Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

U.S. Average Hourly Wage MoM (SA) (Dec)

U.S. Average Hourly Wage MoM (SA) (Dec)A:--

F: --

U.S. Average Weekly Working Hours (SA) (Dec)

U.S. Average Weekly Working Hours (SA) (Dec)A:--

F: --

P: --

U.S. New Housing Starts Annualized MoM (SA) (Oct)

U.S. New Housing Starts Annualized MoM (SA) (Oct)A:--

F: --

U.S. Total Building Permits (SA) (Oct)

U.S. Total Building Permits (SA) (Oct)A:--

F: --

P: --

U.S. Building Permits MoM (SA) (Oct)

U.S. Building Permits MoM (SA) (Oct)A:--

F: --

P: --

U.S. Annual New Housing Starts (SA) (Oct)

U.S. Annual New Housing Starts (SA) (Oct)A:--

F: --

U.S. U6 Unemployment Rate (SA) (Dec)

U.S. U6 Unemployment Rate (SA) (Dec)A:--

F: --

P: --

U.S. Manufacturing Employment (SA) (Dec)

U.S. Manufacturing Employment (SA) (Dec)A:--

F: --

U.S. Labor Force Participation Rate (SA) (Dec)

U.S. Labor Force Participation Rate (SA) (Dec)A:--

F: --

P: --

U.S. Private Nonfarm Payrolls (SA) (Dec)

U.S. Private Nonfarm Payrolls (SA) (Dec)A:--

F: --

U.S. Unemployment Rate (SA) (Dec)

U.S. Unemployment Rate (SA) (Dec)A:--

F: --

U.S. Nonfarm Payrolls (SA) (Dec)

U.S. Nonfarm Payrolls (SA) (Dec)A:--

F: --

U.S. Average Hourly Wage YoY (Dec)

U.S. Average Hourly Wage YoY (Dec)A:--

F: --

Canada Unemployment Rate (SA) (Dec)

Canada Unemployment Rate (SA) (Dec)A:--

F: --

P: --

Canada Labor Force Participation Rate (SA) (Dec)

Canada Labor Force Participation Rate (SA) (Dec)A:--

F: --

P: --

U.S. Government Employment (Dec)

U.S. Government Employment (Dec)A:--

F: --

P: --

U.S. UMich Consumer Expectations Index Prelim (Jan)

U.S. UMich Consumer Expectations Index Prelim (Jan)A:--

F: --

P: --

U.S. UMich Consumer Sentiment Index Prelim (Jan)

U.S. UMich Consumer Sentiment Index Prelim (Jan)A:--

F: --

P: --

U.S. UMich Current Economic Conditions Index Prelim (Jan)

U.S. UMich Current Economic Conditions Index Prelim (Jan)A:--

F: --

P: --

U.S. UMich 1-Year-Ahead Inflation Expectations Prelim (Jan)

U.S. UMich 1-Year-Ahead Inflation Expectations Prelim (Jan)A:--

F: --

P: --

U.S. UMich 5-Year-Ahead Inflation Expectations Prelim YoY (Jan)

U.S. UMich 5-Year-Ahead Inflation Expectations Prelim YoY (Jan)A:--

F: --

P: --

U.S. 5-10 Year-Ahead Inflation Expectations (Jan)

U.S. 5-10 Year-Ahead Inflation Expectations (Jan)A:--

F: --

P: --

China, Mainland M1 Money Supply YoY (Dec)

China, Mainland M1 Money Supply YoY (Dec)--

F: --

P: --

China, Mainland M0 Money Supply YoY (Dec)

China, Mainland M0 Money Supply YoY (Dec)--

F: --

P: --

China, Mainland M2 Money Supply YoY (Dec)

China, Mainland M2 Money Supply YoY (Dec)--

F: --

P: --

U.S. Weekly Total Oil Rig Count

U.S. Weekly Total Oil Rig CountA:--

F: --

P: --

U.S. Weekly Total Rig Count

U.S. Weekly Total Rig CountA:--

F: --

P: --

China, Mainland M0 Money Supply YoY (Dec)

China, Mainland M0 Money Supply YoY (Dec)--

F: --

P: --

China, Mainland M1 Money Supply YoY (Dec)

China, Mainland M1 Money Supply YoY (Dec)--

F: --

P: --

China, Mainland M2 Money Supply YoY (Dec)

China, Mainland M2 Money Supply YoY (Dec)--

F: --

P: --

Indonesia Retail Sales YoY (Nov)

Indonesia Retail Sales YoY (Nov)--

F: --

P: --

Euro Zone Sentix Investor Confidence Index (Jan)

Euro Zone Sentix Investor Confidence Index (Jan)--

F: --

P: --

India CPI YoY (Dec)

India CPI YoY (Dec)--

F: --

P: --

Germany Current Account (Not SA) (Nov)

Germany Current Account (Not SA) (Nov)--

F: --

P: --

Canada National Economic Confidence Index

Canada National Economic Confidence Index--

F: --

P: --

U.S. Conference Board Employment Trends Index (SA) (Dec)

U.S. Conference Board Employment Trends Index (SA) (Dec)--

F: --

P: --

Russia CPI YoY (Dec)

Russia CPI YoY (Dec)--

F: --

P: --

FOMC Member Barkin Speaks

FOMC Member Barkin Speaks U.S. 3-Year Note Auction Yield

U.S. 3-Year Note Auction Yield--

F: --

P: --

U.S. 10-Year Note Auction Avg. Yield

U.S. 10-Year Note Auction Avg. Yield--

F: --

P: --

Japan Trade Balance (Customs Data) (SA) (Nov)

Japan Trade Balance (Customs Data) (SA) (Nov)--

F: --

P: --

Japan Trade Balance (Nov)

Japan Trade Balance (Nov)--

F: --

P: --

U.K. BRC Overall Retail Sales YoY (Dec)

U.K. BRC Overall Retail Sales YoY (Dec)--

F: --

P: --

U.K. BRC Like-For-Like Retail Sales YoY (Dec)

U.K. BRC Like-For-Like Retail Sales YoY (Dec)--

F: --

P: --

Turkey Retail Sales YoY (Nov)

Turkey Retail Sales YoY (Nov)--

F: --

P: --

U.S. NFIB Small Business Optimism Index (SA) (Dec)

U.S. NFIB Small Business Optimism Index (SA) (Dec)--

F: --

P: --

Brazil Services Growth YoY (Nov)

Brazil Services Growth YoY (Nov)--

F: --

P: --

Canada Building Permits MoM (SA) (Nov)

Canada Building Permits MoM (SA) (Nov)--

F: --

P: --

U.S. CPI MoM (SA) (Dec)

U.S. CPI MoM (SA) (Dec)--

F: --

P: --

U.S. CPI YoY (Not SA) (Dec)

U.S. CPI YoY (Not SA) (Dec)--

F: --

P: --

U.S. Real Income MoM (SA) (Dec)

U.S. Real Income MoM (SA) (Dec)--

F: --

P: --

U.S. CPI MoM (Not SA) (Dec)

U.S. CPI MoM (Not SA) (Dec)--

F: --

P: --

U.S. Core CPI (SA) (Dec)

U.S. Core CPI (SA) (Dec)--

F: --

P: --

U.S. Core CPI YoY (Not SA) (Dec)

U.S. Core CPI YoY (Not SA) (Dec)--

F: --

P: --

U.S. Core CPI MoM (SA) (Dec)

U.S. Core CPI MoM (SA) (Dec)--

F: --

P: --

U.S. Weekly Redbook Index YoY

U.S. Weekly Redbook Index YoY--

F: --

P: --

U.S. New Home Sales Annualized MoM (Oct)

U.S. New Home Sales Annualized MoM (Oct)--

F: --

P: --

U.S. Annual Total New Home Sales (Oct)

U.S. Annual Total New Home Sales (Oct)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

Mexico's 2026 recovery hinges on USMCA trade review, dampening domestic policy gains and peso outlook.

Mexico's economic outlook for 2026 points to a fragile recovery, with growth heavily influenced by trade uncertainty surrounding the U.S.-Mexico-Canada Agreement (USMCA) review rather than domestic policy.

According to Bank of America, Mexico's economy is forecast to grow by approximately 1.2% in 2026. This marks a modest improvement from the projected 0.4% expansion in 2025, but the recovery faces significant constraints.

On the domestic front, the economic picture is clearing up. Uncertainty tied to the 2024 constitutional changes is diminishing, allowing for less restrictive government policies.

Key positive factors include:

• Easing Fiscal Policy: The government is not expected to pursue sharp fiscal tightening.

• Looser Monetary Policy: The central bank has started moving interest rates toward a neutral position.

• External Boost: The economy will benefit from stronger U.S. growth and a temporary lift from the FIFA World Cup.

Despite domestic improvements, the recovery will likely be held back by trade-related volatility. The mid-2026 review of the USMCA is the central source of this uncertainty.

While analysts expect the agreement to remain largely intact with only minor changes and continued low U.S. tariffs, the review process itself creates risk. The United States is anticipated to use trade policy as a bargaining chip to address other issues like migration, security, and Chinese investment in Mexico. This could lead to more frequent or targeted reviews, keeping exporters and investors on edge, especially with unresolved disputes in energy, labor, and agriculture.

Fiscal policy is expected to shift from a drag on growth to a neutral factor in 2026. Following a major consolidation in 2025, spending pressures from infrastructure projects and support for the state-owned oil company Pemex suggest a mild easing.

Bank of America analysts project the public sector borrowing deficit to reach about 4.9% of GDP, exceeding the government's 4.1% target. This gap will keep sovereign rating risks on the radar for investors.

Meanwhile, Mexico's central bank, Banxico, is projected to continue cutting its policy rate. With economic growth below its potential and inflation expectations anchored, the bank is expected to lower the rate from 7% to around 6% by the end of 2026, although temporary price pressures might slow the pace of these cuts.

This economic landscape creates a less favorable environment for the Mexican peso (MXN). After a strong performance in 2025, the currency is expected to lose momentum in 2026.

The combination of interest rate cuts, which reduce the currency's "carry appeal," and the persistent uncertainty surrounding the USMCA review is expected to weigh on the peso. As a result, the USD/MXN exchange rate is forecast to approach 19 by the end of the year.

Europe's economy is on a collision course with itself. A new analysis from Deutsche Bank reveals a "two-economy problem" shaping the continent's trajectory into 2026, pitting cyclical resilience against deep-seated structural flaws that threaten its future competitiveness.

The outcome of this conflict will determine whether Europe sustains its economic momentum or buckles under the pressure of an increasingly fractured global landscape.

On the surface, annual GDP growth projections seem to show a slowdown, dropping from 1.4% in 2025 to 1.1% in 2026. However, a closer look at quarter-over-quarter growth—a better indicator of immediate momentum—tells a different story. According to the report by chief economist Mark Wall, this metric is expected to accelerate from 1% to 1.5%.

A key factor supporting this near-term growth is Germany's expansionary fiscal policy, which is poised to offset tightening measures in other parts of the bloc.

Meanwhile, the European Central Bank (ECB) is expected to hold its policy rates steady at 2% throughout 2026. However, the bank may be forced to start hiking rates again by mid-2027, as fiscal stimulus and tight labor markets could push medium-term inflation higher.

Beyond the headline numbers, Europe faces a persistent competitiveness challenge that currency fluctuations alone can no longer explain.

Before the global financial crisis, competitiveness was closely tied to currency movements. That relationship has broken down over the last decade. Data from the European Commission confirms that European firms have been hit by an unusually persistent shock to their competitiveness since Russia's invasion of Ukraine in 2022.

The structural headwinds are significant:

• Energy Prices: Costs remain roughly three times higher than in the United States.

• Supply Chains: The EU is grappling with vulnerable supply lines.

• Regulation: Burdensome rules hinder business agility.

• Labor Market: Access to skilled labor remains a constraint.

"The world is changing. It is becoming more geopolitical, more frictional," Deutsche Bank noted. "The direction of travel with geopolitics is the opposite to how the EU was formed and developed on the back of openness to trade, integration, and rules-based multilateralism."

There are signs that Europe is finally joining the global technology spending boom. ECB President Christine Lagarde has pointed to an uptick in IT spending and preparations for artificial intelligence, as noted in the ECB's Corporate Telephone Survey. Investment data also shows a recovery is underway after the stagnation caused by the energy shock.

However, critical questions remain. It is unclear if AI spending will translate into substantial GDP growth, especially if it relies heavily on technology imports. Furthermore, Europe's economic rigidities could slow the adoption of AI and limit the productivity gains it promises.

Progress on critical reforms remains sluggish. The implementation of proposals from 2024 reports by Mario Draghi and Enrico Letta, aimed at boosting competitiveness, was slow in 2025 and is expected to crawl at a similar pace in 2026.

The most meaningful signal of progress would be a genuine advancement toward a Capital Markets Union or a Savings and Investment Union. Such initiatives would deepen Europe's financial markets and unlock capital for innovation.

For 2026, Deutsche Bank’s baseline view is that resilience will likely win out. The European economy is expected to navigate the immediate challenges.

However, the report carries a stark warning: "unless the rigidities are resolved it will be difficult for the European economy to continue to outperform, at least without generating economic frictions."

Two potential bright spots could offer some support. First, Beijing's "anti-involution" policy might ease the flow of deflationary exports to Europe. Second, stronger U.S. demand leading up to its midterm elections could boost European exports, even amidst ongoing trade friction.

Israel has reportedly entered a state of high alert over the possibility of United States intervention in Iran, where the government is facing the most significant anti-government protests in years. According to three sources with knowledge of Israeli security consultations, the country is closely monitoring the situation.

The heightened alert follows several days of statements from U.S. President Donald Trump, who has threatened to intervene and warned Iranian authorities against using force on demonstrators. On Saturday, Trump declared that the U.S. stands "ready to help."

The sources, who participated in security meetings over the weekend, did not provide specific details on what Israel's high-alert status involves operationally. The two nations previously engaged in a 12-day war in June, which saw the U.S. join Israel in launching airstrikes.

The prospect of American action was a key topic in a phone call on Saturday between Israeli Prime Minister Benjamin Netanyahu and U.S. Secretary of State Marco Rubio. An Israeli source present for the conversation confirmed that the two leaders discussed potential U.S. intervention in Iran.

While a U.S. official acknowledged that the call took place, they did not comment on the specific subjects discussed.

Despite the escalating situation, Israel has not indicated any intention of intervening directly in Iran. Tensions between the two rivals remain high, largely due to Israeli concerns over Iran's nuclear ambitions and ballistic missile development.

In a Friday interview with the Economist, Netanyahu stated that an attack on Israel would lead to "horrible consequences" for Iran. Addressing the ongoing protests, he adopted a more cautious tone, remarking, "Everything else, I think we should see what is happening inside Iran."

Analysts are bracing for a higher US inflation reading in December, with the core consumer price index (CPI) projected to rise 2.7% year-over-year. This forecast is slightly above the 2.6% annual increase seen in November, a figure that marked the smallest gain since early 2021.

Despite the expected uptick, many consumers report feeling a significant drop in price pressures. This discrepancy highlights the complexity of the upcoming data, with some analysts warning that the December figures could be misleading.

The context for December's report is complicated by issues with the previous month's data. The Bureau of Labor Statistics confirmed it could not publish certain month-to-month adjustments in its last CPI report due to a recent government shutdown.

This disruption particularly affected the agency's ability to gather price data in October, leading to unusually stable readings for key rent indexes in the November report. Consequently, the November data may have painted an overly optimistic picture of declining inflation, setting the stage for a statistical rebound.

The December CPI report, scheduled for release on Tuesday, January 13, is expected to reverse some of November's unusual trends. However, experts caution against interpreting this as a new inflationary surge.

"We believe the CPI report will create some misleading stories," one analysis stated. "We anticipate that the December data will be high, largely due to the correction of some of the downward trends seen in November's data. Some analysts might interpret this high reading as a sign that inflation is coming back, but we think that's not correct."

The same analysis suggested that November's report likely exaggerated the inflation downturn by about 20 basis points. While many retailers have been reducing prices and the effects of tariffs have peaked, the December data will primarily reflect a statistical catch-up rather than a fundamental shift in the inflation trend.

This data uncertainty is a key reason Federal Reserve officials are inclined to keep interest rates unchanged for the time being. With inflation readings lacking clarity and the US job market showing signs of stabilization despite weak wage reports, the central bank appears to be in a holding pattern.

The inflation report is just the start of an eventful week for economic news. Market participants will also be closely watching several other key releases and events:

• Federal Reserve Speakers: New York Fed President John Williams is scheduled to speak on Monday, kicking off a week of public appearances by central bankers. Other officials set to speak include Michelle Bowman, Philip Jefferson, Alberto Musalem, and Anna Paulson.

• Retail Sales Data: On Wednesday, January 14, government data is expected to show another significant rise in retail sales. Analysts forecast a 0.4% increase for November (excluding autos), matching October's pace and confirming strong consumer spending in the fourth quarter.

• Other Key Reports: The week's economic calendar also includes data on October's new-home sales, the November producer price index (PPI), and December's industrial production and home resales.

Nationwide protests sparked by a failing economy are placing renewed pressure on Iran's theocracy, which has responded by shutting down internet and telephone access across the country.

The unrest comes as Tehran reels from multiple crises. A 12-day war with Israel in June saw the United States bomb nuclear sites within Iran. Meanwhile, economic pressure has intensified since the United Nations reimposed sanctions in September over the country's atomic program. This has sent the Iranian rial into a free fall, with the currency now trading at over 1.4 million to the U.S. dollar.

At the same time, Iran's "Axis of Resistance"—its network of allied countries and militant groups—has been severely weakened since the start of the 2023 Israel-Hamas war.

Understanding the full scope of the protests has been challenging. Iranian state media has offered minimal information, while online videos provide only brief glimpses of demonstrations amid the sound of gunfire. An internet shutdown has further complicated reporting, and journalists in Iran already face significant restrictions.

Despite this, reports indicate the movement is widespread and persistent.

• Geographic Reach: The U.S.-based Human Rights Activists News Agency (HRANA) reported on Sunday that more than 570 protests have occurred across all 31 of Iran's provinces.

• Casualties and Arrests: The group, which relies on a network of activists inside Iran, stated the death toll had reached at least 116, with over 2,600 arrests.

The demonstrations appear to be continuing, even after Supreme Leader Ayatollah Ali Khamenei declared that "rioters must be put in their place." U.S. President Donald Trump has warned Tehran that if it "violently kills peaceful protesters," the U.S. "will come to their rescue," a threat that carries new weight after American troops captured Venezuela's Nicolás Maduro, a longtime Iranian ally.

The collapse of the rial is at the heart of Iran's widening economic crisis. The nation is grappling with an annual inflation rate of approximately 40%, driving up the prices of staples like meat and rice.

Recent government policies have added to the population's financial strain:

• Fuel Prices: In December, Iran introduced a new pricing tier for its subsidized gasoline, increasing the cost of some of the world's cheapest fuel. The government plans to review these prices every three months, signaling potential future hikes.

• Subsidized Exchange Rate: Iran's Central Bank recently ended a preferential, subsidized dollar-rial exchange rate for all products except medicine and wheat, a move expected to cause a spike in food prices.

The protests began in late December among merchants in Tehran before spreading nationwide. While initially focused on the economy, the demonstrations quickly evolved, with protesters chanting anti-government slogans. Public anger has been building for years, notably after the 2022 death of 22-year-old Mahsa Amini in police custody, which triggered its own wave of massive demonstrations. Some protesters have chanted in support of Iran's exiled Crown Prince Reza Pahlavi, who has encouraged the demonstrations.

Iran's "Axis of Resistance," a network that grew in prominence after the 2003 U.S.-led invasion of Iraq, is now reeling from a series of major defeats.

• Hamas: The group has been crushed by Israel in a devastating war in the Gaza Strip.

• Hezbollah: The Lebanese militant group has lost its top leadership to Israeli strikes and has been struggling since.

• Syria: A lightning offensive in December 2024 overthrew President Bashar Assad, a key Iranian ally and client.

• Houthis: The Iranian-backed rebels in Yemen have been pounded by Israeli and U.S. airstrikes.

Meanwhile, Iran's larger partners have not offered overt military support. China remains a major buyer of Iranian crude oil but has not provided military aid. Russia, which has used Iranian drones in its war on Ukraine, has also refrained from direct military involvement.

For decades, Iran has insisted its nuclear program is peaceful. However, its officials have increasingly threatened to pursue a nuclear weapon. Before the U.S. attack in June, Iran was enriching uranium to near weapons-grade levels—the only non-nuclear-weapon state to do so.

Tehran has also scaled back its cooperation with the International Atomic Energy Agency (IAEA), the U.N.'s nuclear watchdog. The IAEA's director-general has warned that Iran could build as many as 10 nuclear bombs if it chose to weaponize its program. U.S. intelligence agencies assess that Iran has not yet started a weapons program but has taken steps to "better position it to produce a nuclear device."

In a potential signal to the West, Iran recently claimed it was no longer enriching uranium anywhere in the country. However, no significant negotiations to ease sanctions have occurred in the months since the June war.

The current standoff is rooted in a long and complex history. Before 1979, Iran was a top U.S. ally under Shah Mohammad Reza Pahlavi. The 1953 CIA-backed coup that cemented the shah's rule laid the groundwork for future animosity.

The 1979 Islamic Revolution led by Ayatollah Ruhollah Khomeini created Iran's theocratic government and shattered the alliance. The subsequent U.S. Embassy hostage crisis severed diplomatic relations entirely. During the 1980s Iran-Iraq war, the U.S. backed Saddam Hussein, attacked Iran's navy, and shot down an Iranian commercial airliner.

Relations saw a brief high with the 2015 nuclear deal, which lifted sanctions in exchange for limits on Iran's nuclear program. But in 2018, President Trump unilaterally withdrew the U.S. from the accord, reigniting tensions that have continued to escalate.

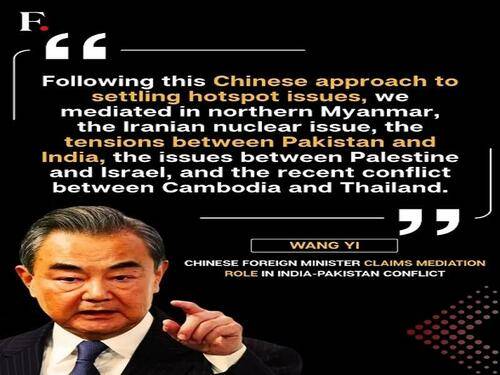

Chinese Foreign Minister Wang Yi recently stated that his country played a mediating role between India and Pakistan during their military clashes last spring. However, an analysis of the region's long-standing diplomatic protocols and geopolitical realities suggests this claim is difficult to substantiate.

The statement echoes similar claims made by U.S. President Trump, which were consistently denied by India and contributed to a deterioration in U.S.-India relations. India's position on this matter has been firm for nearly half a century, making Beijing's assertion particularly noteworthy.

Since the 1972 Simla Agreement, India has maintained a strict policy that all disputes with Pakistan are bilateral issues, explicitly rejecting third-party mediation. This long-standing principle shapes how New Delhi engages with other nations during regional crises.

While India cannot stop foreign diplomats from communicating with Pakistan, it treats each interaction as a distinct bilateral engagement. Indian officials will always take calls from international counterparts to present their country's perspective and prevent Pakistan from controlling the narrative. However, these separate conversations do not constitute a trilateral mediation process.

This context is crucial for understanding what likely transpired last spring. Records show Wang Yi spoke with his Pakistani counterpart, Ishaq Dar, and Indian National Security Advisor Ajit Doval on the same day. From India's perspective, these would have been viewed as two separate bilateral calls, not a coordinated mediation effort led by China.

China's capacity to act as a neutral arbiter between India and Pakistan is fundamentally compromised by its own strategic interests.

• Territorial Disputes: Beijing has its own unresolved border disputes with New Delhi.

• Military Support for Pakistan: China is a key military supplier to Pakistan, providing advanced weaponry, including the JF-17 fighter jets that were used against India in last spring's conflict.

These factors position China as a party with vested interests in the region rather than an impartial mediator.

The timing and context of Wang Yi's statement offer clues to its underlying purpose. The claim was made over six months after the events, during a symposium on "International Situation and China's Foreign Relations."

At the event, Wang listed the India-Pakistan de-escalation as one of several examples of the "Chinese approach to settling hotspots."

Other examples mentioned included:

• Northern Myanmar

• The Iranian nuclear issue

• Disputes between Palestine and Israel

• Conflict between Cambodia and Thailand

Among these, only the ceasefire in northern Myanmar is an indisputable diplomatic achievement for China. The others are either unproven or primarily credited to other actors. The repeated and questionable claims of mediation appear designed to build a specific narrative.

This effort is likely intended to promote President Xi Jinping's flagship Global Security Initiative, a core pillar of China's foreign policy alongside initiatives on development, civilization, and governance. By framing itself as a global peacemaker, Beijing aims to bolster its international standing.

It appears Chinese officials made a strategic calculation that the benefits of promoting the Global Security Initiative outweighed the risk of offending India. Wang Yi would have been aware of India's strong negative reaction to Trump's similar claims and the damage it caused to U.S.-India ties.

Despite this, the decision was made to publicly frame the diplomatic calls as mediation. While intended for a global audience, this boast could needlessly complicate the recent, fragile rapprochement between China and India.

A potential second Trump administration's strategy for Venezuela's oil sector appears to fundamentally misread the complex realities on the ground. The ambitious plan to overhaul the nation's energy industry and control its output faces significant obstacles, from geopolitical ties with China to deep-seated technical challenges that simple subsidies cannot solve.

The core of the proposed U.S. strategy involves a series of non-negotiable demands directed at Venezuela's interim President, Delcy Rodriguez. These ultimatums include:

• Cracking down on drug trafficking.

• Expelling Iranian and Cuban operatives deemed hostile to Washington.

• Halting all oil sales to U.S. adversaries.

These conditions are unlikely to be met, setting the stage for continued confrontation. The administration's vision for overhauling Venezuela’s oil business seems equally detached from reality. Initial suggestions of a subsidy-funded revival, projected to take less than 18 months, quickly evolved into an admission that "a tremendous amount of money will have to be spent," with the expectation that "the oil companies will spend it."

However, major U.S. energy firms are hesitant to invest billions in a nation facing potential chaos, especially if Washington attempts to install a new government over its 28 million citizens.

The ultimate objective behind this high-stakes plan is to drive global oil prices down to a maximum of $50 per barrel. To achieve this, a Trump administration would theoretically seize total control of Venezuela's state-owned oil company, PDVSA, managing the acquisition and sale of nearly all its production.

U.S. Energy Secretary Chris Wright confirmed this strategy at a Goldman Sachs conference, stating, "We are going to market the crude coming out of Venezuela... we will sell the production that comes out of Venezuela into the marketplace."

This plan effectively involves capturing the revenue from PDVSA's crude sales, with the proceeds theoretically deposited into U.S.-controlled offshore accounts for the "benefit of the Venezuelan people." Unsurprisingly, the government in Caracas is expected to reject what it views as outright theft. This strategy is backed by what Homeland Security Advisor Stephen Miller has described as a "military threat" to maintain control over Venezuela.

While the U.S. focuses on control, it overlooks China's deeply entrenched role in Venezuela's energy sector. Although China's daily imports of roughly 746,000 barrels from Venezuela are not irreplaceable—Beijing can easily source oil from Iran, Russia, and Saudi Arabia—its relationship goes far beyond simple trade.

For the past two decades, China has become the operational backbone of Venezuela's oil industry. Its contributions include:

• Refinery technology and heavy crude upgrading systems

• Infrastructure design and control software

• Spare parts logistics and software support

Removing Chinese engineers, technicians, and supply chains would not "liberate" a functioning oil industry. It would leave behind an inert shell. Industry experts estimate that converting Venezuela's Chinese-built oil infrastructure into an American-operated system would take a minimum of three to five years.

Furthermore, Beijing sees the U.S. push in the region as an attempt to force it to purchase energy using petrodollars. This is unlikely to succeed, as China increasingly settles energy transactions with Russia and Gulf nations in petroyuan.

The physical nature of Venezuelan oil presents another major challenge. The country produces superheavy crude, which is as thick as tar and requires specialized processes for extraction. It must be melted to reach the surface and then mixed with a diluent to prevent it from hardening again. For every barrel of oil exported, approximately 0.3 barrels of diluent must be imported.

This technical complexity is compounded by an energy infrastructure that, while shaped by Chinese technology, has been degraded by years of American sanctions. The damage is considered even more severe than that inflicted on Iraq's oil sector in the early 2000s, making any quick revival of production highly improbable.

While the strategic goals of the U.S. plan face serious questions, the turmoil has created opportunities for financial players. Hedge fund vultures are circling, anticipating massive returns. Paul Singer, whose firm Elliott Management acquired the Houston-based subsidiary of CITGO in November for $5.9 billion—less than a third of its $18 billion market value—is a prominent example. Singer has also been a major donor to MAGA-aligned super PACs, contributing $42 million in 2024.

The broader speculative market is eyeing potential profits of up to $170 billion in Venezuela's debt market, with defaulted PDVSA bonds alone valued at over $60 billion. This financial maneuvering underscores how instability, regardless of policy outcomes, generates immense wealth for a select few. Ultimately, the intricate web of technical, geopolitical, and financial factors makes the situation in Venezuela far more complex than a simple strategy of control can address.

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up