Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

U.K. Retail Sales MoM (SA) (Dec)

U.K. Retail Sales MoM (SA) (Dec)A:--

F: --

P: --

France Manufacturing PMI Prelim (Jan)

France Manufacturing PMI Prelim (Jan)A:--

F: --

P: --

France Services PMI Prelim (Jan)

France Services PMI Prelim (Jan)A:--

F: --

P: --

France Composite PMI Prelim (SA) (Jan)

France Composite PMI Prelim (SA) (Jan)A:--

F: --

P: --

Germany Manufacturing PMI Prelim (SA) (Jan)

Germany Manufacturing PMI Prelim (SA) (Jan)A:--

F: --

P: --

Germany Services PMI Prelim (SA) (Jan)

Germany Services PMI Prelim (SA) (Jan)A:--

F: --

P: --

Germany Composite PMI Prelim (SA) (Jan)

Germany Composite PMI Prelim (SA) (Jan)A:--

F: --

P: --

Euro Zone Composite PMI Prelim (SA) (Jan)

Euro Zone Composite PMI Prelim (SA) (Jan)A:--

F: --

P: --

Euro Zone Manufacturing PMI Prelim (SA) (Jan)

Euro Zone Manufacturing PMI Prelim (SA) (Jan)A:--

F: --

P: --

Euro Zone Services PMI Prelim (SA) (Jan)

Euro Zone Services PMI Prelim (SA) (Jan)A:--

F: --

P: --

U.K. Composite PMI Prelim (Jan)

U.K. Composite PMI Prelim (Jan)A:--

F: --

P: --

U.K. Manufacturing PMI Prelim (Jan)

U.K. Manufacturing PMI Prelim (Jan)A:--

F: --

P: --

U.K. Services PMI Prelim (Jan)

U.K. Services PMI Prelim (Jan)A:--

F: --

P: --

Mexico Economic Activity Index YoY (Nov)

Mexico Economic Activity Index YoY (Nov)A:--

F: --

P: --

Russia Trade Balance (Nov)

Russia Trade Balance (Nov)A:--

F: --

P: --

Canada Core Retail Sales MoM (SA) (Nov)

Canada Core Retail Sales MoM (SA) (Nov)A:--

F: --

P: --

Canada Retail Sales MoM (SA) (Nov)

Canada Retail Sales MoM (SA) (Nov)A:--

F: --

U.S. IHS Markit Manufacturing PMI Prelim (SA) (Jan)

U.S. IHS Markit Manufacturing PMI Prelim (SA) (Jan)A:--

F: --

P: --

U.S. IHS Markit Services PMI Prelim (SA) (Jan)

U.S. IHS Markit Services PMI Prelim (SA) (Jan)A:--

F: --

P: --

U.S. IHS Markit Composite PMI Prelim (SA) (Jan)

U.S. IHS Markit Composite PMI Prelim (SA) (Jan)A:--

F: --

P: --

U.S. UMich Consumer Sentiment Index Final (Jan)

U.S. UMich Consumer Sentiment Index Final (Jan)A:--

F: --

P: --

U.S. UMich Current Economic Conditions Index Final (Jan)

U.S. UMich Current Economic Conditions Index Final (Jan)A:--

F: --

P: --

U.S. UMich Consumer Expectations Index Final (Jan)

U.S. UMich Consumer Expectations Index Final (Jan)A:--

F: --

P: --

U.S. Conference Board Leading Economic Index MoM (Nov)

U.S. Conference Board Leading Economic Index MoM (Nov)A:--

F: --

P: --

U.S. Conference Board Coincident Economic Index MoM (Nov)

U.S. Conference Board Coincident Economic Index MoM (Nov)A:--

F: --

P: --

U.S. Conference Board Lagging Economic Index MoM (Nov)

U.S. Conference Board Lagging Economic Index MoM (Nov)A:--

F: --

P: --

U.S. UMich 1-Year-Ahead Inflation Expectations Final (Jan)

U.S. UMich 1-Year-Ahead Inflation Expectations Final (Jan)A:--

F: --

P: --

U.S. Conference Board Leading Economic Index (Nov)

U.S. Conference Board Leading Economic Index (Nov)A:--

F: --

P: --

U.S. Weekly Total Rig Count

U.S. Weekly Total Rig CountA:--

F: --

P: --

U.S. Weekly Total Oil Rig Count

U.S. Weekly Total Oil Rig CountA:--

F: --

P: --

Germany Ifo Business Expectations Index (SA) (Jan)

Germany Ifo Business Expectations Index (SA) (Jan)--

F: --

P: --

Germany IFO Business Climate Index (SA) (Jan)

Germany IFO Business Climate Index (SA) (Jan)--

F: --

P: --

Germany Ifo Current Business Situation Index (SA) (Jan)

Germany Ifo Current Business Situation Index (SA) (Jan)--

F: --

P: --

Mexico Unemployment Rate (Not SA) (Dec)

Mexico Unemployment Rate (Not SA) (Dec)--

F: --

P: --

Canada National Economic Confidence Index

Canada National Economic Confidence Index--

F: --

P: --

U.S. Non-Defense Capital Durable Goods Orders MoM (Excl. Aircraft) (Nov)

U.S. Non-Defense Capital Durable Goods Orders MoM (Excl. Aircraft) (Nov)--

F: --

P: --

U.S. Durable Goods Orders MoM (Excl. Defense) (SA) (Nov)

U.S. Durable Goods Orders MoM (Excl. Defense) (SA) (Nov)--

F: --

P: --

U.S. Durable Goods Orders MoM (Excl.Transport) (Nov)

U.S. Durable Goods Orders MoM (Excl.Transport) (Nov)--

F: --

P: --

U.S. Durable Goods Orders MoM (Nov)

U.S. Durable Goods Orders MoM (Nov)--

F: --

P: --

U.S. Dallas Fed General Business Activity Index (Jan)

U.S. Dallas Fed General Business Activity Index (Jan)--

F: --

P: --

U.K. BRC Shop Price Index YoY (Jan)

U.K. BRC Shop Price Index YoY (Jan)--

F: --

P: --

China, Mainland Industrial Profit YoY (YTD) (Dec)

China, Mainland Industrial Profit YoY (YTD) (Dec)--

F: --

P: --

Mexico Trade Balance (Dec)

Mexico Trade Balance (Dec)--

F: --

P: --

U.S. S&P/CS 20-City Home Price Index YoY (Not SA) (Nov)

U.S. S&P/CS 20-City Home Price Index YoY (Not SA) (Nov)--

F: --

P: --

U.S. S&P/CS 20-City Home Price Index MoM (SA) (Nov)

U.S. S&P/CS 20-City Home Price Index MoM (SA) (Nov)--

F: --

P: --

U.S. FHFA House Price Index MoM (Nov)

U.S. FHFA House Price Index MoM (Nov)--

F: --

P: --

U.S. FHFA House Price Index (Nov)

U.S. FHFA House Price Index (Nov)--

F: --

P: --

U.S. Richmond Fed Manufacturing Composite Index (Jan)

U.S. Richmond Fed Manufacturing Composite Index (Jan)--

F: --

P: --

U.S. Conference Board Present Situation Index (Jan)

U.S. Conference Board Present Situation Index (Jan)--

F: --

P: --

U.S. Conference Board Consumer Expectations Index (Jan)

U.S. Conference Board Consumer Expectations Index (Jan)--

F: --

P: --

U.S. Richmond Fed Manufacturing Shipments Index (Jan)

U.S. Richmond Fed Manufacturing Shipments Index (Jan)--

F: --

P: --

U.S. Richmond Fed Services Revenue Index (Jan)

U.S. Richmond Fed Services Revenue Index (Jan)--

F: --

P: --

U.S. Conference Board Consumer Confidence Index (Jan)

U.S. Conference Board Consumer Confidence Index (Jan)--

F: --

P: --

Australia RBA Trimmed Mean CPI YoY (Q4)

Australia RBA Trimmed Mean CPI YoY (Q4)--

F: --

P: --

Australia CPI YoY (Q4)

Australia CPI YoY (Q4)--

F: --

P: --

Australia CPI QoQ (Q4)

Australia CPI QoQ (Q4)--

F: --

P: --

Germany GfK Consumer Confidence Index (SA) (Feb)

Germany GfK Consumer Confidence Index (SA) (Feb)--

F: --

P: --

India Industrial Production Index YoY (Dec)

India Industrial Production Index YoY (Dec)--

F: --

P: --

India Manufacturing Output MoM (Dec)

India Manufacturing Output MoM (Dec)--

F: --

P: --

Canada Overnight Target Rate

Canada Overnight Target Rate--

F: --

P: --

BOC Monetary Policy Report

BOC Monetary Policy Report

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

Oil markets fluctuated following the U.S. capture of Venezuelan President Nicolás Maduro. Despite the geopolitical shock, prices remained capped as traders focused on global oversupply and unchanged OPEC+ output plans....

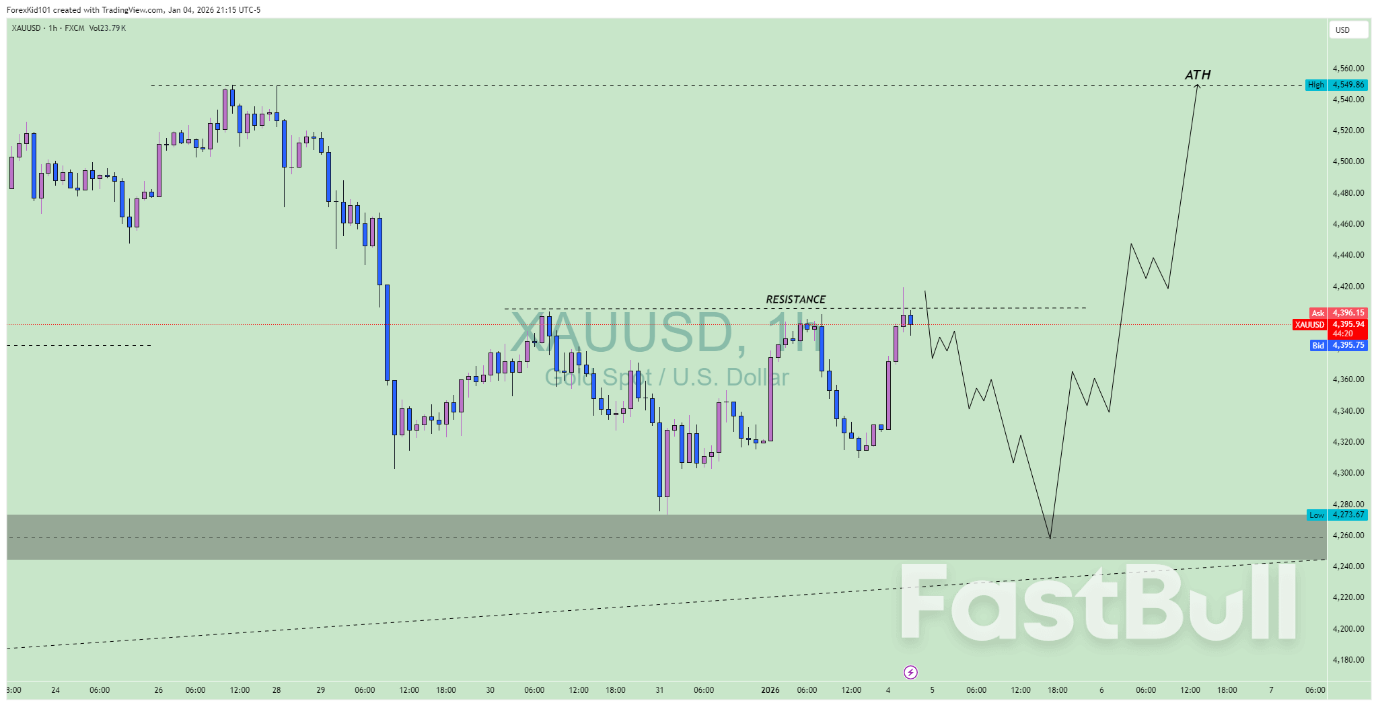

As long as price holds above 4,240, the Daily bias remains bullish, favouring buy setups on pullbacks.A Daily close below 4,200 would weaken bullish continuation and increase downside probability.

As long as price holds above 4,240, the Daily bias remains bullish, favouring buy setups on pullbacks.A Daily close below 4,200 would weaken bullish continuation and increase downside probability. The 1H timeframe is used only for entries, stop-loss control, and trade management.

The 1H timeframe is used only for entries, stop-loss control, and trade management.Nicolás Maduro will have already spent more than 24 hours in one of the toughest US jails when he appears in court Monday to face charges that could keep him behind bars for the rest of his life.

The ousted Venezuelan president and his wife, Cilia Flores, joined the approximately 1,330 inmates at the notorious Metropolitan Detention Center in Brooklyn on Saturday following a surprise night time raid and odyssey that included a US warship, a plane and a helicopter.

For years, the hulking concrete jail has drawn sharp criticism from judges, lawyers and watchdogs. In 2024, one judge bluntly dubbed the conditions at New York City's only federal jail as "dreadful in many respects." Another described them as "dangerous, barbaric."

By all accounts, it's a world away from the rarefied public existence Maduro and Flores had been living.

In Caracas, Maduro lived inside a sprawling military complex called Fort Tiuna.

Venezuela never made public exactly where Maduro resided within the military base and he's shared little of his private living space on social media. But on one occasion followers caught a brief glimpse of a modest kitchen, where his wife was shown making coffee using a worn cloth.

Most of Maduro's public life unfolded at Miraflores Palace, the presidential seat in downtown Caracas that occupies an entire city block. He hosted foreign leaders and athletes at the 19th century French neo-baroque mansion, which features a large central courtyard and ceremonial halls decorated with chandeliers, carpets and portraits of national heroes.

He greeted supporters from the palace balcony during government-organized rallies. Maduro also often had visitors over for coffee, and displayed symbolic items such as the sword of independence hero Simón Bolívar.

On Monday, Maduro will be taken across the water from his Brooklyn lock-up to federal court in Lower Manhattan where he'll face US charges that he played a key role in a broad conspiracy over 25 years to traffic cocaine into the US.

The indictment released on Saturday accuses Maduro and others of partnering with groups including the Sinaloa Cartel and Tren de Aragua, which have been designated by the US as foreign terrorist organizations.

Authorities have devised a plan to whisk the ousted leader across the river by helicopter on Monday, according to a person familiar with the matter who asked not to be identified discussing logistics. They are planning to fly Maduro over New York Harbor on a route that will take him past the Statue of Liberty toward Wall Street. From a helipad there, a short motorcade would carry him to the federal courthouse in Lower Manhattan, said the person.

The hearing is set for 12 p.m. in New York and will be overseen by US District Judge Alvin Hellerstein, 92, a Bronx native appointed by Bill Clinton who has presided over cases tied to the Sept. 11 attacks and major financial fraud trials.

Bail is unlikely. The judge is expected to set an initial schedule for evidence exchanges and pretrial motions, with a trial not expected until at least 2027.

It is not clear if Maduro or his wife has hired a lawyer for the hearing. Sometimes defendants are represented by free lawyers from the Federal Defenders of New York for purposes of an initial court appearance.

At his new temporary cell in Brooklyn, Maduro is likely to be held under the jail's most restrictive conditions.

At MDC, high-risk detainees are typically placed in special housing, where confinement can stretch to 23 hours a day. Movement outside the cell is tightly controlled. Confinement in the MDC "will test the strongest mind," said Justin Paperny, a prison consultant who has advised clients held at the facility.

Paperny cited staffing difficulties, training deficiencies and mental health issues among the prisoners as challenges to maintaining the jail.

Other complaints include rotten food, thin mattresses and filthy, broken toilets. Inmates can become disoriented and lose track of the time, with lights constantly on and no view of the outside, Paperny said.

A representative for the Bureau of Prisons didn't respond to a request for comment. The Bureau of Prisons has said conditions at MDC in Brooklyn have improved, citing staffing increases and a reduced inmate population.

Paperny said Maduro's communications will be closely monitored and his movements carefully managed, with security and physical safety taking precedence over comfort.

The MDC is the only federal jail in New York as the Bureau of Prisons closed Manhattan's Metropolitan Correctional Center in 2021 to address deteriorating conditions. Jeffrey Epstein died by suicide in the MCC in 2019.

Since then, MDC has been a temporary home for high-profile inmates, including Sean "Diddy" Combs, Ghislaine Maxwell and Luigi Mangione.

Sam Bankman-Fried was held in the jail before his 2023 conviction for fraud at his FTX cryptocurrency exchange. While there he said he befriended former Honduras President Juan Orlando Hernández, who was found guilty in 2024 of conspiring to import cocaine into the US.

Hernandez was later transferred to serve a 45-year sentence in a prison in West Virginia. He was recently pardoned by President Donald Trump.

Japan's long-maturity government bonds kicked off 2026 on a downbeat note, as fiscal and inflation worries continued to weigh on the market.

The benchmark 10-year Japanese government bond yield climbed as much as five basis points on Monday to 2.12%, its highest level since 1999. Yields on 20-year and 30-year bonds also rose.

The moves followed a selloff in long-dated US Treasuries, steepening the yield curve as traders price in higher defense spending under the Trump administration stoked by rising geopolitical risks. In Japan, Prime Minister Sanae Takaichi's government is set to lift defense spending to a record next year as part of a ¥122.3 trillion ($780 billion) budget approved by the cabinet last month.

Meanwhile, the yen's weakness has intensified concerns that the Bank of Japan may be slow in its efforts to rein in inflation. The currency gained less than 1% against the dollar in 2025, following four consecutive years of declines.

Long-term JGB yields may continue to face upward pressure "as long as market participants continue to sense 'reflationary' policy intentions on the part of the Takaichi administration," Mizuho Securities Co. economist Yusuke Matsuo wrote in a note on Monday. He added that some of that pressure could be tempered by the Ministry of Finance's plan to cut issuance of super-long bonds in the fiscal year starting in April.

Caution is also building ahead of a 10-year JGB auction on Tuesday. While elevated yields and demand for newly issued bonds may attract some dip-buying, "it is difficult to turn bullish amid lingering concerns that the BOJ is behind the curve," said Keisuke Tsuruta, senior bond strategist at Mitsubishi UFJ Morgan Stanley Securities Co.

The Cuban government said on Sunday that 32 of its citizens were killed during the U.S. raid on Venezuela to extract President Nicolas Maduro for prosecution in the United States.

Havana said there would be two days of mourning on January 5 and 6 in honor of those killed and said funeral arrangements would be announced.

The Cuban government statement gave few details, but said all the dead were members of the Cuban armed forces and intelligence agencies.

"True to their responsibilities concerning security and defense, our compatriots fulfilled their duty with dignity and heroism and fell, after fierce resistance, in direct combat against the attackers or as a result of bombings on the facilities," the statement said.

Cuba has provided some security for Maduro since he came to power. It was not clear how many Cubans were guarding the Venezuelan president when they died and how many may have perished elsewhere.

Maduro, 63, and his wife Cilia Flores were seized by U.S. forces in the Venezuela capital Caracas on Saturday and flown to the United States. Maduro is being held in a New York detention center awaiting a Monday court appearance on drug charges.

Maduro was indicted in 2020 on U.S. charges including narco-terrorism conspiracy. He has always denied any criminal involvement.

After the US's stunning capture of Venezuelan President Nicolás Maduro over the weekend the focus is turning to how quickly the country with the world's largest proven crude reserves can raise output.

In the short term, it's unclear how much oil Venezuela will be able to export and whether flows to China will continue.

And while President Donald Trump has said US companies will spend billions of dollars to rebuild the country's energy infrastructure over the longer term, there are big doubts about whether the oil majors will want to invest in what is a very uncertain environment.

Here's what analysts are saying about Venezuela:

"There will undoubtedly be a segment of the market that will embrace a 'Mission Accomplished' narrative and will pencil-in an easy glide path back to 3 million barrels a day of production," analysts including Helima Croft said in a note, adding that full sanctions relief could unlock several hundred thousand barrels a day in the next 12 months assuming an orderly transition of power.

However, "the situation at the time of writing remains very fluid, but we continue to caution market observers that it will be a long road back for the country," they said.

"In theory, Venezuela could again become a major producer: it still claims to hold the world's largest proven oil reserves," Chief Economist Neil Shearing said in a note. "But theory and reality diverge sharply. If nothing else, geopolitical alignments in Venezuela remain unclear in the wake of Maduro's capture," he said.

Even if output were to rise to levels seen a decade ago, around 3 million barrels a day, that would only add about 2% to global oil supply, Shearing said.

Brent oil prices could average $2 a barrel higher than Goldman Sachs Group Inc.'s base-case forecast of $56 a barrel for Brent this year if Venezuelan crude production falls by 400,000 barrels a day by year-end, analysts including Daan Struyven said in a note. Or, they could be $2 lower if output rises by that amount.

"Along with recent Russia and US production beats, potentially higher long-run Venezuela production further increases the downside risks to our oil price forecast for 2027 and beyond," Goldman said. "We estimate $4 a barrel of downside to 2030 oil prices in a scenario where Venezuela crude production rises to 2 million barrels a day in 2030," compared with 900,000 barrels a day in the bank's earlier base case.

A limited market reaction is likely as there's ample oil supply globally, said Chief Analyst Arne Lohmann Rasmussen. "Venezuela is known for having the world's largest proven oil reserves, exceeding 300 billion barrels," he said in a note. "However, reserves are one thing, production another. Venezuela's oil production today is around 1 million barrels per day."

Given Venezuelan crude is heavy and sulfur-rich, only refineries in the US and some in China can process the oil, Rasmussen said, adding that a potential loss of this type of oil is not particularly problematic for the global market.

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

Log In

Sign Up