Composite PMI (Jan)A:--

F: --

P: --

RBA Press Conference

RBA Press Conference Turkey PPI YoY (Jan)

Turkey PPI YoY (Jan)A:--

F: --

P: --

Turkey CPI YoY (Jan)

Turkey CPI YoY (Jan)A:--

F: --

P: --

Turkey CPI YoY (Excl. Energy, Food, Beverage, Tobacco & Gold) (Jan)

Turkey CPI YoY (Excl. Energy, Food, Beverage, Tobacco & Gold) (Jan)A:--

F: --

P: --

Richmond Federal Reserve President Barkin delivered a speech.

Richmond Federal Reserve President Barkin delivered a speech. U.S. Weekly Redbook Index YoY

U.S. Weekly Redbook Index YoY--

F: --

P: --

Mexico Manufacturing PMI (Jan)

Mexico Manufacturing PMI (Jan)--

F: --

P: --

U.S. API Weekly Refined Oil Stocks

U.S. API Weekly Refined Oil Stocks--

F: --

P: --

U.S. API Weekly Gasoline Stocks

U.S. API Weekly Gasoline Stocks--

F: --

P: --

U.S. API Weekly Cushing Crude Oil Stocks

U.S. API Weekly Cushing Crude Oil Stocks--

F: --

P: --

U.S. API Weekly Crude Oil Stocks

U.S. API Weekly Crude Oil Stocks--

F: --

P: --

Japan IHS Markit Services PMI (Jan)

Japan IHS Markit Services PMI (Jan)--

F: --

P: --

Japan IHS Markit Composite PMI (Jan)

Japan IHS Markit Composite PMI (Jan)--

F: --

P: --

China, Mainland Caixin Services PMI (Jan)

China, Mainland Caixin Services PMI (Jan)--

F: --

P: --

China, Mainland Caixin Composite PMI (Jan)

China, Mainland Caixin Composite PMI (Jan)--

F: --

P: --

India HSBC Services PMI Final (Jan)

India HSBC Services PMI Final (Jan)--

F: --

P: --

India IHS Markit Composite PMI (Jan)

India IHS Markit Composite PMI (Jan)--

F: --

P: --

Russia IHS Markit Services PMI (Jan)

Russia IHS Markit Services PMI (Jan)--

F: --

P: --

South Africa IHS Markit Composite PMI (SA) (Jan)

South Africa IHS Markit Composite PMI (SA) (Jan)--

F: --

P: --

Italy Services PMI (SA) (Jan)

Italy Services PMI (SA) (Jan)--

F: --

P: --

Italy Composite PMI (Jan)

Italy Composite PMI (Jan)--

F: --

P: --

Germany Composite PMI Final (SA) (Jan)

Germany Composite PMI Final (SA) (Jan)--

F: --

P: --

Euro Zone Composite PMI Final (Jan)

Euro Zone Composite PMI Final (Jan)--

F: --

P: --

Euro Zone Services PMI Final (Jan)

Euro Zone Services PMI Final (Jan)--

F: --

P: --

U.K. Composite PMI Final (Jan)

U.K. Composite PMI Final (Jan)--

F: --

P: --

U.K. Total Reserve Assets (Jan)

U.K. Total Reserve Assets (Jan)--

F: --

P: --

U.K. Services PMI Final (Jan)

U.K. Services PMI Final (Jan)--

F: --

P: --

U.K. Official Reserves Changes (Jan)

U.K. Official Reserves Changes (Jan)--

F: --

P: --

Euro Zone Core CPI Prelim YoY (Jan)

Euro Zone Core CPI Prelim YoY (Jan)--

F: --

P: --

Euro Zone Core HICP Prelim YoY (Jan)

Euro Zone Core HICP Prelim YoY (Jan)--

F: --

P: --

Euro Zone PPI MoM (Dec)

Euro Zone PPI MoM (Dec)--

F: --

P: --

Euro Zone HICP Prelim YoY (Jan)

Euro Zone HICP Prelim YoY (Jan)--

F: --

P: --

Euro Zone Core HICP Prelim MoM (Jan)

Euro Zone Core HICP Prelim MoM (Jan)--

F: --

P: --

Italy HICP Prelim YoY (Jan)

Italy HICP Prelim YoY (Jan)--

F: --

P: --

Euro Zone PPI YoY (Dec)

Euro Zone PPI YoY (Dec)--

F: --

P: --

No matching data

View All

No data

Australia's RBA hikes rates, an outlier combating persistent inflation in a hot economy; more tightening looms.

The Reserve Bank of Australia has raised its benchmark interest rate for the first time in two years, signaling a renewed fight against inflation that is proving stickier than anticipated.

In a unanimous decision following its February policy meeting, the RBA lifted the cash rate by 25 basis points to 3.85%. The move marks a significant pivot, coming just six months after its last rate cut in August and reflects growing evidence that the Australian economy is running hotter than expected.

With this hike, Australia’s central bank finds itself in a small club. Alongside the Bank of Japan, the RBA is one of the only central banks in the developed world currently tightening monetary policy.

This contrasts sharply with the outlook in other major economies. Markets are anticipating potential rate cuts in the United States, the United Kingdom, and Canada, while the European Central Bank is expected to hold its rates steady for an extended period.

The RBA's hawkish turn immediately rippled through financial markets. The Australian dollar surged nearly 1.2% to $0.7027, while three-year government bond futures dropped 10 ticks to 95.64.

Investors are now betting that this is not a one-off adjustment. Market pricing implies an almost 80% probability of a follow-up hike in May, with expectations for a total of 40 basis points in additional tightening this year.

"With the RBA now expecting a slower moderation in inflation... the risk is clearly skewed toward a series of hikes rather than a one-off move," noted Harry Murphy Cruise, head of economic research for Oxford Economics Australia.

The central bank's decision was driven by a string of economic data that painted a picture of persistent economic strength and mounting price pressures. The probability of a February hike had already climbed to 78% among traders ahead of the meeting.

Key factors behind the policy shift include:

• Persistent Inflation: Consumer price growth has surprised on the upside for two consecutive quarters. The RBA’s preferred measure, underlying inflation, hit an annual pace of 3.4% in the fourth quarter, well above the central bank's 2% to 3% target range.

• Strong Labor Market: The unemployment rate unexpectedly fell to a seven-month low of 4.1% in December, suggesting labor market conditions remain tight.

• Robust Demand: In its policy statement, the RBA board noted that "private demand is growing more quickly than expected" and "capacity pressures are greater than previously assessed."

• Accommodative Financial Conditions: Strong consumer spending, record-high housing prices, and readily available credit for households and businesses all suggested that financial conditions were not restrictive enough to cool the economy.

The RBA's more aggressive stance follows a period where it prioritized preserving labor market gains, leading it to hike less aggressively than its global peers. However, after three rate cuts last year, inflation re-accelerated, forcing the bank to adopt a more hawkish position.

In a separate economic update, the RBA expressed uncertainty about whether financial conditions were truly restrictive, acknowledging that some indicators suggested they may have been accommodative. The bank now sees a risk of persistently high inflation even if it implements more than two rate hikes this year.

"Overall, it's clear that the RBA believes the road to disinflation will be a long and winding one," said Abhijit Surya, senior APAC economist at Capital Economics.

Surya predicts one more rate increase in May but cautions that more could be necessary. Since the RBA "doesn't expect underlying inflation to return to the mid-point of its 2-3% target even by early-2028, it's entirely possible that it will feel compelled to raise rates even higher."

A landmark trade agreement between the United States and India has ignited a rally in Indian markets, ending months of uncertainty that weighed on investor sentiment. The deal, announced by President Trump, involves significant tariff reductions and a major shift in India's energy purchasing policy.

In a post on Truth Social, President Trump confirmed that he and Indian Prime Minister Narendra Modi had reached an agreement. The core terms of the deal include:

• The U.S. will lower its "reciprocal tariff" on India to 18%, down from 25%.

• India has committed to halt its purchases of Russian oil and buy more crude from the United States.

A White House official clarified that India's commitment on oil purchases would also lead to the removal of a separate 25% penalty previously levied against the country for its Russian energy imports.

The news provided immediate relief to investors, with India's benchmark Sensex index surging 4.5% at Tuesday's market open before trimming some of its gains.

Major companies saw significant jumps in their share prices. Adani Ports & Special Economic Zone rallied 7.0%, Bajaj Finance climbed over 6%, and Reliance Industries added more than 4%.

Textile and Apparel Stocks Lead the Charge

The textile and apparel manufacturing sectors were among the biggest beneficiaries of the trade news.

• KPR Mill and Gokaldas Exports both surged 20%.

• Welspun Living saw its shares rise by 18%.

• Arvind Ltd. posted a 12% gain.

The positive momentum extended to other sectors as well. IT firms Infosys and Wipro each gained about 2%, following a strong session for their U.S.-listed shares. Financial firms also traded broadly higher, with Citi Research analysts noting that Indian banks stand to benefit from their exposure to export-focused industries.

Analysts view the agreement as a major positive for India’s economy and financial markets. Radhika Rao, a senior economist at DBS Group Research, called the deal "unmistakably positive," highlighting that high tariffs had been a primary drag on market sentiment over the last quarter.

The tariff reduction brings India's rates closer to those of most Southeast Asian nations, giving it a competitive advantage over China. The deal also provided a boost to the Indian rupee, which had been driven to record lows against the U.S. dollar partly due to trade policy pressures.

Despite the initial optimism, analysts caution that the celebration could be premature as crucial details of the pact have not yet been released. The full economic impact of India's pivot away from Russian crude oil also remains unclear.

According to Charu Chanana, chief investment strategist at Saxo Singapore, the market's focus will now shift to execution. Key questions include which specific products are covered, the implementation timelines, and the enforcement mechanisms.

Investors will also be watching closely to see if the pledge to buy more U.S. oil will increase India's overall import bill, which could create new pressure on inflation and the rupee. Furthermore, analysts at Citi Research noted a need to examine the details of India's own tariff reductions, which "could have negative implications for some sectors."

India has agreed to a new trade deal with the United States, committing to purchase a range of American products in a move designed to rebalance the trade relationship between the two countries. The agreement covers key sectors including petroleum, defense, electronics, pharmaceuticals, and telecommunications.

The deal follows an announcement from U.S. President Donald Trump, who stated that India had agreed to "BUY AMERICAN at a much higher level." According to Trump, the pact involves slashing U.S. tariffs on Indian goods from 50% to 18% in exchange for India halting oil purchases from Russia and lowering its own trade barriers.

An Indian government official, speaking on the condition of anonymity, confirmed that the primary goal of the agreement is to reduce the trade deficit the U.S. currently has with India.

Recent data from India's commerce ministry highlights this imbalance. In the period from January to November, India's exports to the U.S. reached $85.5 billion, a 15.88% year-on-year increase. In contrast, U.S. imports into India stood at $46.08 billion.

President Trump suggested the potential scale of future purchases could be massive, estimating India could buy up to $500 billion worth of U.S. energy, coal, technology, and agricultural products.

The commitment to buy American goods is a multi-year plan targeting several strategic industries. According to the official source, the list of products includes:

• Petroleum

• Defense goods

• Aircraft

• Pharmaceuticals

• Telecom products

In addition to these purchases, India has reportedly offered greater market access for some American agricultural products and has cut tariffs on automobiles as an immediate step to address Washington's concerns.

This agreement is being treated as the first part of a broader negotiation, with a more comprehensive deal expected to be worked out in the coming months.

The announcement of the initial deal was met with enthusiasm by investors. On Tuesday, India's benchmark Nifty 50 stock index surged by nearly 3%. The Indian rupee also strengthened, climbing over 1% to trade at 90.40 per dollar in early trading.

President Donald Trump is scheduled to meet Colombian President Gustavo Petro at the White House on Tuesday, setting the stage for a tense diplomatic encounter just weeks after Trump accused the South American leader of flooding the U.S. with cocaine and threatened military action.

While administration officials state the official agenda will cover regional security and counternarcotics, the meeting is shadowed by recent hostility between the two presidents. Trump himself hinted at a shift in dynamics, suggesting Petro has become more cooperative following the U.S. operation to capture Venezuela's Nicolás Maduro.

"Somehow after the Venezuelan raid, he became very nice," Trump told reporters. "He changed his attitude very much."

The ideological gap between the conservative Trump and the leftist Petro is vast, but both leaders share a reputation for verbal bombast and unpredictable behavior. This dynamic has created an "anything-could-happen" atmosphere surrounding the White House visit.

Even with the meeting looming, Petro has continued to publicly challenge the U.S. president. He recently called Trump an "accomplice to genocide" in the Gaza Strip and described the capture of Maduro as a kidnapping. Before leaving for Washington, Petro also called on his supporters in Colombia to protest in the streets of Bogotá during his meeting with Trump.

Historically, Colombia has been a key U.S. ally, particularly over the last 30 years in the fight against drug traffickers and rebel groups. However, the relationship has soured under the two current leaders.

Tensions have been inflamed by several key developments:

• Aggressive Military Action: The Trump administration has authorized unprecedented and deadly military strikes against suspected drug smuggling boats in the Caribbean and Pacific, resulting in at least 126 deaths in 36 known incidents.

• Direct Sanctions: In October, the Treasury Department imposed sanctions on Petro, his wife Veronica del Socorro Alcocer Garcia, his son Nicolas Fernando Petro Burgos, and Interior Minister Armando Alberto Benedetti over alleged involvement in the drug trade. These sanctions had to be waived to permit Petro's travel to Washington.

• Diplomatic Downgrade: In September, the U.S. added Colombia to its list of nations failing to cooperate in the war on drugs for the first time in three decades.

The recent U.S. military operation to capture Maduro and his wife on federal drug charges, which Petro has strongly condemned, brought the conflict to a head. Following the operation, Trump issued a direct warning to Petro, stating he could be next.

"And he's not gonna be doing it very long, let me tell you," Trump said of Petro last month, calling Colombia a country "run by a sick man who likes making cocaine and selling it to the United States."

Despite the sharp rhetoric, the two leaders later spoke by phone for an hour, which appeared to de-escalate the situation and led to Trump's invitation for the White House visit.

President Trump has a history of using official meetings to publicly confront world leaders. In February, Trump and Vice President JD Vance criticized Ukrainian President Volodymyr Zelenskyy for what they saw as insufficient gratitude for U.S. aid. Similarly, during a May meeting, Trump forcefully accused South African President Cyril Ramaphosa of failing to address baseless claims about the killing of white farmers.

It remains unclear whether the meeting between Trump and Petro will include a portion in front of the press, leaving open the possibility of another candid and potentially volatile diplomatic exchange.

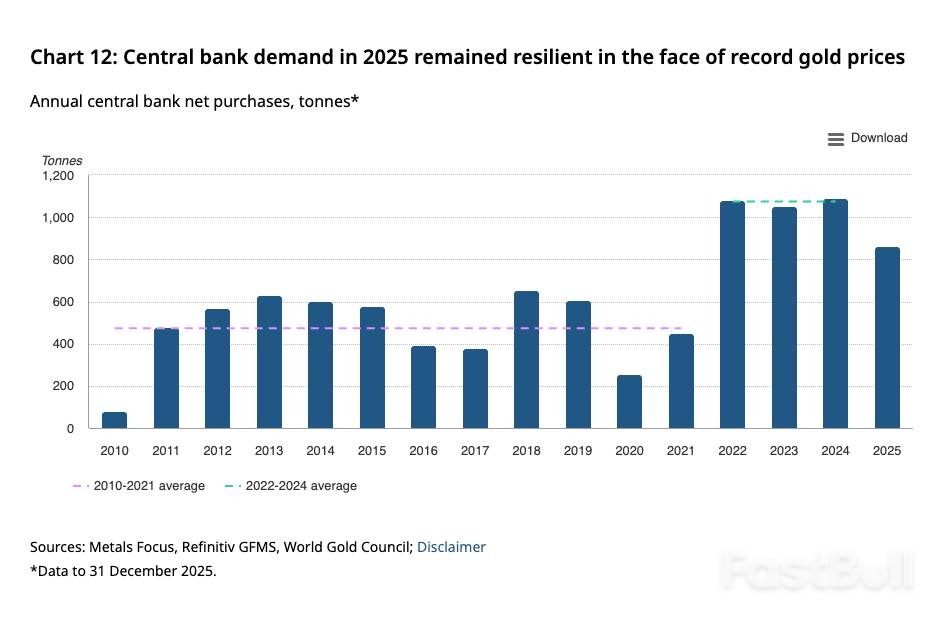

Central bank demand for gold cooled in 2025 but remained far above historical averages, signaling a continued strategic shift toward the precious metal among the world's monetary authorities.

Official institutions accelerated their purchases in the final quarter, adding 230 tonnes to global reserves—a 6% increase over the previous quarter. According to the World Gold Council, this pushed total net buying for the year to 863.3 tonnes.

While this figure represents a 21% decrease from the record-breaking 1,136 tonnes purchased in 2022 and marks the lowest annual total since 2021, it was still the fourth-largest expansion of central bank gold holdings on record. The buying frenzy far outpaced the 2010-2021 annual average of just 473 tonnes.

The surging gold price was a likely factor behind the more measured pace of accumulation. The World Gold Council noted that higher prices prompted "a more cautious approach," demonstrating that central banks are not immune to market dynamics, even as their long-term strategic interest remains firm.

Despite falling short of the 1,000-tonne mark, the council described the 2025 demand as "impressive," underscoring the metal's role as a key reserve asset. In fact, late last year, gold surpassed U.S. Treasuries to become the world's largest foreign reserve asset.

In 2025, twenty-two central banks increased their gold reserves by at least one tonne, with Poland leading the pack.

The National Bank of Poland (NBP) was the top buyer, adding 102 tonnes to its vaults. This brought the country's total holdings to 550 tonnes, which now accounts for approximately 28% of its official reserves. For context, the NBP held only 14 tonnes in 1996 and now holds more gold than the European Central Bank.

Poland's ambitions don't stop there. The NBP has announced plans to purchase up to 150 more tonnes, aiming for a total of 700 tonnes. NBP Governor Adam Glapiński stated this move would elevate Poland to an "elite" status, placing it "among the elite 10 countries with the largest gold reserves in the world."

Other Major Buyers in 2025

Several other nations made significant additions to their gold reserves:

• Kazakhstan: The National Bank of Kazakhstan was the second-largest buyer, adding 52 tonnes in its biggest annual purchase since 1993. Governor Timur Suleimenov confirmed the bank intends to remain a net buyer until global tensions ease.

• Brazil: After a pause, Brazil re-entered the market, with its central bank adding 43 tonnes between September and November, boosting its total reserves to 172 tonnes.

• Turkey: The Central Bank of Turkey continued its steady buying streak, adding 27 tonnes over the year through a series of smaller, consistent purchases.

• Czech Republic: The Czech National Bank also pursued a slow-and-steady strategy, buying gold for 34 consecutive months. It added 20 tonnes in 2025, bringing its total to 72 tonnes, with a goal of reaching 100 tonnes by 2028.

The People's Bank of China (PBoC) officially reported a more modest 27-tonne increase in its gold reserves for 2025, bringing its declared total to 2,306 tonnes. China has now reported increases for 14 straight months, adding 402 tonnes over that period.

However, many analysts believe China's official numbers tell only part of the story. Researcher Jan Nieuwenhuijs has reported that the PBoC is secretly accumulating vast amounts of gold off the books. His analysis suggests China may hold over 5,000 tonnes of monetary gold in Beijing—more than double its publicly admitted figure.

This trend of "opaque activity" was also highlighted by the World Gold Council, which found a major gap between estimated demand and officially reported data. This discrepancy, accounting for 57% of the annual total, suggests substantial unreported buying by official institutions.

While buying was widespread, selling was minimal. The most notable sellers in 2025 were:

• Singapore: Decreased reserves by 14 tonnes.

• Russia: Sold 6 tonnes.

• Jordan: Reduced holdings by 1 tonne.

• Germany: A 1-tonne decrease was linked to its coin minting program.

Despite the slowdown from 2022's record pace, the underlying trend remains strong. The World Gold Council expects persistent economic and geopolitical uncertainty to sustain demand for gold as a core reserve asset.

A 2025 survey of central banks reinforces this view. An overwhelming 95% of respondents expect global central bank gold reserves to increase over the next 12 months. Furthermore, 43% believe their own institution's gold reserves will rise, while none anticipated a decline.

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

Log In

Sign Up